Table of Contents:

- Introduction

- Who is Ian King?

- They’ll tell you that inflation is going down…

- The first punch to the financial gut will be the stock market.

- For those in retirement — it could be catastrophic.

- The real estate market is the second bubble.

- The third bubble is starting to pop right now.

- Of course, the Federal Reserve knows this.

- And here’s where things get really scary.

- How to Survive & Prosper the Coming Middle-Class Massacre

- Infinite Income

- Ride the $16 Trillion Infinergy Revolution

- Becoming part of the Strategic Fortunes community

The Financial Experts Who Predicted the 2000 Tech Crash, the 2008 Crisis, and the 2020 Pandemic, Now Warn Millions of Americans to Prepare for the…

MIDDLE-CLASS MASSACRE

Those In-the-Know Are Dumping Stocks, Bonds, and Real Estate While Secretly Piling Billions of Dollars into the One Investment That Will Survive the Carnage

Today, Americans are deeply concerned…

Concerned that inflation will continue to skyrocket.

That the stock market will keep crashing.

That their homes will lose value.

That their jobs are not secure.

And that interest rates will keep rising.

In fact, a new study shows that Americans are more concerned than ever before…

More than 2002, after stocks fell 50%, crushing retirement accounts.

More than 2008, after housing crumbled, wiping out trillions of dollars in equity.

And more than 2020, as the coronavirus shutdown the global economy, crippling employment.

And you know what — they are right to be concerned.

However, they’re likely not concerned enough.

Not. Even. Close.

That’s because new evidence reveals that the U.S. economy is days away from crashing, and it will make all these past financial crises, look like a walk in the park.

Please understand…

In the coming months, millions of Americans will be financially decimated.

If you don’t heed my warning and take specific actions with your money, I fear you’ll regret it for the rest of your life as every dollar you have — whether in stocks, real estate or even stuffed under your mattress — will be obliterated.

Now, you won’t hear about this from Washington or Wall Street. They prefer to tell you they’ve got things under control — that inflation has been tamed, that a stock and housing market rally is coming, and that interest rates are dropping.

But do you really believe they’re telling you the truth?

Do you think the politicians have your best interest at heart as they accept a record-breaking $11 billion in donations, mostly from the pockets of the 1%?

Do you think Wall Street has your best interest at heart as it scalps money from the billions of dollars in pensions and 401(k)s that it manages?

And do you think the Federal Reserve, which has deep ties with “too big to fail banks” and the corporate elite, cares what happens to you?

After all, aren’t these the same charlatans who told us things would be just fine in 2000, 2008 and 2020 … right before the economy came crashing down.

What nobody wants to admit, not in Washington, on Wall Street or in the media, is that the U.S. economy is skating on very thin ice right now … and at any moment, it will fall to its death.

It’s not a matter of if a crisis will strike. It’s a matter of when.

This looming crisis is more dangerous than anything America has seen since The Great Depression.

Ground zero will be the middle class, the hardworking folks who make America the great nation that it is.

The policeman and plumbers, engineers and electricians, firemen and farmers. The small business owners, teachers and contractors. They’ll be the ones blindsided as decades of economic and political incompetence come to a head.

Former White House economist Larry Kudlow didn’t mince words stating:

And this isn’t anything new…

Bestselling financial author Robert Kiyosaki has warned:

And former congressman Ron Paul has said:

My associates have worked closely with each of these financial experts, and after seeing what’s unfolding, it seems they agree … the middle class will be hit the hardest.

Which is why we call this unraveling — the “MIDDLE-CLASS MASSACRE.”

But, again, you won’t hear about this massacre from our elected officials, or from the media.

That’s why I’m here to warn you: America will soon experience the most devastating financial crisis in history…

I’m not talking about a recession, though as you’ll see, one is coming.

And I’m not talking about inflation, though that will hit hard as well.

But these will be the least of our worries.

I’m talking about the obliteration of America’s middle class.

My research is conclusive. In the coming months…

- The stock market will crash — massacring the nest eggs and retirement plans of millions of middle-class Americans.

- Home values will plummet — massacring middle-class wealth.

- And unemployment numbers will skyrocket — massacring middle-class Americans’ ability to keep their families warm and food on the table.

And there’s nothing anyone can do to stop it.

Not Washington.

Not Wall Street.

Not the Fed.

In fact, many of them may prefer NOT to stop it.

After all, it’s events like these that help them get richer, and richer, and richer … leaving the rest of us behind.

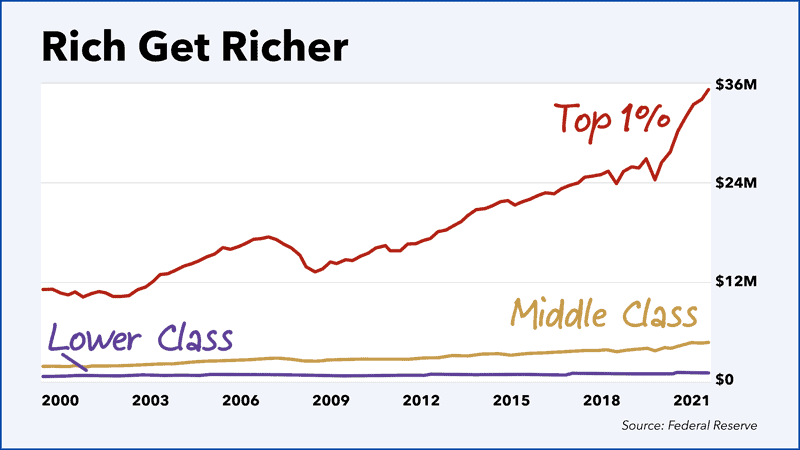

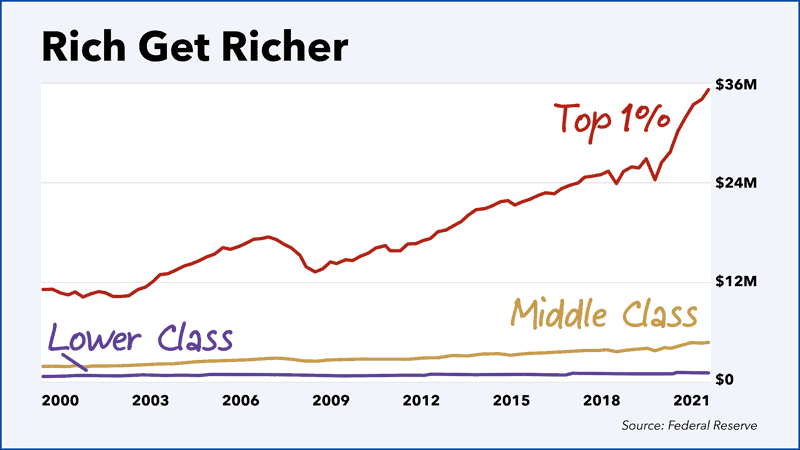

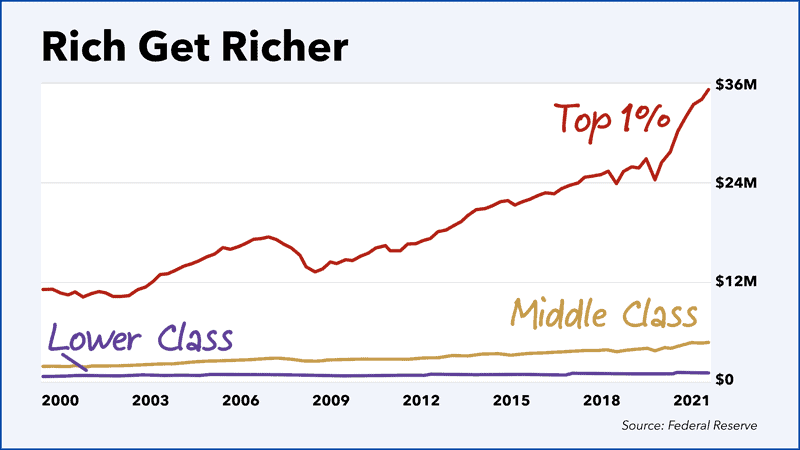

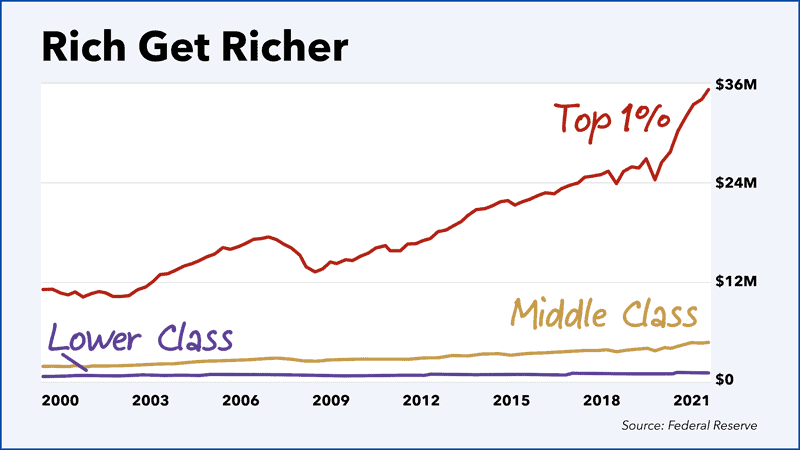

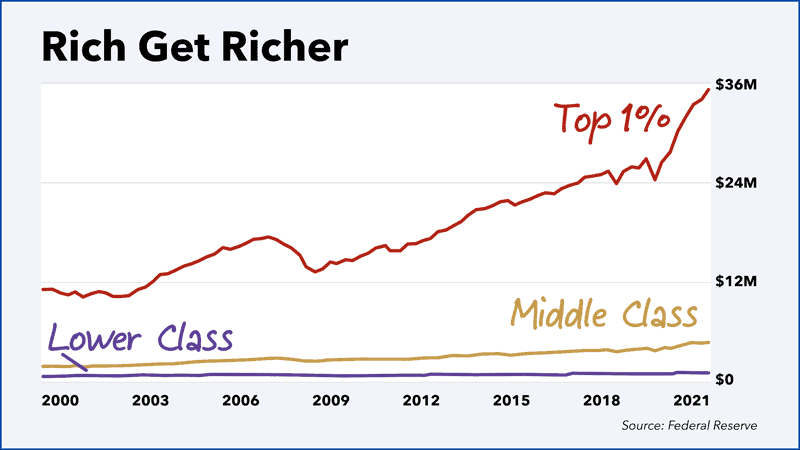

As you can see, over the last two decades, the top 1% has increased their wealth while the rest of us have struggled just to keep up with the cost of living.

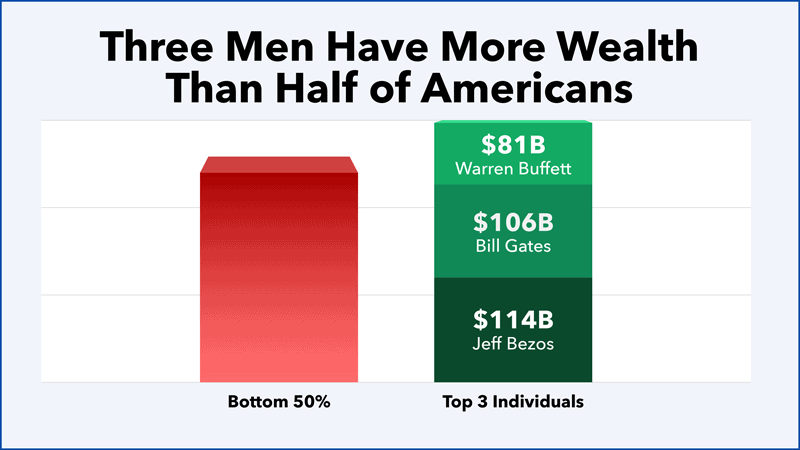

In fact, three of the richest men in America — Warren Buffett, Jeff Bezos and Bill Gates — have more wealth than 50% of Americans.

How can three people have more money than 167 million people?

Why are the rich getting richer while everyone else is being left behind?

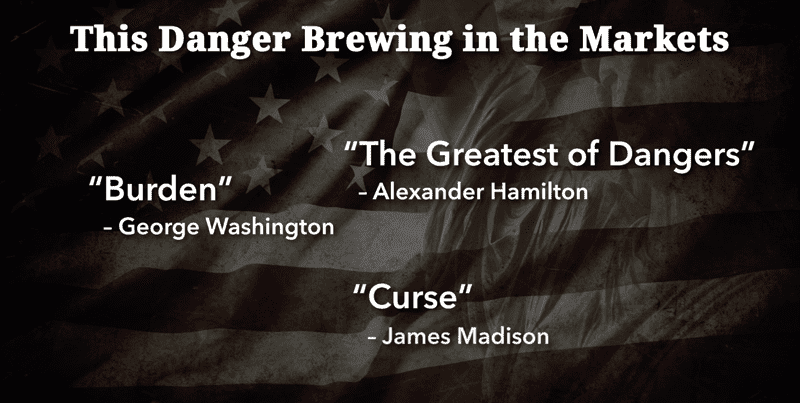

Well, I’ll explain that today, and how it is all linked back to this — the single greatest danger brewing in the financial markets.

A danger our Founding Fathers called a “burden,” “the greatest of dangers” and a “curse.”

But, as you’re about to see, the powers that be chose to ignore those warnings in exchange for more power.

Today, I’ll reveal exactly what this danger is so that you can sidestep the carnage and close the wealth gap.

The evidence is so glaring, that I felt it is my civic duty, as the Chief Investment Director of one of the nation’s most prominent financial research firms, to reveal the facts.

To fire the distress flare (if you will) about the financial reckoning that’s days from striking, so you and your loves ones, can make specific moves right now to sidestep the calamity.

But to also to let you know that even as America unravels, there are ways to stay safe and even profit from the coming fallout by using specific investments that tend to climb when everything else falls.

For instance, I believe the one investment that everyone is telling you to sell right now will begin to soar. It’s the one investment that thrives when there’s chaos and soars when the market sinks.

I’ll tell you all about it in a moment so you can buy it today.

My name, by the way, is Ian King.

As Chief Investment Director at Banyan Hill, a financial research firm with a team of 20 experts — including Chartered Market Technicians, CFAs and data analysts — who are able to see where the economy and markets are heading next.

Our goal is to make navigating these markets simple and profitable for Main Street Americans, which is why over 200,000 people follow our insights.

To be clear, we don't own cable channels or newspapers, like Bloomberg.

We don't buy splashy ads in magazines or on TV, like BlackRock.

We don't sponsor sports stadiums or pay for endorsements from NFL quarterbacks, like FTX.

We don’t need to.

People just hear about our accurate research, and share it with others. That’s likely how you stumbled upon this presentation today.

And over the years, word has spread from Main Street up to Wall Street, which is why people at the top firms, such as Goldman Sachs, Morgan Stanley and Merrill Lynch, eagerly pay for our insight as well.

This is because my team of experts have gained a reputation for predicting crises BEFORE they happen — helping people sidestep the calamity, and also make major profits.

Take 1999 for example.

“Wall Street experts” were on C-SPAN proclaiming the market would quickly soar another 300%.

But my firm disagreed. We boldly stood up to the Wall Street cheerleaders and warned: the party is over.

But we didn’t stop there. We like to show the folks who follow our research how to make money, too. So, we recommended investing in the Prudent Bear Fund, a fund that actually goes up when the stock market goes down. And anyone who followed that recommendation would’ve seen their investment soar 100% over the next three years, while those who listened to the “so-called” experts saw their investment get cut in half.

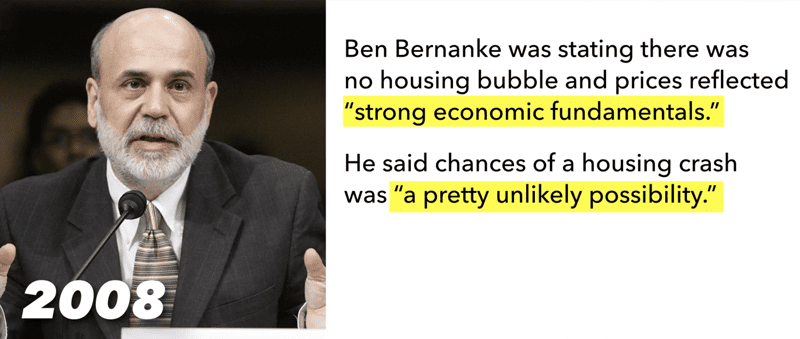

It happened again in 2008.

For years, Federal Reserve Chief Ben Bernanke was stating there was no housing bubble and prices reflected “strong economic fundamentals.” He even went on to say the chances of a housing crash was “a pretty unlikely possibility.”

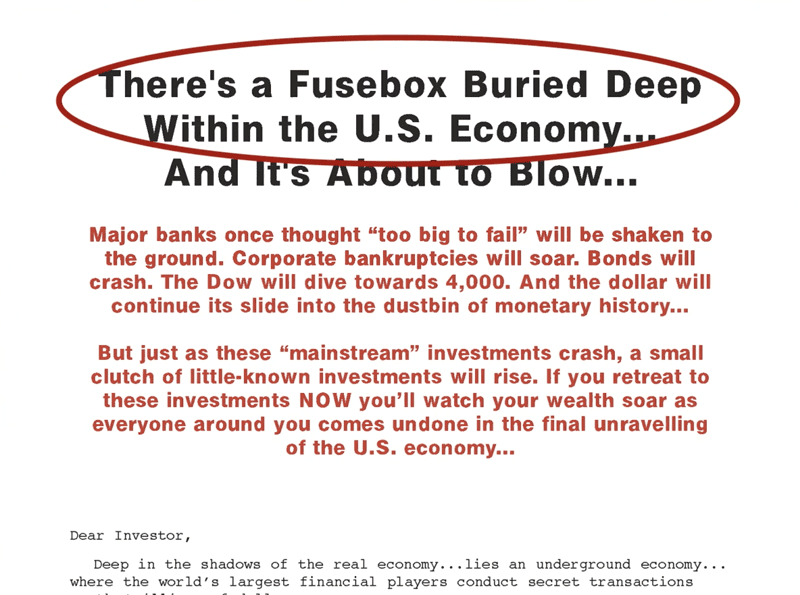

Once again, our firm disagreed. We knew Bernanke was either a liar or an idiot, or perhaps both. So, we warned of a “Fuse Box Buried Deep Within the U.S. Economy.” We reported, and I quote: “Major banks once thought ‘too big to fail’ will be shaken to the ground.”

That fuse box was derivatives. A term very few people had heard about at that time. And everything unfolded exactly as my firm said. Hundreds of banks collapsed, and it brought the U.S. economy to its knees.

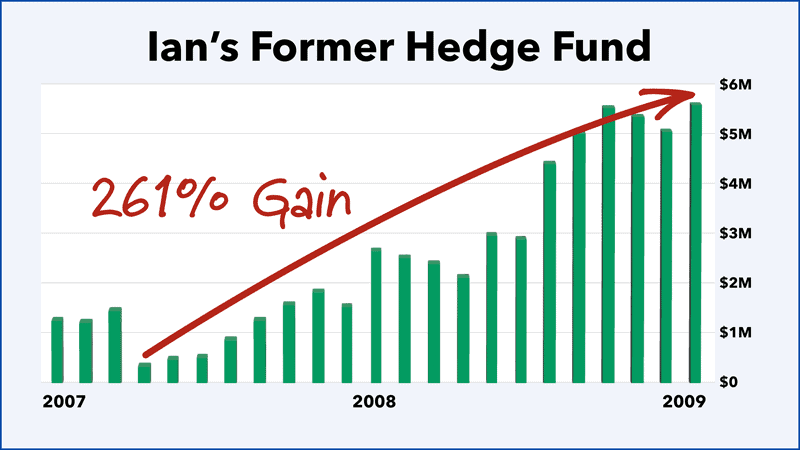

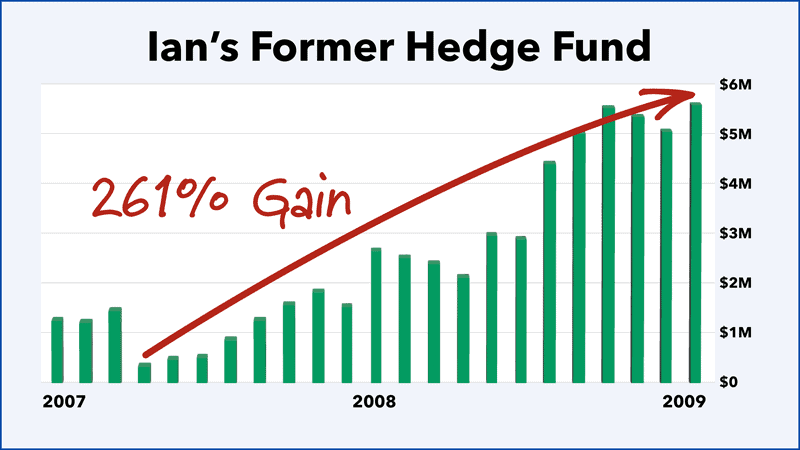

The stock market once again fell over 50%. But my hedge fund saw gains of 261% in less than two years as the crash unfolded.

One more example…

Fox Business asked me to speak on their show in January 2020, a few months before the coronavirus had broken out. This was when most were still calling it the “Wuhan Virus” and thought it would be isolated in Asia.

But I knew it would be bigger. So, I switched topics on the host. Listen in.Click here for soundReplayUnmuteFullscreen

I went on to explain that it could rattle the entire stock market, as well as the global economy.

Two months later, my words (unfortunately) proved all too true. The U.S. shut down. The stock market tanked in one of the fastest crashes ever. The global supply chain ground to a halt. And everyone was suddenly cooped up in their homes, afraid to even shop for groceries.

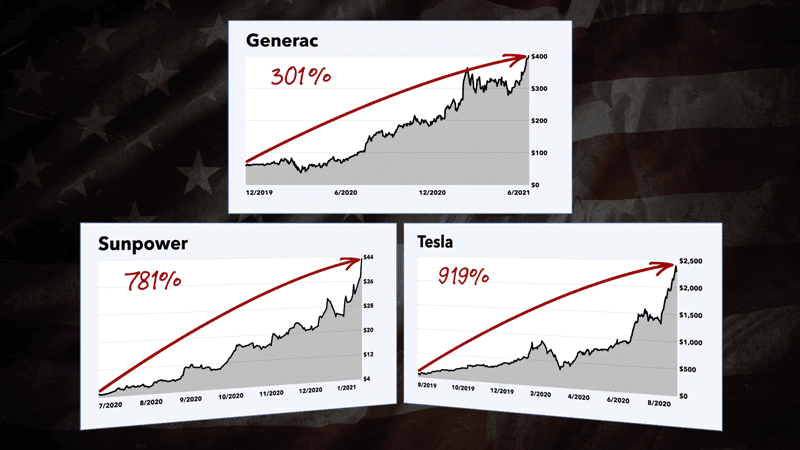

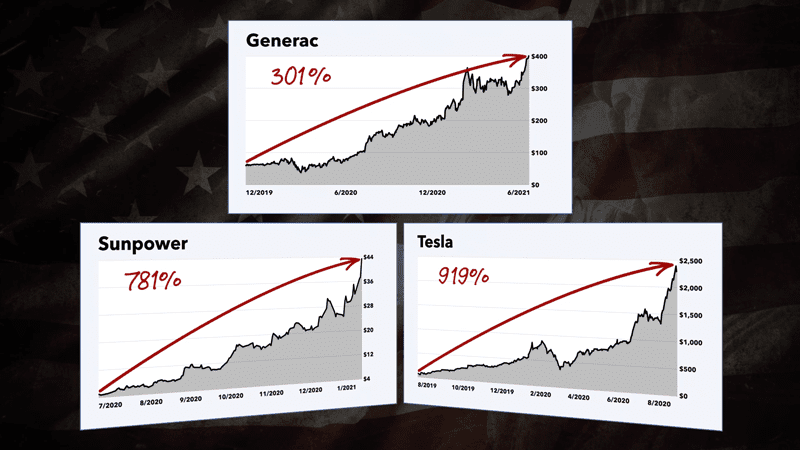

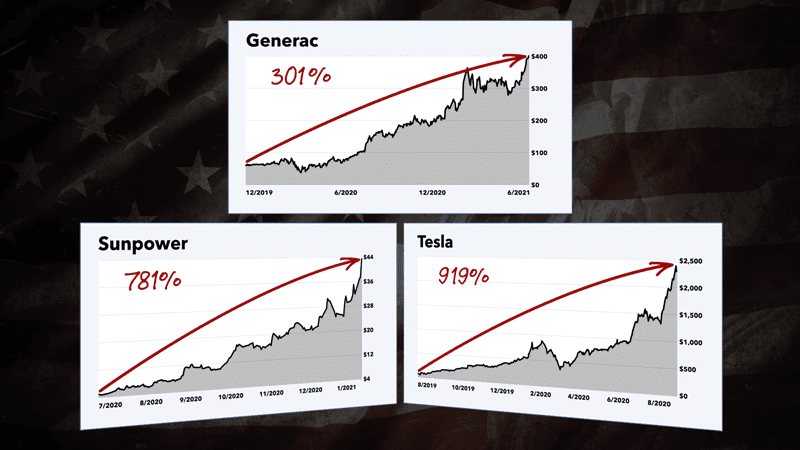

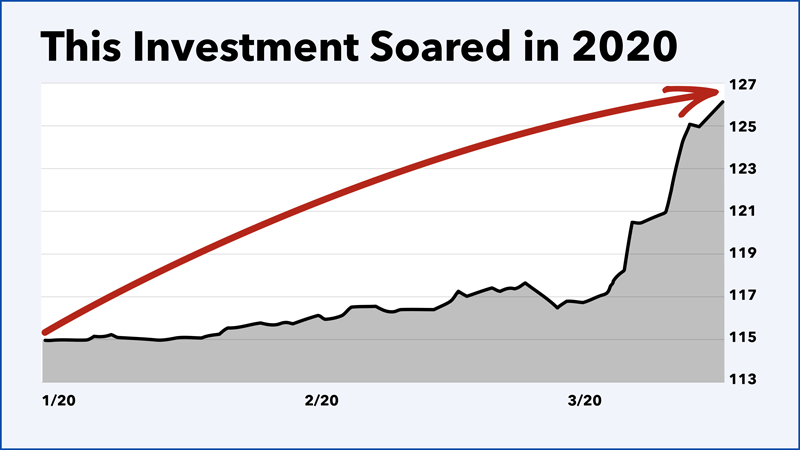

But that was an amazing opportunity, I was able to use that turmoil to land gains as high as 301%, 781% and 919% in less than two years … More on how I did that in a moment.

Why am I telling you all this?

Why am I showing you proof that we predicted the last three major economic calamities?

Because I NEED you to take our current prediction very seriously. All the data proves that the middle-class massacre has already begun.

In all our days, we’ve never seen anything more alarming as what’s about to unfold.

Will this next crisis be more sudden than the 2000 stock crash?

Will it be more devastating than the 2008 housing collapse?

Will it be more painful that the 2020 economic pandemic?

And it will hit the middle class harder than any other group?

All my research is conclusive. Yes.

The Main Street Americans who work the long hours and pay the most in taxes, the people who are the real backbone of our economy … they will take it on the chin when all hell breaks loose.

The rich, they see crashes as opportunities to “buy low.” They love a good jolt to the markets. They have enough play money to get in when there is blood in the streets.

That’s why today, I’m showing you all the facts — the truths that Wall Street, Washington and the media would prefer you never see.

Please understand — I am not the type of person who likes to go around preaching doom.

But when the evidence for the financial massacre of America’s middle class is so glaringly clear, and when nobody else is signaling a warning, I take it upon myself to do so.

And I know that everywhere you look, an effort has been made to make things appear pretty good. The market pops up here and there, we’re told that unemployment is low, the dollar is strong and that interest rates and inflation won’t keep going up…

But as you’re about to see, everything is not what it seems.

As I’m about to show you, America’s economy is on a very frail foundation … like a kid skating on thin ice. Sure, it’s enjoyable … until it isn’t.

It all links back to this one danger.

Our forefathers rightfully called this “the greatest of dangers,” most Americans will not even be able to imagine the outcome.

It will impact almost every aspect of your life: where you live, how you live, where you go on vacation, the car you drive, the way you invest, the food you eat and the products you buy.

If I am right, it will be the reversal of everything you’ve come to know.

We are about to witness a crisis that will drive the great American middle class into extinction.

The American Conservative says: “The American Middle-Class is Disappearing.”

Fortune lamented: “The American Middle-Class is at the End of an Era.”

And CNBC declared: “The Middle-Class is Disappearing.”

But, they don’t know THE why. Well, this … THIS is the why.

If you don’t act now, you could lose more than you ever thought possible. This is a terrible fact. But it cannot be hidden or sugarcoated any more.

The lifestyle you have worked so hard to achieve is about to be altered irrevocably.

But even as America unravels, and debts soar, markets retreat, taxes skyrocket and incomes shrink — there are still ways you can shelter yourself from the coming carnage — perhaps even profit from it…

I’ll tell you how in a moment. I’ll even show you what I’ve been doing to prepare for this calamity.

Look, I know this is a strange time, and the media only makes it more confusing.

They’ll tell you that inflation is going down…

Yet you’re still paying more for gas, groceries and energy than you did just two short years ago.

And they’ll tell you that stocks are poised to rally…

Yet your portfolio has likely taken a beating, setting you back 5, maybe even 10 years.

My research has led me to one conclusion, one I am wholly confident in.

So now, I’ll give you my warning in a simple yet direct form: Sometime in the near future — when you least expect it — the biggest asset bubble in U.S. history will burst.

A bubble inflated to epic proportions by low interest rates, absurd entitlements and reckless fiscal policies.

- Stocks will crash 50%.

- Real estate values will be slashed in half.

- Unemployment will skyrocket to record levels.

America’s once great economy will fall into a prolonged recession, possibly a depression.

You’ll be among the few who know this is coming. The majority won’t fare so well.

Again, my colleagues and I call this the “middle-class massacre.”

Because it’s the hardworking middle class who always take it on the chin in times of crisis.

The poor don’t have much to lose, and they’ll keep getting more and more free stuff from the government.

The rich will find ways to shelter their wealth and grow even richer.

It’s part of the reason they get richer, and richer, while the rest of us get left behind.

But what about the people in between? The millions of Main Street Americans who earn their money honestly, who toil and sweat, what happens to them?

I’ll tell you what will happen — they will be financially massacred.

It’s historically inevitable.

It’s what led to the downfall of the Roman empire. Both inflation and war hit its middle classes especially hard and without a strong middle class, the empire stumbled and fell.

You can see the phenomenon today in high-inflation countries.

In Venezuela, the rich were able to dodge inflation with bank accounts in Miami. The poor had nothing to lose. But the middle class was almost wiped out.

In Argentina, inflation is said to be approaching 100% per year. The rich are moving their money to safety (after so many years of financial crises, they know what to do.) The poor rely on welfare payments. And the middle class, they’re left fighting for their lives to simply provide essentials for their family.

I know this to be true because my company has an office there, as well as about a dozen other countries around the world.

And what’s heading our way will make the dot-com crash, the 2008 financial crisis and the COVID crash seem like a walk in the park.

Our economy is extremely fragile.

More fragile than any other time in history.

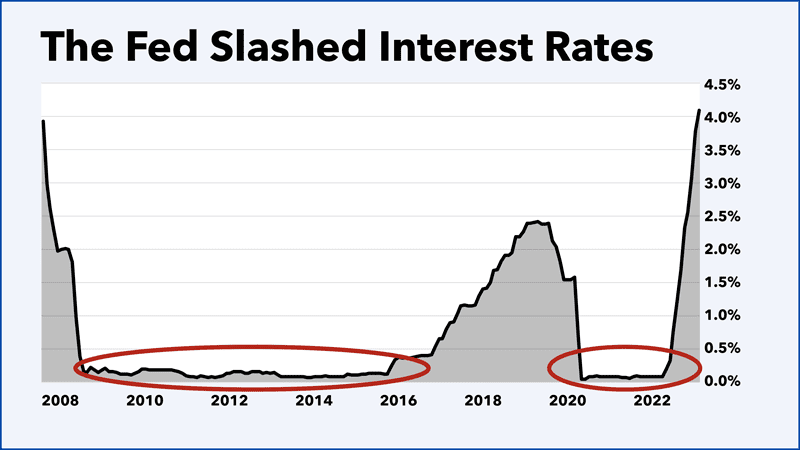

We have to be real with ourselves. Much of our recent “success” came because the Fed recklessly slashed interest rates to nearly 0% for 9 of the last 13 years.

And even that wasn’t enough to keep us going!

So, when things got “tough,” the government took the easy way out – they handed out free money.

$900 billion in student debt forgiveness … granted.

$1 trillion in welfare … granted.

$2.5 trillion in the “American rescue plan” … granted.

With all that free money and low interest rates, how could the economy not look strong?

But eventually, the bill comes due, and the government runs out of stimulus.

They’ve had to hike interest rates and cut free giveaways. The party is over.

Apparently, these Ivy League geniuses didn’t realize that all that cheap money causes inflation.

The great U.S. economy is toppling over as the foundation crumbles beneath our feet, igniting the middle-class massacre.

So what’s next?

The first punch to the financial gut will be the stock market.

Yes, the stock market has been volatile for a while.

But that volatility is a mere warm-up act for a much more unforgiving crash.

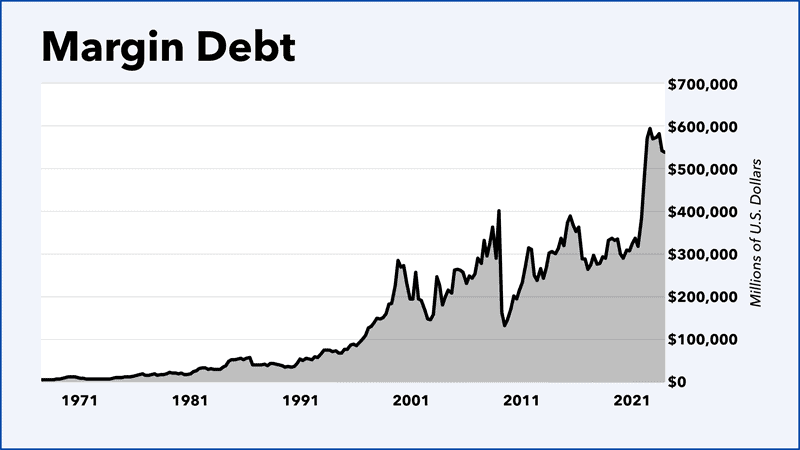

That’s according to data from the government’s own sources that track margin debt. Margin debt measures the amount of money being borrowed, to invest in stocks. As you can see, banks and Wall Street firms are leveraging all the money they have at dangerous levels. This is gambling and speculation in its most extreme form.

And as you can see, its approaching double the levels we saw in 2000 and 2007. And we all know what happened soon after. Companies like Lehman could not pay back all that money they borrowed. They collapsed and brought the entire market down with it.

The market ultimately dropped 55% … and the middle-class had to bail them out.

And it will happen again. As stocks go down, Wall Street will get margin calls and they’ll be forced to sell their positions immediately, which will accelerate the markets sell-off.

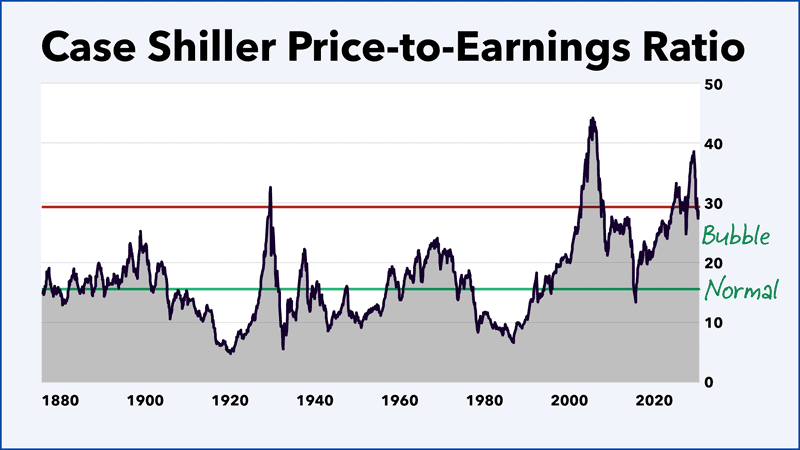

The Case Shiller Price-to-Earnings Ratio is also flashing red.

In a healthy, normal stock market, the ratio is about 16. That means it will take 16 years for a stock’s earnings to equal its price. But right now, the average stock is sitting at 29.

That’s nearly 100% higher than normal.

The only other times we have seen the PE ratios this high was in 1999 and 2007. Again, both times this happened, stocks dropped by 50% and 55%.

So, we know that prices are at maximum levels and people are using maximum margin to get there.

But there are several other warning signs of a looming stock market crash. I’ll give you just one more example …

This one is very straight forward.

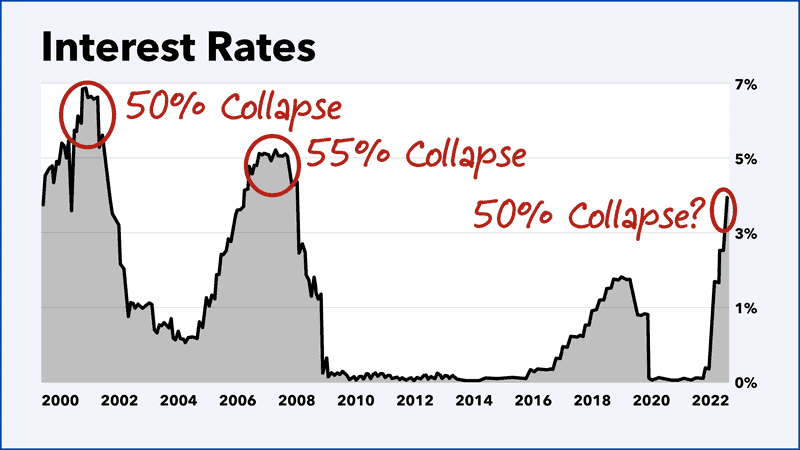

Every time the Fed raises interest rates rapidly, a stock market crash follows.

Take a look.

We saw this in 2000, which triggered a 50% collapse in stocks.

And then in 2007, which triggered a 55% collapse in stocks.

And now here we are again, with rates going up even higher … so, another 50% collapse is inevitable.

I think you can start to understand why…

Legendary investor Jeremy Grantham earlier warned stocks could crash around 50% — but said the outlook has become much darker.

Famed Big Short investor Michael Burry agreed, warning the “mother of all crashes” is coming.

And Robert Kiyosaki warns of the “biggest bubble in history” stating: “God have mercy on us all.”

Remember what it was like during the crash of 2000 and 2008? Well, we are about to go through another crash like those. Most likely, worse.

Millions will see their nest eggs cut in half. They’ll have to put off retirement another 10 years, or perhaps, forget about the concept of retirement altogether.

For those in retirement — it could be catastrophic.

And you know what, this is exactly what Federal Reserve Chair Jerome Powell wants. As Bloomberg reports: “Jay Powell needs investors to lose money. Yes, that pain you’re feeling is intentional. It makes the Federal Reserve’s job easier.”

Of course, since he is the guy pulling the financial strings, he isn’t too worried about it.

That’s because he already sold as much as $5 million at the peak of the market in 2020 in preparation for his rate hikes. His friends in the Fed did the same.

Again, this is why the rich get richer, while the rest of us get left behind.

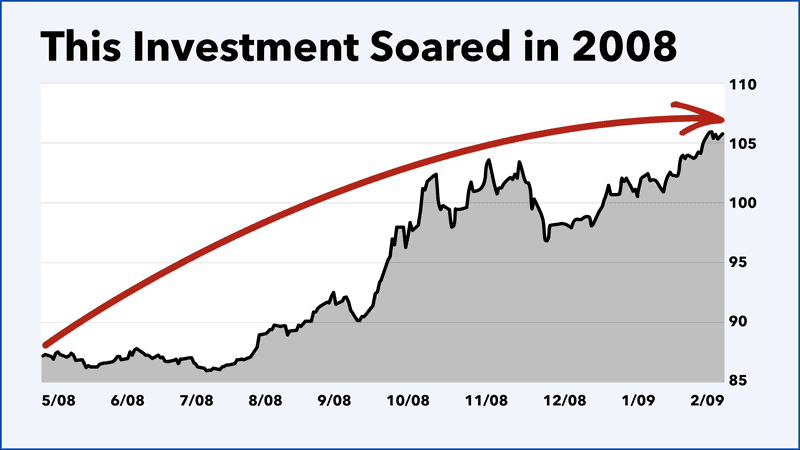

But, with all that said, remember, there are ways to profit. We showed people how to make a 100% gain in 2000, and I guided investors to a 261% gain in 2008.

More recently, after the 2020 crash, I even helped people make gains as high as 301%, 781% and 919% on stocks like Generac, SunPower and Tesla in less than two years.

And we aim to do the same in the months and years ahead.

More on how we will do that in a moment.

First, you need to know that the stock market will just be the first bubble to burst in this middle-class massacre.

The real estate market is the second bubble.

As you know, real estate prices have been zooming higher. This was accelerated to unsustainable levels as the Fed dropped interest rates.

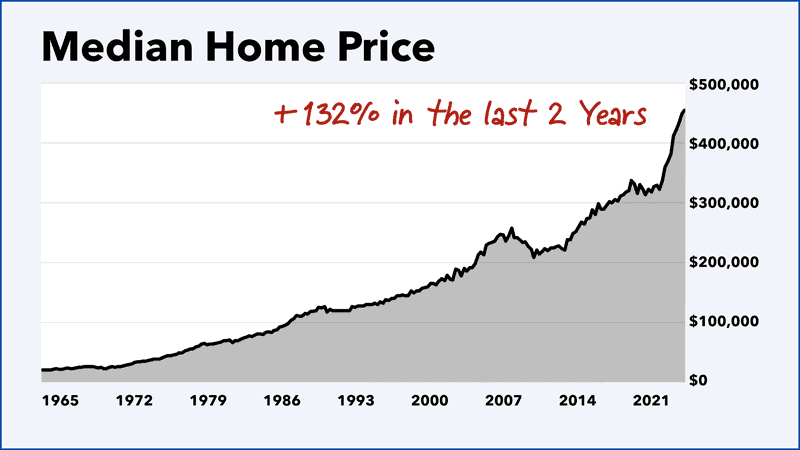

What you may not know is exactly how big this bubble really is: The median home price went up more than $132,000 in the last two years. That’s more than it went up in the previous 20 years.

That is the definition of a bubble if there ever was one!

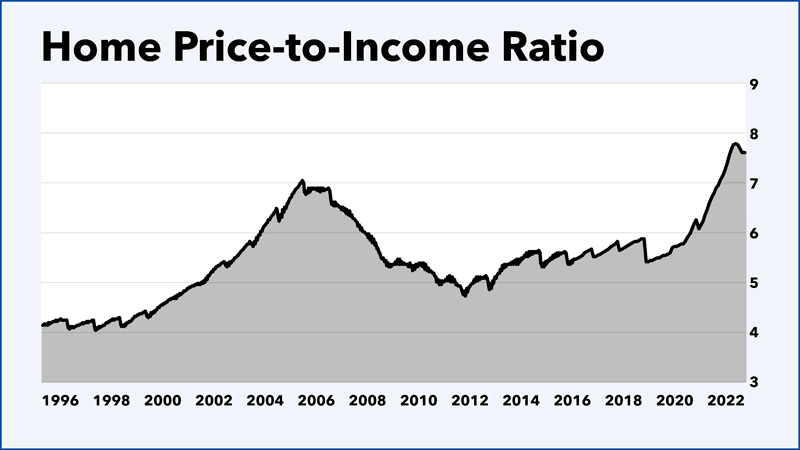

And now the home price-to-income ratio is at an all-time high …

Home prices are now 7X higher than average annual income.

People simply can’t afford to pay these prices anymore.

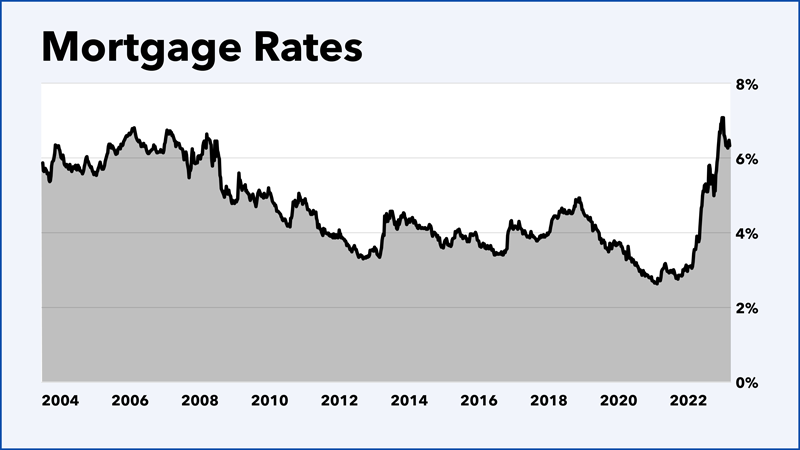

And with interest rates on the rise, mortgage rates are also skyrocketing. They’re at their highest level since the last crash.

And Federal Reserve member James Bullard, has warned its benchmark interest rate could go up as high as 7% — nearly DOUBLE where it is today.

Which means mortgage rates could also double, hitting 10%, even 15%.

And that means real estate prices must fall.

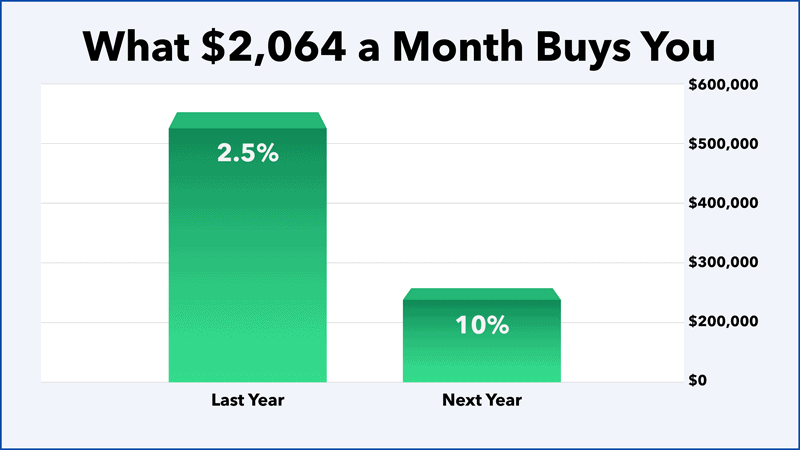

You see, the average person can afford a mortgage payment of $2,064.

At a 2.5% interest, that was enough to buy a $525,000 home.

But with interest rates at 10% — one can only afford a $240,000 home.

Which is why prices are already starting to unravel.

Last quarter alone, prices dropped $45,000 … at the fastest rate in history. That’s not the only thing going down.

Mortgage purchase applications are down 41% year over year — less than we saw at the bottom of the ‘08 crash. Mortgage refinances are down a staggering 84% from last year. And existing home sales have declined for 10 straight months, that’s the longest stretch since 1999.

Meaning listings are on the market for increasingly longer times, and prices must come down.

Bottom line, based on all the data, real estate will crash at least 50% in the coming months.

The New York Times stated: “The Housing Market is Worse Than You Think.”

InvestorPlace revealed: “3 Indicators of a GIANT Housing Market Crash.”

And Forbes is warning of a possible “Housing Market Crash.”

And that’s exactly what Fed Reserve Chair Powell wants. He calls decelerating prices a “good thing.”

But he’s a multimillionaire … so he’s not too worried about a crash in home equity, is he? When you’re in the 1%, and have more money than the 99%, these aren't game-changing problems. In fact, they lean in and find ways to profit.

In the last crash, hedge fund managers like David Einhorn of Greenlight Capital bet against the market and generated $2 billion in profits.

Michael Burry, famous for The Big Short, made $800 million.

And John Paulson made $15 billion.

So, as you can see, the 1% is making a killing and the divide between them and the rest of us just keeps getting bigger and bigger.

It’s the middle class who get financially massacred, because the equity in their homes gets wiped out.

Mixed with the stock market crash, things will get tough.

But again, there are ways to make a profit during these times. Which is why pulling back the curtain and showing you how the 1% makes their money. Yes, you can target gains the same way they do, if you know what to do.

But you’ll want to do it soon, because the third bubble is starting to pop right now.

I’m talking about the employment bubble.

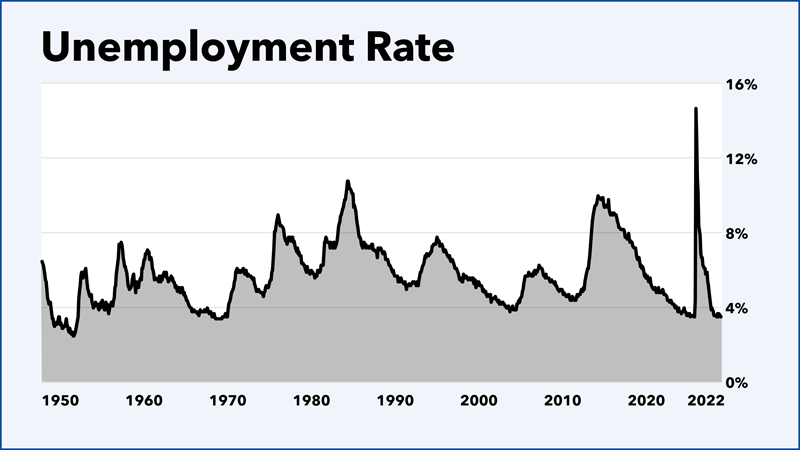

Yes, right now, government officials are bragging that the unemployment rate is low, and that it’s the lowest it’s been in decades.

I think you’ll agree, that something just doesn’t seem right.

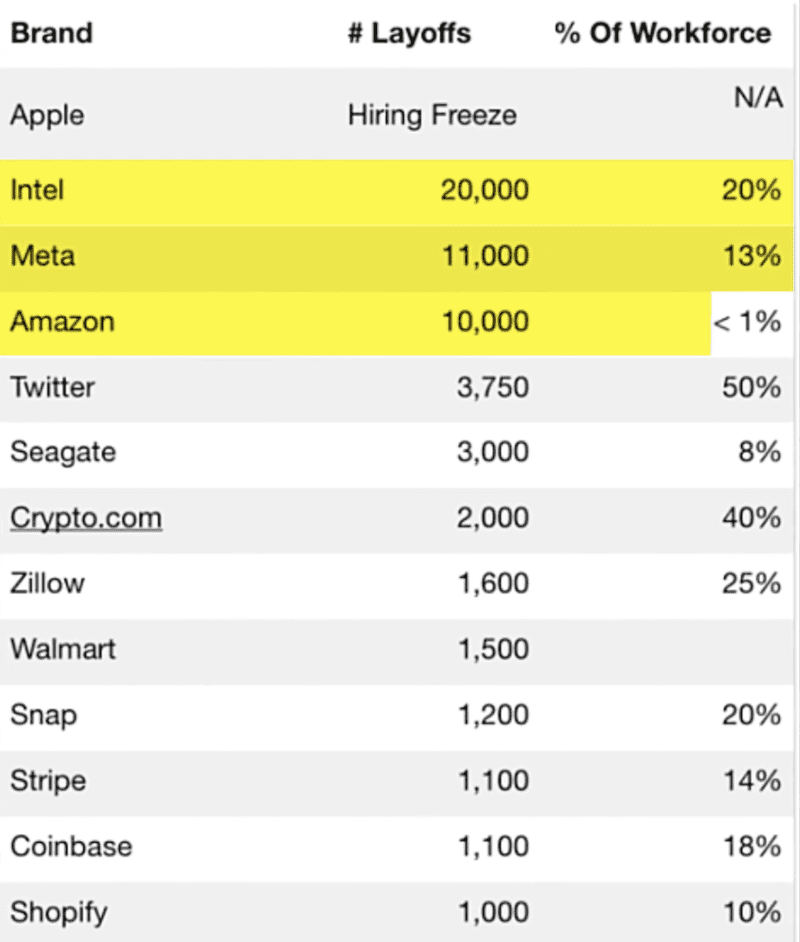

I mean, how can that be accurate when we hear about massive layoffs and hiring freezes by companies from coast to coast on a regular basis. Just look at this list:

Intel, Meta and Amazon alone have let go of 41,000 jobs … tens, of thousands, of people have become newly unemployed in the last few months alone.

So, what’s going on here?

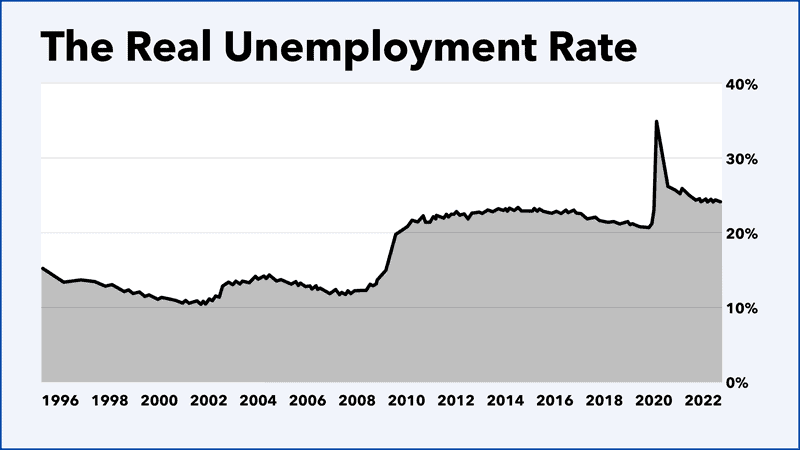

Well, here’s another dirty little secret: The U.S. government does not report the real unemployment numbers.

Not. Even. Close.

You see, starting in 1994, long-term discouraged workers, meaning those who have been unemployed for more than two years and are no longer collecting their unemployment benefits, were no longer counted.

The government literally pretends they don’t exist.

The more accurate number, the real unemployment number, is nearly 25%.

So, how can we have a healthy economy if this many people are not working?

The answer is, we can’t.

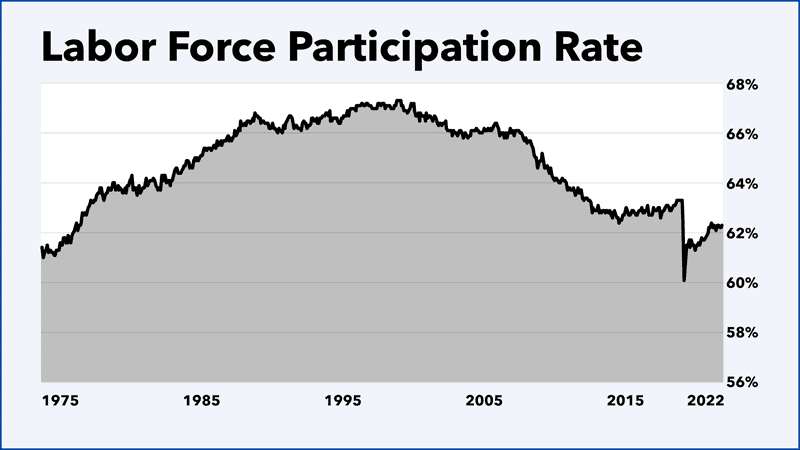

This is the labor force participation rate. It shows how many people are actively working. As you can see, the number of people actually working is at the lowest level we’ve seen since the late ‘70s. And we all know what a great decade that was.

And while Washington is doing a good job of reporting “better than expected” unemployment numbers, they won’t be able to keep this con game going for long.

When the economy begins to implode, and it will implode, expect the real unemployment numbers to jump to 30% this year. Then expect it to surge as high as 50% within the next few years.

And half of all middle-class Americans in their prime-earning years will be unemployed, which will further cause the stock market bubble and the real estate bubble to implode further.

And for those working, expect wages to fall.

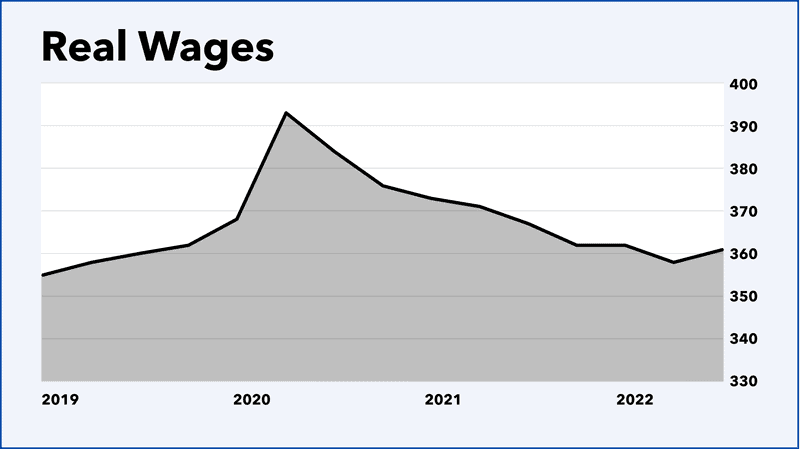

This chart shows real wages, it factors in the cost of food, utilities and fuel. As you can see, real wages are down.

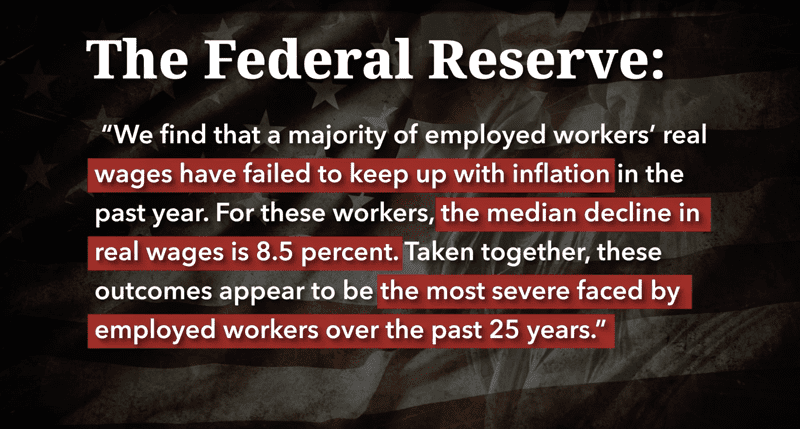

Of course, the Federal Reserve knows this. They admitted: “We find that a majority of employed workers’ real wages have failed to keep up with inflation in the past year. For these workers, the median decline in real wages is 8.5 percent. Taken together, these outcomes appear to be the most severe faced by employed workers over the past 25 years.”

In short, the middle class is taking it on the chin.

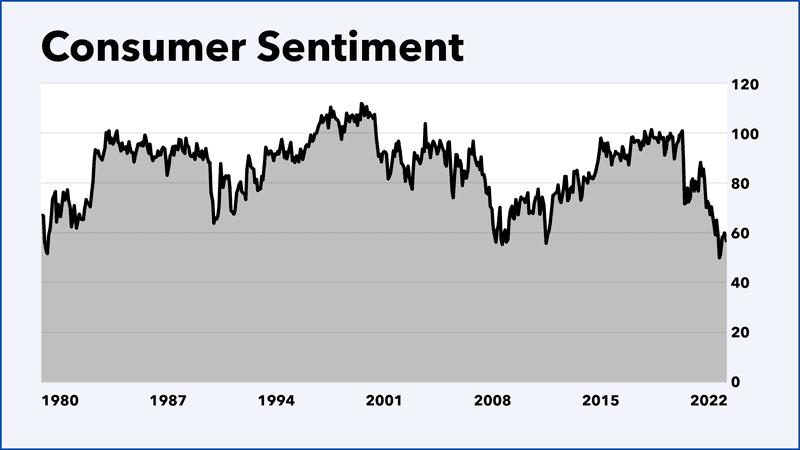

It’s a big reason why so many Americans feel negative about their outlook. This Consumer Sentiment chart measures how people feel about the state of the economy. As you can see, not surprisingly, we’re at historically low levels.

People feel worse today than they did in 2020, 2008, 2000 and even in 1980.

And again, this is exactly what the Federal Reserve wants. At a recent press conference, Fed Chair Powell admitted that he wants to send the U.S. economy into a recession:

“We have to get supply and demand back into alignment and the way we do that is by slowing the economy … and soften labor market conditions.”

That’s Fed speak for saying he wants millions of Americans to go from the assembly lines to the unemployment lines.

That’s because these geniuses now realize that trillions of dollars in free and cheap money created a massive asset bubble in stocks, real estate and wages, and they need a recession to pop these bubbles.

And the media is just now catching on…

- “The Fed Pricked the Everything Bubble” — The Wall Street Journal

- “The Asset Bubble That’s Quietly Popping” — Politico

- “Get Ready, the Fed is Popping the Everything Bubble” — Business Insider

The reality is: The Fed doesn’t want this bubble to burst – they want a “soft landing.”

I want that too. Along with a money tree in my backyard.

But this isn’t a fairy tale. You can’t create asset bubbles and pop them without dire consequences.

Have you ever tried to pop a bubble gently? You can’t. It just pops and splatters all over the place. And that’s what will happen to our economy.

You’ve seen the data for yourself.

What we are about to experience will be worse than any past crises. It will feel very similar to the decade-long recession of the 1970s. Perhaps as bad as the Great Depression. Maybe worse.

Here’s how I see this playing out…

The stock market will fall 50%, along with 401(k)s, IRAs and pension plans. Those planning on retirement will have to put those plans off for 5, maybe 10 years.

Many retirees will find themselves begging for minimum-wage jobs.

Real estate will get cut in half … giving up over $100,000 in equity as foreclosures pop up in every town across America.

And wages will crumble while REAL unemployment soars as high as 50%.

All of this is already starting to unfold.

But, I want you to know that there are solutions, ways to escape the financial calamity, and I want to quite literally put those solutions in the palm of your hand.

These are the same solutions I am using for my family, and I am confident they are appropriate for you as well.

And, there are ways to make money. A lot of money. Again, the last time we faced a crisis like this, I helped people unlock gains as high as 301%, 781% and 919% on stocks like Generac, SunPower and Tesla in 2 years or less.

At the end of this presentation, I’ll show you how to get access to investment opportunities like this.

You need it now more than ever.

The Fed is hellbent on “gently” popping this economic bubble. Which is what they tried to do in 1999, and 2007. But it never works. And when there is no soft landing, they’ll blame foreign countries, past administrations and each other.

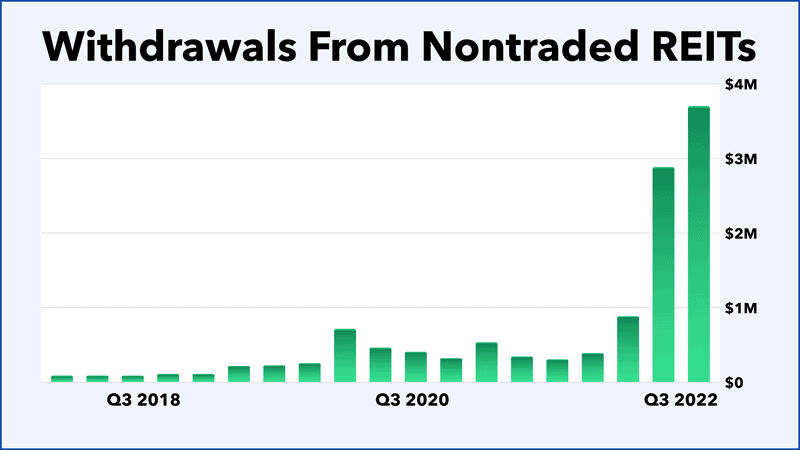

The rich already know what’s about to unfold. Which is why billionaires like Elon Musk, Jeff Bezos and Mark Zuckerberg sold a record-breaking $43 billion in stocks at the top of the market.

The wealthy are also cashing out of real estate funds as fast as possible … the a 12-fold year over year increase in redemptions.

And they’re all putting their money in the one asset that can go up when everything else goes down.

In fact, a record-breaking $5 trillion has flooded into this asset … 50% more than normal.

I want to show you how to make the same move in a moment, in your 401(k), IRA or even with the cash in your bank.

You’ll want to make this move soon. Everything is starting to unravel.

And the sad thing is this: If Washington had listened to our forefathers, they could’ve averted this massive boom and this massive BUST.

That’s because our Founding Fathers warned us of this economic sin, calling it a “curse” and the “greatest of dangers.” But, our government blatantly chose to ignore those warnings.

They committed this crime anyway.

What danger am I speaking of?

What danger could possibly cause a crash in stocks, real estate and employment? What could fuel the entire middle-class massacre?

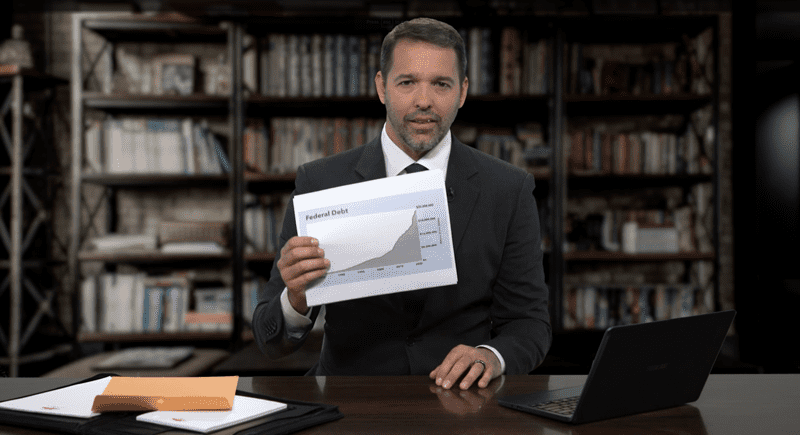

Debt.

Lots and lots of debt…

You see, the sad truth is that much of the prosperity we’ve achieved over the last 40 years did not derive from hard work or innovation, but rather, from debt.

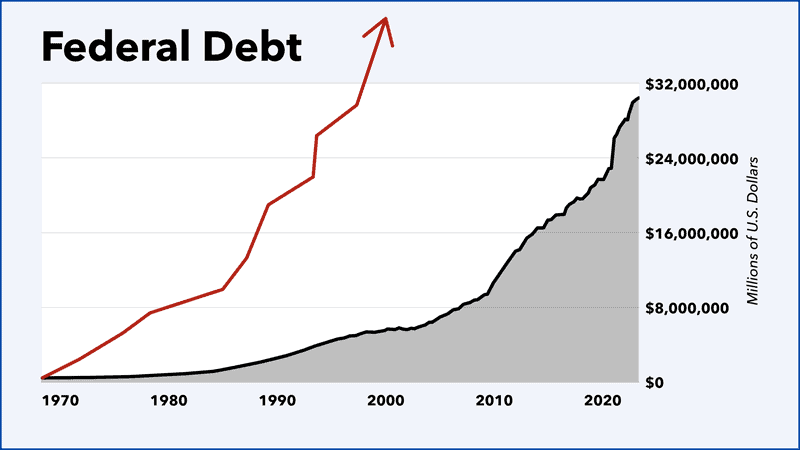

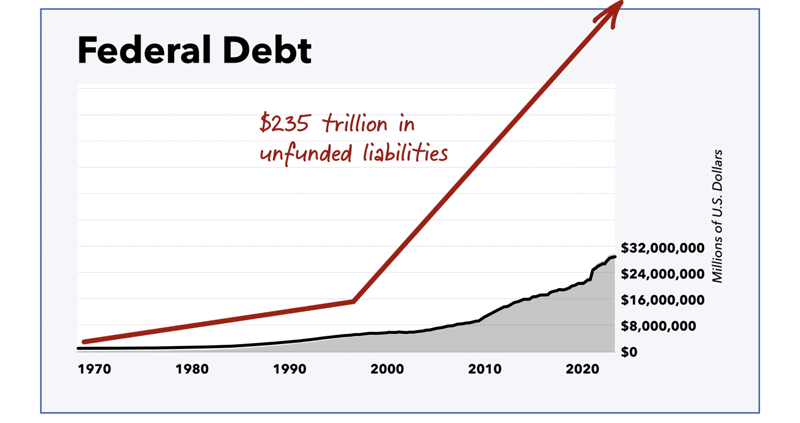

Take a good look at this chart…

In 1980, our federal debt was at $1 trillion.

Today, it is 33 times larger.

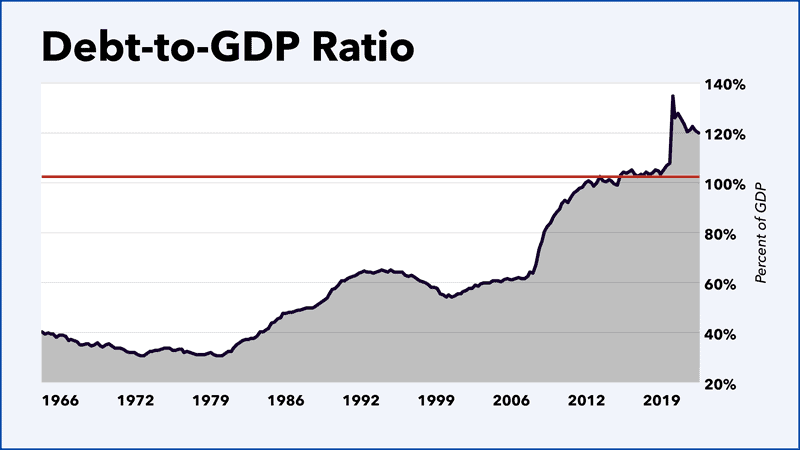

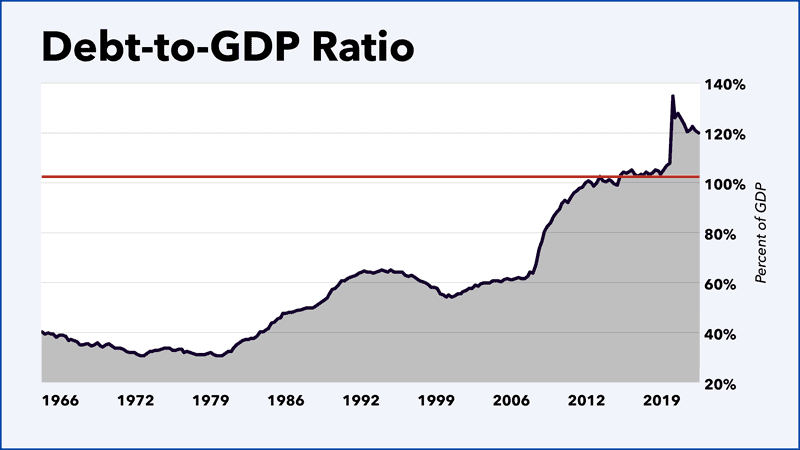

And historically, we were told that was OK, as long as our “debt-to-GDP ratio” stayed under 100%, because then, we’d always make enough to pay off our debt.

Well, we are now at 125%.

This means we aren’t making enough to pay off the debt…

This puts us in the same class as Libya, Sudan and Venezuela.

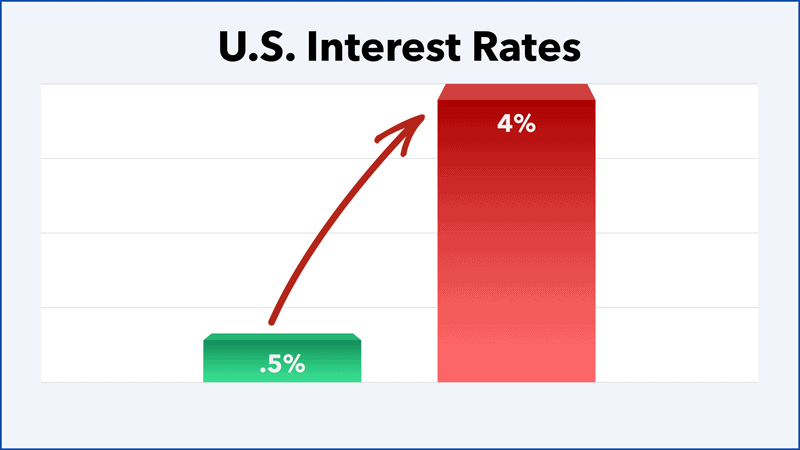

And now that the Fed has been forced to raise interest rates, things are spiraling out of control. That’s because Uncle Sam has to borrow this money through bonds, and his .5% interest rate has jumped up to 4%.

The Congressional Budget Office warned that interest payments ALONE will total around $66 trillion over the next 30 years costing more than defense, Medicare and social security.

In fact, 4 out of every 10 dollars you pay in taxes will go to paying the interest on that debt — up from $1 today.

Which is why Washington just enlisted 87,000 IRS agents to hunt down and squeeze MORE money out of you, me and every other tax-paying citizen.

And who are those “people”?

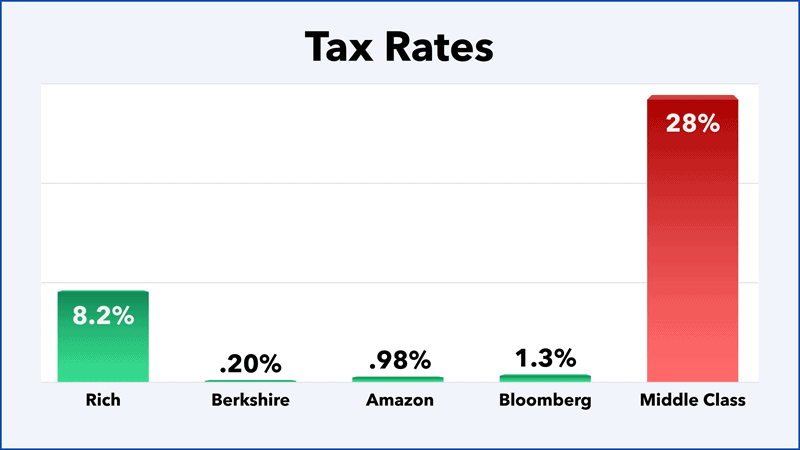

We know it’s not Washington’s wealthy donors. A new study actually found that the richest 400 Americans paid a tax rate of just 8.2%.

In fact, Warren Buffett’s Berkshire Hathaway pays a true tax rate of .10%. Jeff Bezos’ Amazon pays .98%. And Michael Bloomberg’s company pays 1.3%.

Odds are, you pay a higher rate than that, don’t you?

And as for poor, well, they pay next to nothing after all their tax credits.

It’s the middle class…

It’s the middle class that carries the burden. It’s you. It’s me. It’s the farmer, the contractor and the trucker. The teacher, the nurse, the police officer.

And here’s where things get really scary.

As bad as our federal debt is, it’s merely the tip of a much, much bigger iceberg. Because that $31 trillion does not include $235 trillion of unfunded liabilities. Things like social security, Medicaid, Medicare, unemployment compensation, food stamps and more.

I know that number is hard to wrap one’s head around. So, let me make it real for you.

You owe $803,030.

In fact, each person in your family owes $803,030. That’s a whole lot of money.

I think you can see why debt is the exact curse our Founding Fathers told us to avoid at all costs…

Thomas Jefferson said:

Alexander Hamilton warned:

George Washington said::

John Adams warned:

And James Madison said:

Yes, a greater curse than any other.

If only Washington had heeded our forefathers’ warnings.

Instead, the politicians made promises. Promises to pay out lots and lots of entitlements in return for lots and lots of votes.

Many of these are great promises. The problem is, none of these politicians ever figured out how to pay for these promises.

Why would they?

All they care about is making people happy during their four years in office so they can get elected for another four years. I can only imagine the disappointment in our Founding Fathers’ eyes if they were to see this today.

They worked endlessly, and risked their lives, to create an America that would provide “life, liberty, and the pursuit of happiness” for all.

But politicians — on both sides of the isle — over the last several decades have ruined it. They committed the one act of crime our forefathers labeled a “curse.”

A healthy nation grows from productivity, not debt. Which is why our entire economy is skating on thin ice.

We are past the point of no return. We cannot dig ourselves out of this hole because we are literally in the situation where the money our government is taking in is not enough to cover its debt payments.

That’s like a person taking out a credit card to pay off an existing credit card. It’s a dangerous maneuver that will end very, very badly.

And unfortunately, it’s not just on the federal level.

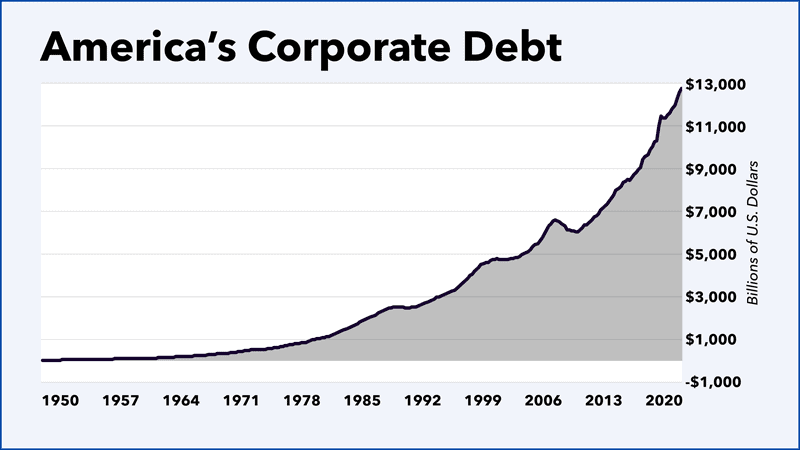

This chart reflects America’s corporate debt. As the Fed lowered interest to nearly 0% for 9 of the last 13 years, corporate America borrowed more and more money to fund its ventures.

They were “growing” because there was access to practically free money.

But now, as interest rates have surged, the era of free money has vanished.

The party is over.

Funding future growth with debt is now too expensive, and companies that were expanding are now contracting … they’re cancelling projects, abandoning office buildings and laying off employees.

Thousands of companies will run out of money, and declare bankruptcy.

And just as worrisome is debt Main Street Americans have taken on.

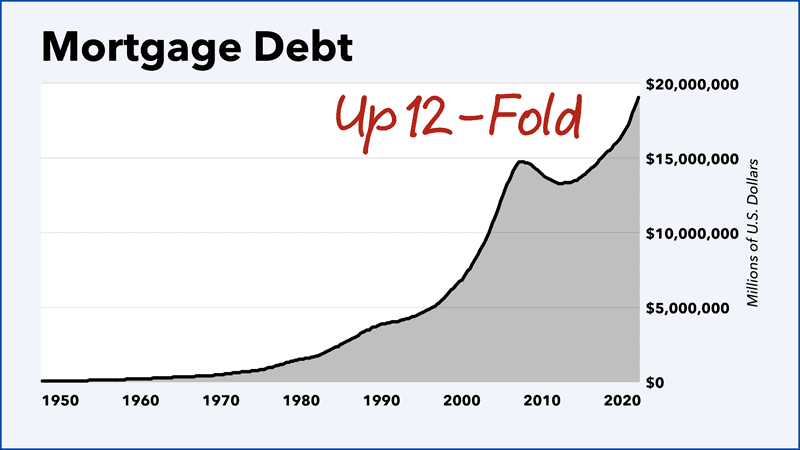

Take mortgage loans for example. Mortgage debt is up 12-fold since 1980.

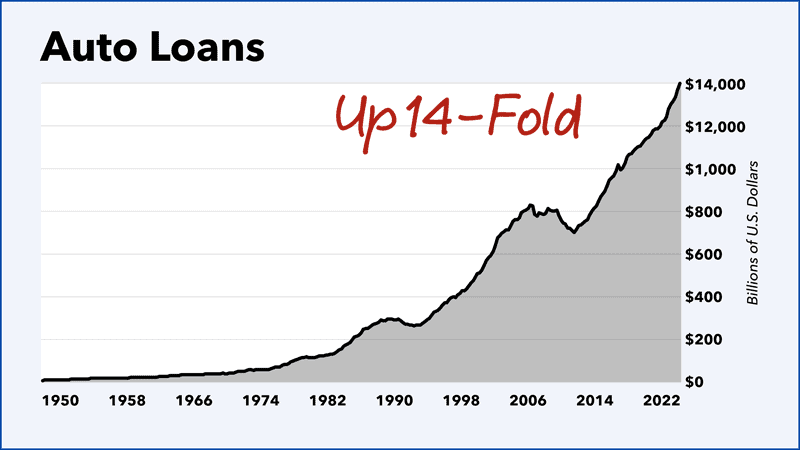

And then there’s auto loans. It’s up 14 times higher than it was in 1980.

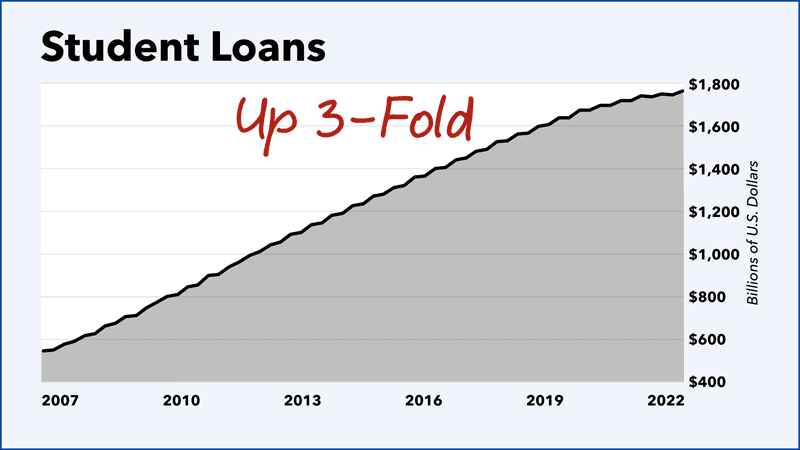

And student loans have risen 300% higher since 2007 when we started tracking this data.

Mark my words: This is not going to end well.

America’s private debt is unpayable.

Most Americans are tapped out and overleveraged.

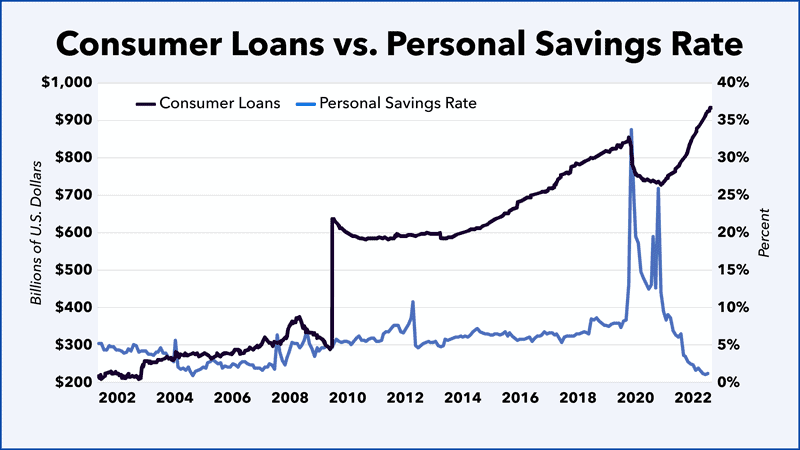

Which is why credit card debt is 500% higher than it was 20 years ago.

And perhaps more alarming, is that the personal savings rate is at an ALL-TIME LOW. All that money given out in 2020, which you can see here, has been spent.

So, savings is going down while debt is going up, I think you can see how this ends.

All this debt, the trillions and trillions of debt, truly are a burden. A curse. The greatest of dangers, on both a personal and national level.

It will lead to the middle-class massacre.

Which is why some economists are now sounding the alarm…

Revealing the true depths of our debt crisis.

Stating that Americans are foolishly ignoring the threat of the debt crisis.

And stating that debt is bankrupting America.

More and more economists are starting to raise red flags.

But they — Wall Street, Washington and the Fed — do not want you to know what’s about to unfold.

Think about it.

It’s in their best interest to have you believe everything’s chugging along fine.

That’s why Bloomberg says: “U.S. Debt is Massive and Expanding. It’s Also Under Control.”

And President Biden even bragged that he reduced the debt by $1.7 trillion … which was completely false.

They don’t want you to know that it is mathematically impossible for the economy to recover and that it’s their addiction to debt that will send this house of cards crashing.

They want you to go to work, pay your taxes and invest in your 401(k) like a good little lemming.

Well, it’s time we do what our forefathers did so many years ago, flip the tables and take control of your own financial future.

You can still protect yourself, your family and your wealth, just like I have.

But here’s the thing: You must act NOW!

There’s little time left.

The evidence I’ve shown you is clear.

The stock market is on the cusp of collapsing a full 50%, real estate prices will be slashed in half and employment will dwindle as the trillions of dollars of debt weigh upon us.

You need to prepare right away. As in, today.

You owe it to yourself, and to your family, to get a clear picture of what’s ahead.

Which is why I am going to rush you my new report. It’s called: How to Survive & Prosper the Coming Middle-Class Massacre.

In order to soar through the new era ahead, you’ll need a whole new financial plan. In this report, I’ll introduce you to an “alternative” investment universe of outstanding (yet misunderstood) secure opportunities.

In this report, you’ll learn about something everyone is telling you to sell right now…

It can be safer than stocks, commodities and bonds, yet in times of crisis, it has more upside.

In fact, when the markets crashed in 2008, it was one of the few things that soared when almost everything dived…

And the same thing happened when the recent pandemic struck…

In fact, it can be as safe as a bank CD!

Investments in this universe are some of the most liquid in the world, with over $600 billion trading every day in some cases.

And in times of trouble, this is hands-down the No. 1 investment the wealthy runs to. Which is why over $4 trillion is currently sitting in one of the largest investments around this asset.

And in this report, you’ll learn all about it.

Plus, you’ll learn a slew of other unusual opportunities to profit through the era ahead, including:

- A radical US-based bank that offers an unusual investment that has tremendous upside and ZERO downside. That’s right, you can’t lose a penny — even when everything else is crashing. Even better, this unique investment — that no other bank in the world (that I’m aware) offers — is FDIC-insured.

- Playing the “other side of the market” with an investment similar to the Prudent Bear Fund that our firm recommended in 1999. This is the trade that could have handed our readers 100% gains — a three-year period when others saw their portfolios slashed in half.

- How to use the Big Short technique that I used to hand my hedge fund investors 261% gains during the worst 18 months of the 2008 financial crisis. I’ll show you three of these opportunities to make a fortune.

It’s all in your FREE copy of How to Survive & Prosper the Coming Middle-Class Massacre.

But, due to the urgency of this situation, I want to go a giant step further.

I also want to equip you with our newest report: Infinite Income.

To outpace inflation, side step crashes and beat the market, you’ll want to dive into this report right away. Today, if possible.

It reveals how a small-town banker in Quincy, Florida, told friends and family to buy a $19 stock during the Great Depression.

Those who still hold this stock (which are a lot), now make $645,000 every year!

Which is why the tiny town of Quincy became the richest town in America.

And now, we want to create our own richest town in America. Which is why we reveal our No. 1 infinite income play inside this report. A stock that we believe will pay an infinite income stream for decades to come so that you can:

- Outpace inflation: For the last 60 years (as far back as the data goes), infinite income stocks have outpaced inflation tenfold!!!

- Sidestep crashes: This infinite income stream is so much more reliable than regular stocks, you could come to embrace stock market crashes.

- Beat the market by 800%: Dividend-growth stocks have outperformed regular-growth stocks, bonds and the like for the last six decades (again, as far back as our research goes).

In the era ahead, you’re going to need to generate as much income as possible.

And in your free copy of Infinite Income, that’s what you’ll discover how to do.

I want you to have both of these reports, Infinite Income along with How to Survive & Prosper the Coming Middle-Class Massacre, for free.

Now of course it goes without saying that all investments carry some level of risk and there are no guarantees of future returns … the opportunities I’m discussing with you today are no different.

But I wouldn’t be telling you about these investments today if I weren’t entirely confident in their potential. The key is to invest only what you feel comfortable investing.

Which is why I also want to invite you to become a member of my Strategic Fortunes community, 100% risk-free.

This membership includes…

Access to my model portfolio which details every investment I recommend. You’ll see the buy price and why I’m recommending it. Best of all, you’ll get a 48-hour head start on any investment I make. And when it’s time to sell, I give you the same lead time.

Now, not every pick is a winner. No investment strategy is perfect. But as you can see, our top gains are very strong.

Along with all these other stocks.

I have no doubt more profits like these will come in the years ahead.

A membership also includes access to all trade alerts.

Any time I make a trade, you’ll be notified by email, with the option to get a heads-up via text and through my app.

It really does make investing simple.

You just get the trade instructions, along with why I’m making that trade, and you decide if you want to join in on it. All it takes is about 10 minutes a month.

Additionally, you’ll get full access to my weekly webinar.

In it, I update you on our positions and answer the common questions coming in from the community. I’d love to have you participate.

You’ll also get access to my entire team at Banyan Hill through our daily e-letter, The Banyan Edge. This includes insights from Charles Mizrahi, a 40-year Wall Street veteran who called the crashes of ‘87, 2000, 2008 and 2022.

It also includes Michael Carr, a Chartered Market Technician and former nuclear missile architect, who designs short-term trading strategies to beat the market.

Amber Lancaster, a Bloomberg expert.

And Adam O’Dell, who designed a stock power rating system to beat the market 3-to-1.

My team, is now your team.

One more final benefit. Every month I release an eight-page report that details new investments we are making. I do more of a deep dive in these reports. I analyze our stock picks so you can feel confident should you choose to invest in it.

I hope you can see the benefit to becoming a member.

Over 100,000 Americans have already joined, and they love what they see. Here’s a bit of our favorite feedback.

Michael wrote in:

Harry said:

And Ronald bragged:

I’d love for you to become our newest member, and get a similar note from you in a few months.

It’s why I do what I do…

You see, when I first started as an investor, I lost nearly every dime I had. I was ready to quit. And that’s when a senior investor took me under his wing. He told me: “Now that you know how to lose money, let’s see if you can learn how to make it.”

And thanks to his guidance, I did.

I’ve made money through every boom and bust during my career, and all my financial worries are in the past. I want the same for you … to be your mentor, and guide you through the economic landmines ahead of us.

To help you bridge this gap…

To no longer being concerned about inflation, or a market crash or a housing crisis, or unemployment.

To know what it’s like to live financially secure.

And as a member of my Strategic Fortunes community, you’ll always be ahead of the curve.

It will be like getting tomorrow’s newspaper, today.

And that kind of advantage can make you wealthy. Very wealthy.

In fact, the opportunity will be huge if you’re prepared. As this “everything” bubble crashes — those who are positioned properly will reap the rewards.

Not only to get to rich from certain “down-market” investment strategies, but also from the small group of companies that have the potential to thrive in the coming years…

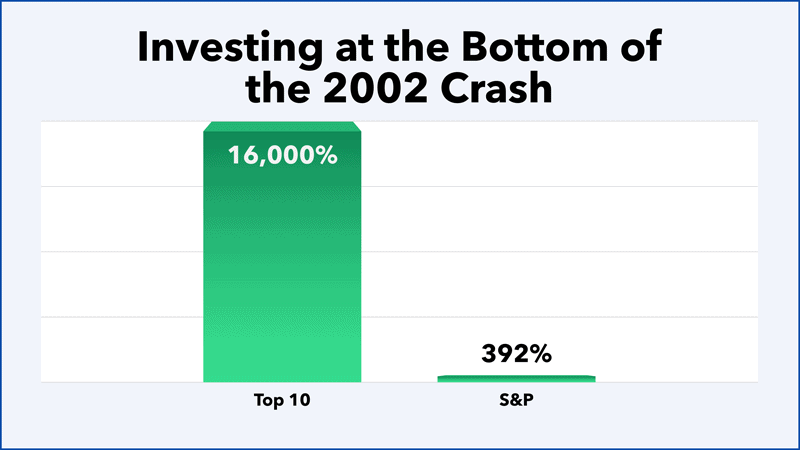

In fact, had you invested in the top 10 companies at the bottom of the 2002 crash, your average gain would be 16,000%.

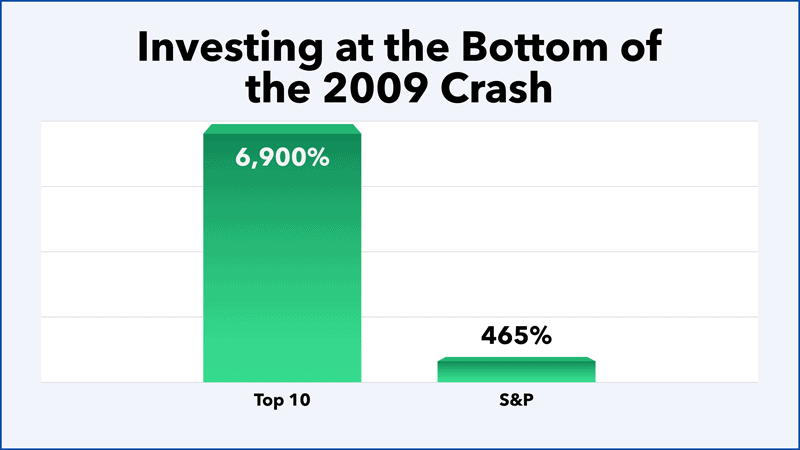

And had you invested in the top 10 companies in the 2009 bottom, your average gain would be 6,900%.

Those are the kind of companies we’ll be targeting during this next crisis.

And I want to give everyone I can the opportunity to join.

Which is why a membership to Strategic Fortunes costs just $199 a year.

I think that’s a great deal — and a far cry from the $1 million my hedge fund clients had to ante up for access to my research.

But because of the tumultuous times I see in the coming months, and because I want to help as many people as possible — I’d like to offer you a much better deal.

If you join today, through this special offer, I’ll see to it that you pay just $47 for an entire year of my work, so you can know exactly what to expect in the months ahead, and how to prepare for whatever comes our way.

Your benefits include…

- Special report No. 1: How to Survive & Prosper the Coming Middle-Class Massacre.

- Special report No. 2: Infinite Income.

- A one-year membership to Strategic Fortunes that includes access to the model portfolio, trade alerts, weekly updates, monthly issues and more.

With that said, I want to make sure NOTHING is holding you back.

So, here’s the deal. Your membership comes with a 100% satisfaction guarantee.

Here’s how it works … sign up and try it out for one full year. Get the trade alerts, read the reports and watch the webinars. If, after a full year, you are not fully satisfied, let me know and I’ll send you a full refund.

Again, try Strategic Fortunes out for the full year and if you aren’t completely blown away, just let me know and I will issue a full and prompt refund.

I sincerely hope you’ll consider this offer seriously.

If you want to protect your livelihood and your family from the breaking point that lies ahead, if you’d like me to help you sidestep the calamity and guide you to the moneymaking opportunities as they unfold — the best thing to do now is click the button below this video.

When you do, you will find out how to claim your two free reports, How to Survive & Prosper the Coming Middle-Class Massacre and Infinite Income, along with your risk-free membership to Strategic Fortunes.

Actually, join today and I’ll send you another FREE report…

It’s called: Ride the $16 Trillion Infinergy Revolution…

With U.S. energy prices soaring more than any time in the last 40 years, it’s critical we find new ways to heat and cool our homes. That’s why I’m excited to tell you about a new type of infinite energy.

In this report, you’ll discover everything you need to know … including why the world’s biggest companies like Microsoft, Google, Amazon, Apple (to name a few) are spending billions to get in on this energy revolution, and why Big Oil companies like Chevron, BP and Shell are fronting hundreds of millions so they don’t miss out on this fast-emerging trend.

And you’ll get full details on one innovative Silicon Valley company that’s at the forefront of it all. For early investors, this could present the opportunity of a lifetime.

In Ride the $16 Trillion Infinergy Revolution you’ll learn exactly how you can take advantage of this opportunity now.

And it’s yours FREE just for signing up for your risk-free trial membership to Strategic Fortunes.

Again, this is all 100% guaranteed. You have one full year to decide if it's right for you.

If after one year of being a part of the Strategic Fortunes community you decide this isn’t right for you — simply let us know and I’ll see to it that you receive a full, prompt and courteous refund.

There’s nothing you have to give back. No conditions you need to meet. You’re either thrilled with our work or you receive a refund — and you keep everything you’ve received.

Thank you so much for listening to this important presentation.

I hope you’ll find that becoming part of the Strategic Fortunes community will be one of the best financial moves you’ll ever make.

Because, the middle-class massacre will strike with full force in the next few months, and while everyone else will be wondering what hit them, you’ll have seen it coming in plenty of time, and you’ll have a clear, profitable plan in place.

To get started, simply click on the “Join Now” button below.

I’m confident that in a year from now you’ll look back on this day, and be glad you took the time to watch this presentation and become a member of Strategic Fortunes.© 2023 Banyan Hill Publishing. All Rights Reserved. To ensure that you are using our information and products appropriately, please visit our terms and privacy pages. Do not sell my information.