Shocking Decision from the Biden Administration…

The U.S. Gov’t’s Covert

Plan to Hand Wall Street

Control of Crypto

The SEC JUST announced Bitcoin ETF approval but this is only the beginning …

“When this happens, Bitcoin is going to $100,000.”

— America’s Top Crypto Trader, Juan Villaverde

NARRATOR: Crypto trader Juan Villaverde has cracked the code.

He released his proprietary timing algorithm in the middle of a raging crypto bull market, at the beginning of 2018.

But Juan’s math said something different from the crowd.

Instead of parroting the rest of the bulls, Juan stuck his neck out and warned investors: The party was over. A crash was coming.

He got hate mail and was even the victim of a cyberattack.

But he was also right.

Bitcoin crashed 84% over the next few months.

Later that year, crypto investors were in the doldrums. The talking heads were bearish on Bitcoin.

Yet Juan’s math went against the crowd again.

He called the bottom.

And three days later, Bitcoin began a prolonged bull run.

In the years since, Juan has gained a reputation for nailing the really big crypto calls.

He booked separate gains of 477%, 333% and 153% on Bitcoin.

1,148%, 826% and 673% on Ethereum

1,135% on THORChain

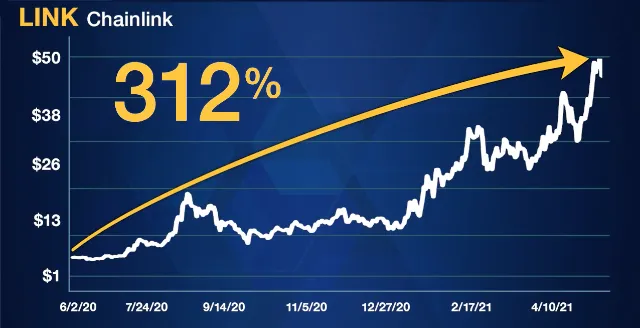

312% on Chainlink

He found Cardano at just 4 cents …

And helped investors make 29 times their money.

Just $10,000 into Cardano would’ve made over a quarter of a million dollars.

Keep in mind, these aren’t just cherry-picked winners.

In fact, the average return of Juan’s crypto recommendations is 328%.

That includes the losers …

Juan’s big predictions have drawn attention and praise from places like CNBC, Fortune, Forbes and The Motley Fool.

But Juan has mostly managed to stay out of the spotlight.

He doesn’t often make public pronouncements.

However, today Juan has come forward with a massive new prediction.

Right now, the so-called experts are burying crypto.

Prices have stayed flat for months.

A confusing regulatory environment has scared people away.

But once again, Juan’s math says the complete opposite.

His timing model points to a bull market just over the horizon.

He thinks this could be the last time you’ll ever be able to buy Bitcoin at this low of a price.

And he believes a surprise announcement by the U.S. government will be the spark to ignite this raging bull market.

Here’s Juan with more:

JUAN:

Hi, I’m Juan Villaverde.

The Securities and Exchange Commission, or SEC, recently declared war on cryptocurrencies.

It filed lawsuits against the two main crypto trading platforms: Coinbase and Binance.

The SEC chair declared almost all coins outside of Bitcoin and Ethereum to be illegally traded securities.

To make matters worse, two different efforts by Congress to set clear rules for the crypto market have stalled.

The regulatory and legal confusion around crypto has scared away investors.

The mainstream headlines are filled with negative stories.

One news outlet even asked if the U.S. was trying to kill crypto.

But I recorded this message to tell you:

Nothing could be further from the truth.

This isn’t a bad time to buy crypto.

It’s the best time.

You see, there’s something going on in the background that almost everyone has missed.

Just seven days after the lawsuits were filed against Coinbase and Binance, another story slid by almost

unnoticed.

It was an application, filed by $9 billion Wall Street giant BlackRock, to create a spot Bitcoin ETF.

Why is that important?

Because BlackRock has close ties with the Biden administration.

And it has a nearly spotless record of ETF approvals.

Don’t let the government lawsuits fool you.

Wall Street is engaged in a stealth takeover of cryptocurrency.

And when Wall Street’s takeover is complete – starting with BlackRock’s Bitcoin ETF – I expect the price of Bitcoin to spike immediately.

And it may never come back down.

Bear in mind, however, the clock is ticking.

This approval could come at any moment.

And you don’t want to be caught flatfooted.

This Could Happen Tomorrow

The law states the SEC has to make a decision on BlackRock’s ETF within 240 days from its June

application.

Which means Valentine’s Day 2024, at the latest …

But here’s the thing: I don’t think it’ll wait nearly that long.

BlackRock has an incredible record of approvals … it’s only been rejected once in 572 tries.

A 99.8% success rate.

But that’s not all.

BlackRock is the world’s largest investment asset manager, with over $9 trillion under its guidance.

And it’s developed a buddy-buddy relationship with the Biden administration.

The company donated large sums of money to both Joe Biden’s presidential bid and other liberal causes.

BlackRock’s CEO Larry Fink essentially created ESG investing, a philosophy championed by Biden officials.

It’s no surprise because BlackRock’s ties to Biden run deep.

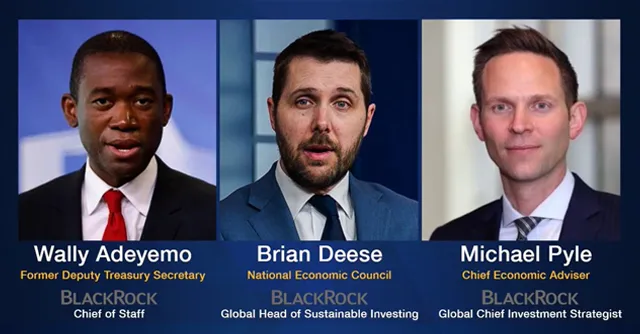

Former Deputy Treasury Secretary Wally Adeyemo used to be Fink’s chief of staff at BlackRock.

Brian Deese is Biden’s head of the National Economic Council. He used to be BlackRock’s global head of sustainable investing.

Vice President Kamala Harris’s chief economic adviser, Michael Pyle, was BlackRock’s former global chief investment strategist.

The chair of the BlackRock Investment Institute’s brother is Biden’s senior adviser and chief campaign strategist.

So, what happened a week after the SEC sued Binance and Coinbase is curious, to say the least.

Not only did BlackRock file an application for a Bitcoin ETF … but it uses Coinbase as its pricing source.

It begs the question:

If the Biden-controlled SEC seems to be making it clear that crypto isn’t welcome in the U.S. …

Then why were its top donors applying to manage crypto investments just a week later?

Look, I’m a crypto trader, not a politician.

I’m not looking to offend or provoke anyone. I’m just following my research to its logical conclusion.

I’ve laid out the facts for you, so you can evaluate for yourself.

But, I believe BlackRock’s ties to the White House will win the day.

That’s what politics is after all, like it or not. You scratch my back, I scratch yours.

Once approval is granted, you could see the price of Bitcoin – and a small handful of essential cryptos – .

spike, immediately

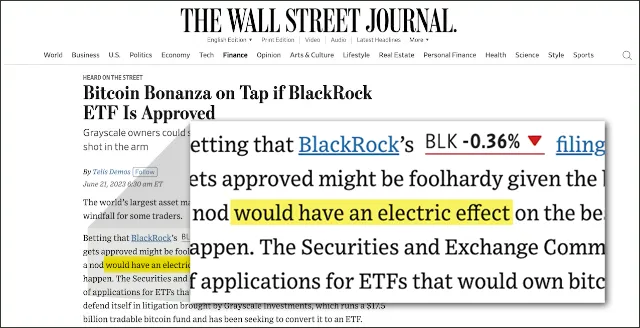

In fact, The Wall Street Journal said BlackRock approval would have an “electric effect” on the crypto market.

But, while the law says the SEC must announce a decision on BlackRock’s application by Feb. 14 …

I believe an answer will come much sooner …

Beyond BlackRock’s spotless approval record and its cozy ties to the government regulators … it added a sweetener to the deal.

An offer the government can’t refuse.

It would allow for “surveillance” of the trading platform by the Nasdaq, granting it confidential information on buyers, sellers and prices.

Ostensibly, this is to stop manipulation of the spot price of Bitcoin.

But it would also give the government access to this information. Which essentially grants it the power to monitor individual investors and potentially limit investments or gains.

Plus, all your information would be shared with the IRS in real time.

In other words, the deck would be stacked against the individual investor and in favor of the government and Wall Street.

After BlackRock’s application, a number of others hit the public record.

Fidelity, ARK Investment, Invesco, WisdomTree and Valkyrie all turned in applications as well.

And every single one of them added this surveillance clause.

I predict the SEC will approve BlackRock and a number of other spot Bitcoin ETF’s – paving the way for Wall Street to control access to crypto investments.

And it could happen any day.

Like it or not, Wall Street’s crypto takeover could send the price of Bitcoin to $100,000 or more.

Lots of smaller coins could see exponential gains.

BlackRock’s spot Bitcoin ETF approval is just the beginning though …

Just the spark that starts the raging fire.

Because my timing model is also flashing green.

Now, past performance doesn’t always indicate future success.

But the last time I saw a bullish signal like this was when I called the bottom in 2018.

The bull market started just three days later and never looked back.

Now, I feel strongly that we’re about to enter a new bull market. One without historical precedent.

Bitcoin ETF approval is just the start.

As crypto moves further into the mainstream and becomes an available investment in mutual funds, retirement accounts and more …

The value of Bitcoin and others like it will naturally rise.

In fact, I think $100,000 Bitcoin must be on the lower end of what’s possible in this bull market.

Don’t let the confusion around the SEC’s lawsuits and the negativity from the mainstream media scare you.

This is NOT a bad time to buy cryptos.

It’s the best time.

And perhaps, the last time before the price spikes forever.

I believe it’s important you buy Bitcoin before anything else.

As the standard bearer, it’s the best store of value.

After all, BlackRock’s Larry Fink called it “digitized gold.”

I’ve shown people separate gains of 333%, 477% and 153% on Bitcoin alone, just by using my timing model to buy at the optimal moment for profit.

In a moment, I’ll share the best way to build your Bitcoin portfolio, one trade at a time.

I’ll share my system for reading the ups and downs to prevent losses and maximize profits.

I’ll also show you how to legally buy Bitcoin right now – without going through Wall Street and without raising red flags with the U.S. government.

But while my Crypto Timing Model can help you maximize your profit on Bitcoin’s rise, it can do even more than that …

You see, my system has identified a handful of alternative coins that will not only trace Bitcoin’s price, but have the potential to exponentially outgain Bitcoin.

This has happened before, thanks to my timing model …

It applies to altcoins just like it applies to Bitcoin and Ethereum.

The average gain on every single crypto recommendation I’ve made is 328%. And that includes the losers.

I helped folks make nearly five times their money on Bitcoin …

11 times their money on Ethereum.

And 11 times their money on THORChain.

I also showed them how to make 29 times their money on Cardano.

The Cardano pick alone would’ve turned $10,000 into over a quarter of a million dollars.

And according to my math, the next run-up in crypto prices could produce similar winners.

A few select alt coins could see unheard-of climbs.

But I have to warn you:

Don’t just go out and buy any old crypto.

Now, more than ever, there are very few, lower-risk options with a legitimate chance to make a profit.

A few diamonds in the rough in a market filled with scams and garbage.

In fact, right now my proprietary algorithm says 95% of all cryptos are worthless.

That means, if you just blindly buy crypto without doing your research, you have a 95% chance of losing your money.

I don’t want that to happen …

Which is why I am doing something I rarely do.

I’m going to publish our Weiss Ratings Authorized List of Cryptos.

And I’ll give you a chance to claim your copy in a moment.

Weiss Ratings is a completely independent ratings company with a 50-year reputation for honesty when it comes to rating stocks, bonds – and now cryptos.

And I use these tried-and-true ratings – in conjunction with my timing model – to help get a full picture of the crypto market.

Those ratings are geared toward safety.

Anything below a B- is not fit to buy.

In the end, just 18 coins made our authorized list.

These are the only ones we believe worthy of your examination at the moment.

If you see a coin and it’s not on this list, don’t buy it.

And the truth is, I don’t even think all 18 of those coins are actually worth buying.

This is just the list I use to start my research. I don’t recommend every coin on the list.

So, I’ve narrowed it down even further …

And created a more exclusive list of one.

That’s right, I’ve identified ONE virtually unknown coin I think you should buy before all the others.

This is the coin I’m most excited about right now. I think it has the same potential as Cardano when I first found it.

I’ll share all the details about this unique project with you in my special briefing called, “The Only Altcoin to Own Right Now.”

I will rush this and your Weiss Ratings Authorized List of Cryptos to you as soon as this video is over.

I’ll explain how you can claim a copy in a moment.

I want you to have this information because I believe in the power of digital currency …

And I see a time in the very near future where Bitcoin, Ethereum and a number of other currently forgotten-about coins are at all-time highs.

But I understand we’re in a strange moment right now.

The government’s crackdown …

The legal attack on some of the largest trading platforms …

Plus, uncertainty about how regulations and taxes will affect you in the future.

All these reasons could make some folks queasy when it comes to buying cryptos.

It’s certainly not a time to just throw darts and hope for the best.

Only the cream of the crop, the very best coins, are worth owning.

I think we’re in a very difficult market for smaller altcoins.

The future legal landscape is confusing and forcing some of these companies to register as a security could tank prices.

That’s why I think it’s important to utilize our Authorized List of Cryptos – only 5% of all rated coins make the grade for us.

When the regulatory environment clears and the crackdown is over, our ratings may see things differently.

Right now, personally, I only strongly recommend one altcoin.

This coin is one that has been unfairly swept up in the SEC’s lawsuits and the current debate about what is a security and what isn’t.

I’ll admit, there’s a few coins out there with no utility whatsoever – it’s a gray area as far as securities go.

And that’s why we don’t recommend those kinds of coins.

But I believe in this one alt coin precisely because it was created to solve a tangible, Layer-2, smart-contract problem.

This is a utilitarian coin with a specific purpose.

And it works hand in hand with Ethereum.

If you don’t already know, Ethereum is like digital silver to Bitcoin’s gold.

And it happens to be one of the coins outside of the SEC’s crosshairs, because it has a real use.

Even better, when Ethereum goes up, which I believe it will when Wall Street gets involved with crypto …

This altcoin could go up even more.

Late in 2021, Ethereum surged 153%.

But this coin climbed 319% — more than double the reward during the same bull market.

When Wall Street takes over crypto, Ethereum could soar 10x or higher.

And this coin could double that – doing 20x or more.

I can’t tell you more about this coin here, but I’ll share all the details in my special report, The Only Altcoin to Own Right Now.

I’ll give you the name of this coin.

I’ll share step-by-step instructions on how to buy it.

And I’ll recommend a proper entry price with max upside.

I’ll show you how to get a copy of our Weiss Ratings Authorized List of Cryptos and The Only Altcoin to Own Right Now in just a moment.

But that’s only part of the resources I’d like to send you today, so you can use my proprietary timing model to take advantage of Wall Street’s crypto takeover.

The 4 Stages of Every Crypto Bull Market

In 2018, I was able to time the top and bottom of the crypto market almost down to the day.

I warned that the market was due for a crash in January 2018 – when the rest of the crypto investors were still buying more.

I was attacked from all sides by crypto bulls.

But sure enough, the market tanked.

Bitcoin’s price crashed 84% over the next few months.

The rest of the year was gloom and doom for the crypto market.

On Dec. 12, 2018, less than a year after I called the top …

I said we had hit bottom and Bitcoin, along with most other cryptos, was headed for a bull market.

Sure enough, a bull market started just three days later.

This is how I’ve been able to book specific gains of 477%, 333% and 153% on Bitcoin – while avoiding big losses.

Trust me, I’m not just throwing darts and guessing at these dates.

There is a real pattern to how the Bitcoin price moves.

In fact, a lot of people believe the crypto market is unpredictable.

But, nothing could be further from the truth.

Using my math and trading background, I created a proprietary algorithm that tracks the true movement of Bitcoin and other crypto.

And when I analyzed the results, I saw that crypto, especially a mature coin like Bitcoin, trades in a very orderly pattern.

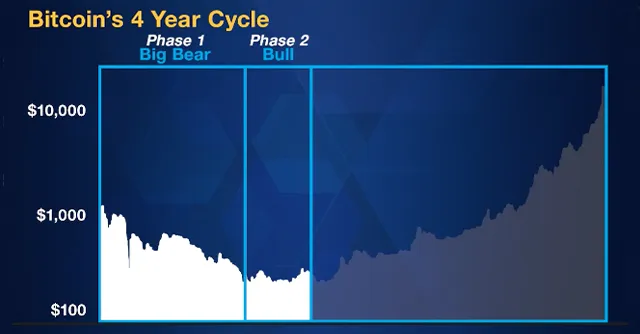

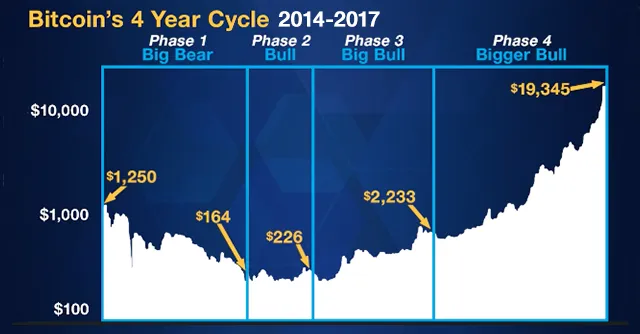

I discovered there are four distinct phases to any Bitcoin bull market. And each phase lasts about a year.

Take a look at Bitcoin’s chart from 2014-2017.

The first stage is called the Big Bear.

It usually comes just after a recent top.

It lasts about a year and drives the price down.

The second stage is the Transition stage – investment is starting to pick up after a breather.

No new lows are made, hence the transition from bear to bull.

But at this stage, we still don’t see the truly big move yet …

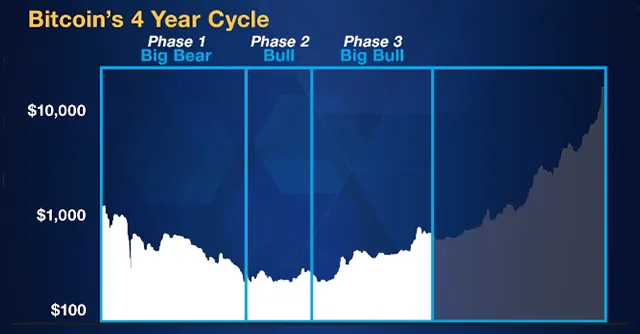

Stage three is the Big Bull – a spike that appears to reach a top …

Only for Bitcoin to stride into stage four – the Bigger Bull – which moves the price even higher.

And then the cycle starts again.

It happened from 2014-17.

And it happened between 2018 and 2021.

I believe last year was stage one – the Big Bear.

But now things are turning bullish …

And I expect a Bitcoin ETF approval to signal the launch of the Big Bull stage.

In my Ultimate Bitcoin Timing Guide: How to Pick the Big Bottoms and Big Tops with Confidence, I’ll show you exactly where I’m targeting as the point of no return for Bitcoin’s price.

And I’ll explain why this will be a smaller-than-normal move for Bitcoin – yet it could still take the price over $100,000 easily.

I’ll also share more about my 80-day cycles …

These are short-term patterns that appear in every stage of the larger four-year trend.

These 80-day cycles are the key to buying – and selling – your Bitcoin at just the right time.

I’ll show you how to time these moves almost to the day, in my Ultimate Bitcoin Timing Guide.

Keep in mind, past performance doesn’t indicate future results. Cycles can change, bear markets can last longer, bull markets can be shorter.

I’ll also share guidance on how to deal with these variances of the timing model.

I’ll send you all three of my crypto resources today, at no charge.

- The Weiss Authorized List of Cryptos

- The Only Altcoin to Own Right Now

- The Ultimate Bitcoin Timing Guide: How to Pick the Big Bottoms and Big Tops with Confidence

All you have to do is order a risk-free subscription to my monthly newsletter, Weiss Crypto Investor.

Weiss Crypto Investor uses my proprietary timing model to determine which coins you should buy – and when you should get in and out of those coins.

So, you can have the opportunity to buy or sell ahead of the crowd.

You’ll always get the latest updates on my Crypto Timing Model – before anyone in the public hears my prediction.

I won’t say it on TV, a podcast, an interview or anywhere else – before I’ve told my Weiss Crypto Investor Members.

Every month, I’ll give you the newest information from proprietary algorithms. I’ll show you exactly where you are in the cycle.

And I’ll recommend what you should buy and sell with the investment money you allocate to crypto.

The idea – simple as it is – is to use the timing model to tell us the best time to enter and exit our positions.

Is it always possible to time things exactly?

Of course not, there is no perfect system for investing.

However, our overall track record is remarkable.

We’ve recommended 30 separate crypto trades over the past five years.

The average gain was 328%.

And that includes the losers.

Some of the winners were even more extraordinary.

Like, 1,135% on THORChain …

And 2,925% on Cardano.

Anyone following my signals could’ve doubled their money or better three different times on Bitcoin.

They could’ve booked gains of 673% … 1,148% … and 826% on Ethereum.

Booking these kinds of big gains requires precise timing.

So don’t worry, I won’t leave you sitting on the sidelines while the big moves are happening.

I will alert you at any time during the month, as soon as possible, whenever something changes with our recommendations or the crypto market as a whole.

Like potentially when BlackRock’s Bitcoin ETF is eventually approved.

Plus, you can follow my thoughts on the crypto market, along with our top crypto analysts at Weiss, every day in Weiss Crypto Daily, which comes free with your subscription.

In fact, here’s everything you get today, when you subscribe to: Weiss Crypto Investor.

- 12 Monthly Issues. On the fourth Friday of every month, you’ll get a new issue full of my latest research on the crypto market, along with a fresh recommendation on where you should be investing your money.

- ASAP Alerts and Updates. Any time the market swings or something changes with one of our recommendations, you’ll be the first to know. We’ll send timely alerts to keep you ahead of the rest of the crypto market.

- Free Subscription to Weiss Crypto Daily. Keep up with the everyday movements of the crypto market with our expert crypto analysis. All of our analysts contribute to bring you the latest news, gossip and investment advice in the world of crypto.

- Access to my Proprietary Timing Model. Your subscription to Weiss Crypto Investor buys you access to the signals I give you based on my extremely successful, proprietary Crypto Timing Model. No one other than our members gets access to this tool. And as you’ve seen, this tool has led to large, repeated gains on Bitcoin … 477%, 333% and 153% … Ethereum … 1,148%, 826% and 673%. And it identified Cardano as a buy before anyone else – leading to a 2,925% gain.

- The Only Altcoin to Own Right Now. My Crypto Timing Model has picked out one altcoin that I predict could really take off as Wall Street gets control of the crypto market. This could be the next Cardano. And you can get it at a great price right now. Find out all the details in this report.

- The Weiss Ratings Authorized List of Cryptos. This is our authorized list of cryptos to buy, based on Weiss Ratings formula. The cryptos we’ve rated B- or better. If a coin isn’t on this list, you should probably avoid it all costs. Keep in mind, this isn’t a buy list. It’s just a small list of the handful of cryptos we’ve rated as providing the best combination of maximum return potential and lowest risk.

- The Ultimate Bitcoin Timing Guide: How to Pick the Big Bottoms and Big Tops with Confidence. I’ll show you how to spot the different stages of a crypto bull market – and how to use them to avoid losses and book maximum gains. Weiss Crypto Investor is not a trading service. We don’t jump in and out of recommendations. But we do use the timing model to sell before the top and buy at the bottom.

I mentioned this was a “risk-free” subscription to Weiss Crypto Investor.

Here’s what I mean:

Your Weiss Crypto Investor subscription lasts for one year.

If you’re not satisfied with our service, you can cancel, and we’ll give you a full refund – at any time during your first 12 months.

We want you to feel comfortable with our research and recommendations.

I think, once you’ve had a chance to dig into your bonus reports and see the potential value in my recommendations, you’ll want to stay with us for the long haul.

That’s why I’m confident in giving such a generous refund policy.

So how much will a year of Weiss Crypto Investor cost you?

Our publishers value the special reports I mentioned at nearly $1,000 or more.

And we could probably get away with selling these for that much.

But our stated goal is to give regular folks a chance at life-changing crypto gains.

And charging thousands for this service would defeat that purpose.

Before I tell you how much the price is – there’s one more bonus I’d like to send you.

It’s an essential tool for the market we’re in right now.

The Best Legal Way to Buy Crypto in America

You see, with Binance and Coinbase under attack …

The SEC sending mixed messages on the legality of specific coins …

And banks now under pressure from the government to deny Bitcoin transactions …

It can be a little confusing as to what is legal …

And what the best method is to purchase legal crypto – with the highest amount of safety and the lowest amount of fees.

Our analysts are on top of every announcement, every new rule and government proclamation.

And we’ve put together an up-to-date guide for you.

It’s called The Best Legal Way to Buy Crypto in America.

It will walk you through the best places to buy and trade crypto right now, without facing legal or banking scrutiny.

We’ll show you how to store your coins, which platforms are safe and which to avoid.

We’ll give you a step-by-step primer on how to fund your wallet, how to buy and sell coins and how to cash out when it’s time. And we’ll give you some tips to avoid scams or thieves.

Whether you’re a newbie or a veteran, the rules are constantly changing. Our primer, The Best Legal Way to Buy Crypto in America, will help you stay on top of the shifting sands of regulation.

It’s a complement to the rest of our reports and a must-have if you’re interested in taking advantage of Wall Street’s coming takeover of crypto – and what that means for future prices.

We’ll send it straight to your inbox just moments from now, free of charge.

All you have to do is order a risk-free subscription to Weiss Crypto Investor.

How much will that cost you?

Less than a tank of gas …

We’ll give you 12 months of Weiss Crypto Investor, with all these critical bonus reports:

- The Only Altcoin to Own Right Now

- The Weiss Ratings Authorized List of Cryptos

- The Ultimate Bitcoin Timing Guide: How to Pick the Big Bottoms and Big Tops with Confidence

- The Best Legal Way to Buy Crypto in America

Plus, all the other bonuses we offer to Weiss Crypto Investor Members.

All for just $49 a year.

We could be on the verge of a historic run-up in crypto prices.

The potential heavy involvement of Wall Street could send Bitcoin’s price over $100,000.

And I expect the government to approve BlackRock’s ETF any day now.

When that happens, it will be the rocket fuel that sends crypto into orbit.

With our special reports and my Crypto Timing Model, you’ll be in the best position to profit off crypto in the near future.

And we’ll keep you informed on this ever-changing market. So you can stay one step ahead with your investments.

In past bull markets, I’ve shown my readers huge gains …

Just one winner like the 2,925% we gained on Cardano would pay for your Weiss Crypto Investor subscription multiple times over.

And if I’m right about Wall Street and the government’s intentions … we could be on the verge of a bull market unlike any other.

Please join me at Weiss Crypto Investor.

And make potentially life-changing profits in the meantime.

Click on the link below to subscribe.

Weiss Crypto Investor

© All rights reserved | 11780 US Highway 1, Palm Beach Gardens, FL 33408-3080 | 877-934-7778