Nanotechnology is the field of technology/science that studies the breakdown of materials into their nano divisions (one-billionth of a meter). It has been seen that at these sizes (typically between 1 and 100 nanometers), materials have different characteristics and uses. This opens up an entirely new dimension in materials science with implications for the scientific fields of chemistry, biology, physics and engineering.

The technology is already used for fabrication of semiconductors and their progressive miniaturization to densely pack billions of transistors on a single integrated circuit (chip) and thereby boost its functionality.

But miniaturization is but one use of this technology, which can potentially reinvent life as we know it.

For example, scientists are developing tiny sensors that could be injected or implanted into our bodies for monitoring purposes. These sensors could be used for early detection and prevention of disease, detection of inflammation, control of organ function, and so on. They are particularly useful in early diagnosis and treatment of neurodegenerative diseases.

Nano particles (of gold, for instance) have been found to be highly effective at drug delivery to the exact site where you want the medication. This can allow the reduction of dosage by 100X, thus significantly reducing the side effects. In a cancer patient, they can identify the cancer cells and destroy them, leaving the healthy cells intact, thus improving survival rates and patient discomfort. They can identify a number of pathogens and kill them.

Outside the body, tiny sensors attached to critical infrastructure like bridges, aircraft and nuclear power plants for example, can monitor the condition of the structure, to determine if it is working optimally.

Because nanoparticles have different and very interesting characteristics, it’s not far-fetched to imagine that we will soon have coatings and paints including them. So, when cracks appear in structures, they are automatically mended by these particles. This will increase the longevity of whatever it is we’re building.

[Mad Rush: Surging Demand for Computing Power Could Make You 10x Your Money]

Kyoto University has developed a semiconductor that allows solar panels to double the amount of sunlight converted into electricity. Researchers at UC San Diego have developed a nanoparticle-based material that can convert to heat more than 90% of the sunlight captured.

Most importantly, it can withstand temperatures up to 700 degrees Celsius and survive outdoors for several years despite exposure to air and humidity. Nanotechnology can make wind turbines stronger and lighter and some nanoparticles facilitate thermal insulation, which can save energy and reduce costs.

Nanotechnology is somewhat less effective at water treatment because of the tendency of nanoparticles to accumulate and thereby lose their special characteristics. But it has been seen that some nanoparticles are good at detecting various bacteria and pathogens, as well as heavy metals in waste water.

Food packaging is also getting a makeover to improve resistance to external environments and increase the shelf life of food.

In textiles, researchers are looking at the possibility of no-crease, no-stain materials for clothes and stronger, lighter alternatives for things like helmets and sports equipment.

The main roadblock to deployment is the safety of exposing nanoparticles to the human body and there’s much research going on in this area.

Of course, the strongest driver of change will be the ability to collect Big Data with this technology. The potential for data is so tremendous that it will turbo charge all efforts to increase R&D on safety.

[Hot New Tech: Why DARPA teamed up with this little-known company in a $1.5 billion program]

So, although it might sound like science fiction in some cases and far-fetched in others, nanotechnology will hit us sooner than we imagine. Within the next 2-3 years, this will be a phenomenon to reckon with. Consequently, it makes sense to keep an eye on the companies focused on the area.

The Zacks Nanotechnology industry is currently in the top 8% of Zacks-classified industries although we have limited knowledge on most players, given that they are so small and that there is still limited following among analysts.

3 Nanotech Stocks to Buy for Now and Future Gains

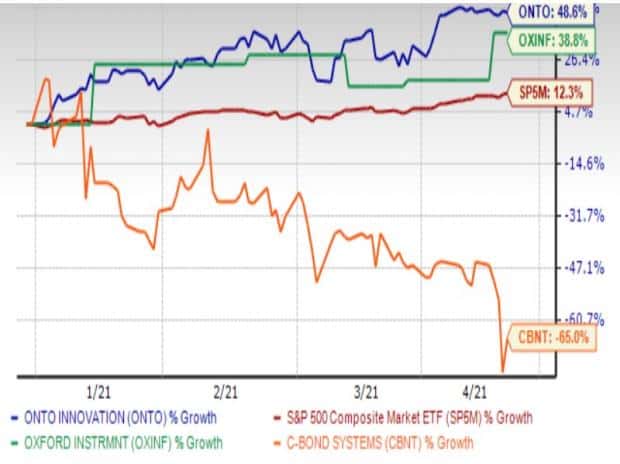

Of the three stocks that have received some attention from analysts, Onto Innovation Inc. (ONTO) is the most followed. Formed through a merger between Nanometrics Incorporated and Rudolph Technologies, Onto makes process control tools for macro defect inspections and metrology, as well as lithography systems. Its products are used in silicon wafer substrates, as well as power and data storage devices.

The two analysts providing revenue estimates currently expect 18.3% growth this year and 8.9% growth in the next. The three earnings estimates making up the Zacks Consensus are calling for 42.0% earnings growth this year and 14.6% in the next.

The Zacks Rank #3 (Hold) company has a Growth Score of A.

Abingdon, UK-based Oxford Instruments plc (OXINF) is a holding company focused on R&D, manufacture and sale of advanced tools and systems targeting the nanotechnology (hi-tech tools to characterize, analyze, manipulate and fabricate at a nano scale), industrial products (tools and components for industrial applications) and services (smart services, training and refurbishment) segments.

For the year ended March ’21, the company is expected to have clocked revenue and earnings of $425.8 million and 97 cents, respectively. This is expected to go up a respective 3.3% and 5.2% in 2022. There could be an upward revision after the company reports.

Current earnings estimates represent a 15.5% increase in 2021 and a 17.2% increase in 2022.

The Zacks Rank #1 (Strong Buy) company has a Growth Score F.

[Urgent: Getting in on this company could generate a 950% gain in the next few months]

CBond Systems, Inc. (CBNT) is a nanotechnology company that has developed and manufactured the patented C-Bond technology to enhance properties of strength, functionality and sustainability within porous material systems. Its current focus is on the multi-billion-dollar glass and window film industry.

The company’s current-year sales are expected to go from $0.6 million to $2 million. The current-year loss is estimated to be 2 cents.

The Zacks Rank #3 (Hold) company has a Growth Score of D.

[See Also: How to Make a Killing on Spatial Computing’s “Killer Apps”]