Table of Contents

- Introduction

- Who is Brad Thomas?

- SWAN Stocks Revealed

- Their income and profits are rock-solid

- These companies pay out millions…

- There’s a way to flip them into even more money

- “I’m Rooting for a Recession”

- The Next Big Market Shift

- Brad’s #1 Stock

- The SWAN Portfolio

- Sucker Yields – and How to Avoid Them

- The Intelligent Income Investor

- What You’ll Get Today

— Wide Moat Research Presents —

Millionaire Investor Reveals

The “SWAN” Retirement Blueprint

How to make all the money you need for a comfortable retirement – in any market – with a small portfolio of unique stocks.

Revealed below: the name and ticker of the #1 stock

Brad Thomas doesn’t have an Ivy league degree.

And for years, he knew practically nothing about the stock market.

Yet today, he’s the most popular expert on Seeking Alpha.

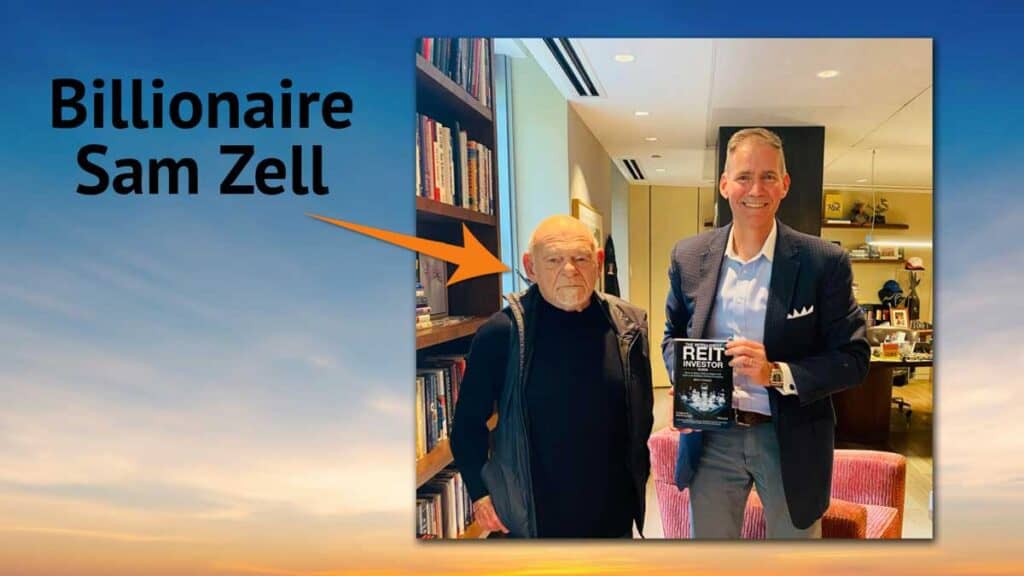

His investment research is endorsed by billionaire investors, CEOs, and more.

And in today’s volatile market, while most folks are losing money, he’s found an unusual way to profit.

It’s not by betting against stocks… or buying options or government bonds…

What’s his secret?

As you’ll see, Brad doesn’t invest the usual way.

You won’t hear his method promoted on CNBC.

And it’s the last thing your broker might tell you to do.

But let’s face it…

The conventional advice is not working. Not by a long shot.

That’s why I’m thrilled he’s agreed to join us, today.

For the first time, he’s come forward to share what he’s doing with his own money right now – including the name and ticker of his favorite stock.

Brad Thomas, welcome.

Brad:

Thank you, Chris. It’s great to be here.

Host:

Brad, like I was saying, you don’t come from a typical investing background.

In fact, you made your first fortune outside the stock market.

It’s only recently that you started recommending stocks.

And it’s all because of a major breakthrough that’s changing the lives of everyday folks.

Brad:

That’s right.

Today, I’m going to show you something that might seem a bit radical.

I call them “SWAN Stocks.”

Host:

SWAN stocks?

Brad:

That’s right…

The ONLY investments I own today fall under this category. And for good reason.

All you have to do is own a small handful… and you could retire wealthier than you would by trading, chasing the latest “hot” stock, or doing anything your broker tells you.

Host:

Wow, that’s a big statement.

You’re saying everybody watching can essentially buy SWAN stocks today… and never worry about money again?

If that’s true, they must be something special.

Because most stocks I follow? They’re deep in the red. Apple has fallen as much as 26%. Amazon 38%. Netflix 70%. Investors have been losing money hand over fist.

Brad:

They are…

And unfortunately, the pain is only going to continue for most people.

Because they’re following the kind of playbook that ONLY works during a boom.

And that’s why I focus solely on SWAN stocks.

When you own them, recessions… bear markets… crashes…

None of those things matter the same way anymore.

Not only are these stocks beating the market…

They allow you to collect thousands of dollars every month – no matter what’s happening in the world.

And that stream of payouts can rise year after year.

Host:

And these SWAN stocks… Are they companies we’ve heard of?

Brad:

I think you’re going to be surprised.

These stocks rarely get mentioned on the “money channels.”

Very few investors have ever heard of some of them. Even fewer own them.

I aim to change that today. Because let’s face it, we’re beyond the point of pain right now.

This is not a “nice-to-have” investment.

It’s a must-have – especially in this environment.

Host:

Brad, your team sent along some examples of everyday folks who are following your SWAN approach.

I have to say, the results are impressive.

One man said it’s helped him “lay the foundation for income for life.”

Another man, who describes himself as a “humble cabinet maker,” says “I stuck to [this strategy] and have done well through multiple crazy drops over a few years. You’re my hero.”

These are just a few examples. There are hundreds more…

Brad:

That’s what’s great about this approach.

Anybody can invest in SWAN stocks – through their regular brokerage account.

You don’t need a background on Wall Street…

You don’t need decades of experience…

This is as close to “autopilot” investing as you can get.

There’s only one catch…

Host:

Uh-oh. What’s that?

Brad:

You’ll want to move fast.

Something big is happening in the market today. A major shift. Something we haven’t seen in decades.

And I believe we could see hundreds of popular stocks fall – even further than they already have.

However, if you follow my lead, you could come out far ahead.

But you’ll need to act now.

The longer you hold onto the stocks that are falling apart – the harder it will be to recover.

I’ll explain everything – including the name of my #1 stock.

Host:

As you can see, folks, you’ve made a smart decision to join us today.

If Brad’s discovery is all he claims it to be, this is a game-changer for anyone at or near retirement.

No more trying to time the market…

No more worrying about recessions or bear markets…

With one small group of stocks… you could put your money worries behind you for good.

Today, we’re going to get to the bottom of it – including Brad’s top SWAN stock.

Okay Brad, let’s jump right into it.

What are these stocks?

And how did you discover them?

From Riches to Rags to Riches

Brad:

I discovered them the hard way.

Host:

What do you mean?

Brad:

Here’s what happened…

For as long as I can remember, I wanted to work in real estate.

That was always my passion.

So when I graduated from college, I got my first job.

I started out on the bottom, as a leasing agent, but I realized that the big money was in being a developer.

So I quickly started making deals.

Before long, I was developing full-blown shopping centers worth millions of dollars.

Host:

When was this?

Brad:

The early 2000s.

Those were the days, Chris…

You’d literally drive to a little town. Find Walmart. Find the outparcel for $100,000. Throw up an Advanced Auto Parts. Sell it. And go on to the next one.

I did this dozens of times.

All told, I personally arranged the financing for $1 billion of real estate transactions.

As the deals got bigger, so did my bank account.

I was worth $1 million. Then $10 million. Then $25 million.

Host:

So far, this doesn’t sound like a hard lesson. This sounds like a success story.

Brad:

It was.

On the surface, everything was going great.

But there was a problem…

As the money came in, my tolerance for risk increased.

After a while, I began to feel like I was Oz, the all-powerful.

Host:

Uh-oh. We all know how that story ends…

Eventually, the curtain is pulled back on Oz.

The same thing happened to you?

Brad:

Yes.

Long story short, when the real estate bubble burst, I got crushed.

I was worth a lot on paper, but I had very little cash.

When the income from my properties dried up, I could barely pay the interest on the loans.

The only reason I didn’t file for bankruptcy was because I couldn’t afford to pay the bankruptcy attorney.

Here I was, a 35-year old developer with five kids, living in a $2 million house… and now I’d lost everything.

Chris, we all have defining moments in life. Mine came in a parking lot.

My wife asked me to go pick up diapers and milk.

I was sitting in the parking lot of a $15 million property that I once developed. I remember thinking out loud,

“Why is it that I have just $20 in my pocket and the bag boys – in jobs that I helped create – are better off than me?”

Host:

It sounds like the answer is that you took on way too much risk.

Brad:

Yes. I had forgotten the most important lesson in investing: protect principal at all costs.

I had become a gambler, not a developer.

Host:

What a devastating turn of events…

But seeing where you ended up, you clearly didn’t let this setback ruin you.

Brad:

I didn’t. As the legendary investor Benjamin Graham once said:

“Adversity is bitter, but its uses may be sweet… in the end, we could count great compensations.”

I had to build myself back from the ground up. With five kids, there was no time to waste.

Host:

So what did you do?

Brad:

I had to make a choice.

Either bag groceries – which was actually my first job – or figure out a better way to invest.

That led me to the approach that I’m sharing today.

It completely changed my life.

Host:

Right… in preparation for this interview, I did some research on you…

Thanks in large part to this change, you’ve been able to travel the world.

You’ve met with and interviewed well over 100 CEOs and business leaders.

You’re an adjunct instructor at NYU.

You wrote a book on President Trump and his real estate empire. You even met with him on multiple occasions.

You’ve been interviewed on Fox Business, CNN, MSNBC, Fox and Friends, and many more programs.

And what I’m most jealous of…

You own not one, but two Porsches!

It seems like you’re living the dream life.

Brad:

You’re right. I’m very blessed.

I also have a beautiful wife, five wonderful children, and recently, my first grandbaby.

But it’s not just me, Chris.

The everyday people following my work are seeing great results.

That’s what I’m most proud of.

Host:

But why, Brad?

What are these SWAN Stocks? And why are they such an effective way to accumulate wealth?

SWAN Stocks Revealed

Brad:

Okay, let me explain…

SWAN is the term I use to describe the ONLY kind of stocks I want to own, period.

Today – tomorrow – basically forever.

SWAN is short for “Sleep Well at Night.”

Host:

Sleep well at night…

Wouldn’t that be nice?

With the way the market’s been acting, I’m sure I’m not the only one who’s had some restless nights.

Brad:

Right – unless you’re already wealthy, the market’s been a nightmare. And even if you are wealthy, you’ve probably also lost a lot of money.

I just saw a stat…

77% of Americans are anxious about their finances right now.

77%!

That’s tens of millions of people.

Host:

I believe it… I see it every day. Practically everybody I talk to is worried.

Brad:

And unfortunately, most folks are choosing the wrong solution.

They don’t realize there’s a small group of stocks they can buy today… forget about… and grow wealthy from year after year.

See, so many investors have been conditioned to think “I’ve got to find the next big thing.”

Host:

I’ve been guilty of that myself… I think, “if I could hit it right with a $1 stock… or a tiny crypto… my worries would be over.”

Brad:

But that’s basically betting your life on a lottery ticket.

Maybe it works for a few people…

But it’s not a realistic way to get wealthy.

That’s why I ignore what most people are doing. I avoid so-called “Hot” stocks and focus on SWAN stocks.

Host:

I get what you’re saying… It’s something we all wish for. To make more money… with less stress.

But in today’s market? How is that possible?

I mean – if what you’re saying is true… If these “Sleep Well at Night” stocks really exist…

You’d think we’d all know it by now. My broker would have put me into these stocks months ago.

Brad:

Chris, I’m going to tell you a secret about brokers.

They want commissions.

You’re right… they would never tell you to create a “SWAN Portfolio.”

That’s their worst nightmare!

The more active you are, the more money they make.

Same thing with the “money channels.”

Can you imagine one of the talking heads saying, “the truth is, if you buy a handful of stocks you can turn off the TV and relax.”

Host:

Fair point. No, they want you glued to your TV 24/7.

Brad:

That anchor would be fired faster than you can blink.

And it’s a shame. Because when you dig into the numbers, you can make a lot more money with my approach.

Host:

Can you give us an example?

SWAN Benefit #1

Brad:

Oh, I’ll do better than that. I’m going to give away my favorite SWAN stock in just a minute.

But first I think it might help to get more specific…

You’ve asked me what makes these stocks so special.

There are three main things.

The first and most important is, they’re “anti-fragile.”

Host:

Anti-fragile? What does that mean, exactly?

Brad:

Simple – their income and profits are rock-solid. In some cases – these companies have contracts in place that ensure the checks keep rolling in.

Or they have a product that’s so critical to modern life – no one can do without it.

Host:

So, in other words, when the markets get rocky… Or when there’s a recession…

It doesn’t affect them the same way it does your typical company.

Brad:

Right. In many cases, they just keep climbing.

Another thing about these stocks is… their value – their share price… isn’t based on hopes and dreams.

You’ve probably noticed how things like tech stocks and cryptos have tanked recently.

Host:

Yes. Why is that?

Brad:

It’s partly because they were valued based on unrealistic expectations.

But the stocks I’m talking about are the complete opposite.

They’re the most predictable, “sleep well at night” stocks on the market.

That’s why they’re beating the market as we speak.

Listen to this one…

One of my picks doesn’t get anywhere near the attention that Tesla, or other “hot” stocks. But it’s arguably given more everyday folks the chance to become millionaires than any other company.

And it’s just getting started…

Billionaires, politicians, and wealthy investors are loading up on this stock.

In fact, earlier this year it was congress’s favorite new buy.

Host:

Why do they like it so much?

Brad:

Because it has a near-monopoly on one of the most popular products in the world…

On average, its share price has doubled every year, for a decade…

And it pays out billions to its shareholders every year – no matter what happens in the markets.

Can you imagine being one of those shareholders, Chris?

Host:

No… Growing my wealth 1,000% over ten years. And on top of that, making thousands of dollars in income?

It seems too good to be true!

Brad:

It does. But that’s exactly what’s happening with this stock.

Another one of my picks crushed the market during the first half of the year.

Look at this.

While the market dropped 19%, it delivered double-digit gains.

Host:

Wait. While just about every popular stock plummeted… this stock delivered double-digit gains?

Brad:

Yes. And it continues to beat the market today.

These are just a few examples.

As a group these stocks are beating the market by nearly 2-to-1.

Again, these kinds of “anti-fragile” returns are very rare.

But they’re available right now with these SWAN stocks.

Host:

I’m excited to get more details about these plays… and I’m sure I’m not the only one.

But first I want to hear the second benefit of your approach.

SWAN Stocks Benefit #2

Brad:

The second is income.

Chris, how well you would sleep if you had money rolling in month after month…

And those payouts were growing so fast, they wildly exceeded your cost of living?

Host:

I think I’d sleep pretty darn well!

Brad:

Well, with my SWAN stocks, that can be your new reality.

These companies pay out millions… even billions of dollars to their shareholders.

And just to be clear, this goes way beyond ordinary, quarterly dividends.

As you’ll see, some of these stocks are legally obligated to pay you. They don’t have a choice.

In other cases, they pay you three times more payments than the typical company.

All told, with my group of SWAN stocks, you get paid nearly 50 times a year.

Host:

So, a payday almost every week, on average.

Brad:

Yes. And here’s the best part…

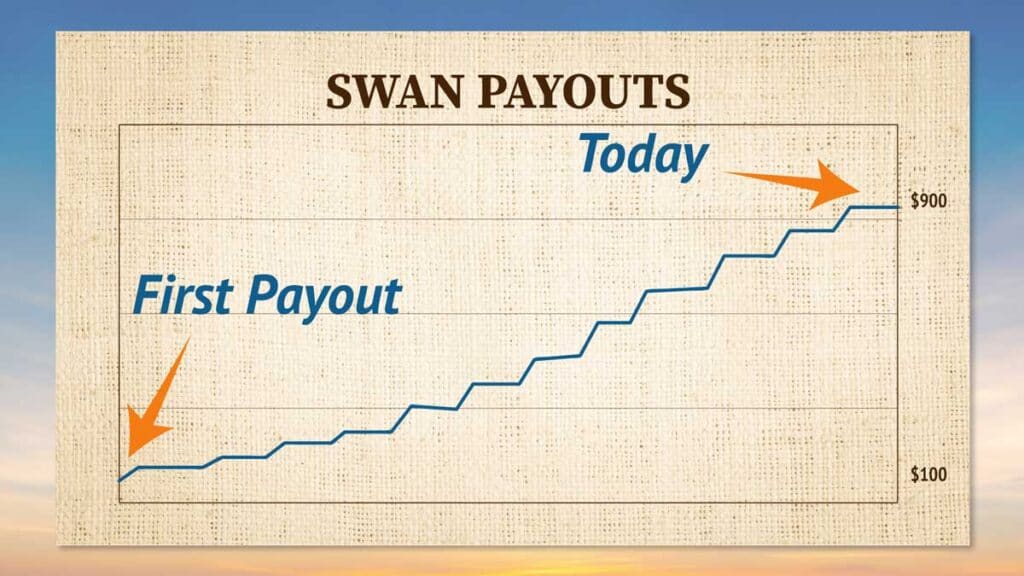

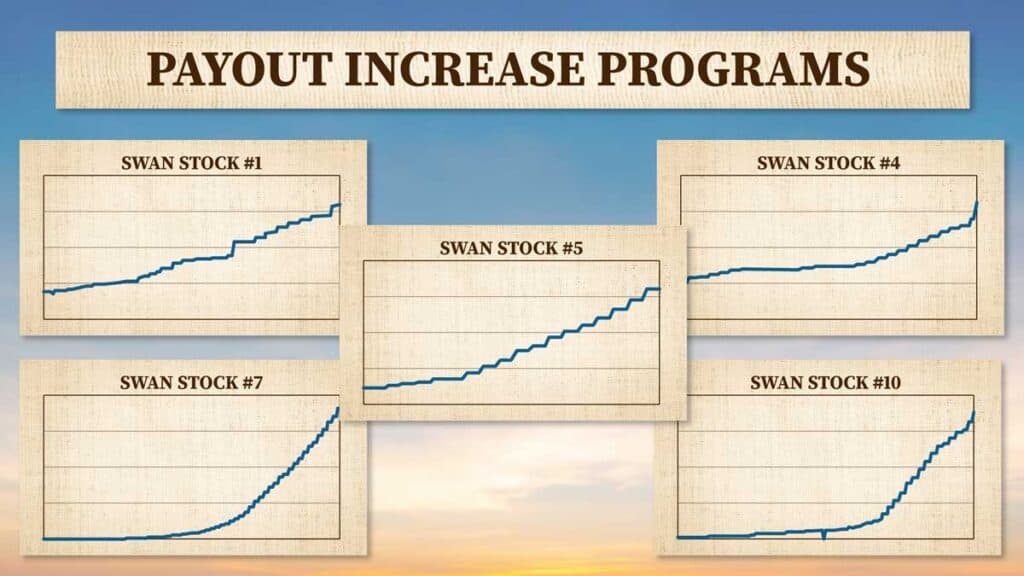

Every one of these companies has implemented what I call a “Payout Increase Program.”

Host:

How does that work?

Brad:

If you start out getting $100 deposits… over time those can become $150… $200… even $300 or more.

Host:

Is that true? The payouts could really double or triple over time?

Brad:

They could do a whole lot more than that, Chris.

Just listen to what’s happening with a SWAN stock I bought a while back.

I’m so happy about this investment, I have the stock certificate.

I keep it up on my wall, but I brought it with me today.

Host

Wow… there it is.

I didn’t know you could get those.

Brad:

Yeah, pretty neat, right?

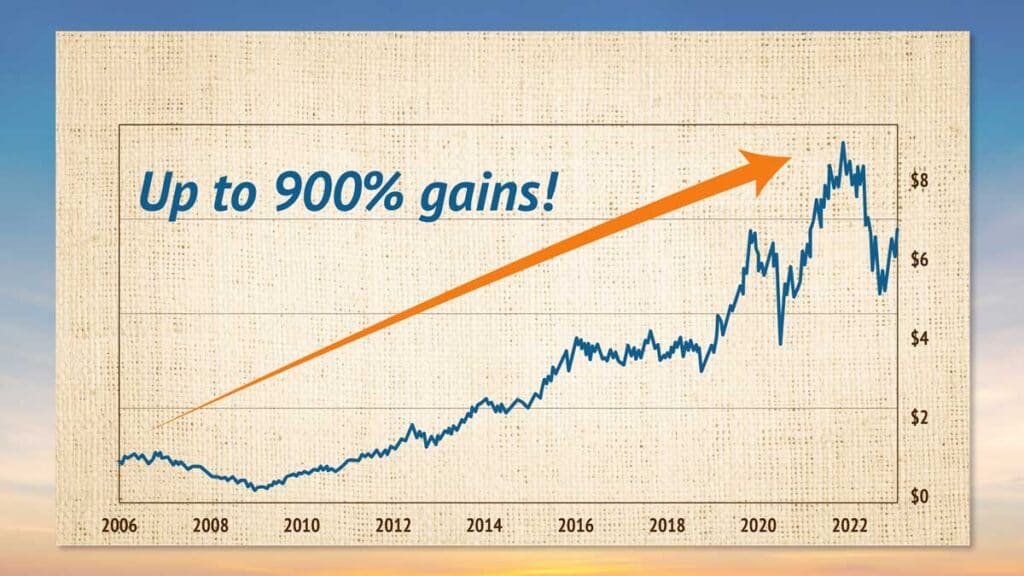

Now, since I invested in this company, it’s gone up as much as 900%.

You might be wondering, why not sell?

After all, I could cash out for a big payday.

Host:

Right… Why are you still holding?

Brad:

Because this stock has a payout increase program.

Since I invested, its payouts have jumped 800%.

Host:

So you’re pocketing 800% more income – without doing a thing?

I’m not going to ask you how much you’re making, but check my math here…

That increase turns a $100 income stream into $900.

$500 into $4,500.

And $1,000 into $9,000.

Brad:

That’s exactly right.

Isn’t that amazing?

Normally, that kind of return is next to impossible.

But with SWAN stocks, that is precisely what can happen, over time.

I brought some charts with me to illustrate this point.

Can we pull them up?

Host:

Okay, they’re up. Go ahead.

Brad:

These are charts of my top SWAN picks.

Now Chris, as these charts flash on the screen – tell me – do you see a pattern?

Host:

Well… the most obvious thing I can see is… they’re all going up.

Brad:

Right…

And not only that…

In some cases, they’ve NEVER gone down.

Not once.

Host:

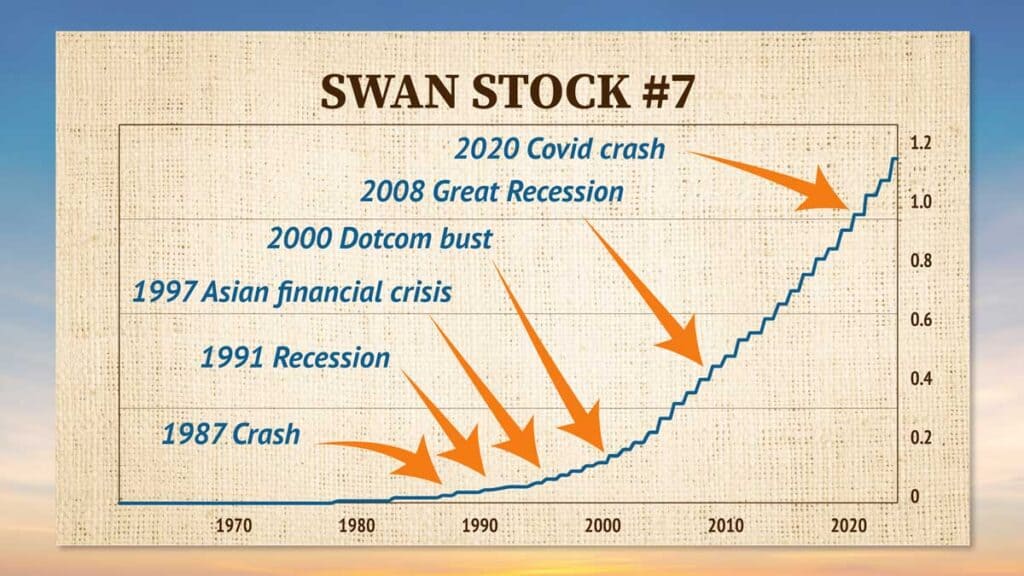

I see you’ve marked some crashes and panics…

The crash of 1987… The recession of the early 1990s.

The DotCom bust… the Great Recession of 2008…

Even during the steep COVID crash of 2020… And even this year – which has been pretty awful for most of us. The payouts have ONLY gone up.

That’s shocking…

Brad:

Do you see why I call them Sleep Well At Night stocks?

Host:

And you don’t have to do a thing to get these increases? No paperwork? No additional filings? Nothing?

Brad:

Nothing.

The money gets deposited into your account, automatically.

Watching that money grow is an amazing feeling, Chris.

Listen to this next example. It will blow your mind…

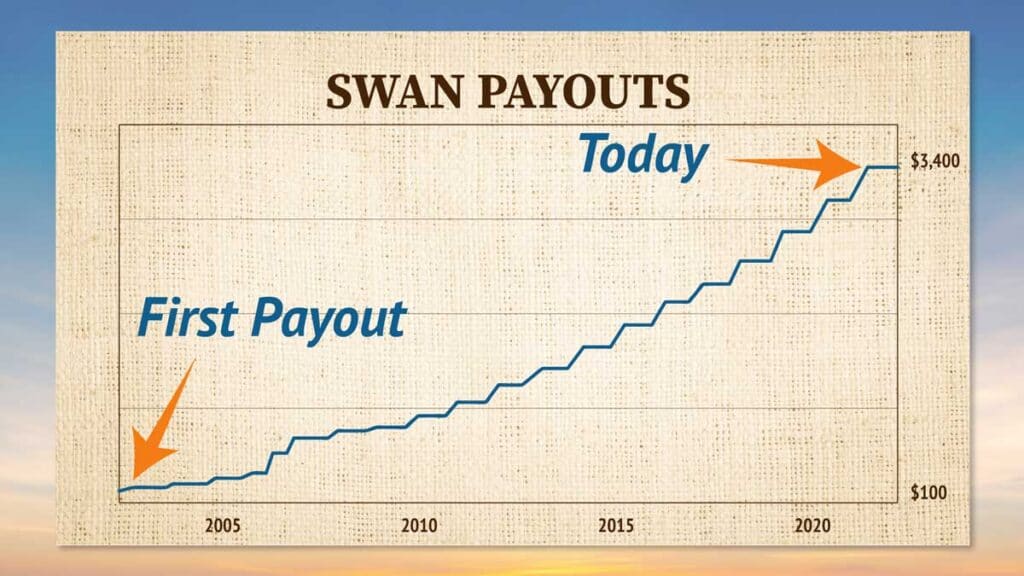

This is another SWAN stock I have up on my wall.

I brought this one with me too.

Host:

What’s the story behind this one?

Brad:

I bought this one a few years before the other one.

It’s worked out better than I could’ve ever imagined.

First off, its share price has soared as much as 3,600%.

But even better than that…

It’s raised its payouts 3,400%.

Host:

You’re making 34 times more than you were at the beginning?!

Again, check my math.

That turns a $100 income stream into $3,400…

A $500 stream into $17,000…

And a $1,000 stream into $34,000.

Brad:

Do you know anybody who’s gotten a 3,400% raise from their boss? Or on their Social Security checks?

Host:

No. Social Security can barely keep up with inflation.

Brad:

That’s what’s great about these stocks.

You don’t have to leave your finances up to a boss – or a government agency that doesn’t give a hoot about you.

You’re in control.

Your income can go up every year – no matter what.

Host:

And just to be clear, these payouts come in addition to capital gains.

You get both, right?

Brad:

That’s right.

The share price barely matters at all.

This stock has had ups and downs over the years.

But who cares?

Through all of them, my checks have gotten bigger.

Host:

So I assume these two plays on your wall made your list of top SWAN stocks?

Brad:

No.

They’re great long-term investments… I don’t plan on selling anytime soon…

But they didn’t make the cut.

I’ve found some others that I think are even better.

One of these stocks has increased its payouts every year for more than 50 years.

Think of all that’s happened since then, Chris.

Do you know how many recessions we’ve had in that time?

Host:

Gosh… it’s gotta be a lot. How many?

Brad:

Eight.

Through it all, this company’s raised its payouts.

Yet very few people know about it.

Another one of my plays recently increased its payout by 64% — in just three months.

Imagine you invest in a company… Then, three months later, your $500 income stream is $820. And you didn’t have to do a thing!

Another of these firms pays out every month. It’s been doing that for nearly 29 years.

Host:

I’m trying to do the math… how many payouts is that?

Brad:

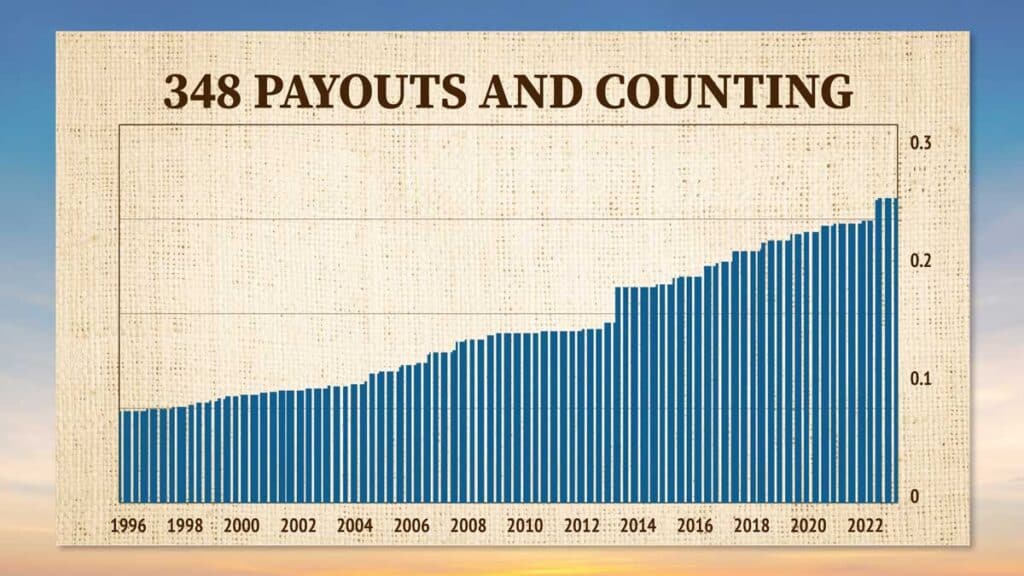

348. It’s never missed once, and the payouts have increased almost every year.

Again, this kind of thing is not normal.

It’s only available with a tiny fraction of SWAN stocks.

If you invest in these plays today, you could start collecting hundreds, even thousands of dollars.

And that number could grow every year.

Host And you’re going to give the name of your #1 pick, right?

You haven’t forgotten.

Brad:

I haven’t forgotten.

I’m going to show it to you. I promise.

But first, there’s one more big benefit of these stocks…

SWAN Stocks Benefit #3

Host:

And what’s that?

Brad:

Even when the market crashes… as we know it will…

You won’t have to panic like most people.

In fact, you might even look FORWARD to the next crash.

There’s a way to flip them into even more money.

Host:

How does that work?

Brad:

Okay, let me explain…

Imagine you invest in a regular stock.

Facebook. Google. What have you.

And let’s say the market crashes.

What happens?

Host:

You lose money.

Brad:

Right. If the stock drops 50%, half your money is gone.

And you may have to wait several years to make back that money.

Are you with me?

Host:

Yes. That all makes sense.

And you’re saying that’s not what happens with SWAN stocks?

Brad:

No.

Not only do you keep receiving your payments… These payments can be like rocket-fuel to your portfolio.

Host:

How so?

Brad:

If you choose, you can reinvest these payments back into the company.

You can use them to buy additional shares at lower prices… which gives you bigger yields… and positions you for bigger checks down the road.

Host:

So, in simple terms, you can use a crash to compound your wealth even faster?

Brad:

Exactly. Every crash… every recession… and every pullback is not something to fear.

With SWAN stocks, these are opportunities to make even more money in the end.

Host:

Well… that sounds great, Brad.

But still, in the moment, those drops can be gut-wrenching.

Brad:

That’s why I decided to become a “voice of reason” during the 2020 crash.

I knew exactly how people were feeling.

When I nearly lost everything, it was devastating.

I knew people would want to sell and swear off investing forever.

So, on March 13th, right as the world was shutting down, I wrote an article titled: “Stay Calm, This Too Will Pass.”

Host:

We have a quote from that article. It says:

“The real winners in all of this – and yes, there most definitely will be winners when everything is said and done, probably sooner than later too – will be those investors, analysts, and businesses that can think long-term.”

In hindsight, that analysis was spot on.

And did you practice what you preached? Did you think long term?

Brad:

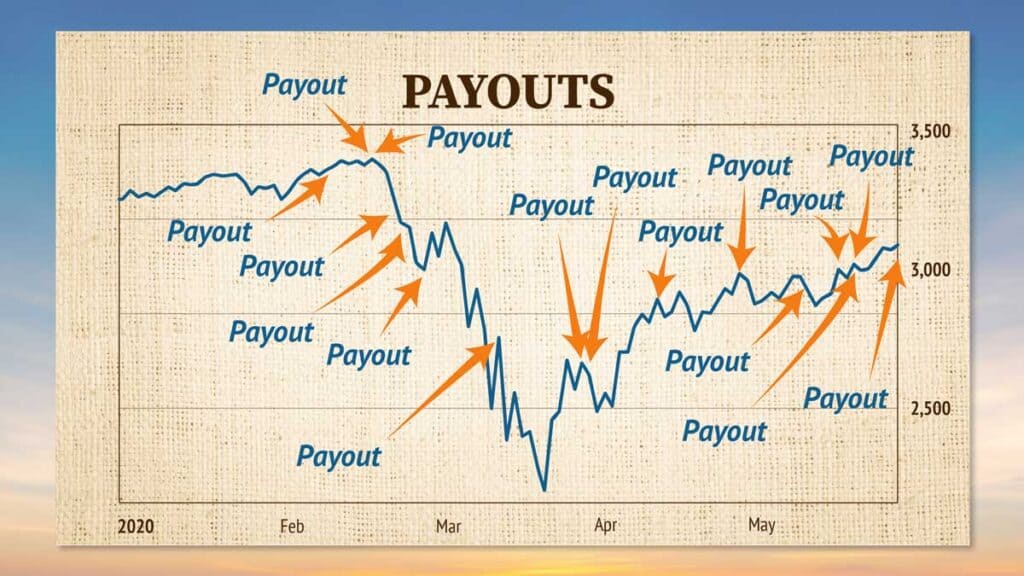

Absolutely. My team and I backed up the truck.

The market started falling in late February. It bottomed on March 23rd.

We recommended buys on March 9th, 12th, 16th, 18th, and 20th, and even March 23rd.

Host:

Wow, you helped folks get in on the exact day the market bottomed?

Brad:

The exact day.

Anybody who followed our advice had the chance to lock in huge yields for unbelievable companies.

They’re positioned to get massive payouts for years to come.

Host:

That took guts, Brad.

Even most experts were panicking at that time.

How did you have the stomach to do that?

Brad:

Look, I’d love to pretend that it took nerves of steel.

But the truth is, it was a piece of cake. We were thrilled.

Again, with SWAN stocks, there’s a lot less risk.

Obviously, there’s still SOME risk. Nothing is ever guaranteed when it comes to investing. Including with these stocks.

But look how my SWAN portfolio performed during this time…

Host:

Wow… there’s, what, a dozen paydays in there?

Brad:

More than a dozen.

While the market was crashing, you could’ve seen one payday after another.

Host:

And what about more recently?

In a lot of ways, 2022 has been even worse than 2020.

The stock market had its worst start to the year in decades.

Millions of people are now delaying retirement.

How have your SWAN picks held up?

Brad:

Fantastic. During the first half of 2022, my SWAN portfolio crushed the market. It beat it nearly 2-to-1.

And since then, it’s only done better.

Best of all, you could have collected a new payout an average of almost once a week.

Imagine the peace of mind this gives you.

Imagine waking up every day without worrying about money.

You check the news… see all sorts of scary stories about the economy… but you don’t care.

You know that with your SWAN stocks, you can sit back… relax… and wait for the next payday.

Host:

It sure sounds better than the alternative.

I see people trying all sorts of risky things like shorting… trying to “time the bottom,” or even trading so-called “meme” stocks.

Your way sounds a lot simpler to me.

Brad:

It’s so much better. And again, I’m not the only one who feels that way.

My team and I have received hundreds of notes from our readers.

They love this approach.

Host We have a few of them on the screen.

“I am approaching my retirement day and the stability and income provided by the portfolio choices has been just what I wanted.”

“The market is getting more and more volatile and [has] gone thru the challenge from the virus, interest rates and war. But the portfolio I hold following Brad and his team's guidance has been able to give me results that allow me to Sleep Well At Night.”

Again, there are many more just like them.

It’s clear that your work is resonating with everyday people, Brad.

Brad:

Chris, despite the difficult times we live in, there’s no reason we have to suffer.

This can be a time of great prosperity.

All you have to do is find a small group of SWAN stocks… and let them make you wealthy.

“I’m Rooting for a Recession”

Host:

So I take it you’re not worried about what happens next.

Recession… Downturn… Whatever happens, you’re not losing sleep.

Brad:

Not at all. A few months back I wrote an article titled, “I’m Rooting for a Recession.”

Host:

I bet that caused a stir.

Brad:

It did. It was the most popular article on Seeking Alpha that day.

Look, I truly sympathize with people who are fearful of recessions.

However, the fact is, I look forward to weakness in the stock market.

As Warren Buffett says, “be fearful when others are greedy, and greedy when others are fearful.”

I love buying SWAN stocks when they're trading for a bargain.

Host:

Well, using Warren Buffett’s criteria, this certainly seems like a time to be greedy.

Brad:

Absolutely.

It’s no accident that Warren Buffett has been on a spending spree.

He’s loading up… and I recommend everyone do the same.

As the market enters a new phase, now’s the perfect time to buy my SWAN stocks.

Host:

Does this new phase have to do with the massive “shift” you mentioned earlier?

The Next Big Market Shift

Brad:

It does.

Let me explain…

For over a decade now, we’ve been in what I call a “dartboard” market, Chris.

From 2009 to the start of 2022… picking stocks was as easy as throwing darts.

Every stock you hit was a winner.

Unfortunately, those days are over.

Host:

And why is that?

Brad:

Inflation.

With inflation hitting 40-year highs, the Fed has finally started to raise rates.

This has sent shockwaves through the market all year long.

With less money to go around, riskier assets… like cryptocurrencies, SPACs, and others… have done especially poorly.

Host:

And you don’t see the Fed changing course anytime soon?

Brad:

I don’t.

Remember… Even now, rates are historically low.

As recently as the mid-2000s they were twice as high.

The Fed could double or triple rates from here… they still wouldn’t be close to all-time highs.

Host:

So where does that leave us?

Brad:

It means investors have to be choosier.

Many of the investments that worked in the past are no longer going to work in the future.

You can’t put $500 in some small tech stock… or a fancy crypto play… and expect to make 1,000% overnight.

Those days are over.

That’s where my SWAN stocks come in…

They’re perfect for this new inflationary environment.

Host:

Why is that?

Brad’s #1 Stock

Brad:

Four of my stocks are a unique type of real estate investment.

Now, if you know anything about inflation, you’ll know that real estate is a perfect inflation hedge.

That’s because inflation causes the value of land and buildings to rise.

So, as a hard asset, real estate can protect your portfolio from inflation – and deliver big income in the process.

Host:

Makes sense. Unlike cash in the bank… which loses value from inflation… real estate increases from inflation.

Brad:

Correct. Now, here’s what I like about these stocks in particular.

They come from a tiny subsector of the real estate market.

Most people have never heard of this corner of the market. But it does especially well during periods of high inflation.

Listen to this…

A group called S&P Global performed a study a few years back.

They wanted to see which investments did the best during the worst interest rate environment ever – the late 1970s.

Guess what?

This group of stocks performed nearly 3 times better than the S&P.

Host:

So, while many stocks lag, with these stocks you could crush the market for years?

Brad:

Exactly.

And it gets even better…

Not only do all these stocks have Payout Increase Programs…

They’re required by law to pay out 90% of their taxable income to shareholders.

Host:

I’ve never heard of that before. Is that common?

Brad:

No. It’s extremely rare. But it’s 100% real for these SWAN stocks.

That’s why these companies have issued payouts for decades. They don’t have a choice!

Through the tech crash, the financial crisis, the COVID pandemic… they’ve never missed a single payment.

Not only that, in some cases they pay out monthly.

Host:

So, instead of the usual 4 payments, you’re getting 12 a year?

Brad:

Yes.

You get three times more.

Host:

All in all, these stocks are perfect for today’s market.

You could get market beating gains…

A series of rising income streams…

And inflation protection.

Host:

Well, if anybody knows a good real estate investment, Brad, it’s you.

You were a real estate developer for over 20 years.

During your career, you saw rates rise sharply, and fall sharply, and everything in between.

And you were involved in $1 billion worth of real estate transactions.

So, you would know better than anyone what makes a good investment.

And these are all available through any brokerage account?

Brad:

Yes. You buy them like any other stock.

And that’s just four of my SWAN picks.

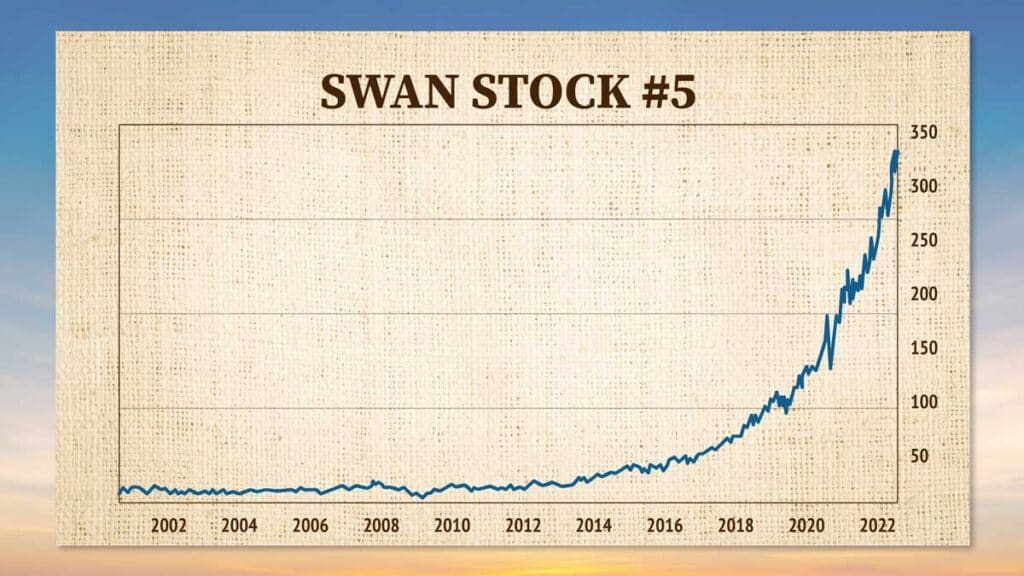

Another of my picks – Pick #5 – is a favorite of the world’s wealthiest investors. It counts more than 60 members of Congress, and dozens of billionaires, among its investors.

Host:

Is this the one that’s doubling every year, on average?

Brad:

Yes.

It’s one of the most resilient stocks I’ve ever seen.

Look at it during the 2008 and 2020 crashes.

For some firms, those crashes were devastating.

For this one? Over the long term, they were insignificant.

Host:

You’re right… a couple blips on the radar.

Brad:

Bottom line: this stock could help you grow your wealth for years to come.

And right now, you can get it for a good deal.

Host:

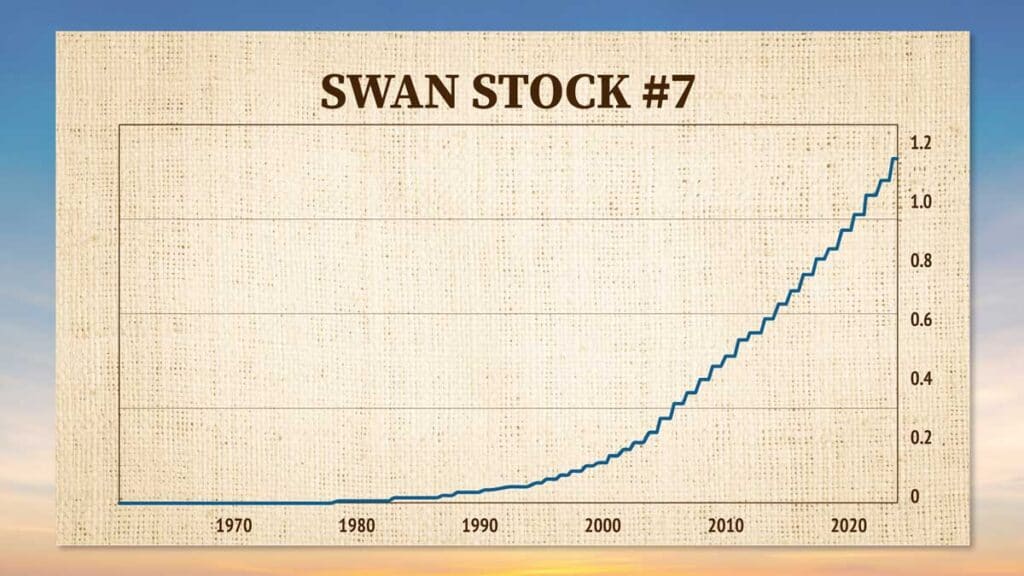

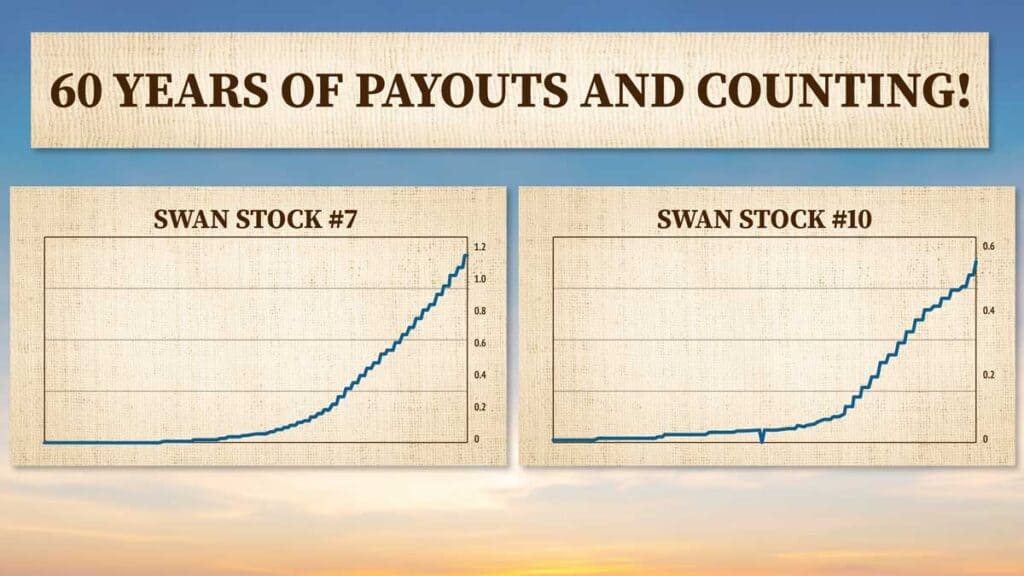

Of your ten picks, which has been growing its payouts the longest?

Brad:

It’s a tie between #7 and #10.

Each has been raising its payouts since 1962.

Again, think of all that’s happened since then.

Think of how many companies have come and gone.

Yet, for 60 years now, these companies have been rewarding shareholders.

Can you see why I believe these stocks can help you retire comfortably, Chris?

Host:

I can. I’ve been making a checklist in my head…

Capital gains. Check.

Income. Check.

Growing payouts. Check.

Market crash protection. Check.

Beating the market right now. Check.

Huge growth potential. Check.

Never having to time the market again. Double check on that one…

And I could keep going…

Brad:

They’ve got it all, Chris.

They’re the ultimate sleep well at night investments.

Host:

I think this is a good time to give us the name of your top pick.

What is it?

Brad:

Okay, here it is. Mid-America Apartment Communities. Its ticker symbol is “MAA.”

Host:

It’s up on the screen, folks. You’ll want to write that down. Mid-America Apartment Communities. Ticker symbol “MAA.”

But remember, this is just one of Brad’s picks. He’s got nine more… and as he’s explained, they all have just as much potential.

Brad:

They’re all flying completely under the radar.

One of them is trading for half the price of my top pick.

Another trades fewer than a million shares a day. That’s tiny.

Apple does that every five minutes.

I’d bet fewer than 1 in 10,000 investors have heard of them.

You have the chance to get them while they’re completely unknown.

Host:

So, how can folks get their hands on all these picks?

Brad:

I’ve put all the details in my brand-new report, The SWAN Portfolio.

This report will show you exactly how to get started.

I’ve never seen another report like it.

As far as I know, it’s the only one of its kind. No other expert I know of offers a way to create a comfortable retirement – using one small portfolio of SWAN stocks.

Host:

And just to be clear, this guide is not available anywhere else on the web.

The only way to get it is through today’s special offer.

Brad:

That’s right. I’ve never revealed it on Seeking Alpha, or any other platform.

Host:

What’s in the report?

Brad:

I give a full breakdown of each stock.

I had thousands to choose from. I chose these ten for very specific reasons. You’ll see why I believe they’re the best stocks for today, tomorrow, and forever.

Plus, I’ll also show you how their Payout Increase Programs work.

Host:

Are any of them expected to increase their payouts soon?

Brad:

Yes. I can’t guarantee anything. But in the past, some of the raises have come right around this time of the year.

You’ll definitely want to get in before that happens.

Host:

In the report, you also explain why these stocks are perfect for today’s high-inflation environment. Isn’t that right?

Brad:

Yes. Remember, the “never-ending” bull market is over.

We’re in a completely new environment.

I’ll explain why these stocks could be the biggest winners during this next phase.

Host:

And that’s just the beginning. I’m seeing a summary of the report on the screen. You also reveal:

- How to get started even if you only have a few hundred dollars

- Why you should never risk more money than you can afford to lose – and why you don’t need to with these picks

- Why these stocks have performed so well in bull and bear markets

- And much, much more

And Brad, I understand you also have a companion report as well.

Tell us about that…

Brad:

It’s called: Sucker Yields – and How to Avoid Them.

Chris, nobody loves a high-yield stock more than I do.

But they’re not all created equal. Some of them look great at first glance… but are actually hidden landmines.

Host:

Now, if I’m not mistaken, you literally wrote the definition for “sucker yields,” did you not?

Brad:

Yes. Around seven years ago, I submitted it to the financial dictionary website Investopedia for $50. You won't find it there anymore, but the concept is just as relevant today as it was back then.

Sucker yields are something you must avoid like the plague.

Host:

So, what are sucker yields, exactly?

Brad:

They’re low-quality companies with unsustainable dividends that cut their payouts, often numerous times.

Chris, I can’t count how often I’ve seen it happen…

Investors will see a stock yielding high-double digits, and they’ll pile into it. But that incredibly high-dividend yield is only half the picture. And it ends up pulling the rug out from under unsuspecting investors’ feet.

Host:

So, in the report, you explain how to tell whether a stock yielding 10%, 15%, or even 20% is an incredible buy or a sucker yield?

Brad:

Yes – including the names of several of the biggest sucker yield plays available today.

Host:

I’m especially excited for this report.

You’re the ideal expert to talk about risk management.

Just look at this note one of your readers sent in. He wrote, “[I’ve] saved myself from some huge losses during this turbulent market. I can’t imagine investing without [Brad’s research].”

There are many more just like this.

Brad:

The last thing I would ever do is put your nest egg at risk.

Protect principle at all costs. That’s my number one priority.

My team and I spent countless hours developing a risk management system.

It was a lot of work, but it was worth every minute.

If you follow it, I truly believe you’ll be prepared for whatever dangers may lie ahead.

We lay it all out for you in this report.

Host:

Excellent.

Okay, so between your special report and your bonus report, you’re offering arguably the most timely research that anyone can get their hands on today.

But there’s one more thing you haven’t mentioned, Brad…

You’ve saved your best bonus for last.

I think this is a good time to tell everyone about it…

Brad’s New Venture

Brad:

Sure.

Listen, I was fortunate to discover SWAN investing when I did.

There was a point in my life when I didn’t know how I would provide for my family. Let alone retire.

But thanks in large part to this investment strategy… I got my life back, and then some.

Others haven’t been so fortunate.

They’re watching the markets tank…

They’re seeing their nest eggs shrink…

And they’re wondering, “did I miss my chance? Is the retirement I hoped for a lost cause?”

The answer is no.

You CAN get the retirement you’ve always dreamed about.

And I want to help you.

To that end, I’ve launched a research service called: The Intelligent Income Investor.

And right now, we’re offering a special deal to anyone who joins today.

Host:

How does this research service work?

Brad:

Every month, my team and I scour the market for SWAN stocks.

They’re not easy to find. It takes hours and hours of research. Less than 1% of stocks pass our strict criteria.

But when one does, we recommend it to our readers, along with a full analysis.

Host:

Obviously, past performance doesn’t guarantee future returns. And all investing involves risk.

That said, your past performance has been amazing.

From 2020 through mid-2022, you ran a similar research service.

You had a near-perfect track record. You went 15-for-16 on your closed positions, with gains like 124%, 191%, and more – in a matter of months.

And on top of that, you gave your subscribers the chance to earn thousands in income.

To do that in a market like this is beyond impressive, Brad.

I don’t know anybody who’s navigated this bear market as well as you and your team.

And stepping back even further…

For nearly a decade now, you’ve shown a global audience how to multiply their wealth – in good markets and bad. Many of these folks have sent in glowing praise…

“I normally do not write reviews. But I felt [Brad and his team] deserve recognition. The amount of information they make available is impressive compared to the cost of the service. Keep up the great work.”

“Outstanding service with excellent articles and feedback. Detailed information provided and love the CEO interviews that give further benefits to their recommendations. Very pleased with this service and highly recommend.”

I debated joining for over a year. I am so glad I finally pulled the trigger. Tons of value for a very low cost. Daily updates are also great. I’ll be a lifelong member!”

Brad:

Thank you, Chris. I love hearing those stories. It makes it all worthwhile for me.

Unfortunately, too many people are taking the wrong approach today.

Either they’re selling everything… or they’re taking on way too much risk.

It’s not their fault – they’re just doing what they know.

The answer is so much simpler: buy a few SWAN stocks and let them make you wealthy.

Host:

Now, in the past, it cost a pretty penny to follow Brad’s ideas.

The regular price for his research was $500 a year.

However, with this new venture, you won’t have to pay anywhere near that.

The retail price for a 12-month membership to Intelligent Income Investor is $199.

That means you can get started for less than half of what folks have paid for Brad’s work in the past.

Brad:

And I’ve arranged an even better deal, Chris.

Host:

Oh really?

Brad:

Look, a lot of folks are struggling right now.

I truly believe my research is the best way for them to get back on track.

The last thing I want is for the price to get in the way.

So, I convinced my publisher to knock the price down to $49.

Host:

For an entire year?

Brad:

Yes. The full 12 months.

Host:

Folks, I hope you realize how good of a deal that is.

Brad is one of the most-followed experts on these stocks.

What’s more, others have paid literally ten times that for his research.

For the chance to access an entire year of his best ideas for a few pennies a day?

You’re not likely to ever see a better deal than that.

Brad:

There’s only one catch, Chris. I can’t guarantee this price will be available for long.

It’s a special, limited-time deal.

My publisher reserves the right to raise it any time, without notice.

Host:

Please don’t wait, folks.

To get started, just click the button on your screen.

It will take you to a secure page – you’ll be able to place your order.

While you’re doing that, let me review everything you’ll get when you join today.

What You’ll Get Today

One full year of Intelligent Income Investor (Value: $199).

As a new member, you’ll receive Brad’s latest research immediately.

Then, every month around the first Monday, you’ll receive his latest ideas.

Plus, you’ll also get frequent updates as needed.

Brad:

One thing, Chris. Obviously the best opportunities don’t always happen according to a schedule. Some months you may get two recommendations. Other months we may hold off. Or, the pick might come in a mid-month update.

It depends on what’s happening in the broader market.

But either way, each pick is designed to help our readers achieve a worry-free retirement.

Host:

Makes perfect sense.

You’ll also get…

Special Report: The SWAN Portfolio (Value: $199). Each of these stocks has what it takes to help you sleep well at night – you’ll get the names and tickers of all of them, along with a full write-up.

Bonus Report #1: Sucker Yields – and How to Avoid Them (Value: $199). This report includes the names of several of the most dangerous high-yielders on the market.

Plus, you also get…

Bonus Report #2: Brad’s #1 Growth Stock (Value: $99). Tell us about that, Brad.

Brad:

This is my stock for those looking to jumpstart their entire portfolio.

I call it a “have your cake and eat it too” play.

Host:

What do you mean?

Brad:

Not only does it have huge upside potential…

It’s extremely low-risk… and it’s a bargain.

It’s trading at the same level it was before the pandemic…

Yet its revenue, gross profit, and earnings are all up significantly since then.

I think it’s an easy double, or more.

Host:

If you were to buy all this research separately, you’d be looking at nearly $700.

Today, it’s all yours for just $49.

And last but not least, you’re also protected by Brad’s 60-day money-back guarantee.

How does that work, Brad?

Brad:

It’s very simple…

I’m happy to say that most of my readers love my research.

I get positive feedback all the time.

However, if for some reason it’s not for you, that’s okay.

Just call our customer service team within the next 60 days, and they’ll give you a full cash refund.

And to make it fairer than fair, I’ll let you keep my special reports. No questions asked.

Host:

Just remember, folks, you could start profiting immediately.

Like Brad said, these companies average around one payout per week, on average.

The next ones are coming right up.

If you’re a shareholder BEFOREHAND, you’re going to get your cut. If you’re not, you’ll completely miss out. Please don’t let that happen to you.

Just click the button below to join Brad right now.

Okay Brad, any last words?

Brad:

I want to thank you for having me on, Chris.

And I want to thank all of you watching for joining us as well.

I can’t wait for you to get started.

This is the best way I know of to make money not only in today’s market… but for years to come.

Once you start seeing the fruits of SWAN investing, you’ll be hooked for life. You’ll never want to invest the old way again.

Join me today and I’ll show you everything you need to know.

Host:

Well said.

Okay folks, unfortunately that’s all the time we have.

Again, to get started, just click the button on your screen.

You’ll be taken to a secure order form, and within minutes, you’ll be able to access all the research he’s promised you.

For Brad Thomas, I’m Chris Hurt saying so long…

October 2022

Disclosures & DetailTerms of Use | Privacy Policy | Ad Choices | Do Not Sell My Info

© 2022 Wide Moat Research. All Rights Reserved.