Table of Contents:

- Keith Kaplan Introduction

- Predict a stock’s future behavior with incredible accuracy

- Stock DNA could have helped you avoid the biggest pitfalls of 2022

- The Stock Genome Project issued buy alerts on some of the biggest winners of 2022

- Maximize your gains, minimize your losses, and avoid catastrophe

- Wall Street-caliber research for the retail investor

- It all boils down to this algorithm

- See if any stocks are in Buy or Sell mode

- Position Size Calculator

- The Stock Genome Project: How to 10X Your Portfolio With Stock DNA

- Stock DNA Portfolio

- This could be your only chance

PRESENTED BY TRADESMITH

$18 million, 11-year Scientific Study Reveals Investing Breakthrough of the Century:

“THE STOCK GENOME PROJECT”

After over a decade of research and development, a team of elite data scientists have successfully mapped out the DNA of over 50,000 stocks and funds

PAUL:

Is it possible to use DNA to predict the behavior of the stock market?

This might sound outlandish to some…

But our guest tonight says he and his team have spent over a decade answering that question.

They call it the Stock Genome Project…

And it’s been responsible for predicting some of the biggest stock market gains — and losses — of the past decade.

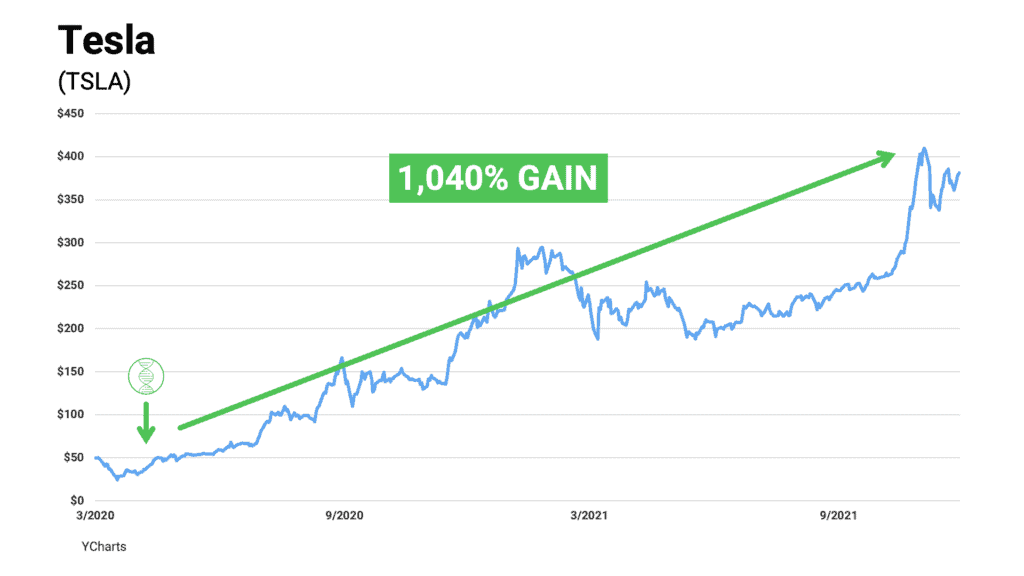

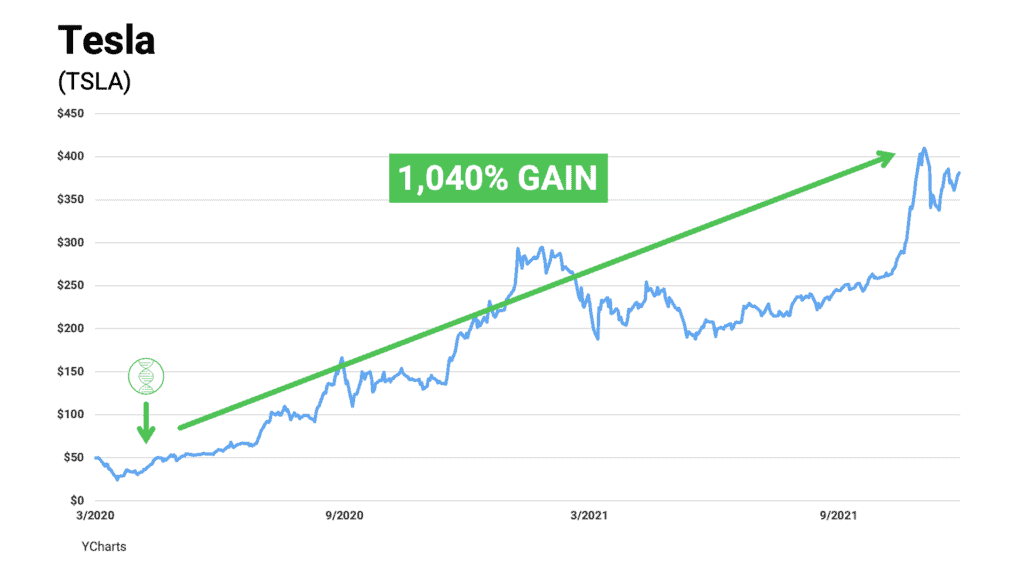

It signaled a “buy” alert on Tesla before it soared 1,040%…

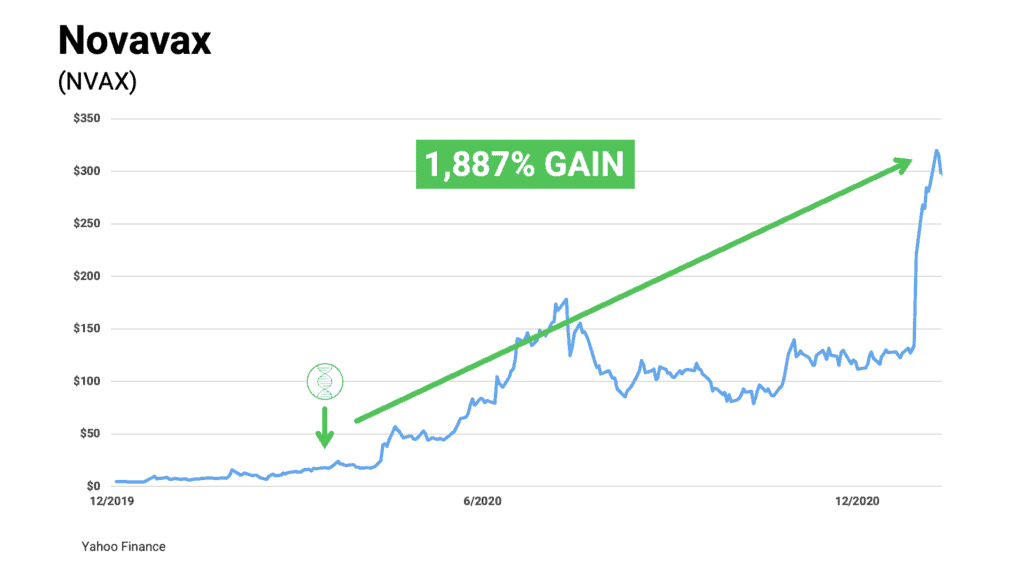

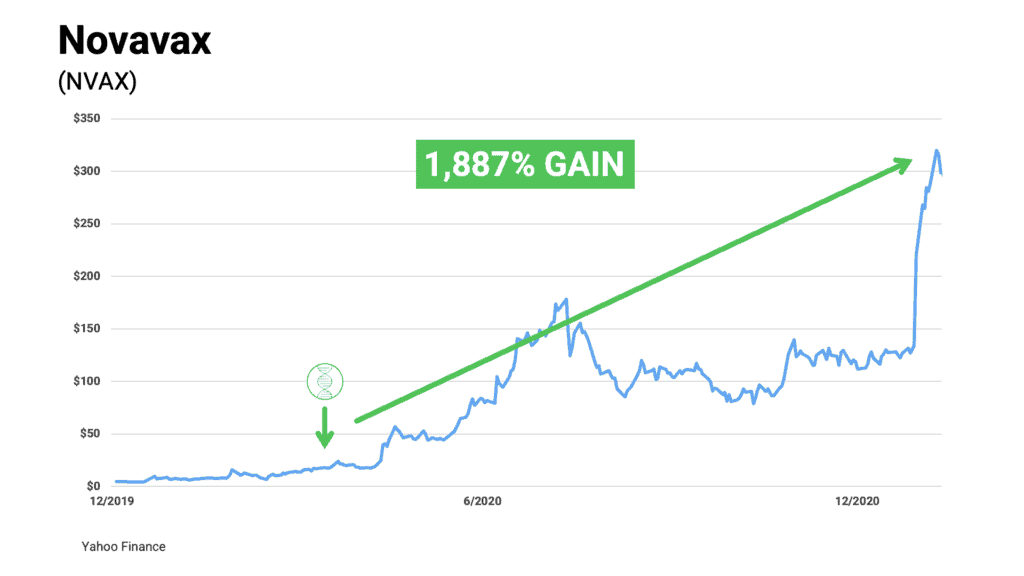

Novavax before it soared 1,887%…

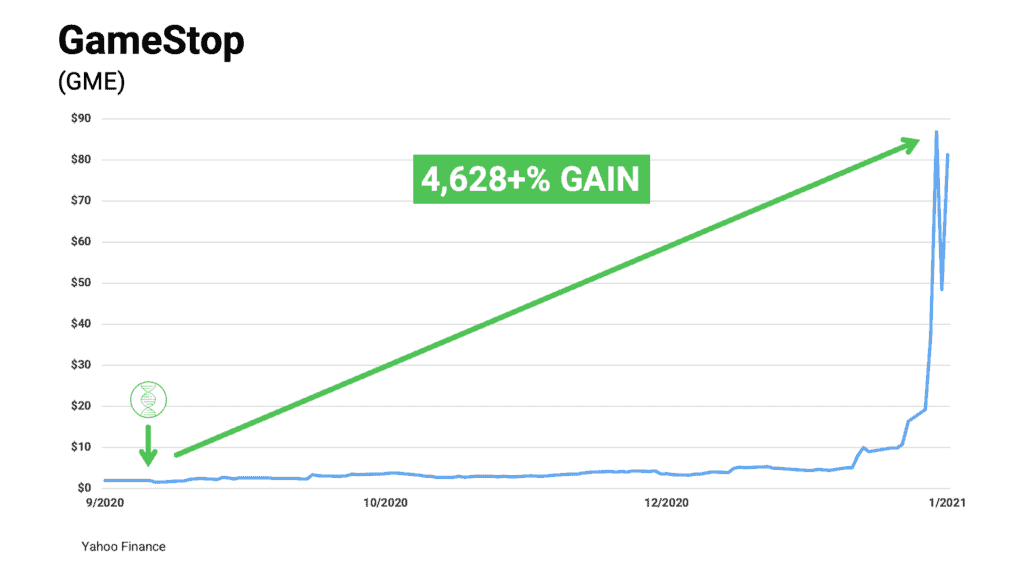

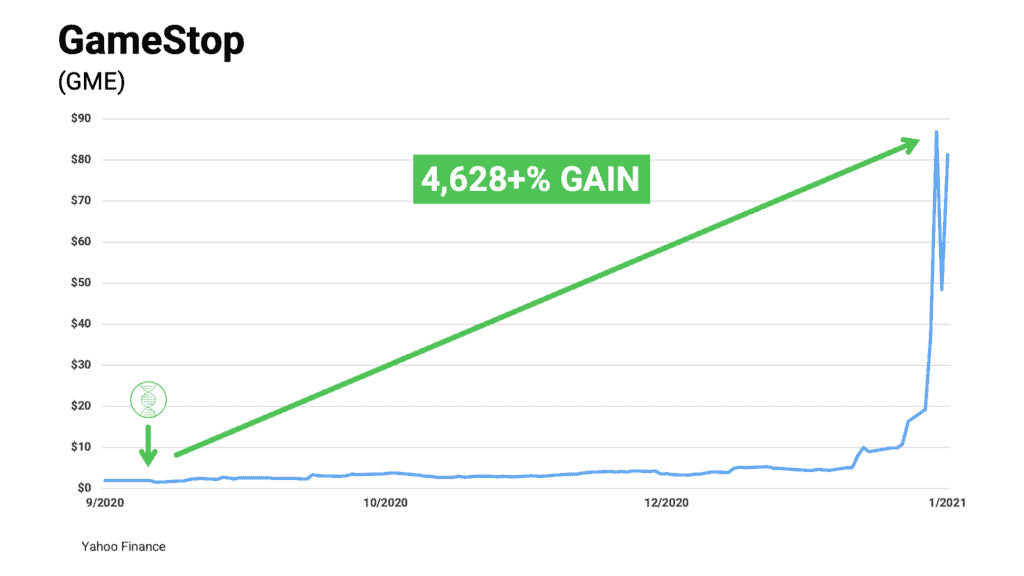

And GameStop before it exploded 4,628%…

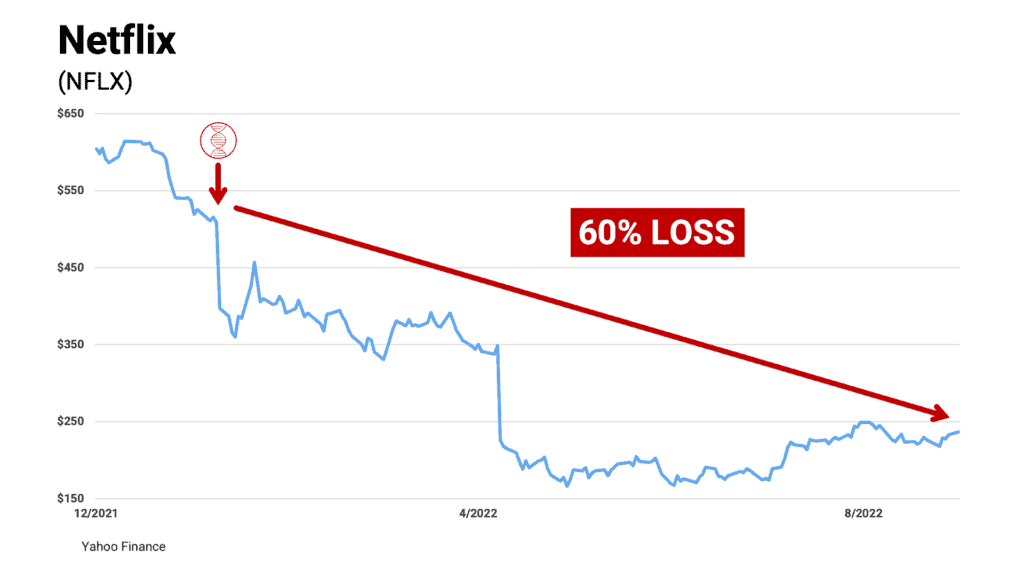

It signaled to sell Netflix before it plummeted nearly 60%…

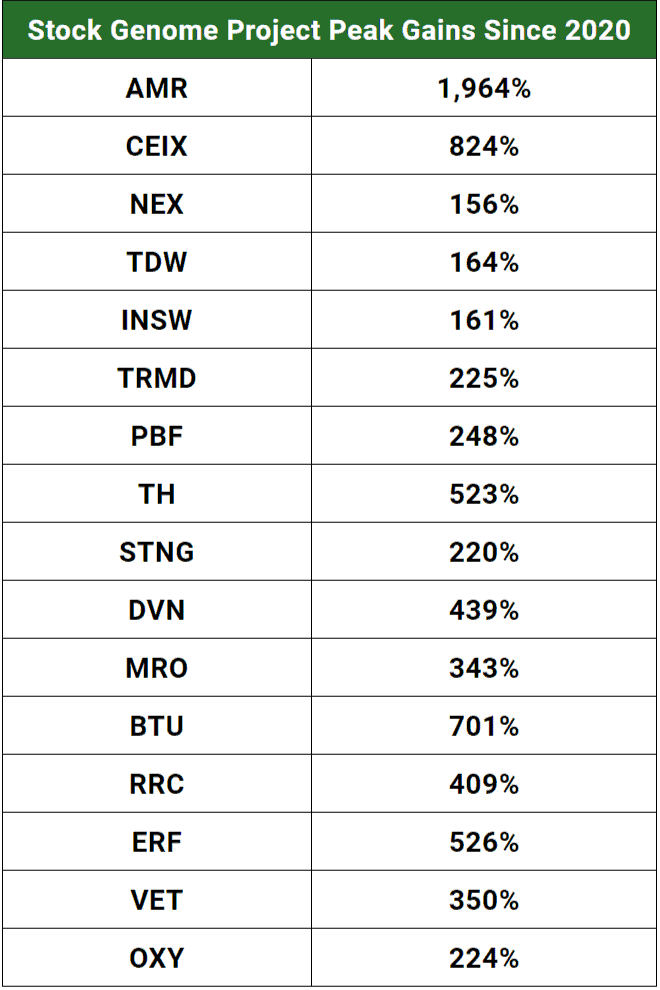

And while the market was falling apart in 2022, it had already issued buy alerts on over a dozen of the top performing stocks serving the energy sector.

It’s all possible thanks to what our guest tonight calls “stock DNA” — the unique genetic code hidden in every stock.

Joining me in the studio is Keith Kaplan, CEO of TradeSmith, the company responsible for the Stock Genome Project — and mapping out the DNA of over 50,000 stocks.

Keith, thank you for joining us.

KEITH:

I couldn’t be more excited to be here, Paul.

We’ve spent a lot of time and money on this project…

We believe it’s going to fundamentally change the way the average person invests.

Once you see the predictive power of the Stock Genome Project for yourself, you’ll understand why this is such a game-changer.

I’m here today to show folks how simply understanding the DNA of the stocks in their portfolio can help them maximize their gains…

Minimize their losses…

And stop relying on “gut instinct” — or simply bad information — to guide their investing decisions.

PAUL:

Well, you’ve certainly come to the right place.

A lot of folks tune into these broadcasts to learn how to get an edge in the investing world.

It sounds like that’s exactly what you’re offering.

But I won’t lie to you, Keith, you may have your work cut out for you.

I mean “stock DNA?”

“The Stock Genome Project?”

You have to admit that sounds a bit strange.

Why don’t you start by explaining what exactly we’re talking about here.

KEITH:

Of course. I don’t blame you for being skeptical, Paul.

I would be too if I were you.

To put it simply, a little over a decade ago my team of data scientists made an amazing discovery…

They found that every stock on the market has its own unique DNA…

And much like human DNA, you can use it to predict a stock’s future behavior with incredible accuracy.

We’ve spent over a decade and tens of millions of dollars figuring out a way to sequence the DNA of over 50,000 stocks, funds and ETFs.

The result is a proprietary stock screening system we’re calling the Stock Genome Project.

PAUL:

That’s fascinating.

So, you’ve essentially taken the concept of DNA or “genetic behavior” and applied it to the stock market?

KEITH:

That’s exactly right.

If you look at a person’s DNA you can tell a lot of things about them.

You can tell what color their eyes are, how tall they’re going to be, what color their hair is…

You can even predict their level of academic achievement and how likely they are to commit crime from an early age.

DNA is extremely predictive of future behavior and characteristics.

The human genome project was this massive collaborative effort to understand the genetic behavior of people…

The Stock Genome Project is an effort to understand the behavior of stocks.

The difference is that we’re not doing it in a lab…

We’re using an $18 million supercomputer that performs hundreds of millions of calculations per day to sequence the DNA of the entire stock market.

What we’ve uncovered is mind-blowing.

Every stock has its own unique DNA!

No two stocks are the same, just like no two people are the same.

PAUL:

This is a fascinating concept, Keith.

I’ve done a lot of interviews with a lot of smart investors, but I’ve never heard of anything like this.

KEITH:

That’s because it’s our proprietary project, Paul.

It’s the result of over a decade of research and development.

We believe we’ve uncovered the single greatest edge in the investing world.

When most investors analyze stocks, they’re looking at surface-level metrics like earnings per share and revenue projections.

But those metrics don’t give you enough to go off of. They don’t show you the full picture.

That’s why we use proprietary stock DNA sequencing technology to look at the fundamental “genetic code” of each stock.

I won’t mince words — this technology is extremely powerful.

Essentially, we’ve mapped out the behavioral characteristics of more than 50,000 stocks, funds, and ETFs.

We’ve learned things that even the world’s most successful investors don’t know.

It may be the most powerful investment technology that’s ever been made available for Main Street Americans.

In fact, it’s allowed us to crush the performance of billionaire investors in our back tests.

And it’s also allowed us to predict major market moves, weeks ahead of time.

PAUL:

See, that’s where my skepticism comes in, Keith.

You’re telling me that this Stock Genome Project screening system has predicted major market moves…

What kind of market moves are we talking about here?

And to follow that up, are we talking about real time predictions, or is this all just backtested data?

KEITH:

Those are great questions.

This system has, in fact, predicted stock market crashes in the real world, in real time.

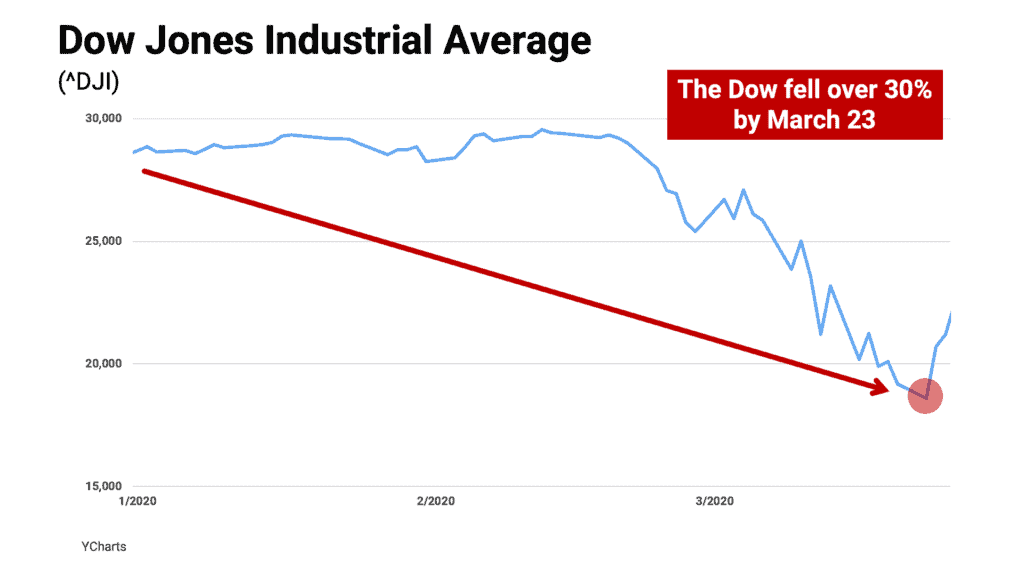

For example, remember back in 2020 when the markets tanked over 30% following the pandemic?

PAUL:

I do. That was a staggering drop after one of the longest bull runs in history.

I know a lot of folks took a massive hit because they simply didn’t see it coming.

KEITH:

That’s true. Frankly, there’s no way they COULD have seen it coming…

Unless, of course, they had access to the genetic code of over 50,000 stocks…

PAUL:

Keith, are you about to tell me that it was possible to avoid the crash of 2020 thanks to stock DNA?

KEITH:

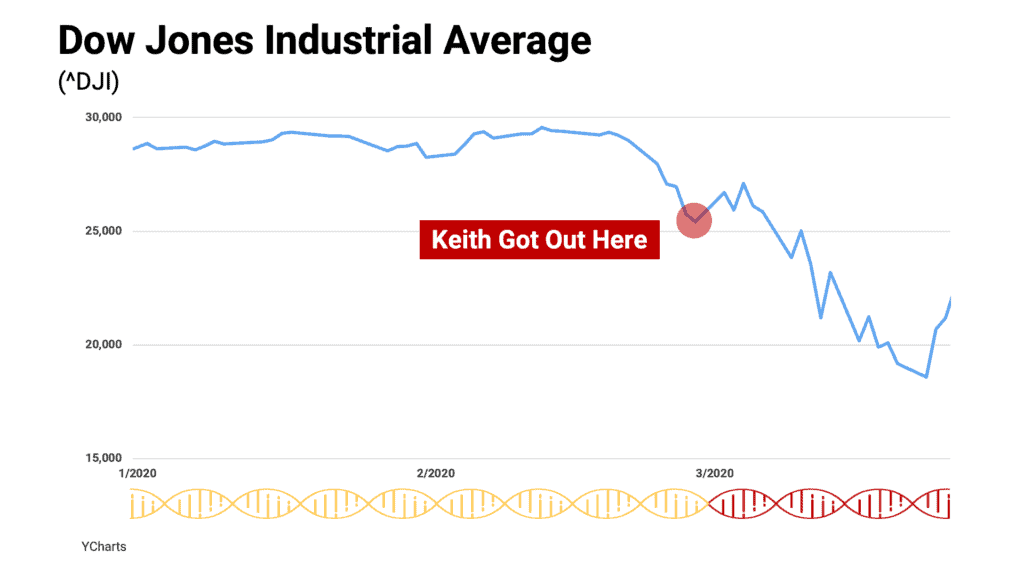

I am. Using the Stock Genome Project I personally avoided losses of 30%.

Take a look for yourself…

You can see where the market started to crash in February…

Like you said, if you just waited it out, you would have lost over a third of your money.

Meanwhile, if you had access to the DNA of over 50,000 stocks and funds like I do, you’d have seen it coming from a mile away.

That circle right there is where I got out, right after the initial dip.

Here’s a picture of my actual portfolio:

As you can see, I sold and went mostly to cash on February 28, 2020…

That’s when the DNA of the stocks in my portfolio went “red.”

That means the system was telling me the stocks were outside of their healthy range and it was time to decide if I should sell.

And I wasn’t the only one…

We’ve opened the Stock Genome Project to a small group of everyday Americans…

Here are some of the emails they wrote us following that crash:

One man from Arizona named Richard avoided a $100,000 loss…

Michael H. from Oregon saved a few hundred thousand…

And Bernie E. from Texas told us he managed to get out entirely — weeks in advance.

***The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.***

PAUL:

Wow, that’s amazing.

Now, were these people all trading the same stocks?

I mean, does this work no matter which stocks are in your portfolio?

KEITH:

Another great question, Paul.

As far as I’m aware, they all had completely different portfolios.

That’s the beauty of the Stock Genome Project.

As long as the stocks in your portfolio are among the 50,000 stocks we track, our system monitors their DNA on a daily basis.

Then it gives you a signal you can use to decide if it’s best to buy, sell or hold the stock.

It’s as simple as punching the tickers of your favorite stocks into a computer…

Then the system takes over and starts giving you DNA alerts.

PAUL:

Okay, so you’re saying this “Stock DNA” screening system works on the stock market as a whole…

But it also predicts the behavior of individual stocks?

KEITH:

You got it.

PAUL:

So, what about 2022?

We saw a lot of stocks crash last year.

A lot of big name companies got absolutely slaughtered.

Did your Stock Genome Project predict those as well?

KEITH:

Absolutely.

This system predicted many of the biggest winners of 2022 as well — even as the overall market fell nearly 20%

But first, I want to show you how understanding Stock DNA could have helped you avoid the biggest pitfalls of 2022.

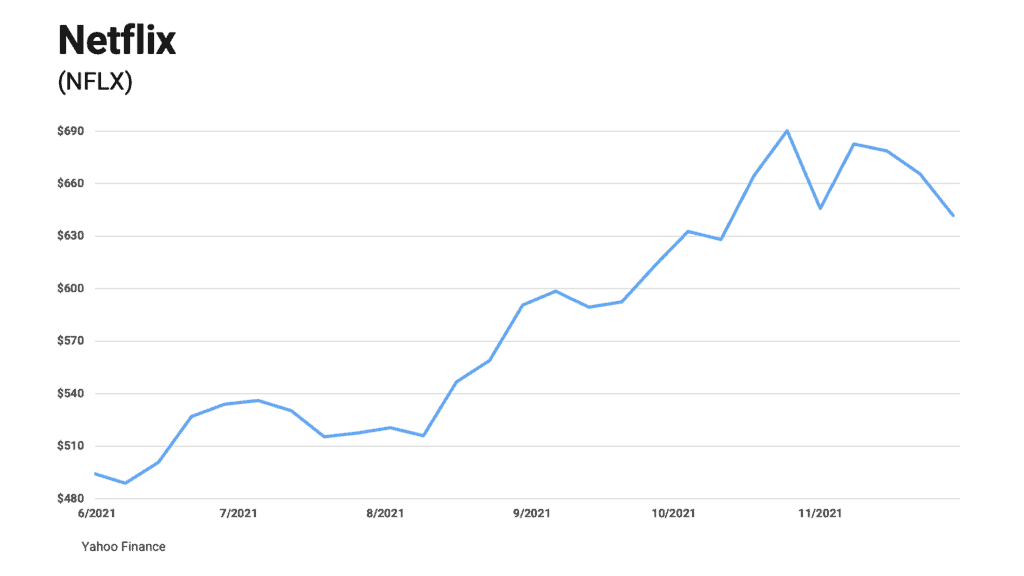

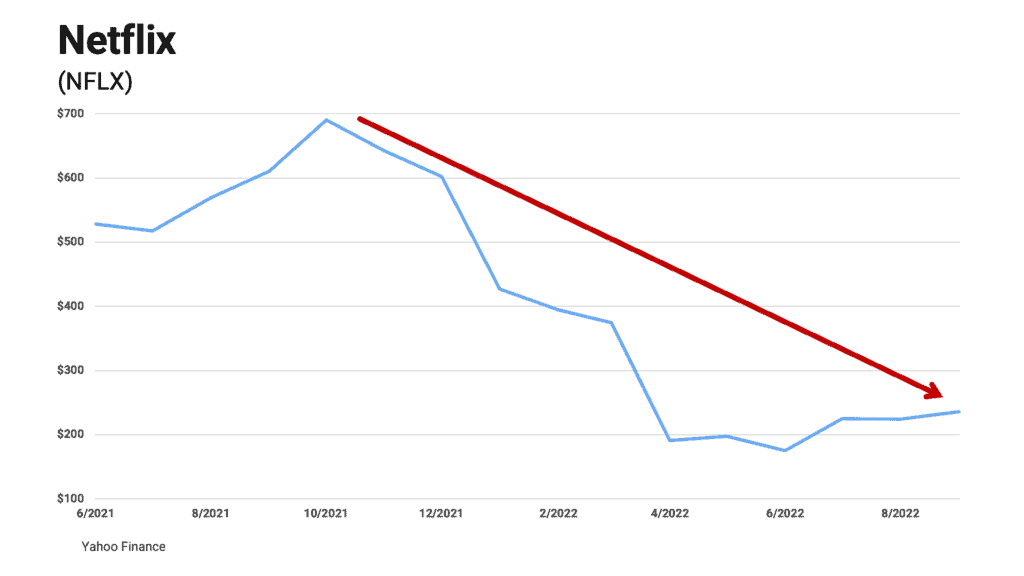

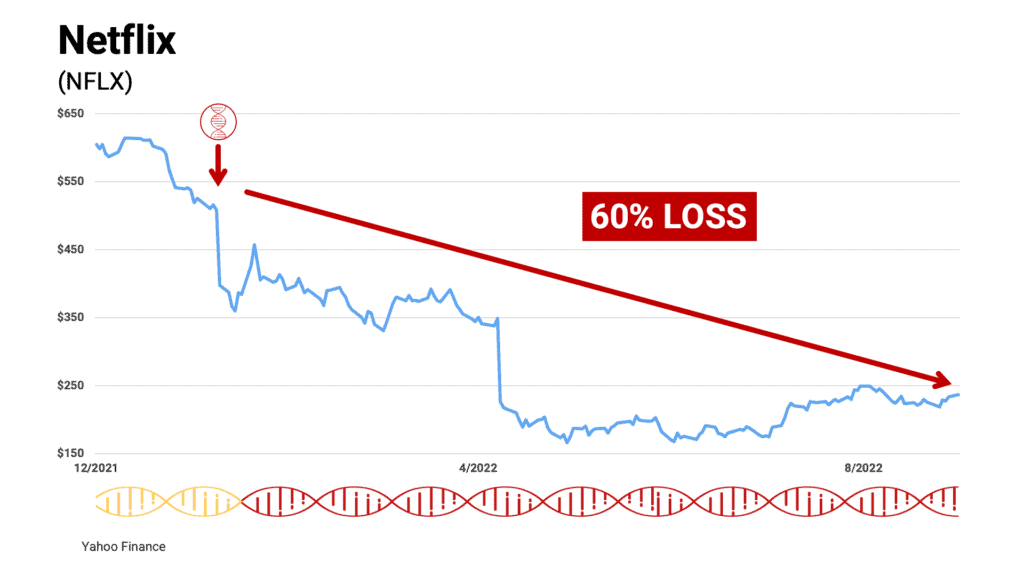

Take Netflix for example.

In late 2021, Netflix was flying high.

A lot of folks were starting to think FAANG stocks were unbreakable.

But of course, over the past year we’ve seen a very different story.

If you’d have held onto Netflix through the bottom in 2022, you’d be sitting on losses of as much as 60%.

That’s over half of your money, gone.

But — if you had access to the DNA of Netflix…

PAUL:

Don’t tell me… You would have gotten out before Netflix tanked?

KEITH:

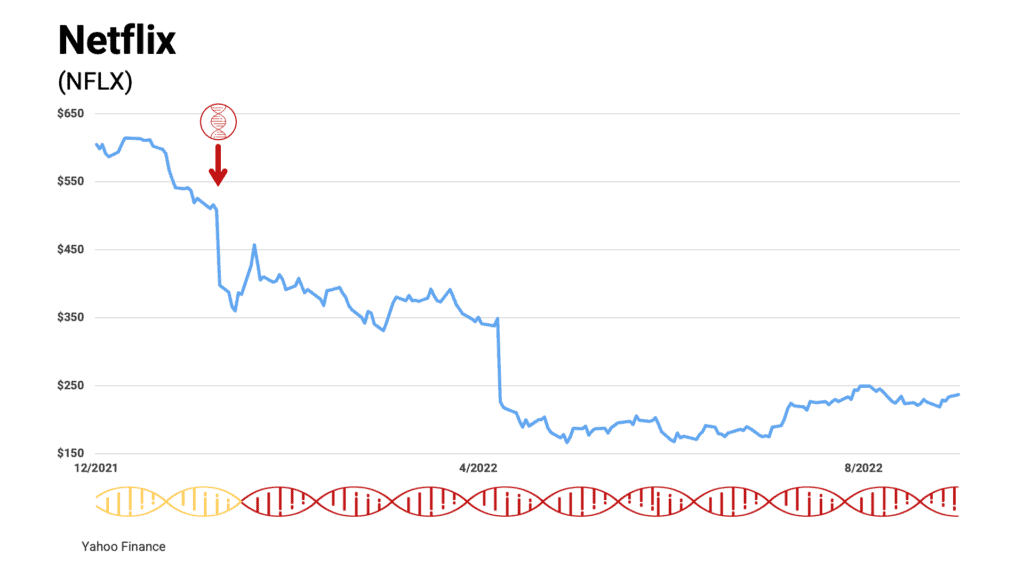

That’s right.

Check this out…

This is a chart of Netflix with stock DNA alerts.

As you can see, the DNA of Netflix went “red” in January of 2022 when it was still trading for around $500.

So say that you had Netflix in your portfolio at that time…

You would have known to sell it way before it plummeted to nearly $150.

But only if you had access to its unique DNA.

PAUL:

Wow, so by having access to the DNA of Netflix, you could have avoided losses of 60%?

KEITH:

That’s right. And that’s just one example.

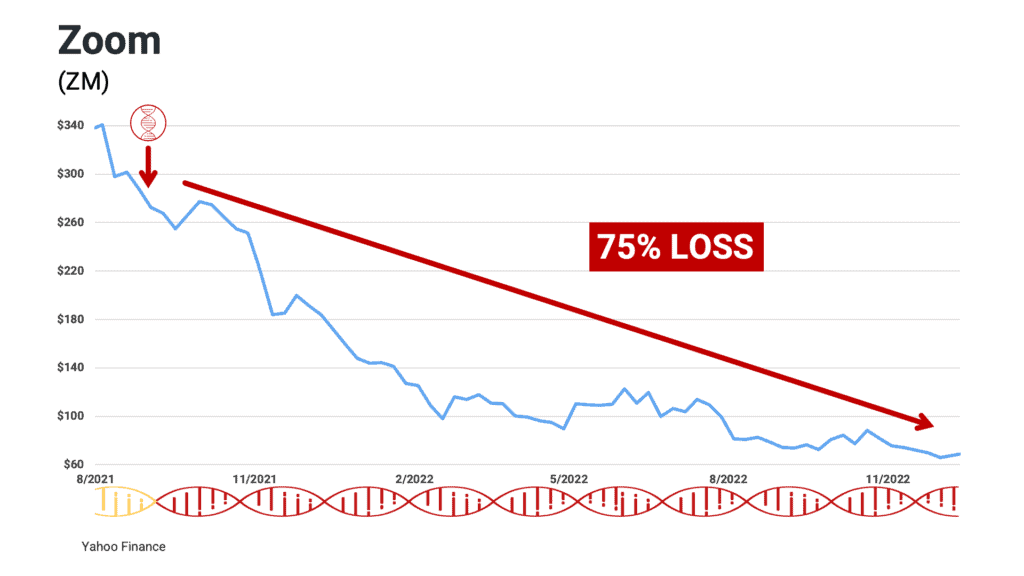

The same thing happened with Zoom…

Starting in late 2021, the stock dropped from around $280 to $70.

That’s a 75% loss for anyone who held on through the decline last year.

But if you simply looked at the stock’s DNA, you would have known to get out and save yourself from taking that massive hit.

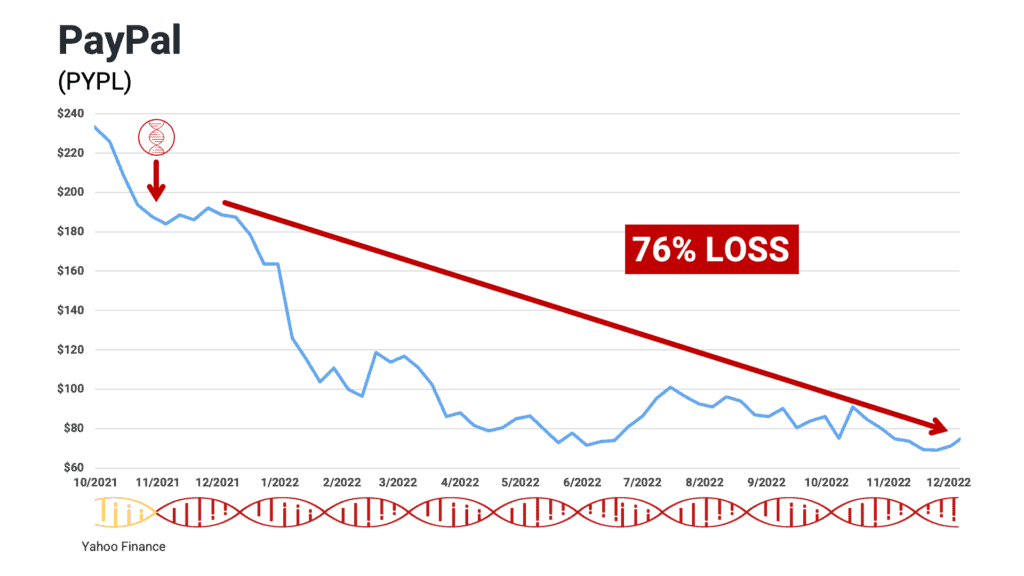

Then there’s PayPal, which dropped 76% from 2021 through last year.

But by analyzing PayPal’s DNA, you would have seen that crash coming and had the opportunity to get out and avoid the worst of it.

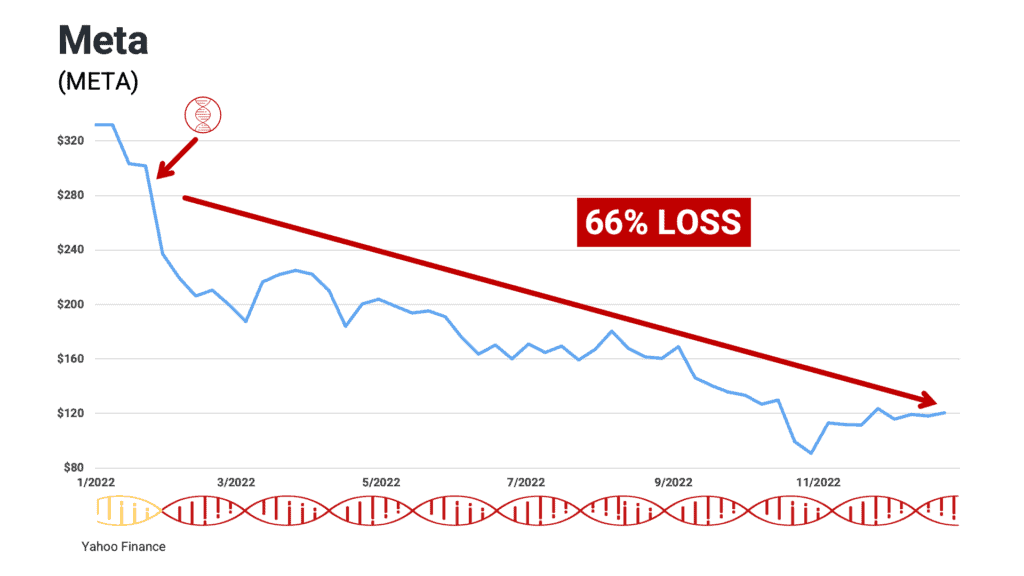

The same thing happened with Meta — formerly known as Facebook…

That stock plummeted 66% last year…

But the Stock Genome Project would have told you it was time to consider getting out all the way back in early February, 2022.

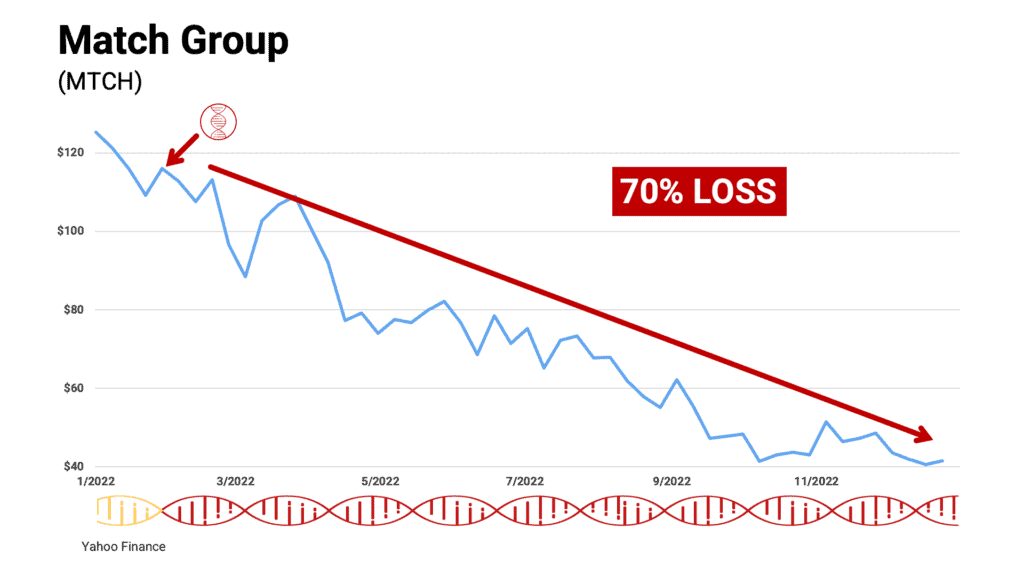

Match Group — the dating app conglomerate plummeted from nearly $134 to $40…

That's a 70% loss.

But if you had access to these DNA alerts, you would have known to get out when it was still trading for $114.

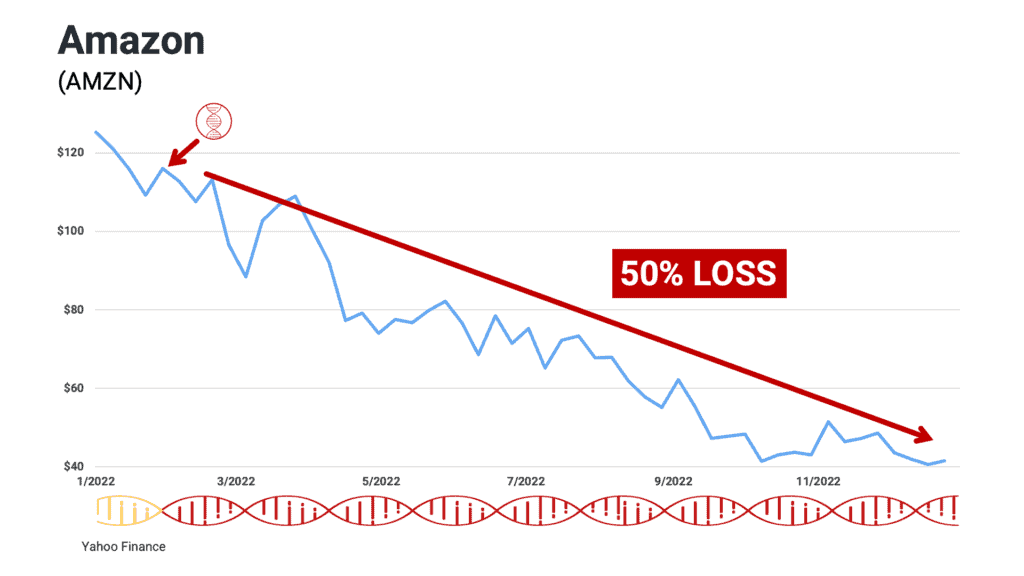

It also predicted the drop in Amazon’s share price back in January, 2022…

If you held onto Amazon throughout the year, you would have lost nearly half your money…

But the Stock Genome Project would have alerted you to consider getting out when it was still trading for around $140 — right before it cratered.

PAUL:

Wow, Keith. I know a LOT of folks were holding onto those stocks last year.

I don’t think most of them were lucky enough to get out when your system indicated though.

It seems like your system could have saved them a lot of heartache.

KEITH:

Exactly. I could go on and on with tons of other examples from last year alone…

But my point is, understanding the DNA of the stocks in your portfolio is the single best way to avoid losses like these.

And keep in mind, these aren’t just back tested examples.

The Stock Genome Project actually issued these sell alerts in real time.

In other words, if any of these stocks were in your portfolio, you would have gotten an alert to sell them BEFORE the worst of the crashes — just like I did in 2020.

PAUL:

That’s amazing.

One of the hardest parts of investing is knowing when it’s time to cut your losses…

But it seems like the Stock Genome Project takes the guesswork out of that process.

KEITH:

You’re right.

You know, one of the best things about the Stock Genome Project is that it takes human emotion out of the equation.

A lot of folks saw these stocks plummeting and dug in their heels.

They refused to sell because they were too emotionally invested.

They sat there waiting for the turnaround — maybe they even doubled down and bought more.

The Stock Genome Project was specifically developed to avoid that mentality.

It just gives you the cold, hard facts.

It tells you “this is what’s most likely to happen next” according to each stock’s unique DNA.

Just like human DNA tells you when you’re at a higher risk of contracting a disease…

Stock DNA tells you when a stock is at risk of collapsing.

It also tells you when a stock is healthy and worth buying.

Even in a year like we had in 2022 when it seemed like nothing worked.

PAUL:

2022 was an abysmal year for most investors Keith, me included.

If what you’re saying is true…

Then simply knowing the DNA could have not only saved me a fortune by avoiding certain catastrophes…

It could have made me a lot of money too?

KEITH:

That's absolutely correct, Paul.

The Stock Genome Project issued buy alerts on some of the biggest winners of 2022 — even as the market was collapsing.

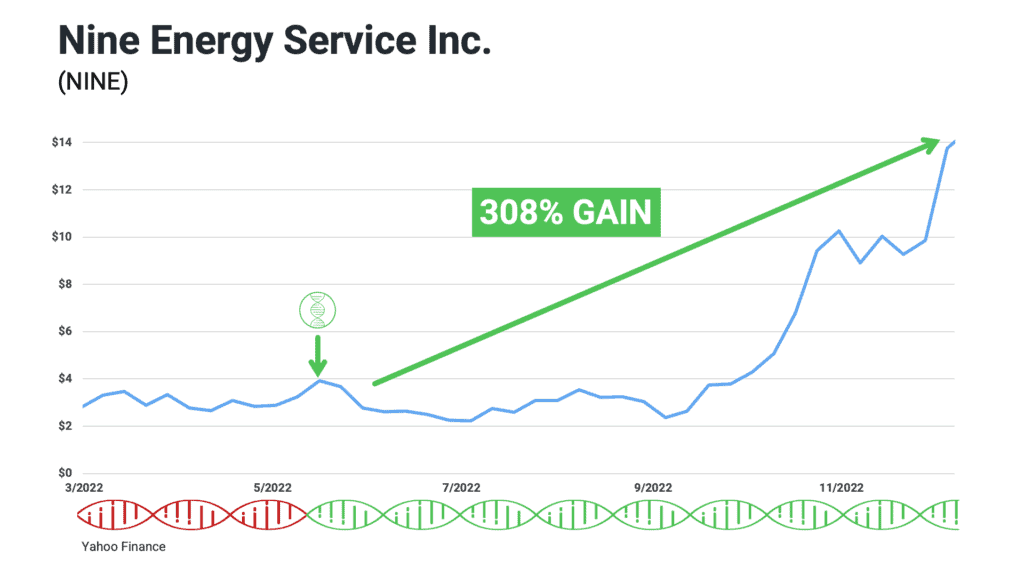

For example, on June 1st it issued a buy alert on a company called Nine Energy Services…

At the time the stock was trading for $3.38…

It had been trending sideways for months…

But the Stock Genome Project analyzed the stock’s DNA and gave it the green light — meaning it indicated that the stock was in a healthy state and ready to buy.

Sure enough, by the end of the year Nine Energy Services exploded to over $13.

That’s a 308% gain in six months, while the overall market was trending downward.

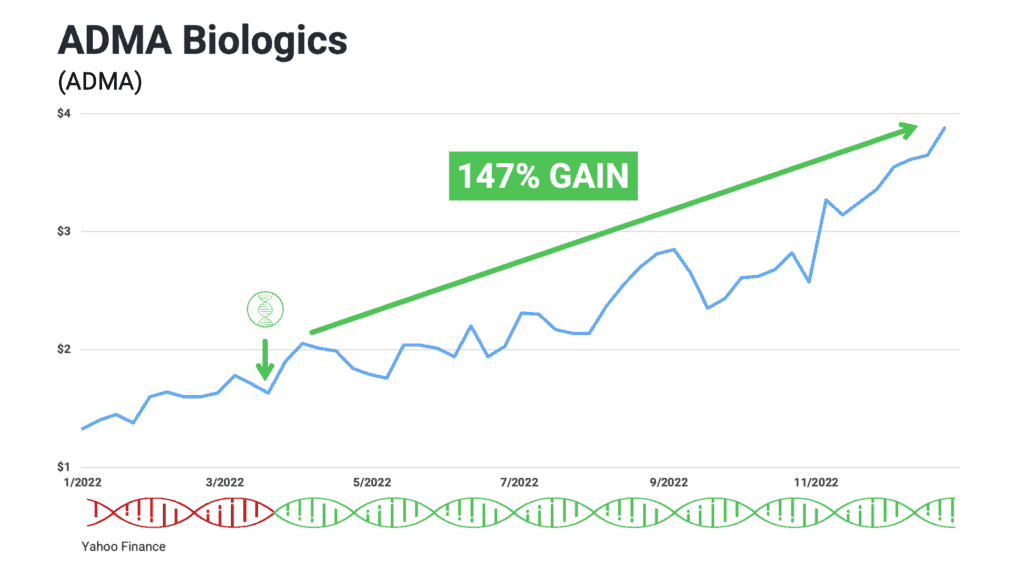

Another example is a pharmaceutical company called ADMA Biologics.

The system issued a buy alert for this stock at $1.56 back in March, 2022.

By the end of the year, the stock had climbed to $3.86.

That’s a 147% gain — more than double your money while the overall markets went down 14%.

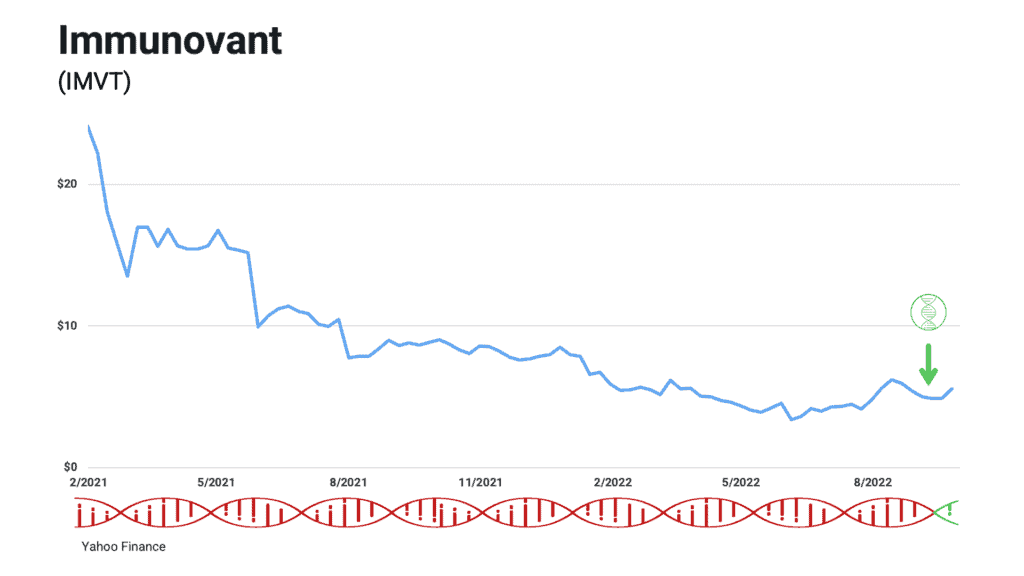

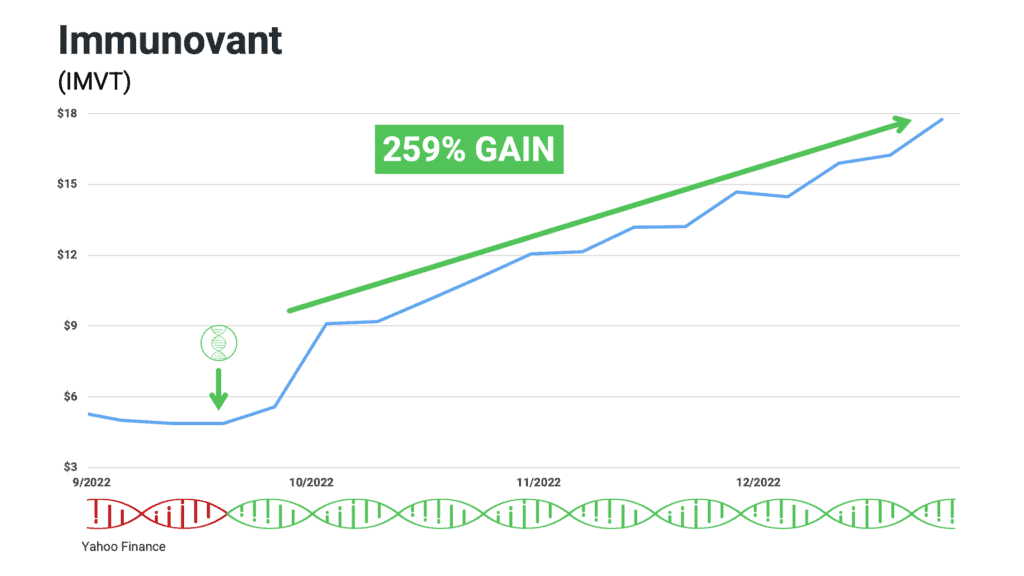

The same thing happened with Immunovant.

The Stock Genome Project issued a buy alert on this company just a few months ago in September…

The share price of this stock had been sliding downwards for almost two years.

Based on the price action, most investors wouldn’t want to touch it with a ten foot pole…

But the system analyzed its DNA and signaled that it was ready to buy.

By the end of the year, the stock jumped from $4.85 to $17.41.

That’s a 259% gain within three months.

And again, that’s while most folks were losing money.

PAUL:

Wow, imagine making 259% gains while everyone around you is losing money in the markets.

People would look at you like you’re a genius.

KEITH:

That’s the impact Stock DNA can have on your investments, Paul.

It doesn’t just look at surface level metrics…

It looks at the genetic code of each individual stock.

That’s what allows it to predict major winners while the overall market is in turmoil.

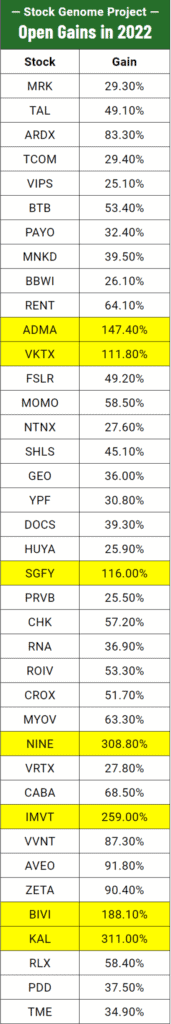

And we’re not just talking about a few lucky shots here…

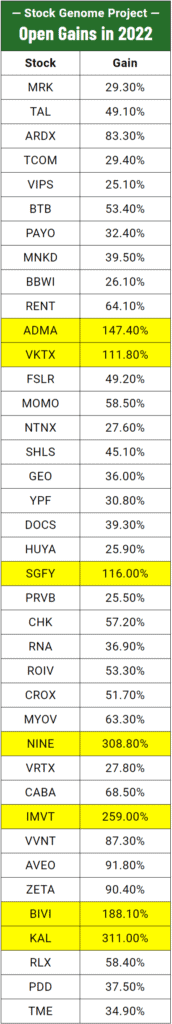

It issued buy alerts on dozens of winning stocks in 2022.

Take a look for yourself…

147% on ADMA…

111% on VKTX…

116% on SGFY…

308% on NINE…

259% on IMVT…

188% on BIVI…

311% on KAL…

The list goes on and on.

The Stock Genome Project issued buy alerts on all of these stocks, and many more in 2022 alone.

And while the opportunity to see these gains has passed, and these are some of our best examples, they show how powerful stock DNA can be when it comes to pinpointing huge winners — even in the worst markets.

PAUL:

Keith, I’m honestly lost for words.

Most folks would kill for those kinds of gains in a good year when the markets are going up…

The fact that your system identified all of these stocks during the turbulence of 2022…

That’s nothing short of amazing.

KEITH:

Well, buckle in Paul. We’re just getting started.

After all, those gains are just from last year.

If you zoom out a bit more, the numbers get even more impressive.

As you probably know, the energy sector is one of the only corners of the market that saw any growth in 2022.

Well, by analyzing the DNA of the entire stock market, the Stock Genome Project saw that coming WAY ahead of time.

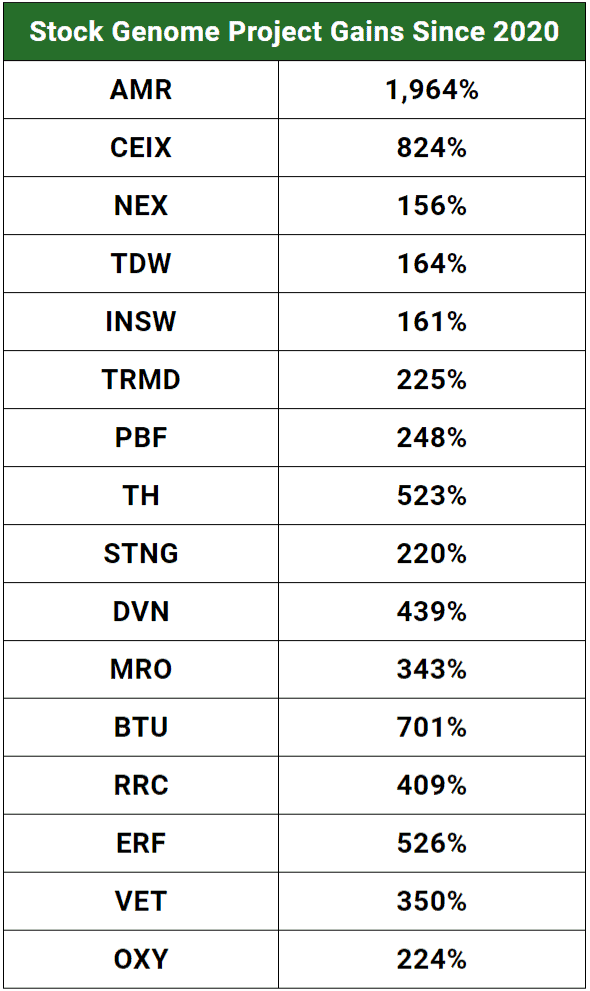

In fact, it issued “buy” alerts on some of the top performing energy stocks all the way back in 2020.

And it signaled to hold them through all the chaos for astronomical gains.

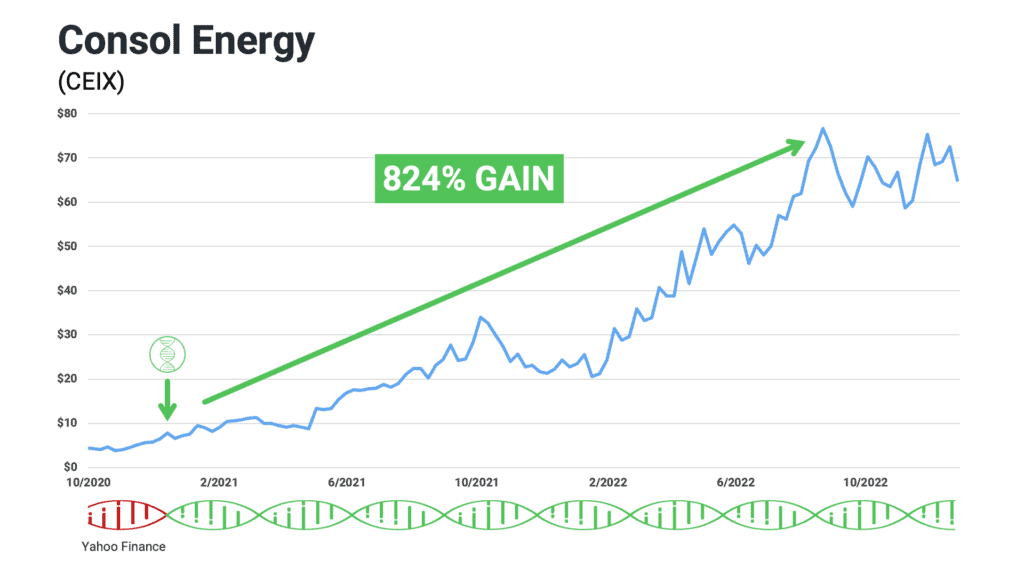

For example, it issued a buy alert on a stock called Consol Energy all the way back in December of 2020…

If you’d simply bought and held that stock like the Stock Genome Project suggested, you’d be up as much as 824% today.

That’s turning every $1,000 invested into nearly nine thousand dollars in less than two years.

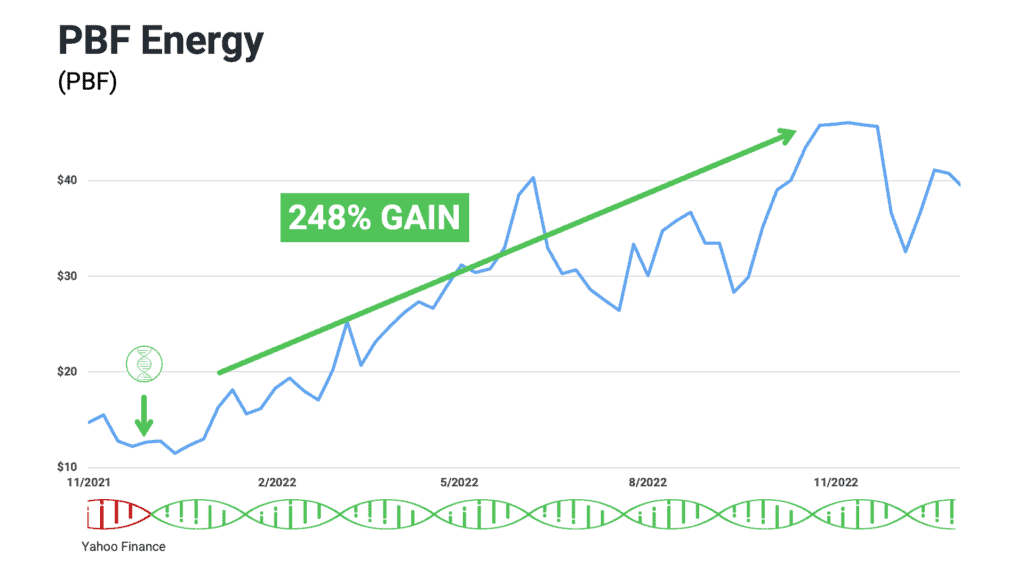

Then there’s PBF energy.

The Stock Genome Project indicated this stock was a buy in late 2021.

It was trading for around $13 when the system gave it a green light.

Over the next year it soared as high as $45.57.

That’s a 248% gain in 12 months.

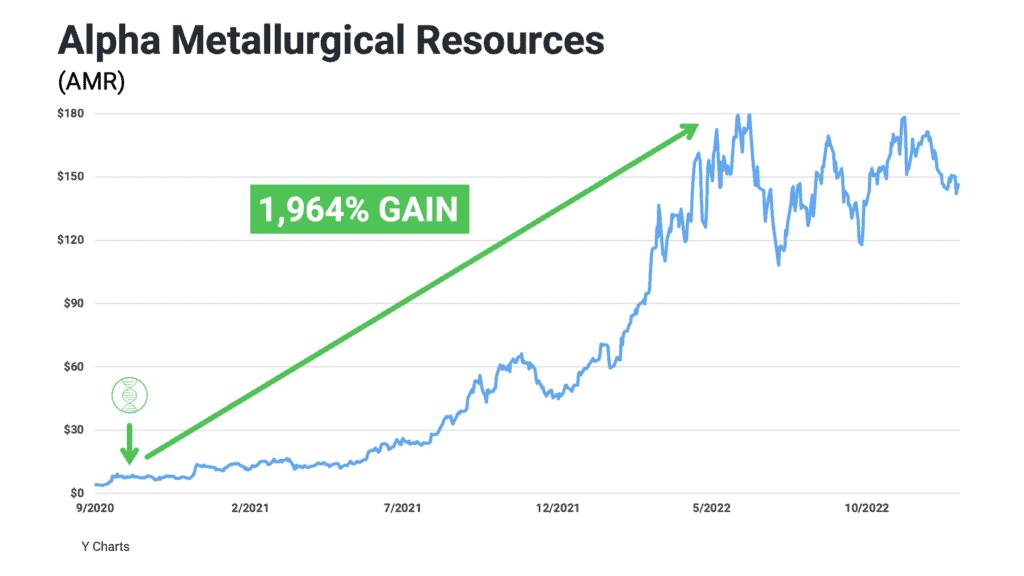

Then there’s a company called Alpha Metallurgical Resources.

The Stock Genome Project issued a buy alert for this stock in October of 2020 when it was trading for $8.00.

Over the course of the next two years, the stock exploded as high as $165.

That’s a 1,964% gain in a little over two years.

Meaning every $1,000 invested in AMR would have turned into almost $20,000.

And $5,000 would have turned into nearly six figures.

Again, this all happened within the past two years alone.

All because the stock’s DNA was screaming that it was a buy.

PAUL:

I don’t know what to say, Keith.

Those gains are incredible.

I think what’s even more impressive is just how early your system identified these stocks as buys.

KEITH:

You know, we like to believe there’s always a bull market somewhere.

It’s just a matter of finding it, and getting ahead of it.

That’s where the Stock Genome Project excels.

It runs millions and millions of calculations every single day on every single stock using a proprietary algorithm we created…

Then it determines an optimal time for you to decide if you should buy, hold or sell a stock based on its unique DNA.

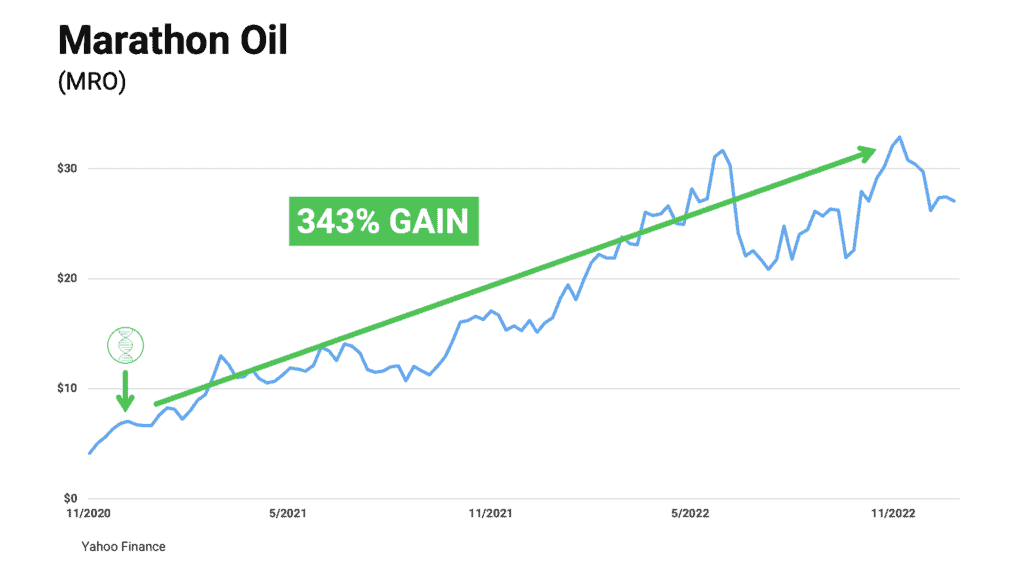

That’s how the system knew to issue a buy alert on Marathon Oil in 2020 when it was trading for $6.73.

Over the next 23 months it soared 343%.

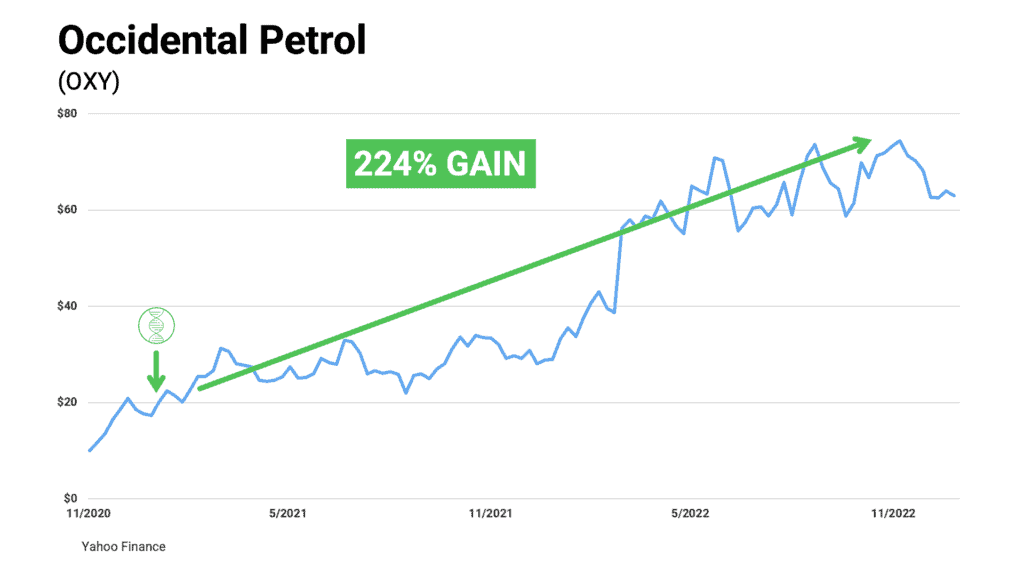

It issued a buy alert on Occidental Petroleum Corporation in January of 2021 before it soared 224%…

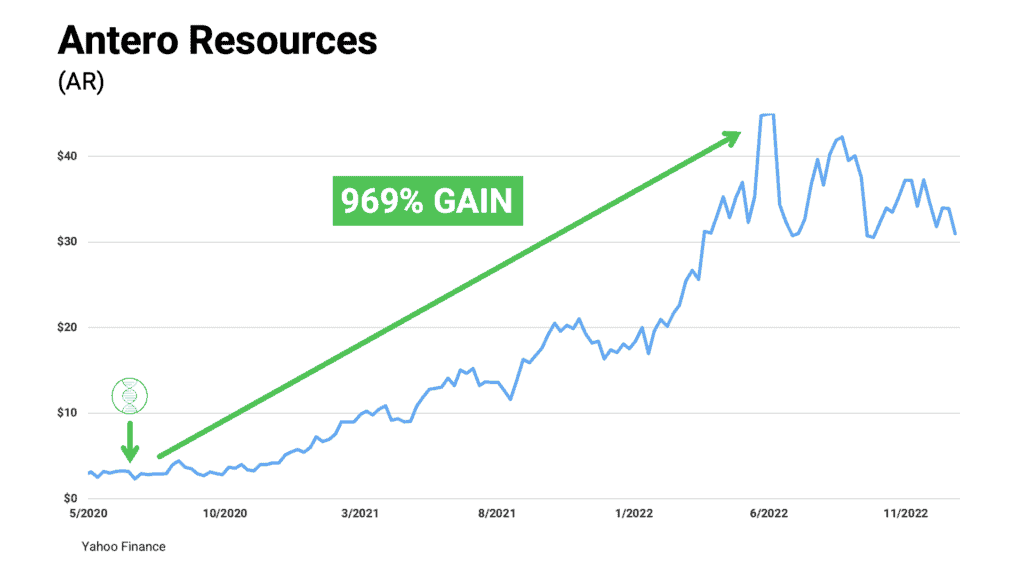

It identified Antero Resources in June of 2020 before it exploded nearly 1,000%…

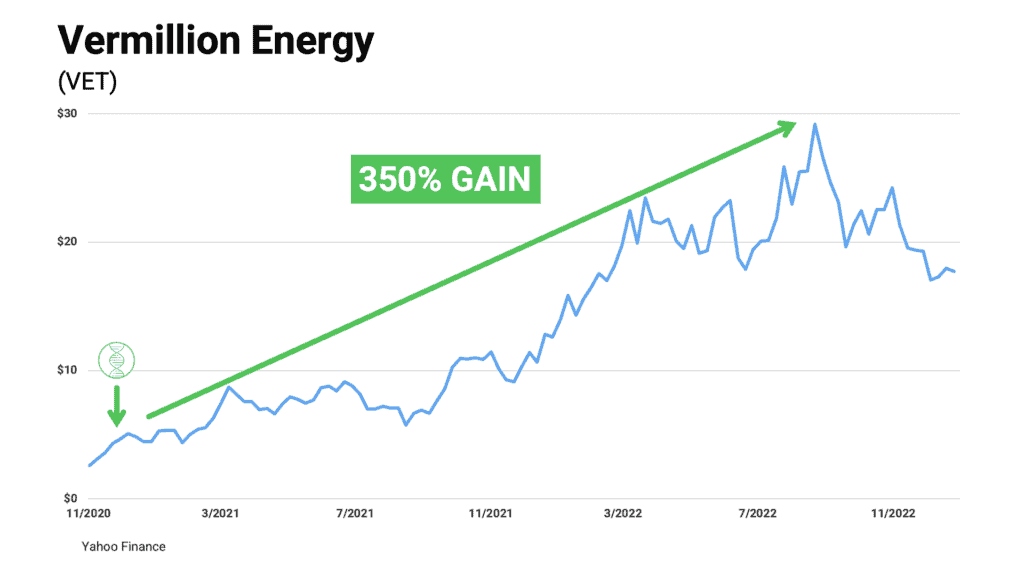

It gave the green light on Vermilion Energy before it soared 350%…

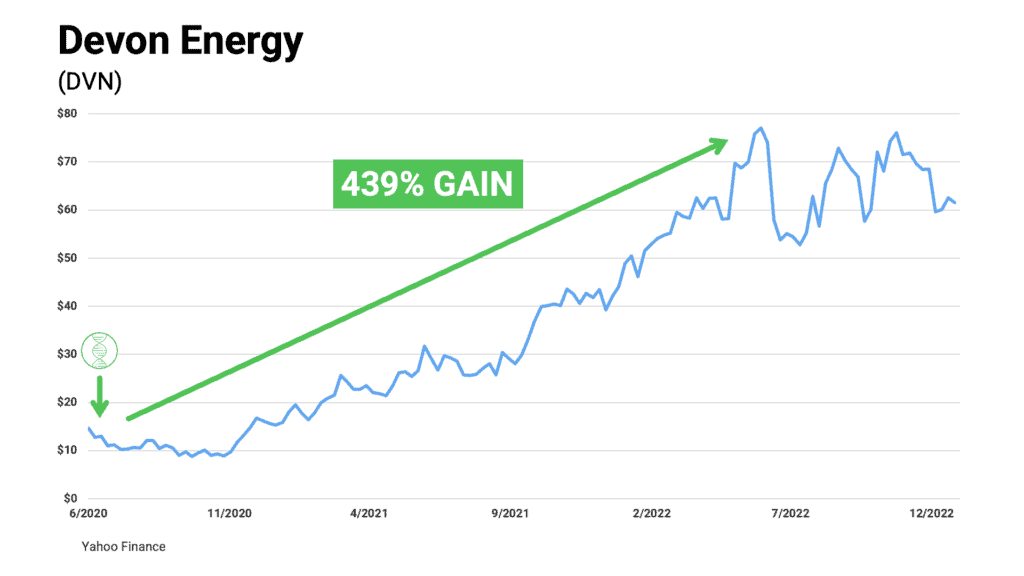

Devon Energy before it went up 439%…

I could go on and on…

These are just a few examples the Stock Genome Project has pinpointed over the past few years.

As you can see, thanks to our DNA sequencing technology, the Stock Genome Project can correctly identify which stocks are poised to explode — no matter which way the market is headed.

Many of the folks who already have access to the Stock Genome Project had a fantastic year in 2022.

Sadly, that wasn’t the case for most people.

Most Americans LOST money last year.

That’s why I’m stepping forward today. We’re finally ready to release the Stock Genome Project to the world.

We believe this is the biggest breakthrough in history for Main Street Americans.

I’m talking about all the folks watching at home right now.

By simply having access to the DNA of the stocks in your portfolio, you can decide when it’s time to sell to maximize your gains, minimize your losses, and avoid catastrophe.

It can help you determine the perfect time to buy too.

PAUL:

I can’t even begin to tell you how powerful all this sounds, Keith.

KEITH:

Not just powerful, empowering.

The main goal of the Stock Genome Project is to put power back in the hands of the little guy.

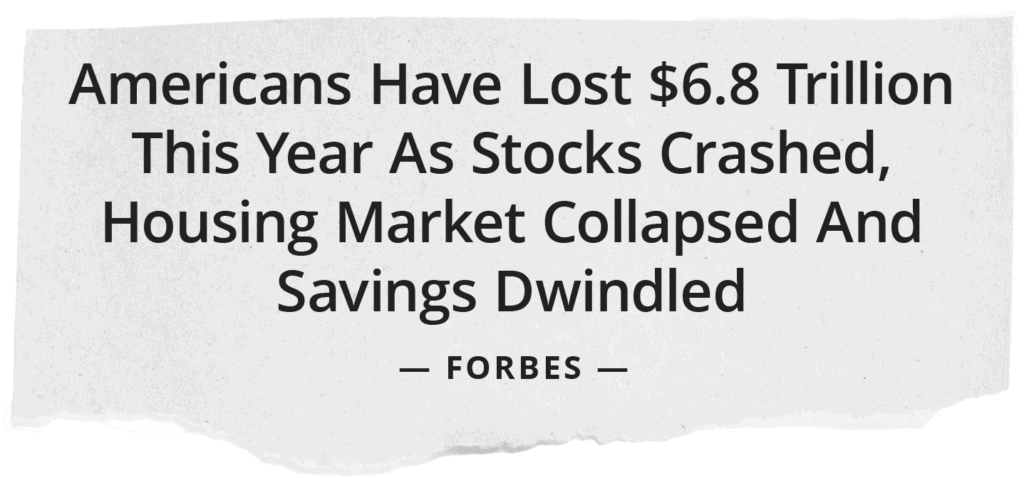

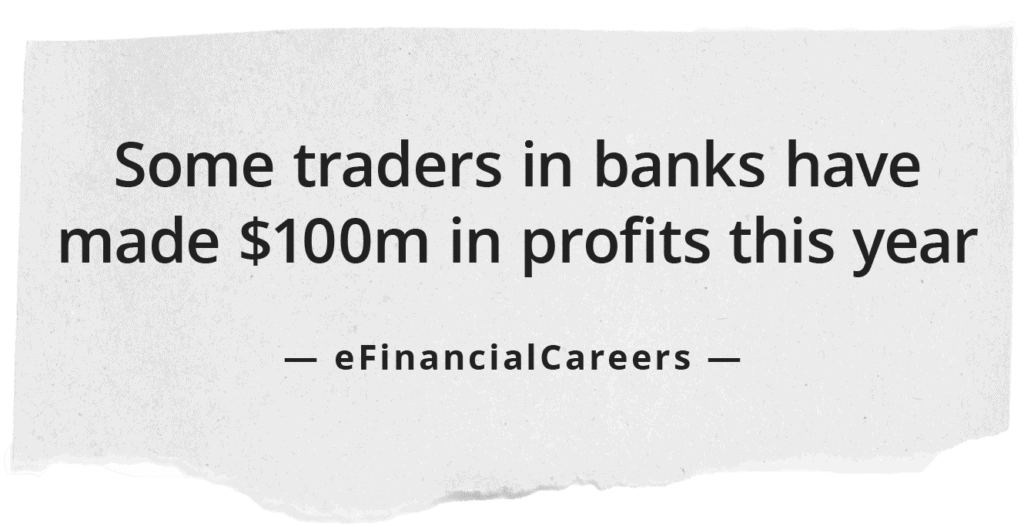

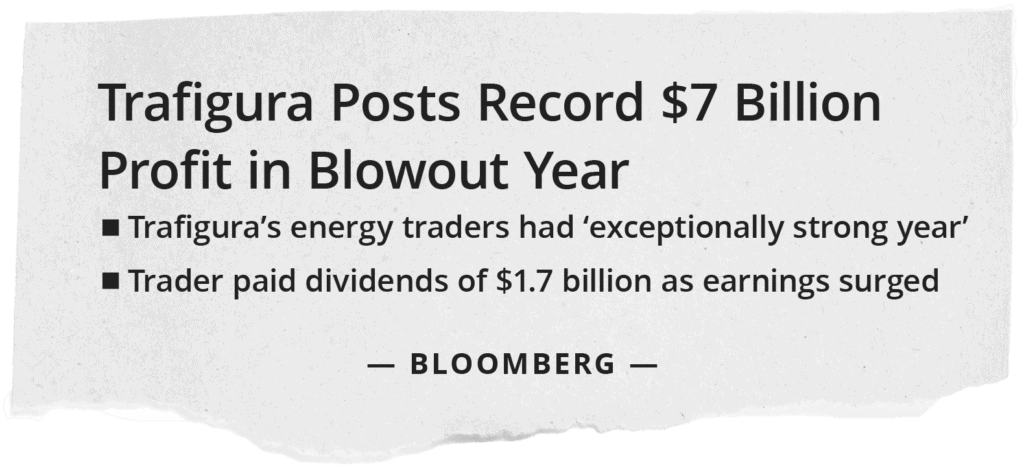

Most people probably have no idea that Wall Street firms made money hand over fist last year — many of them had record years!

Meanwhile, trillions of dollars were disappearing from the retirement accounts of Main Street Americans…

PAUL:

Why am I not surprised… but what does that have to do with the Stock Genome Project?

KEITH:

Everything, Paul.

The fact is, Main Street investors are at a huge disadvantage against the behemoths on Wall Street.

These guys have billions of dollars and teams consisting of thousands of people.

They pay millions of dollars for extremely high-level data, research, and super powerful computers.

Unless you work for one of these big financial firms, you’ll probably never get access to these high caliber, market-crushing tools.

The Stock Genome Project changes all that.

This is Wall Street-caliber research for the retail investor.

The little guy can use this to level the playing field… and even beat Wall Street at their own game.

That was our goal with the Stock Genome Project — and that’s why we’ll never tailor this technology to the Wall Street elite.

PAUL:

I’m glad you brought that up, Keith.

Earlier you mentioned that you’d actually back tested the Stock Genome Project against the portfolios of billionaires…

You eluded to the idea that it could in fact beat the big money at their own game.

KEITH:

You’re absolutely right, Paul.

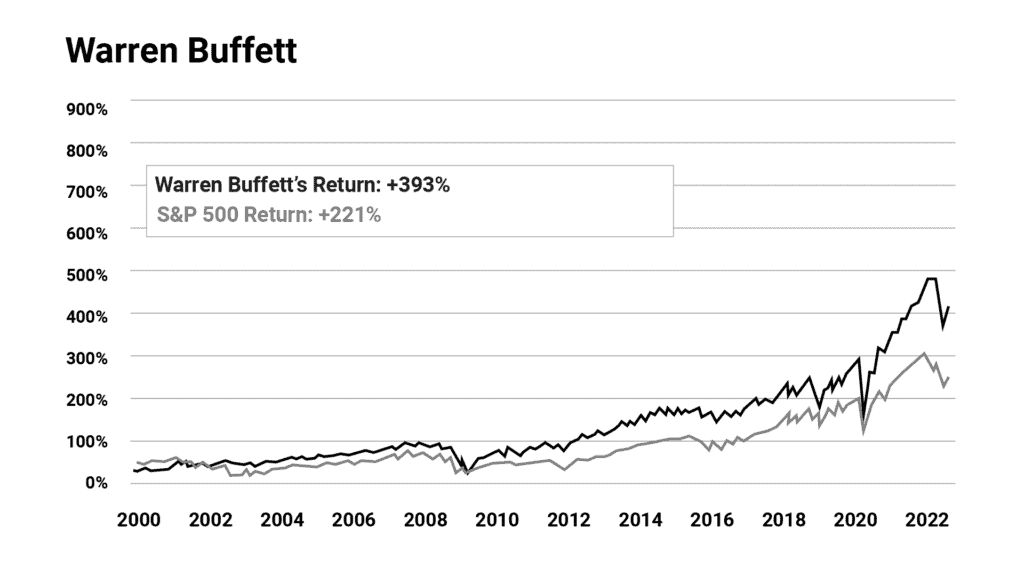

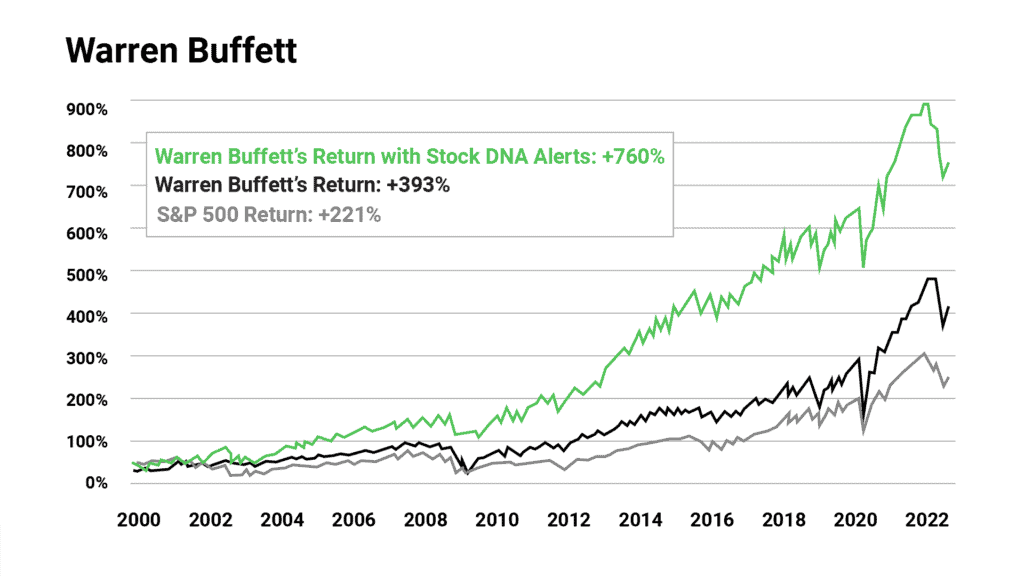

Just look at what we could’ve done with Warren Buffett’s portfolio…

This chart represents Buffett's gains since 2000 versus the gains of the overall market.

Now, those returns were no joke — we’re talking about nearly 400% here.

He’s considered one of the greatest investors alive for a reason.

But check this out…

Here’s Buffett’s portfolio with the Stock Genome Project screening system applied:

As you can see, the Stock Genome Project would’ve taken his portfolio and put it on steroids.

We’re talking about nearly doubling the returns of one of the greatest investors alive — all thanks to stock DNA.

PAUL:

How is that even possible?

We’re talking about buying and selling the same stocks here, right?

KEITH:

That’s right. It all boils down to timing, Paul.

Even the best investors are guilty of buying and selling at the wrong times.

They don’t have access to the DNA of over 50,000 stocks like we do, so they don’t see the full picture.

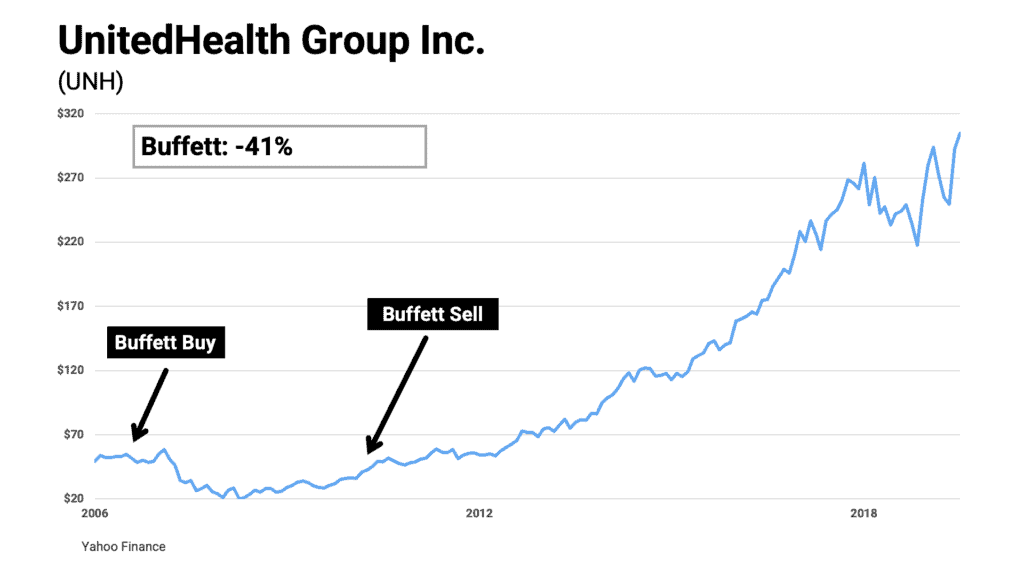

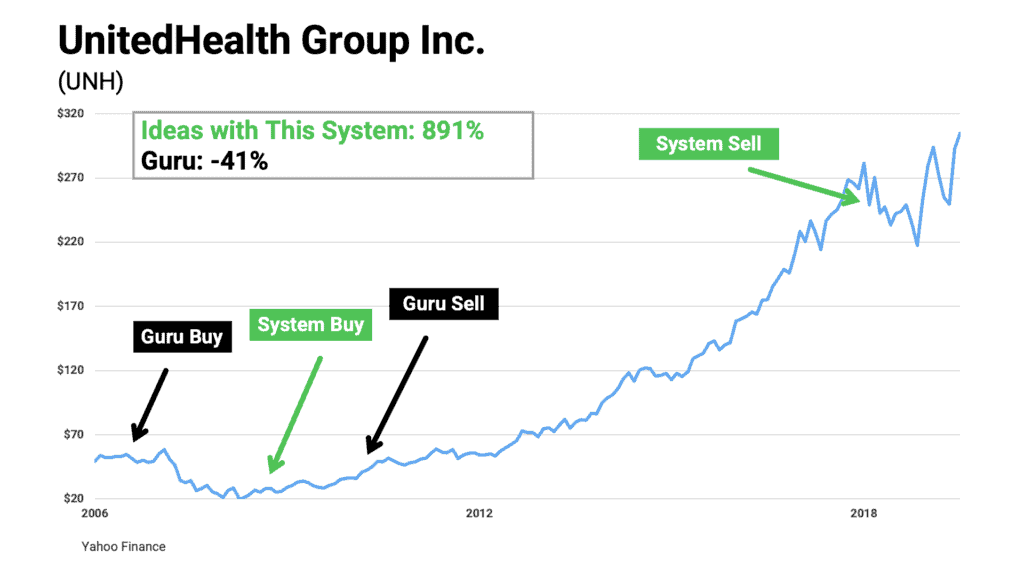

For example, here’s a trade Buffett made back in early 2007.

He bought one million shares of healthcare giant, UnitedHealth Group.

This was right before one of the biggest financial collapses in history occurred.

UnitedHealth’s stock cratered and Buffett eventually sold his shares for a loss of 41%.

PAUL:

So, one of the greatest investors alive lost 40% of his money on what seemed like a great idea at the time?

KEITH:

Yeah, it’s never fun losing millions of dollars, even if you’re a billionaire.

But how would this trade have looked if Buffett had access to the Stock Genome Project?

What you’ll notice is — if Buffett had access to the stock’s DNA — he would have known UnitedHealth wasn’t a buy until mid-2009.

That’s when the Stock Genome Project indicated that the stock was healthy again.

And instead of taking a loss of 41%, Buffett would have stayed in the trade for years and walked away with a gain of nearly 900%.

PAUL:

That’s the difference between losing nearly half your money and making 10X your money.

KEITH:

That’s right. And he’s not the only billionaire investor we’ve tried this out on…

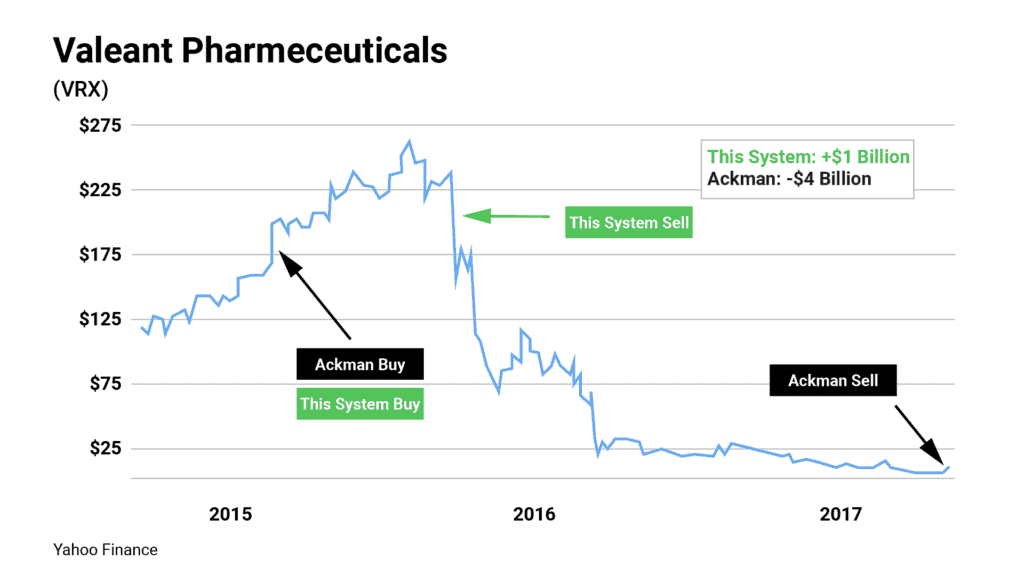

Take a look at this chart from a famous trade billionaire Bill Ackman made in Valeant Pharmaceuticals a few years ago.

When Mr. Ackman placed his trade, Valeant was all over the news.

They became the poster boy for drug companies hiking the prices of their drugs in the name of profits.

And as the media turned negative, investors started fleeing the stock and Bill Ackman lost $4 billion in roughly two years.

But if he was using the Stock Genome Project to track this trade…

He would have gotten out before the worst of it and walked away with an easy $1 billion profit in under a year!

PAUL:

Wow, so again, that’s a $1 billion profit in a year versus a $4 billion loss in two years.

If your Stock Genome Project has this kind of effect on the portfolios of the greatest investors of all time…

I can’t imagine what kind of impact it could have for individual investors.

KEITH:

Well, you don’t have to imagine, Paul.

We’ve tested that out too.

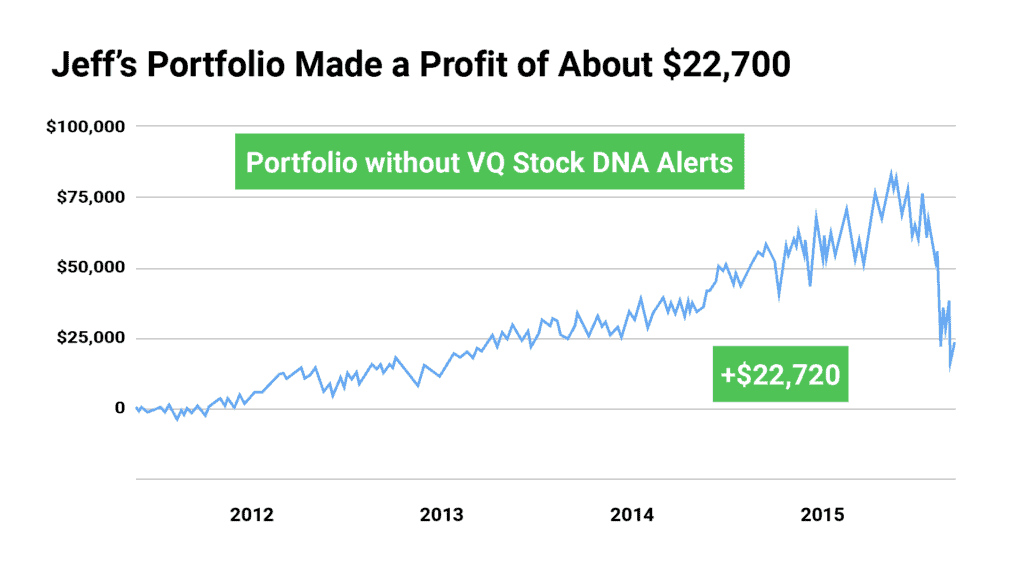

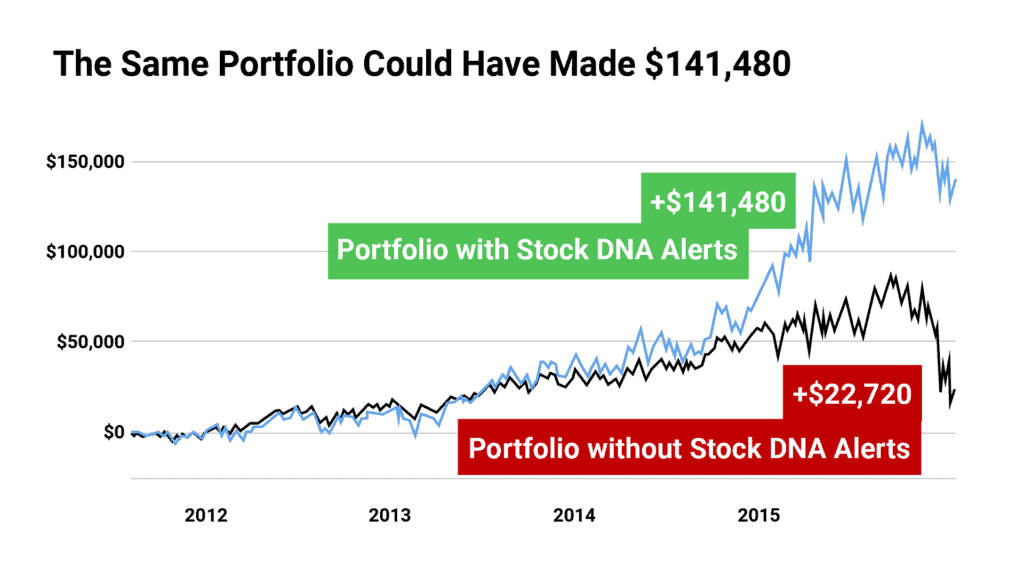

This chart shows the results of a REAL investor when we applied the Stock Genome Project screening system to all of his past trades.

Take a look at this portfolio.

It belongs to Jeff Z. in Arizona. He had a little over $300,000 in his portfolio.

And during this period, he made a profit of about $22,000.

Not terrible.

But had he used the Stock Genome Project to help guide him…

Look how much more money he could have made.

He would have made $141,480 if he had access to the DNA of the stocks in his portfolio.

That’s a difference of about $120,000.

That’s how much money he left on the table.

And remember, all this with the exact same investments.

With the help of the Stock Genome Project, he could have made an extra $120,000.

Shocking, right?

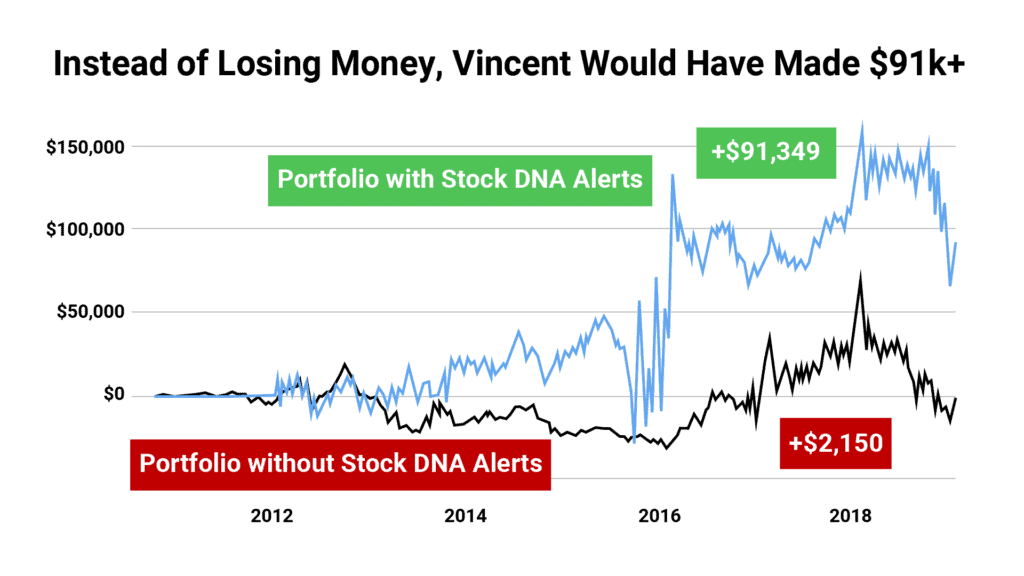

Take a look at this other portfolio…

It belongs to Vincent S. from LA. He had about $220,000 invested.

During all this time, he actually lost money. He lost $2,150.

Now, look how much he could have made if he had used our stock DNA system.

He would have made a little over $91,000.

In other words, the Stock Genome Project could even help turn a losing portfolio into a profitable one.

PAUL:

This is powerful stuff, Keith.

And just to be clear, these are all real portfolios from real people?

I mean we’re talking about real money here, right?

KEITH:

That’s right. After analyzing so many of those portfolios in this backtest…

We saw that the Stock Genome Project would have added an average of $97,347 to their accounts.

We also noticed that even when people were profitable, they were still leaving a ton of money on the table.

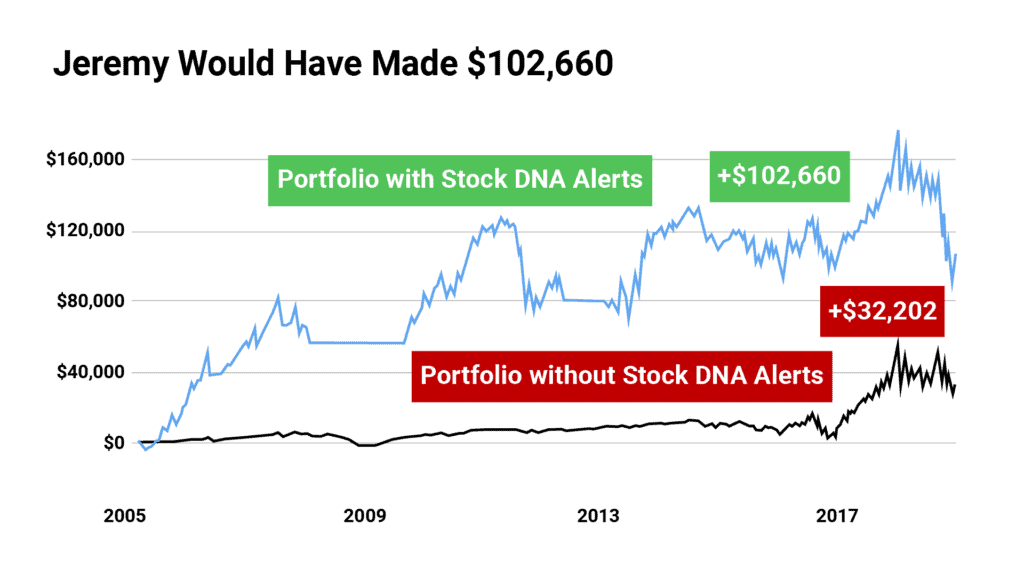

That's what happened with Jeremy B. from Chicago. He had a portfolio of about $150,000.

As you can see, he made a little over $32,000 on his own.

That’s not bad.

But look how much more he would have made if he was using the Stock Genome Project.

He’d have made more than $102,000.

PAUL:

So, the difference here was about $70,000?

KEITH:

Exactly. That’s how much money he left on the table.

We saw this over and over again…

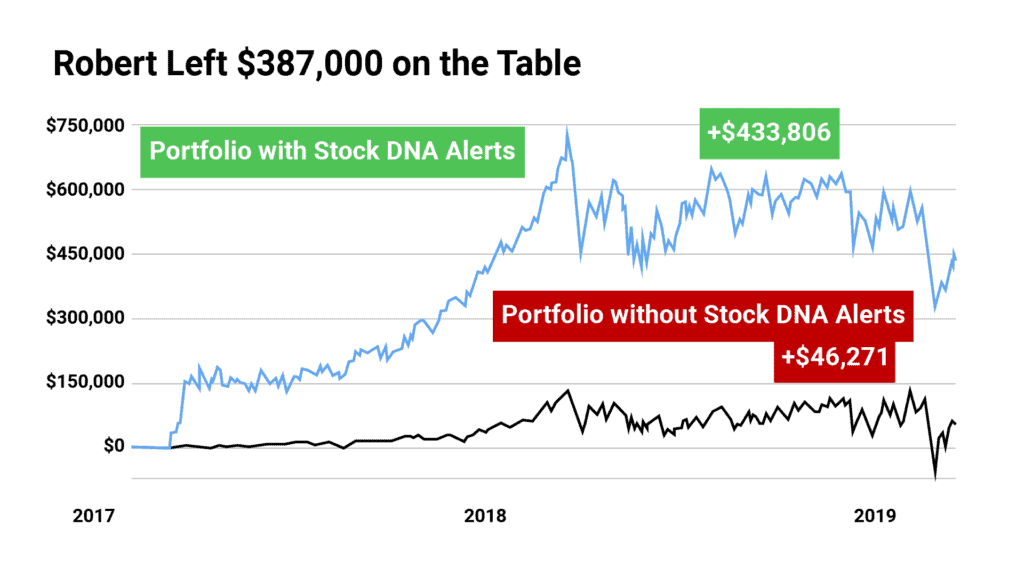

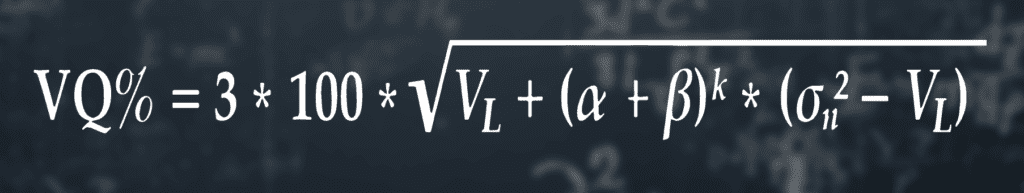

Robert B. from Florida left more than $387,000 on the table…

Steve S. from New York left a little over $97,000.

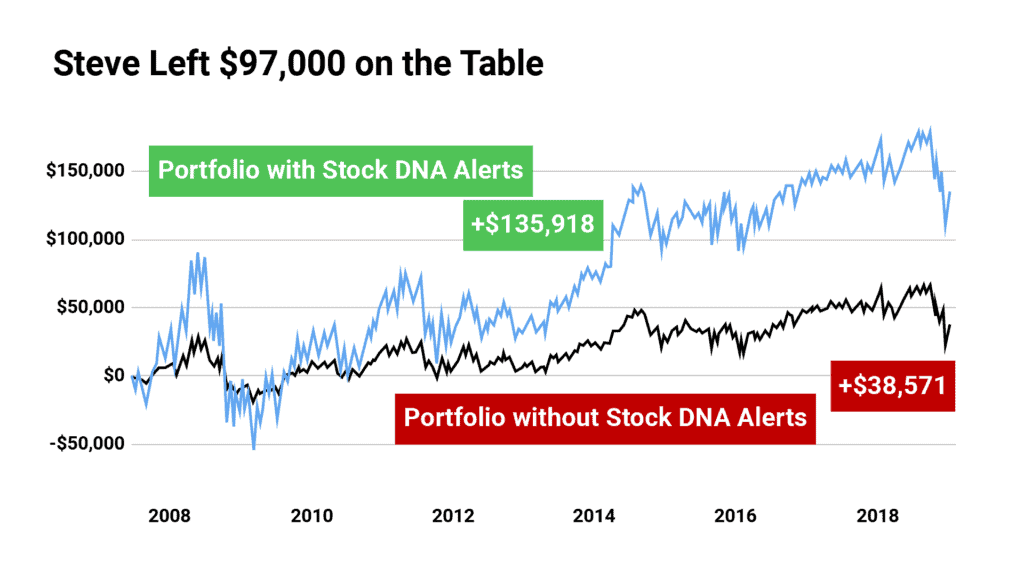

This last one I want to show you is brutal….

This belongs to John M. in Chicago.

He had a pretty big portfolio of $4.6 million.

But he lost $1.4 million during that time.

And he didn’t have to lose all that money.

Check this out…

With the Stock Genome Project, he would have made almost $370,000, instead of losing money.

Again, with the exact same investments.

And the difference in this case was more than $1.8 million… enough to fund an entire retirement.

While nobody can promise you’ll see exactly the same results as these people…

The important thing you have to understand is that the stocks these investors bought didn’t change.

And neither did the date they bought the stocks on.

The only difference was using the Stock Genome Project to track the DNA of their investments and alert them when to decide if they should sell and get back in.

It can have a dramatic impact on your results.

PAUL:

These results are insane, Keith.

I’m really starting to see the big picture.

It seems like your discovery could change the way people buy and sell stocks forever.

When I hear about financial breakthroughs of this caliber… the words “Nobel Prize” come to mind.

KEITH:

I’m glad you’re starting to understand the gravity of the situation, Paul.

We’re actually in talks at the office about submitting it for a nomination with the Nobel Prize Committee.

Given how groundbreaking this technology is, we think we may have a real shot.

We’re not doing it for fame or notoriety, but really as advertising.

We think everyone should know about this.

This is something that can help people. LOTS of people.

And what better way to get our work out there than contending for the most prestigious prize in finance and economics!

Because no matter what kind of investor you are, understanding the DNA of the stocks in your portfolio has the potential to change your financial life.

PAUL:

Keith, I’m sold on the Stock Genome Project.

I shudder to think of the gains that I’ve lost out on by not having access to the DNA of the stocks in my portfolio.

But I’m still confused about how all of this actually works behind the scenes.

Without getting too technical, can you explain what goes into the DNA of a stock?

I know you mentioned you use this $18 million supercomputer…

But what does the computer actually do?

KEITH:

I’d be happy to explain, Paul.

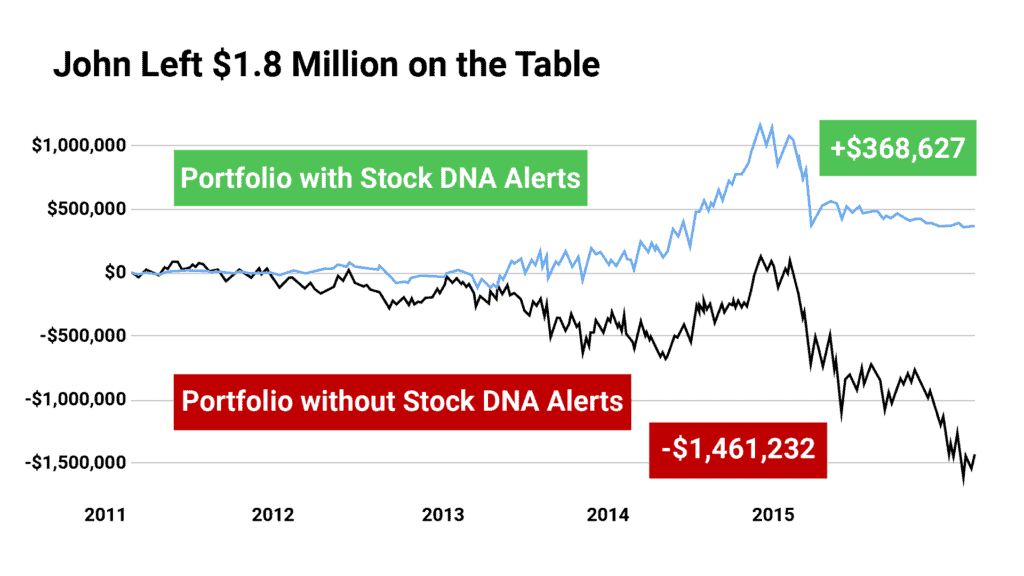

It all boils down to this algorithm I mentioned earlier…

What you’re looking at is among the biggest investing breakthroughs in history

Those two letters on the far left are the key to unlocking the DNA of every stock, and every fund on the market…

PAUL:

VQ? What is that?

KEITH:

The VQ is the “secret ingredient” behind the Stock Genome Project.

It’s the “genetic behavior” of a stock.

And while it may sound fancy, it’s actually shockingly simple to understand…

VQ is short for Volatility Quotient.

And what my team discovered is that every stock in the world has a unique VQ…

In other words, every stock has its own unique DNA. No two stocks are the same, just like no two people are the same.

That includes mutual funds, index funds… and even ETFs.

They all have their own unique genetic code, which we call the Volatility Quotient.

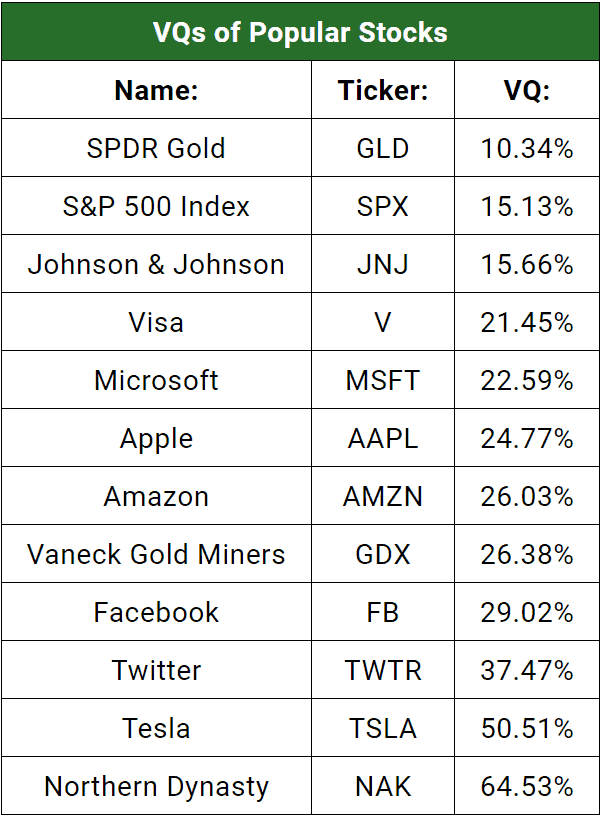

Take a look…

From blue-chips like American Express… to high-flying growth stocks like Tesla… to tiny gold miners like Northern Dynasty Minerals.

Every single one of them has its own VQ — its own unique DNA — which we can use to predict its behavior.

Now to find the VQ, my team measured the volatility of every stock in the market…

From the wildly volatile Tesla, to mildly volatile Amazon, to stable and steady blue-chips like Johnson & Johnson.

Now that may sound simple enough, but it was actually an enormous undertaking requiring over a dozen data scientists and programmers and millions of dollars over the last decade.

Today, this algorithm tracks 3,053 data points based on a stock’s price, volatility, portfolio size, and risk tolerance.

It makes 9,250 calculations per day, per stock.

That’s every… single… day…

That gives us the VQ — or as we like to say the “DNA” of over 50,000 stocks.

And that, Paul, is what makes the Stock Genome Project the most powerful piece of software available for Main Street Americans.

PAUL:

Wow, this is fascinating, Keith.

If I understand correctly, you're saying this is a dynamic process?

Meaning the data on each stock is monitored every single day?

KEITH:

That’s right. We don’t just run the numbers on each stock once…

We run these calculations constantly, day in and day out.

That allows us to maintain an up-to-the-minute model of each stock’s tendency to move up, down, or sideways.

The VQ tells you how volatile a stock is, and then calculates the exact price to sell it, based on its current price and volatility.

For those of you that don't know what a trailing stop is…

It’s the foundational strategy many of the greatest investors in the world use to decide when to sell stocks.

Think of it like a predetermined exit point.

We took that strategy and made it much better with our VQ algorithm by custom tailoring it to every stock or fund in the market.

PAUL:

So, to put it another way, it helps show you how much “wiggle room” you should give a stock before it’s time to sell?

KEITH:

You got it. And on the flipside, it can help you determine the price to buy back in…

More conservative stocks like Johnson & Johnson have a lower VQ.

Whereas more volatile ones like Tesla or Amazon tend to have a higher VQ.

In other words, what my team discovered is you want a much BIGGER trailing stop for volatile stocks.

And a much SMALLER trailing stop for less volatile companies.

PAUL:

So you’re saying the VQ is the heart of the Stock Genome Project?

In other words, the VQ is the “DNA” that drives all of these alerts?

KEITH:

Exactly. You can think of the VQ as the “genetic code” of each stock.

The same way that DNA tells us about the behavior and characteristics of a person…

VQ tells us about the behavior of a stock.

It gives us a unique range of movement for each stock — so we can tell whether to buy, sell or hold.

That’s how we were able to predict the crash of 2020…

The fall of stocks like Netflix, Amazon and Zoom in 2022…

And issue buy alerts on stocks that went up as much as 300% last year, even as the overall markets were tanking.

We have decades of VQ data on all of these stocks…

We know how they behave in bear markets, bull markets, times of war, times of inflation — you name it…

That’s how we can predict what’s most likely to happen next.

PAUL:

I think I’m starting to understand…

The VQ essentially analyzes how a stock has behaved in the past based on its range of movement…

And that tells you how it’s most likely to behave in the future?

KEITH:

That’s right. It runs millions and millions of simulations on every stock and assigns it a unique score based on its volatility.

Bigger, more established stocks are obviously going to have a lower VQ…

And smaller, more risky stocks have a higher VQ.

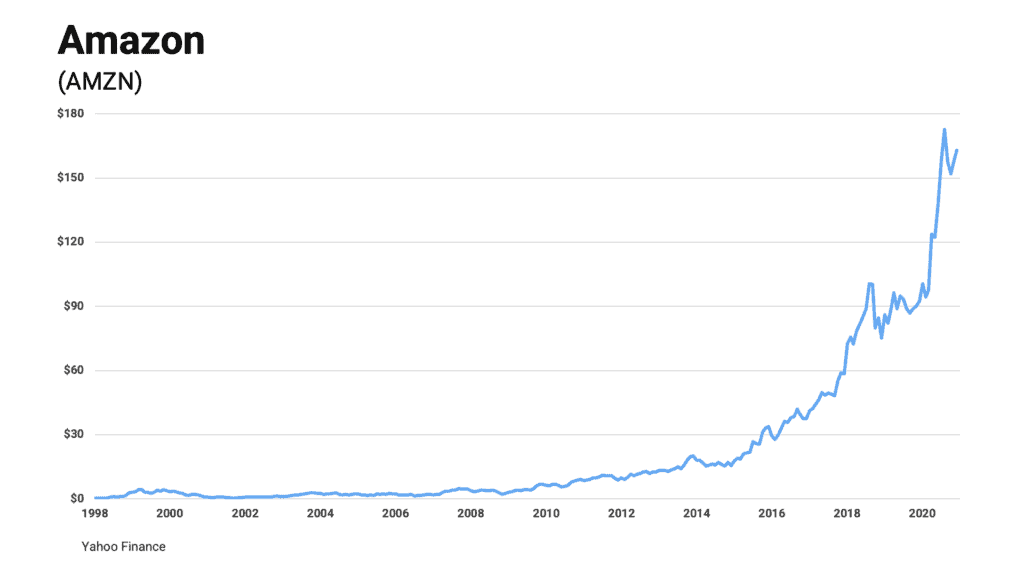

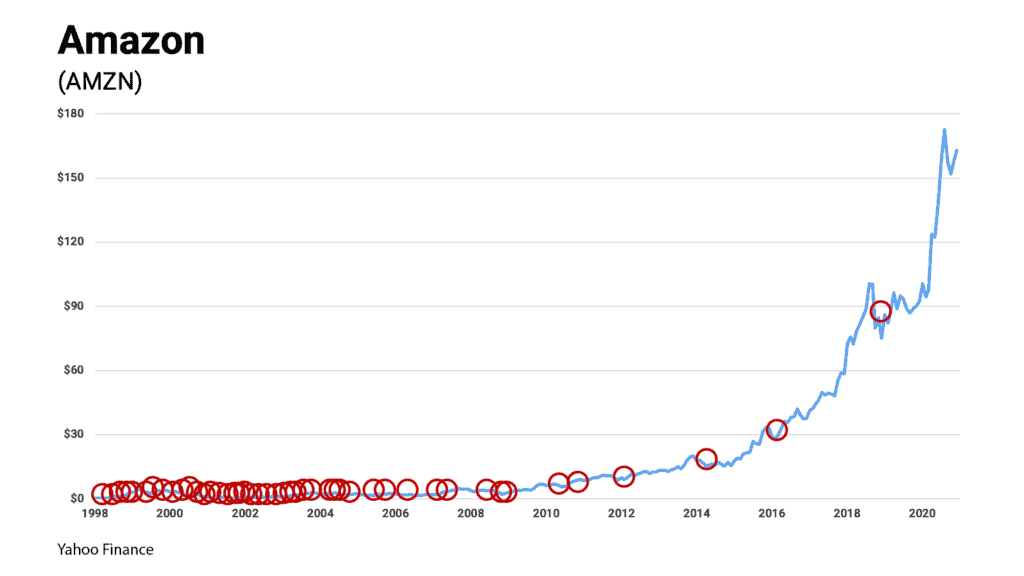

Take Amazon for example…

This Wall Street darling, has minted an untold number of millionaires with its meteoric rise. One of the most popular stocks in the world.

But even with all of that success, it’s historically had some pretty big swings.

Believe it or not, it’s fallen 25% or more as much as 48 times since it IPO’d in 1997.

So it doesn’t make sense to use a 25% trailing stop on Amazon because that’s a normal swing for this particular stock.

PAUL:

In other words, if you sold Amazon every time it dipped 25%, you would have lost out on a lot of gains in the long term.

KEITH:

Exactly. That’s why it’s so important to understand the unique behavior of each stock.

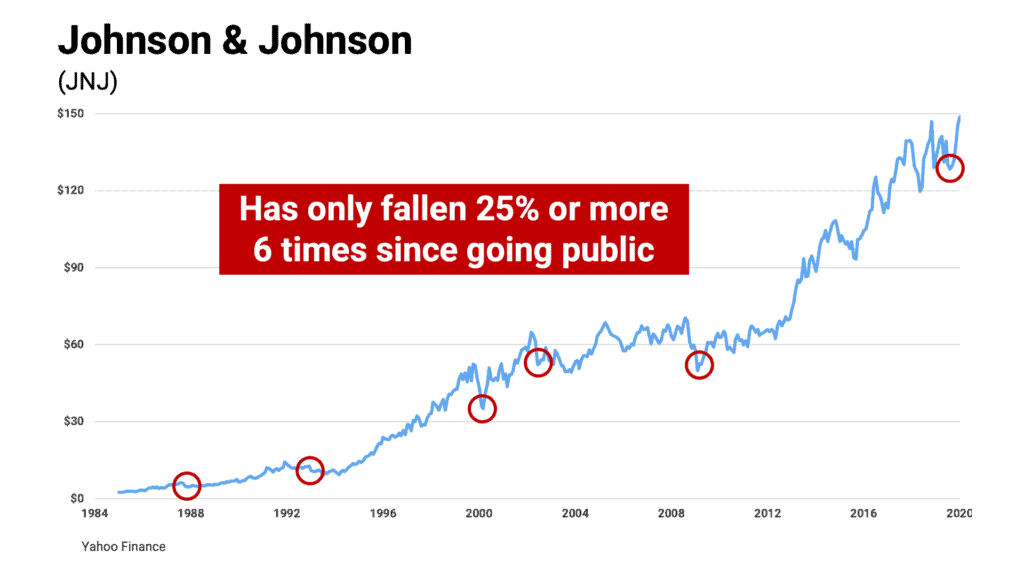

Now let’s compare that to a big-cap, blue-chip stock like Johnson & Johnson…

It’s only fallen 25% or more six times since going public… and they were all during massive market collapses.

So in this case, I’d argue a 25% trailing stop would be too wide.

Because historically, when Johnson & Johnson has fallen 25%, the market is in serious trouble.

My point is this: No two stocks or funds are the same.

So it doesn’t make sense to use the same trailing stops across the board.

If you sell a stock like Amazon too soon, you’ll probably miss out on incredible gains.

If you sell a stock like Johnson & Johnson too late, you’ll suffer a catastrophic loss.

And this is where most of us run into serious trouble and have poor investment results.

Here’s an example a lot of folks watching at home may be able to relate to…

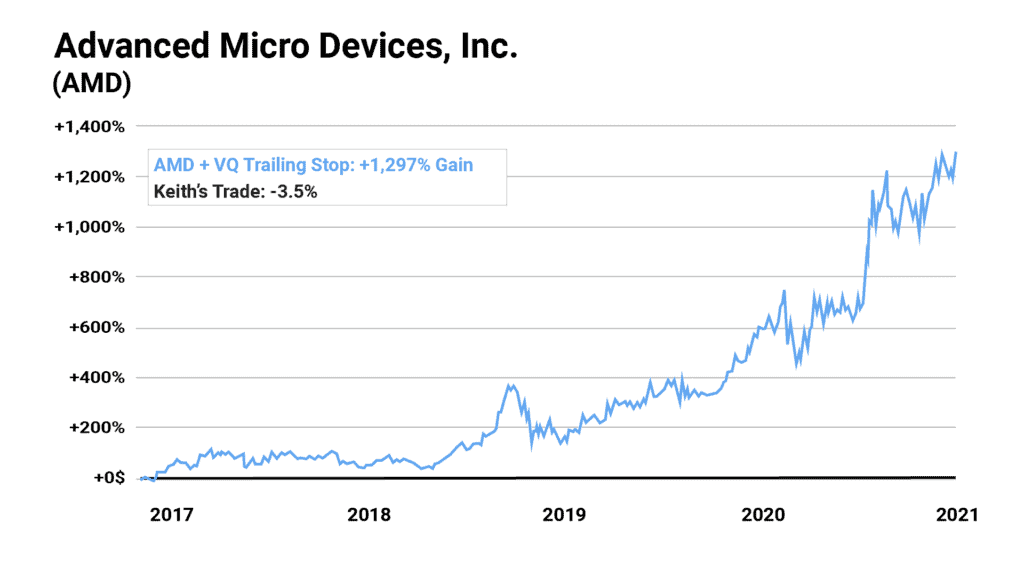

Back in 2016, I bought shares of a company called Advanced Micro Devices (AMD).

The stock was still trading for around $6.50 at the time.

Within a matter of weeks, the share price started to fluctuate and I decided to cut my losses.

Believe it or not, I was proud of myself for only losing around 3% of my money on that stock…

PAUL:

Ouch. I think I see where this is going.

KEITH:

Yup… Little did I know that AMD would go on to become one of the biggest computer parts manufacturers in the world — on par with companies like Intel.

I panicked and sold AMD for a loss.

But if I had access to the stock’s DNA, I would have known to hold on through all the ups and downs and eventually walk away with a gain of nearly 1,300%.

PAUL:

That’s painful…

That’s the difference between turning $1,000 into $970…

And turning that same $1,000 into nearly $13,000.

KEITH:

It is painful, Paul. And it’s all because I sold way too soon.

How many times have you told yourself that you would sell an investment when it got back to break even, only to watch it keep falling and falling until it's worth so little you don’t even bother selling it anymore?

Or how many times have you panicked out of a stock, only to watch it soar hundreds of percent afterwards?

PAUL:

That’s definitely happened to me.

KEITH:

It’s happened to everyone. Main Street Americans and billionaires alike.

The VQ solves that problem — by taking all of the guesswork out of the perfect time to enter or exit a trade for maximum gains.

That’s how our system was able to issue buy alerts for stocks like Tesla, before it soared 1,040%…

Novavax before it soared 1,887%…

And GameStop before it exploded 4,628%…

PAUL:

This is starting to make a lot of sense, Keith…

But you said it yourself, this was created by a bunch of data scientists and mathematicians.

Do you have to have a lot of technical expertise to use this system?

KEITH:

Sure, if you tried to reverse engineer this algorithm and do it yourself, it would be extremely complicated.

But we created the Stock Genome Project to be user friendly.

We wanted the average person to be able to use it, without any prior experience.

That’s why we designed the interface using an easy-to-follow color system.

If a stock is green, that means the stock’s DNA is healthy — its VQ is within an acceptable range according to the algorithm and it’s a buy.

If it’s red, that means it’s time to consider selling.

And yellow just means hold with caution.

All you have to worry about is those three colors and the system takes care of everything else behind the scenes.

It really is that easy to use.

PAUL:

That actually sounds pretty straight-forward.

Just plug your stocks into the computer and the color system helps you make more informed decisions based on each stock’s DNA…

I think the big question on everyone’s minds at this point is, “how can I try this out for myself?”

KEITH:

Well, that brings us the reason we’re here today, Paul.

The Stock Genome Project is finally ready to be released into the world.

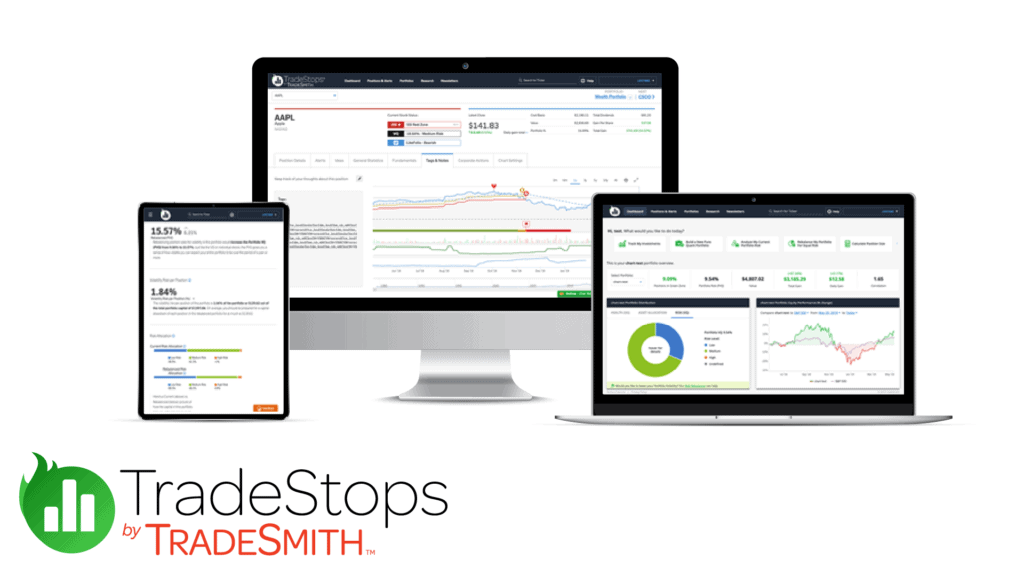

We’re making it publicly available through our platform called TradeStops.

And it’s available to you right now.

Let me pull up a few pictures to show you how it works…

Because it comes with a host of benefits…

The first one is that you’ll be able to…

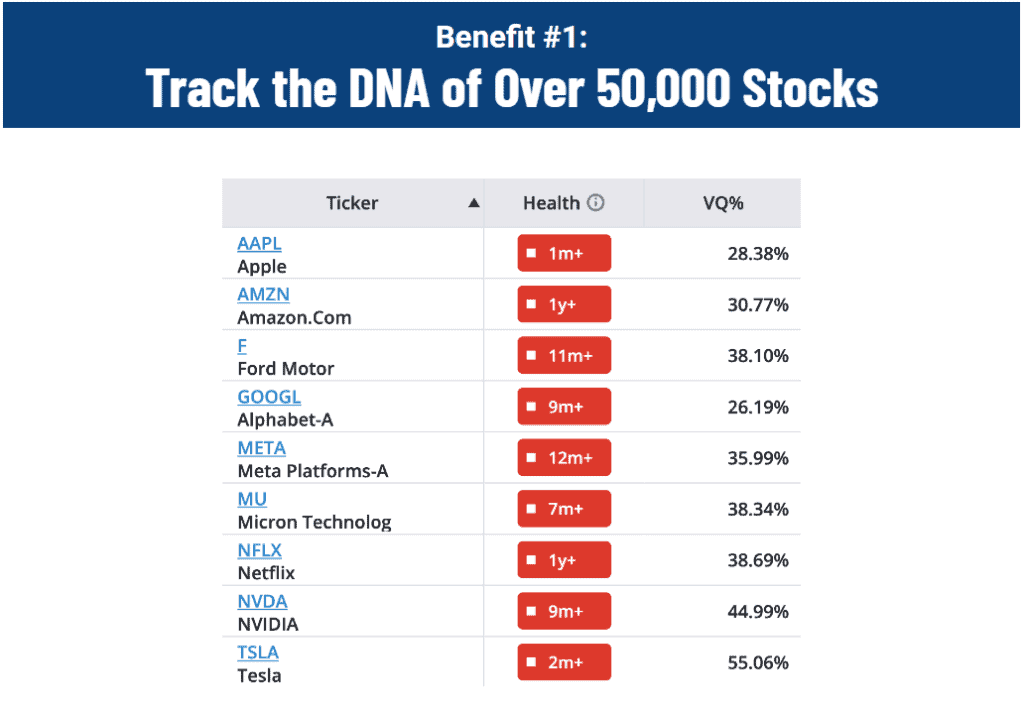

I’m talking about the VQ for commodities, funds…and of course all 51,254 stocks.

You can just go online and type any ticker symbol…

And it will give you the VQ — AKA the unique DNA — of that stock…

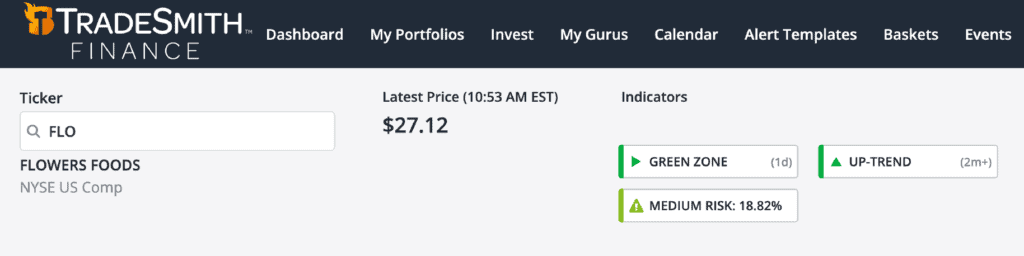

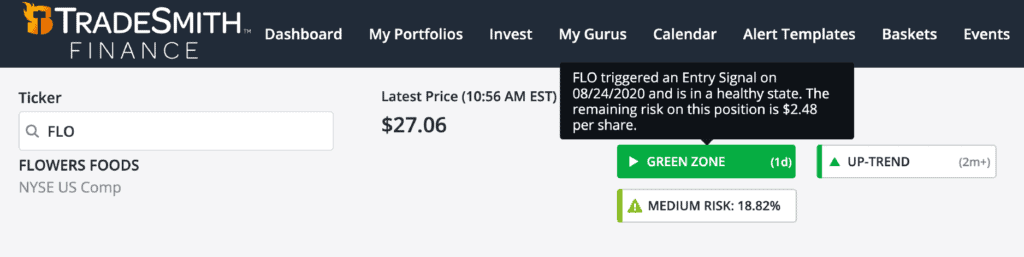

So say for example, you type in FLO — that's a popular stock right now.

You’d get the VQ for Flowers Foods.

When you click on the VQ, you can see that means if the price of Flowers Foods drops below $24.53 a share, you should sell.

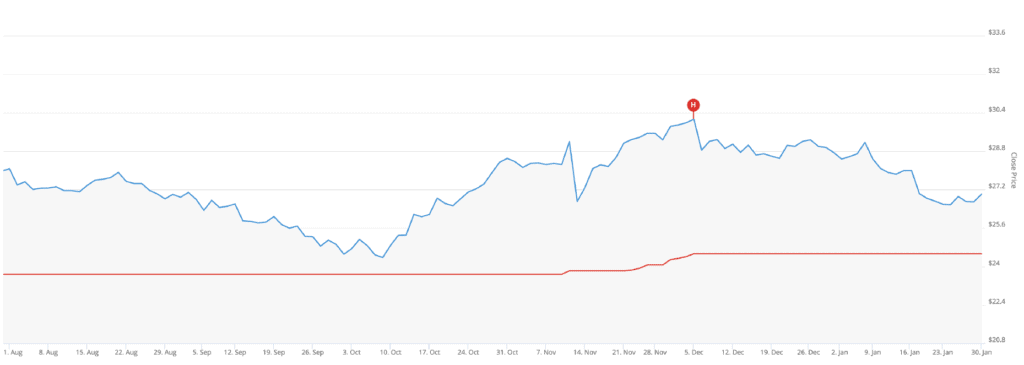

And right below that, you can see the chart of FLO with the VQ as a red line.

PAUL:

So that VQ line will change according to how the stock is moving?

KEITH:

That’s right. That number is updated automatically on the site every single weekend.

Depending on the time you’re reading this, that VQ will have changed.

The system is constantly updating based on what a stock’s DNA is saying.

PAUL:

Wow, that visual representation makes it easy to understand.

KEITH:

Exactly. Like I said, our goal with this software was to make it simple and user friendly.

You don’t need any technical experience to use it.

And that’s just the beginning…

You’ll also be able to…

As you can see here, there’s also something called health status.

These are the DNA alerts we’ve been talking about.

If it’s green, it means the stock is in buy mode.

If it’s red, it means it’s in sell mode.

When the stock drops below its VQ, it goes into red mode.

To figure out when it’s safe to get back into the trade…

We combined VQ with a few other proprietary algorithms that measure momentum.

So it only goes green when we can confirm the stock is no longer in a downtrend.

PAUL:

Wow, so this tool basically makes it so you’ll never wonder again if you should buy or sell something.

KEITH:

That's exactly why we created it. And that’s still just scratching the surface…

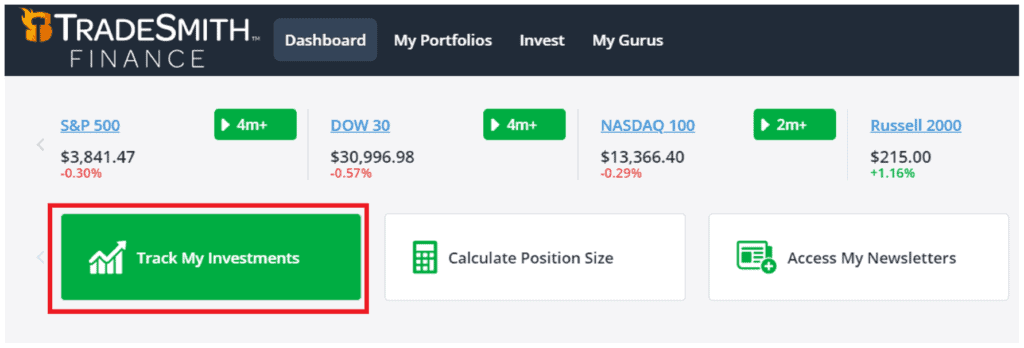

Once you log in to the website, you’ll also be able to…

When you log in, you'll see a button where it says “track my investments.”

Once you click on it, it will give you an option to connect your brokerage account to our software.

And you’ll be able to see all of the investments you’re holding right now and the VQ for each of them… as well as their stock DNA health status.

So it's an automatic way for us to import your data from your brokerage account.

And when you buy or sell a position at your brokerage account…

Our software will pick up on that. We’ll automatically detect newly sold or purchased positions and update your portfolio accordingly.

PAUL:

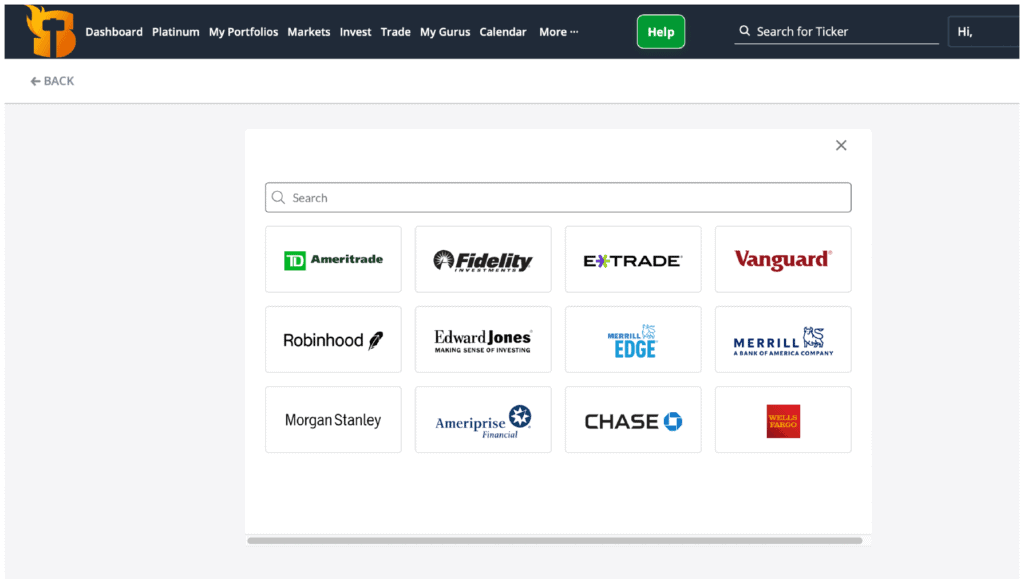

That’s convenient. Am I going to have to sign up for a specific broker for this to work?

KEITH:

We work with all major brokers… you can see the list here on our website…

It includes TD Ameritrade, Fidelity, Charles Schwab, E-Trade, and even some not pictured, including Robinhood, Interactive Brokers… and much more.

If you have more than one brokerage account, you can even connect all of them to our system…

And you’ll be able to see all of your portfolios and all of your positions in one place.

It takes just minutes to set up. It’s very easy and secure because we use bank-level encryption.

You see, we take privacy and security of your data very seriously.

We only import the data from your portfolio.

It means that nobody, including you will be able to make changes to your portfolio through our website.

We also don’t share your personal information.

And we don’t sell or rent it out to anyone.

We’re using the same safety protocols used by big institutions like American Express.

And keep in mind… linking your brokerage account is just an option.

If you don't want to link it, that’s fine too.

You can enter the data manually if you prefer.

PAUL:

It seems like you guys have thought of everything!

KEITH:

Well, like I said — we've been working on this for over a decade, Paul.

But there’s still more…

You’ll also be able to…

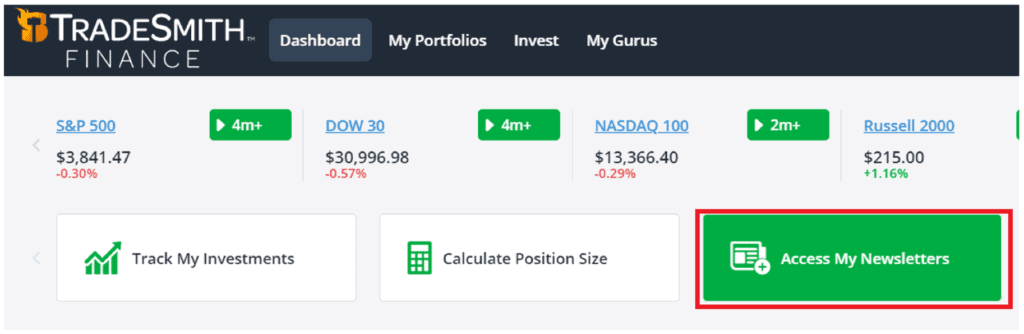

You see, a lot of our members subscribe to financial newsletters to help them pick stocks.

So we created this feature where you can also link our system to your subscriptions.

When you log in you’ll see a button that says, “Access My Newsletters.”

Once you click, you’ll be able to link that to your subscriptions just like you’re able to link to your brokerage account.

We import data from each newsletter’s model portfolio…

And you’ll be able to see the VQ and the stock DNA health status for all of the recommended positions.

So this is a great complement to those financial publications.

And because we partnered with the biggest publishers out there…

If you have a subscription right now, there’s a good chance your publisher is already synced up.

PAUL:

So, say that I have a subscription to InvestorPlace, Agora Financial, Stansberry or Legacy Research…

You’re saying the software will automatically track all of those stocks?

KEITH:

That’s right. It just takes a couple of clicks of your mouse.

All of those picks will instantly sync up with your account…

And every time a new pick is issued it will show up on the website so you can run it through our system.

Then you can see what the stock’s DNA is saying.

It’s a great addition to your favorite newsletters and research services.

But that’s not all…

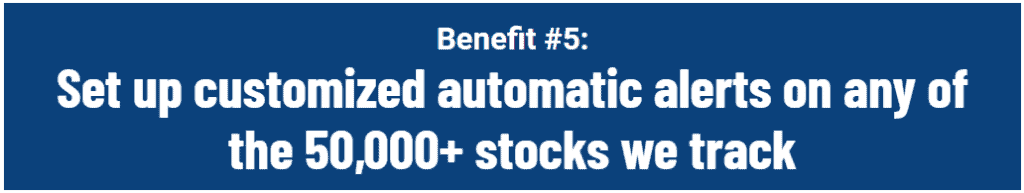

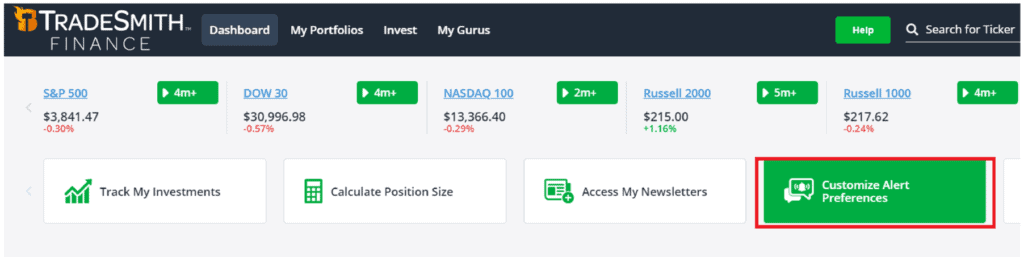

You’ll also be able to…

See this button here that says, “Customize Alert Preferences”?

Once you click on it, you’ll be able to set up alerts for entry signals, exit signals, warning signals and much more.

That way, you won’t have to be constantly checking our website.

Just relax…

And we’ll send you an alert when something requires your attention.

When it’s time to consider buying, you’ll get an alert.

When it’s time to consider selling, you’ll get another alert.

It’s as simple as that.

PAUL:

Wow, so you can just enjoy your life without having to be constantly worried about what might be happening with your portfolio?

That sounds great.

KEITH:

Exactly. It’s as automated as you want it to be.

Whether you’re the kind of person who likes to check your portfolio once a week…

Or an investing enthusiast who likes to monitor their portfolio every single day…

This software was built to accommodate you.

It’s all about empowering YOU to make informed decisions, however you choose to.

We’ve spent over a decade designing this software to finally level the playing field between the wealthy Wall Street elite and hard working Main Street Americans.

So, no matter what your goals are, our stock DNA technology can help you achieve them.

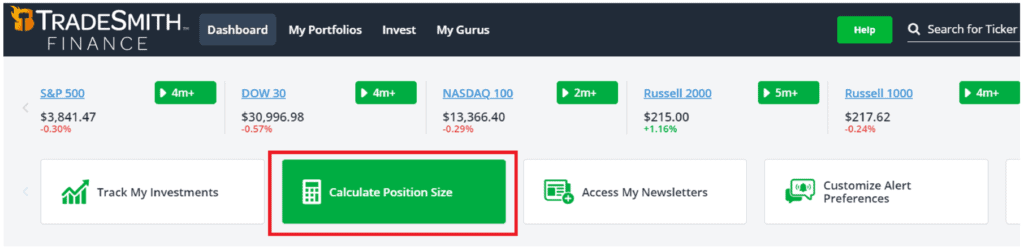

And there’s still more…

You’ll also gain access to our…

This tool takes all of the stocks you’re invested in, runs them through our Stock Genome Project – AKA the VQ algorithm…

Then it tells you how much money you should be allocating to each stock based on its volatility.

PAUL:

You’re saying stock DNA can not only be used to determine the perfect time to buy and sell a stock…

It can help you create the perfect portfolio?

KEITH:

That’s right.

Just as you wouldn’t sell a low-risk stock like Johnson & Johnson at the same time as a high-flyer like Tesla…

You also wouldn’t give them equal weight in your portfolio.

Otherwise you’re giving one risky stock the opportunity to make or break your entire portfolio!

We’ve found that investors all make the exact same mistakes when it comes to sizing their positions.

They put too much money in high-risk stocks and not enough money in low-risk stocks.

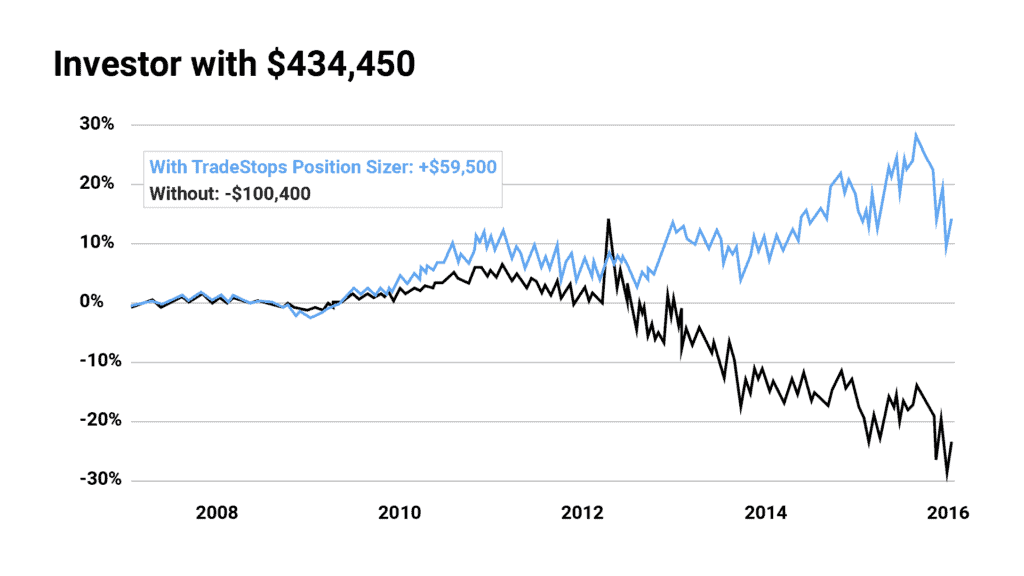

Just look at this chart from our backtest:

The black line shows the original performance of an actual investor who lost more than $100,000 over about an 8-year period.

The blue line shows what this same investor could have made on the exact same stocks, bought and sold at the exact same time but ONLY changing the amounts invested so that more money went into the lower-risk stocks…

PAUL:

Wow, what a difference!

KEITH:

It never fails to amaze me that something so simple as changing the amounts you invest could have such a profound impact on your results.

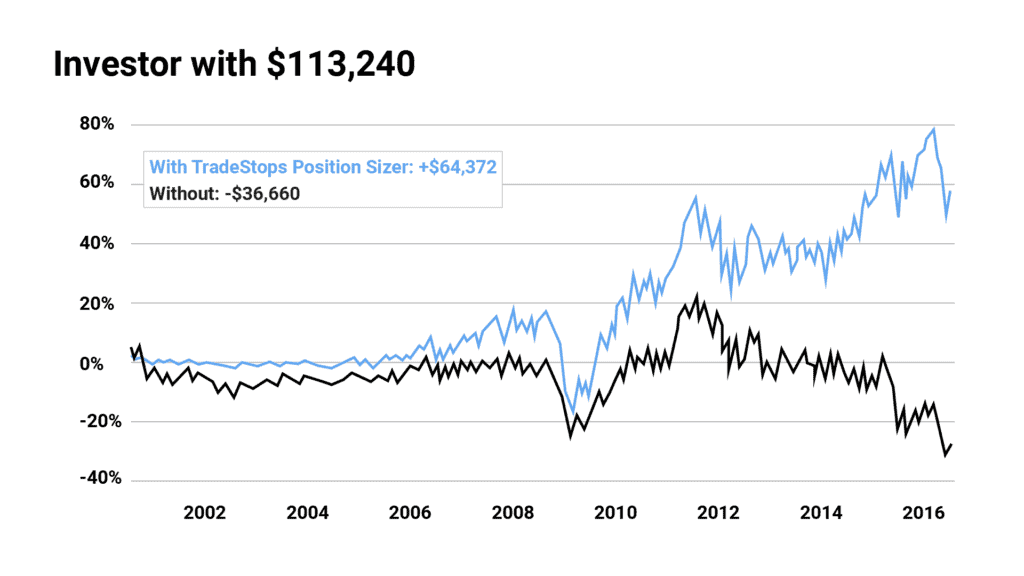

Here’s another example of a real investor’s portfolio that we analyzed…

In this case, the investor started with an account of about $113,000.

And over a 15-year period, his portfolio lost more than $36,000.

But by making one change to his position sizing, this investor could not only have avoided losing nearly 30% of his money…

He could also have actually GROWN his portfolio by 56%.

PAUL:

And again, this is just buying and selling the exact same stocks, at the exact same time – but adjusting your position sizing?

KEITH:

That’s right. Just look at the difference.

That’s why we developed a position size calculator that can help you determine the perfect position size of any stock that you currently own… or wish to buy.

You simply enter the name of any stock in your portfolio — and it will calculate the ideal position size for each stock you buy based on the stock’s DNA and your own information.

While these are some of the best examples we’ve seen, after running thousands of back-tests on REAL investor trades, we found that perfect position-sizing should do two things:

- It should prevent catastrophic losses, by allocating less money to risky stocks.

- But it should also increase your potential gains by making sure you’re putting enough money into stable, lower-risk stocks that are producing the most consistent returns.

It’s an important balance. But when you get it right, the payoff can be incredible.

This is one of my favorite tools in TradeStops, simply because it’s so easy to use.

With a few clicks of your mouse, the Position Size Calculator will measure the risk of any stock that you’re considering for your portfolio…

And show you exactly how much to buy to lock in the highest potential gains with the lowest possible risk.

Look, I know we’re covering a lot of stuff here…

But don’t worry if this is overwhelming…

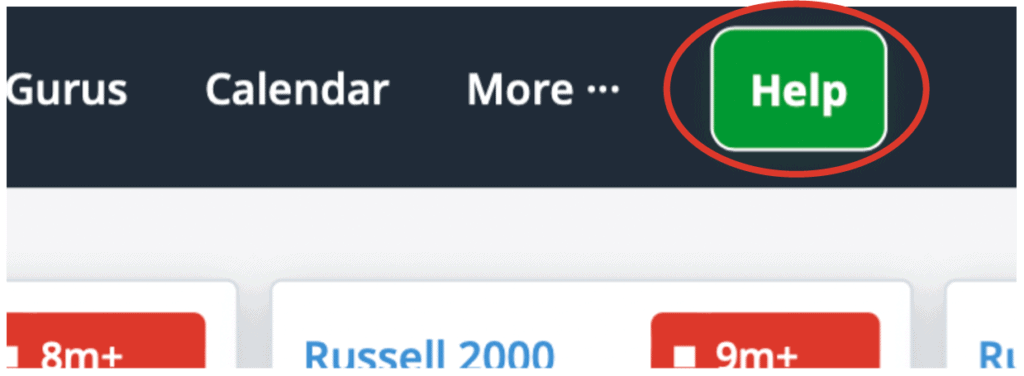

Because when you log into the website you'll find a green “help” button at the right top corner…

Click that button and you’ll be able to…

It has a couple of video tutorials that will walk you through all the basics of our system.

We also have a dedicated, friendly, U.S.-based customer support hotline willing to help you out.

You’ll even get access to our…

We have a team of education specialists on staff.

You can book a one-hour appointment with them and they will help you out.

So even if you’re not good with computers, there’s nothing to worry about.

Because the sole mission of our concierge program is to help you get comfortable with the system, and guide you every step of the way.

Of course, our support team cannot give out personalized investment advice.

But we can help you with any questions about how to use the tools we offer in TradeStops.

By now, I hope you realize this Stock DNA software truly is something special.

But in case you’re still not convinced…

Here’s What People Are Saying About the Stock Genome Project website

***The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.***

As you can see, this system is already showing a lot of folks how to become better investors.

Of course, with all these tools and benefits, this isn’t cheap.

We invested a lot of money in developing this stock DNA system.

Just think about this…

To calculate the VQ and entry points for just one stock, our computer has to perform 9,250 mathematical operations.

Just for one stock.

If you upload a portfolio of 20 stocks to our software, then we’re talking about 185,000 operations.

PAUL:

That sounds like it involves a great deal of math.

KEITH:

Exactly. And that requires a lot of computational power.

That’s why it took us years to build this system.

We had to hire a team of data scientists, mathematicians, PhDs, and software engineers.

I actually recently calculated how much we spend every year on data feeds, research and development, and security.

And that figure is over $2 million.

That’s why access to our stock DNA tools isn’t cheap.

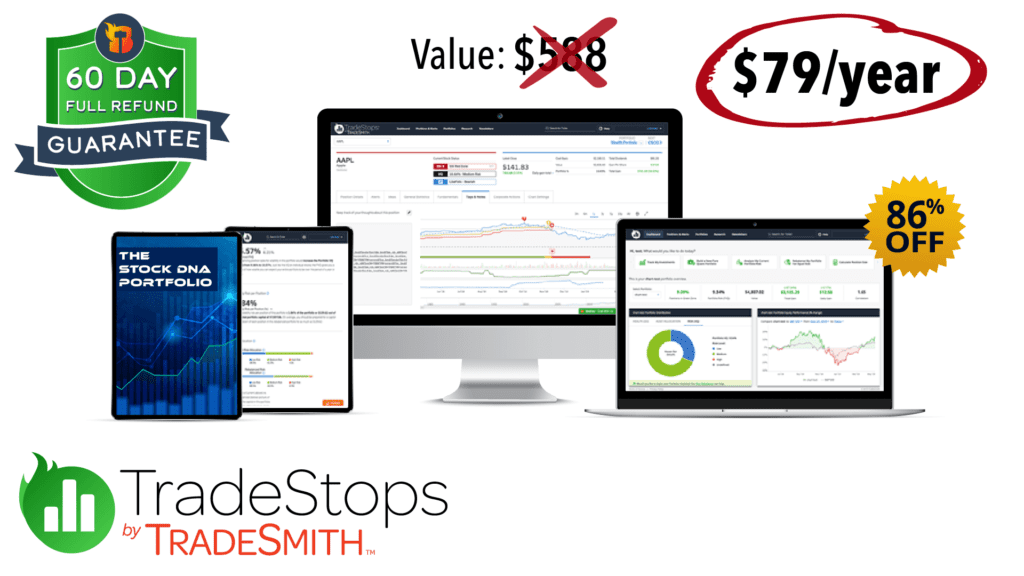

If you go to our website, you can see that we normally charge $588 per year for this.

I know that’s a lot of money….

But when you consider that, on average, this stock DNA software could’ve helped add $97,347 to investors’ accounts…

That price is a no brainer if you ask me.

PAUL:

$588 seems like a steal.

I know a lot of folks would gladly pay that amount if they could go back in time and avoid the losses of the past few years.

KEITH:

Exactly. Even if it saved you $1,000 last year, it would have paid for itself and then some.

Not to mention the fact that it also pinpointed some of the best performing stocks of 2022 — even as the market was falling apart.

Just to recap…

It would have triggered a buy on Nine Energy Services before it jumped 308%.

IMVT before it jumped 259%.

And KAL, before it soared 311%…

The list goes on and on…

While the chance to see those gains has passed, any one of them could be enough to make up for a $588 price tag.

But here’s the thing…

I realize a lot of folks watching right now don’t know me yet.

I don’t think it would be fair for me to ask you to just trust me.

For the folks watching, my goal is to earn your trust.

So, I want to do two very special things for you right now…

First, I don’t want price to be an issue, so I’m going to give you a big discount…

It’s not going to cost anywhere near $588 to try out TradeStops today.

And second, I won’t ask you for any long-term commitment.

I’ll give you 60 days to test drive our system, which you can use to decide if this is right for you.

But before I give you the details of this huge discount…

I want to tell you about a brand-new report we’ve created to help you get started.

We’re calling it The Stock Genome Project: How to 10X Your Portfolio With Stock DNA.

Inside you’ll find everything you need to know to get started immediately with this powerful software…

You’ll learn how to track the VQ — AKA the DNA — of every single one of your investments…

How to search our database of over 50,000 stocks for the next big potential winners of 2023 and beyond…

How to allocate your portfolio for minimal risk and the biggest upside…

And so much more.

Everything you need to know to get started is in this report…

You’ll receive a free copy the moment you decide to try out TradeStops.

PAUL:

Keith, we’ve covered a lot of ground so far…

Let's quickly recap everything you get…

- Access to the VQ — the unique DNA — for more than 50,000 stocks, ETFs and Mutual Funds

- Access to all of your stocks’ health status so you can see if they’re in buy or sell mode

- Ability to connect all of your brokerage accounts to the software

- You’ll also be able to connect your newsletter subscriptions to the software

- You’ll be able to set up customized automatic

- And use the Position Size Calculator

- You’ll also gain access to video tutorials in the quick start program…

- And you’ll get access to the concierge program, where you can schedule a call with one of our specialists

- And let’s not forget your new report The Stock Genome Project: How to 10X Your Portfolio With Stock DNA.

Did I get all that right?

KEITH:

You got it. Like I said, normally all of this would cost $588.

But I have a special deal for anyone watching right now…

There's just one more thing I want to tell you about before we get to that though.

We've taken the liberty of creating your first model portfolio for you.

When you log into the website for the first time, you'll see a list of 10 stocks.

While all investments carry risk, and past performance is no guarantee of future success…

These 10 stocks are the ones we believe have the biggest upside based on their unique DNA.

The system is already tracking them for you. You just have to choose whether or not you want to buy them.

You can find them in the Stock DNA Portfolio when you log in for the first time.

Our Stock Genome System has given all of these stocks the green light…

It's sequenced their DNA and told us they could all be huge winners over the next 12 months and beyond — no matter which way the market goes.

You'll receive this model portfolio for free when you try out TradeStops today.

It's all set up and ready for you the second you log in for the first time.

PAUL:

It just keeps getting better and better, Keith…

Why don't you tell us about this special discount? How much is going to cost to get access to all of this?

KEITH:

Sure. Instead of going to our website and paying the regular price of nearly $600…

Today, through this page only…

You can get unlimited access to TradeStops and ALL the tools and reports we’ve talked about for just $79 a year.

That’s a full 86% discount — a savings of $509!

I want to make sure there are as few obstacles as possible for you to give this software a shot…

Because once you try it out for yourself, you’ll wonder how you ever lived without it.

And like I said, this is a totally risk-free offer.

Take the next 60 days to try out TradeStops…

If you’re not 100% happy for any reason, just let us know within 60 days of purchase and we’ll give you a full refund…

No questions asked.

PAUL:

Well, Keith, I think we’re just about out of time here.

For the folks watching at home, click the button below to get started with TradeStops now…

You’ll be taken to a separate page where you can review all the details of this offer one last time before you join.

With just one payment of $79, you’ll get access to all the benefits Keith mentioned — including stock DNA alerts, and all the tools TradeStops offers for a full year.

***That’s less than 22 cents a day… for a tool that could’ve helped investors add an average $97,347 to their accounts.

Anything else you’d like to add, Keith?

KEITH:

This is by far the best deal we have ever offered…

Which is why it comes with a catch.

As I showed you earlier, we’re charging $588 on our website.

That’s what others have paid.

If we start getting a lot of complaints from our current customers because we’re offering the same service for a much lower price…

We might have no choice but to increase the price back up to $588.

So, I really don’t know how long I’ll be able to keep this online.

If you close this page and try to come back later, there’s a chance it will be offline… or be updated with the new price of $588.

So, click the button below to lock in this incredible deal. This could be your only chance.

You've seen how powerful these stock DNA alerts are.

They were even able to time the market almost perfectly during the coronavirus crisis.

You’ve seen how this tool flashed a buy signal for the hottest stocks of 2022.

You’ve seen the case studies that showed how everyday folks like you are leaving a ton of money on the table… in some cases hundreds of thousands of dollars.

Remember, a back tested analysis of dozens of real portfolios showed this tool would have helped add an average of $97,347 to their account.

You’ve seen the impact it could have had on portfolios of billionaire investors..

And the impact it could have had on the portfolios of everyday traders.

Now it’s time for a decision.

You can pretend you never watched this presentation and go on with your life.

But like I showed you today, we all make terrible mistakes when it comes to investing.

So, if you keep going without this tool, chances are you’ll keep making these costly mistakes…

Mistakes that could end up costing you the retirement of your dreams.

TradeStops can help you avoid those mistakes.

It’s time to stop leaving all that money on the table and put it back into your account.

This is the only tool that could help you make more money from the same investments you’re already making, all while reducing your risk.

So click the button on this page to get started…

Remember, you can try out a TradeStops subscription for the next 60 days at no risk to you.

Try it and decide later.

You really have nothing to lose, but a lot to gain.

I’m sure you’ll make the right decision for you and your family.

PAUL:

Keith, thank you for joining us today.

And for the folks watching, thanks for tuning in.

Again, click the button below to view the full details of this offer and get started with TradeStops immediately.

February 2023

For full disclosures and details, please click here.

©2023 TradeSmith, LLC. All Rights Reserved.

Terms of Use | Privacy Policy