In this Article

- Sell in May and Go Away?

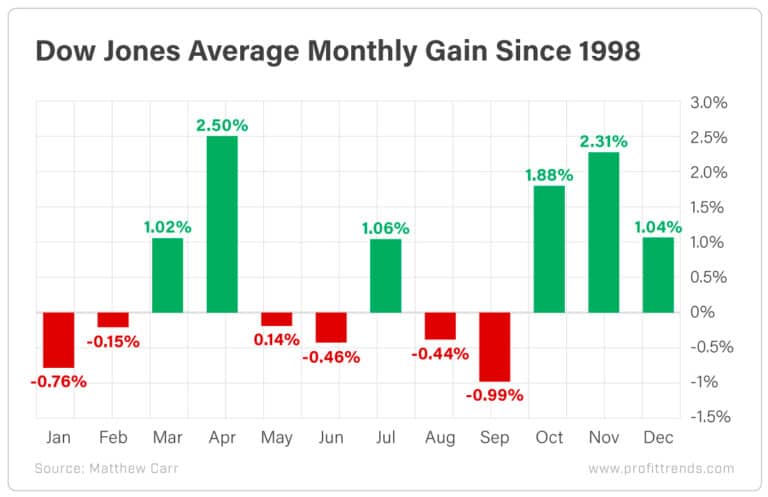

- Average monthly gains for the Dow since 1998

- May can be full of turbulence

- May is also a month for buying

The S&P 500 is in correction territory… again.

The Dow Jones Industrial Average shed nearly 2,200 points over the last seven days of April. And it continues to head lower.

The Nasdaq and Russell 2000 are at new 52-week lows, deep in bear country. And the market has been nothing but mayhem in recent weeks.

So much so that even one of the most dependable trends over the past decade and a half crumbled apart. April’s stretch of awesome gains for the Dow came to an end as stocks tanked in the closing days of the month.

Instead of posting a positive return – which blue chips had done in April every year since 2005 – the Dow tumbled more than 5% last month. This marked the worst performance for the index in April since 1970.

And to top it all off, U.S. stocks are exiting their worst first four months of the year since 1939.

With all that pessimism, no news would be good news at this point.

But now we’re heading into one of the most infamous months of the year for stocks: May.

And for those of you who – for whatever reason – need another excuse to be bearish, the month has long been an investor favorite to avoid.

The famous saying goes, “Sell in May and go away, don’t come back till Labor Day.” The ye olde English version ends “Don’t come back till St. Leger’s Day.”

Regardless of whether you’re a fan of the U.S. or U.K. release, neither the Beatles nor Eminem has a rhyme that will live on as long as that one.

But is there truth to this idea – especially in a year like the one we’ve had so far? Or is it one of Mr. Market’s most misunderstood pearls of wisdom?

[Don't Miss: Nomi Prins – The #1 Stock for America’s Great Distortion]

Sell in May and Go Away?

May gives us “Star Wars” Day (“May the 4th be with you”).

Then there’s Cinco de Mayo, Mother’s Day and Memorial Day – the official start of one of my favorite seasonal investing trends, beer drinking season, as well as summer driving season.

None of those holidays are as lucrative as Easter, Thanksgiving or Christmas. Nor are they particularly disastrous.

So why the market hatred for May?

Summer vacations.

The “Sell in May” concept originated in England at a time when aristocrats, bankers and other wealthy elites would flee the suffocating heat of London to summer in the countryside.

The adage carried over to the U.S., where most people take vacations between May and September.

Investors, the adage says, pare back their exposure to the markets in these months by having their money take a vacation as well.

This leads to a summer lull in the markets as volume sputters to a trickle. Things don’t normalize again until after the summer ends and children go back to school.

For decades, the theory seemed efficient enough. From 1950 to 2013, the Dow averaged a 0.3% return from May to October and a 7.5% gain from November to April.

And when we look at the stretch of average monthly gains for the Dow since 1998, the period from May through September doesn’t look very promising.

Three of the four worst months of the year for stocks occur in that five-month span. And since 1998, the Dow has averaged a loss of 0.73% from May to October.

But a lot of the damage came between 1998 and 2011. In the nearer term, the story is a lot different.

Since 2012, the average return of the Dow between May and October has been 3.48%.

We live in a modern world. With the broader adoption of smartphones, people are connected to the markets 24/7, year-round. Even on vacation, they can place trades.

And that reality has poked holes in the “Sell in May” maxim.

[First Look: “The One Stock Retirement” – The World’s Most Predictable Stock]

May’s Mayhem

May can be full of turbulence.

The looming shadow of “Sell in May” hangs over it.

And first quarter earnings wind to a close in the month, meaning we enter a quiet period at the company level until second quarter earnings begin in late June.

So it shouldn’t come as a surprise that May is prone to some exceptionally steep drops.

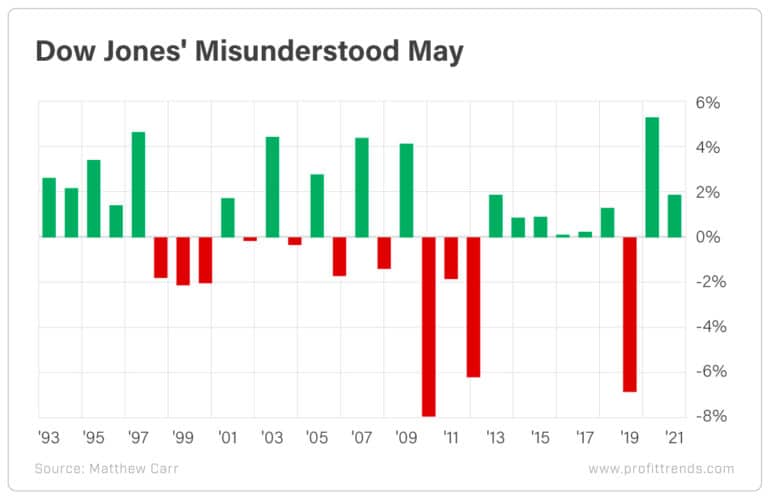

But the Dow has ended May with a loss only 11 times since 1993.

That means blue chips end the month with a gain 62.1% of the time.

The reality is, January, June, July, August and September are far worse months for stocks than May. And since 2013, the Dow has ended May with a loss only once.

That said, we can see that when stocks do fall in May, they tend to fall hard, particularly since 2010. The month has seen three losses of more than 6% during that decade and change.

Historically, May marks the beginning of a very difficult stretch for investors. A lot of that has to do with the impact of money managers, Wall Street executives and average Americans heading off on summer vacations, as well as the cyclical nature of industries like retail and shipping.

But those industries aren’t very large components of the major U.S. indexes anymore. And since smartphone adoption crossed 50% in 2013, summer vacations have no longer weighed on markets as they once did.

Because May is also a month for buying. It’s the start of some profitable trends in industries that take off in summer, like beer and travel.

So investors shouldn’t be looking to sell in May and go away. They should be looking to rotate into the sectors that are heating up for the summer.

Here’s to high returns,

Matthew