The A.I. System That Labeled Silicon Valley Bank as “High-Risk” (6 Months Before It Collapsed) Sounds the Alarm…

Sell These 1,918 “Safe” Stocks Now!

REVEALED: Why 40% of Stocks Are Now Rated “High-Risk” … Putting Up to 60 Million American Retirement Accounts in Grave Danger.

[Official Transcript]

It’s Friday, March 10.

9:27 a.m.

It’s not surprising America’s biggest tech companies are pumping billions into AI at a breakneck pace…

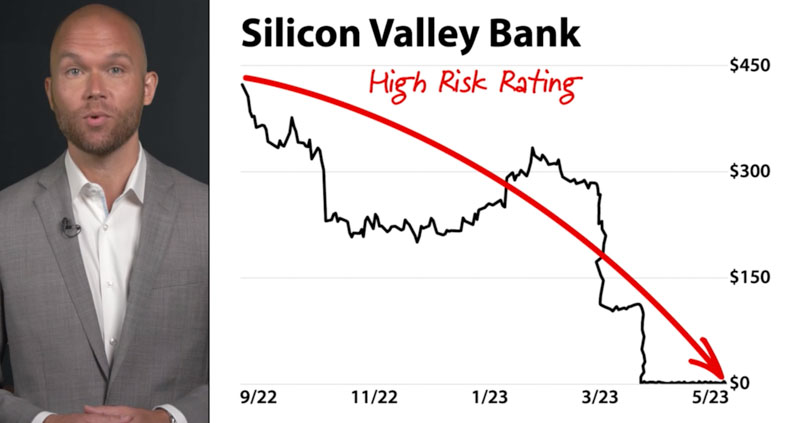

Silicon Valley Bank’s (SVB) stock is collapsing, falling from $267 a share down to $39…

Trading is halted before the market even opens.

Minutes later, the FDIC announces the bank has been shut down.

Delisted. Closed. Erased.

Everyone is shocked.

Well, almost everyone…

Two weeks earlier, top executives at SVB were quietly selling their shares … to the tune of several million dollars … including the CEO who walked away with $3.5 million in cash?

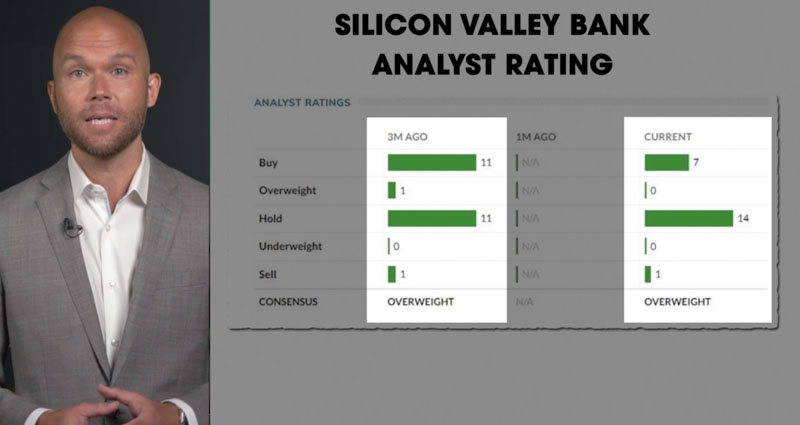

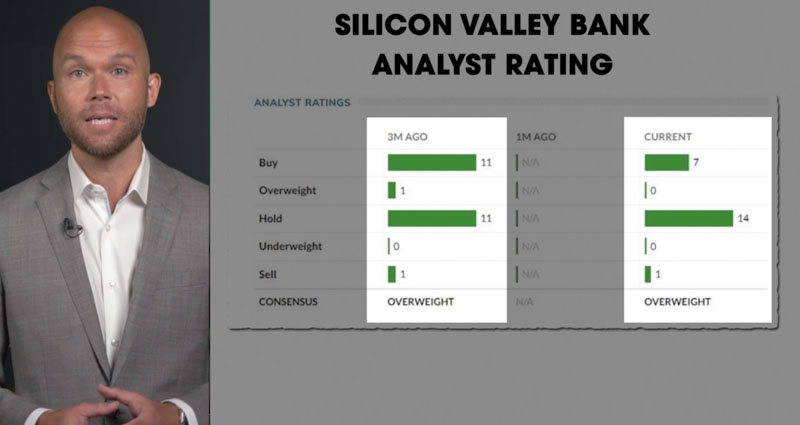

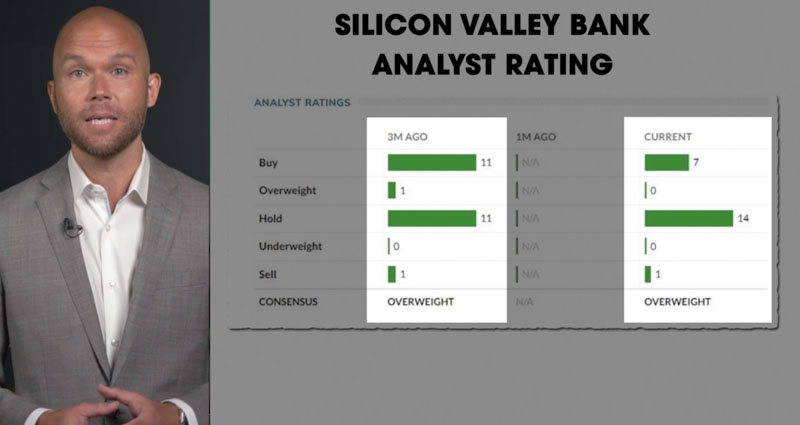

Yet, despite the selling from insiders … information readily available to Wall Street analysts … 23 out of 24 of them gave its stock a buy, overweight or hold rating … basically telling the world that it’s was a “safe haven.”

A month prior, Jim Cramer told his CNBC audience: “Consider me intrigued … [there’s] more room to run … has always been a very good business … it’s a very compelling situation … the stock’s still cheap … they’re not going away … SVB’s nearly 40% rally this year is a drop in the bucket.”

He told people buy SVB … one month before it imploded.

How did he, and 23 out of 24 analysts, get it so wrong?

And, how did one rogue analyst get it so right?

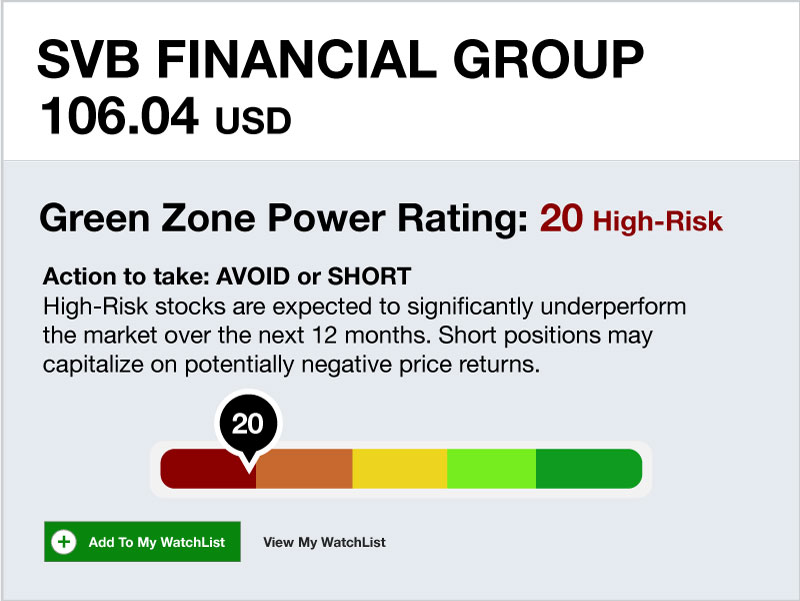

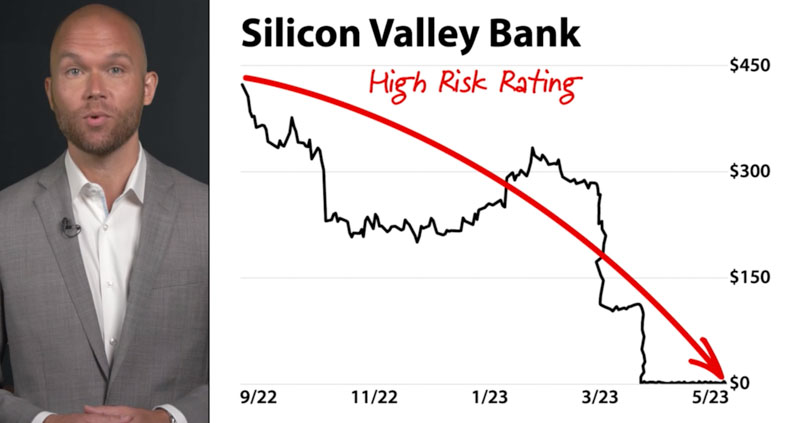

An analyst who’s system, six months before SVBs collapse, gave the bank a “high-risk” rating while the stock was still trading at $400 a share…

And as it fell to $300 and then $200, despite any pushback he got from the Wall Street powerhouses, confirmed that it was high-risk.

Anyone who used this insight with their investment decisions was able to sidestep the carnage.

And this was not an anomaly.

On average, stocks this rogue analyst and his system rated high-risk have gone down 37% over the last year … some falling as much as 80%, 90% and 100% … such as Signature Bank, First Republic Bank and Credit Suisse.

And others like Carvana, Beyond Meat and Wayfair, which have dropped as much as 80%, 97% and 98%.

Who is this rogue analyst, and why is his system so right, while so many are so wrong?

His name is Adam O’Dell.

Today, you’ll meet Adam as he reveals why most expert analysts fail to do the one job they are asked to do … give an accurate rating of a stock, yet walk away untouched … and often times wealthier … as Main Street Americans pay the price…

Often times losing 100% of their investment.

It’s one of Wall Street’s biggest, darkest, cover-ups that allowed executives at SVB to walk away with millions of dollars while their “safe” stock plunged to less than a dollar.

More importantly, you’ll see how this coverup led Adam to spending 10 years of his professional career developing his own, proprietary stock rating system … one that has the power to alert investors to sell stocks, just like SVB, before they collapse.

A system that now, alarmingly, is issuing a high-risk alert on v1,918 stocks. That’s 40% of all publicly traded companies.

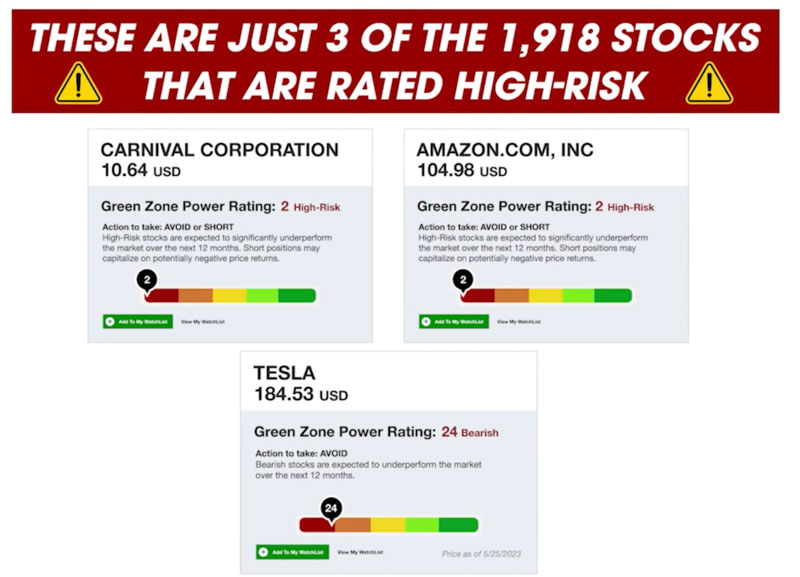

Stock like Target, Amazon and Tesla are just three of the stocks on his blacklist.

You’ll want to consider selling them now.

Not next week.

Not tomorrow.

Today.

As you’ll soon see, like Silicon Valley Bank, most of these 1,918 stocks are getting Wall Street’s highest ratings … they’re touted as “safe havens” … which is why they’re lurking in as many as 60 million IRAs, 401(k)s and even pension funds.

I fear they could be lurking in your nest egg, too.

But it’s not all bad news.

Today, Adam … who has already achieved accolades only given to the top vi1% of financial expertsvii … reveals which stocks his system shows you should consider investing in.

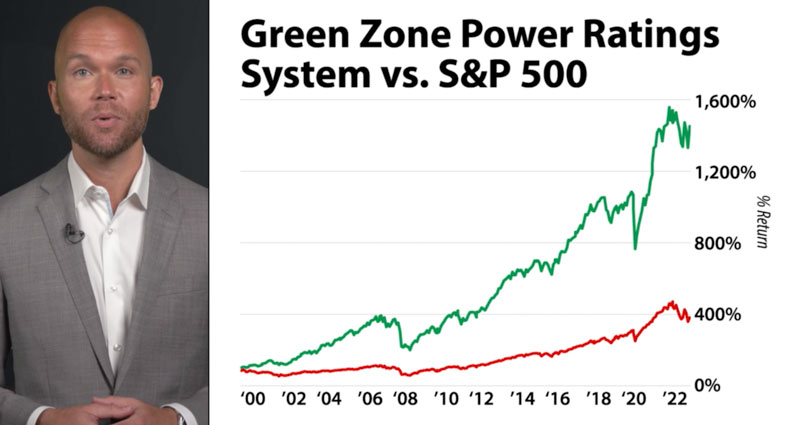

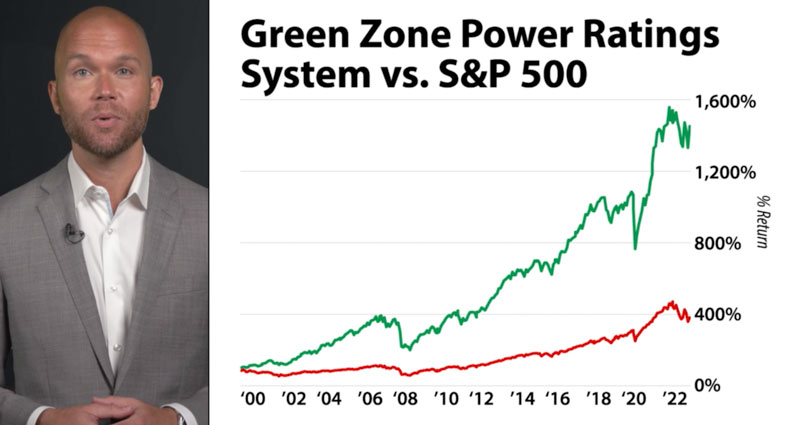

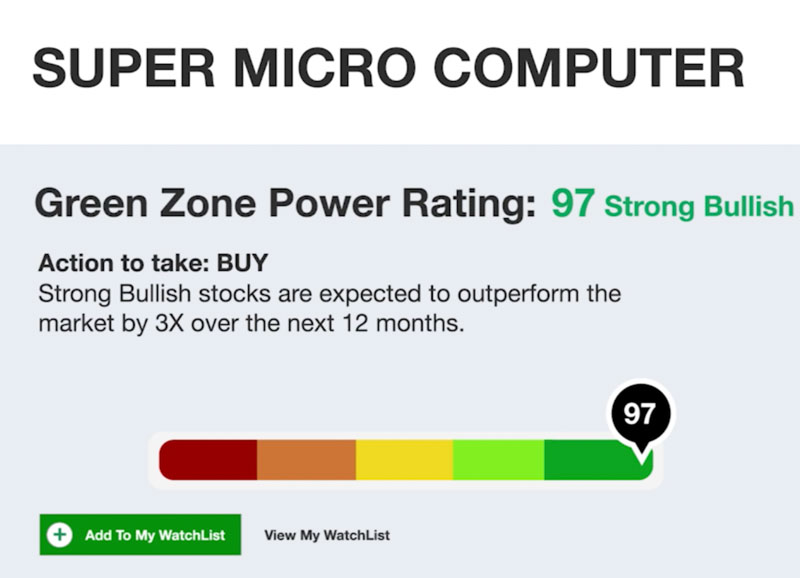

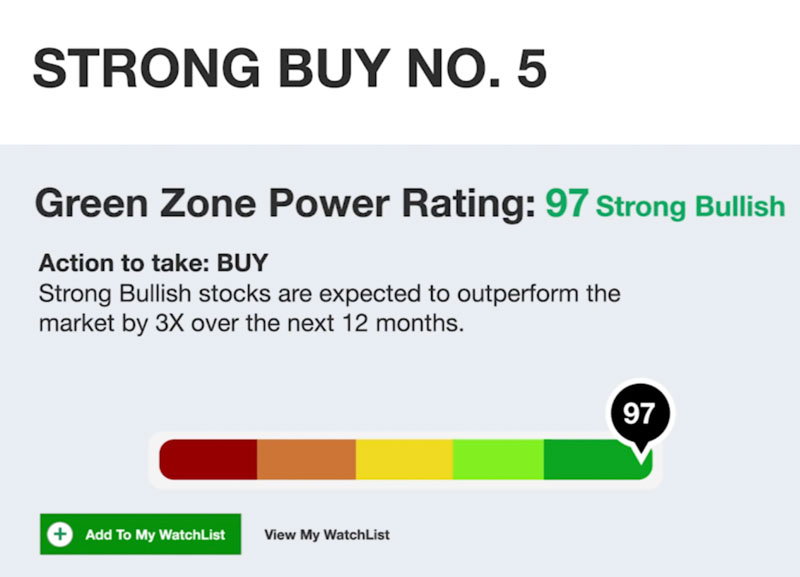

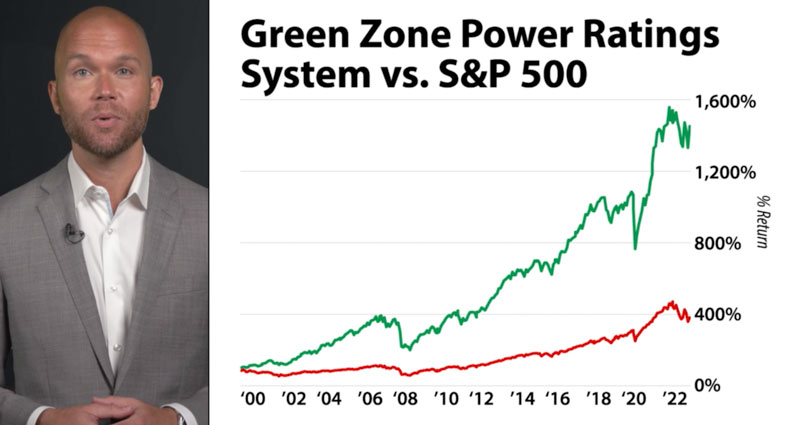

Twenty years of historical evidence, rigorous back tests and real time results show stocks that get his “bullish rating” could have beaten the market 3-to-1.

This green line, the one that’s up 1,300%, represents Adam’s top-rated stocks.

That’s more than triple the returns the S&P 500 over the last two full decades.

Adam’s stock rating system, now patent pending, is second to none, and well worth the time, energy and over $5 million he and his firm invested … as it helps him and his team navigate these tumultuous markets.

And his system is a powerful tool that can do the same for you. Providing you with a snapshot rating on a stock — so you can make smart, well-vetted decisions with your investments. Mark my word, using Adam’s rating system as your guide can have a tremendous impact on your portfolio.

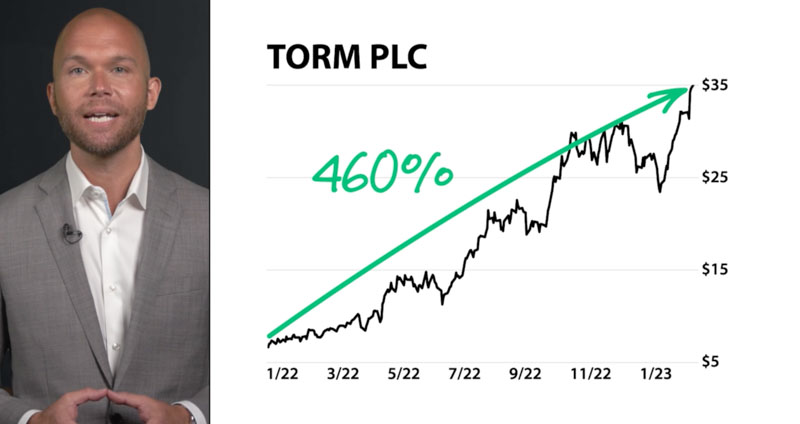

For example, in 2022 — one of the worst years in stock market history — Adam’s system gave “buy” ratings on ixOpera, Mammoth Energy and Torm … and those companies have risen 113%, 318% and 460%.

Simultaneously, it gave a high-risk rating to stocks such as, BRC Inc., Allego and Arrival … these companies have fallen 83%, 89% and 99%.

Today, he’s revealing how you can get access to all 1,918 of his system’s high-risk ratings … stocks that are likely lurking in your portfolio … that could kill off a large portion of your retirement … unless you dump them today.

And he’s releasing his top buy recommendations based on his ratings system. Eleven stocks that few have ever heard of … not yet, anyway. You’ll get details on them right here, live, in this presentation. You’ll want to buy them. Immediately.

So, take out a pen and piece of paper, and listen closely…

Hello. My name is Adam O’Dell.

I’m the Chief Investment Strategist at Money and Markets. We’re a fiercely independent research firm based in Palm Beach, Florida.

Unlike Wall Street analysts, we receive no incentives, or have any outside affiliations, that skew our ratings in any way.

If a stock is rated bullish — it’s because it deserves a bullish rating.

If it’s rated high-risk — it’s because it deserves a high-risk rating.

And if it’s a hold, well, you get the idea.

That’s the way investment research should be — free and clear of outside influences. Based solely on facts. Not opinions.

This is the core principle I founded my firm on.

I didn’t want anyone or anything to sway our investment research. It doesn’t matter if a company is willing to pay me $1 million or $10 million for a bullish rating. I don’t accept bribes. Because our goal is singular … to help everyday Americans make smart decisions with their money.

When our members make more money, they tell a friend or two, and our business grows.

That’s the way a business should be — results driven.

Which is why today, over 180,000 investors follow our work.

Ironically, among those who pay to receive our research are financial professionals at top Wall Street firms like Morgan Stanley, UBS, Deutsche Bank and U.S. Bank. Despite all the resources at their fingertips, they gladly pay to receive our research.

That’s because our ratings are unbiased and derived from undisputable facts … using over 100 data points that are continuously computed through our system to verify only the best companies get our approval.

This is why our results are second to none.

Which brings me to the urgency of this message.

Right now, 1,918 stocks … are rated high-risk.

That’s 40% of all stocks.

When these stocks fall, they will fall hard and fast … dragging 401(k)s, IRAs and pension funds down with them.

Such devastation could cause many people to put off retirement for years. Maybe decades. Others may lose out on retirement, altogether.

Such as the people who held Silicon Valley Bank…

On paper, the company looked like a sound bank.

At one point it had over $200 billion in assets … including investments from JPMorgan, Vanguard, BlackRock and Morgan Stanley.

But six months before the collapse, when the stock was still trading at $400 a share, my system changed it’s rating to high-risk.

It was published on our website for all to see.

Anyone who followed this insight was able to move their money out of the stock. Or, if they had money deposited in the SVB, they were able to move their cash to another bank.

Most people didn’t listen, though.

Didn’t matter how many people I tried to warn.

But I get it. I do.

Twenty-three of 24 analysts gave SVB a “buy,” “hold” or “overweight” rating … right up until the day the stock collapsed.

Jim Cramer was smashing his red button telling everyone to buy the stock.

But they were wrong.

My system was right.

That’s not me bragging. That’s the result of years of hard work that me, and my team, put into my patent pending Green Zone Power Rating system.

And this is not an isolated incident.

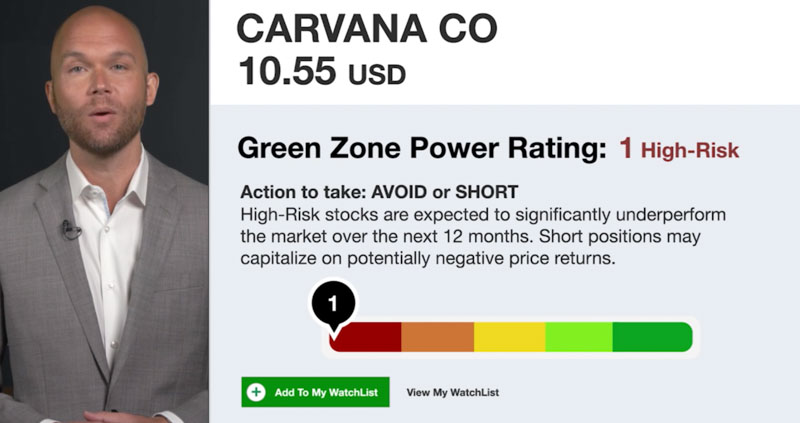

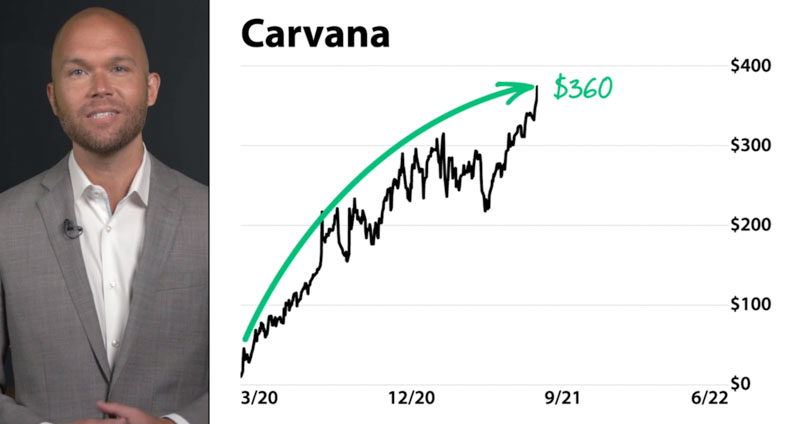

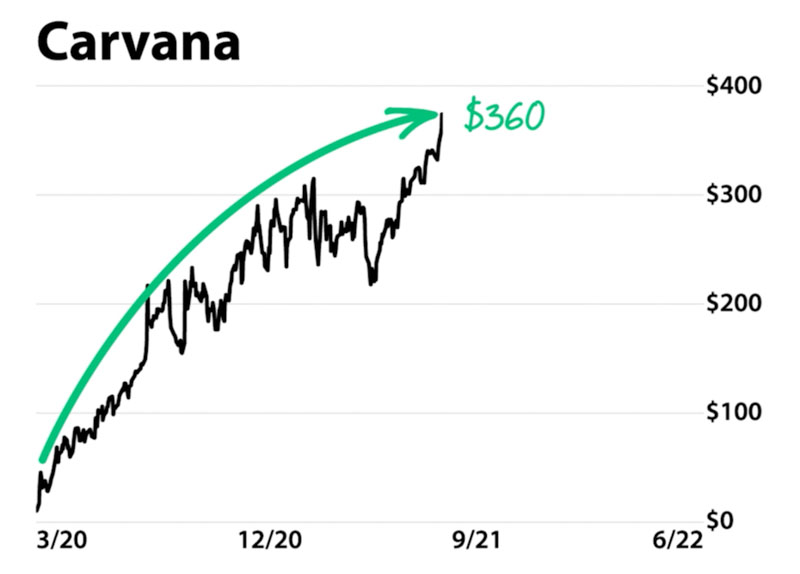

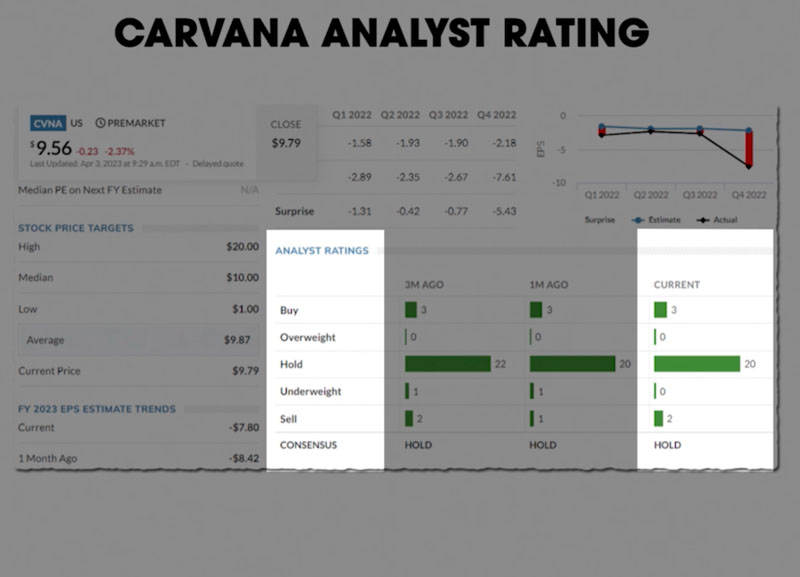

Carvana is another example.

You know, the used car dealership that was buying cars and flipping them in hopes of a profit?

My stock rating system determined that Carvana was nothing more than an oversized, overpriced Pez dispenser for cars, operating at a massive loss.

It never gave Carvana’s stock a “bullish” rating. Not once.

It was a high-risk from day one.

And at first, I looked like a fool as the stock soared to $360 as more and more Wall Street analysts jumped on the bandwagon giving the company glowing reviews.

And the media loved the story talking about the Carvana rally…

And how the stock was soaring…

Microsoft co-founder Bill Gates even went in big on its stock:

But my rating system confirmed the stock was high-risk.

Because unlike Wall Street, we ignored the fantasy … and any bribes … and focused on facts.

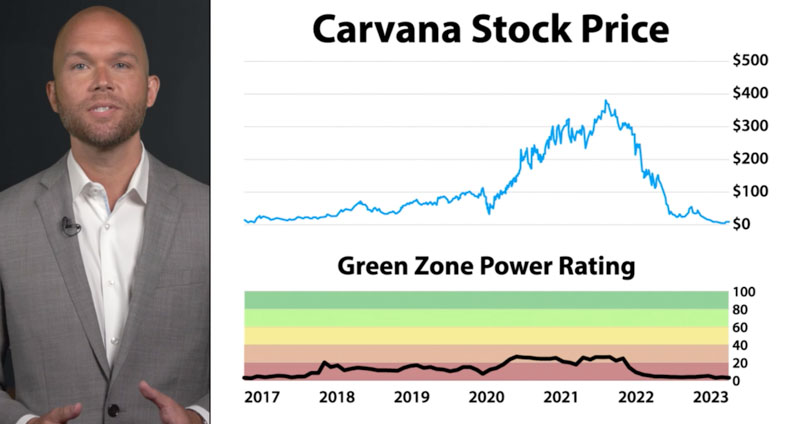

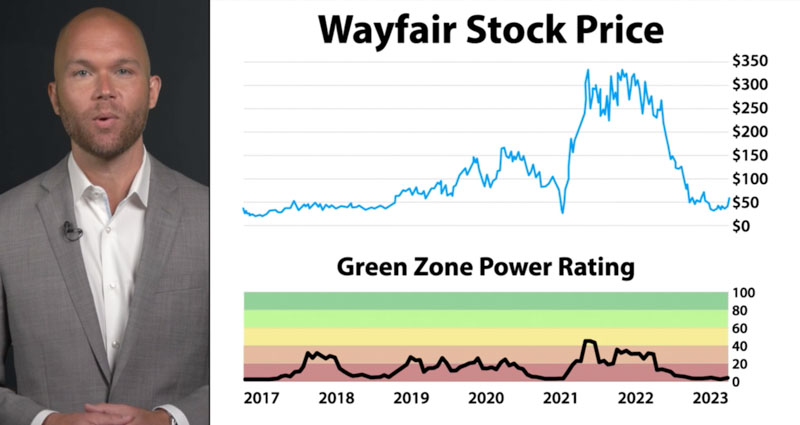

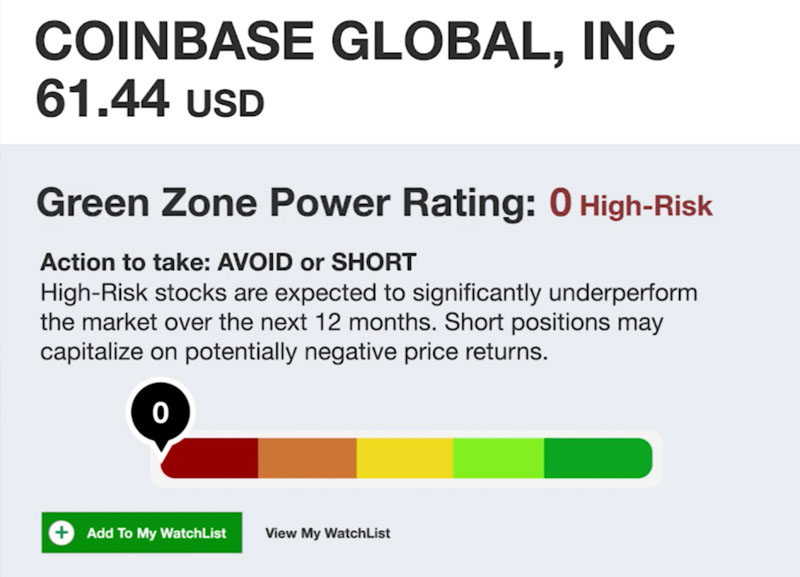

As I’ll explain in more detail in a moment, my proprietary Green Zone Power Ratings system is grounded in a powerful algorithm that crunches over 100 different factors that impact a stock’s price.

Then it generates a rating from 0 to 100.

When a stock holds a rating of 40 and lower — you should avoid it like the plague.

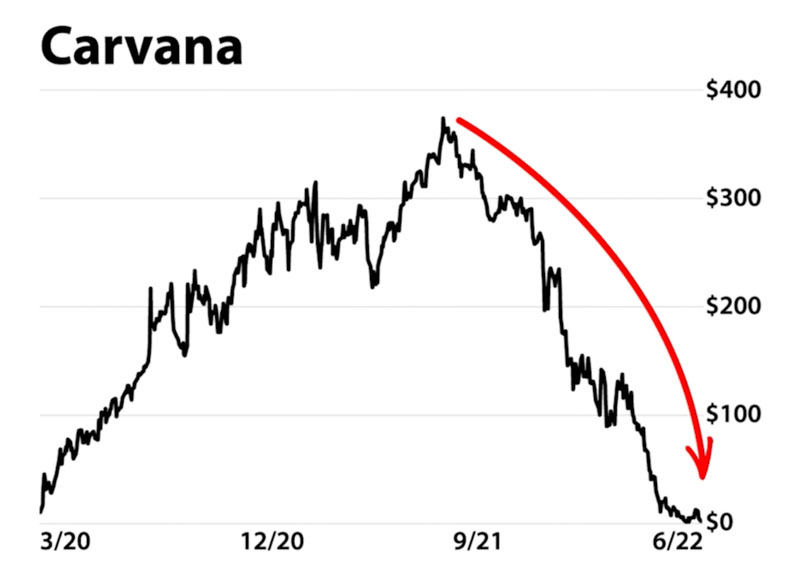

The black line in this chart, that’s my system’s rating. As you can see … Carvana never went higher than 30 … even as the stock soared to $360.

Again, for a period of time, I looked like a fool.

But 20 years of research, back testing and proven results told me that something was off. Way off. That the company was the next Pets.com.

So, it came as no surprise to me, my team or the Money & Markets community, that after the “hype” wore off, Carvana’s stock plummeted 97% in less than a year.

What’s crazy is, even to this day, 23 out of 25 Wall Street analysts covering the stock give it a hold or buy rating.

And they do this fully knowing that the CEOs father, who has 84% control of the company, and who was already convicted of bank fraud, sold $2.5 billion in shares as the stock peaked out at $360.

Tell me … in what world is it OK for insiders to walk away with $2.5 billion in profit while Wall Street advises ordinary investors to hold the stock as it falls 97%?

It might be legal, but that doesn’t make it right.

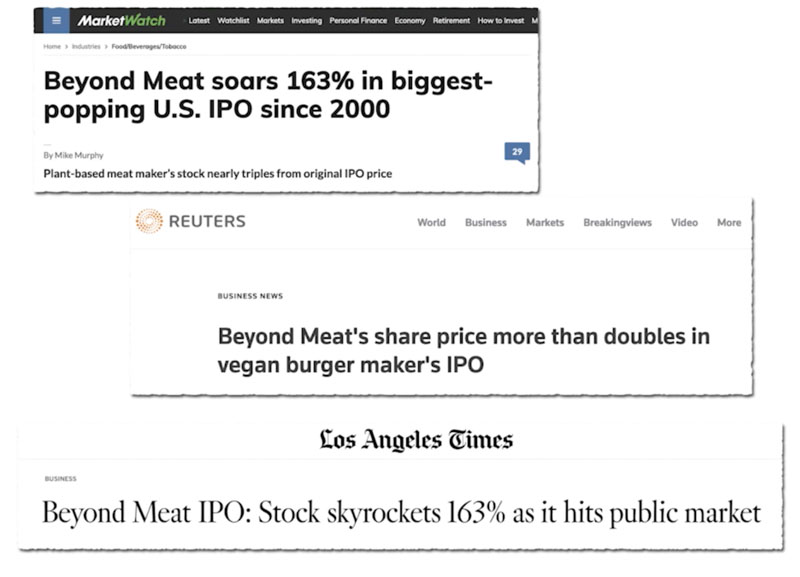

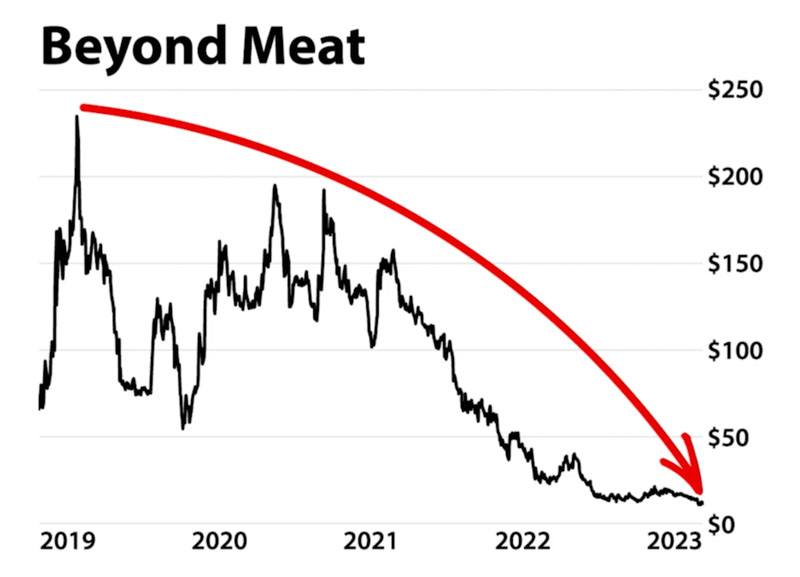

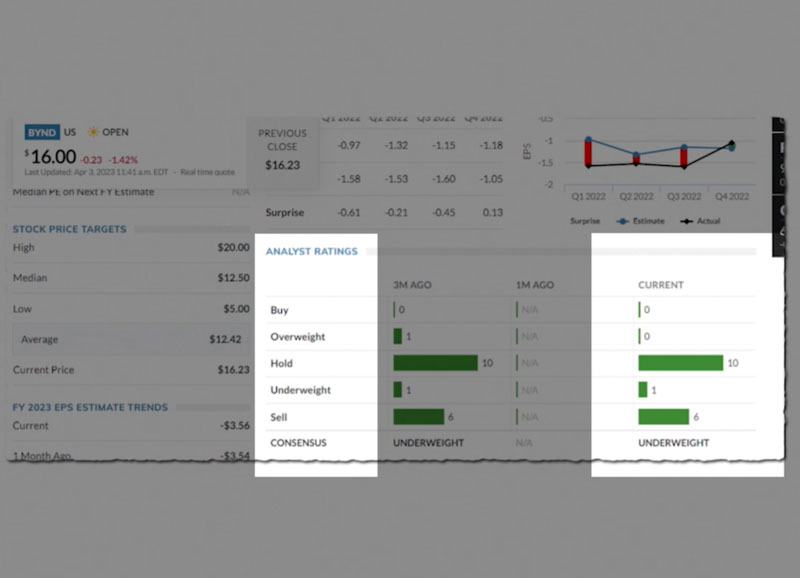

Here’s another example … Beyond Meat.

In 2019, it went public to much fanfare…

MarketWatch, Reuters and the Los Angeles Times praised the company when it went public…

The stock ultimately soared 254% … enjoying stunning growth as its fake meat products landed in fast-food chains like Subway and McDonald’s.

However, only 5% of Americans consider themselves vegetarians. So Beyond Meat was selling a product that 95% of the population had no use for, and no desire to buy.

There was no way it could sustain the $14 billion market cap.

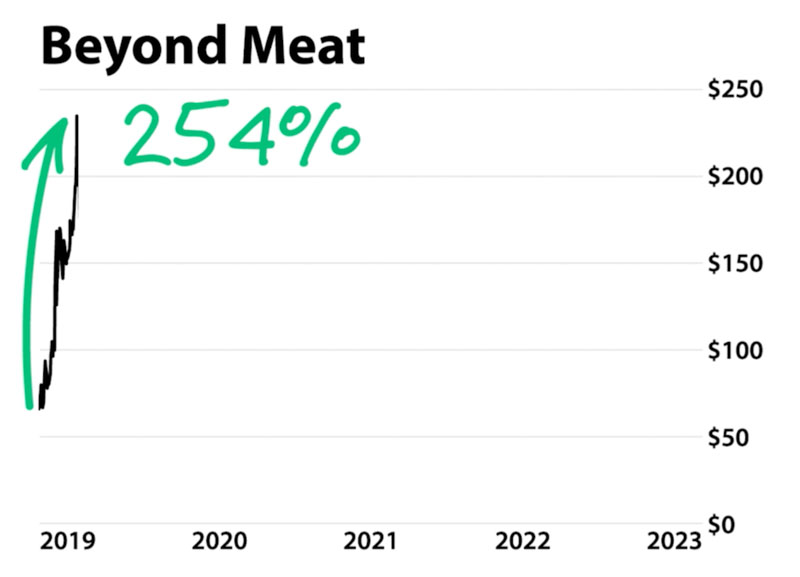

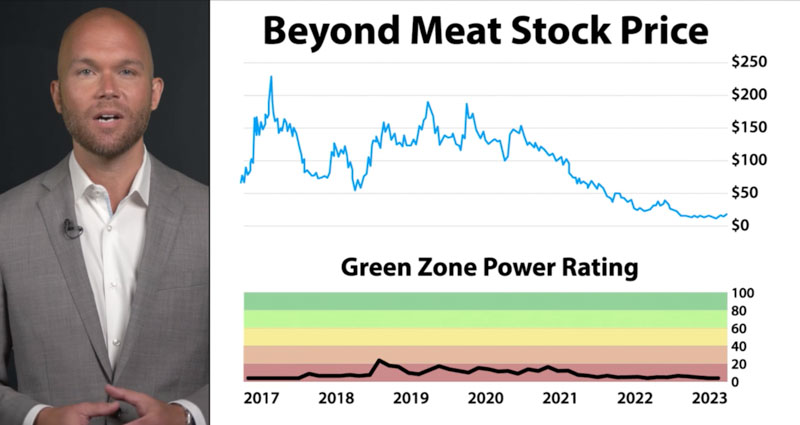

My system, as it analyzed all 100 metrics, was able to see that Beyond Meat’s stock price was beyond logic.

It saw right through the smoke and mirrors … never rating the stock above 25. Again, anything below 40 you should definitely avoid.

As you can see, the black line clearly shows it had the lowest possible rating while the stock’s price was highest.

Sure enough, the stock dropped 98% from its high.

Even to this day, the majority of Wall Street analysts have not told their clients to sell this fake meat stock … despite the fact that insiders have sold $16 million in shares.

Again, it may be legal, but that doesn’t make it right.

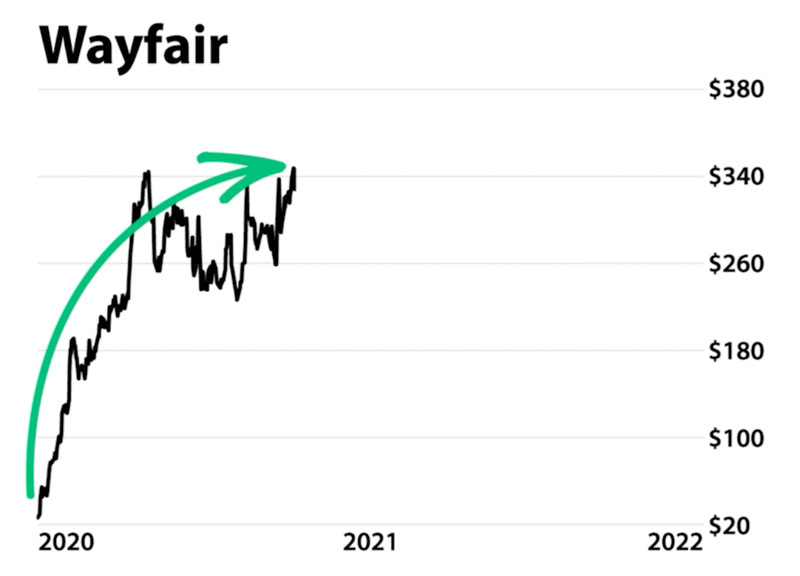

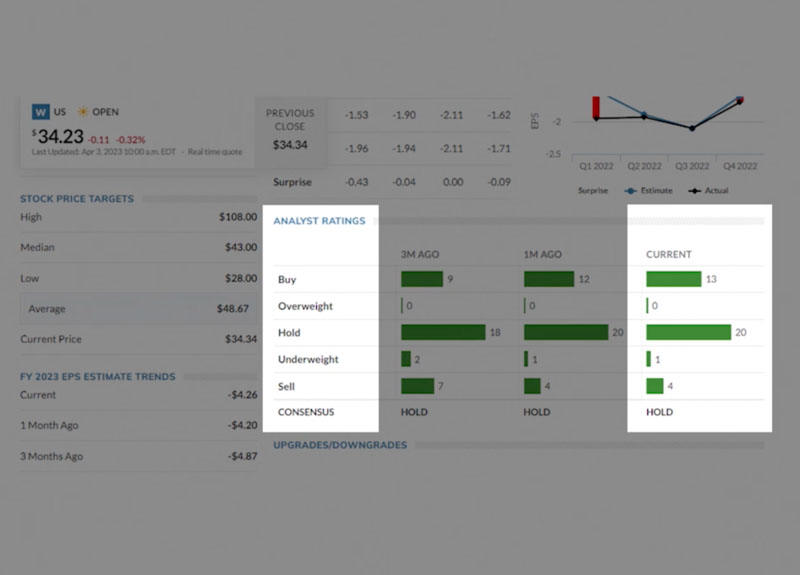

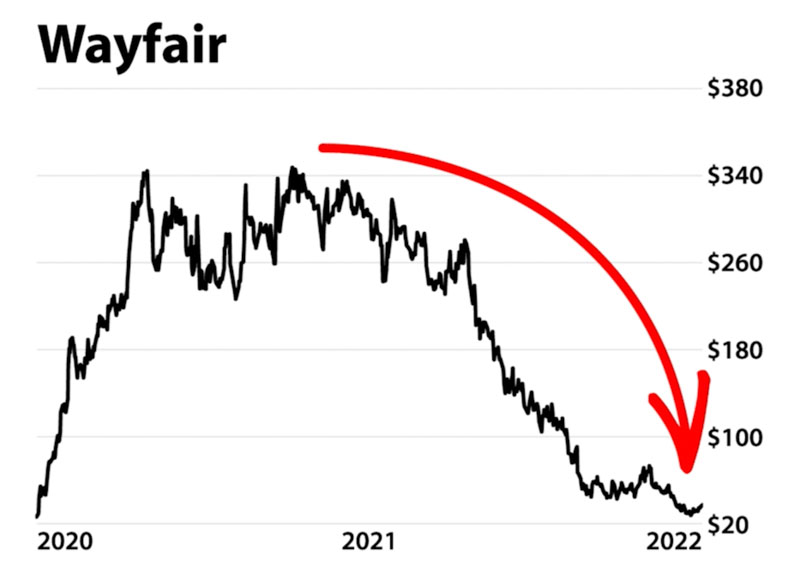

One more example … Wayfair, the online home goods company.

During the pandemic, people remodeled their homes and relied on online shopping to redecorate while they were cooped up inside.

Boston Business Journal, CNBC and InvestorPlace all noted its remarkable growth…

As Wayfair’s stock soared from $39 … all the way up to $343 … my system didn’t buy into the hype.

Looking at the numbers, analyzing the facts and combing through over 100 different metrics … separated fact from fiction.

The story Wall Street bought (and sold investors) was that the company was growing rapidly, so it was OK that its margins were thin.

But we knew that the minute the pandemic-driven shop-from-home economy slowed down … it was clear as day, it would crumble.

Which is why Wayfair lost nearly $943 million in 2022 alone.

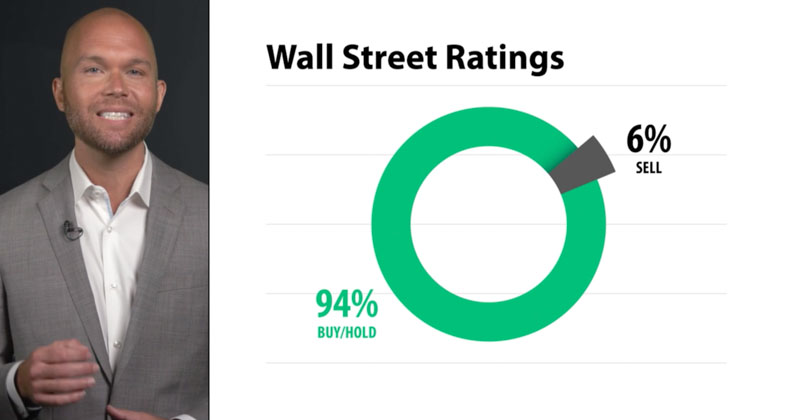

Wall Street analysts sure didn’t warn the public this was coming. Of the 37 analysts following the stock, only 4 have given it a sell rating.

Despite the fact, that once again, insiders were dumping the stock … cashing in on millions of dollars.

It might be legal, but … you and I know that doesn’t make it right.

Of course, most Main Street investors were blindsided as the stock crashed over 80% in less than a year.

But that was not the case for those who use my Green Zone Power Ratings system.

They were able to see that for nearly two years its stock was rated below 20.

Meaning, HIGH-RISK…!

Now, some watching may be wondering … wouldn’t it be better to invest in these companies anyway, try to capture the quick profits and get out before they collapse?

Maybe.

But, all investing carries risk, and that kind of “get rich quick” strategy is especially risky. And since nobody can time the market perfectly, that’s too much risk for my taste.

Besides, I don’t like to invest my money alongside shysters who pump their stock price up … enticing the American people to buy … while quietly selling their shares.

I prefer to invest in solid companies with great leaders, and a sound business model. A company that creates great products and provides great services.

And I have 11 such companies on my radar now … each with a strong bullish rating above 95.

You won’t hear about them in the mainstream which is why I’m going to give you access to them.

You see, my Green Zone Power Ratings system is designed to see through the hype. That’s how it knew Carvana, Beyond Meat and Wayfair stock prices were based on fantasy and not fact … because it looks at each company’s financials.

It analyzes 100 metrics of data to determine what’s really happening in a business.

Which is why, in December of 2021, at the peak of the market, my system had all of these “get rich quick” stocks rated high-risk…

Vroom was given a score of just seventeen … since then, it is down 94%.

Rivian was given a score of zero, it is down 89%.

Coinbase got an eight, it’s down 76%.

In fact, 137 of those stocks are now basically worthless, down 90% or more.

I’m showing you this track record not to impress you, but rather impress upon you the gravity of my message today.

The very same system that issued a high-risk rating on all these stocks over the last one to two years … is now issuing a high-risk alert on a record number of companies.

One thousand nine hundred and eighteen of them.

Today, I’ll show you how to get my new report called Blacklist … with all 1,918 stocks you’ll want to consider selling right away.

Including Target, Amazon and Tesla.

And, over a dozen banks that my system identified as the next victims from the Silicon Valley Bank fallout … including one with over 68 million customers in the United States.

You can download your copy of Blacklist within the hour.

It’s critical you have the names and ticker symbols of all these companies. Many of them are rated as “safe” by Wall Street, and are therefore held in 401(k)s, IRAs and even pension plans.

But before you download this report, it’s important that you understand why my system keeps getting it right — issuing high-risk ratings on Silicon Valley Bank, Carvana, Beyond Meat and Wayfair before they crash … while nearly every Wall Street analyst gets it wrong.

In 2015, Harvard came out with a critical study…

It revealed that 37% of publicly traded companies are no longer trading within five years.

This was no surprise to me, as I had worked closely with a Harvard economist for several years and we spent a good amount of time warning investors about the follies of the stock market.

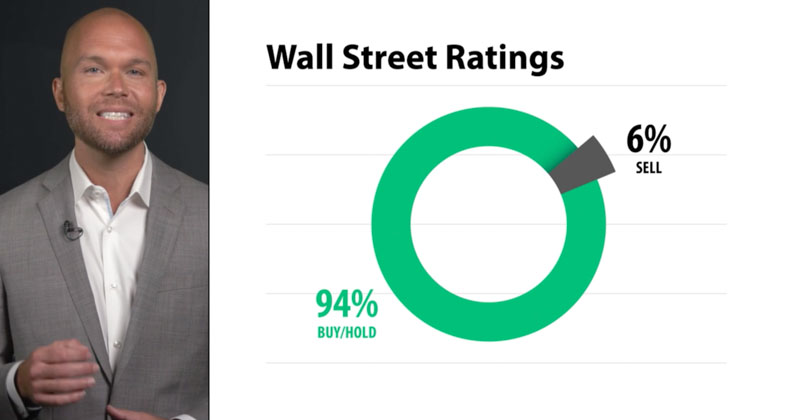

But what still shocks me, is that despite this FACT, Wall Street rarely issues a “sell” rating on a stock.

On average, Wall Street gives a mere 6% of companies a sell rating.

Meaning, out of 100 stocks, they are saying to avoid only 6 … yet, they know full well that 37 of them will not survive in the long-run.

A stock market analyst has one job…

To rate a stock so clients know whether they should buy, sell or hold.

So why would they give only 6% of stocks a sell rating when they know 37% won’t even make it?

Why would 23 of 25 analysts give Carvana a thumbs up to Main Street investors while the CEO’s father … a man convicted of bank fraud … openly sells $2.5 billion in shares?

Why would 23 of 24 analysts give SVB a buy rating while insiders, such as the CEO, were selling shares for millions of dollars?

How could these Wall Street analysts, who literally have one job to do, get it so wrong?

CNBC asked the same question … why do Wall Street analysts almost never put sell ratings on stocks.

Slate ran an article … why Wall Street hates the “S” word…

Fortune finds it odd that despite profit warnings, recession fears and layoffs … Wall Street analysts still advise investors to buy, buy, buy.

And Business Insider ran an expose saying “why Wall Street never tells you to sell.”

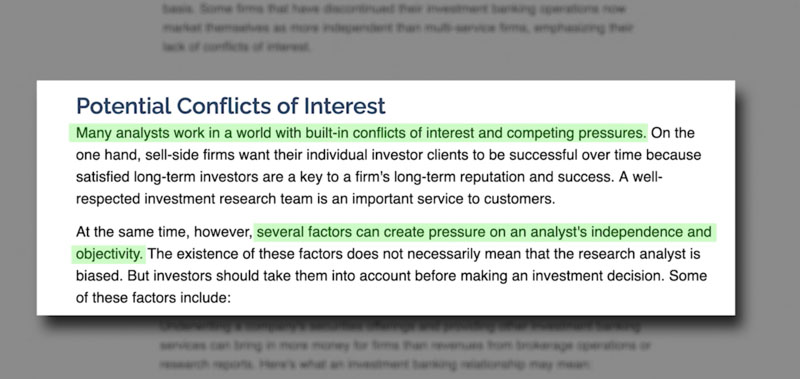

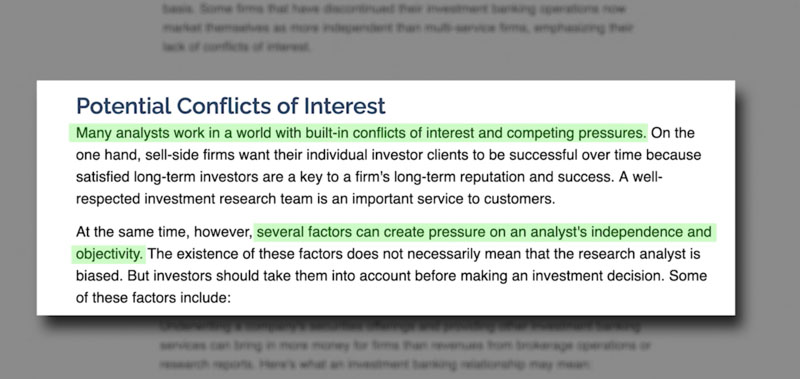

Come to find out, the answer can be found from a study done by none other than the U.S. Securities and Exchange Commission … the SEC.

The short version of its findings:

“Many analysts work in a world with built-in conflicts of interest and competing pressures … several factors can create pressure on an analyst's independence and objectivity.”

What “conflict of interest” is it alluding too?

Well, here’s a little-known fact. Something Wall Street would likely prefer you never hear…

A big part of an analyst’s paycheck … a massive part … comes from how many meetings they can get set up between their wealthy clients and company executives … so their clients can get inside information.

Do you think an analyst can set that meeting up if they have a “sell” rating?

Nope.

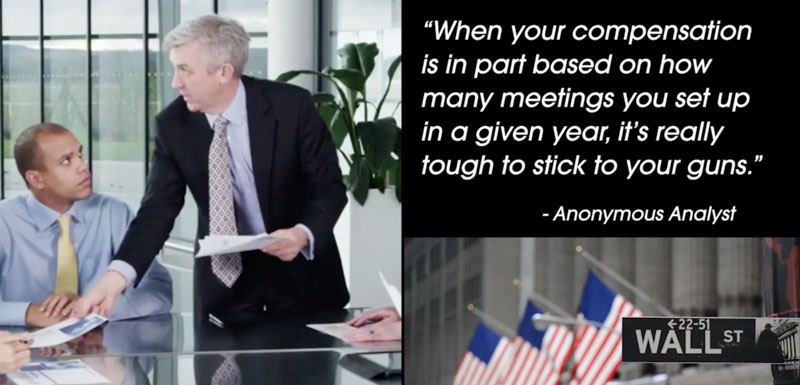

As one analyst admitted: “When your compensation is in part based on how many meetings you set up in a given year, it’s really tough to stick to your guns.”

So, the SEC is right. There is a conflict of interest.

Wall Street analysts have an option … to tell the truth, or make money.

They prefer to make money.

Is it legal? Yes.

Does that make it right … of course not.

And that’s why a mere 6% of publicly traded companies had a sell rating at the start of 2022, and 94% had a hold rating or buy rating…

Leading millions of Main Street Americans to hold stocks such as Align Technology as it fell 68%…

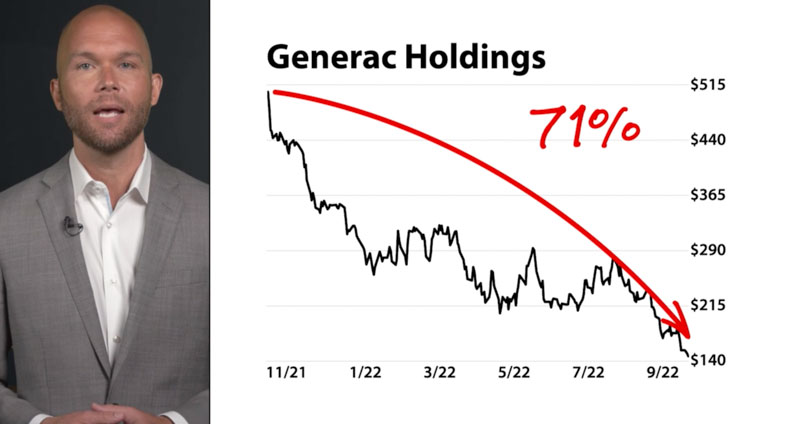

Generac Holdings, which fell 71%…

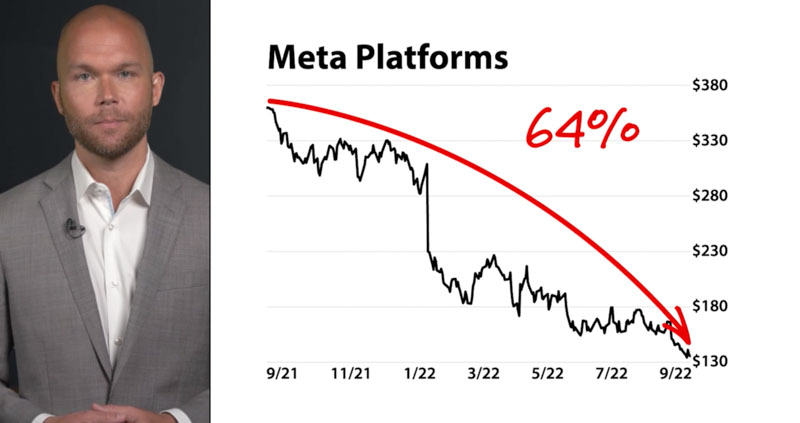

And Facebook, which dropped 64%.[i]

Years, perhaps decades, of money saved up in retirements, invested in “safe” stocks … gone, wiped out, vanished.

Silicon Valley Bank was another “safe haven” with 23 of 24 analysts giving it a thumbs up on the eve of its collapse.

Signature Bank, First Republic and Credit Suisse too.

The SEC can call it a “conflict of interest.”

I call it a crime.

This isn’t just deception. It’s outright manipulation.

Look, I come from a small town in West Virginia where your word…your reputation… is everything. I’ve seen people, hardworking men and women, lose their retirements because of this injustice.

Which is why, over 10 years ago … my team and I decided to invest $5 million in our own rating system.

A system that would be unbiased … that would only look at the facts…

A system that could warn Americans to avoid the 37% of companies that will be gone over the next five years…

Right now, as mentioned … it has high-risk alerts on 40% of the stocks out there … over 1,900 companies.

Many of these stocks look like Silicon Valley Bank…

They look good today … with rave reviews from TV pundits and “buy” ratings from analysts.

But they’ll be gone tomorrow.

Again, SVB went from $238 one day, down to $36 the next … before being delisted.

Eliminated. Deleted.

As if it never existed.

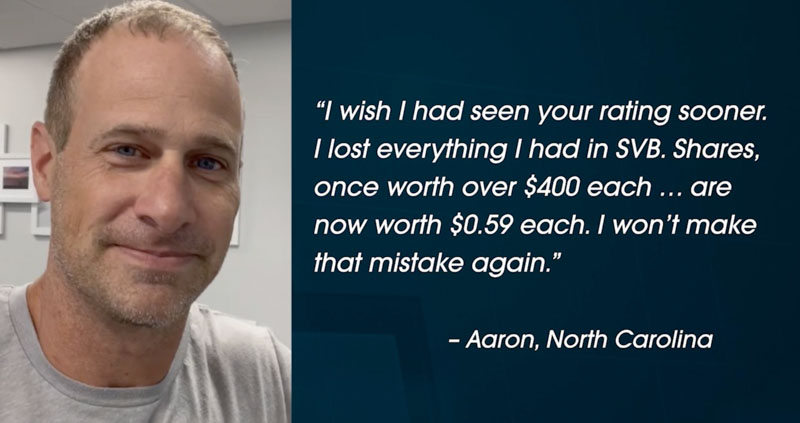

And regular people got hit hard.

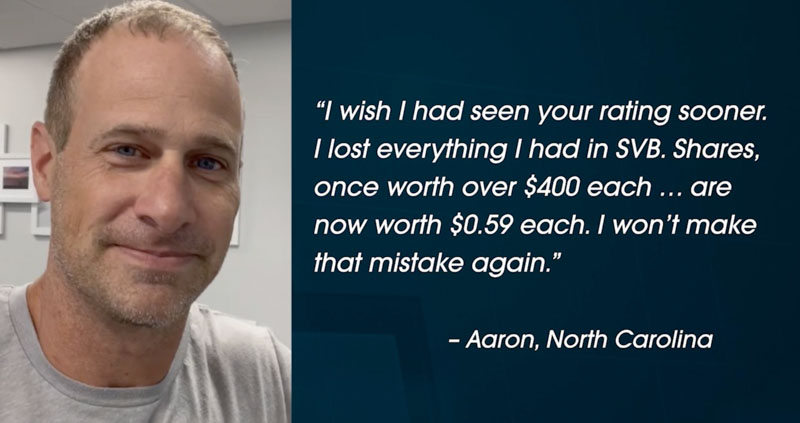

I got a note from Aaron in North Carolina. He’s a father of four, a board member of his church and a coworker. He wrote: “I wish I had seen your rating sooner. I lost everything I had in SVB. Shares, once worth over $400 each … are now worth $0.59 each. I won’t make that mistake again.

There are 1,918 other companies like SVB out there.

Odds are, right now, they’re sitting inside your retirement account. They’re financial timebombs that can set you back 5, 10 … even 15 years.

They could wipe out your retirement altogether.

Let me give you an example…

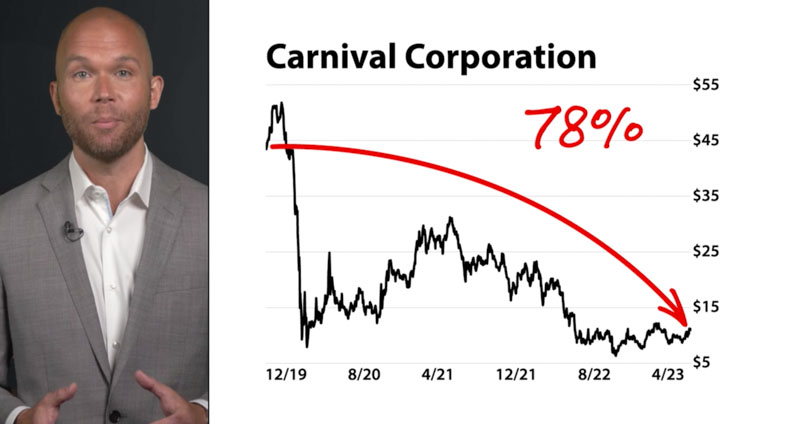

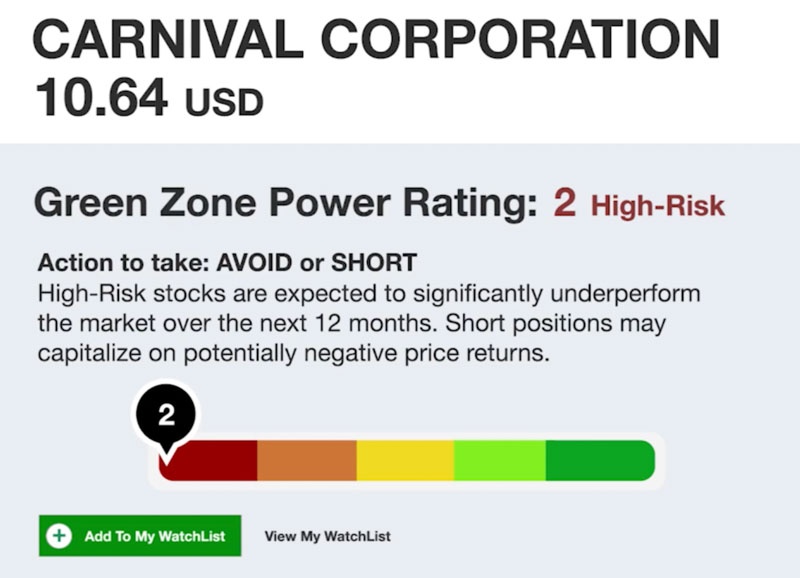

This company’s motto is: The World’s Most Popular Cruise Line. It carries over 13 million people in a single year, on the 23 ships in its fleet.

It has a market cap over $13 billion, has 120,000 employees, does over 1,500 voyages annually … and there’s a good chance you’ve set sail on one of its ships.

Not Royal Caribbean or Norwegian.

I’m talking about, Carnival Cruise Lines.

Wall Street analyst’s love the stock … giving it safe haven status. 22 out of 24 analysts have it as a buy or hold rating.

My patent pending Green Zone Power Rating system is not so optimistic.

That’s because my system has no biases. I do not get paid to set up a meeting between Carnival’s executives and my clients.

Unlike Wall Street, I refuse to compromise my integrity.

I refuse to put profit over people.

This is why my system only looks at the facts. It first downgraded Carnival in December 2019 giving it an official “bearish” rating — scoring below 40.

Since first deeming it bearish, the stock has plummeted…

Dropping 78%.

It may surprise you that my system gave Carnival, one of America’s most popular cruise lines, a bearish rating. As of this recording, it scores a pathetic 2.

If you own the stock, consider SELLING NOW!

Don’t be like Aaron … who watched his investment turn into mere pennies … and then regretted it.

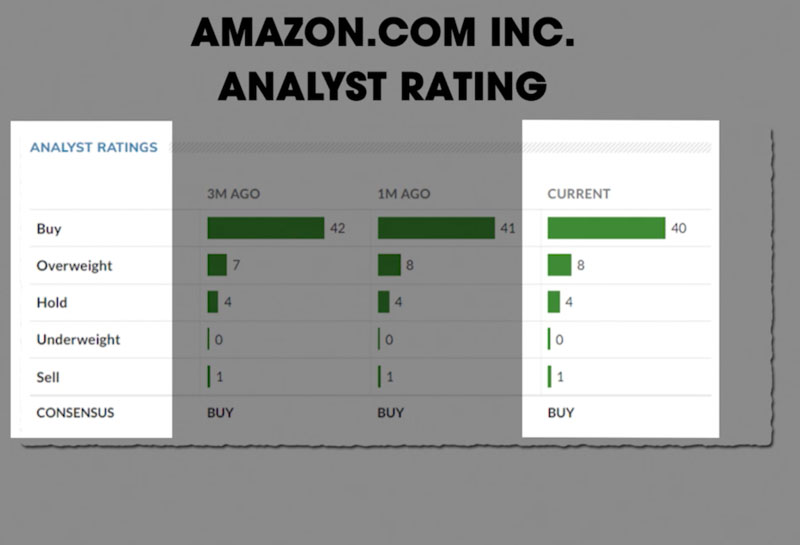

Amazon is another stock on my blacklist.

My system first downgraded the stock last May.

Yes, it has a robust online store and the convenience of having practically anything delivered within 24 hours is great.

But the company is SO big, and the margins SO small, there’s no room for future growth. The financials didn’t make sense.

And sure enough, Amazon soon became the first company in history to lose $1 trillion in value.

Shockingly, Wall Street analysts don’t see it the way my system does.

Out of 53 analyst ratings, only 1 is a sell.

Meanwhile, my patent pending Green Zone system has zero optimism on Amazon.

Deeming it high-risk, scoring a 2 out of a possible 100.

If you own Amazon, consider SELLING.

Since first giving it a bearish sell rating, its stock has dropped as much as 33%.

But it still has a long way to go.

I’ll reiterate — if you own Amazon’s stock … CONSIDER SELLING NOW.

It has a HIGH-RISK rating.

I expect it to fall another 50% from here. If not more.

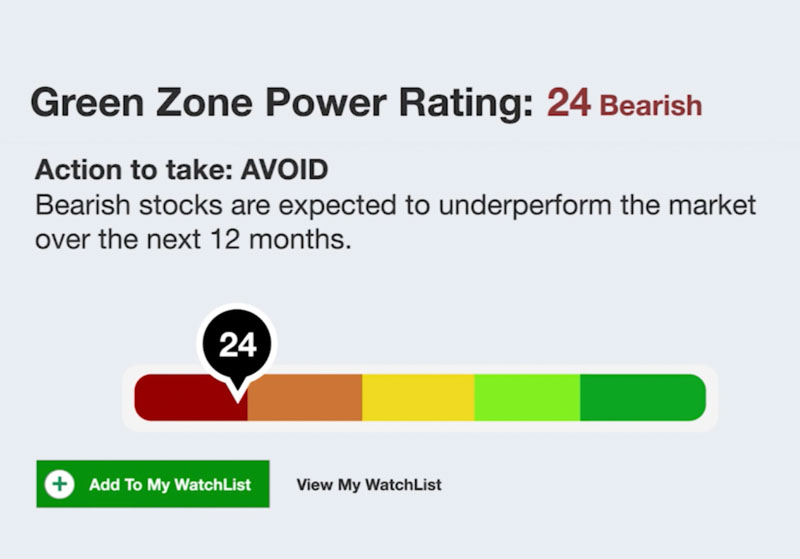

One last example.

It’s one of the most valuable companies in the world.

I suspect its CEO knows this … which might explain why, over the last eight months, he cashed out $23 billion in shares.

When the CEO of a company is dumping shares, like with SVB, Carvana, Beyond Meat and Wayfair … that’s a massive red flag.

Other insiders have already followed suit.

In the past year, they’ve unloaded over 60,000 shares…

And not a single insider has bought.

But it gets worse…

The Department of Justice is conducting a criminal probe against this company.

It’s also facing production and supply chain issues on three continents. Last year, the company failed to hit its sales targets.

This is all going to come back and hurt the company’s bottom line.

Yet Wall Street analysts still love the stock.

Only 5 out of 47 have given it a sell rating…

But my system has already accounted for all this.

My system downgraded the stock back in 2020.

Since, the stock rating has tumbled to 24 … and it’s heading lower.

It’s one of the most volatile stocks on the market, dropping as much as 52%.

I’m talking about Tesla.

Just like Carnival and Amazon, if you own any Tesla … I strongly urge you to SELL NOW.

Frankly, I wouldn’t be surprised to see it fall another 80% to 90% from here.

These are just 3 of the 1,918 stocks that are rated high-risk.

For the record, I’m not predicting some kind of massive stock market crash.

Frankly, I don’t pretend to know what the Federal Reserve will do with interest rates any more than I can predict if a squirrel will cross the road.

I don’t know what kind of free money program the government will concoct next to keep the masses happy.

I don’t have a crystal ball.

No system, including mine, is 100% perfect.

But if the market does crash, it will be tough.

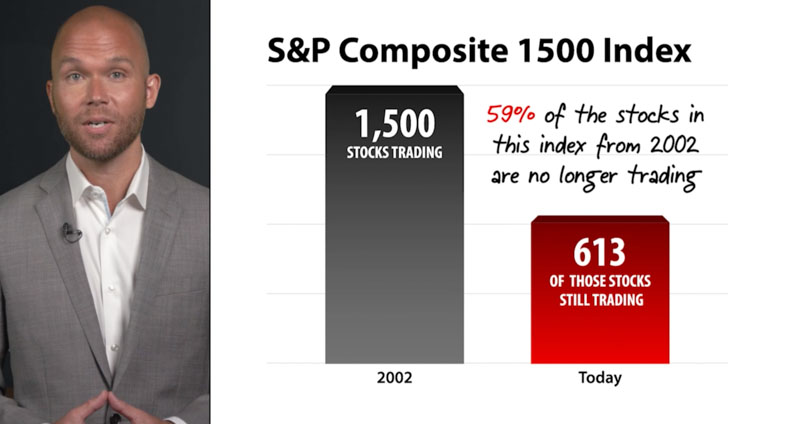

In normal times, 37% of publicly traded companies will no longer be trading within five years. That’s a fact.

But when a crash hits, things get worse.

Since the market bottom of 2002 … 59% of the stocks on the S&P Composite 1500 Index are no longer trading.

Many went bankrupt.

Others were bought for pennies on the dollar.

The lucky ones were acquired, and merged.

Same thing happened after the 2008 financial crisis … with 42% of the publicly traded stocks no longer existing today.

Companies with amazing promise, Wall Street’s approval and media attention … disappeared. They were erased. Deleted.

Look, when money is easy … through low interest rates and loose lending policies … “good enough” companies can make it.

But those days are behind us.

A great reckoning is here.

We now have inflation, high interest rates, and bank failures.

According to my Green Zone Power Rating system, that drills down into the financial health of a company, more than 1,900 companies are in grave danger.

I call it like I see it.

When no one else is sounding the alarm bells, I take it upon myself to do so.

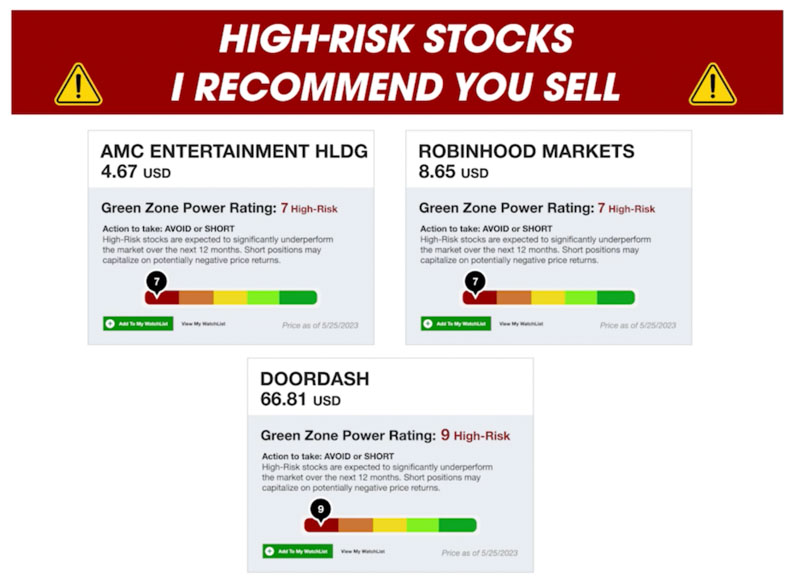

A few more stocks I strongly recommend you sell include… AMC, Robinhood, and DoorDash.

These are the obvious ones.

They are just a handful of the 1,900 stocks my system issued bearish ratings on.

And after further analysis of my own, I am convinced you should avoid these stocks too.

If you have any money in stocks, it’s critical you get the names and ticker symbols of all these companies right away.

You’ll get full details on every bearish-rated stock in my new report: Blacklist.

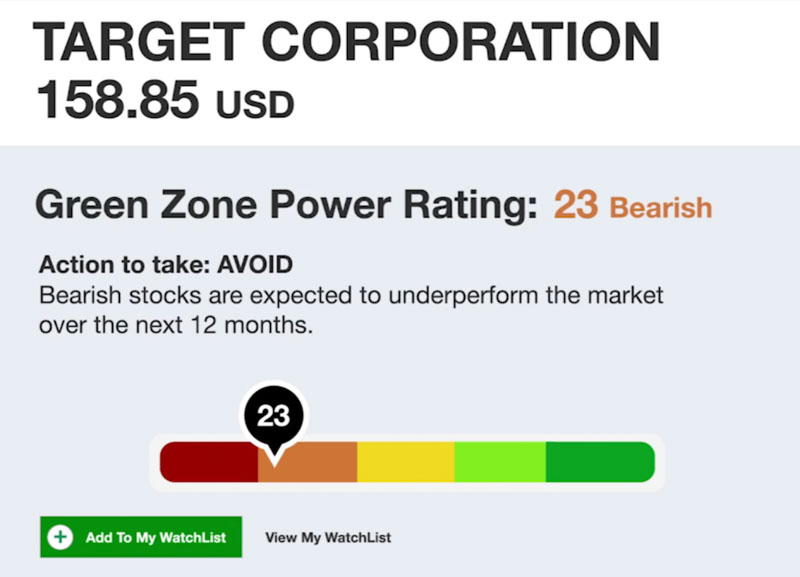

This list includes stocks we already covered like Carnival, Amazon and Tesla … but there are several others you will want to consider selling right away.

For example…

America’s “favorite” mouse, Walt Disney Company, its score is a meager 14.

Retail giant Target has a dismal score of 23…

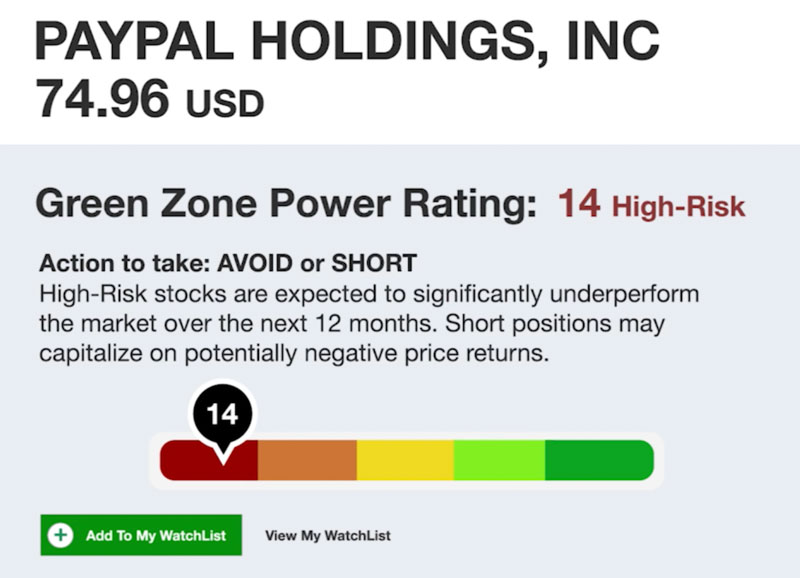

PayPal has a score of 14…

Draft Kings, the online sports betting company, is a risky stock with a rating of 5.

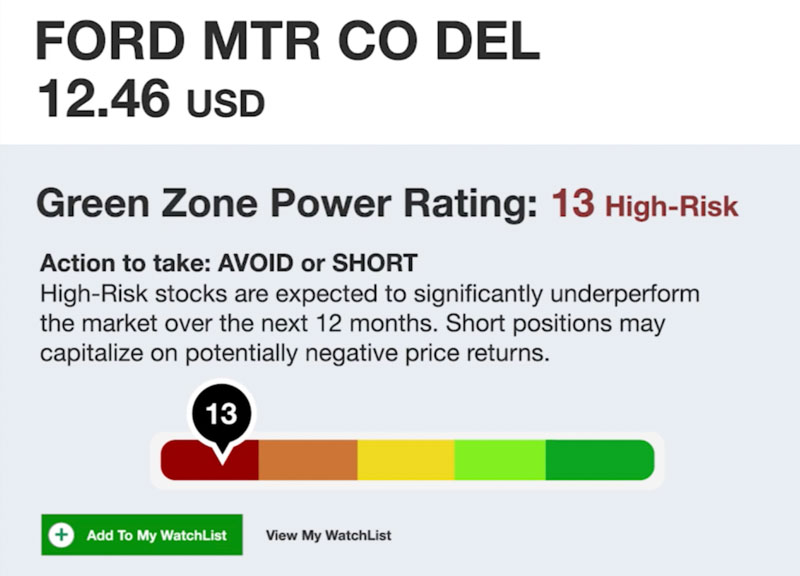

America’s most popular truck manufacturer, Ford, scores a dismal 13.

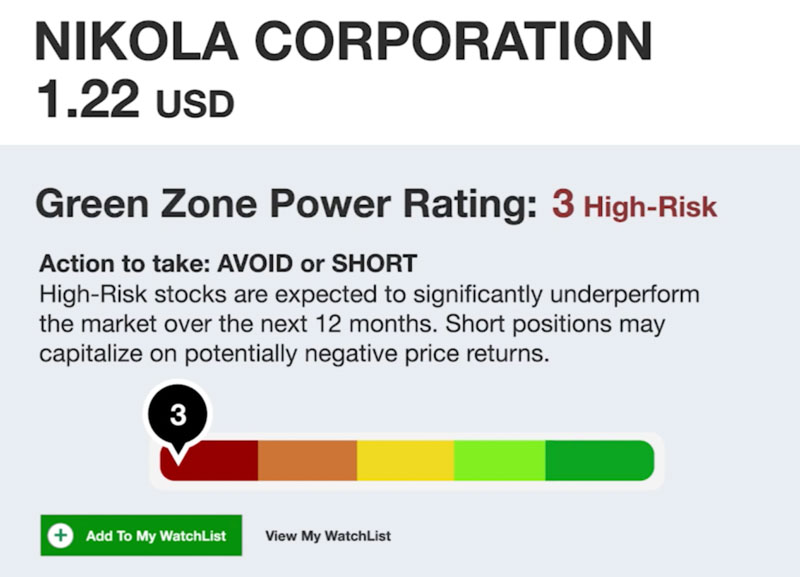

Nikola, the Tesla wannabe, scored a 3 on my scorecard.

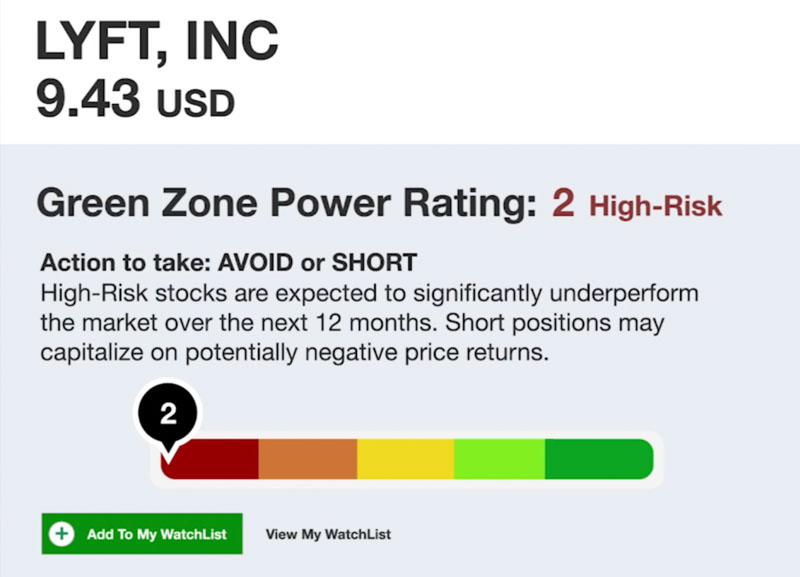

Lyft will never compete with Uber. It scored a 2.

And Coinbase … the crypto exchange … is in deep danger. It scored a 0.

If you own any of these stocks directly … or in your 401(k) or IRA funds, please … sell them.

They could fall 50% … 75% … 95% … or more … and you could lose everything.

This is why I want to get a copy of Blacklist to you right away.

It’s imperative you consider selling these 1,900 high-risk stocks, today.

But, before you claim your copy, you should know…

Despite everything I’ve just told you… I’m not a doom and gloomer.

I make my members money by avoiding the losers, and identifying the winners.

And that’s actually what I’m known for.

You see, I’m what’s called a Chartered Market Technician, or CMT.

Of the 6.3 million people working in financial services in America today … just .1% have qualified as a CMT.

That’s the top 1% of the top 1%!

This is why a Harvard economist recruited me, why I’ve been asked to speak at investment conferences around the world, and why over 180,000 people follow my insight.

You see, I spent most of my career as consultant with high net worth clients, hedge funds, and commodity trading advisors.

I designed and set up over 2,000 custom algorithms for traders. It was an incredible education on profitable trading strategies.

These high-caliber investors were essentially revealing their biggest secrets to me.

I saw how they used various indicators…

I saw how they screened charts…

I saw what strategies they used…

Everything from high-level macro analysis … all the way down to the fine print on quarterly earnings statements.

Most importantly, the algorithms I set up for them were hooked up to their brokerage accounts.

So I saw in real time, which strategies were profitable, and which were complete garbage. You better believe I took notes and wrote my own algorithms … and kept them locked away

In short, I discovered how to decipher what’s really happening within a business…

So, while most analysts are looking at sentiment, FDA approvals, or speculating over takeover talks…

Or technical charts like Bollinger bands, 200 day moving averages, and what not…

My Green Zone Power Rating system … takes a more holistic approach.

I’ve developed an advanced AI-based rating system, that ranks stocks based on the six qualities that drive market-beating returns:

- Momentum

- Size

- Volatility

- Value

- Quality

- Growth

There’s a lot more to my Green Zone Power Ratings system, I don’t want to bury you in the details … but it analyzes 100 individual metrics across these six factors, giving us an in-depth, 360-degree view of a company’s strengths, and weaknesses.

A few of these metrics include… return on equity, gross and net profit margins, and price-to-cash flow trailing 12 months.

After analyzing each and every data point, it then scores each stock and assigns it a numerical ranking.

By taking this more holistic, well-rounded approach … we aim to put the probabilities in our favor … to identify opportunities that offer the most potential return for the least amount of risk.

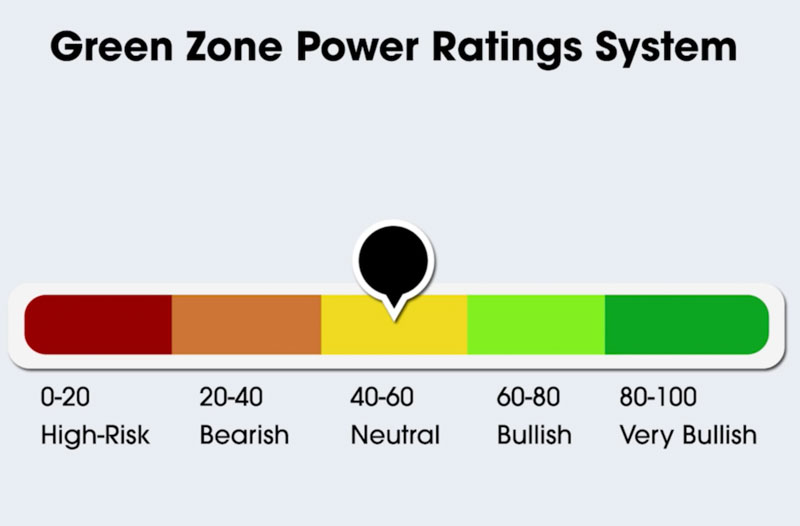

As mentioned earlier, it does this by assigning every stock an overall rating from 0 to 100.

When a stock rates 40 and lower … It’s bearish, or what I call the “red zone.”

When a stock ranks 80 or higher … it’s very bullish, or what I like to call the “Green Zone.”

- 0-20 = High Risk

- 20-40 = Bearish

- 40-60 = Neutral

- 60-80= Bullish

- 80-100 – Very Bullish

And based on two decades of historical data, back testing, and real time application, stocks with a bullish rating could have beaten the market 3-to-1.

This green line, the one that’s up 1,300%, represent my top-rated stocks.

That’s more than triple the returns the S&P 500 over two full decades.

And it works in bull markets, flat markets and even bear markets.

Think about that, according to 20 years of stock market data, stocks with bullish ratings could have tripled the market.

That means, with this Green Zone Power Rating system in your hands, your wealth could grow three times larger than just jamming your money in a stock index fund.

Again, how is that possible?

How has my system been able to beat the market while most financial experts can’t even match the market?

It’s simple, really.

As the SEC stated, THEY have a conflict of interest.

I do not.

I don’t accept a dime from corporate America or Wall Street.

And I don’t get swept up in the emotion, the stories, and the headlines … the lunatics on CNBC yelling Buy. Buy. Buy.

When you only look at the facts … one can see which stocks you should sell, and which ones you should buy.

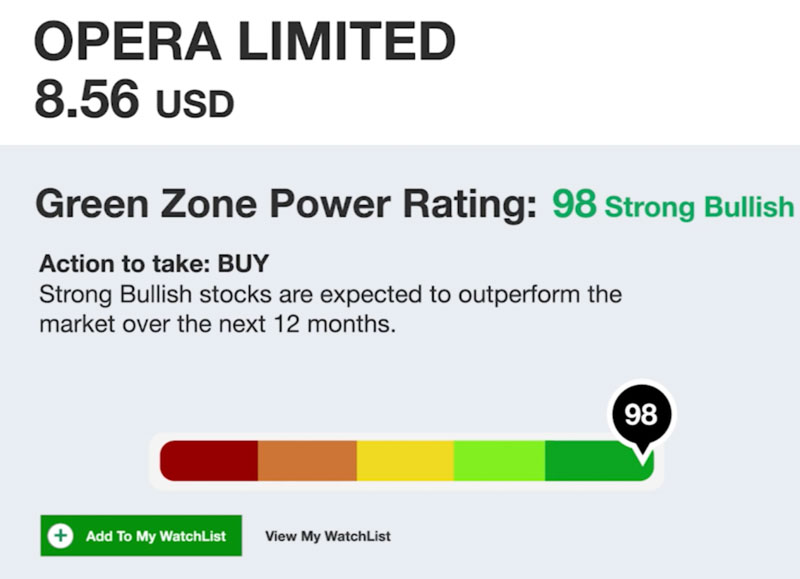

Last October, for instance, my system publicly issued a bullish rating on a little-known company called Opera Ltd. It’s a Norwegian technology company.

After my system analyzed over 100 data points, it was clear that it was a great investment with a lot of potential.

Anyone who saw the bullish rating of 98…

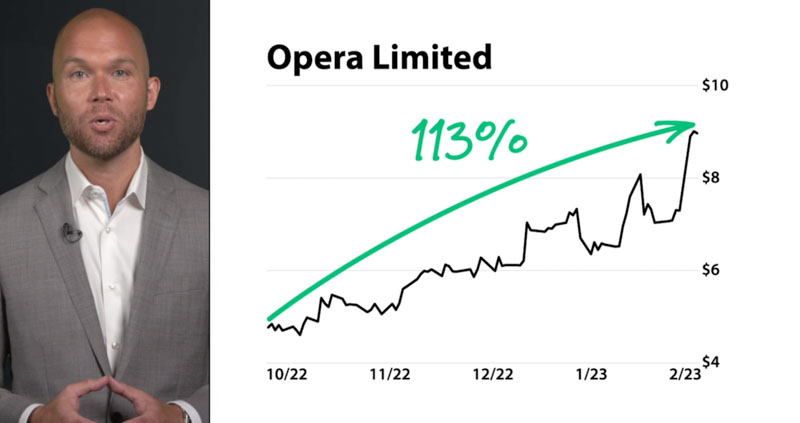

Had the opportunity to make up to 113%…

Enough to double their money in just 4 months.

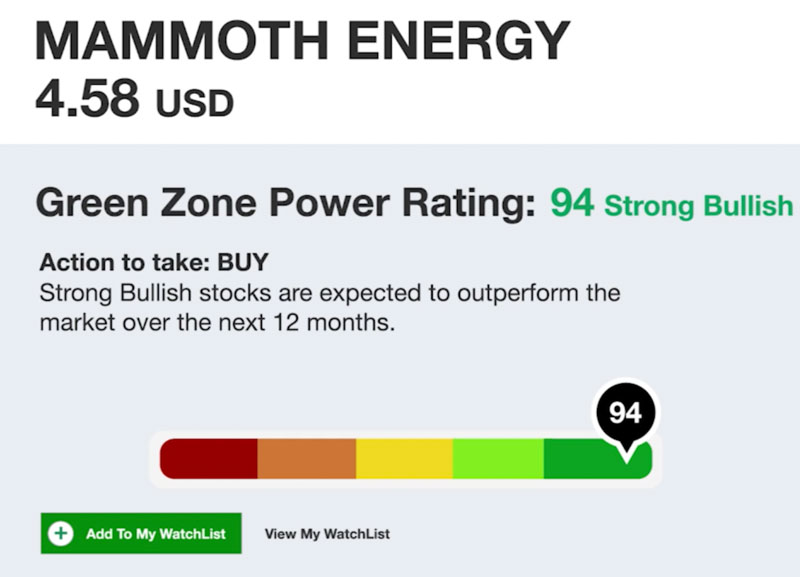

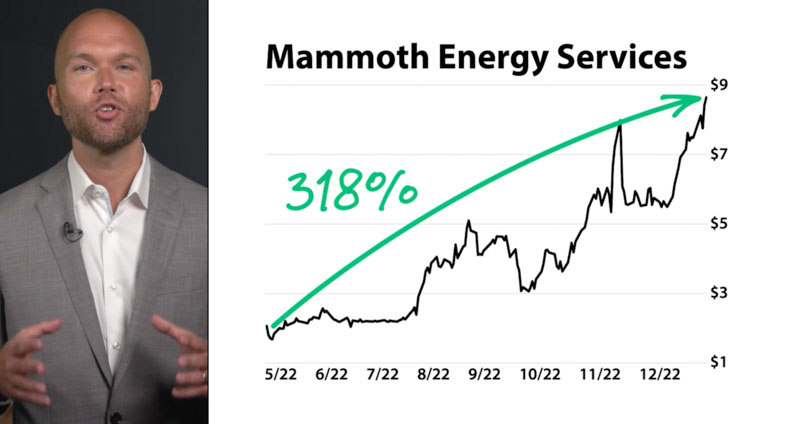

It also upgraded Mammoth Energy Services to a buy rating in early May and gave it an official strong bullish rating of 94 last August.

This Oklahoma-based oil and gas company was overlooked.

Since the first upgrade, Mammoth’s stock took-off…

Shooting up for peak gains of 318%.

Investors who saw my bullish rating could have tripled their money in just 7 months.

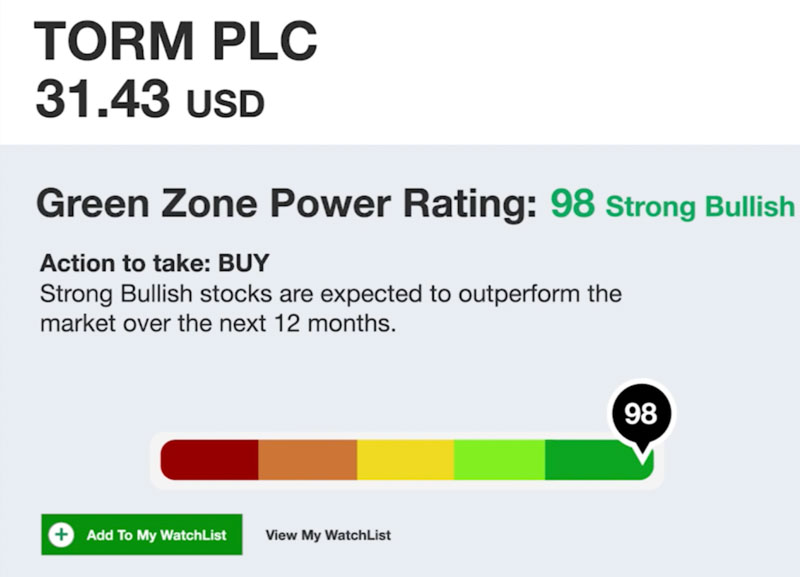

Then there’s Torm PLC, a $2.8 billion marine shipping company.

Just 14 months after my system upgraded its stock to a bullish rating, it surged 460%. Ultimately it got an official strong bullish rating of 98 last October.

Folks, 460%. That’s enough to turn every $1,000 invested into $5,600 if timed perfectly.

Now, odds are, you’ve never heard of Torm, Mammoth, or Opera. That’s because Wall Street and the media like to talk a lot more about popular companies like Carvana, Beyond Meat, and Wayfair … and Carnival, Amazon, and Tesla.

They make great headlines.

But the best investments … the ones with the highest reward with the least amount of risk … are often overlooked and unheard of.

Take Assertio Holdings.

My Green Zone Power Rating system upgraded this pharmaceutical company, before it shot up 145% in 11 months…reaching a strong bullish rating of 99…a nearly perfect score.

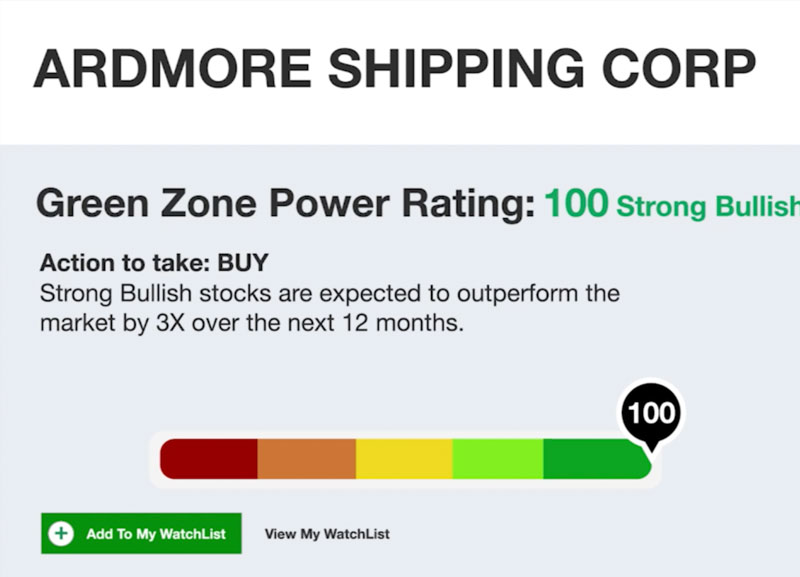

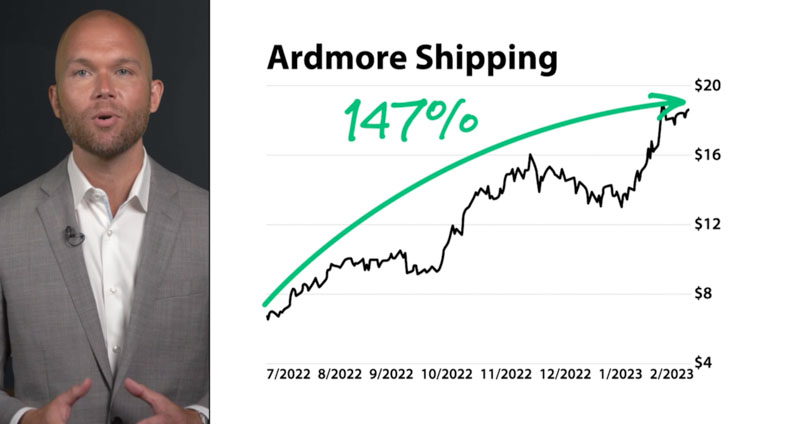

Ardmore Shipping got an upgrade to a bullish rating, before it jumped 312% in less than a year … ultimately hitting a perfect rating of 100.

And it gave CECO Environmental a rating upgrade to a buy before it soared 256% in a mere 10 months … reaching a top rating of 98

In the last three years alone, my system has identified 127 triple-digit winners — with average peak gains as high as 193%.—TRIPLE DIGIT WINNERS—

Let me say that again.

That’s 127 opportunities to make an average peak gain as high as 193%…

Of course not every stock identified went on to be a winner. And these gains would have required perfect timing.

Most people don’t see that many winning picks in a lifetime, but those who follow my rating system, and research services, could have seen those in just three years.

These are the kind of results that could change your life, without worry. Take it from some of our most successful followers.

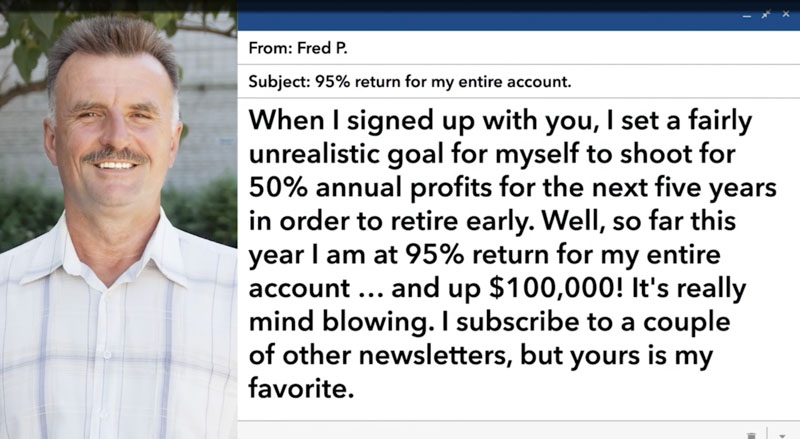

Take Fred P., for example, he’s now on his way to early retirement. He wrote me to boast… “when I signed up with you, I set a fairly unrealistic goal for myself to shoot for 50% annual profits for the next five yeas in order to retire early. Well, so far this year I am at 95% return for my entire account… and up $100,000! It’s really mind-blowing. I subscribe to a couple of other newsletters, but yours is my favorite.”

Or Don L., who made a huge gain in just six months. He said… “I sold half my position in CSIQ for a tremendous gain of over $9,000 or 127%. Great stock choice and great result in less than six months.”

And then there’s Vitus P., who’s on an incredible winning streak. He wrote in… “So far I’m up on 7 of 8 trades. I have recommended you to my kids and friends. I let them know I trust you cause I’m making money using your research and picks.”

Nothing brings me more pleasure than helping people like Fred, Don and Vitus make money.

And through my Green Zone Power Rating system, they’ve had the chance to average about three triple-digit winners per month.

Some top-rated stocks from our untracked recommendations have hit peak gains of…

- 684% in eight months on Plug Power

- 544% in seven months on Daqo New Energy Corp

- 526% in five months on MicroStrategy Inc

- 496% in five months on Fulgent Genetics

- 302% in seven months on Aptevo Therapeutics

You can see why my team and I filed a patent — it’s one of a kind.

To my knowledge, no other rating system is close to being this powerful.

And, while no system is infallible, you can use mine with confidence to help decide whether you should buy, sell or hold a stock.

The stronger a company is, the higher its rating goes. If it’s over 80, it’s a strong indication to buy.

The weaker a company is, the lower its rating goes. If it’s under 40, it’s a strong indication to sell. Right now, 1,918 companies are rated under 40. The only other time there were this many bearish ratings was 2000 and 2008. That should tell you something right there.

This will be a tough year in the stock market.

Many stocks will not make it.

They will be delisted … deleted … erased … like SVB.

However, I’ve honed in on a short list of 11 companies, actually. These are “cream of the crop” companies that my system … based on fact, not fantasy … identified as solid investments.

After analyzing them on my own it’s clear — they are poised to make the biggest gains over the next few years.

Each one has a strong bullish rating over 95.

Some of these you may have heard of.

Most, you haven’t.

I put all the details on these 11 stocks inside my report called … Buy List.

I want you to have both of these reports today.

I highly encourage you to run through the 1,918 stocks on the Blacklist, consider selling them and move your money into these 11 stocks in the Buy List.

Sell the losers.

Buy the potential winners.

It’s that simple.

For a look at the profits that could be in store for you, just look at stocks my system issued bullish ratings on during one of the worst markets on record … 2022.

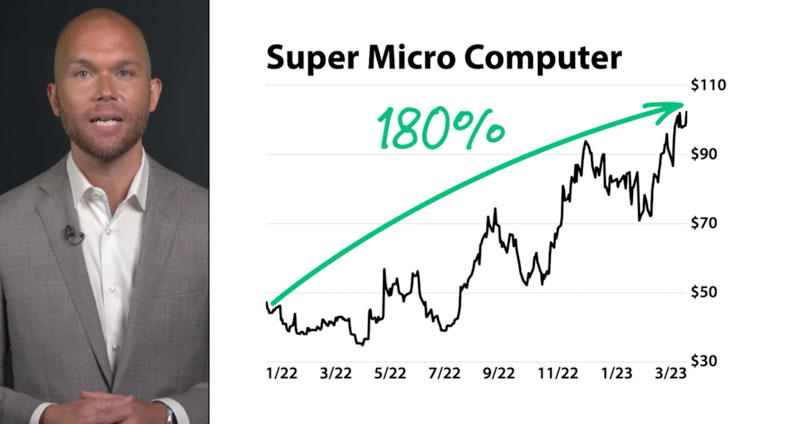

Super Micro Computer entered the bullish zone … surging past a score of 80 … last January.

In just 15 months, its stock surged to a peak of 180%…

Yes, it went up as much as 180% while the entire market fell over 20%.

Last July, same thing happened with Ardmore Shipping…

Its stock took off right away.

Shooting up, as much as 147%.

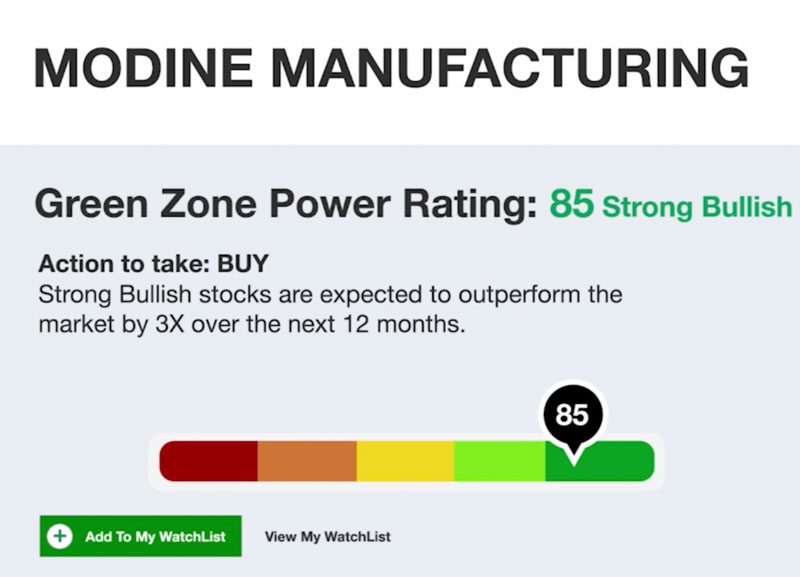

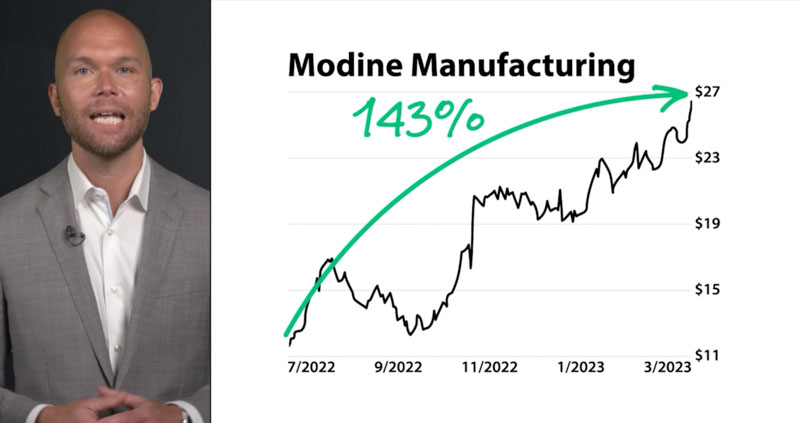

And Modine Manufacturing received a strong bullish rating last July…

And right on cue, its stock began to soar…

Hitting peak gains as high as 143%.

That’s how fast big gains can come when gets a stock bullish rating.

Of course, not every stock that gets a bullish rating is a triple-digit winner.

We’ve seen quite a few double-digit gains as well.

Some of our most exceptional peak gains over the last 14 months include…

- 90% gain on International Seaways (INSW).

- 89% gain on Asure Software (ASUR).

- 76% gain on Axcelis Technologies

- 57% gain on Scorpio Tankers

- 66% gain on TravelCenters of America

- 18% gain on Universal Insurance Holdings

- 42% gain on Hello Group

My point is, even in times of crisis — like last year, with inflation surging, interest rates jumping and the stock market in a freefall … my Green Zone Power Rating system was able to find winning stocks.

Of course, today, I’m highlighting just a small sample of the thousands of ratings that are available to anyone with access to my Green Zone Power Ratings system.

I’ll show you how to access my system in a moment.

First, it’s important you know, that ultimately, the investment decisions you make using this system are up to you. While my system gives you a powerful rating of a company at a point in time…

The ratings from the system should not be considered an official buy or sell recommendation. You should always research every stock on your own.

Now, investing is never risk-free. You can’t get a lot of reward without taking on a little bit of risk, and so you should never invest more than you can afford to lose

But also know, that my system seeks to eliminate as much of that risk as possible.

It only makes sense … healthy companies with solid valuations, no debt, cash on hand … these companies can dominate their industries in tough economies, and even more so in good economies.

And in your copy of Buy List … you’ll get details on the 11 companies my system has identified as the best stocks for the years ahead.

I analyzed each of these stocks on my own and consider them strong buys. These include…

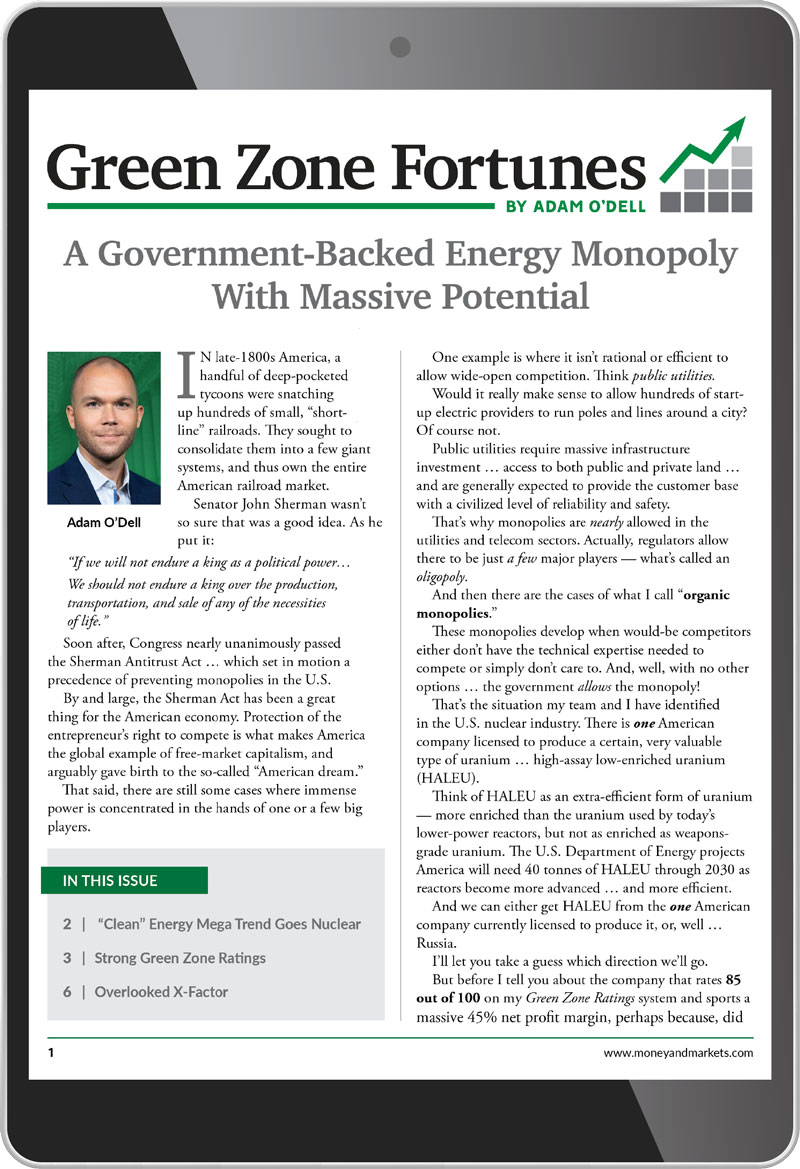

Strong Buy No. 1. This company is in the booming energy sector and comes in with a near perfect 97 rating.

When it comes to energy, this company does it all. It explores and produces, it transports, it refines and even sells at retail gas stations. The gains here could be massive as demand continues to surge, as an added bonus … it also dishes out a solid 4.70% dividend.

Strong Buy No. 2 comes in with a rating of 96.

This Virginia-based homebuilder and mortgage banking company has some of the best financials I’ve ever seen. Its stock has tremendous momentum and quite frankly, it looks like it’s just getting started.

Strong Buy No. 3 has a rock-solid 98 rating.

With America’s energy infrastructure in the need of repair, this innovative Colorado-based company, has two decades of industry-leading experience … and is at the forefront of it all.

Strong Buy No. 4 comes in with a 97 rating.

This pharmaceutical company has developed a product to help fight America’s ongoing opioid crisis. This is the one cutting-edge pharma you want to own for the future.

Strong Buy No. 5 has a solid 97 rating.

This Silicon Valley firm manufactures computing and data storage hardware. And with huge demand to process large amounts of data faster … this company has the solution to maximizing data more efficiently. This is the one tech company every investor should own.

And those are just 5 of the 11 stocks in my Buy List.

You’ll want to invest right away. Today, if possible.

Which is why I included everything you need to know on each of these stocks inside this special report. The ticker symbols, an in-depth breakdown of the company, my Green Zone Power Rating system’s findings, plus, my recommended buy-up-to price … everything you need so you can buy these stocks today.

And I want you to have it, free of charge, along with … Blacklist.

Again, sell the stocks on the Blacklist … and move your money into the stocks on the Buy List.

It’s that simple.

I want you to have both of these reports, for free.

But frankly, it would be a disservice to stop there.

To truly help you reach your financial goals … whether that be making a million dollars or securing the million you already have saved up … we need to go a step further.

You see, I created a community for likeminded investors.

I call it … Green Zone Fortunes.

There are currently 71,000 members … from 20-year-olds in California to 90-year-olds in Florida to farmers in Iowa to ranchers in Texas.

And I’d be honored to have you as our newest member.

Benefits include all of the following…

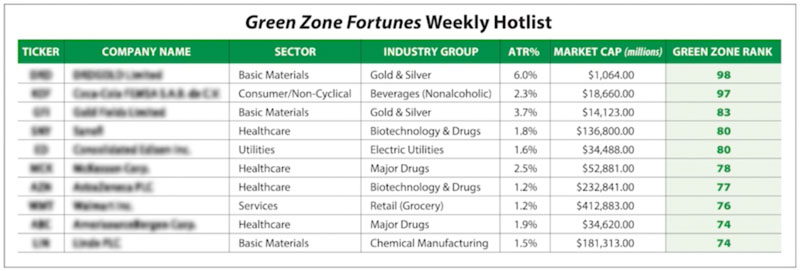

My Weekly Hotlist: For the last three years, every week, my team sends out a list of 10 highly rated stocks to put on your radar.

And we’ve already had 127 stocks peak out with triple-digit gains … such as Aviat Network that went up 404% … Atlanticus that went up 744% … and Plug Power that went up 791%.

Now, with that said, not every pick makes this much money. In fact, some positions have gone down. And achieving peak gains like these requires absolute perfect timing on the buy and the sell, which of course can be difficult.

But when 127 recommendations have gone up 100% or more, it’s easy to see that you don’t need to hit the absolute peak for the gains to stack up.

Most people don’t see that many triple-digit gains in a lifetime, but members of my Green Zone Fortunes community could have seen those in just three years.

With that said, if you want a bit more guidance, details on exactly when to buy and when to sell … along with additional research … then you’re going to love my monthly newsletter.

Access to my Monthly Newsletter: Each month, I comb through all the top-rated stocks, and do an in-depth analysis on them in order to come up with my No. 1-rated company.

I’m talking about the single investment that I believe is best poised to make you money. I’ll give you all my research … along with the exact price to pay for it.

And when it’s time to sell, I’ll let you know.

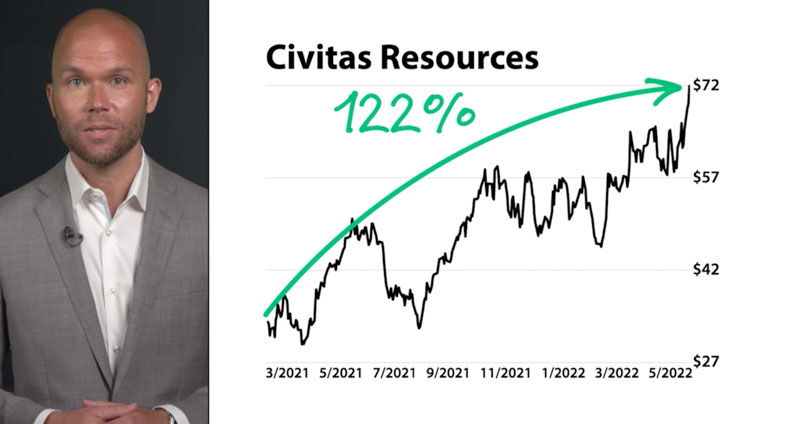

Like the time I recommended Civitas Resources. Members got in and out within 14 months for a gain of 122%.

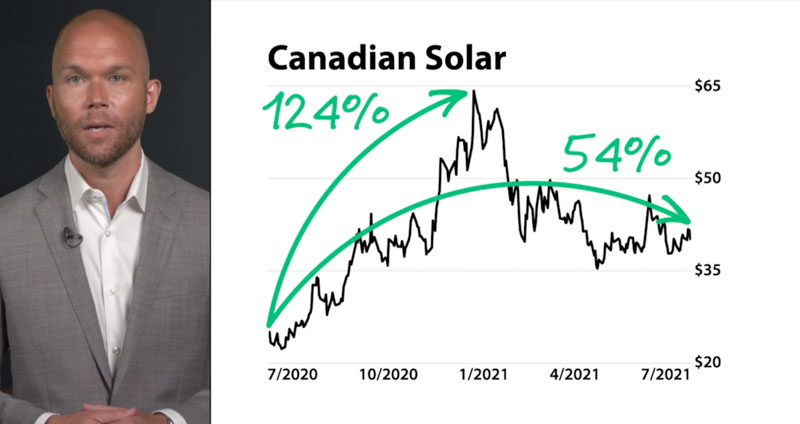

Or the time I recommended Canadian Solar. Members got in and out of that investment within five months for a gain of 54% and 124%.

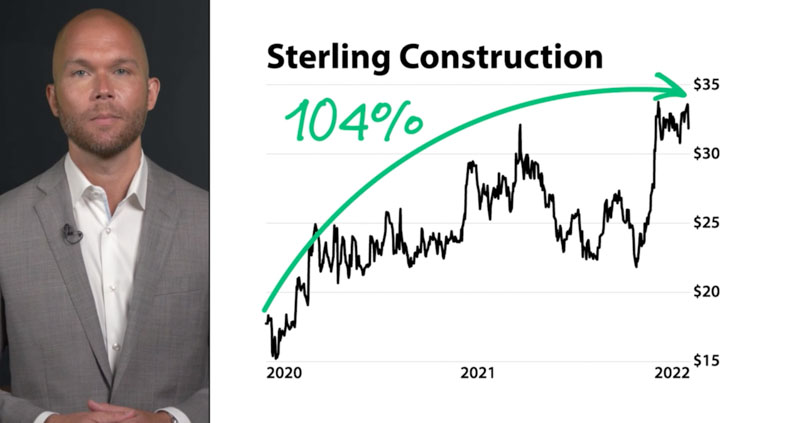

And the time I recommended Sterling Construction. Members were able to get in and out of that investment within 27 months for a gain of 104%.

In short: I do all the heavy lifting…

All you have to do is read my research, choose to buy in and watch your potential profits pile up.

People like Kyle love receiving this each month… “I have been following your advice all the way back to May 2013. I have complete trust in your research and fully expect it to be hugely profitable. Kudos for purchasing Barrick Gold well before Warren Buffett.

And John who said… “Overall your results have been unbelievable. This past year has been the best in all of my years of investing.”

And Dave who boasted… “Already exceeded the return I had hoped for and my wife thinks I’m a genius.”

Members to my Green Zone Fortunes community also get…

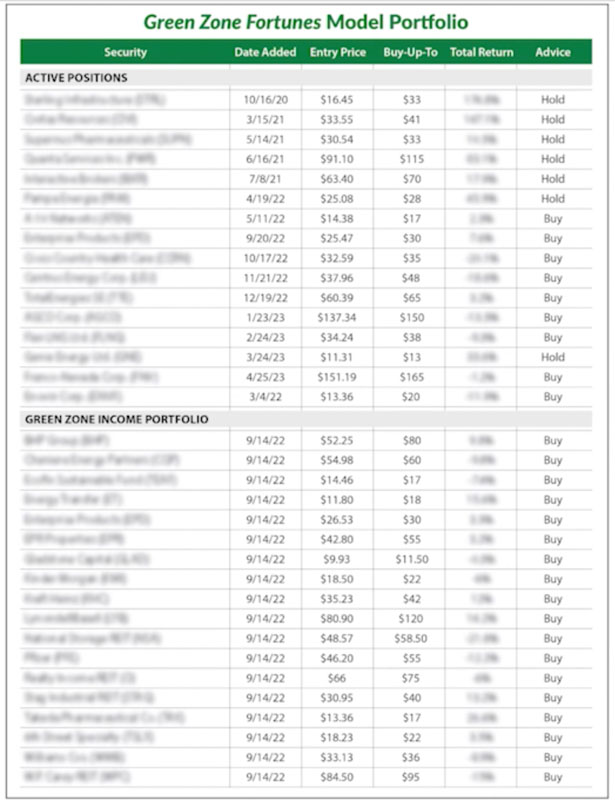

Access to my Model Portfolio: This is a portfolio of stocks that I’ve recommended throughout the years as part of my monthly newsletter based on my Green Zone Power Ratings system. You’ll see exactly which ones to buy, hold and sell … along with all my research on the stocks.

Trade Alerts: Any time we make a trade, you’ll be notified via email … and if you like, I’ll also text you.

Members love how simple this makes investing.

They might be traveling, working or at the beach … they get the alerts, make the trade and go on with their day.

Mind you … this is NOT an active trading service. We average about one to two trades a month.

You’ll also get my…

Weekly Updates: Every week I send you a simple update on the markets, and answer some of the common questions that come in from the community.

This is more of open discussion. Members truly enjoy this benefit as they are in the loop.

You also get our…

Daily Stock Ratings: Every morning, one of my team members … Matt Clark … will send you a featured stock. They are usually highly rated stocks that members may want to consider buying. But sometimes they are urgent alerts with stocks that you should sell.

You’ll also get access to my…

Momentum Principle Millionaire Video Series.

In seconds, you can be watching all five modules of My Momentum Principle Millionaire Video Series on the screen in front of you…

This exclusive video series reveals all my market-beating secrets … including exactly how my system could’ve smashed the market 3-to-1 for over two decades…

Plus, you’ll also learn:

- My No. 1 secret behind CRUSHING the market year after year. Hint: It’s more to do with old-age wisdom than trading algorithms and “high-tech” financial tools.

- My Simple Catch Up Strategy to help you boost your retirement income fast … even if you’re close to retiring or already retired. I also reveal…

- The No. 1 “hidden” indicator that tells you when markets are about to crash ahead of time. You won’t hear this from the media or Wall Street … but when it flashes, it’ll give you the warning you need to protect your portfolio!

And much, much more.

One more benefit to members…

A Robust Customer Care Team: Again, I’ve been doing this for over a decade. And want to make sure you have the best experience possible … which is why I have a customer care center in Maryland and well as Ireland. They are there to answer any questions you have about your membership.

Again, all of this is available to the 71,000 members of my Green Zone Fortunes community.

And I would be honored if you would be our newest member.

Investing on your own, especially in this environment, is dangerous.

And as you’ve seen … Wall Street is no help. Analysts put profit over people … giving approval to 94% of stock. Despite proof that over one-third of all stocks fail within five years of going public.

Millions of people are being led to the financial slaughterhouse.

Retirements will be wiped out.

Dreams will be crushed.

Fortunes will be lost.

I don’t want that to happen to you.

I’ve seen it way too many times in my career.

It’s why I stepped back from Wall Street and decided to design my own stock rating system.

It’s for you … and the millions of other Main Street Americans who need REAL guidance based on REAL facts.

I do have one favor to ask, though.

Once you become a member … and see how incredibly beneficial it is as you avoid the losers and invest in the winners … tell your friends and family.

Right now, at this very moment … 1,918 stocks are on my high-risk list. I have no doubt that some of them will fall 50%, 75% and even 95%.

Help them avoid potential losses.

And help them see the opportunity that’s ahead.

That’s all I ask.

It’s not a requirement. Just a favor … from one Main Street American to another.

With that said, there is one more important thing.

To give you the best investment insight, I hire the best people and pay for the best data feeds.

So, I have to offset my cost.

Which is why a membership to Green Zone Fortunes does not come free.

The $199 price tag is a drop in the ocean compared to the value you’re getting.

And that’s without mentioning the $1000-plus worth of bonuses you get the moment you become a member.

But here’s the thing…

You’re not going to pay $199 today.

If you take me up on this special offer right now, you can claim a full year membership to Green Zone Fortunes for just $47…

If that is too much for you, I’m sorry … then a membership is not right for you.

And I truly believe that, thanks to the insight you’ll receive, this will be the best investment you ever make.

With that said, I know we just met … and I don’t want anything holding you back from joining today.

Which is why I’m taking all the risk off the table.

So, here’s the deal.

If you are not 100% satisfied with your membership within the first 90 days, let my team know and we will issue you a full refund.

So…

- If you don’t love the 11 stock picks I give you in Buy List.

- If you don’t find value in skirting the 1,918 stocks in Blacklist.

- If you don’t find incredibly great stock recommendations in my model portfolio.

- If you don’t find value in getting real-time scores on stocks through my Green Zone Power Ratings.

- If you don’t enjoy the daily updates, weekly hotlist, monthly reports, the trade alerts and everything else you get…

Let me know.

And I will refund every last penny.

No questions asked.

Why would I make you such an incredible offer? Why would I have you access to all my research … valued at over $1,000 … for just $47 … risk-free?

Well, since day one, I’ve vowed to never be like Wall Street. To never put profits over people, but instead, put people over profits. I want to make sure you absolutely love your experience with Green Zone Fortunes.

And, frankly, I’ve made this exact offer for YEARS.

It’s rare to have a person cancel their membership.

I truly believe that you’ll look back on this day and see it as a turning point in your financial journey.

A day when you went from confusion, frustration and sleepless nights…

To clarity, victory and … sleeping soundly.

I want that for you.

I truly do.

Again, it would be an honor to have you as our newest member.

To get all the details, simply click the orange button below.

And look … if you are one of few people who decide this isn’t right for you … I want you to know that’s OK.

But it would be a shame if you didn’t at least try it out.

Which is why … even if you decide to cancel … you can keep the Blacklist and Buy List special reports.

Those are yours.

No strings attached.

Because the reality is there are over 1,900 stocks that I’ve officially given high-risk ratings to. Historical evidence proves that some of these stocks will fall 50%, 75%, even 95%.

If you own any of the stocks on this list — you’ll want to sell them immediately.

And the 11 stocks on the Buy List … well, you’ve seen how many stocks that are highly rated have gone up triple digits within a year.

Imagine how relaxed you’ll feel knowing your portfolio is free of higher-risk stocks, and your potential profits are limitless.

That’s what I want for you.

Actually, join today and I’ll send you another FREE report…

It’s called … The Bank Stability Report Card.

There are currently 248 financial institutions that now have a bearish rating.

While I’m not sure which will be the next to fall, there are several national banks that I’m watching closely at the moment.

You know their names and likely have a bank account, mortgage, auto loan or credit card at one or more of these institutions.

In this report, you’ll get the complete list of banks that could be the next Silicon Valley Bank, Signature Bank or Credit Suisse … banks my Green Zone Power Ratings identified as high-risk — long before they tumbled.

The Bank Stability Report Card is your go-to resource to see which banks you’ll want to get your money out of, and which ones will weather the storm.

And it’s yours FREE when you become a member to Green Zone Fortunes today.

Seems like an easy decision to me. Especially when you can get a 12-month membership now for just $199.

And it couldn’t be any simpler to join.

All you have to do is click the orange button below to review the details of your order before accepting.

This is everything you get.

You’ll save $2,800 when you join today.

With that said, there’s one more thing I want you to have.

And while I can’t put a price on it, I know you while find it invaluable.

That is…

Full access to my Green Zone Power Ratings system.

The moment you join, I’ll send you a private link — I encourage you to bookmark this webpage — so you can use my patent pending system to help you with your investment decisions … anytime you want.

Twenty years of historical evidence, rigorous back tests and real-time results show that stocks that get my “bullish rating” could have beaten the market 3-to-1.

This green line, the one that’s up 1,300%, represents my top-rated stocks.

That’s more than triple the returns the S&P 500 over the last two full decades.

This Green Zone Power Ratings system, now patent pending, is second to none, and well worth the time, energy and the $ 5 million my team and I invested in it.

And I want you to have full, unfiltered access to it.

It’s there, at your fingertips, any time you need it.

So, simply click the button below to review everything that comes with your membership to Green Zone Fortunes today.

I’m quite certain that years from now, you’ll look back on this day, on this very moment, and you’ll be thrilled you made the decision to join Green Zone Fortunes…

Thanks for listening, I look forward to having you as our newest member.

© 2023 Money & Markets, LLC. All Rights Reserved. To ensure that you are using our information and products appropriately, please visit our termsand privacy pages. Do not sell or share my personal information.