Table of Contents

- Introduction

- Wall Street Legend Louis Navellier

- What this “Impact Event” prediction could mean for you and your money…

- The market during our last Great Inflation

- Finding shares that are ridiculously cheap

- “Five New Buys For The World’s LAST Oil Boom.”

- “10 Toxic Stocks to Sell Immediately.”

- “Three Golden Income Opportunities.”

- To sum this up…

Brought to you by InvestorPlace

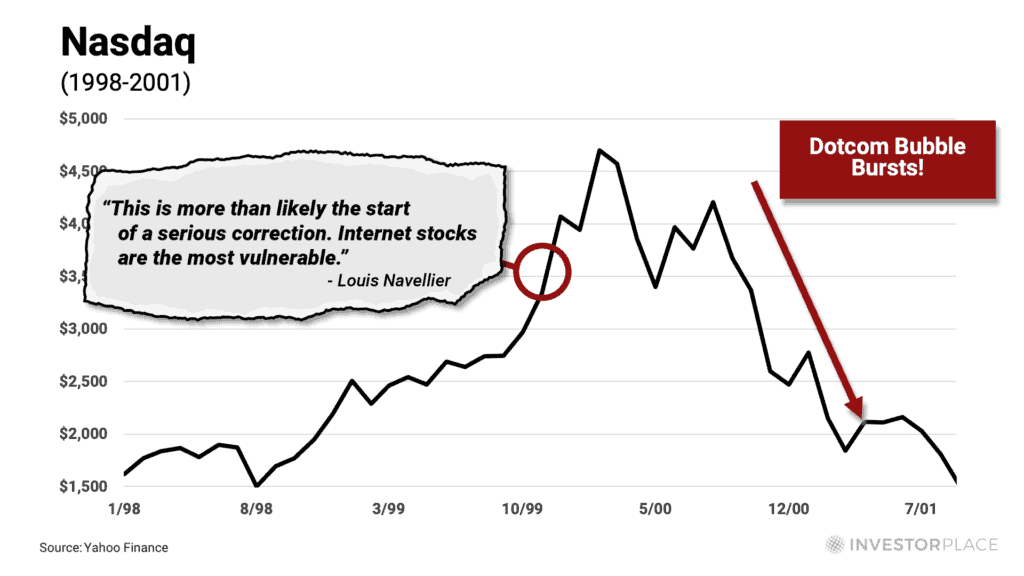

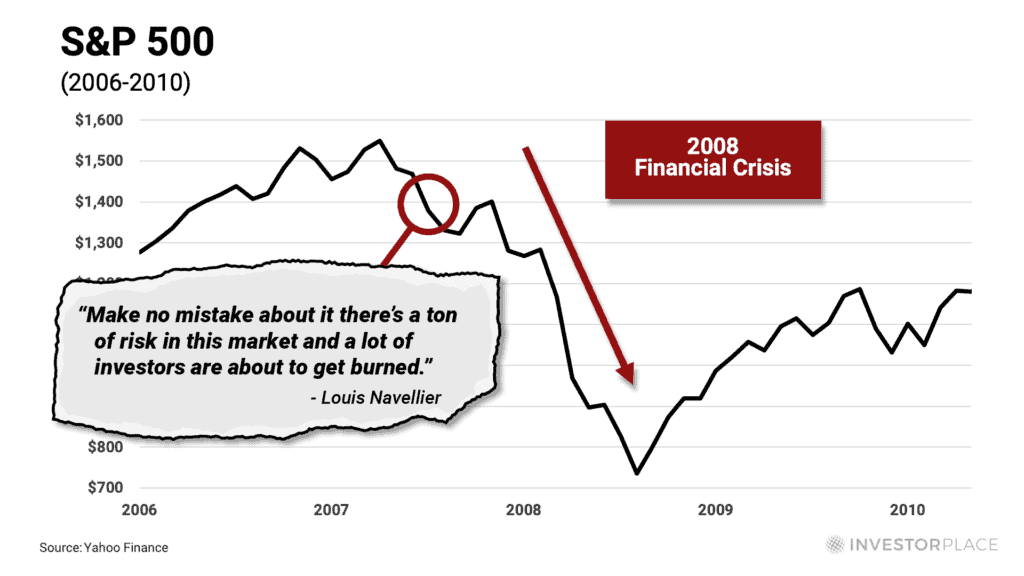

The Same Market Legend Who Called The '87 Crash…

The Dotcom Bomb… and The 2008 Financial Collapse Now Warns…

“A Massive

NEW ‘IMPACT EVENT’

Is Headed Straight For Main Street…”

Bigger Than War. Bigger Than $6 Gas. And It Could Flatten Millions of American Investment Accounts, Even As It Makes a Few Very Rich…

If you’ve let your brokerage statements pile up…

If you watched your bank balance dwindle…

If you wince every time you pull up to a gas station…

I’ve got some news for you.

Because, as much as I want to tell you it’s almost over…

It turns out there’s yet another “Impact Event” hurtling toward Main Street…

An event so huge…

The Bank of America says it will hit with a $150 trillion aftershock… and could send tremors rippling across markets for the next three decades straight.

To put that in perspective…

$150 trillion is over 16 times more than we spent on Covid bailouts…

It’s 20 times bigger than the impact of the 2008 crash…

And it’s nearly seven times larger than America’s GDP…

In fact, $150 trillion is almost double the size of the entire world economy.

Yet, few investors see this “Impact Event” coming.

Fewer still understand what it could mean for their money.

As a result, they could get trapped in the wrong investments.

Others will use this “Impact Event” to get very rich.

Before it’s done, we could see this event mint new millionaires… a few billionaires… and quite possibly, our first trillionaire.

We’ll have over 30 years to watch the details play out.

At the same time, you’ll want to act on this now.

Especially if you’re a Baby Boomer like our expert guest.

Why?

Because, as he’ll show you, this could also be the last great market opportunity of our lifetimes. Our guest has already identified ways to profit from it.

And he's ready to share some of those details with you today.

Hi, my name is Brit Herring.

In just a moment, you’ll find out what this “Impact Event” is…

You’ll find out how to prepare…

You’ll get the name of our expert’s #1 stock to BUY NOW.

First, though, let tell you a little more about our guest…

You might recognize him…

He’s spent the last 45 years dominating the backroom chatter on Wall Street.

In addition to appearing on CNBC, Bloomberg, and Wall Street Week… he’s been featured by Barron’s, Forbes, and the Wall Street Journal, to name a few.

In fact, Kiplinger calls his track record…

Business Insider calls his underlying market approach…

And The New York Times calls it…

Louis has also been featured in bestselling books…

And he’s famously perfected an algorithmic, stock-finding system that’s so powerful, it’s beaten the stock market by margins as high as 3-to-1…

Over the last 45 years, he’s used that same system to uncover…

Those discoveries include…

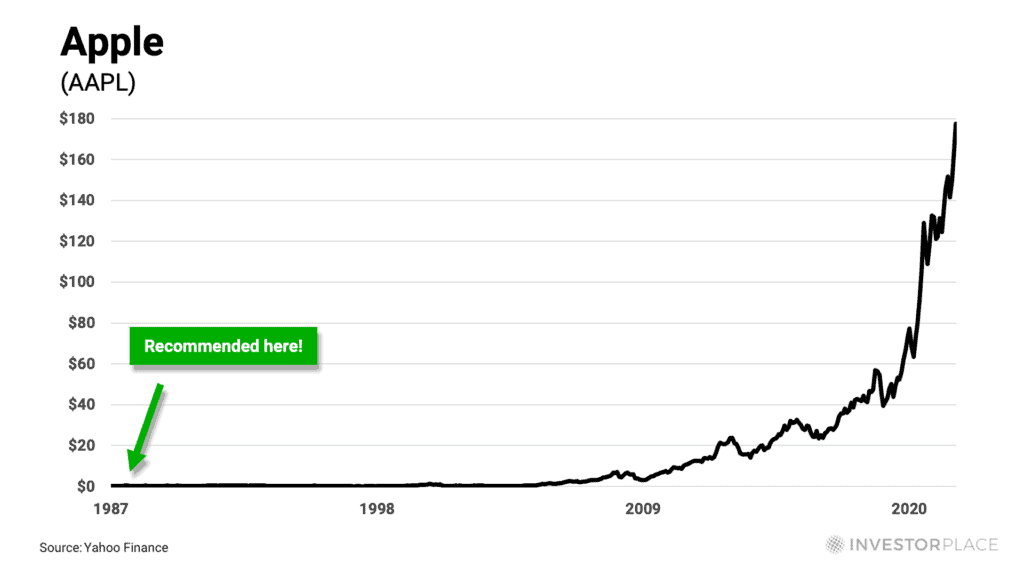

Apple at just 37 cents…

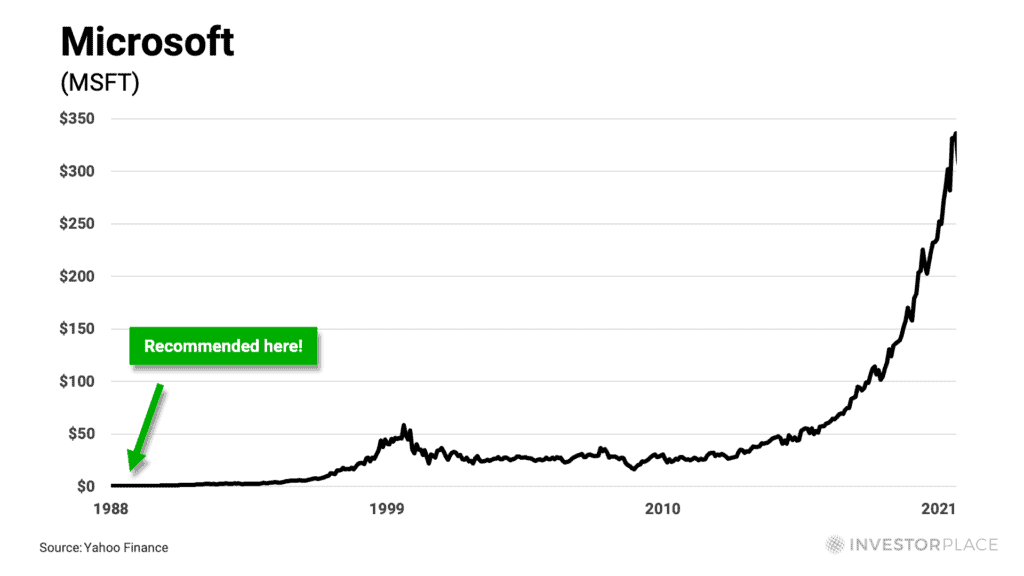

Microsoft at 38 cents…

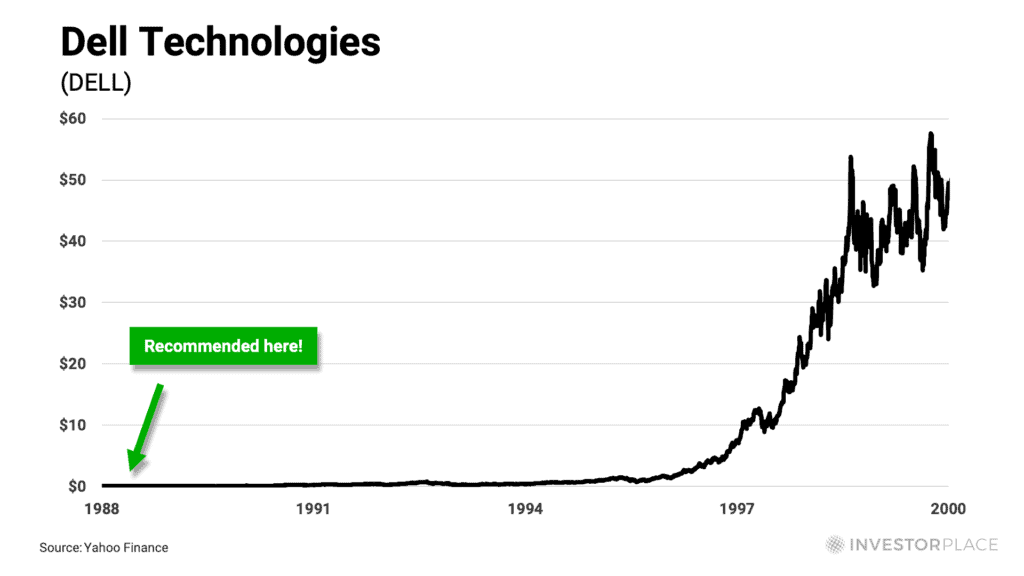

And Dell for under a dollar…

He also used his system to name Nvidia at $9…

Netflix at $7…

and Amazon at $43.

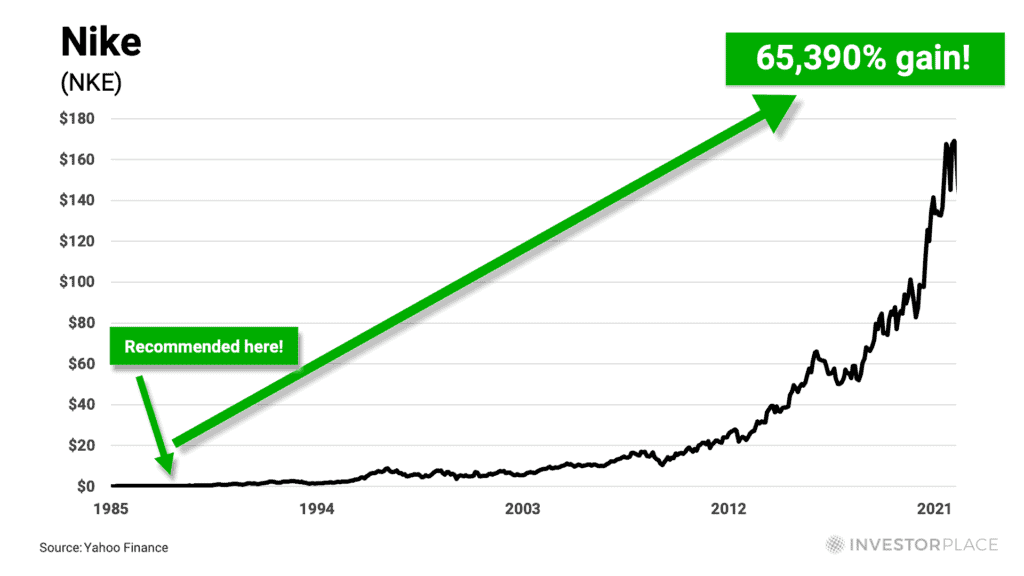

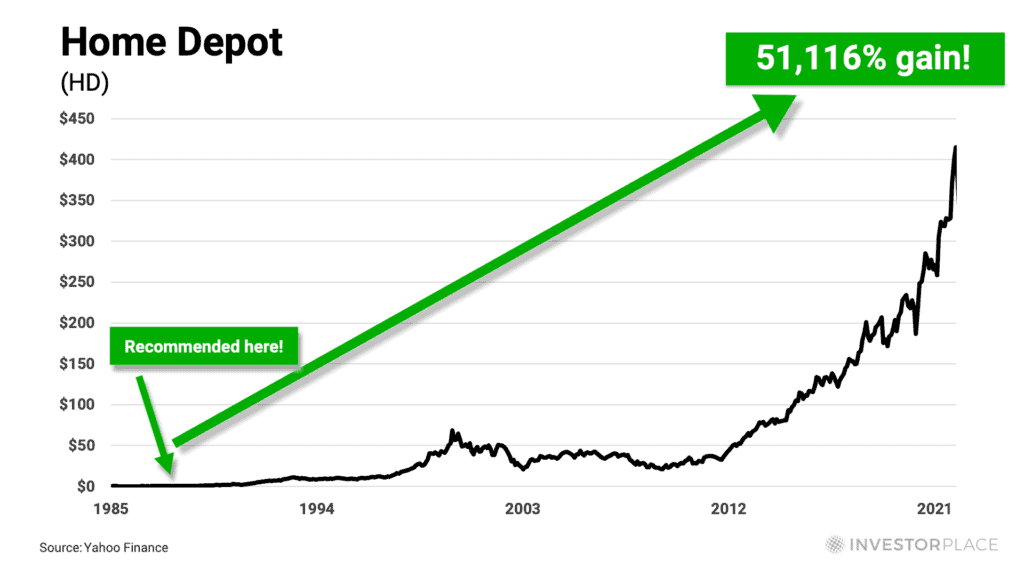

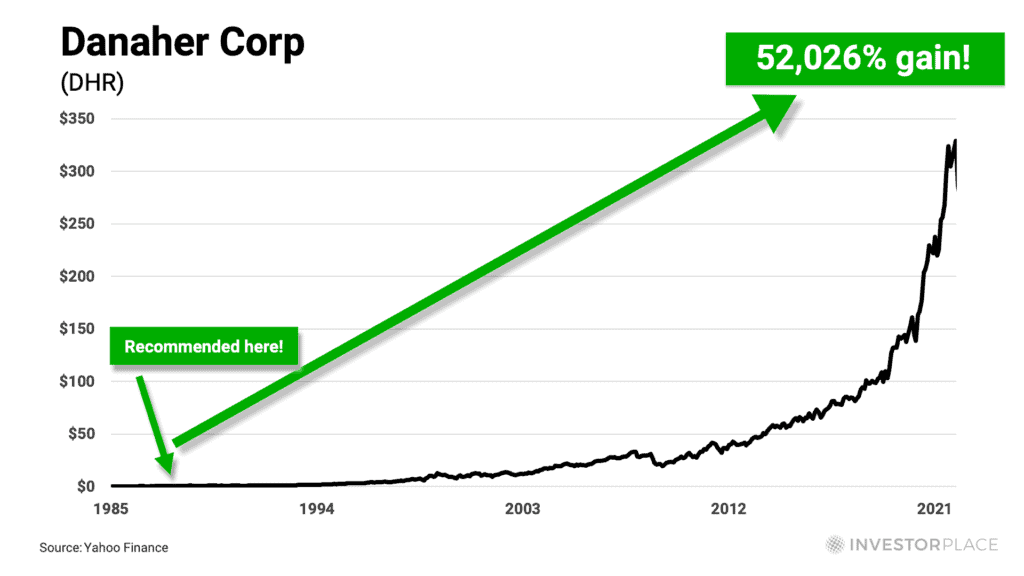

And the list goes on, with returns as high as 52,026%… 60,860%… and 88,655%…

Today, he’s one of America’s richest men.

With over $1 billion entrusted to his care.

You’ll hear more about all of this. Our expert guest will also give you his #1 stock name to buy right now. Along with his #1 stock to dump.

So let’s jump in and get started…

BRIT:

Louis Navellier, welcome.

LOUIS:

Hi Brit, thanks for having me…

BRIT:

Louis, we’ve got a LOT to cover today…

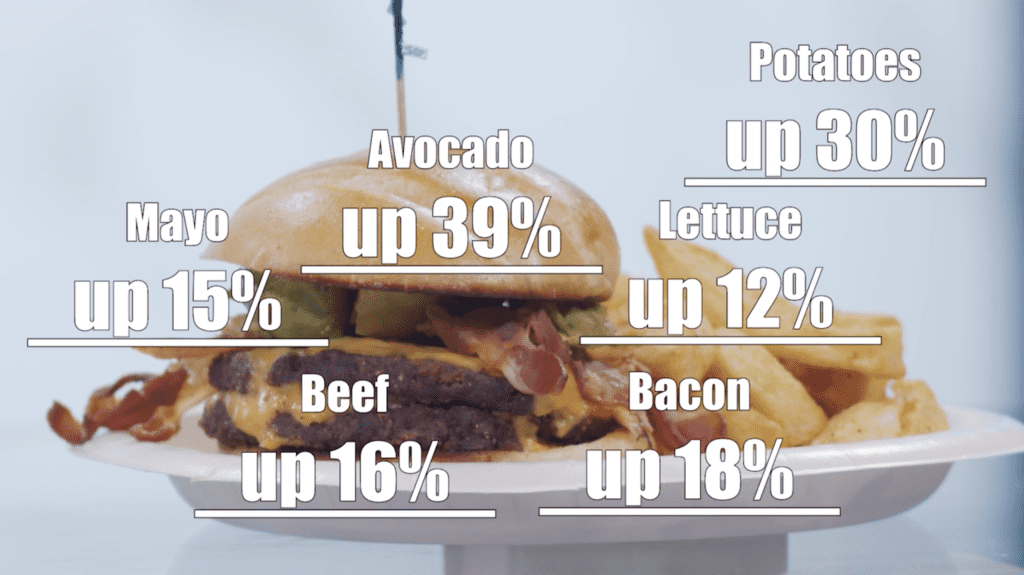

Not the least of which is the fact that, for some reason, there’s a cheeseburger sitting here on this table…

But before we get to any of that…

I hope you don’t mind if I embarrass you for a second.

So, if you don’t mind…

Let’s take a step back to the beginning…

Your family had very little money…

And your father was a bricklayer…

Who worked 60 hours a week…

A start like that really could have limited your options.

Lucky for you, though, you were also a math prodigy.

And you used that to pull yourself up.

By age 19, you’d finished college and were already getting your master’s degree with a concentration on finance and probability…

LOUIS:

That right, and that’s when I got incredibly lucky.

I got a chance to make the discovery of a lifetime.

BRIT:

You’re talking about the day you discovered a unique set of algorithms that’s allowed you to crush stock market returns, year after year…

Despite multiple market crashes, recessions, oil shocks, and worse over the course of your 45-year career…

LOUIS:

Yes, because it was then I met a professor who assigned me to a special project… and got me access to mainframe computers at Wells Fargo so I could work on it.

That's the lucky break that lead me to my discovery.

Using those powerful computers, I was able to figure out a systematic way to beat markets by as much as 3-to-1.

Without hunches. And without a lot of high-risk gambling.

It was all algorithms, coding, and math.

BRIT:

From there, Louis, you finished your Master’s program…

You launched your own financial firm…

And you made your first million by age 30…

And today, you’re a One-Percenter with two mansions…

A luxury car collection…

And over $1 billion in investment accounts entrusted to your care.

LOUIS:

I have to say, I couldn’t have done any of it without the help and support of my family…

BRIT:

I’m sure you’ve been very lucky that way, Louis…

But the investors you’ve helped over those years have been lucky too…

Because, with the help of your system…

You’ve not only helped them discover countless blockbuster gains... but you’ve also helped them navigate no fewer than five recessions … 15 different market crashes… and countless oil shocks, banking panics, terror attacks…

Basically, Louis, you and your system have breezed through just about every kind of crisis that would normally make it difficult to be a successful investor.

Anybody who wants to confirm that – or anything else we're saying in this presentation – can take a look at our details and disclosures page for proof.

And Louis, even now, in the wake of one of the most gut-wrenching market shakeups in decades… with war still raging in the Ukraine… with the endless COVID variants still in the news… and still-high inflation…

I understand you’ve discovered at least 12 different stocks… in the middle of all this chaos… that are already up an average of 20.72%.

That’s just incredible.

And now you’re getting ready to do it again.

You’re about to reveal another major prediction…

This massive $150 trillion “Impact Event”…

That you say could easily unleash some of the greatest gains of your career.

LOUIS:

Just to make sure this is clear, Brit…

Even though I’m convinced this coming “Impact Event” could give our viewers some of the greatest investment opportunities of their lifetimes…

I’m not usually in the business of chasing trends or big events.

At least, that’s not how I pick my best recommendations.

My system is exclusively designed to scour the stock market for individual, high quality shares. No matter what else is going on in the headlines.

If a pattern shows itself – like it’s doing right now – it’s only because my algorithms have picked up on a growing shift in the flow of money.

In other words, we zero in on the companies that stand to profit the most from the next big cycle… rather than identifying big cycles and then looking for stocks.

That’s what I’ve found works best for every kind of market.

BRIT:

And you’ve certainly got the track record to prove it…

With past gains as high as 12,990% on T. Rowe Price… an 8,151% gain on Amazon… 30,243% on Amgen … and 29,229% on Adobe…

And many winning recommendations that span across all kinds markets…

That’s exactly why you’re considered such a legend, Louis.

But before we dive into your big prediction, I’m afraid there’s still more…

Because, even though you’ve just said you don’t usually predict macro events… and that you prefer to let your individual stock picks do the talking…

Your record for predicting major market events is still just as uncanny.

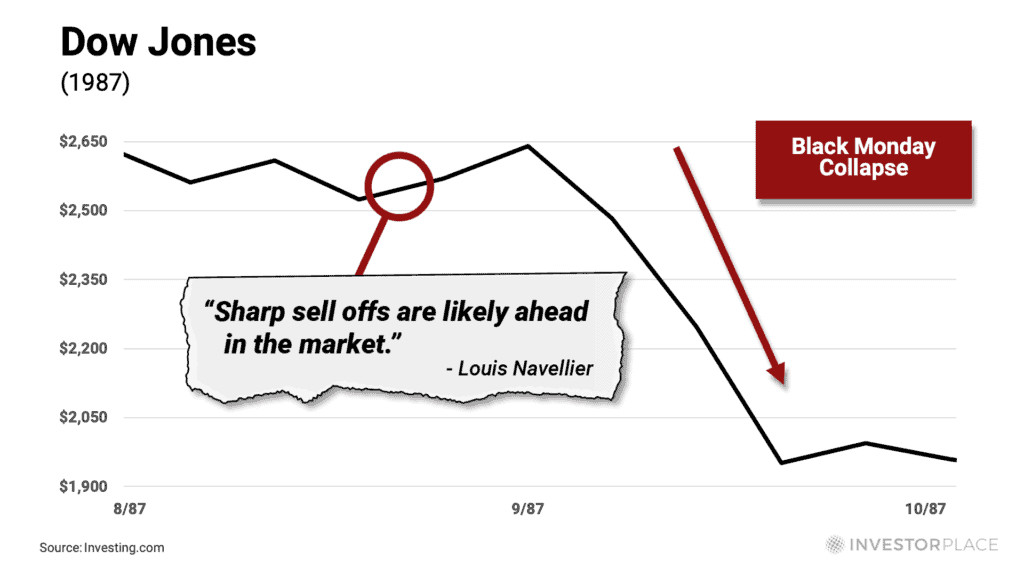

Like the time right before the Black Monday Meltdown of 1987…

When you told your readers, “sharp sell offs are likely”…

Or just before the Dotcom Crash in 2000, when you warned readers to brace for a “serious correction” in Internet stocks…

Or in 2008, when you announced, “A lot of investors are about to get burned…”

And now, Louis, you’re back with another of these rare major predictions… a warning about a major “Impact Event” ahead…

That could simultaneously bankrupt those who don’t see it coming…

Even as it gives a few other, more prepared folks a chance to make staggering gains…

In just a second, you’ll find out exactly what this “Impact Event” prediction could mean for you and your money…

You’ll also get the name and ticker symbol for Louis' #1 STOCK BUY for right now… along with his #1 STOCK TO DUMP IMMEDIATELY… here on camera…

But Louis, now that our viewers have a better picture of who you are and what you’ve been able to do to reshape Wall Street over the last four decades…

There’s still one more elephant in the room we have to address…

LOUIS:

Ha… you’re talking about the cheeseburger.

BRIT:

Exactly. Our viewers will think we brought lunch to the interview!

LOUIS:

That’s not a bad idea, Brit.

But I asked your team to put the burger here for a completely different reason.

See, there are actually three things I want to make sure we do today.

First, yes, I want to talk about this huge “Impact Event” that’s coming.

I also want to show them how to prepare for it. I’ve got a three-step action plan that I can share with everybody at the end of this interview.

But before we get into all that, I’ve got to address the extremely serious situation our viewers and millions of other folks are in right now.

Because, in many ways, they have no idea what kind of risks they’re actually up against. And I don’t just mean crashing stocks or soaring inflation.

There’s something worse… something you’re not being told… that’s going to make it much harder for you to recover from this downturn…

And harder still to get ready for the “Impact Event” ahead.

And the best way for me to illustrate that – without getting lost in a lot of market mumbo-jumbo and economic jargon – is with this cheeseburger…

BRIT:

Louis, I’m getting hungry just thinking about it.

So you’d better start explaining…

LOUIS:

Simply put, everybody is feeling the pain that’s baked into our markets right now. But a lot of investors are confused about how we got into this situation.

Worse, that confusion could hold them back in the days ahead.

And it’s not their fault.

Rather, it’s a phenomenon I call the “Big Money Illusion.”

BRIT:

The “Big Money Illusion”… what does that mean.

LOUIS:

See, for decades, I’ve watched institutions like the Fed and Wall Street feed investors cues about the markets, money, and where we’re headed next.

And investors lap it up.

Economists release a job report, they buy.

The Fed hints at rate hikes, they sell.

And I get it.

Because what else do most investors have to go on, right?

The trouble is, those very same institutions tend to lie.

Or at least, they paint the picture they find most convenient.

Take what you’re hearing about our “official” inflation rate. For years, the government told us it hovered around 3%. Now they say it’s hit 8.5%.

Already, that would be bad – if it were true.

At that rate, if you were to retire tomorrow with a half-million in your account, my calculations show that it would be gone within six years.

A 65-year-old would be broke by 71.

Yet, this burger proves that even that “official” 8.5% rate is ridiculous…

Take the lettuce…

Over the last year, it’s shot up in price by 12%.

Or how about the mayo, up 15%…

And the beef, up 16%…

The bacon now costs 18% more…

While the avocado slices are up 39%…

Even the potatoes used to make the fries are up 30%.

My point is, how are you supposed to invest to beat the soaring cost of living… when the institutions won’t come clean about how fast real prices go up?

Obviously, we’re not just talking about burgers.

This past winter, home heating costs were up 160%…

Right now, gas prices are up 154%…

Meanwhile, home prices are up twice as fast as “official” inflation…

While rents have shot up four times as fast…

And, according to a Harvard study, drug launch prices have shot up – on average – about 20% a year for nearly 14 years straight!

If you get sick and need one of those new drugs, you could be looking at a bill as high as $180,000 a year… just for one prescription!

BRIT:

I see what you’re saying.

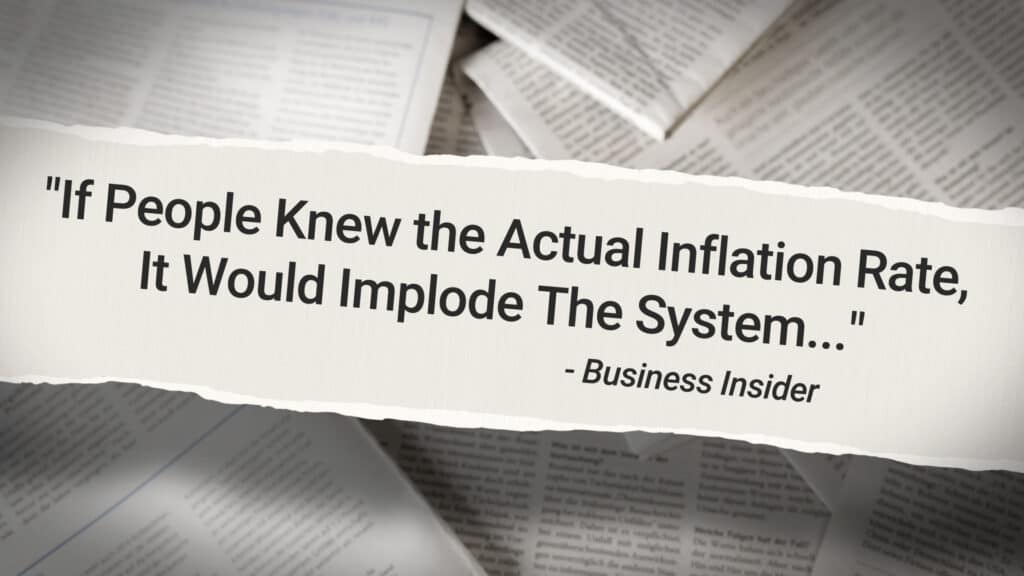

In fact, I saw a headline recently that said…

LOUIS:

It absolutely would, Brit…

Yet, most Americans will never know those real rates. Because it benefits the institutions – and the elites who control them – to keep us in the dark.

They want you to believe they’ve got it under control.

But did you know that, just since the start of the 1990s, the government has changed the way they calculate inflation more than 20 times?

BRIT:

You've got to ask yourself, why would they do that?

LOUIS:

And I can give you an easy answer…

It's because re-calculating the rates to look lower than they are lets the government send out smaller Social Security checks…

It also lets them keep spending and borrowing… keep printing cash… and keep buying votes and support with subsidies and bailouts, without getting questioned about whether any of that behavior is a good idea.

And, unfortunately, that’s just the beginning of this illusion.

See, the next thing the elites want you to believe is that we’re all in this together.

I think Bill Clinton’s line was, “I feel your pain.”

But guess what?

If you think you’re feeling the pain a lot more than others, you might be right. Because we’re not all getting hit equally.

Case in point, take my crowd, the one-percenters.

Yes, we run businesses and have costs. Yes, we fill up at the gas station, same as you. In fact, I’ve got a fleet of luxury cars with tanks to fill.

But, if I’m being honest, am I losing a lot of sleep over inflation?

No.

In fact, a few of us are even making money on soaring prices.

I’m not saying that to brag. I’m just pointing out that we’re not the segment of the economy you need to worry about right now.

Likewise, look at the lower-income crowd.

Sure, they face high gas and grocery prices too. But very few own crashing stocks. Fewer still pay taxes. And most of them got pandemic bailouts.

The real people you need to worry about are Americans stuck in the middle.

And by the way, Brit, that doesn’t just mean people making $50,000 a year.

I’m talking about families with a small business… or with two or three kids in college… and retirees paying high taxes on government-mandated distributions.

Because you can look rich on paper and still live paycheck to paycheck.

BRIT:

And it’s those Americans you really want to warn today…

LOUIS:

Exactly.

Because, even as they struggle to recover from today’s downturn… it’s this group that’s the least prepared for the “Impact Event” I see ahead.

BRIT:

Can you explain what you mean by that?

How are they less prepared than anybody else?

LOUIS:

It’s simple, really.

See, a lot of middle Americans have done exactly what they’re supposed to…

They’ve worked hard. They’ve saved up. They bought index funds. They’ve paid down their mortgages.

But the “Big Money Illusion” has them fooled.

It’s made them think they’re a lot safer than they really are.

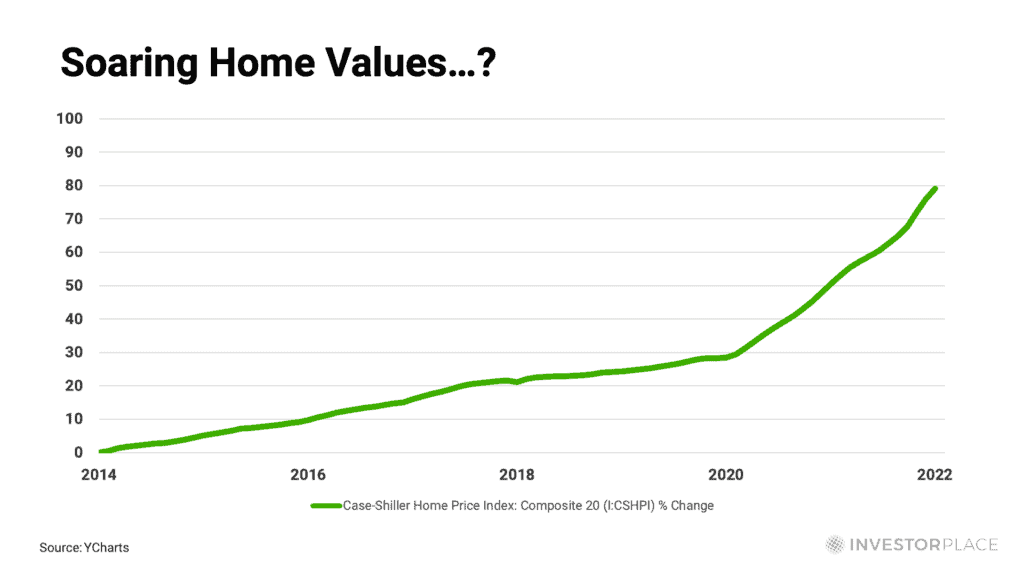

Take one of the biggest assets most middle Americans own – a house.

Let’s say you bought one in the mid 90s for a few hundred thousand.

And now your realtor’s telling you it’s worth $1 million or more.

Sounds great, right?

But look at this…

What you see here is the rising home price index.

But let me ask you, Brit… you have a home… has it gotten any bigger?

BRIT:

Not that I know of…

LOUIS:

So, did it really add hundreds of thousands to your net wealth over the last few years? Or is that also some kind of “Big Money Illusion?”

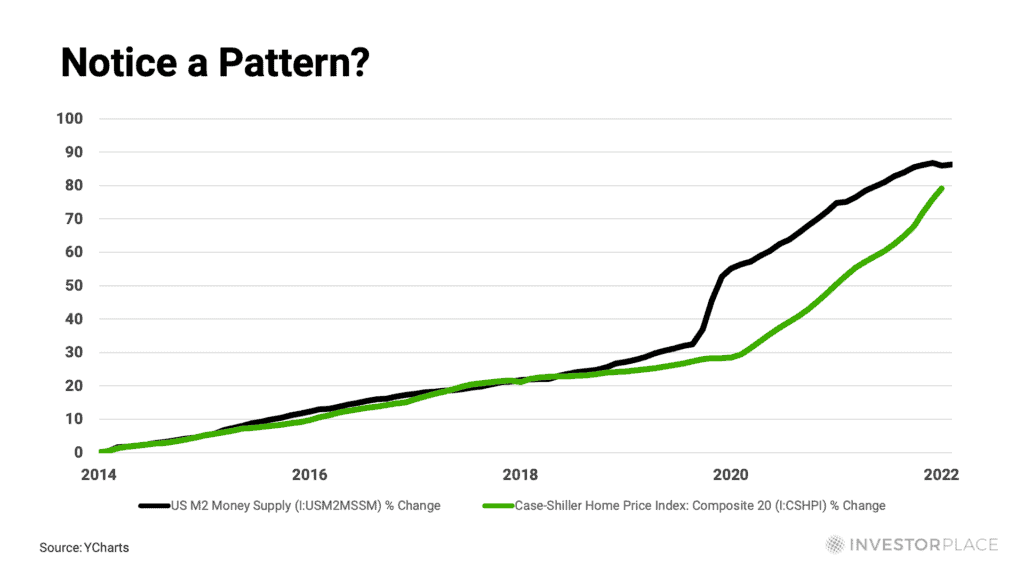

Before you answer let's look at the chart again…

This time, we've added in the soaring money supply.

Notice anything?

BRIT:

Yes, it's almost an exact match.

LOUIS:

Correct… and you'd get a similar match if you compared it to other rising costs like healthcare, college tuitions, and other big expenses.

In other words, it's not so much the value of those things going up… it's that the dollars you use buy them have gone down.

Because our government has printed trillions of dollars in excess cash.

That's the real reason we've got soaring inflation.

It’s the same for those index funds you own.

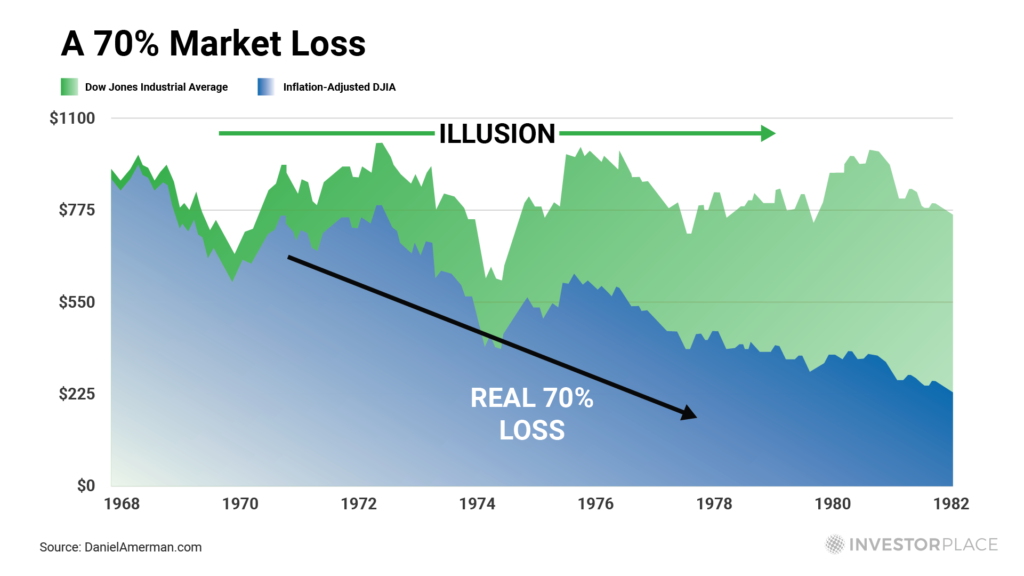

If we can put our next chart on the screen…

What you're looking at now is the market during our last Great Inflation.

As you can see, anybody who tried to retire back then likely had it rough. The top line shows that the Dow went nowhere for fourteen years, from 1968 to 1982.

But now look at the blue line.

That's what the real return was, once you took inflation into account.

In other words, the value of the market actually plunged 70%.

Because 1982 dollars were weaker than 1968 dollars.

BRIT:

And you’re saying that’s what’s happening now?

LOUIS:

I’m saying that's what happens any time you’re trying to measure market performance against the backdrop of this “Big Money Illusion.”

Because inflation – whether it’s the “official” rate of 8% or even just 3% or the unofficial real rate of rising prices – is always going to cut into your returns.

BRIT:

So, if you can’t beat those rates…

You’re in trouble…

Because you’re going to fall behind…

LOUIS:

That’s correct.

And because the “Big Money Illusion” distorts the truth about how much you’re actually at risk of falling behind, it’s not enough for you to just beat rising costs.

You have to beat them by a LOT.

That’s the only way you can ensure enough margin to keep you safe.

Fortunately, there’s an easy way to do that.

BRIT:

Gold? Real estate? Inflation-protected bonds?

LOUIS:

Believe it or not, it’s none of those things.

After four decades of studying markets, I'm absolutely convinced that the single best way to get out ahead of rising costs…

And the single best way to consistently beat markets…

Is as simple as owning the highest-quality individual stocks you can find.

Preferably, while their share prices are still low and the rest of Wall Street is starting to pile in.

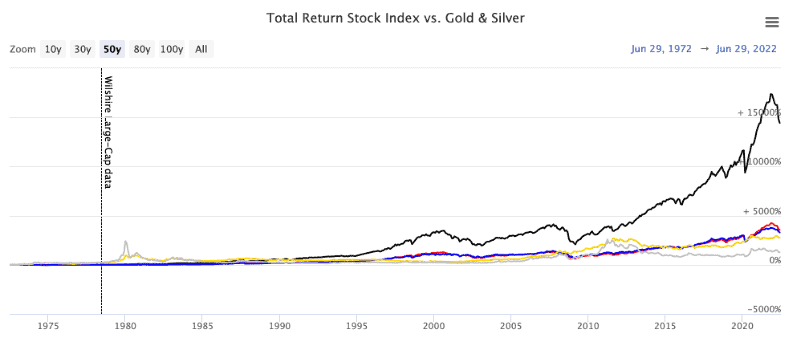

Let me show you what I mean in one more chart…

What you’re looking at is a performance comparison of gold… silver… the Dow and S&P indexes… and a blend of high-quality, cash-rich company shares.

Keep in mind, we’re talking about 45 years of data…

Including oil wars and gas lines… recessions, crashes, and currency collapses… even multiple terror attacks and political scandals…

And as you can see, the cash-rich companies absolutely crushed the other investments. In good times and bad.

BRIT:

So, to make sure this is clear…

You’re saying the key to recovering from this crushing bear market…

And the key to getting ready for this “Impact Event,” going forward is to simply identify as many of these cash-rich, quality companies as you can…

While prices are still low enough that you could make a substantial return.

LOUIS:

Yes, that’s exactly right.

BRIT:

Okay, Louis, so… we’re getting close to the big reveal.

You’ve laid the groundwork… you’ve spelled out the hidden risks that we all face… and, in just a second, you’re going to show us what’s coming…

Just to remind viewers, Louis will also name his #1 STOCK BUY… here on camera… along with his #1 stock to sell, ahead of this major market event…

But Louis, before we lift the curtain…

You’ve just told our viewers the single best way to beat markets — in this or any market — comes down to holding premium-quality individual shares.

And to own them before the big money shows up.

I just want to echo what viewers might be thinking. Because, clearly that’s not easy… or everybody would be doing it.

And yet, I’ve got more proof here that over the course of your legendary career, you’ve managed to do exactly that. Over and over again.

Take this quote from the Wall Street Journal, where they wrote…

Or the New York Times, who reported…

And Kiplinger's Personal Finance, who said…

In other words, with the help of your amazing market system, you’ve found the stocks that crush markets, in good times and bad…

Over his spectacular career, Louis' system has helped to identify…

LOUIS:

That's always the goal, Brit.

After all, just because markets are shifting, that doesn't mean there's nothing out there to buy. You just need to know where to look.

That's exactly what my system is designed to do.

BRIT:

Like the times you recommended Amgen at 86 cents… T. Rowe Price at 98 cents… Oracle for just 51 cents… Microsoft at 38 cents… and Apple at 37 cents…

In fact, I had my team do some number crunching. When we took a look at your top 100 picks over the last four decades, we found that the average split-adjusted buy price on shares you identified clocked in at just over $3.70.

That’s incredibly low.

Especially when you consider the average share price on those same top recommendations went on to hit $200 each.

That works out to an average gain of 9,171%.

Talk about staying ahead of inflation!

Again, that’s just the average.

Over the course of your career…

You’ve had many picks that went much, much higher…

Like your Nike recommendation, which shot up as high as 65,390%…

On Home Depot, they could have seen as much as 51,116%…

On Danaher Corp, they could have gained as high as 52,026%…

Your Amgen pick shot up 30,243%… Progressive Corp jumped 16,520%… and Ross Stores was up 19,869%… Teva Pharmaceutical was up 12,991%…

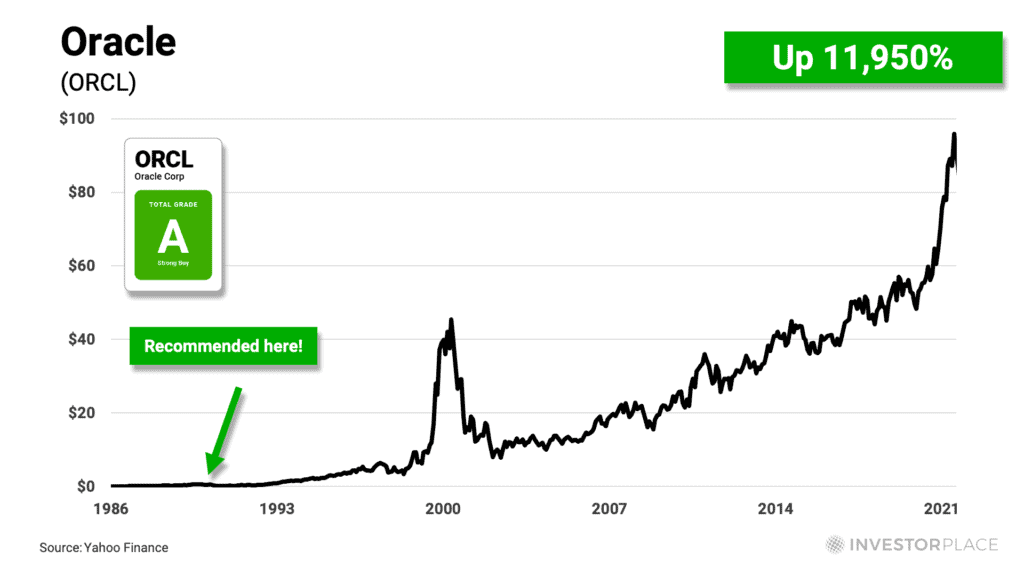

You also pegged Amazon for 8,151%… Netflix for 7,750%… plus Oracle, for 11,951%… and we’re still not even close to listing your top 100.

And like I said, you’ve done it all during every kind of imaginable market.

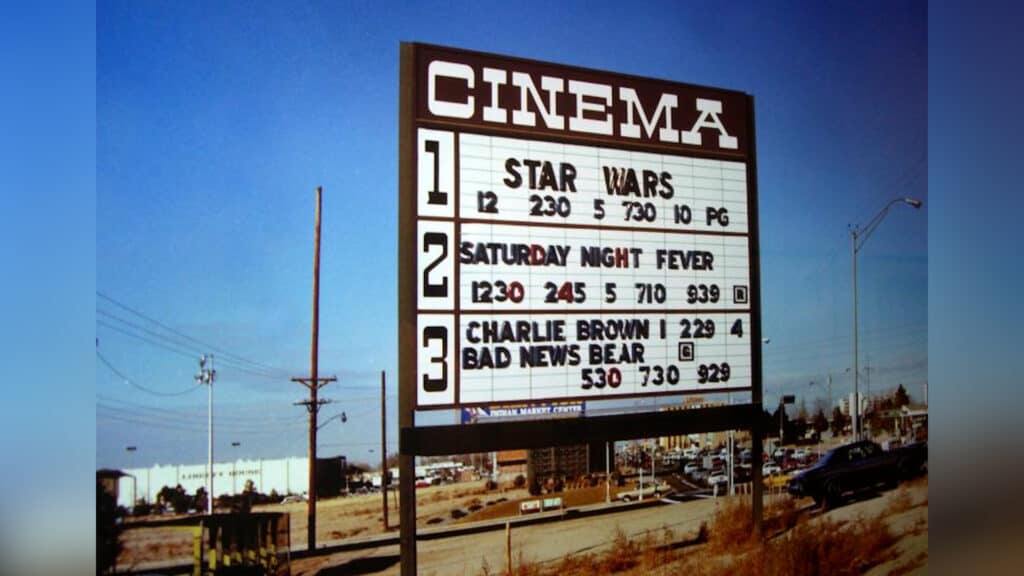

In fact, the year you discovered your system was 1977.

Star Wars was still in movie theaters…

Jimmy Carter was in the White House…

And our last Great Inflation was still raging…

LOUIS:

I remember it like it was yesterday.

In fact, we had a situation a lot like the one we’re in right now. High gas prices. A volatile market. Uncertain politics.

BRIT:

And yet, there you were…

A 19-year-old grad student, fresh off the discovery of a stock-finding system that not only changed your life…

But would go on to change the entire face of Wall Street.

In fact, the approach you helped pioneer – called “quantitative investing”— helps drive the highest share of stock trading volume worldwide.

It's no wonder Forbes dubbed you, “The King of Quants…”

And Business Insider once called your underlying approach…

Naturally, I can’t think of a better tool to help guide folks out of this mess we’re in right now… or to help them survive the “Impact Event” you see ahead.

So, Louis, we’ve kept everybody on the edge of their seats long enough.

Let’s lift the curtain and reveal your big prediction.

Tell us about this $150 trillion “Impact Event”…

LOUIS:

Let me start by asking you, Brit…

When you hear other people talk about the reasons for today’s financial crisis, what are some of the things you hear them talk about?

BRIT:

Well, let’s see… there’s all that stuff about supply lines… and the huge Covid bailouts… the war in Ukraine… and, of course, record high gas prices…

LOUIS:

And boom… right there.

If there’s a common thread, it’s that one… high gas prices.

Think about it.

What’s the backbone of every economy on earth? Energy.

Already, it’s a $6 trillion global industry.

From the trucks that carry fruit to markets to the ships that imported your flatscreen TV… and to the plastics and parts used to make your computer…

Energy prices are baked into everything you buy.

For years, we’ve had an oasis of low prices. We barely had to think about it. And prices for just about everything reflected that. But those days are gone now.

For years, we’ve had an oasis of low prices. We barely had to think about it. And prices for just about everything reflected that. But those days are gone now.

Why?

Take Putin’s war in Ukraine…

As bombs rained on Kyiv, over 1,000 companies have cut back or cut off operations in the Russian market — including some of the world’s biggest oil companies.

As bombs rained on Kyiv, over 1,000 companies have cut back or cut off operations in the Russian market — including some of the world’s biggest oil companies.

Meanwhile, the entire European Union just agreed to cut most of its ties to Russian gas and oil.

So now, ask yourself this… do you think that, once the war on Ukraine finally ends, those companies will go back and re-invest billions in Putin’s backyard?

How about the EU?

Russia was their #1 supplier.

Now they’re looking at freezing this winter and paying gas prices close to $10 a gallon.

How soon do you think they’ll want to rush back to Putin as a provider?

At the same time, you can’t take the world’s third largest energy producer offline without consequences.

All by itself, that’s a disruption that could impact oil markets for decades.

And then there’s the world, post-pandemic. Remember how, before Covid, all anybody could talk about was the “globalized” economy?

We’ve seen the risks that creates.

And now the world is de-globalizing just as fast. We’re duplicating business and looking to localize energy.

That’s going to boost costs.

It’s also going to force countries without oil to develop alternatives.

But here’s the final piece of the puzzle.

For years now, you’ve heard politicians, scientists, and an increasing number of companies talk about de-carbonizing the world economy.

Whether you think that’s a good idea or not… whether you think it’s possible or not… it’s no longer a small minority that’s saying it.

At least 136 countries…

Representing 80% of the world population…

And 91% of the world GDP…

Have signed on to hit the reset button on global carbon economy.

And it’s not just countries and governments.

More than 700 private companies have also jumped on the bandwagon.

Big companies like Walmart… Amazon… Apple… Volkswagen… BP and Royal Dutch Shell… Ford and Honda… JP Morgan… Chevron… Microsoft.. Verizon…

We’re talking about a massive segment of the world market.

Of course, nobody’s switching to a de-carbonized economy until the technology is there. Meaning, it has to be better and cheaper than today’s energy.

That just means you’re going to start seeing money pour into innovation, as a way to cut down those costs.

So not just wind and solar and the usual suspects, but huge investments in hydrogen fuel cells… lithium batteries and lithium substitutes…

Networked storage… EV companies… smart grids… hybrids and hydro… as well as investments in energy tech that has yet to be discovered or developed.

Even old school industries could grab new traction during the transition.

Oil companies will likely become “integrated energy” companies, hedging their bets with new energy-tech research.

Old school miners could transition to producing new key minerals.

Construction companies will transition to using low-carbon cement.

Forbes is saying we could see a third of all Fortune 500 companies replaced by firms that will innovate and support the de-carbonized global reboot…

And Bank of America says this is an epic transition that could play out for three decades… at an annual average investment cost of $5 trillion per year…

For a total of $150 trillion, before it’s all said and done.

The inflation that will cause… the market disruption… the rebalancing of entire economies… it's absolutely staggering…

BRIT:

It's true… $150 trillion isn’t just a lot of money…

It’s an unimaginable amount of money…

LOUIS:

And yet, Brit, this isn’t just some throwaway political idea anymore. This is already picking up steam in the private sector.

We’re talking about over 450 banks, insurers, pension funds, and asset managers… in 45 of the world’s richest countries…

Including firms like BlackRock, HSBC Holdings, Morgan Stanley, and Deutsche Bank… who have already committed over $130 trillion in capital…

This is happening.

BRIT:

So, I should start selling all my oil stocks?

LOUIS:

Absolutely not.

In fact, I predict you’ll see $150 oil before you see it crash to zero.

Look, this is a huge movement… and $150 trillion is a massive amount of money to flood into the market… but this impact won’t be pretty.

Take the transition to EV cars.

No question, they’ve exploded in popularity.

They’ve taken a college dropout, Elon Musk, who used to sleep on his office sofa and shower at the YMCA… and made him the richest man in the world.

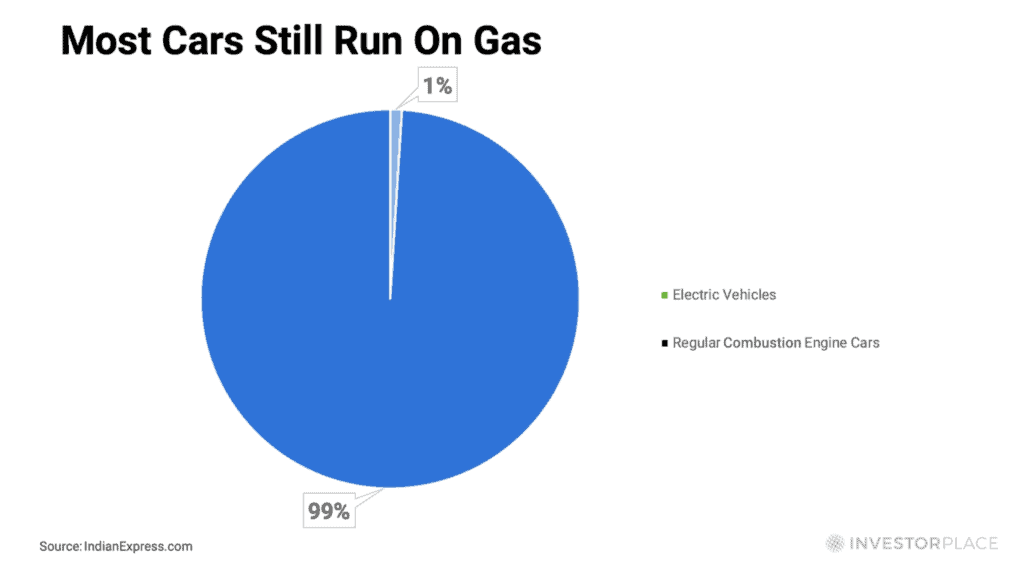

And yet, as you can see here…

Right now, EVs represent less than 1% of the 250 million vehicles on US roads.

And less than 5% of all the cars sold worldwide.

That pace is definitely picking up.

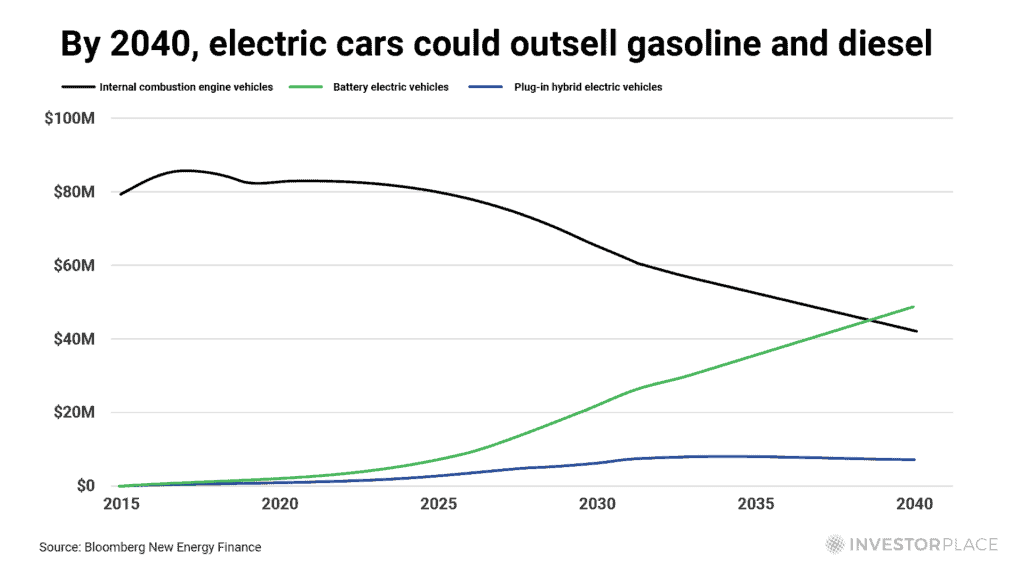

But, even according to Bloomberg, EVs won’t dominate car sales until 2040…

That’s 18 years away.

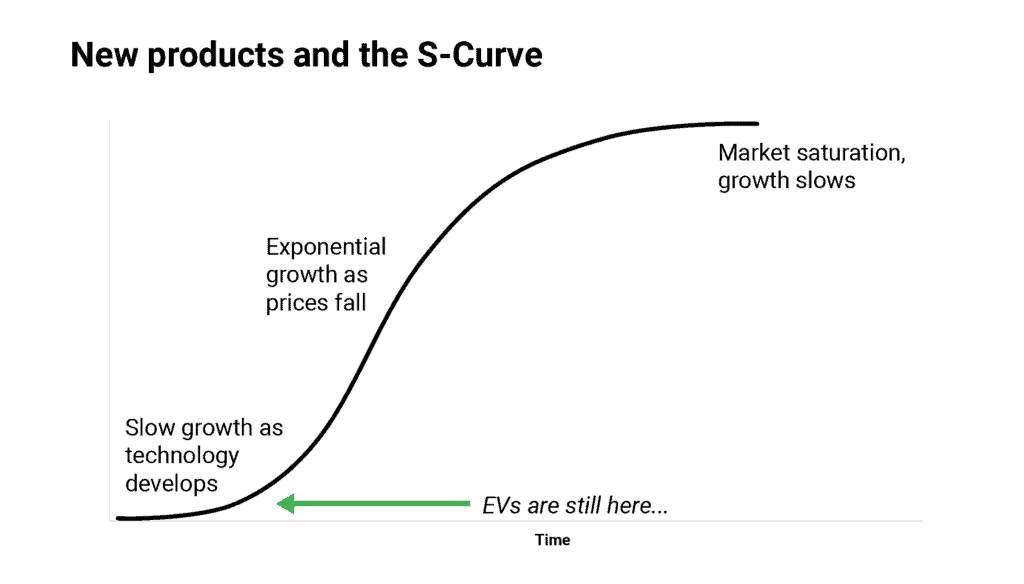

Make no mistake, it could easily happen faster.

We know from past tech megatrends that adoption has a way of picking up momentum and taking everybody by surprise.

With innovation and trillions of dollars in investment cash about to slosh around in energy markets, EVs could go exponential.

Like we saw with the Internet. Like we saw with the Silicon Age. Like we saw with the adoption of radio and television.

Still, we’re still at the very earliest stage…

What’s more, you can’t build EV cars without plastics.

And plastics use oil.

We also don’t have viable electric airplanes or cargo ships yet.

Meanwhile, the utility companies that will charge all those new EV batteries still largely run on coal and natural gas.

On top of that, you have to figure the failure rate for startups in every megatrend – even the most successful fundamental tech transitions of all time – is 90%.

As this $150 trillion tsunami of cash enters the market, we’ll likely get more winners like Tesla. But we’ll also get duds that aren’t worth a nickel.

In other words, bank on plenty of opportunities to buy explosive new energy tech… with a massive megatrend that has 30 years to run…

But before that, bank on the fact that demand for regular oil and gas isn’t going anywhere, anytime soon.

BRIT:

So this coming “Impact Event” is really a chance to make a lot of money on old and new energy markets.

LOUIS:

To put it another way, you know already I love collecting cars.

I've owned at least three hybrids and I've got a luxury EV which – by the way – is in the shop right now because it won't charge.

Meanwhile, I’ve got several classic, gas-burning sports cars, hot rod trucks, and four-door sedans too. I’m not going to let them rot or give them away.

So yes, I’m looking at EV stocks… battery stocks… and other new energy companies. But I’m absolutely tracking classic energy stocks.

In fact, I believe we’re headed for what could be the LAST GREAT OIL BOOM in our lifetimes. And I’ve written a whole report on it.

It’s called “Five New Buys For The World’s LAST Oil Boom.”

Inside, it lays bare the names and ticker symbols of five great companies that could not only rocket higher on surging oil prices… but could surge exponentially higher.

Because they’re leveraged to the price of oil, which means even small upticks in the oil price could show you big returns.

BRIT: Leveraged gains… can you explain what you mean by that?

LOUIS: Sure.

See, I’m not the only one who sees years of high-priced oil, leading up to this $150 trillion global energy “reset.”

Rystad Energy, one of the world’s leading research firms, says oil could hit $200 a barrel…

Goldman Sachs also came out with a $200 target, as early as last March… and they're still making the case for rising oil prices right now.

What’s sure is that money – trillions of dollars’ worth – will flow into these companies. When it does, you want to own the best ones at the right time.

Even Fortune magazine recently wrote…

As I said, my own forecast is at least $150 a barrel.

Already, that’s more than double what oil prices were before the pandemic.

But now you’ve got Goldman and other experts…

Saying oil could go as high as $200 or more.

Regardless of whether they’re right… or I’m right…

Remember what I said earlier…

When oil prices soar, they send shocks through our entire economy.

That fact alone could throw water on the Fed’s plans to beat back inflation.

Factor in the flood of money that this $150 trillion “Impact Event” could unleash, and you could see even the “official” inflation rate jump as much as 3% higher.

In other words, we could be looking at combined 5% or 6% inflation as the “new normal.” Not just for the next few years… but for decades to come.

That’s not factoring in the other trillions of dollars in entitlements and spending programs we’re sure to see over the years ahead.

Like I said, it’s not enough to match or beat those numbers.

If you want to get richer, you need to beat them by a LOT.

That’s why I don’t want anybody watching to feel satisfied with just a double or even a triple. I want to give them a chance at 10X or 20X returns.

That’s why my team and I have used our algorithms to zero in on five oil companies that won’t just track oil, but could jump many times higher.

How?

By focusing on firms that have a better than 1-to-1 relationship between upticks in the oil price and their own surging oil revenues, earnings, and cash flow.

That way, even as oil prices goes up $5 or $10, these companies we’ve isolated could see their many times that jump in their share prices.

For instance, take the first company you’ll find in my new report.

In the first quarter of 2022, they posted a 318% gain on year-over-year energy earnings.

Compare that to the S&P, which posted 4.4% earnings growth earlier this year.

Already, that’s one of the reasons I’m calling it my #1 BUY for this first oil-centric phase of the coming $150 trillion “Impact Event.”

Not only is it seeing explosive growth, it’s also cheap.

It’s got a price-to-earnings ratio under 9 – that’s an incredible bargain during a surge in oil prices.

What’s more, this first recommendation in my report is loaded with cash. Which is why this same company can afford to pay you a fat 6.6% dividend.

And it’s just one of five companies that could give you a chance to bag huge profits, as the early stages of this “Impact Event” unfold.

BRIT:

And of course, Louis, you promised our readers you would reveal your #1 BUY… here on camera… are you ready to do that right now?

LOUIS:

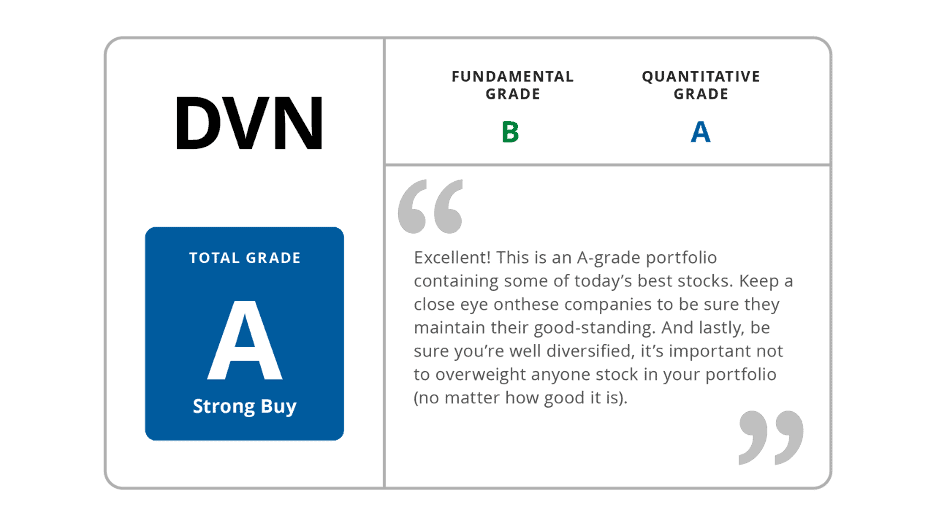

I am, Brit… my #1 STRONG BUY…

Which, of course, means that it has also earned a rare “A” grade from my rating system…

Is none other than Devon Energy with the ticker symbol, “DVN”…

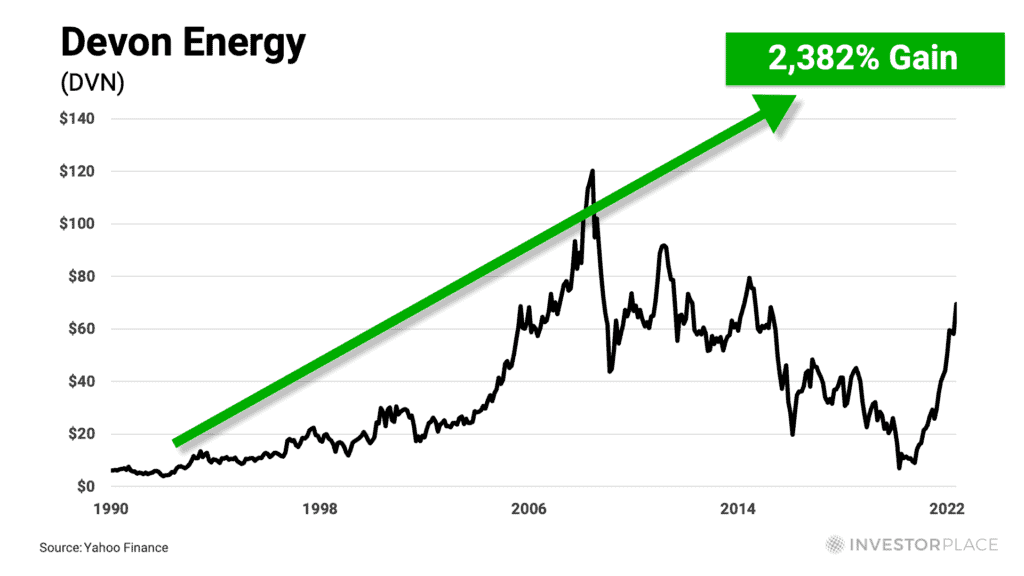

By the way, it’s not the first time my system put Devon on the radar screen. I also came across it as buy before oil shot up in the early ‘90s…

As oil took off, Devon’s shares rose 2,382%.

Of course, those are exceptional gains.

And my system doesn’t always get it right, since nothing in the market is guaranteed. All investments carry risk.

But it’s solid proof that when you buy the right companies… at the right time… you’ve got a chance to make some impressive returns.

I’m convinced all five companies you’ll find in “Five New Buys For The World’s LAST Oil Boom” are perfectly positioned for incredible growth.

Of course, I can’t name the other four here.

I have a research team to pay.

But I’ve worked out a special offer for our viewers, which will allow my publisher to send you a copy of “Five New Buys For The World’s LAST Oil Boom”— free.

In fact, that would be the first of three steps I’d recommend for viewers to take – let me send you the full copy of this report…

So you can get ready for the first tremors of this “Impact Event.”

BRIT:

So, step one – and it’s a good one – send for the report, study the five oil moves inside, and you’ll get a chance to lock in an exponential return on oil’s next uptick.

LOUIS:

That’s right – as much as 10X or 20X, if my system is right about these five “A-Grade” moves. And I have to say, we've got a strong history of getting it right.

BRIT:

Which is a perfect segue into my next question.

You mentioned “grades” for stocks.

And we’ve talked about how your system has picked stocks that beat markets in all kinds of conditions, both good and bad.

I know a lot of Wall Street insiders and experts have paid top dollar to get access to your methods… but can you tell us at least a little about how you do it?

LOUIS:

Well, it’s a little more complicated than we’ve got time for here. After all, we’re talking about 45 years of calculations, analysis, and perfecting my algorithms…

But if I can simplify it for our viewers…

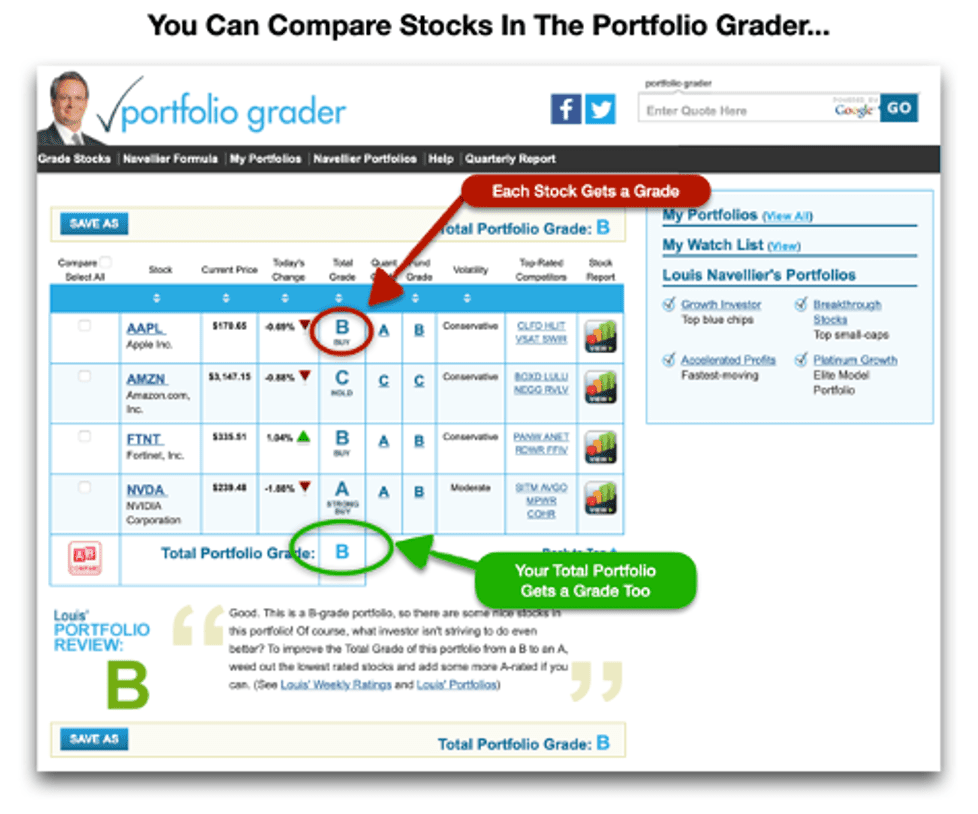

Every week, my team collects data points – what I call “precursors” — for over 6,000 stocks. There are eight precursors we analyze for every stock.

Each of the eight — sales growth, operating margin growth, earnings growth, cash flow, return on equity and a few others – reveal the quality of a stock.

In all, that adds up to nearly 50,000 data points. We apply my algorithms to all of them at once, using a bank of high-powered computers.

Then we simplify the data to assign “grades” to each and every share.

They work just like the grades you know from high school.

If a share earns an “A” grade or a “B” grade, you can decide to buy more.

If it’s a “C” grade, you should hold.

If it’s a “D” or “F” grade, run for the hills.

Which leads me to step two of the action plan I want to give our viewers…

See, once you discover how well my grading system works, I'm guessing you'll want to get those grades for other shares too – like shares you may already own.

Or even the shares you're just thinking of owning.

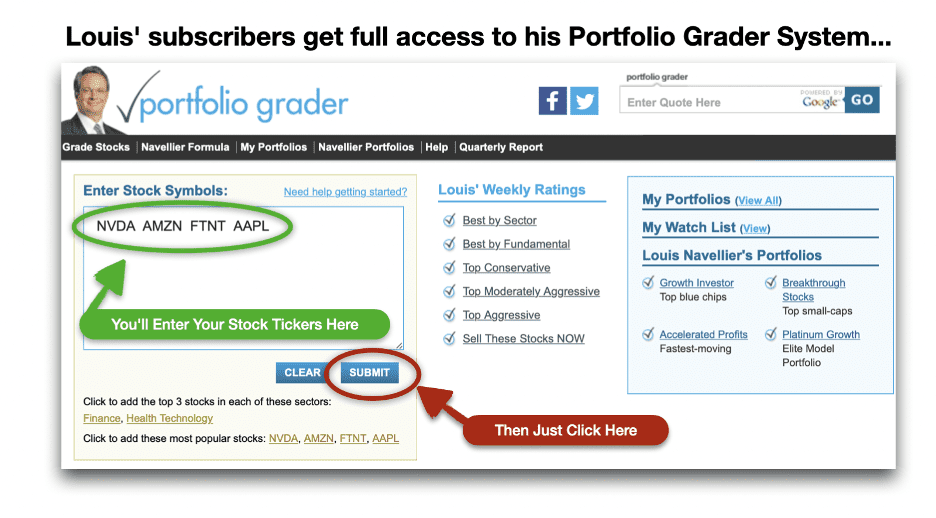

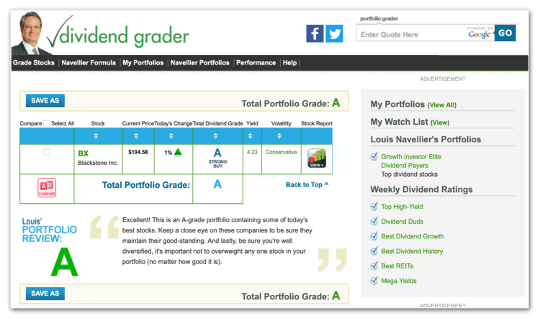

That's why I’ve also created an easy research tool you can use to get grades for almost any other stock you want to see evaluated.

That tool is called my “Portfolio Grader”…

You can use if for free, as part of the special offer my publisher and I have put together.

All you need to get started is a ticker symbol.

Just enter it into the box and hit submit.

My algorithms will do all the work behind the screen. Within seconds, you’ll get a full “grade” for that stock, so you’ll know exactly what to do.

You can use this tool to grade every share in your portfolio…

Only you can see which tickers you enter.

This is just for you to get a clear, unbiased gauge on whether you’re holding the right stocks – or to get an unbiased view on what to buy or sell next.

It’s easy to do.

And I’ve had incredible success with the results.

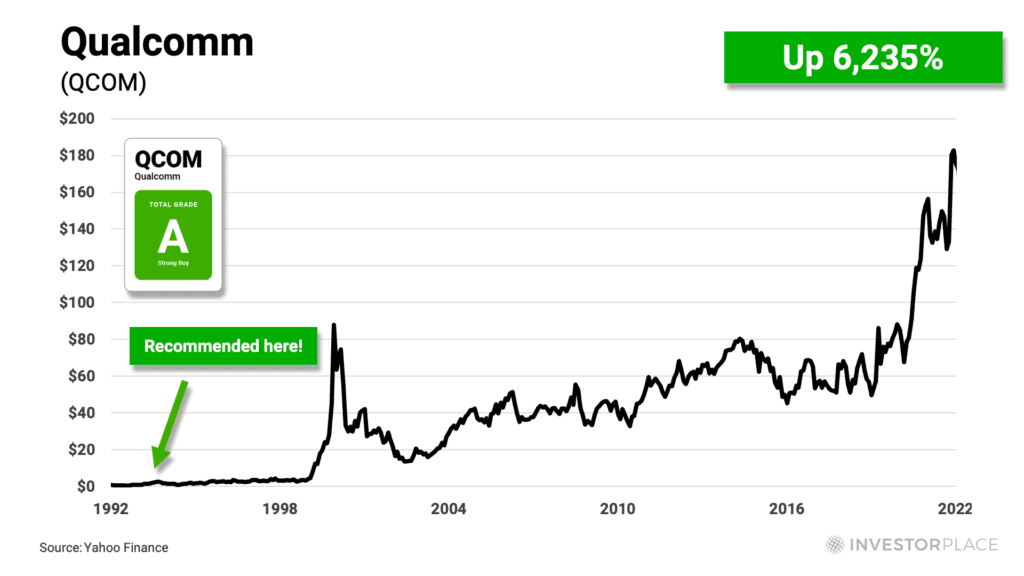

For instance, Qualcomm was an “A” grade stock, according to my system… right before it exploded for a 6,235% return…

So was Oracle, before it shot up nearly 11,950%…

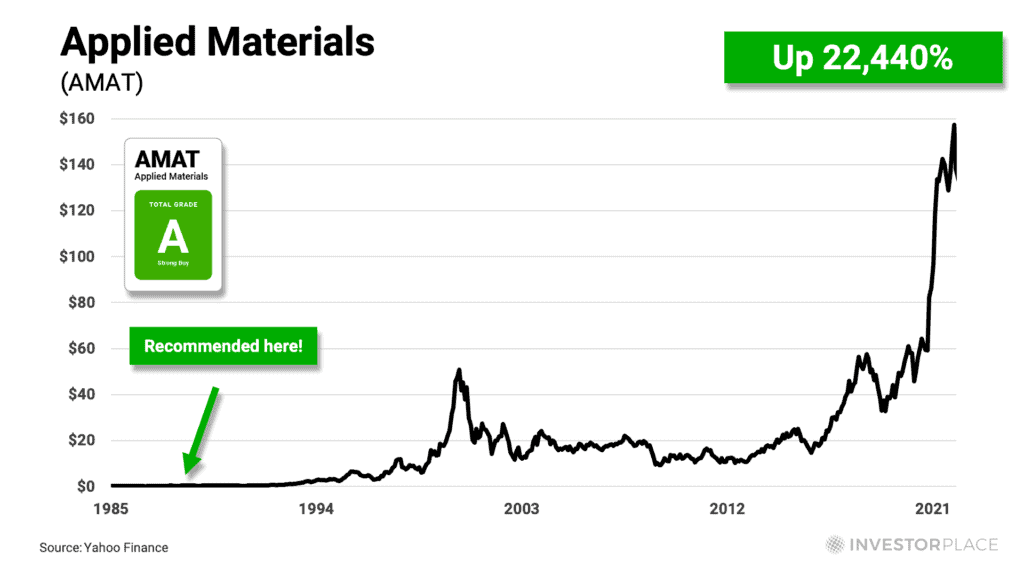

And so was Applied Materials, which soared 22,440%…

BRIT:

Let’s just repeat that so it’s clear.

The algorithms that you’ve packed “under the hood” in your free Portfolio Grader are identical to the algorithms you use in your regular recommendations.

Algorithms you’ve used to pick winners like…

Amgen, for a gain of 30,243%…

Progressive Corp for returns of 16,520%…

Ross Stores for 19,869%…

Apple, up 36,165%…

Teva Pharmaceutical, up 12,991%…

Microsoft, for another 60,861%…

And you’re ready to give viewers access to your Portfolio Grader free, starting right now, as part of the special deal you’ve put together.

If you don’t have a link to it yet, you can get it today.

We’ll include one when you accept Louis’ invitation below.

It’s yours to use as often and however you like.

But before we race ahead, Louis…

You’ve just said your team grades more than 6,000 stocks every week.

We know you’re seeing high grades on energy stocks.

But what else are you seeing rise to the top?

LOUIS:

Right now, I’ve got 32 stocks in my model portfolio that show “A” and “B” grades. That’s too long of a list to give you here.

But let’s just say, my system always takes us to where money flows.

When inflation rages, that means my system will uncover companies that prosper from inflation.

If we shift to a recession, my system will shift gears and start identifying the companies people still count on when times are rough.

It's really that simple.

Of course, Brit, it’s not just the top-graded stocks you need to watch.

We're also uncovering “D” and “F” graded stocks you need to dump. Especially in a market like the one we're experiencing right now.

That’s why I’ve identified the ten most toxic of these shares in another new report. It’s called, “10 Toxic Stocks to Sell Immediately.”

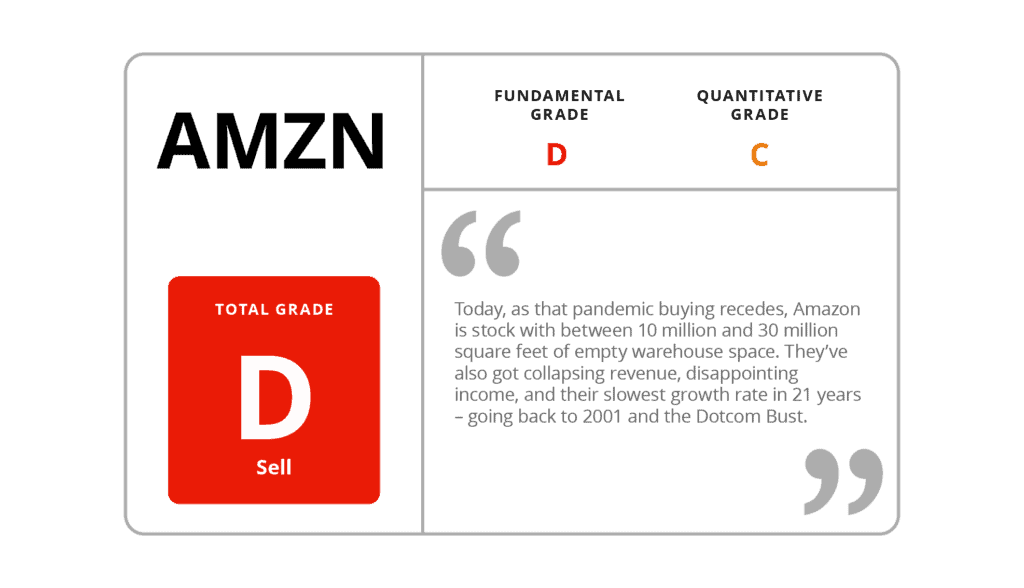

BRIT: Can you give us the #1 stock on that DUMP list?

LOUIS: Yes, my #1 share to DUMP…

And this is going to take a lot of investors by surprise…

Is Amazon…

Which of course has one of the most famous ticker symbols on modern-day Wall Street, AMZN.

It might sound crazy or impossible to a lot of people that Amazon…

The very same company that made mega-billions for Jeff Bezos…

Is suddenly scraping rock bottom on my grading scale…

But the fact is, we’ve come a long way from their glory days at the height of the pandemic, when everyone did so much extra shopping online.

Today, as that pandemic buying recedes, Amazon is stuck with between 10 million and 30 million square feet of empty warehouse space.

They’ve also got collapsing revenue, disappointing income, and their slowest growth rate in 21 years – going back to 2001 and the Dotcom Bust.

Of course, the other nine stocks on my DUMP NOW list include more shockers.

Like one incredibly popular media company that just posted an overall “F” grade…

Plus two more pandemic darlings with a lot farther to fall… and a household-name communications company our viewers are highly likely to own…

Along with two extremely popular social media companies… and a famous retailer you know well, all with SELL NOW grades, according to my algorithms.

They’re dead weight and could drag down your performance.

You should think about dumping every one of these shares.

You can get the names and tickers in your report, “10 Toxic Stocks to Sell Immediately.”

BRIT:

So, if I can recap…

The first step you recommend to our viewers, to help them get ready for this “Impact Event” and the $150 trillion, multi-year megatrend on the horizon…

Is for them to let you send a copy of, “Five New Buys For The World’s LAST Oil Boom,” which lays out the five energy stocks that could soar in the first phase of this event.

Second, you’re telling our viewers to re-evaluate every share they own or hope to own, so they can separate all the top-quality shares from the most toxic.

And you’re offering to give them full access to your proprietary, easy-to-use “Portfolio Grader” to help them do that, for as many stocks as they like.

You’re even ready to send them a report — “10 Toxic Stocks to Sell Immediately” – that will name ten toxic shares to dump right now…

And your third step?

LOUIS:

Already, Brit, if our viewers are doing those two things…

Making sure they’re in the right oil stocks for this first, chaotic phase of the massive $150 trillion new energy megatrend ahead…

And making sure they’re getting OUT of the most toxic “D” and “F” graded stocks, both for right now and going forward…

I believe they’re going to do a lot better than most investors.

But there’s one more step I’d like to see everybody consider taking right now, to help them survive and thrive in the turbulent markets ahead.

And that’s investing for income.

Whether you’re talking about soaring costs and inflation…

Or a possible recession, where paychecks are shrinking…

That means it’s absolutely critical for retirees and anyone else looking to cover expenses, to develop new, reliable income streams.

Few investments are better for getting you that income than high-quality, reliable stocks that will pay you dividends, just for owning shares.

That’s why, in addition to those first two reports and other research, I want to give viewers full access to another one of my proprietary research tools.

I call it the Dividend Grader…

It’s also included free with today’s special offer.

It works just like the Portfolio Grader, except it uses four other key data points to grade high quality shares that also pay income.

Trust me, you’ll want to have this kind of cash coming in over the months ahead.

Use the tool to grade income-paying stocks you own, want to buy, or just want to explore at a deeper level.

To help you get started, there’s a third free report I want to include with today’s offer. It’s called, “Three Golden Income Opportunities.”

One of the opportunities has already helped readers of my regular research see gains of up to 733%. All three can show you higher income than CDs or bonds.

BRIT: With those three steps, Louis…

The inflation-ready plays that could pay up to 10x profits… the 10 toxic stocks to dump immediately… and the three exceptional, high-quality income recommendations…

You’re already offering to help our viewers cover a lot of bases.

And, I think it’s safe to say, you're giving them all a better chance to protect themselves from this looming “Impact Event…”

But there’s still more, isn’t there?

LOUIS:

That’s right…

Because, as you know, the key secret to success for my system is that it doesn’t fixate on headlines or trends outright…

Instead, it starts with the quality of specific, individual shares… no matter what sector they’re in… or what the rest of the market is doing.

For my team, it’s all in the numbers.

That means, if something changes, a stock can get downgraded… or upgraded… and it can change from a BUY… to a HOLD… to a SELL… overnight.

It rarely happens that fast.

Most stocks in my system hang on to their buy status for around four to six months. When the market pivots, new high-quality shares take their place.

Keeping up with those shifts takes work…

It takes a team of analysts…

It’s takes algorithms and data collection…

And it takes a bank of super-charged computers to do the math.

If we’re already doing that work, I see no reason you should have to do it too.

That’s why, in addition to sharing all those tools we just talked about, I want to invite you to join my flagship research service, Growth Investor…

Each and every week, you’ll get to look over my shoulder as my team and I apply my algorithms to over 6,000 publicly traded companies.

I’ll give you weekly updates that reveal which ones have jumped ahead to earn “A” and “B” grades, so you'll know which stocks to buy.

I’ll also let you know if any of our recommendations lost ground, so you'll know exactly when it's time to sell.

Once a month, you’ll also get a “deep dive” report about all the highest-graded stocks on my radar… along with my forecast for the latest megatrends.

We’ll also explore the rare, premium quality stocks that have just earned my highest “Quantum Score”…

BRIT:

Your “Quantum Score” – what’s that?

LOUIS:

It’s like my “ninth pre-cursor.”

It’s also a kind of secret sauce for targeting truly exceptional gains.

See, my “Quantum Score” is an algorithm that tells me where the smart money is likely to go next.

By that, I mean the floods of cash that’s about to pour out of big Wall Street institutions…. and into a focused class of shares.

When a stock gets that kind of attention, it could really show you extraordinary returns. My “Quantum Score” can gauge that level of interest in real time.

I share all that in my monthly Growth Investor reports.

Between issues, I also send out flash alerts and weekly five-minute podcasts.

That way, you never have to feel like you’re going at it alone.

For instance, let’s say a stock jumps up a grade or drops a grade…

Or some huge news item rattles the markets…

I’ll shoot out a “Flash Alert” that lets you know exactly what to do.

BRIT:

So you're really covering all the bases.

LOUIS:

Yes, but there’s still something else.

My Growth Investor readers also get full access to a members-only model portfolio…

The portfolio lists every “A”… “B”… and “C” recommendation we cover, with STRONG BUY… BUY… AND HOLD recommendations for each.

It gets updated every week.

So even between flash alerts, you can check in whenever you like to which stocks are up… which are down… and what to do next.

BRIT:

That’s a lot, so let me try to sum this up…

You’re inviting everyone watching to join you, right now, as a subscriber to your premium research service, Growth Investor…

Where you’ll guide them to winning stock picks, using your legendary, market-beating algorithms…

You’re also giving members full, free access to your Portfolio Grader and Dividend Grader research tools, so they use your system to grade stocks in real time…

Plus, you’ll give them full 24/7 access to your model portfolio, which they can pull up and review anytime they like…

And you’ll send a library of special reports…

Including details on how to tap the first phase of this coming “Impact Event”… which toxic shares they might want to purge from their holdings… and how to collect more volatility-proof income…

To spell that out so it’s clear, the special offer you’re getting today includes…

- A full one-year subscription to Louis’ flagship advisory service, Growth Investor, with 12 monthly issues that give you deep dives on the best new recommendations.

- Regular “Flash Alerts” between issues, so you won’t miss a single chance to buy or sell for even bigger returns…

- Unlimited access to Louis’ three model Growth Investor portfolios on his members-only website, with a wide range of picks to choose from…

- Unlimited access to Louis’ Portfolio Grader stock-rating engine, which has all of his same proprietary algorithms, packed under the hood…

- Unlimited access to Louis’ Divided Grader tool, which uses four more key data points to identify high-quality, low-risk investment income streams…

Plus Louis’ brand new reports…

- “Five New Buys For The World’s LAST Oil Boom,” with five ways to beat today’s inflation and get ready for tomorrow’s $150 trillion “Impact Event”

- “10 Toxic Stocks to Sell Immediately,” which reveals ten popular “D” and “F” rated shares you may want to purge from your portfolio..

- And “Three Golden Income Opportunities,” which shows you three top-class dividend payers to help line your pockets with cash…

Louis, that’s quite a bundle.

Am I missing anything?

LOUIS:

Of course, new readers will also get full access to my library archives of issues and reports, so they can dig into all of our past research.

They’ll also get full access to our world-class customer service team, who can help them with any questions they might have about their new subscription.

That can’t include personal investing advice, of course.

But the team will pass general questions to me so I can answer the most important ones in my weekly updates.

And, yes, finally…

There is one more thing…

When you click through to see my invitation page, you’re going to see that there's a special “mystery bonus” included, just for everyone watching today.

I don't want to give away too much here.

Let's just say that, in the wake of this $150 trillion “Impact Event” we're going to see more than one radical market shift take place.

The evolution of this event will be a long game with many phases.

We'll see more shakeups not only in the oil market… but in battery technology, alt-energy production, the market for EVs… and much more.

The rare opportunity detailed in your mystery bonus is tied to that trend.

It's more of a speculation than I usually share, but I want to share it anyway, because this one has real 50-bagger potential.

You can find out more about how to claim your mystery bonus, along with the rest of your special bundle, when you follow the link below.

Once you get there, all you have to do is agree to try a risk-free subscription to my research advisory, Growth Investor…

BRIT:

So now we come to brass tacks, Louis…

How much is this going to cost?

After all, we already know you’re using your same market system to manage over $1 billion for pension funds and other rich clients…

We also know funds like yours often require a minimum account of $250,000 just to get in the door…

And that you’ve already been paid as much as $30,000 by some of your clients, just to gain access to access to the power of your algorithms…

We also know that nobody out there has piled up a track record quite like yours, with over 675 money-doubling recommendations…

More than 300 stock picks that shot up five times over… and an incredible 178 market calls that each soared by at least 1,000% or higher…

So there’s not a doubt in my mind, you could name your price.

LOUIS:

First, Brit…

Let me be clear, all investing – even with a proven system like mine – carries risk. And those returns you’ve just reeled off don’t guarantee we’ll do it again.

What’s more, I like to be careful with my own money… and a lot more careful when talking about ways for somebody else to invest.

So rest assured, whatever our viewers decide to do next… I’m never going to recommend that anybody invest more than they’re willing to lose.

I care about being open and honest.

So it’s important for me to say all that, loud and clear.

But I can also say this much…

These first 45 years of working with my system certainly has proven extremely successfully. For me… for my family…. and for my clients.

All told, the average gain for my Growth Investor since it’s inception is 25.1%

So you’re right, I’m proud of that track record.

And I guess I could charge a lot more for access to Growth Investor.

But that’s not what I want to do here.

Like I said, I didn’t grow up with a silver spoon in my mouth. And I don’t think anybody else should have to be born rich to get a similar advantage.

So I’ve already told my publisher, I want to make this accessible. That’s why I’m not asking anybody today to pay more than $49 a year.

That's it.

There’s nothing else to pay and no hidden fees or charges.

Just the one price, which works out to $4 a month.

That’s less than you’d pay for a fancy coffee or a single book on investing.

In return, you’ll get systematically selected stock recommendations… carefully vetted and graded by my strict algorithms… any one of which could show you profits of 10X or better.

I hope that sounds fair to everybody watching.

BRIT:

It certainly sounds fair to me.

Still, lots of people want reassurance.

And Louis, I know that you and your publisher have something for that too…

LOUIS:

Yes, we do.

For anybody watching who wants to try my research but still isn't 100% committed, let me also offer you a full money-back, quality guarantee…

If you don’t feel my work, my forecasts, and my recommendations are showing you the best possible opportunities to multiply your money, just let me know. You’ll be entitled to a full refund of everything you'll pay to subscribe. No questions asked.

That means you’ll get a full 30 days to make up your mind.

If you decide it's not for you, you can cancel and get a full refund.

You'll still get to keep everything I’ve sent, with no hard feelings. Because I’d much rather part as friends.

Again, I hope that sounds fair.

BRIT:

It certainly does…

If you’ve watching now, this is your chance…

All you need to do is click on the link below…

I’m going to urge you right now to act on this.

Once more, here’s everything you’ll gain access to when you agree to Louis’ risk-free trial offer…

You’re not going to regret it.

And again, you’re completely protected by Louis' full money-back guarantee.

All you need to do now is click this link to get started…

Louis, thank you so much.

You’re a legend and a gentleman.

LOUIS:

It's been my pleasure…

BRIT:

And for you viewers at home…

I'm Brit Herring… thanks again for watching…

And don’t forget to click the link below to help you get started…

August 2022

For more details, see our disclosures and details page.

Copyright © 2022 InvestorPlace Media, LLC

1125 N. Charles St, Baltimore, MD 21201

About Ad Choices Terms & Conditions Disclosures & Disclaimers Privacy Policy Do Not Sell My Personal Information