70-times more leveraged than Lehman Brothers…

You’ll Never Guess Which

BIG American Bank is

Going Bankrupt

And just like Lehman Brothers, the government won’t save them

- Introduction

- Shocking Government Document Exposes a Fraud 70-Times Bigger than Lehman Brothers

- “The Smoking Gun” of the Next Catastrophic Financial Scandal

- How You Could Protect Yourself and Profit From the Undoing of this Bank

- A $202-Trillion Disaster

- How to Find Out Which Big American Bank is Next to Fail

- 4 Elite Banks That Will Save You

- The Swiss Banks of America

- 92% Win Rate Over the Past Ten Years

- An Unprecedented Opportunity

Dear Friend,

Hello. My name is Michael Lombardi.

I’m the founder of Lombardi Publishing Corporation, a financial forecasting firm I started over 30 years ago.

There is a major U.S. bank that right now is leveraged 349-to-1 and our government isn’t doing a thing about it.

But we’re not worried.

… just like we weren’t worried when Lehman Brothers collapsed in late 2008.

Let me explain…

If you were around in 2007, you remember no one was calling for the collapse of the markets that happened in 2008. That’s almost no one.

Here’s the exact e-mail I sent our customers in 2007 warning about what was going to happen:

“Over the past few weeks I’ve written about subprime lenders and how their demise will hurt the U.S. housing market, the economy and the stock market. There’s no escaping the carnage headed our way because the housing market and subprime business are falling apart.”

I remember people laughed-off our “outrageous” predictions back then. But we persisted. By late 2007, we were warning our customers that we were headed for a financial catastrophe.

When we looked deep into how overleveraged big banks were back then, we didn’t like what we saw.

In the fall of 2007, we started begging our readers to get out of stocks, especially real estate and banking stocks.

On November 29, 2007, I sent this urgent alert out to our customers:

“The Dow Jones Industrial Average, the S&P 500 and the other major stock market indices finished yesterday with the best two-day showing since 2002. I’m looking at the market rally of the past two days as a classic stock market bear trap. As the economy gets closer to contraction, 2008 will likely be a most challenging economic year for Americans.”

The rest is history.

Everything started to blow up in 2008 and billions of dollars in stock market equity vanished in the blink of an eye…

The Dow dropped over 40% between September and March…

The worst market crash since 1929…

It was a devastating time for retirees, investors, executives and employees.

Now, well over a decade later, we’re in the late stages of another great bull market…

Everybody thinks things are going fine… what happened in 2008 is the last thing on people’s minds. That fear was replaced with a health pandemic.

The government seems to have the banks under control. It seems the banks have learned their lesson… and we won’t repeat the past.

But let me warn you…

That’s NOT what my research shows.

Shocking Government Document Exposes a Fraud 70-Times Bigger than Lehman Brothers

You see, I recently commissioned a small research team to investigate the soundness of America’s financial system…

Very much like I did in 2007, months before Lehman collapsed and the financial system unraveled.

To be clear, I’m not an alarmist. And I’m not a pessimist by nature.

In fact, I much prefer it when times are good and everybody is making tons of money. Who doesn’t?

But I’m also not the type to bury my head in the sand.

That kind of delusional thinking leads to the poorhouse.

After all, there are many warning signs right now that the stock market has reached its top…

And a crash could not only be inevitable, it could be imminent.

Few are suspecting it, just like nobody expected the 2008 collapse.

I told my research team I want to know exactly what the trigger would be for the plunge and just how far stocks would fall.

I had no idea what we would turn up…

But what we uncovered is so astonishing… so urgent…

And potentially so destructive for so many retirees, and so many livelihoods, I created this presentation to bring the results of our investigation to you.

If you have any money in the markets, this will affect you.

If you have a 401(k) or mutual fund, this will affect you.

If you have any retirement savings or anything in U.S. dollars, this will affect you.

Our revelation came when we stumbled upon a little-known government agency’s web site.

I doubt 1 in 1,000 Americans would recognize this government department.

It may be the last place anyone would ever look for the kind of information we uncovered.

“The Smoking Gun” of the Next Catastrophic Financial Scandal

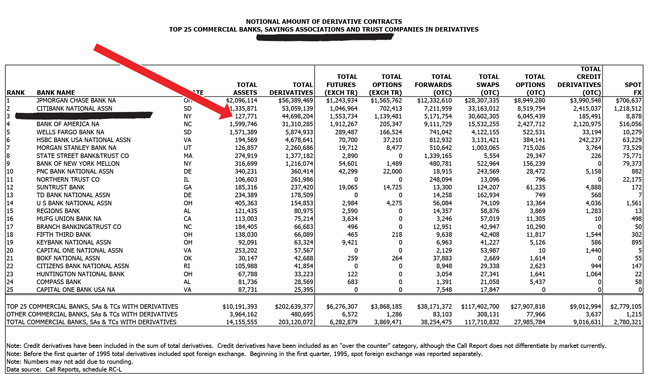

Buried deep on page 26 of a quarterly report from a government agency, we found something that made my jaw hit the floor.

It was the same reaction I had when I first saw Lehman’s balance sheet.

Only this time it could be a whole lot worse.

A much bigger catalyst that could devastate the global economy… unraveling the market.

Take a look…

The line I point to on this document reveals the precarious financial situation of one of Wall Street’s biggest banks.

A bank much bigger and more powerful than Lehman.

Few would ever believe this bank could fail.

But it’s now pumped up its leverage to catastrophic heights.

A move that I believe will ultimately bring its own destruction.

And the U.S. economy’s, too.

In a moment, you’ll see why this clue is just the first of many in a much larger financial scandal.

The tip of the iceberg in a coming market collapse the likes of which we may have never seen before…

Why it will be infinitely worse than the last crisis…

Why no bailout can save it this time around…

But not all will be bad…

How You Could Protect Yourself and Profit From the Undoing of this Bank

Although I believe the inevitable crisis will devastate the majority of unsuspecting investors…

There are always ways you could safeguard your money… and even turn a profit—from it.

In a moment, I’ll reveal a handful of potential safe-haven investments I’ve recommended my readers use to shelter their money…

…it includes a series of banks that have never collapsed and have never needed a bailout…

Banks that pay up to 400% more than the average bank CDs…

Some have even grown their payouts as high as 36% in recent years.

More on that in just a moment.

But first, let me show you WHY I believe the revelation in this document makes things so worrisome.

When Lehman collapsed in September 2008, it was ridiculously overleveraged.

What’s more, they tried to cover up their massive potential losses.

Then one day they couldn’t keep the lid on it any longer. The crack in their ship was exposed as a massive hole that sunk the entire vessel… bringing the U.S. economy down with it.

Almost nobody saw the crisis coming. But as I said before, we warned our readers about the carnage headed our way.

Right through 2007, we were telling our readers to get out of stocks and to get ready for a collapse…

… a collapse that I believe is about to happen again.

That’s because the next big bank to fail is overleveraged 349-to-1 right now!

That’s simply unheard of. It means that for every $349 of obligations, it actually has only $1.

It has stacked up an incredible $44 trillion in obligations.

Yes, that’s “trillion,” with a very big “T.”

That’s…

- Almost 2 times as much as the U.S. government’s debt;

- 2.5 times more than the combined GDP of Europe;

- And 70 times more leveraged than Lehman Brothers before they collapsed.

I’m convinced that once this bank’s finances come out of the dark and splash across the mainstream, becoming what everyone is talking about…

…the magnitude of the crash that follows could be unimaginable.

What will happen next?

The Dow at 10,000 or below?

401(k)s… emptying fast?

The dollar collapsing?

FDIC Insurance not enough to cover deposits?

Washington paralyzed?

Hard to believe?

It was for me, too.

But once you consider my evidence…

And the history behind this…

I think you’ll make one unavoidable conclusion:

We may be on the precipice of a massive explosion that’s about to cause the American economy to unwind…

One that this bank paved the way for with irresponsible trading practices…

The same kind that detonated the economy in 2008.

But now it’s reached an unfathomable scale…

And just like with Lehman, the collapse will just be the tip of the iceberg…

An event that exposes a much bigger swindle perpetrated by Wall Street’s banks…

Only this time we’re talking about the largest debt EVER amassed in history.

A massive $202-trillion stack of obligations they created out of thin air…

That’s more than 2.5-times bigger than the world economy…

And more money than has ever been created at any time in history.

A $202-Trillion Disaster

It’s unbelievable.

Most can’t even wrap their heads around that number.

In short, a bailout is impossible.

Yet I doubt 1 in 1,000 Americans is privy to it.

Of course, I’m talking about derivatives.

You may remember derivatives mentioned during the last financial crisis.

The financial contracts that were swapped between the biggest financial institutions in the world…

Warren Buffett famously called them “financial weapons of mass destruction.”

Yet few understand them. Or just how catastrophic their impact could be.

Especially when we’re talking about sums in the tens of trillions.

I see derivatives as nothing more than a legalized form of gambling.

A bet that something will either happen or will not happen in the future. In the end, someone will win money and someone else will lose money.

But here’s the thing…

Despite the fact that Lehman’s collapse was triggered by these toxic contracts from the housing and loan markets…

… that other large banks unraveled in the aftermath… requiring hundreds of billions in bailouts…

… and that Washington claims to have gotten the situation under control with tight regulations…

… the banks didn’t learn their lesson.

They’re still swapping stacks upon stacks of derivatives…

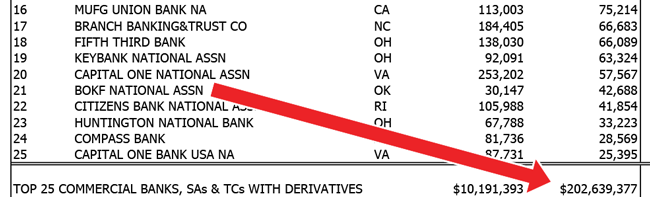

According to the document you’ve already seen, the sum now totals an unbelievable $202 trillion.

Take a look at the bottom line…

$202 trillion—more than 2.5X the size of the world economy—is a gigantic time bomb that could go off at any point.

The question isn’t “if”…

But “when?”

And that’s where this gets scary…

The pin to prick this bubble is closer than you might think…

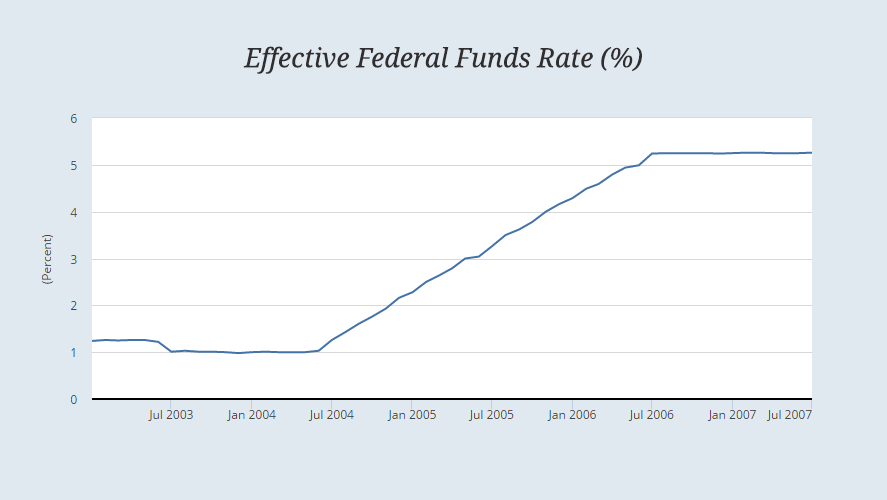

As you know, the Federal Reserve will be raising interest rates to fight inflation.

And that’s why I believe the derivatives market will begin to unwind…

Because many of these derivatives are what are known as “interest swaps.”

I won’t get into a financial definition here, but they are highly sensitive to interest rate fluctuations.

We’re not the only ones who’ve noticed either…

Bloomberg says that as the Fed hikes rates, “For banks, which count interest-rate swaps and other instruments as their biggest derivatives holdings, the shock could be severe…”

This is what happened the last time around.

Take a look at interest rates leading up to the subprime mortgage crisis…

This caused these “interest swap derivatives” to come undone at the seams.

So while the markets have paid very close attention to what the Fed is doing with rates…

Few understand the very deep, far-reaching bubble it will burst when the time comes.

Or how it will leave one of Wall Street’s biggest banks stuck owing over $44 trillion in obligations…with nowhere to go but down…

… followed by the other top banks in the country that swap toxic assets amongst each other…

… potentially triggering a total $202-trillion crisis.

I’m convinced we will see the markets lose confidence faster than ever.

It’s no joke, because it will cause not only a loss of confidence that will make all stocks, bonds and CDs fall…

… but also a loss of money, which is tied to the price of everything.

And this isn’t just Lehman Brothers…

This is potentially more than $202 trillion.

And this time, we’ll have nowhere to turn either.

Because let’s face it; even if the Fed wanted to help, it couldn’t.

The $202 trillion it would need to inject into the economy would just be too huge…

But here’s what you could do…

How to Find Out Which Big American Bank is Next to Fail

In our research report, The Next Big American Bank to Collapse, you’ll get the name of the bank that’s 70x more leveraged than Lehman Brothers.

You’ll get the details on our investigation, including the $202-trillion derivative bubble.

This report will alert you to the systemic failure we believe is fast approaching…

To help you in that matter, we’ve ALSO put together details on the world’s ultimate potential safe haven.

A place where many investors safeguarded their money during the last crisis…

And that could even shelter your savings from the collapse that I believe is headed our way.

I’m talking about financial institutions outside the reach of both the Fed and the derivatives time-bomb that I’ve been showing you.

I’m talking about….

4 Elite Banks That Will Save You

I’m talking about a unique set of banks that have been tested and proven to withstand the tide of economic destruction…

…a group of banks that went through the 2008 financial collapse with no worse than a minor hiccup.

You see, while traditional investment banks like JPMorgan, Citibank, Wells Fargo and Bank of America received help during the Lehman Brothers’ collapse…

These financial institutions had no failures, no bailouts and no losses.

They are regulated tightly by a benevolent power with no ties to the Fed and no history of financial volatility…

And over the past 150 years, they’ve avoided the intermittent crises other banks have experienced.

In fact, the reason why banks like Lehman and the colossal giant I have been telling you about in this presentation fail is the exact reason why these banks are so safe.

The Swiss Banks of America

You’ll get all the details on these super-safe banks in a bonus report I’ve put together for you, 4 Elite Banks That Will Save You.

Inside this report, you’ll find the names of the banks in this unique group… and exactly why they’re so much safer and more secure.

You’ll ALSO see how they could not only safeguard your assets, but also help them grow…

In fact, these banks offer a unique income program that pays multiple times more than average bank CDs…

…a program that has paid out reliably and consistently every year going back as far as 1829.

And in recent years the 4 elite banks you will learn about in my report have boosted their payouts by as much as 25% to 36%.

They provide the most consistent and reliable and fastest-growing income stream I’ve ever seen.

I consider them a MUST-HAVE for both safety and income, especially in a crisis situation like the one I’m predicting will happen.

That’s why today I’m also giving you a third report, 3 Best Bank-Guaranteed Income Plans… containing full details on this income program… the three best plans available right now for potentially safe and rising income… the banks that offer them… and how to enroll online—it couldn’t be easier!

Putting it all together for you

At this point, you’re probably saying:

“Okay, Michael. How do I get my hands on the three new reports you and your analysts have just completed so I can find out what big American bank will go bust next, how I could survive and profit off this disaster, and how can I gain access to the elite group of banks that will withstand the crash and pay me?”

Our three new research reports…

The Next Big American Bank to Collapse

4 Elite Banks That Will Save You

3 Best Bank-Guaranteed Income Plans

All three of these special investor research reports are yours with our compliments and in your hands via e-mail within 48 business hours just for trying my Judgment Day Profit Letter.

I believe fortunes will be lost as the rally in stocks that started in 2009 comes to a screeching halt. You need to position yourself to be among those precious few who actually make money from this event.

Holding Your Hand All the Way

More important than the three reports, I want to send you our Judgment Day Profit Letter.

There is no doubt about it. I’m convinced the biggest stock market crash in history is about to happen and that it will devastate the economy.

That’s what our Judgment Day Profit Letter is all about—helping our customers make money as the stock market and the economy fall apart once again.

With our Judgment Day Profit Letter, you could make money by:

Buying ETFs and stocks that rise in value as the market crashes, as the VIX fear index soars, as company stock buyback programs go into overdrive, as bond funds invested in stocks take a big hit, and as overleveraged stock market investors exit the market like a herd.

Our Judgment Day Profit Letter is a simple eight-page newsletter, the goal of which is to protect the wealth of our readers from the stock market’s gyrations, while showing our readers how to profit as the stock market comes down.

Short selling of individual stocks, by the way, is banned from the mandate of Judgment Day Profit Letter.

In each issue, we review the positions outlined in our three special reports:

- The Next Big American Bank to Collapse

- 4 Elite Banks That Will Save You

- 3 Best Bank-Guaranteed Income Plans

You get our Judgment Day Profit Letter two ways: We e-mail it to you; and you get a secret password for a web site you can visit to see the current issue posted online anytime you’d like.

E-mail alerts, which are separate from the newsletter, are sent to you in between the newsletters when I believe there is a something important to say that can't wait for the newsletter. Hence, we’re in contact with you up to 24 times a year.

92% Win Rate Over the Past Ten Years

When the bull market started raging after the 2008 collapse, a lot of investors sat on the sidelines.

Not me.

Instead I went on the hunt for discounted opportunities…

The kind that are priced at just a fraction of their actual value.

This led to a string of remarkable profit opportunities for readers of my Judgment Day Profit Letter.

In my Judgment Day Profit Letter portfolio of recommended investments, I have an unprecedented 104 winners out of 113 closed stock picks over the past ten years!

That's a 92% win rate at picking investments that went up in value!

Now, I want to make this perfectly clear:

While my track record might sound great…

…there's no guarantee the stock or stocks you choose to invest in based on my recommendations will make money.

Past performance is no guarantee of future results—and all investments—no matter how safe they sound—have risk.

That said, let me tell you about…

An Unprecedented Opportunity

For a publication of this nature, we usually charge between $995 and $1,995 for one year of service.

The three special research reports we are sending you, we’ve priced at $99 each: $297 total.

Since I believe we are headed for the biggest stock market crash we’ve ever seen, and the most turbulent financial times America has been in since the Great Depression, I wanted to make our Judgment Day Profit Letter as affordable as possible.

Hence, I’ve slashed the regular subscription rate for one year of Judgment Day Profit Letter—12 monthly newsletters, 12 monthly e-alerts—to $295, and you get the three special, hot-off-the-press research reports I’ve mentioned just for trying our Judgment Day Profit Letter.

Through this special offer, I’ve slashed another $100 off the regular rate and brought this introductory offer down to the exceptionally low price of only $195 for one year of service.

Be One of the Fortunate: Protect Yourself & Profit from the Stock Market Crash Headed Our Way!

Act now to secure your place, get your three special research reports, and lock in a tremendous discount.

To recap, you’ll get:

- 12 monthly issues of our Judgment Day Profit Letter newsletter

- Up to 12 separate, monthly e-alerts from Judgment Day Profit Letter

- These three special research reports just for trying Judgment Day Profit Letter:

- The Next Big American Bank to Collapse

- 4 Elite Banks That Will Save You

- 3 Best Bank-Guaranteed Income Plans

And, of course, everything comes with a money-back guarantee: If there is ever a time you are not happy with Judgment Day Profit Letter, you can cancel for a refund of your undelivered issues.

The three special research reports… they’re yours to keep no matter what.

I’ve told you about my previous stock market predictions and how they’ve already come true.

I’ve given you details on the next big American bank that I believe will collapse…

…and why it’s the first domino before the other big banks and the economy fall.

And I’ve given you the answers on how you could protect yourself and profit from the stock market catastrophe headed our way.

The next step is yours.

Click the order button below to join us today!

Click Here Now to Order

Yours truly,

Michael Lombardi, MBA

Founder

Lombardi Publishing Corporation

Celebrating Over 30 Years of News, Information & Analysis

Services to Over One Million Customers in 141 Countries

Dear Reader: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. We are 100% independent in that we are not affiliated with any bank or brokerage house. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose. The opinions in this content are just that, opinions of the authors. We are a publishing company and the opinions, comments, stories, reports, advertisements and articles we publish are for informational and educational purposes only; nothing herein should be considered personalized investment advice. Before you make any investment, check with your investment professional (advisor). We urge our readers to review the financial statements and prospectus of any company they are interested in. We are not responsible for any damages or losses arising from the use of any information herein. Past performance is not a guarantee of future results. All trademarks and registered trademarks are the property of their respective owners.

Copyright 2022; Lombardi Publishing Corporation. All rights reserved. No part of this document may be used or reproduced in any manner or means, including print, electronic, mechanical, or by any information storage and retrieval system whatsoever, without written permission from the copyright holder.