Miracle on Main Street

This No. 1 Ranked Investment Expert Has Already Helped 100,000 Americans Discover Financial Freedom. Now He Has an Even Bolder Mission, and It Starts with You.

[Official Transcript]

Hello, I’m Mike Huckabee…

And I want you to take a good look at this map…

See the dots popping up … each of these dots represents a person … police officers, entrepreneurs, doctors, teachers, farmers … people from all walks of life, from all corners of America, yet, they all have one thing in common…

They’re all rising up, and taking control of their financial future.

That’s right…

Despite the wild times we’re living in, these 100,000 Americans … yes, 100,000 … are defying the odds. They’re boldly taking control of their financial future by using a simple service they can access on their computer, phone or tablet … a service that gives them clarity, peace and confidence with their investments.

Take John from Dallas for example. He signed up about a year ago and says:

Dodi from Florida writes:

Royce in New York boasts:

Reza from California comments:

And I love this one from Jeanie in Michigan:

It’s no wonder why many are calling this service a “Miracle on Main Street.”

And it’s all thanks to the man…

A man crowned the top market timer … seven years in a row, after he correctly called the infamous 1987 Black Monday crash.

A man ranked the No. 1 trader by Barron’s as he helped his clients achieve annual gains as high as 100% during the ‘90s.

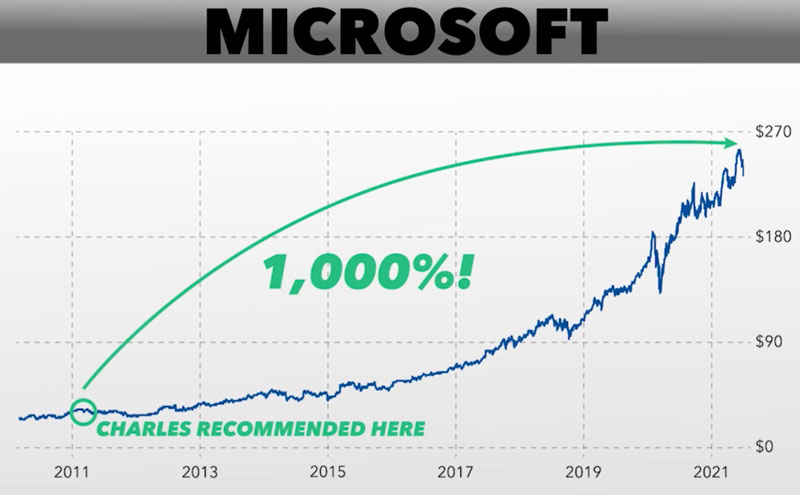

And a man who recommended companies such as Apple, Microsoft and TJ Maxx, giving people the chance to make gains of up to 1,000% over the last decade.

A man who has befriended and given advice to the likes of Sarah Palin, Dave Ramsey, Bill O’Reilly … and, well, me.

His name is Charles Mizrahi.

Today, you’ll see exactly how he’s helping these 100,000 Americans and why they call this service “unparalleled,” “refreshing” and “wonderful.”

And then you’ll have the chance to join them.

With that said, Charles, thanks for joining me today.

Charles: The pleasure is all mine, governor.

Mike: Charles, you and I have been working together for a few months in preparation for this event. You’re already helping these 100,000 Americans go from confusion, fear and frustration with their investments … to clarity, peace and success.

It’s an amazing feat. Many are calling it “a Miracle on Main Street.” But now … as a part of this event … you have an even bolder mission. Talk about that.

Charles: Well Governor, it’s been an honor to help these 100,000 Americans. And to hear their stories, to see their successes, why … it’s truly humbling.

But as great as that is, I knew, with your help, we could do even better. I knew we could reach more people. So, I’m going all in with a bigger mission. The 100,000 Americans I’ve helped so far, is just a start. I want to help 1 million Americans reach their financial goals. And it starts today, with this event. With those who are watching right now. This is the start of something incredible.

Mike: One million. That is bold, however … after seeing how you’ve improved so many lives, I have no doubt that together, through this event and everything we’re going to show our viewers today, we’ll reach that goal. I know those watching right now will love your service. I love it. They’re going to love it.

With that said, I’d be remiss if I didn’t start today’s conversation, with our first conversation that took place in the middle of the 2020 pandemic.

I’m going to play a short clip from that interview, and I encourage you to pay close attention, because inside this clip, Charles reveals his secret to helping all these Americans reach their financial dreams.

See if you can spot it…

Mike: Charles, can you expand on this some? What’s the secret?

Charles: You see Governor, most people today treat the stock market like a lottery ticket. They blindly invest in stocks … tech stocks, penny stocks, IPOs and the like … hoping to strike it rich quick.

Mike: There’s a lot of that going on. I see people, Charles, who are glued to their phones, checking the stock market every day, every hour. They’re watching the news, buying and selling. That can’t be healthy.

Charles: It’s not. They’re gambling. They’re taking huge risks with their hard-earned money in order to make a killing. And even if they’re making money … their winning streak will come to an end because you could only go so far counting on luck. The stock market isn’t a casino. But people are treating it that way. People used to hold stocks, on average, for eight years. Guess what it is today?

Mike: It has to be under a year.

Charles: Four months. Just four months. And here’s why that’s a problem. The secret to making money in the stock market, a lot of money, is to see every investment you make as a partnership.

Mike: Explain what you mean by a “partnership.”

Charles: Sure. To do that … let’s go back to the origins of the stock market. An agreement was signed over 200 years ago under a buttonwood tree, right around where the New York Stock Exchange is today. This agreement paved the way for companies to raise money by selling shares to the public. It gave you and me …and everyone watching … a chance to become a “partner” in any publicly traded company we wanted.

Mike: Because when you buy a stock, you’re really buying a piece of the business. As the business grows, your share of it increases in value.

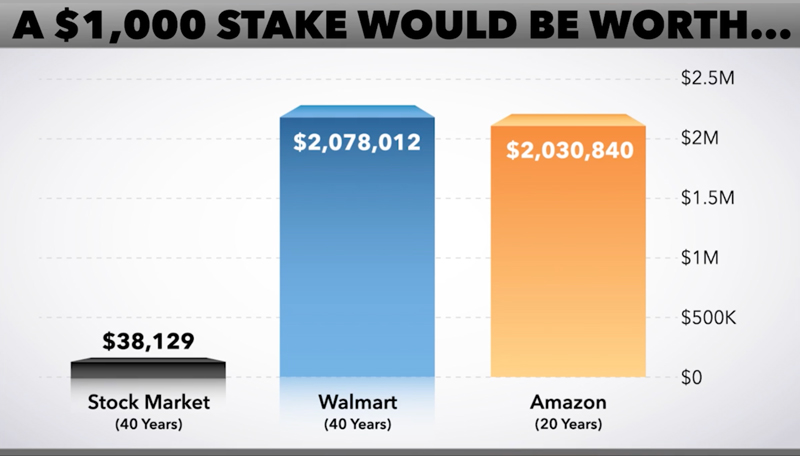

Charles: Right. In that clip you just played, we talked about investing in Walmart and Amazon. Well, you would’ve been “partners” with Sam Walton for 40 years and Jeff Bezos for 20 years and as those businesses grew, so would your investment.

A $1,000 stake in either company, get this … would now be worth over $2,000,000.

Mike: That’s incredible. $1,000 would turn into $2 million. So, it doesn’t take a ton of money to make a ton of money if we “partner” with these companies for the long run.

But, Charles … I’ve got to state the obvious here. Most of us don’t know which companies to invest in. Back then, I would’ve just as likely invested in Sears as I would in Walmart, and that company dwindled down to nothing.

Charles: I hear you. Which is why I created this service. Through this service, I can show everyday Americans which companies to avoid, and, more importantly, which ones to invest in.

Mike: The next Amazon? The next Walmart?

Charles: That’s the goal.

Mike: Great. Well, I know you are going to reveal your top three stock picks in a moment … the ticker symbols and all. These companies are leading industries that are expected to rise 500% or more over the next decade, and the stocks … well, they could do even better.

But first, Charles … talk more about why you created this service. I mean, you were named No. 1 in the country. So why would a legend on Wall Street create this service for those on Main Street?

Charles: Sure. Well, I loved working on Wall Street. I became a floor trader when I was just 20 years old and over the years, I was fortunate to do well for both my clients and myself.

Mike: OK. You’re being humble, Charles. You were ranked the best by Barron’s, top market timer seven years in a row and even made annual gains as high as 100% in the ‘90s.

Charles: But during the late ‘90s, something was off. People stopped investing, and started gambling. We all recall the stories … you know, of people who were making fast fortunes in the stock market but had no idea what they were doing.

Mike: Those were insane times.

Charles: My mother in law is a good example. She and a group of friends started an investment club. They were speculating in all these dot-coms. They even asked me to speak at the group, and I told them the right way to invest. After an hour, I thought I got through to them, but as I walked out, I heard one of them say: “OK, how much can we buy of pets.com, or something along those lines.” I sighed and realized I didn’t make a dent in their thinking.

Each week, she would gloat about how well the club was doing. And they were doing great.

Mike: But then came the crash.

Charles: Yeah, and then came the crash.

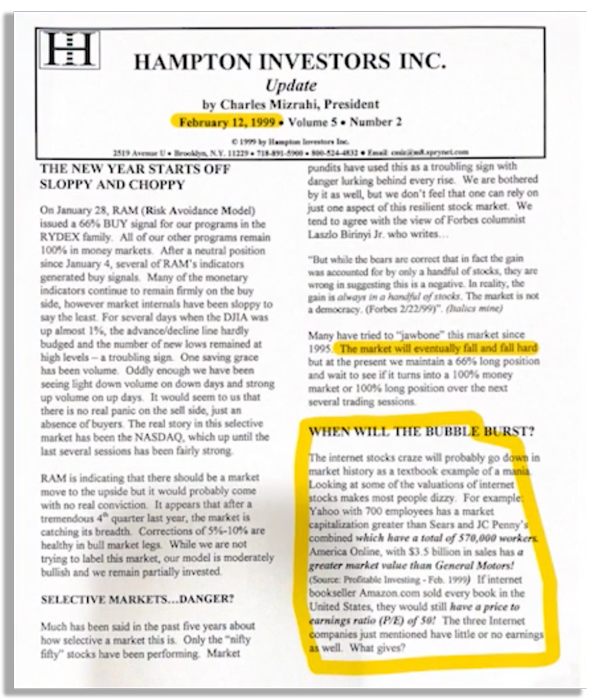

Mike: However, you warned them, Charles. You warned everyone. In 1999, you wrote, “The internet stock craze will probably go down in market history as a textbook example of a mania” and that the “market will eventually fall, and fall hard.” You were correct. The entire stock market dropped 50%.

So, I’m guessing your mother-in-law started following you after that.

Charles: She did, along with many friends and family members.

Word got out, and more and more people started following me. As that group grew, I created an online service where I could share my insights and top stock picks. All they had to do was log in, get the details and make the trade on their own. When it was time to sell, I’d let them know through email. More and more people started using it.

Mike: You recommended stocks such as Apple, Microsoft, TJ Maxx and several others that have climbed higher over the last decade … as much as 1,000%.

Charles: That’s right. So, this service became a way for me to show people on Main Street that you don’t have to gamble to make money. Instead, I wanted to show them how to invest like the pros on Wall Street. Not the talking heads on TV … but rather, the real pros … the people who find the leading companies to partner with. And the best part is, those who followed my insight weren’t stressing out or worrying. They were able to sleep better at night. That’s why I do this. That’s what inspired the service I’m sharing with you today.

Mike: And that’s the reason I’m here today, helping you lead this event. This mission isn’t about you. This is about helping the American people.

This service … which our viewers can get on their computer, phone or tablet … you upgraded it three years ago to reach people outside of your community. And now 100,000 are signed up and getting your insights. And, according to their own words, they’re defying the odds. Many are calling it a “Miracle on Main Street.”

Charles: It’s amazing, really. I never thought I’d be able to transform so many lives. But doors keep opening up. And that’s no coincidence. God has a plan and I believe that’s why you and I are sitting here today.

Mike: I couldn’t agree more. Now, in a moment we’ll talk about this service, as well as your top three stock picks.

But first, Charles, 100,000 people. That’s a big number. Every dot on this map represents a person. So … it’s easy to gloss over the impact you’re making. But these are real people from all across America who now have the chance to make lots of real money.

I want to highlight a few examples that I came across so that our viewers know that anyone can take advantage of your service, no matter where they’re from, how much money they have or how old they are.

Charles: Sounds good.

Mike: OK, great. This first example is Stuart. Now, Stuart actually studied at Columbia University, which has one of the top investing programs in the country, yet, he’s turned to you for guidance.

Here’s what he wrote…

Charles, this is great.

He’s relied on you and your various services for the last decade, and is now living the American Dream. Because of YOU.

Charles: And this is why I tap dance to work every morning. It’s because I’m able to help people like Stuart.

Mike: Let’s meet another person. This is Roy from Tennessee. He said: “My wife and I lost $30,000 investing on our own. It was money we couldn’t afford to lose.”

But then they found you, Charles. And after four months with you, just four months, Roy said:

Charles: That’s why I created this service … it makes investing simple, enjoyable and profitable. It gives me so much joy to see how it’s working for so many people.

Mike: I have to read just one more. This one is from John in Colorado. He’s a retired police officer. His story is amazing. In 2008, he and his wife lost everything they had in the stock market. He says: “Our nest-egg, all $100,000, was gone.”

So, as you can imagine, he was very hesitant to invest in the stock market again. But then he found you, Charles, and you restored his faith. He’s been following your investment recommendations for about a year, and loves it.

He wrote:

Charles: Hearing these stories … stories like John’s … inspire me to work hard each day. It just goes to prove that when people invest in the right companies, they can make a lot of money … but it does so much more.

Mike: It gives them a peace of mind. It gives them freedom.

Now, I’m going to show one more example, from a person I think everyone will recognize. You’re going to love this.

Take a look at this clip…

Mike: Charles … what used to take Sarah years to make, she’s now making in weeks. That’s really something.

Charles: Yes, it sure is … and I’m so happy for her. She was really frustrated with her investments, so I told her, just like I told you, “I’ll pay you to try out my service.” All I asked is that she share the results, and … they were great.

And as great as that is, as great as it is helping Sarah and these 100,000 people, we need to help 1 million Americans. That’s why we’re here today. To help those who are watching, right now, achieve the same level of success.

Mike: I can’t agree more, and I’m glad to be a part of this mission.

But before we get too far ahead, I want to address something on everyone’s minds. A lot of people, Charles, are anxious about their financial future. They’ve put their hard-earned money in their 401(k), their IRA and other retirement accounts … but, with the stock market bouncing up and down, they’re nervous.

On one hand, you have some experts saying, “The sky-high prices make sense,” and on the other hand, experts are saying, “I think we’re going to see the worst crash in our lifetime.”

Americans want to know, our viewers want to … who’s right?

Charles: Well, governor, I wouldn’t ever bet against America. There will be some ups and downs, but we’ll continue to prosper. It’s in our very DNA.

However, here’s the thing … when you invest in the right stocks, the short-term market fluctuations don’t really matter.

Think about Walmart and Amazon. How many downturns did they survive over the last three decades?

Mike: The last three decades? That would be … the crash of 2000, 2008 and even 2020.

Charles: Exactly. These companies not only survived those downturns, they became stronger because of them. They adapted to the new environments. They innovated their processes. They upgraded their products.

And they grew no matter if a Democrat or Republican was sitting in the Oval Office, no matter if we were at war or peace, no matter if inflation was high or low.

Mike: Makes sense. So, the right companies will continue to prosper no matter the economic or political environment. Charles, you’ve even told me — and, some people might take offense to this — “it’s our patriotic duty to invest our money in these innovative companies.”

Charles: Yes, I wholeheartedly believe that.

Mike: OK, explain what you mean.

Charles: Sure. So … I’ll use the example of Cornelius Vanderbilt. Now, of course, a lot of people know that Vanderbilt gained his wealth through the expansion of railroads over 150 years ago.

Mike: It may seem hard to fathom today, but at the time, a railroad connecting the east and west coast of America was so radical, it changed not just how we travelled, but where we lived, how we shopped, how capitalism thrived. It’s even why we have time zones today.

Charles: Right. So, Vanderbilt made a fortune. Now, the family could’ve just sat on their money. But they didn’t. What most people don’t know is that the Vanderbilt family continued to invest in other innovations … for example, in 1886, they were early backers of Thomas Edison’s company, which eventually became General Electric.

With the Vanderbilt funding, Edison was able to experiment with electricity.

Mike: As Edison said, he never failed, he just found 10,000 ways not to a make a lightbulb. That took a lot of funding. But, eventually, he got it right and it changed the world.

Charles: Exactly. My point is this — every big innovation needs bold investors, and those investors are rewarded.

In this case, every $1,000 invested in GE way back then, is now worth $1.7 million … while $1,000 stuffed under the mattress would’ve diminished to virtually nothing.

And, just as impressive, during the last 100 years, over 1 million people have been employed by GE, and of course … we’ve enjoyed having light.

Mike: Talk about a win, win, win. The company gets the money it needs to do big things, investors are rewarded and so are the American people.

Charles: Exactly. And you don’t need to be a Vanderbilt to do this. Thanks to the Buttonwood Agreement, everyday Americans can invest in these innovative companies through the modern day stock market. And it’s our patriotic duty to do so. These companies can use our capital to grow, provide services or products and create numerous jobs.

Mike: I can see why you say it’s our patriotic duty to invest in them.

Charles: Every innovation needs investors.

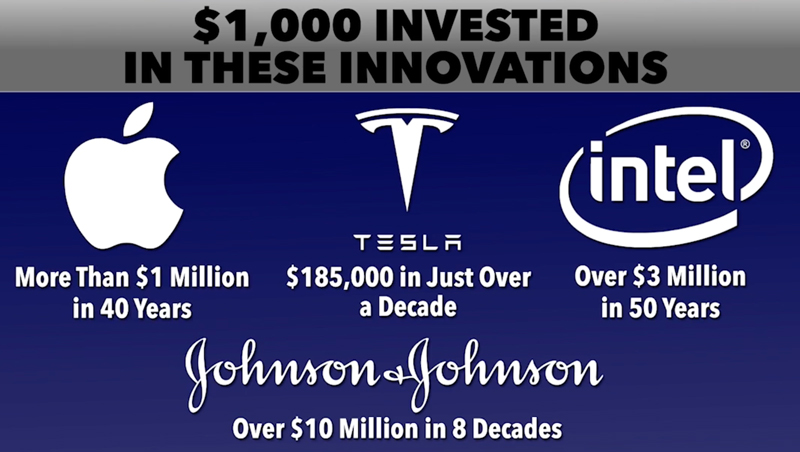

From Johnson & Johnson’s first band aid to Tesla’s first electric car to Intel’s computer chips to Apple’s iPhone … they all needed money to innovate.

And the investors are rewarded handsomely for it.

Every $1,000 invested in these companies would be worth a small fortune.

Johnson & Johnson would be worth $10.7 million in 8 decades.

Tesla would be worth $185,000 in just over a decade.

Intel would be worth $3.2 million in 50 years.

Apple would be worth $1.2 million in 40 years.

Mike: Now, Charles, these are some of the greatest examples in stock market history. Getting in early on stocks like these would be a true one-in-a-lifetime fete, it doesn’t come easily. But when you find one of these companies, a person doesn’t have to trade these stocks, buying them and selling them every week. All a person has to do is invest once and let the companies do the rest.

Charles: You got it, Governor. By owning the right stocks … the right companies … they’ll march through bull and bear markets, through high and low inflation, through times of war and time of peace.

Mike: Again, I can see why you say it’s our patriotic duty to invest in them. And, there’s also a Biblical case. In the book of Matthew, Jesus talks about the parable of the talents.

The master gives talents — another word for money — according to the ability of each man. After a long time, when the master returns, the man who got five talents, created five more through his investments. The one who got two, created two more. The one who got one, was afraid and buried it.

But the master scorned him saying: “You wicked and lazy servant!” The lesson being that we’ve been given certain gifts, spiritual gifts and yes, even financial gifts, and we shouldn’t bury them.

Charles: What I find very insightful was that they doubled it “over a long time.” They didn’t go off and gamble their money or try and grow their money 10 fold overnight.

That’s what investing in the right companies can do for you. It can help build generational wealth.

Mike: You know, Charles, you say “It’s always a great time to invest.” But, you did tell me before the show that right now … this very year … is an amazing time to invest. It’s one of the reasons we are holding this event today.

Charles: Sure. Again, it’s always a great time to invest. But, from time to time, as in once in every 50 years or so, it’s a WONDERFUL time to invest. And we’re in the middle of one of those times.

And that’s because we’re in a “convergence.”

A convergence is when a whole bunch of innovations come together at the same time. When that happens, it’s turbo charges growth. Right now, we have artificial intelligence, the Internet of Things, 5G, Blockchain, battery power, robotics, and so much more…all taking place at once.

When these technologies converge, new technologies are born.

Mike: Can you give an example of what you mean.

Charles: Sure. Take this smartphone. It’s a 10-year old technology that was made possible by the convergence of AI, 5G, microchips and the Internet of Things. These other technologies converged to make the smartphone possible. And because this smartphone exists … other companies like Uber, Amazon and Facebook are thriving.

Mike: It’s almost perpetual growth.

Charles: Exactly. We’re currently living through a period of time where technologies are converging to make other technologies at a very rapid pace. It’s kind of like a snowball being rolled down a very long and steep hill. As it rolls forward it picks up momentum and starts to grow really big really fast.

Think about autonomous vehicles … they need all kinds of technologies in order to become possible such as advanced lithium-ion batteries, sensors, Big Data and IoT.

And think about precision farming. Farms today use Big Data to measure soil samples, and then use advanced technology to apply the right amount of fertilizer where needed … increasing yield.

Mike: Makes total sense, Charles. And when people invest in these innovations, they can be propelled forward.

In a moment, Charles is going to show you how to use a “scorecard” to pick the right companies to partner with, and then, he’ll even give you his top three stocks to buy. Each company is positioned as the leader of an innovation that’s on the verge of rising 500% or more over the next decade.

But most importantly, we’ll show you how you can join the 100,000 Americans who are already using Charles’ service to get his top stock picks, plus so much more.

I want to, once again, call attention to these folks. These are hardworking men and women who are already getting Charles’ top stock picks through his service.

But this time, I want you to hear it in their own words…

Mike: Charles, these are great. It definitely feels like a “Miracle on Main Street.”

Charles: I used to help rich people get richer when I was on Wall Street. But, helping folks on Main Street like this … it’s way more rewarding. Some people like Patrick have $200,000 or so allocated to my picks, others start with just a few thousand dollars.

Mike: I can’t wait to show our viewers how this service works so they start having success as well. Again, they can use it on their phone, tablet or computer. It’s super simple to use. They’re going to love it. I love it.

But before we dive into details, I know a lot of people out there are skeptical. And for good reason. A new study shows that 90% of professionals can’t beat the market. So, 9 out of 10 are failing. They have one job, beat the market, and they can’t do it. Your model portfolio, however, is beating the market. How?

Charles: There are a lot of reasons. But one key factor is this … I don’t have to dilute my investments. You see, most of these professionals are required to have 100 stocks or more in these funds.

Why would anyone want to own 100 stocks? I don’t want to invest in your 99th best recommendation. I want your top 20 recommendations.

Here’s the thing … a lot of these companies are dead weight.

Let me show you what I mean…

Over the last decade, the entire S&P 500 … essentially, the stock market … has gone up 200%.

Mike: That’s pretty amazing if you ask me.

Charles: It is. But, guess how high the top 20 stocks went.

Mike: Well, I know you’re making a point so I’ll go high … 1,000%? 1,500%? 2,000%?

Charles: The top 20 stocks went up 2,300%.

Mike: OK, that’s a lot. So, to your point, why own 500 stocks, or even 200, or even 100? All you need to do is invest a little bit of money in a few innovative companies and then, watch as the prices go up.

Charles: Right. In this case, a $1,000 investment in the stock market would have turned into $3,000. Not bad. But that same $1,000 invested in the top 20 stocks would’ve turned into $24,000.

Mike: That’s a big difference. However, again, I don’t have the ability to know which stocks to invest in. I couldn’t pick out Walmart or Amazon, or these top 20 stocks. And I don’t think I’m alone. Most of us don’t have the ability, or the time, to figure out which stocks will be winners and which ones will be losers.

However, Charles, you have a 40-year track record of doing exactly that.

Charles: I do. Now, I don’t always get it right. I don’t have a crystal ball. But yes, I do stack the odds in our favor because I know what to look for.

Mike: But … I want to dig a little deeper. I’m still wondering, and I know our viewers must be too, how are you able to spot the stocks that go up, and go up so much over such a long time? How are you able to find these innovative companies that make investors so much money, and … help so many Americans?

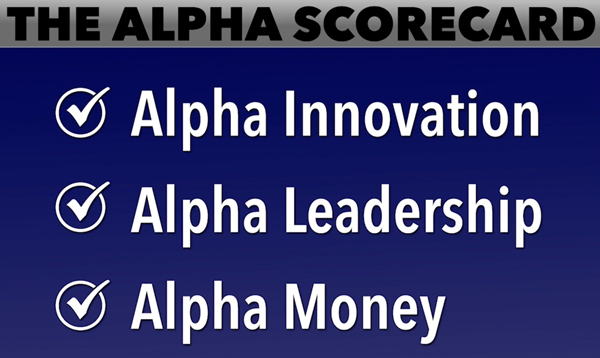

Charles: I use the Alpha Scorecard. A company must have …

A company must get an “A” rating on all three of these Alphas … innovation, leadership and money.

Mike: OK, Charles. Now, I know we don’t need to understand the miniscule details of your Alpha Scorecard, that’s what so many rely on you for, but … you’ve got to give me some more details here. Can you break that down for us a little more?

Charles: Sure. For Alpha Innovation, I’m looking for companies that have an edge in a major, multibillion-dollar industry. They’re going to disrupt the competition and move America forward.

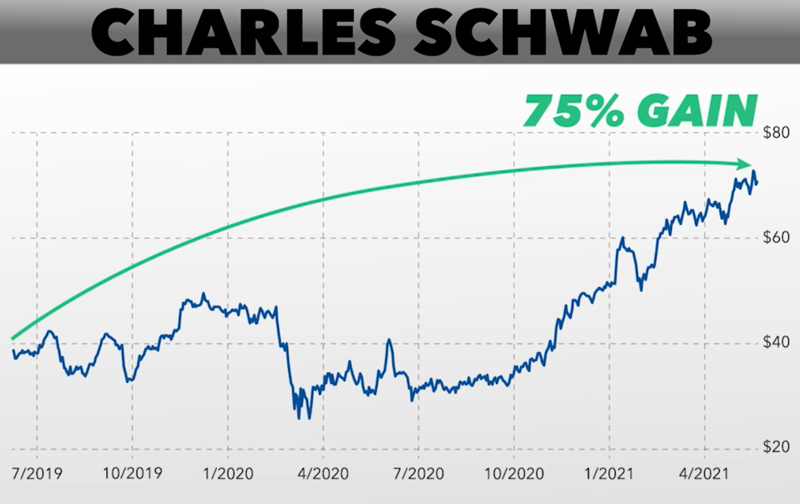

Take Charles Schwab for example …

Mike: This was one of your recommendations you gave in 2019, and those who followed your insight are up more than 50%.

Charles: Yeah. And it’s just getting started. Here’s why … Schwab is innovating the entire $500 billion financial technology industry … an industry that, according to my research, could grow 800% over the next decade.

Mike: So, the industry is $500 billion now, AND it’s expected to grow 800% over the next decade … so, to, $4 trillion.

Charles: Exactly. And thanks to Schwab’s easy-to-use app, the stock is marching higher and higher. So, Schwab gets an A+ on innovation.

Mike: But, why Charles Schwab? Why not another company, like Fidelity or E-Trade? They have apps too.

Charles: Great question. That comes down to the Alpha Leadership. We want a “business partner” with a successful track record. Schwab’s CEO, Walter Bettinger, has been with the company since 1995 and helped the company grow fivefold since he took the helm in 2008. Fortune even named him a top businessperson of the year.

Every great leader has dedication, focus and vision. Behind every great company is a great leader.

Mike: Like Sam Walton with Walmart and Jeff Bezos with Amazon. Makes sense. And what about Alpha Money?

Charles: Sure. As you said, we want to look at the financials. This is where most people get it wrong. They look for a cheap stock price. They see a stock under $10 and think it’s cheap. Well, it might just be priced at $10 for a reason.

Mike: There’s a lot to look at. Like revenue, earnings and so forth.

Charles: Right. To get the underlying worth of the business, I look at the data behind the stock price … the balance sheet, the income and cash flow statement, and so much more.

At the end of the day, I’m constantly digging through the numbers to make sure it all adds up. I’m simply trying to make sure we are buying a good company at a good price. That’s it in a nutshell.

Mike: So Schwab got an A+ in every category … innovation, leadership, and money. And you told people to buy it and pay up at $40 a share. Today, it’s more than 50% higher.

Charles: I expect we’ll hold this position because Schwab’s business continues to grow stronger. And as long as the business continues to increase in value, so does the stock price.

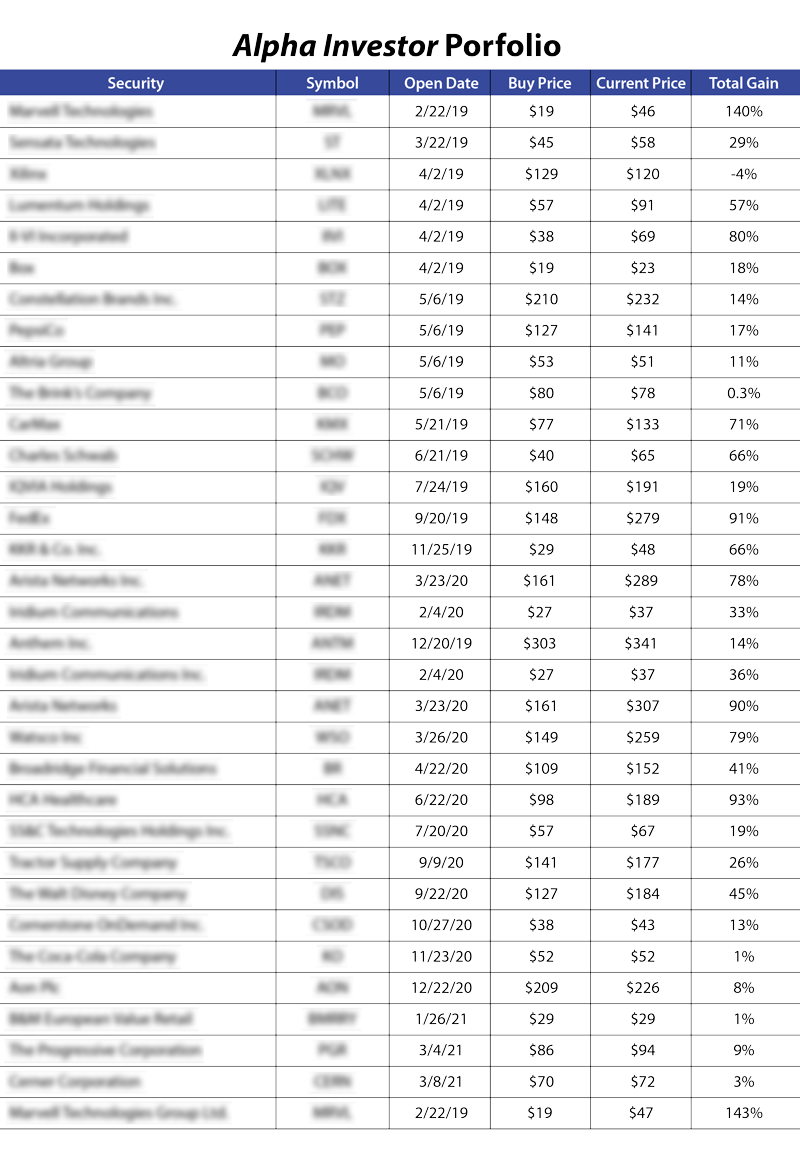

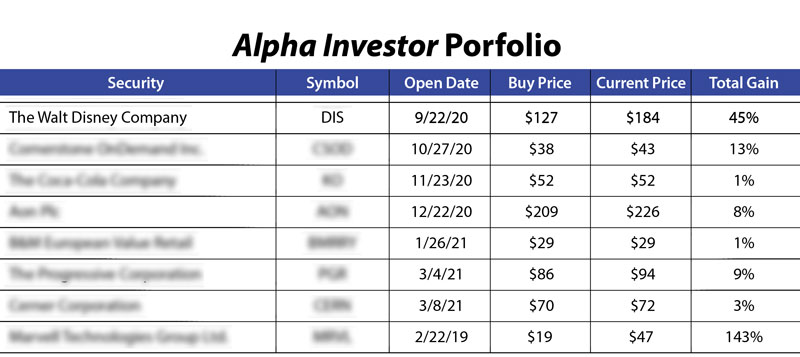

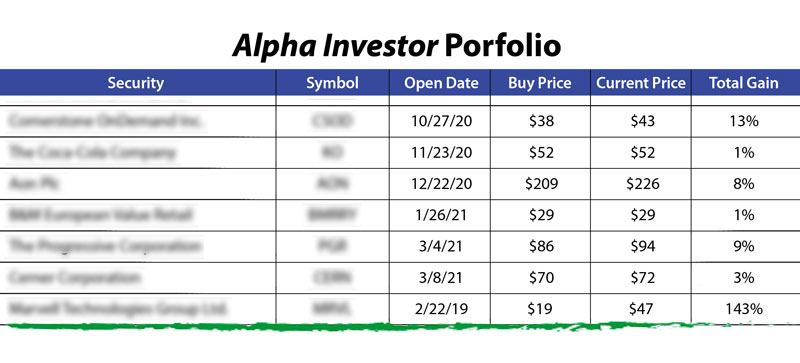

Mike: Charles, I’ve been looking over your model portfolio … and, I’m going to have our video team share it with our viewers here. I blurred out the names, but … this is the exact portfolio they can get access to in just a few minutes. They’ll be able to buy these exact stocks.

And as I scroll through these open positions, one thing is clear…

There are a lot of winners.

Charles: Thanks. Now, with that said, these don’t include the four positions I’ve sold. If I see a position moving against us, I try to sell out of it before it turns into a loss.

Mike: Well, there’s always a chance these stocks could go down. All investing carries risk, which is why a person shouldn’t invest more than they can stand to lose. So, it makes sense to let go of the bad position so you can focus on the winners. But, Charles even those “bad” positions averaged a 3% gain over the last two years.

Charles: Well, I like to get rid of the companies that underperform and focus on those that outperform. These open positions are just starting to go up. Over the next few years, I expect these stocks will go much, much higher.

Mike: Charles, I know everyone watching will have the chance to access all these stock picks in just a few minutes. But, we’ve been telling our viewers that you’ll give away three of your top stock positions. I think now would be a good time to do that.

Charles: I agree. Let’s do it.

This first one is … Arista Networks. It’s up around 100% in just over a year. Arista is disrupting the cloud computing industry … an industry that could grow 500% over the next decade according to my research.

Mike: So, to be clear, the industry is expected to grow 500%, not the stock.

Charles: Right. So, as you can imagine, if the industry is growing 500%, well, Arista has room to march just as high, if not higher.

Mike: That’s a great example of a stock that has a high stock price, but … you must think it’s still a great bargain.

Charles: Exactly. A $200 price might sound like a lot, but … Amazon probably sounded like a lot at that price too back in 2012 but it went on to soar 1,000% from there.

Mike: Good point. What’s your next top stock pick?

Charles: Everyone will recognize this next company, Disney. It’s up about 40% in six months already. As you likely know, it’s disrupting the video streaming industry … and my research is showing that video streaming could grow 500% in the next decade.

Mike: And once its parks fully reopen, won’t that just be a boon for the company?

Charles: Exactly. There’s a lot to be excited about with Disney.

Mike: OK … what’s the third stock pick?

Charles: It’s called Lumentum. It’s up 60% in two years, and it’s disrupting the AI industry … an industry that could grow 3,000% over the next decade according to all my research. So, a lot of room to run there.

Mike: Charles, these are three great stocks. Is there one that’s your favorite?

Charles: Well, this one, right here. It’s up 130% in two years. But, the company is disrupting the 5G industry … an industry that I expect will grow 3,800% this decade. As you can imagine, it has room to go higher.

Mike: A lot of people might feel like they missed out if it’s already up 143%.

Charles: They might. But, people thought they had missed the train when I recommended Microsoft in 2011. It had already gone up a ton. But, it kept on going up … and those who followed my recommendation are up 1,000% today.

Just think, if the AI industry is going up 3,800%, this company could really take off. And I’m not the only one saying this…

The experts are loading up on it. William Blair gave it an “outperform.” Piper Sanders upped the price target and gave it an “overweight” rating. Others went on record saying it’s a “compelling buy.”

In order to get in before the price shoots higher, people will want to invest soon.

Mike: It sounds like a great opportunity. So, all of this makes sense. If the industry the company is in is expected to grow fivefold, in some cases thirty fold, the company leading the way should do fantastic as well.

Charles: You got it. Once you find an innovative company, with great leaders and great financials leading a growing industry, the results are basically inevitable. They might not come next month, or a year from now, but … in time, the company should become a big winner, for America and for the people who invest in America’s future by investing in its best companies.

Mike: Charles, well, so far … the portfolio looks amazing. You’re helping Main Street Americans do what 9 out of 10 professionals on Wall Street can’t do … beat the market.

It is, as they say, a Miracle on Main Street.

So, congratulations.

Charles: Thanks. But the real congratulations go to the 100,000 people who took a bold step forward and decided to join me. It’s been a crazy market these last few years, through the pandemic and the recovery. But, they hung in there. And they’ve been awarded for it.

Mike: All these people from all across America are using your insight right now to invest in their futures. I’m going to read off a few more examples quick because it’s so important for our viewers to know that these folks once stood in their shoes, but … they took a step forward and tried this service out.

Tim from Ohio writes:

Kathy in New York says:

Michael in Oregon writes:

I could go on and on, Charles.

Charles: That’s what this is all about, really. Helping these folks make a lot of money, and have peace of mind doing it. Now I have a new mission … to go from helping 100,000 people to 1 million.

Mike: Agree. So, I’m guessing our viewers are itching to know … what is this service and how does this service work? So let’s talk about that.

Charles: It’s my elite research service called Alpha Investor, of course, named after my three Alphas. But, it does exactly that. It enables anyone to become an Alpha Investor … a great investor.

Mike: I’ve had the chance to study it and use it for months now, and I love it. So, I’m going to use my ipad to show the actual service.

Charles: Sounds good.

Mike: Alright. I’m going to log in here. A lot of stuff will be blurred out for privacy reasons.

On the top … is a link to the model portfolio.

I just click it, and it opens up that same portfolio we just had up. You can see everything Charles recommends.

You have the name of the stock, the symbol, the open date, current price, last price, total gain and buy-up-to price.

Again, this portfolio is beating the market. Something that 9 out of 10 financial experts can’t do.

Now, if you want more information on the stock, you can just click here … and it opens up an eight-page report with all the details.

This eight-page report is one of my favorite parts, Charles.

Charles: I want to make sure you’re well informed. So, I release one of these reports every month … that way you have all the information you need to decide if you want to invest.

Mike: What I like about this, though, is that you write it in a very conversational way. It’s not cluttered with heavy financial jargon. It’s just straight-forward, and, really, a fun and easy read.

Charles: When I write these, I imagine myself having the conversation over a cup of coffee with my mother-in-law. I make it enjoyable and easy for anyone to grasp. So yes … it’s very conversational.

Mike: Well, it’s working. I’m going to go back to the homepage, and I’ll clicking on the Trade Alerts. Tell us about these.

Charles: Anytime I recommend you buy or sell a stock, you get an email … that way you never miss a thing. You can even get a text alert to notify you when one of these trade alerts are sent out.

Mike: So, for example, on February 23, 2021, you told subscribers to sell out of Wyndham Hotels for a 23% gain.

Charles: We had held it for two years, which is okay, but … I saw a better opportunity. So I told subscribers to cash out and move on.

Mike: Got it. You also have the weekly updates. These are 15-minute webinars that you record every Wednesday. In it, you review the portfolio, you answer common questions that have come in, and you explain what’s going on in the overall market.

For example, in 2020 … right in the middle of the crash, when everyone was panicking, in your webinar you told people not to worry.

Charles: Everyone was writing in, “should I sell, should I sell?”

Mike: Well, here are your exact words.

You went on to give four specific ways people can deal with volatility.

Mike: Charles, you were calm in the middle of the storm.

Charles: A lot of people were worried, and rightfully so. But, I’ve been doing this for 40 years and I’ve seen this movie before. I knew our investments would do just fine. There’s not much that surprises me.

Mike: Well, your subscribers were thankful for your wisdom and insight. One wrote…

You were a beacon on a hill … cool, calm and collected during those adverse times.

Charles: I’ve found that the biggest mistake people make when it comes to investing is becoming too emotional. We know not to panic and sell, but our emotions can get the best of us, whether that be fear or greed.

Mike: Makes sense. I just want to quickly show a few more features of your service. You have a getting started section.

Charles: This is for anyone new to investing. They’ll get the Beginners Guide to Investing … a simple booklet that talks about the basics of investing, how to set up a brokerage account and how to place a trade. Things like that.

There’s the Alpha Investor manual … explaining my three Alphas in more detail.

All this material is there if you need it.

Mike: Got it. And then you have the special reports section … these are special recommendations where you take a deeper dive into specific investment opportunities.

The frequently asked questions section and testimonials … success stories from those who’ve used Alpha Investor for a while.

Its’ really as simple as that.

With that said, any time a person has a question about their subscription, you have a team of VIP customer care representatives right here in the U S of A to help them out.

Charles: That’s right. You’re never left alone or in the dark. Just give my team in Maryland a call, and they will walk you through whatever you need.

Mike: Charles, this is incredible. Again, the name of the research service is Alpha Investor. In a few minutes, a button will appear beneath this video and anyone watching will be able to click on it to find out how to get access to it.

But, we have a lot of questions coming in, and I’d like to address them first.

Charles: Sure thing. Let’s take them.

Mike: Here’s the first, from Mary in New Jersey. “Recently, the government dumped $6 trillion into our economy just to keep it afloat. That’s 5 times as much as Obama’s bailouts from a decade ago. How is this sustainable? Won’t the stock market, and our economy, eventually crash?”

Charles: Great question. Mary’s right. These bailouts aren’t sustainable. Our national debt is off the charts, and I think it’s creating a culture of dependency. I don’t like it. But, with that said, the government did just drop $6 trillion into the U.S. economy … that $6 trillion sloshing around the economy will fuel the stock market higher.

And remember … the companies I’m recommending are the type of companies that are in position to survive and thrive in the long run.

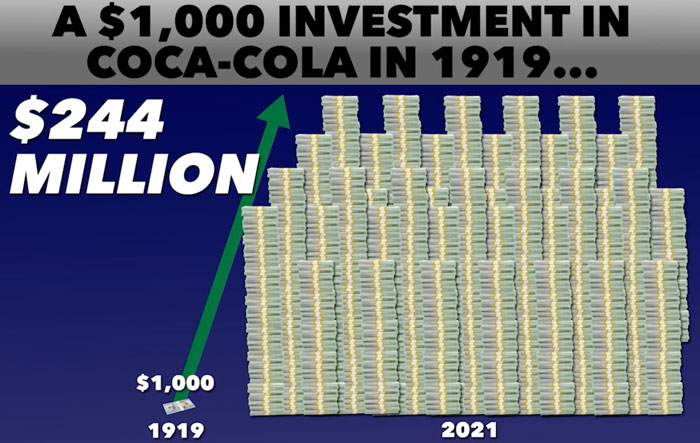

Think again about Coca-Cola. It survived inflation and deflation, times of war and times of peace, and stock market booms and busts.

Mike: When society became more health conscious, Coke even figured out how to get into health drinks. That’s innovation.

Charles: That’s right … they’re not sitting still. Which is why an original investment in Coke, back in 1919, with dividends reinvested, would turn every $1,000 into more than $200 million…

Mike: That amount of wealth in unfathomable.

Charles: The companies I recommend are the same way. They are at the forefront of industries that are expected to grow 500%, even 3,000% over the next decade. So, our investments should do fine in the long run.

Mike: Great. Next question is from Frank in Nebraska. “I love the sound of this. But all my money is in a 401(k), so can I still follow your stock recommendations?”

Charles: Most 401(k)s allow people to invest in stocks now. So, it’s possible. But, if you can … try to open up another account … with a company like Schwab … and start investing. It’s pretty simple to do and well worth it. Because most 401(k)s give you exposure to the overall stock market. And while it has done well over the last decade, going up 200%, remember, the top 20 stocks went up 2,300%.

Mike: That’s a big difference. Here’s a great question: “I’m a super conservative investor. I don’t even own mutual funds and the idea of losing money terrifies me. Should I sign up?”

Charles: Only do what you are comfortable doing. I personally want to encourage people to be bold, but … if an investment keeps you awake at night, then you’re taking on too much risk. Just keep in mind, you can start small, and build confidence.

Mike: Makes sense. I’m sure a lot of people are curious about this next question from Sam in Maine. “This sounds incredible, but … how much does access to Alpha Investor cost? You seem like a generous person, but I’m sure you want to make some money.”

Charles: Another good question. As mentioned earlier, I want to get as many people investing the right way as possible. We’re in the middle of a convergence of technologies and the amount of wealth that will be made is, literally, once in a lifetime. Right now, we have 100,000 subscribers, but … my goal is 1 million. So, we want to do whatever we can to meet our goal.

However, as this person points out … I have expenses. We have a customer care team. A video team. An IT team. A top-notch research team. And, to help us recommend the best investments, we have the best tools available. Bloomberg terminals, Capital IQ access and the like. These data feeds are not cheap.

So, all I’m doing is asking people to cover my expenses … which is why a subscription to Alpha Investor comes out to less than $10 a month.

Mike: Well, that’s incredible, Charles. Less than $10 a month. I know people used to pay tens of thousands a year for your financial advice. So, $10 a month is a steal. I mean, I can’t get an appetizer at a steak house for less than $10.

So, this is an incredible offer.

Charles: I do ask for one thing. I ask that they sign up for a full year up front. This isn’t for my benefit, it’s for theirs. They need to get the full experience of the service … when the market is going up, when it’s going down, and when it’s flat out boring. Give time for the stock picks to play out.

Mike: In a sense, just like you give your recommendations time to play out, you want them to give this service time to play out.

Charles: Exactly. But, I understand why some folks might be hesitant to sign up for the full year. So, here’s my deal … sign up today, and if you don’t like what you see … at any point over the next 12 months, let my team know and we’ll send you a full refund.

Mike: So, let me get this right. If they sign up today, they can try Alpha Investorout for the entire year … get your top stock picks, watch your weekly webinars, get your trade alerts … and if they don’t like what they see, you’ll issue them a full refund.

Charles: Every last cent. Look, I don’t want people paying for it if they aren’t benefiting from it. Now, with that said, I offer this because I know for a fact that the vast majority of people never ask for a refund.

Mike: Well, we’ve seen the results today. Current Alpha Investor subscribers won’t stop boasting about the peace of mind they have, the profits they’re making and how simple your service is to use.

An incredible offer. This is risk-free for our viewers.

With that said, I have another good question here. This one if from Craig in North Carolina … “How much time will it take to use Alpha Investor? I run my own business and have 4 kids, so, I’m pretty busy as it is.”

Charles: Probably about 15 minutes a month. That’s it. That’s all it takes. Just 15 minutes.

If you want to spend more time with me … watch every weekly update, read every article and report I put out, you might spend a few hours with me every month. There’s something to read every day, if you want it. But if you’re busy, you can do it all in 15 minutes a month.

Mike: Here’ another good question. This one from Scarlet in Florida. “Love all of this. Do you have an app I can download?”

Charles: Yes, we do. Once you sign up we will show you how to download it.

Mike: I downloaded it a few weeks ago. This is my preferred way of using Alpha Investor. I get push notifications when there’s a trade, and it’s so easy to navigate.

Let me take another great question. This is from Georgana in New Jersey. “I’m totally new to investing. I’ve never bought a stock in my life. Is this something I can do?”

Charles: Great question. If you are totally new to investing, I’d suggest you start by reading the Beginners Guide to Investing which is easy to find on the Alpha Investor website. This will explain how to open an account, place a trade and everything in between.

Mike: And again, they can start small, and build confidence. With that said, I noticed a lot of your subscribers are newer investors, and they’re doing great.

Just listen to these short videos.

“I’m new to investing, so it is fun to watch my account grow. I used $16,000 to start and I have $1,700 in profit … in just two months.” — Chris Fein

“I figured I’d give your service a trial run. Now, I’m telling my friends and family about your service.” — Dan Goss

These are great.

Charles: And keep in mind, if you sign up, and you realize it’s not for you … no problem. Just give my team a call and get a full refund. It’s as simple as that.

Mike: Okay, we have time for one more question. This is from Billy in New York: “Charles sounds brilliant. Will he just manage my money for me?”

Charles: Today, with how easy it is to invest on your own, a subscription to Alpha Investor is a better choice. You get all my best stock picks, my weekly updates and trade alerts … you just make the investments on your own.

Mike: In a way, thanks to a convergence of technology, you and your team are innovating how people invest. I mean … I get your top stock picks sent right to my phone. It’s amazing. Charles, I’ve been following you for a while now. And, I love what I see. Not just from the performance, but … I’m impressed with who you are as a person.

You’re already helping 100,000 people, and, our goal is to reach 1 million people.

Charles: That’s right. And, the moment they sign up … within the next few minutes … they could be looking at the model portfolio. They will have the chance to invest in all the companies we spoke about today.

Such as Arista which is leading the way in cloud computing, an industry that’s on the verge of soaring 500% over the next decade.

Disney which is leading the way in streaming video, an industry on the verge of soaring 500% over the next decade.

Lumentum which is leading artificial intelligence, and industry on the verge of soaring 3,000% all within the next decade.

And of course, my No. 1 stock. The company that’s leading the way in 5G, an industry that’s on the verge of soaring 3,800% over the next decade. Buying this stock today could set a person up for incredible wealth. It could be like buying Amazon or Walmart decades ago.

So, don’t wait. The earlier they get started, the better.

Mike: Great. Now, that order button should be underneath this video at any moment. All our viewers have to do is click it, and it will take them to the order page. With that said, Charles … thank you for sharing your insight today.

Because of you, 100,000 Americans are already marching toward their financial goals.

Charles: And with your help, I know we’ll reach 1 million people. I know many who are watching right now, they’re struggling. Maybe they’re struggling with anxiety about the volatility in the market, perhaps even losing sleep at night.

Or perhaps they’re being tempted to try to get rich scheme.

I can help them. I can help them invest in good companies that make good products and pay people a good wage.

And right … right now is a great time to get started. We’re seeing a convergence of innovation creating new technologies.

5G. AI. The Internet of Things. Autonomous vehicles. Precision medicine. Robotics.

Our world is transforming in front of our eyes. This is a rare opportunity in history to invest in some truly great companies that will change the world for the better.

Mike: It’s truly exciting. With that said, once again, thank you. And thank you for joining us for this event. For more details on how to sign up for Charles’ Alpha Investor service, click the button beneath this video.

I’m Mike Huckabee, and God bless.

April 2021

© 2023 Banyan Hill Publishing. All Rights Reserved. To ensure that you are using our information and products appropriately, please visit our terms and privacy pages. Do not sell or share my personal information.