Table of Contents:

- Introducing Mark Rossano

- Fed Chairman Greenspan called the market “exemplary” with “no signs of inflation.”

- Surveys show 9 in 10 of Americans are worried about inflation… and expect a recession this year.

- The bursting of the BIGGEST bubble we’ve ever seen.

- His ‘System’ is the basis for modern central banking.

- ENDGAME: The Final Bubble Survival Blueprint

- Diesel Doomsday: Powering Through the Gas Crash

- Ag-Pocalypse: America’s Last Two Agricultural Saviors?

- You still have time…

URGENT: $500 Trillion Time Bomb Has Initiated the American Economy’s…

ENDGAME

The biggest asset bubble in 800 years has finally exploded.

Here are the culprits… the collateral… and the 3 steps you must take immediately to insulate your wealth

Plus, the investments designed to soar as much as 10-fold in the aftermath…

“A lost decade coming… for the global economy”

– World Bank

Dear Reader,

Hello – and welcome to Endgame.

My name is John Walters… today you’re going to discover the unvarnished truth of what has been happening in our economy here in America.

But, more importantly, you’re going to see exactly what’s going to happen next… as an epic crisis of unparalleled proportions unfolds.

We’re talking about a $500 TRILLION time bomb planted in the heart of the market… and it has already begun to detonate…

It stands to vaporize more than $16 trillion in household wealth over the next 12 to 18 months…

While sending the vast majority of stocks into a cataclysmic death spiral.

According to our guest today – many of the stocks in your portfolio could fall further than 30% in the months to come… while the market as a whole is chopped in half…

This means 401(K) retirement plans… which lost a quarter of their value in 2022… are in jeopardy of seeing the other shoe drop.

Worse – he says there are a handful of financial institutions, right now, which are about to go belly up in the next 18 months.

If your money is in any single one of them… you could be stuck relying on the goodwill of the soon-to-be stretched thin FDIC… the Treasury… or the beleaguered Fed to deliver you from ruin.

This sounds grim – I know.

But there is no way to dance around what our guest today sees coming…

An Endgame to the economic system which has dragged Americans along for decades through artificial booms, busts, and hobbled along through the aftermath of a global pandemic.

As you’ll see, this has been borrowed time…

This endgame was set in stone 300 years ago…

when the blueprint which steered our economy into this minefield was first developed… and toppled a nation.

And now, a crisis of unprecedented magnitude has arrived.

Bigger than the S&L Crisis.

Bigger than the Tech Wreck.

Bigger than the Subprime Crisis… and the double-dip recession fears.

And I’m afraid to say – bigger than the calamity of the pandemic, which throttled markets across the globe.

He’s not the only one saying this, either.

BNP Paribas, one of the TEN largest banks in the world, is forecasting a global downturn in GDP and recessions in both the U.S. and eurozone.

The World Bank is urging investors to brace for a “lost decade.”

And the International Monetary Fund stated “the worst is yet to come,” warning of an imminent global recession.

However, there is hope…

Because the man who is going to lay out the full story for us today is a veteran with more than 20 years in the markets…

He was there at the front lines when 2008 unfolded… helping guide Morgan Stanley around the Bear Stearns collapse…

And became a “go-to” analyst called on by Bloomberg for his deep insights into the markets.

His name is Mark Rossano.

And today, Mark is going to use his deep insights into the markets… to dissect precisely what has led us to today’s pandemonium.

But there is a light at the end of the tunnel – because Mark is going to share the 3-step blueprint he has assembled for you…

Four moves to insulate you against further crisis…

While positioning your portfolio in the most powerful assets of the next 18 months – at minimum.

Investments which could protect you from the firms destined to go belly up…

Investments which could unlock gains upwards of 8,900% in 24 months – if history is any guide

Investments which could help you turn back the clock, recovering some of the wealth lost over the last year…

The average investor has already paid a pound of flesh, with portfolios reflecting losses on par with the Great Depression following the 2022 collapse…

Mark has stepped up to the plate, today, to help you circumvent the next leg of this fallout…

The Endgame which will decimate those unfortunate few who have closed their eyes to the reality of what’s unfolding…

But allowing a select few to thrive at each step.

With that said – Mark, welcome to the broadcast. Thank you for joining me.

Mark: Thanks for having me, James.

I’m glad to finally get down to this.

James: Me too. You’re making a pretty shocking prediction…

That housing prices will fall 30%.

That $16 trillion could be pulled out of the economy…

That more than 1000 financial institutions will be insolvent within 12 months…

And that we could see the market decline more than 50%.

That’s a lot to swallow.

Mark: It is, definitely, but I am not going to mince words: the American public is about to endure an outrage that eclipses the 2008 fiasco.

It may be the most shameful series of events and sinister attacks on Main Street I’ve seen in two decades of investing… and even longer as an economist.

We’re looking at the bursting of the biggest bubble we may ever see in our lifetimes.

And while they’ve dressed the recent market events up – like lipstick on a pig – we’ve already experienced our own Black Monday level event. The endgame isn’t going to start – it’s well underway.

I see organizations as powerful as the Bank of Japan reduced to rubble.

James: OK, I can tell you’re very passionate about this… but I don’t want to lose the plot… because in all this bedlam, you say there is a route to prosperity.

Mark: Absolutely. Look, every major crisis in American history has made it possible for a handful of people to become very, very wealthy.

In 1987, Paul Tudor Jones made over $100 million by nailing the crash

Sir John Templeton cashed in big time in 2000 as the tech wreck tore the market apart…

In 2008, the Subprime Mortgage Crisis led to some of the biggest home runs in history – with John Paulson securing a $20 billion windfall…

James: Of course, you’re not saying people watching are going to make billions of dollars.

Mark: No, but I am trying to illustrate a point…

Every catastrophe creates windows of opportunity if you know where the wind is blowing.

However, there will be pain – especially for those who aren’t prepared… who haven’t taken the necessary steps to insulate themselves.

Unfortunately, those are the folks who could watch their stock holdings plummet as much as 30% in the next 18 months…

Watching their retirement dreams go up in smoke as 4o1(K)s and IRAs are vaporized…

While the value of their homes are chopped in half…

All while we watch unemployment rates triple.

James: Now, Mark, I hear you – but officials across the board have sworn on a stack of Bibles that there is no risk of an event on the scale you’re talking about.

Mark: Yeah, well, let me share a great little reminder of how reliable these bureaucrats are: on November 8th, 2007, Fed Chairman Ben Bernanke testified in front of a congressional committee that the economy was facing risks, not recession, and that they expected “slower growth, but positive growth, going into next year.”

James: Well – many of us can remember how that played out.

Mark: Within weeks of Bernanke’s statement, the US fell into a recession that saw the Dow Jones literally cut in half.

In March of 1999, President Clinton and VP Al Gore were patting themselves on the back for building “the strongest economy in a generation.”

Fed Chairman Greenspan called the market “exemplary” with “no signs of inflation.”

And now, in the midst of the current crisis, Fed vice chair for supervision, Michael Barr, said “The banks we regulate… are well protected from bank runs through a robust array of supervisor requirements.”

He said that on Thursday, March 9th, as the bank run on Silicon Valley Bank was underway.

And KPMG, one of the “Big Four” accounting firms in America, gave SVB a clean bill of health when they audited the company… two weeks before they collapsed.

Then, like the icing on top, Janet Yellen had the gall to look straight into a camera and say “Let me be clear that during the financial crisis, there were investors and owners of systemic large banks that were bailed out . . . and the reforms that have been put in place means we are not going to do that again.”

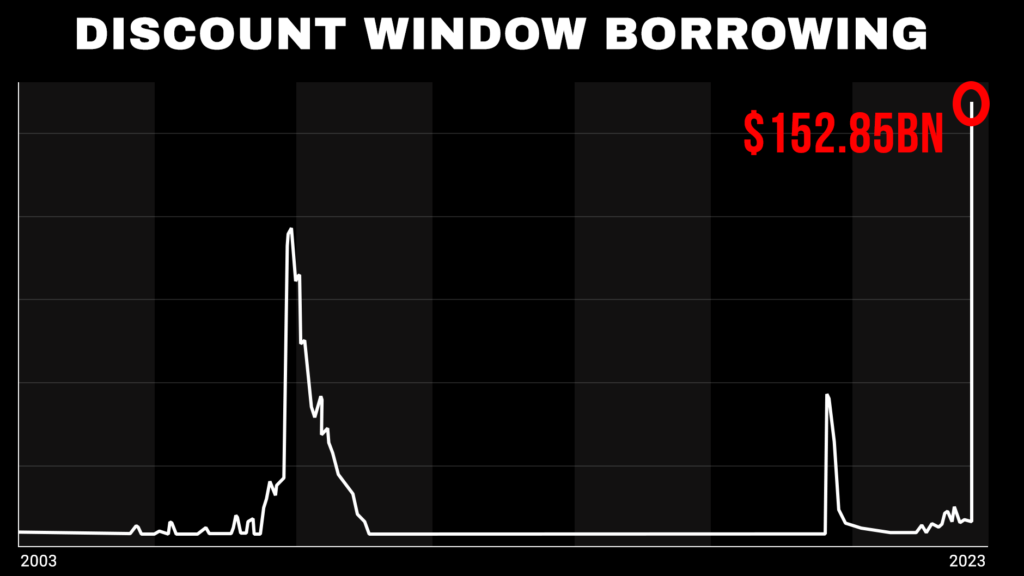

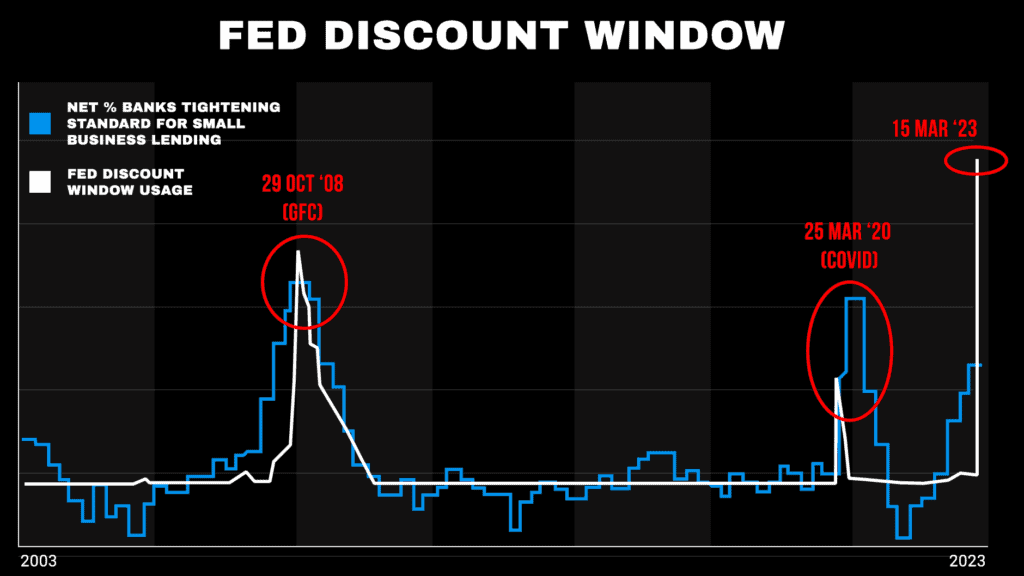

A few days later, the Fed quietly published its weekly update – showing Discount Window Borrowing had jumped to all-time highs, towering over the amount banks borrowed from the Fed during the 2008 crisis.

In this span of time, Credit Suisse, First Republic, and a slew of other banks rolled straight off a cliff.

How these people say any of this with a straight face is beyond me.

Just recently, the Fed Bank Stress Test, they specifically did not test any banks against a rise in interest rates.

But, you know, “the system is sound.”

James: It’s amazing. They really are full of hot air.

Mark: They’re not here to tell you the truth – they’re there to spin the fable that earns them points in the media, or gets pats on the back and praise from politicians. Or strengthens a re-election campaign.

James: They’re also there to keep the market sedated – and the truth, the truth IS we’re going to discuss today… Well, it’s not about keeping people artificially “calm.”

Mark: I wish. But that’s not the reality.

The reality is we’ve seen a series of events which set the stage for the worst economic crisis America has seen in a century… perhaps ever.

Starting with a $500 trillion bomb which has already begun detonating… and will leave a $16 trillion crater in American wealth.

James: You’re talking about a calamity 10x larger than the $50 trillion 2008 Subprime Crisis.

Mark: While I had my reservations before… the last “nail in the coffin” so to speak has just been hammered in.

I don’t think we’re going to see a Subprime… a tech wreck… a savings & loan crisis…

I think we’re going to see something much worse, James. This is an endgame to decades of careless monetary policy.

They’ve spent decades compounding this problem.

We won’t see this isolated to money, or stocks – this is a contagion that will spread to our food. To our jobs. To our cars. To our homes.

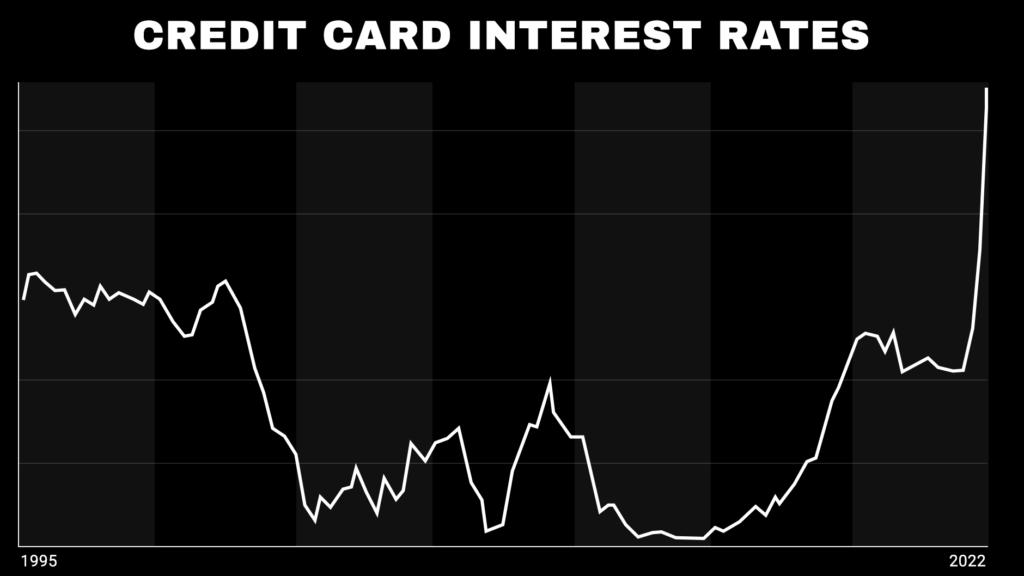

We’ve already started to see it, with all-time high consumer debt levels and soaring credit card interest rates near 24%… some have even gone as high as 30% APR.

They’ve created a situation so insurmountable, they’re going to have to either crash the markets or let inflation gallop like it's the Kentucky Derby.

It’s a turning point, James. Nothing will be the same.

James: OK, let’s take a step back, Mark – you’re obviously ready to start breathing fire.

Mark: I get very passionate about this stuff. I have three daughters – this stuff affects them. It impacts their futures. We are stuck trusting Washington lawmakers to not drop the ball. It’s disgraceful for the people who run our financial system to be so irresponsible.

James: You have a lot to say – but many of our viewers, they’re probably not as familiar with your work. I’d like to make sure they understand the gravity of what it means for you to be saying these things.

I mean, you’re not an alarmist by nature.

Mark: Not by a long shot. If you've followed me through the things that I've done on my podcast, Primary Vision Network, or on other things that I've written, and continue to write for Freedom Financial Research… you know I want to believe that solid economics and thinking can win, but you can't ignore math or the financials or data at this level.

James: Well, you’ve built a career on that…

Again – you were a junior portfolio manager at Morgan Stanley in 2006, you witnessed the sale of Bear Stearns to JP Morgan… and were on the ground floor as the Fed rubber stamped shotgun weddings between flounder institutions to “save” the economy in 2008.

Mark: James, it’s like working in a hot dog factory – you have a hard time eating what they give you once you know how it’s made.

James: Still, you had a tons of successful trades there at Morgan Stanley if I recall?

Mark: Yeah I had a good run, but mostly it drew the attention of The Street… which led to me becoming a Senior Analyst for three different high-profile Wall Street firms.

James: And just so our viewers understand… some of your wins in the market have been pretty enormous.

Can you detail those a little?

Mark: Well, I bought my wife’s engagement ring with profits from my investing… and put the downpayment on my house in Long Island, in a nice neighborhood…

Plus, there’s the trades that have put over $800,000 in my pocket in just a few short months.

James: Incredible.

But I know you also had some crushing scores while you were on Wall Street.

Can you tell us about any of those?

Mark: I wouldn’t be comfortable being too specific about any of those — just for professional courtesy and etiquette reasons…

But I’ll tell you about one of them, in a general sense.

Mainly because it was so cool that I’ll never forget it as long as I live.

This one time, I saw a very juicy upside situation unfolding in one particular energy stock…

I followed it through the court system for over 18 months.

So I literally jumped up from my desk on the open trading floor and started screaming to all my colleagues to play it immediately.

I remember shouting at the top of my lungs “buy until you’re uncomfortable — then double it!”

And as I recall, the firm raked in so much money over the next half-hour that I got a standing ovation, right there on the trading floor. The CEO even gave me a bottle of champagne to pop.

James: Talk about getting your feet held to the fire – you need a lot of conviction to stand up and tell a room of seasoned traders to make a move like that.

Mark: I never take half measures, James. I dedicate myself to my research… and when I make a statement, I’ve done the legwork, I’ve vetted. Most of my career has involved moving tons of investor money, and I’ve taken that duty seriously.

James: You haven’t stopped. You run the extremely informative Primary Vision Network, with some of the best data on the global markets – from energy to monetary policy and beyond – that I’ve ever come across…

As well as your own firm, C6 Capital Holdings.

All of this to drive one thing home, Mark – you’re not new to how the world works.

You’ve been an advocate for Main Street… you made almost $1 million off just a single investment… and you have governments knocking on your door asking how to navigate their problems.

Now, a bigger problem – you’re saying the biggest of our lifetime – has emerged…

And our viewers need to know exactly how it’s going to unfold… and what to do in preparation for the shockwaves.

Mark: I want to be clear: there is no crystal ball of exactly how these things play out. I’m an economist – I take the data, data even the Fed doesn’t want to talk about, and I lay it out.

As the joke goes – economists have called 15 of the last 2 recessions.

A lot of this stuff is published in broad daylight, but 99% of the public can’t interpret what H.2 or H.4 or H.8 filings mean – even though their impact is felt in every single neighborhood across America.

James: You can actually speak their language.

Mark: The banks have smashed a metaphorical Tower of Babel, so the average person cannot comprehend what they’re saying.

But the reality is this: we’re soon going to see unemployment triple.

We’re going to watch the cost of goods increase by as much as 50% over the next 12 to 18 months, leading to food shortages in America as rest of the world.

Millions of Americans will find themselves bound with the ‘golden handcuffs’ – locked into homes which have lost more than 30% of their value, which they can get no positive equity in, but bought at such low interest rates and mortgage payments that they can’t afford to sell it and move into another home.

This is a real terror that I expect will cause the loss of untold amounts of wealth alone by paralyzing cash flow.

Meanwhile, the Dow Jones, the NASDAQ, and the S&P will continue to crater – I see them each collapsing another 30-40% from here, wiping more than $16 trillion out of the markets… and vaporizing trillions in household wealth.

James: As scary as that sounds, Mark… I think everyone at home knows something is wrong.

Surveys show 9 in 10 of Americans are worried about inflation… and expect a recession this year.

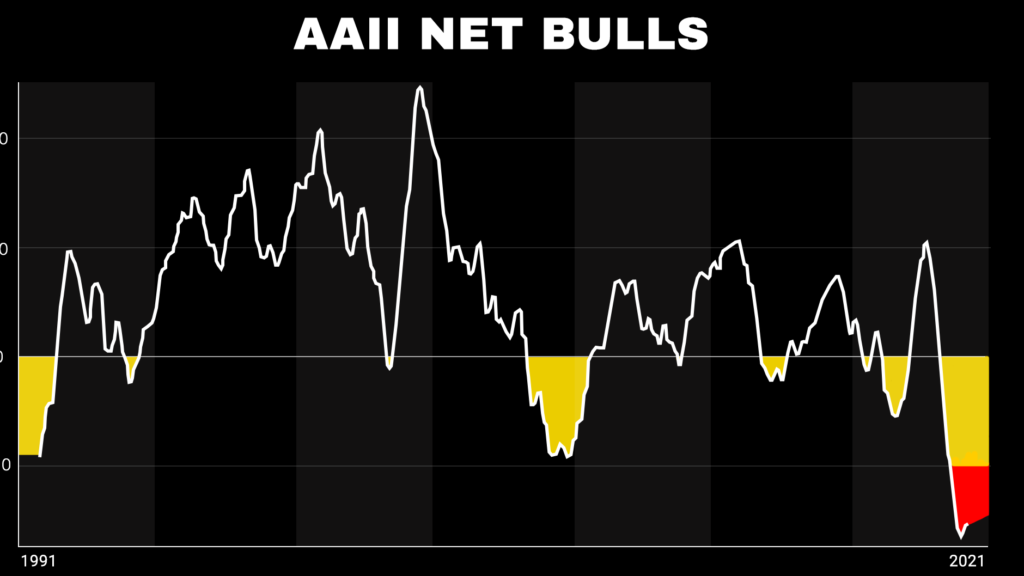

The American Association of Individual Investors found that investors have never been this bearish for this long… even through the 2008 crisis.

Mark: People have been living paycheck to paycheck for years. It’s why consumer credit card debt has hit a RECORD high of $986 billion.

We’ve already seen this begin with savings rates at the lowest levels since 2005…

Not only are people taking on debt at the fastest pace ever- with consumer debt as a whole hitting a record high of $16.9 trillion…

But they’re getting torn apart by HISTORIC credit card interest rates…

I’m talking about rates as high as 30% in some cases.

Just think about this: people bought homes at the highest prices ever on record – double the median price during the subprime crisis…

They bought these houses at rock bottom interest rates.

Now, interest rates are soaring… home prices are falling… and people are refusing to accept the loss on the value of homes.

It’s one reason we saw mortgage applications fall to their lowest levels in March since 1995.

And now, with wages sinking, with savings eaten up, they’ve had to turn to credit cards to pay for groceries… which have increased in price by 30% on average…

People are even using credit cards to pay their mortgage.

Then those debts are coming back almost 20% bigger.

So it’s not surprising what has come next.

James: Default.

Mark: Default.

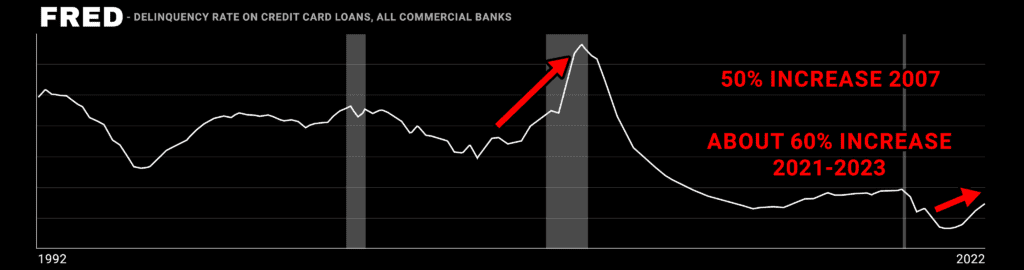

Starting in 2006, we saw a 50% increase in defaults on credit card loans.

Since 2021 James, we’ve already seen a near 60% increase. And that’s before the most recent events rocked the market.

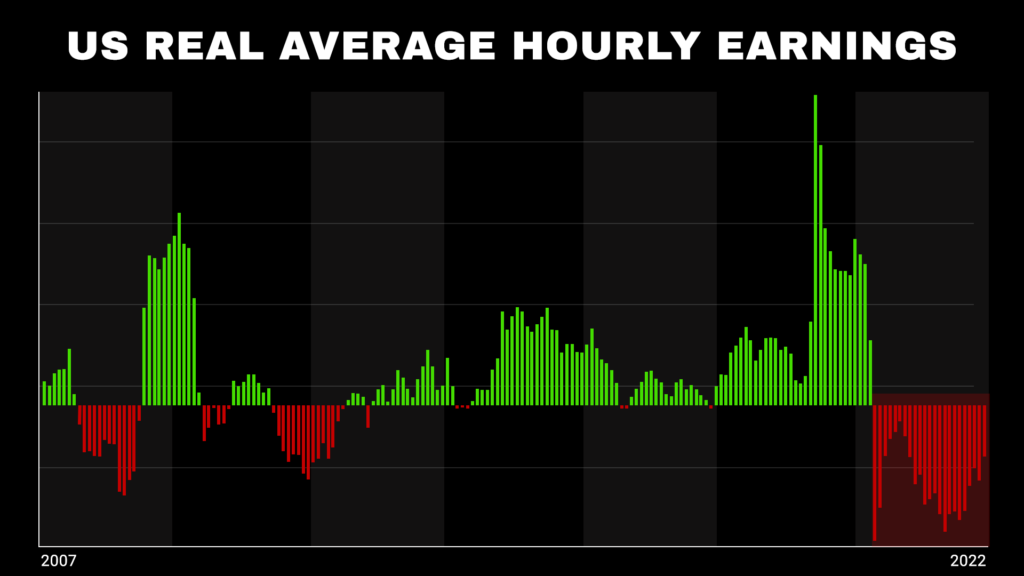

And the first time in a century when real wage growth globally has been negative. (-2%)

They’ve been firmly negative for over two years in the USA.

People have a right to be scared… but, unfortunately, it gets worse from here.

James: But why now? I mean, we’ve had one of the longest, most prosperous bull markets… we have a coalition of central banks and institutions working to keep the economy afloat in an unprecedented united front…

Why is it NOW you say we’ve crossed the point of no return?

Mark: There are a few specific triggers, James – but one in particular… We’ve seen it coincide with every major market unwind of the last 50 years…

And digging deeper – it was the single indicator for every depression/recession over the last 150 years.

James: Are you actually forecasting a depression instead of a recession?

Mark: I can’t say it won’t be the case. The data is there. But you have to understand what made The Great Depression possible was demographics.

America had gone on a wild, open armed immigration spree… meaning the workforce was massively inflated.

The actual definition of a depression was created to account for 20% unemployment… which we’ll likely never see again just due to how the census is conducted.

James: Meaning that…

everything else can reflect depression level signals… but without unemployment at 20%, it can’t technically be defined as one.

Mark: Exactly.

We can never be 100% sure of how fast or how deep a decline will be – but we can use data like this… data which people have documented after living through the chaos as a warning for future generations.

And right now, I can tell you that elected officials know what’s coming – but instead of a big collapse like we saw in 1929 into the 30s, they’re trying to gradually pump the brakes into a 1970s style perpetual slowdown. One way or another, we’re on a collision course.

James: But you have a route through this pandemonium – through these surging debts and collapsing economic indicators?

Mark: I do. Three-steps, which I’ll lay out in this presentation.

My team and I have done the legwork, James. I run a private equity fund… I’ve had access to some of the most advanced protocols in the market through my time at Bloomberg…

And that’s led me to identifying three specific maneuvers people must make today in order to shoot the gap…

I’m talking about protecting your savings… while laying the groundwork for gains of 450%… 1300%… and 4,00% over the next 12 to 24 months.

James: You seem pretty confident in these strategies.

Mark: You have to understand – when I say this is an Endgame, it’s because they’ve been inflating this problem for decades… It's not a new bubble – it’s just one big one… mixed with leverage.

James: What do you mean?

Mark: OK, I have a few important data points here.

Everyone – I’m going to show you a number of shocking correlations, so I ask you pay close attention to what we’re about to walk through. This is data most people gloss over.

Once you see the macro factors at work… I want to show exactly how it’s going to be felt in every household across the United States… and how you can chart your course through it.

James: Alright Mark, let’s take a look at what you have for us.

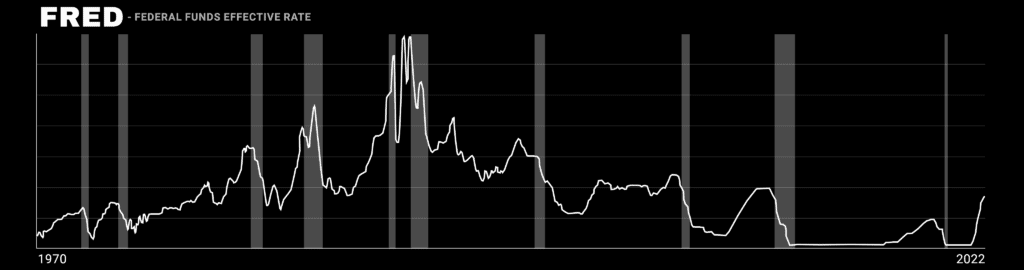

Mark: First – this is the Federal Funds Rate. This is the interest rate banks charge other banks to lend cash on an overnight basis.

James: We can see some pretty long valleys and some very sharp peaks.

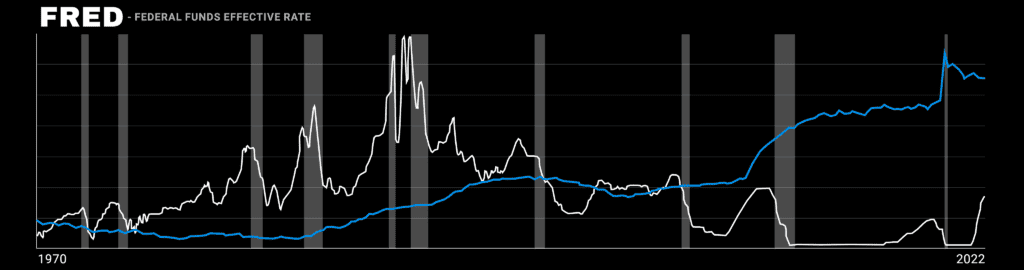

Mark: Keep that in mind. Now, we’re going to overlay it with the Fed’s own database, showing the debt as a percentage of GDP.

We go back to the 1970s and we can see – they’ve never brought this percentage down longer than for a brief intermission… long enough for things to cool down so they could deploy the next volley.

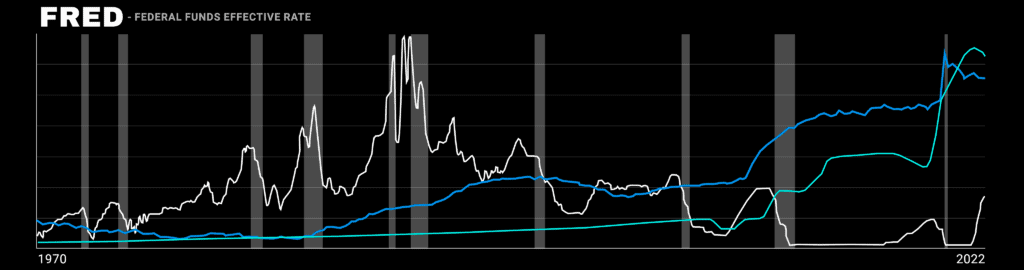

Now, this chart is going to get a little busier… we’re going to add Federal Debt held by Fed banks, James, and the movement of the S&P.

Do you see what’s happening here?

James: It’s mind blowing. More debt, at an increasing percentage of GDP, shoved higher by low interest rates.

They just print MORE money, and move it into something else. It’s like they keep putting crutches under the market.

Mark: What they’re doing is using the air from one deflating bubble to help start inflating another. Here’s the kicker where it all comes to fore.

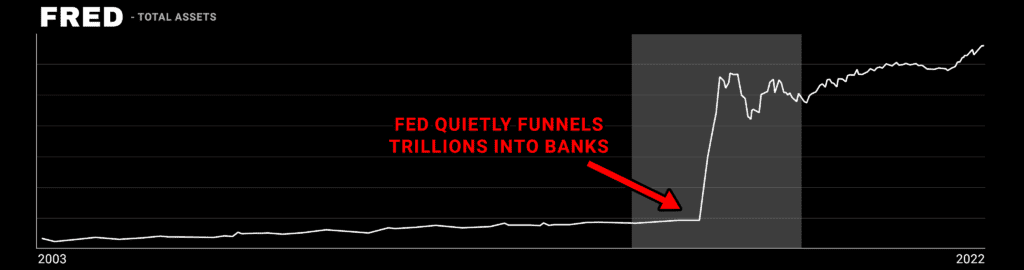

Rather than just increasing the public debt in your face… because everyone was justifiably outraged in 2008… they started having the Federal Reserve, an organization “independent of the federal government,” buy up debt to inject liquidity.

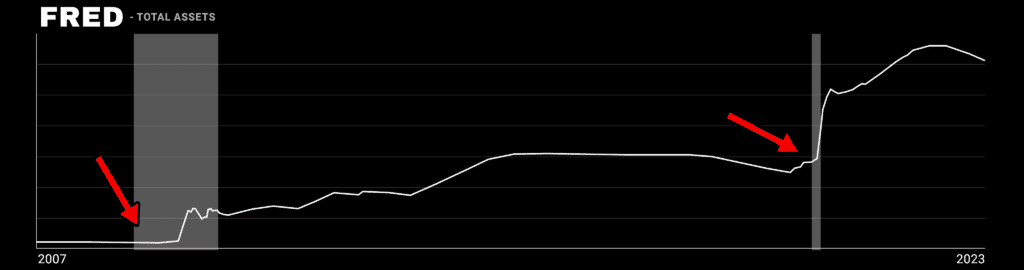

You can see how leading to 2008, the Fed’s Balance Sheet was flat as a board… and then the Subprime Crisis meant everyone scrambled. They had created a far more systemic risk with housing which had to be handled at full throttle.

So now we’re going to do one more – just to drive the point home.

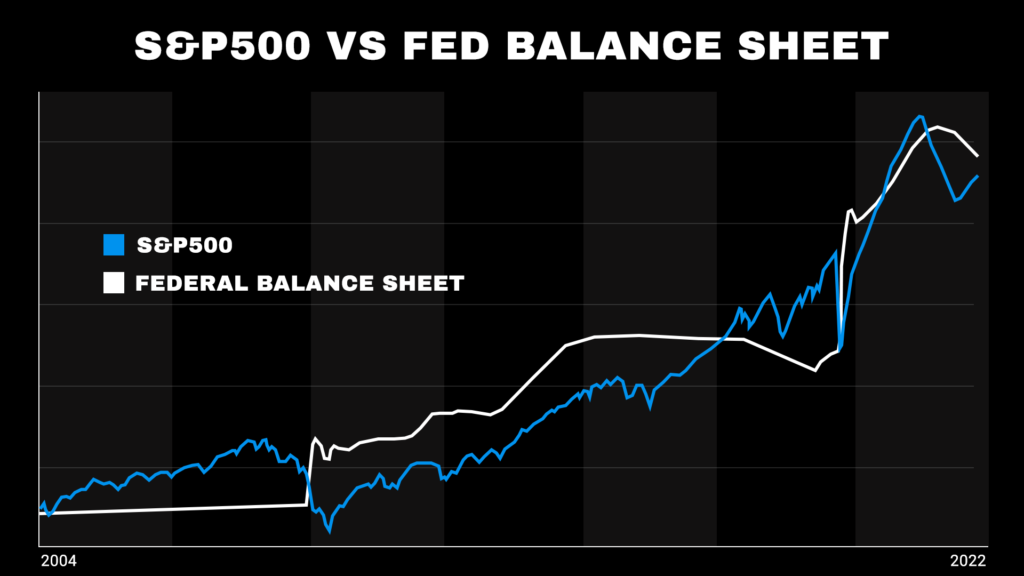

This is the Fed’s balance sheet and the stock market since 2004.

James: They’re totally hand in hand, even when the Fed’s balance sheet dips the market looks like it has a sharp drawdown.

Mark: Exactly. You can see how long they've been playing economic hot potato – tossing it for the next generation to carry before it burns them too badly.

Now, all of that to make this point: money has never vanished.

They’ve never really REDUCED the size of the debt, the artificial inflation of sectors – all the stuff they’ve been doing from 1999 and beyond, back to Volcker dealing with the S&L Crisis in the 80s… it never went away.

They’ve just found more, creative ways of hiding it – until now. Every Fed Chairman plays a game of hot potato – he juggles the problem until it can become somebody else’s problem.

Until we’ve reached a point where this problem is a 500 TRILLION dollar time bomb ready to detonate inside the economy.

James: OK – you’ve said that $500 trillion figure.

What is that?

How does it even exist? The global GDP is only $84 trillion.

Mark: Let me show those charts again. To keep things simple…

What happened in 1999?

James: The peak of the DotCom bubble.

Mark: Then in 2008?

James: Housing market bubble.

Mark: Now – in 2022, what happened?

James: Well – covid pushed everyone into online tech companies again, and that burst.

Mark: No. That’s what it looks like. That’s how it’s dressed. Everyone sees their favorite furniture by mail company lose 90% and thinks this was tech wreck 2.0.

But what happened is the bursting of the BIGGEST bubble we’ve ever seen.

I’m talking about the asset which underlies everything.

Housing is priced by it. Cars. Food. Stocks.

I’m talking about bonds.

James: How big are we talking here?

Mark: In the United States alone, the largest bond market in the world, we’re looking at $51 TRILLION in bonds…

About half of which is in Treasuries – which have grown six-fold since 2008.

James: By comparison, the credit default swaps which led to the subprime crisis was, what, around $55 trillion?

Mark: Right on the money.

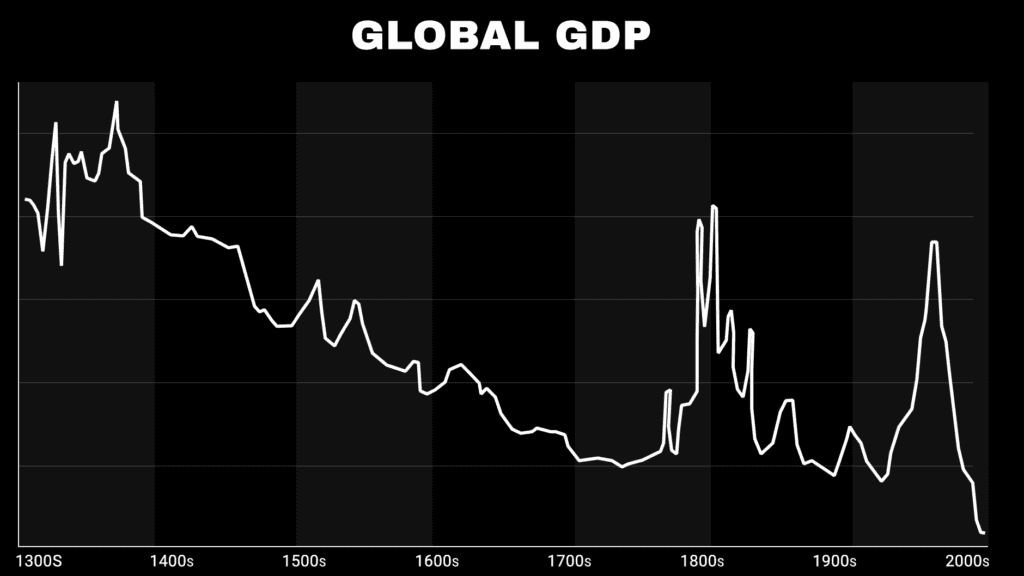

According to the Bank of England, the current bond situation has created the biggest asset bubble in 800 years.

Keep in mind what I just said – not the biggest bond bubble. Biggest bubble, period.

800 years ago, the world was suffering the Black Death, the Great Famine, and then the collapse of the Italian banking houses.

James: You’re saying this is quite literally a ONCE IN A MILLENIA event.

But – you’ve said $500 trillion a few times.

As big as $55 trillion in US bonds sound… or $123 trillion globally… it’s not $500 trillion.

Mark: Bonds underpin the entirety of the global economy. They are what everything else is valued against – they’re supposed to be the last word on reliability.

Well, that ended. That ended last year after more than a decade of the Fed, the Treasury, and Uncle Sam kicking and screaming their way through it.

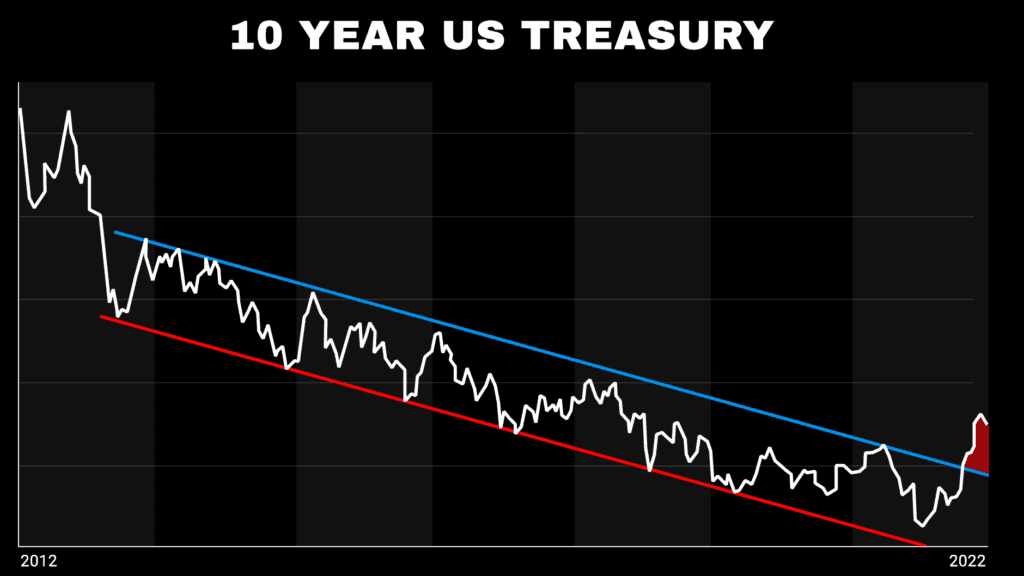

When the 10-year U.S. Treasury inverted the yield curve, the entire system unraveled.

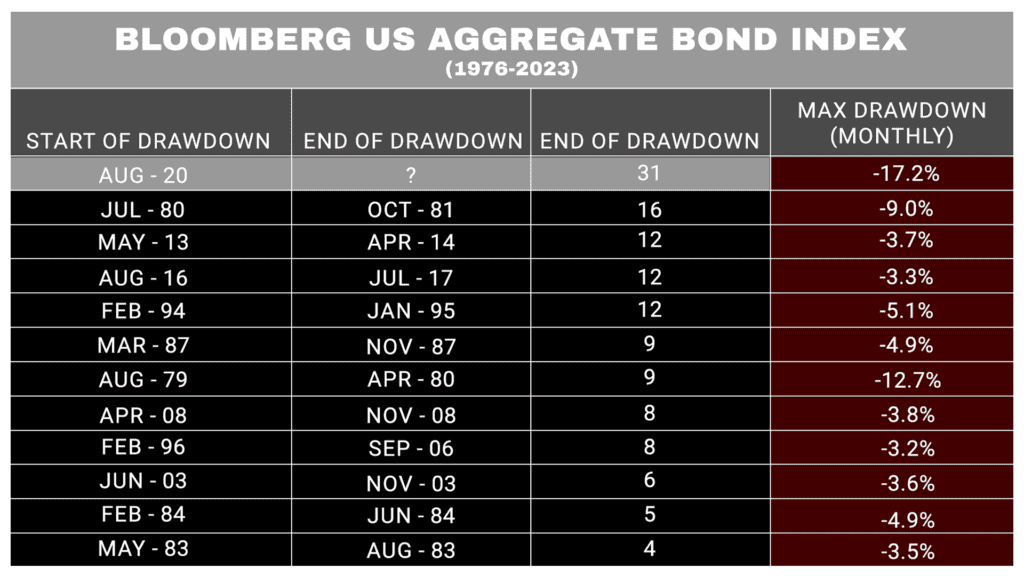

We are actually in the middle of the longest bond drawdown in history.

So far, it has gone 3.5 times longer than 2008… 5 times longer than drawdown following the Tech Wreck… And nearly TWICE as long as the drawdown during the recession of 1980.

Just recently we saw liquidity- the ability to SELL bonds – crash.

While the MOVE Index – a little known chart most bankers will NEVER draw your attention to – is running to its highest levels since 2008.

This index measures the volatility of the bond market. It’s the volatility of the economy itself.

Even the Securities & Exchange Commission itself published a paper recently stating, “Global bond market liquidity is drying up at a time when many investors around the world may need it most.”

We’ve already seen early damages: The global economy saw $30 TRILLION go up in flames last year.

James: You’re talking about the equivalent of, what, 40% of the global GDP?

Mark: Right. But here’s where the $500 trillion comes.

In 2000, it was just tech stocks that inflated.

In 2008, we blew up credit default swaps, which tied into the housing market. A bigger problem – a systemic problem.

The bond market controls the entire derivatives market – everything is priced against bond yields and interest. Anything that involves leverage and credit – you’re talking derivatives.

The notional size of derivatives range from $500 trillion to, get this, $1 quadrillion.

Warren Buffet has actually called derivatives…“Weapons of Mass Destruction.”

This is tantamount to putting a bomb under the world’s largest electrical power stations and watching it tick down to zero.

The explosion isn’t some small power outage – it’s a blackout that shuts off the entire grid.

James: I hope you all are paying attention – because Mark has just carefully walked us through the exact dilemma which has brought us to this point…

as a brutal crash threatens the American economy… capable of sending the prices of our homes, our food, our gas…

everything around us is on the verge of spiraling out of control…

While unemployment races to double-digit highs… while savings dry up… and, tragically, personal bankruptcies rocket to nosebleed inducing highs…

But again, there is a way through all of this… and Mark is going to put that roadmap in your hands.

Mark – this is… well, it’s a lot. You’ve shown historic debt levels. The presence of the largest bubble in almost 1,000 years – and not from some nameless organization…

But the BANK OF ENGLAND! The UK’s own central bank!

But getting down to brass tacks…

This seems like a very macro thing. Like the purview of central bankers and politicians.

How does this effect our viewers at home?

How does this reverberate into the life of a family of four, just trying to have a nice car, a decent home, pay for groceries, and raise children – or a retiree, just trying to enjoy their golden years?

Mark: That’s always the danger when you speak in trillions – when you get down to huge, sweeping concepts like this.

If you took a trillion one dollar bills and laid them end-to-end, you would exceed the distance from here to the sun.

It’s how central bankers have pulled the wool over our eyes for so long – because they want it to seem distant. The more apathy and confusion, the more impossible to grasp, the more often they can do it.

Well, they can’t anymore. The implosion of the bond bubble has let the air out of the entire world. And their plan is to leave you, me, and everyone watching, with the bill as they dine and dash from the ‘party’ they brought us to.

Specifically, there are two economic ‘wheels’ which are about to stall out, James.

When they go- well, Katy bar the door! And I believe we have officially crossed the point of no return.

James: I want to hear more about those wheels, but what exactly was that turning point? When do you think we crossed over?

Mark: Really, it kicked off with central banks raising rates.

So far, we’ve had 9 consecutive rate hikes – that’s about the most back to back hikes we’ve had in history.

So it’s no surprise this unprecedented levels of stress caused the two things to shake out immediately…

First, the collapse and bailout of the $1.4 trillion Credit Suisse by UBS for just $3.2 BILLION… which showed how much garbage was piled up in even the BIGGEST institutions.

Second, the return of the crisis instrument: dollar swap lines.

James: Can you clarify what a dollar swap line is?

Mark: A dollar swap line is the Fed essentially trading US dollars to other nations to give them liquidity injections.

We saw them used primarily in 2008 and 2020 to keep countries solvent.

James: The Subprime crisis and Covid years, you mean.

Mark: Right. When there is a major, systemic problem… That's when everyone comes knocking for liquidity and safety. Banks need money loans. The dollar is the world’s trade currency, so the more of them in circulation, more banks have on hand, the “better” they are.

Both Credit Suisse and the dollar swaps signal one thing: major trouble.

And they’ve set the stage for the real problem – the multi-trillion dollar issue that’s going to ravage people like us… our children… and our children’s children

James: How so?

Mark: Credit Suisse was a systemically important institution – but as we’ve seen since 2008, a systemically flawed institution that had received multiple bailout. They were BIGGER than Lehman Brothers. In fact, the market capitalization of Credit Suisse was bigger than its home country – Switzerland – by about over 50%.

All $16 billion of its bonds got written down to zero… shareholders of Credit Suisse received one share of UBS for every 22 shares of the bank’s stock they held…

Some of the bonds that were written down to zero were actually created purely to keep them solvent during their most recent liquidity crisis… because this was by no means their first one. It just happened to be their last one.

James: In short- both bond and shareholders got wiped out.

Mark: You want to talk about precarious market environments?

One of the 30 banks considered systemically important to the global economy just got flattened because of a bank in California setting off a chain of events which has led to a global banking crisis.

With the collapse of SVB (Silicon Valley Bank), Signature Bank, and First Republic Bank here in the US… we’ve now seen the 2nd, 3rd, and FOURTH largest bank unravelings in US history occur within a week of each other.

Here’s my point: these banks have proved one thing – they are in bad shape. They’re all insolvent. And they’re connected.

Remember the discount borrowing window?

They took billions out almost overnight to stay afloat.

$152 billion. We’re talking 3x times what they took during covid. More than they took during the 2008 crisis.

That’s here – that’s America.

Naturally, this contagion was spreading… fast… despite Yellen and the Washington gangsters saying it was under control.

But then Powell and the other central bankers made the final move – they reopened the dollar swaps.

James: What are dollar swaps, exactly?

Mark: For one, they’re the Fed quietly admitting that inflation is not the priority for them anymore.

James: Even though Powell did raise interest rates recently.

Mark: That's lip service. Dollar swaps – which were offered monthly or weekly before – are now being offered daily. These are short term loans of US dollars the Fed gives to other central banks, who can then inject it as liquidity into their own institutions. This shows that right now, quantitative easing has stopped in the US… but it’s really a loan AGAINST our banks in America to add liquidity to the Euro and dollar abroad.

James: Meaning MORE dollars are in circulation… pushing inflation up.

Mark: Which will push our costs of living through the roof.

James: After we’ve already seen the consumer price index triple in a matter of twelve months, no less.

Mark: Keep in mind, James – banks and institutions love these swaps.

Because of how they’re structured, they can record these things off-balance sheet.

James: Wait, so you’re saying banks around the WORLD have some untold amount of dollar-linked debt?

Mark: It’s not untold.

The Bank of International Settlements – the central bank of central banks – says this number is north of $80 trillion. It’s just recorded in, as they put it, “a blind spot.”

James: You’re kidding me.

Mark: They called it “huge, missing, and growing.” Like you said, those currency swaps were backstops for 2008 and 2020 primarily…

We’re talking about times of major peril. And they were expanded further during times of low interest rates – the lowest in history.

Now, those short-term swaps are rolling over at much, much higher rates…

James: And so the risk of default is higher as servicing that debt grows.

Mark: The Wall Street Journal did a write-up on this. They called it a “bomb” that could detonate with even the slightest change in financial tensions.

James: Financial tensions like we’re seeing right before our eyes… like what just capsized Credit Suisse and three big American banks.

Mark: Specifically – it creates a crisis in which borrowers can’t borrow because lenders are afraid to give money out. The same dilemma that froze our economy in 2008.

But really, there’s an even more telling story… to really drive home what has happened here… and what’s coming next.

And it starts with a convicted Scottish murderer and prison escapee who became the finance minister of France… and the father of modern central banks.

James: Whoa – let’s hear it.

Mark: I’m telling everyone this so you understand what’s happening here was seen hundreds of years ago. The same policies. The same outcome. The same frantic need to build an economic castle, even if it’s on sand.

As Mark Twain liked to say, “History doesn’t repeat itself, but it does rhyme.”

It starts with a man named John Law…

Law was a Scottsman who, back in the early 1700s, proposed some powerful, pretty novel ideas.

He suggested that money lacked intrinsic value and didn’t need to be backed by gold or any precious metals.

In his opinion, as long as we increased the supply of money we increased credit, which increased general welfare.

His ultimate belief was that a national bank could lower interest rates by increasing money supply… which would reduce debts, for one.

James: Sounds very familiar.

Mark: This was more than 300 years ago, James.

And Law had a plan to put this all into play with a grand experiment.

In 1715, following the death of King Louis the 14th, he approached the Regent, Philippe The Second, Duke of Orle’Ans – the nephew of Louis the 14th.

Louis’ successor, the 15th, was only 5 years old at the time… so in no position to handle the mess his father had left. Hence Philipe was assigned office as ‘Regent’ until the heir was old enough.

But that meant Philippe had to deal with a major problem.

See, the late king had been a bit of a war monger – and his lust for conflict had BURIED the French economy in a debt EQUAL to the entire national output.

In other words: a debt to GDP ratio of 100%.

To quote historian Earl Hamilton: “Bankruptcies were rife; thousands of workers were unemployed; manufacturers were idle; commerce was stagnant; and agriculture in distress.”

James: That could have been written about 2008.

Mark: And the solutions presented were the same.

John Law came to the Duke and summed his problems up to him neatly: you owe too much money, and you pay too much interest on that debt.

But he had a solution for him.

He wanted to establish a bank – and increase the supply of money… ‘an abundance of money,’ he said, ‘would lower interest rates to 2 per cent.’

James: Only 2%? We’ve seen 0% now.

Mark: Oh yeah. And as you’ll see… a bond bubble at 2% destroyed a currency and collapsed the French economy…

But that’s skipping ahead.

Now, Law wanted to set up a national bank – like the, at the time, recently established Bank of England or the first European national bank, the Wisselbank in Amsterdam.

They shot him down… initially. Instead, they let him start The General Bank, a private institution with the Regent’s patronage and a government edict making its notes legal tender for the payment of taxes.

James: Similar to how the Federal Reserve is a “private” bank.

Mark: Bingo.

Shortly after, Law bought a company called the Mississippi Company, which possessed monopoly trading rights to the French Louisiana – half the landmass of the United States excluding Alaska.

We later bought that property from Napoleon for eighteen dollars per square mile.

By December 1718 – we’re talking just a few years here – the General Bank was nationalized… and became The Royal Bank.

That’s when things finally blasted off.

It meant there was NO LIMIT to the amount of money Law could issue – money which was denominated in the primary currency of the time.

Come the summer of 1719, Law arranged for the Mississippi Company to purchase ALL of France’s national debt in exchange for an annual payment.

James: Like the Fed buying up Treasury debt since 2008.

Let’s pull up that chart you showed earlier – the overlay of the Treasury’s balance sheet and the stock market.

Mark: Right. That chart could have been identical to what happened in 1719.

Law told government creditors, “Why don’t you redeem those bonds to my company in exchange for shares of the stock?”

In short – let me hold the debts… just invest in stocks!

The people who got into that first offering saw their money grow forty-times over…

It led to the coining of a word we all know today: millionaire.

And Law was able to build the hype around the Mississippi Company with standard propaganda: he told people about how explorers were leaving France to the El Dorado of Louisiana to mine gold, and silver in abundance.

The truth is that it was a backwater port, where more than half the settlers died or fled back to Europe.

But the driver was simple: the MASSIVE money supply. People would dump cash into shares of the company because the Royal Bank supplied speculators loans at 2%!

Law created what would be dubbed ‘the chimera’ – a massive market bubble built around the Mississippi Company financed through CHEAP, low interest government debt.

This bubble spread across all of Europe, James.

The bank employed six full time printers to keep the press rolling.

At the time, bank cashiers still had to hand sign bills. That was replaced with printed impressions – like you see on modern banknotes.

By 1720… bank issuances had increased 50-fold and was equal to twice the amount of gold and silver coins in circulation.

Law became one of the richest men that ever lived – spending around $350 million in modern money to purchase the Palais Mazarin… what is now the National French Library.

James: I’m gonna take a guess and say this whole thing turned sour.

Mark: Fast. Everyone had started to see the ‘emperor’ had no clothes – there were no profits to substantiate the OUTRAGEOUS share price of the Mississippi Company… and when the company which owns the national debt has no value – what does that mean about the nation itself?

James: It’s like we saw recently with the tech crash – private equity and banks holding credit for these rudderless companies – these zombie companies – could do it all day when it didn’t cost them anything– when borrowing money was cheap due to zero percent interest… even if the company had no path to cash flow.

But when you start trying to monetize it… when you realize everything is suddenly getting much much more expensive…

The perspective starts to change a little.

Mark: Exactly James. You’re seeing exactly what people started to notice during the bubble.

Well, in 1720, it led to the creation of another word we use now – “realize”.

Mississipians began trying to “realize” their ideal paper holdings into real, non paper holdings.

Law then took the route of every crazed monetarist: he proceeded to ban gold and silver. He started to artificially change the price of precious metals. He denounced hoarding money and told people to circulate cash and stop saving it all – aka, velocity of money. Something our own Fed harps on.

James: You weren’t kidding. It’s like deja vu just hearing you go through all of this.

Mark: Get this…

People started feeling the pain –

Law’s experiment had caused the price of a commodity index in France to DOUBLE in a year, leading to out of control inflation soaring towards 23%.

Creditors began to realize as money circulation slowed, as people began to actually sell off shares of the company… it wasn’t worth anything. Any attempt to redeem the shares – like a Treasury IOU – was met with discouragement.

Shares went from 18,000 livres – the currency of the time…

to 10,000…

to 5000…

to 1,875.

The economy collapsed.

Not just in France, but across Europe a market crash sent nation’s into a tailspin.

The Royal Bank was stormed by citizens, who smashed Law’s carriage to pieces, and ultimately led to him being denounced by the Regent and fleeing France… abandoning his wife and daughter.

By the end of 1720, there was no quote attached to paper livres – the public had completely disowned the currency.

France tumbled into a depression – the bodies controlling taxes, debt, the national mint, overseas trade… all of them fell apart and had to be rebuilt.

There wouldn’t be another national bank in France for 80 years, when Napoleon would step in to pull the nation out of the aftermath of the French Revolution…

A Revolution which John Law’s experiment paved the way for by hobbling the French economy’s growth for the next 70 years.

James: What an insane story. All of that because of a bubble in bonds. It fundamentally altered the French economy for nearly a century.

Mark: Here’s the thing – Law isn’t some vague character in financial history.

He’s considered one of the world’s ‘great’ economists. They teach his work in college economics courses.

His ‘System’ is the basis for modern central banking.

A system which led to out of control inflation near 23%, riots, and financial collapse. A system which ultimately led to the French ‘Reign of Terror’ and Revolution.

One Yale professor actually said Law’s approach to economic activity is: “the essential principle underlying the decisions by the U.S. Federal Reserve Bank today.”

I showed everyone this earlier, James – once Lehman Brothers collapsed, panic called the shots.

The Fed didn’t take a page from Law’s book – they swiped the whole thing!

Cheap credit, buying up government bonds hand over fist to provide easy money for speculators to push asset prices to the stratosphere, crashing interest rates to all-time lows.

This was the first time in history interest rates had ever hit 2%.

Look at this again… look at the Fed fund rate overlay with the market.

It’s insultingly obvious. Low interest rates, to feed a debt addicted economy, pushing us to artificial highs.

James: When you see it now… you truly ‘realize’ how scandalous it is.

Mark: Instead of millionaires, though, we had a historic number of new billionaires.

And just like then, when people began to realize the valuation of all these bad holdings… as interest rates climbed and made money expensive… things started to fall apart.

James: It’s amazing how all of this data has been available… and yet the people at the helm of our economy sailed right into it.

Mark: Yep. The global economy is a ship. The bond bubble was the iceberg. Only this one stood clear out of the water and policymakers covered their eyes. They ignore the lesson history’s first foray with low interest rates taught us.

Now, these people are running around trying to tarp the holes.

They slashed interest rates to the LOWEST levels in 5,000 years

They got the global banking system addicted to the drug of cheap debt. They all collateralized in bonds… levering up their positions… which then became too expensive for them to manage in the wake of a stifled economy as inflation ran rampant.

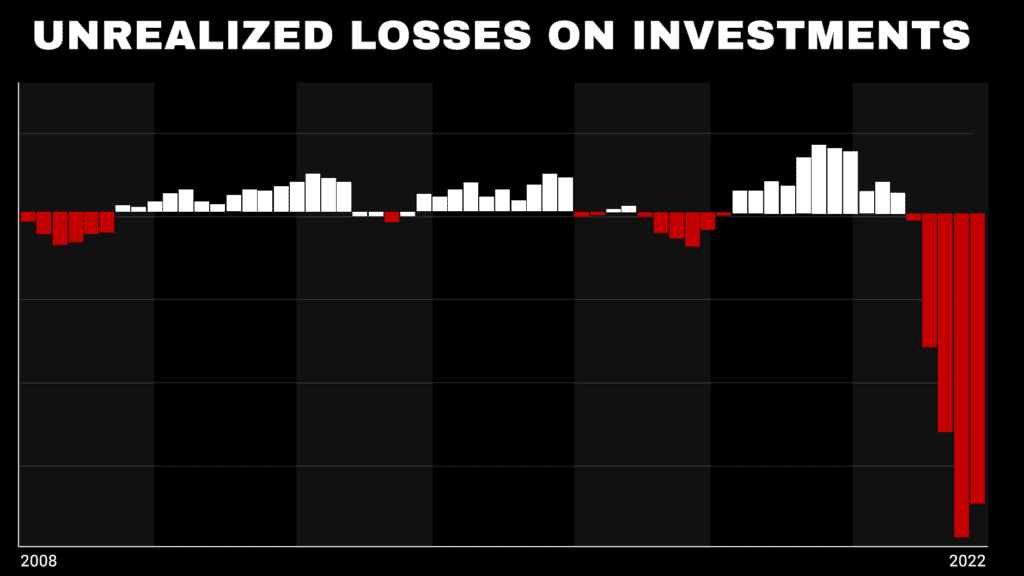

It led to banks reporting almost $700 billion in unrealized losses… almost 10x MORE losses than they had in 2008.

Now, the chickens have come home to roost – rising rates with surging inflation, brutal debt deleveraging, and outrageous corporate valuations have turned this into a systemic contagion.

Even with the market’s panic, yields on 2-Year Treasuries have refused to come up – showing that the market, the smart money, knows the crisis hasn’t even reached its apex.

James: No wonder SVB came apart.

Mark: Now, with the swap lines reopening – they’ve said one thing: these banks matter. Liquidity for banks matters.

But what that does to us – to our money, to our families – we can be left out in the rain.

It’s why I see the 40% collapse in housing…

The 50% crash in stocks…

And the cost of living continuous to soar across the board…

While potentially 1,000 banks fail in the months to come.

James: Mark – I have to ask the obvious question.

Couldn’t all of this be undone by the Fed turning dovish? During the most recent meeting, the Fed hiked rates 25 basis points… but couldn’t Powell stop this tragedy in its tracks by slashing rates again and pivoting?

Mark: That’s a great point, and that’s a common misconception. But as Morgan Stanley was forced to admit recently too, “Every [Fed] hiking cycle over the last 70 years has ended in recession.”

But really, it goes back further – as far as 1929…

The Fed made a pivot in August 2007 – stocks didn’t bottom until February 2009, 18 months later after falling 50%.

The Fed made another pivot in December 2000 – it took 21 months before stocks hit the trough, losing 38% of their value.

On average, you’re looking at 14 months and near 30% further declines in the market from the moment the Fed pivots.

Part of this is because there’s no perfect time to pivot… in the 70s, the Fed thought inflation was going to walk down from 13% to 4 or 5%. They made a big pivot, which actually caused inflation to take out new highs and ushered in Volcker.

We have a similar setup now – elevated commodity prices. Sticky inflation. And an economy which would be smashed to a pulp from a pivot.

James: So really… it’s when the Fed starts to pivot that you should buckle up.

Mark: The other side is – they can’t pivot. Powell knows it.

Remember what happened during the Mississippi Bubble – John Law kept slashing rates, refusing to let interest tick up, and it caused commodity prices to explode, sent inflation to the moon, and utterly destroyed the value of the currency.

If he pivots, Powell knows the embers of inflation will be stoked into a wildfire that will burn the dollar to a cinder.

Similar to what I just said about the 70s pivot that caused inflation to balloon.

Powell has two choices – break the back of banks with higher rates… or break the dollar and send us into an out of control economic spiral.

That’s what happens when you have $500 trillion in leveraged debt to deal with. It’s the same lesson John Law had to deal with.

James: Mark – We’ve seen the details of this massive asset bubble in bonds…

Not just the $123 trillion globally… but $500 trillion of derivatives saddled on top of it.

The final in a series of bubbles the Fed has inflated for more than two decades…

The biggest bubble the world has seen in 800 years…

Inflated by the lowest interest rates in recorded history…

Causing three of the biggest bank failures in US history within a week… and the failure of one of the largest banks in the world, the TRILLION dollar Credit Suisse.

And instead of ‘taking their medicine,’ so to speak, the Fed has bailed out banks and injected potential TRILLIONS of liquidity into the markets again…

Opening the spigot of currency swaps, which are already a ticking $80 trillion time bomb… while ripping open the Discount Borrowing Window, establishing a new “backstop” in the form of the Bank-Term Funding Program…

All of this is underwritten by the Treasury, the Federal Reserve, and the FDIC…

The Federal Reserve which is handcuffed, incapable of raising rates too much or pivoting – as either path will be a death blow to the US as the $500 trillion bond bubble continues to flatten the economy.

Mark: That’s a great summary.

James: It’s like you said – all of this is wrapped up in big numbers, in complicated swaps, and derivatives, and collateral designed to make it a maze for the average person.

What you’re doing here is blowing down those walls – but I think the most important part is for people to understand… this doesn’t stay isolated to the marble halls of Wall Street and central bankers.

This comes home. This takes a pound of flesh from us, the regular people.

Mark: These firms have had a profit parade at the expense of the average person.

Banks saw a profit jump of almost 90% in a single year…. By cutting into funds they set aside for protection against credit losses.

James: I’m sure that didn’t help when the bonds started turning toxic on their balance sheets.

Mark: Exactly. So we look at what the Fed has done…

They inflated the biggest bubble of the last millenia, driving inflation rates to their highest levels since 1981.

For the average person, when stocks were moving across the board… this was like manna from heaven.

Because private equity was dumping FREE money they were getting at near zero interest into any company with a quirky name.

James: I remember reading that private equity actually experienced some its best years ever…

Close to $1 trillion in capital raising.

Mark: And some of the biggest single day IPO gains of all time…

Companies like Zoom jumped 172% in a day…

Shake Shack hit 218%.

Beyond Meat ran up 263%.

James: All of which are now down 50-90%.

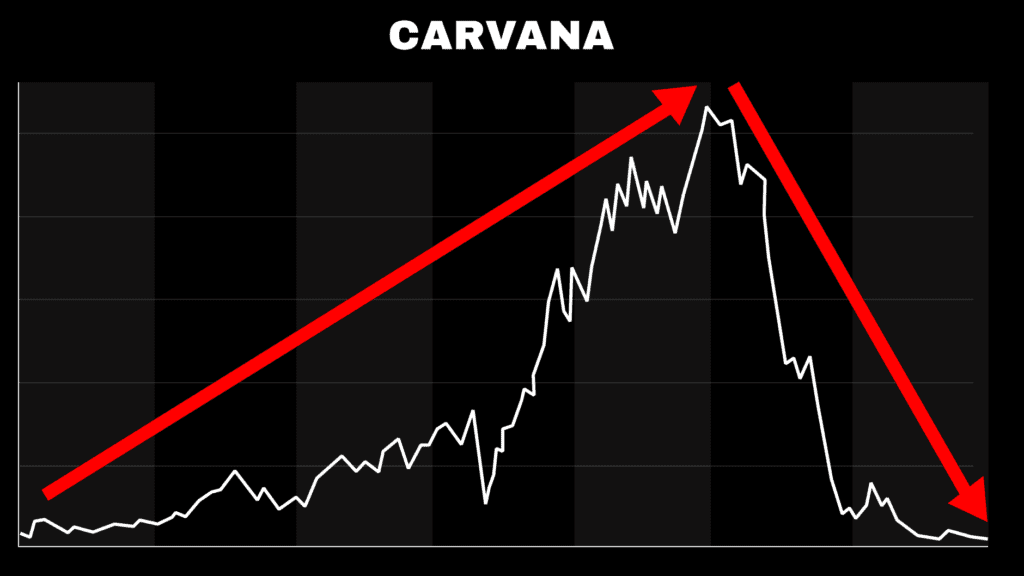

Mark: Just look at a Carvana chart to see something really shocking. That’s because what powered them was that easy, cheap money.

It’s the same reason we got to the point where we somehow created one new unicorn company a day.

I’m talking about companies hitting over $1 billion in valuation before they even went public.

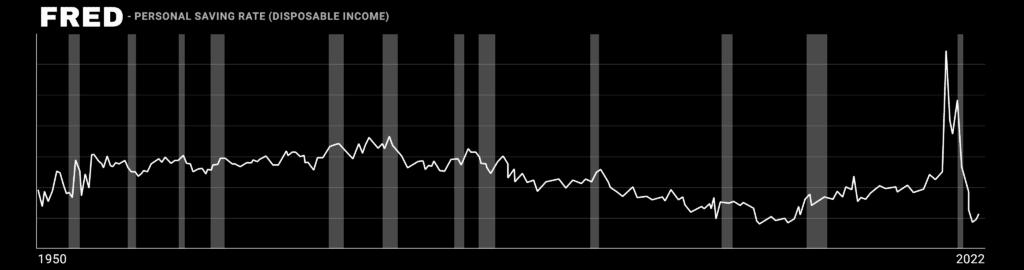

During covid, personal savings ran to almost 34% – the highest rate of savings among consumers since 1959.

But then the Fed slashed interest rates… and, just like John Law in 1719, urged people to spend… to speculate… to stimulate.

James: Meaning people weren’t encouraged to save – they were encouraged to SPEND. To speculate. To jump on Robinhood’s slick platform and trade options, trade crypto, hope for stock to “moon.”

Mark: As a result, savings are now at the lowest rate they’ve been since 2005, when we were racing towards the cliff known as the Subprime Mortgage Crisis. We’re talking a near all-time low.

Imagine saving only $2.30 for every $100. That’s where the average person is.

James: But what about all the savings from before?

Mark: You can see here – part of that major inflationary maelstrom was all that personal savings being used as a massive percentage of income. 26%, to be exact.

Again – like John Law before him, Powell’s policy encouraged consumers not to save – but to spend on frivolous companies.

James: We’re talking about a QUARTER of income being generated from personal savings… you mean $26 out of every $100 spent was from the “rainy day” fund?

Mark: You got it. That’s the highest savings as a percent of income we’ve seen in over 70 years of data… then it cratered to 3%… a low only seen during the 2008 Crisis… when people stopped having savings as employment dried up.

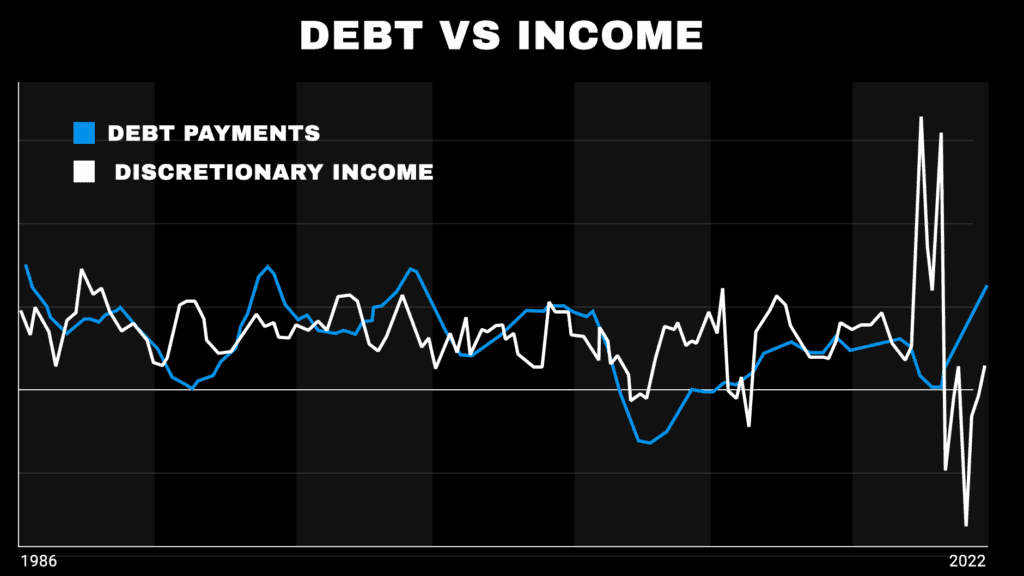

Today, debt payments are growing FASTER than discretionary income.

This data here from Morgan Stanley paints a grim picture.

You can see DEBT payments (blue line) rocketing while income (white line) bottoms out.

As a result, the AVERAGE savings account balance is less than $42,000 – and that includes demographics ranging from under 18 to 100 years old. The average account balance is actually closer to $5,000.

And that's why we like to break things down into quintiles, James. A lot of the savings in America is sitting at that top 1% And by the time you get to the top 20%, You've essentially seen the most amount of savings. Everybody below that quintile is struggling to keep up with expenses.

This only makes the fact real wage growth has been firmly negative even worse – it means that while inflation has soared…

While savings have gone up in flames..

James: People have had to find other ways to survive.

Mark: I want to emphasize – this is because of pure economic ignorance on the part of the policymakers.

It’s because of people like Yellen and Powell we’ve seen these calamities…

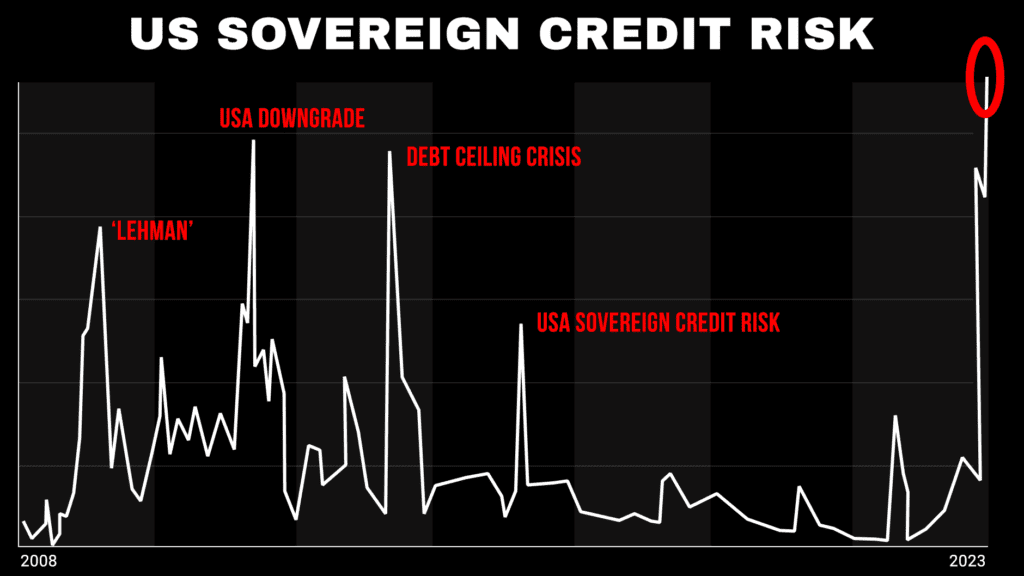

It’s because of Yellen and Powell the US sovereign credit risk has soared to a RECORD high.

It’s because of Yellen and Powell that the next phase of this catastrophe is going to play out, and rip north of $10 trillion… as high as $16 trillion… out of the market…

Right now, there are two wheels turning the economy… like the tires on a bike. And both are about to go flat.

James: You really think these two “wheels” locking up will be enough to stall the US economy?

Mark: The entire bond bubble was inflated to keep these wheels turning.

In essence, the market is a merry go round – once which the Fed and Central Banks around the world are constantly trying to keep spinning and spinning.

But they can’t keep that artificial momentum up forever – and that is what has caused the freefall for consumers like us – it’s what’s sending our interest rates on credit cards, houses, cars, soaring…

Causing food prices to surge…

Destroying savings…

Annihilating commercial real estate…

And causing real wages to flounder in negative territory for years.

In short order, it’s going to be why unemployment catapults to new highs…

James: I hope you all lean in and listen – according to Mark, these two “wheels” of the economy are the impetus for the largest asset bubble in history.

$500 TRILLION in bond derivatives have been inflated to keep these wheels turning… and now, with that bubble pricked… they’ve begun to stall… and paralyze the American economy with them.

Alright Mark – lets hear it.

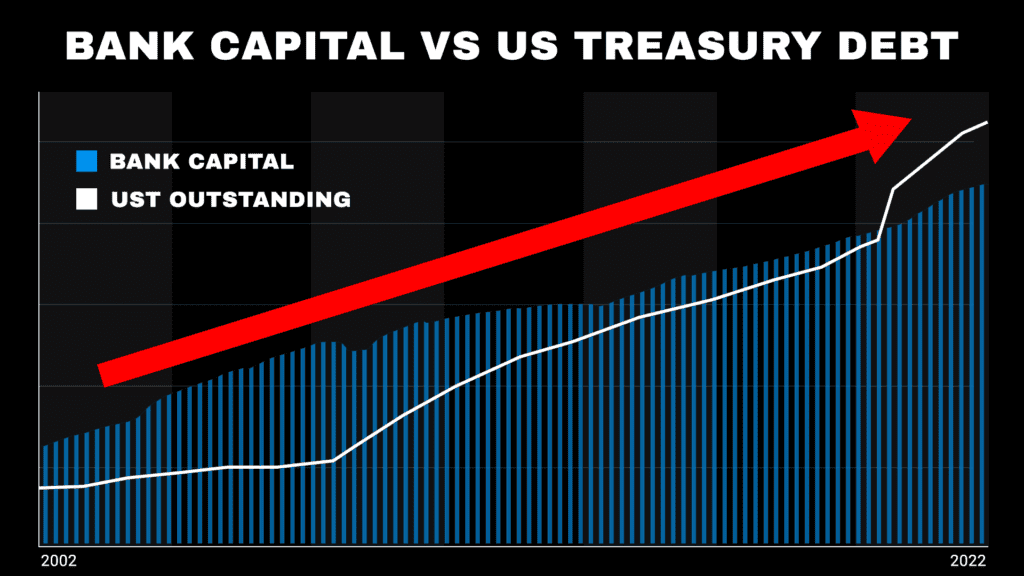

Mark: The first wheel you have to understand – is banks. Small, regional banks, specifically.

The first place the Fed goes with money during a crisis is banks.

Greenspan injected over $100 billion of liquidity into banks during the early stages of the tech wreck.

In 2008, The Treasury was given go-ahead by passing of the $700 billion TARP – a license to purchase toxic financial assets and stabilize the banking sector… while the Fed slid open the discount window and poured $110 BILLION into banks in one week.

Plus there’s the $3 trillion the Fed added to its balance sheet in a little over 6 weeks as it bought up debt and increased bank liquidity.

James: In short… the first fire they try to put out is banks.

Mark: Right. But this time… rather than only dealing with megabanks, a more “grassroots” issue has exploded.

Your small, regional banks took on the obligation of lending for the most part.

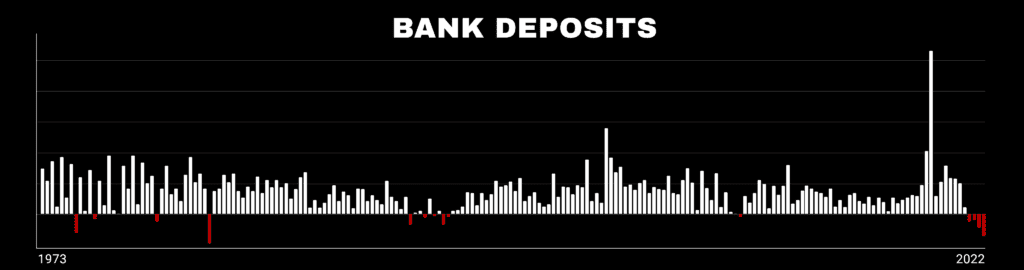

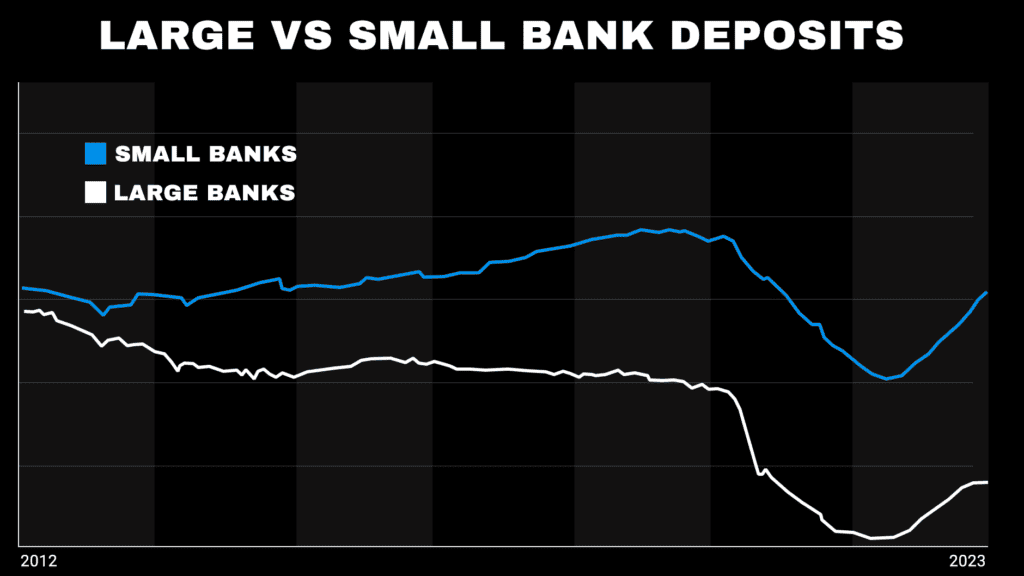

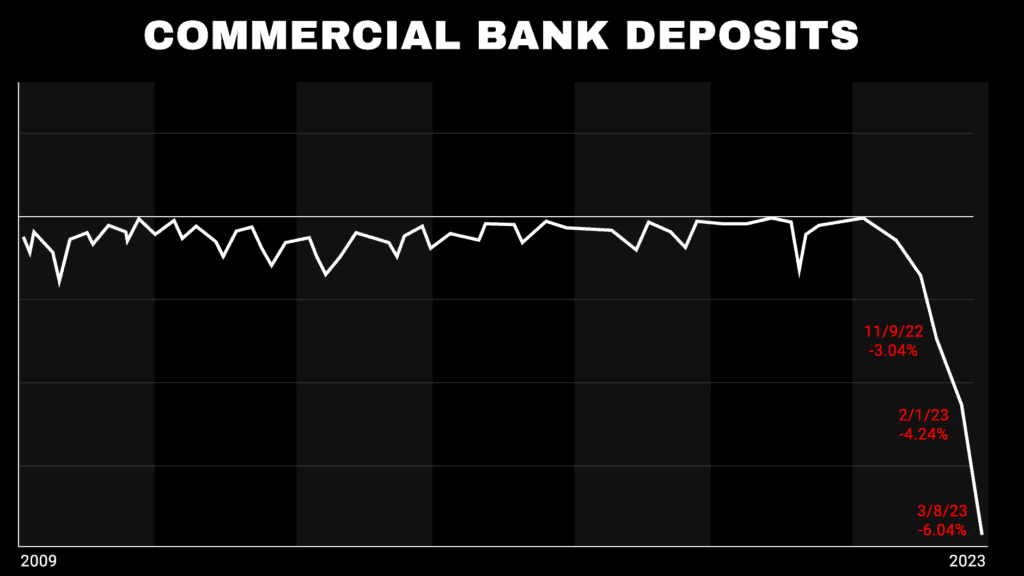

They’ve been borrowing at a record pace while deposit outflows – meaning losses and withdrawals of funds – have hit their highest levels since the financial crisis. Really, since the oil shock in the 70s.

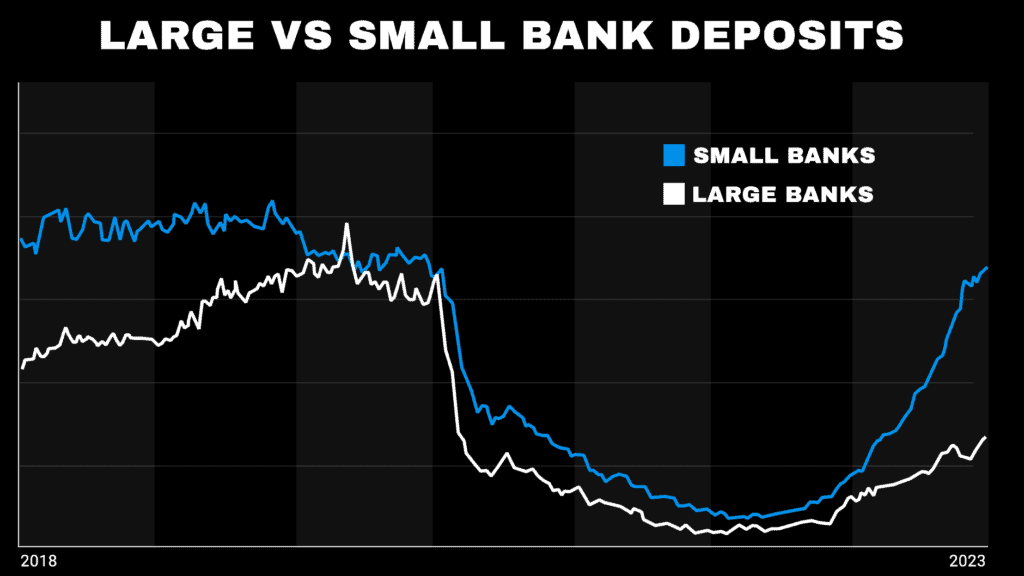

That’s just banks in general – when you look at this rate of deposits for small banks, you can see they’ve had their legs taken out from under them…

This money has flowed into big banks who are able to offer higher yields…

CNBC actually commented that we’ve only recently seen the flows from small banks into firms like Citi, JP Morgan, and Wells Fargo start to slow down.

James: Banks that, like you showed earlier, have taken over $100 BILLION from the Fed.

Mark: We all know the phrase – “too big to fail.”

Except a lot of little places failing makes a big problem

And you can see how they bridged the gap: They borrowed money to fill their reserves at a rate of almost 90%…

And derived more than 82% of their income from loans… as opposed to the bigger banks which only make 60% of their income from loans and leases.

Steve Blitz, an economist from TS Lombard, said that this loan income dependence made small banks “more aggressive in lending and borrowing… to fund themselves.”

So we’re talking about a MASSIVE sensitivity to any change in loan repayment or deposit outflows.

James: I hope everyone is seeing these charts on their screens, because this stuff is shocking.

Mark: Here’s where things get really nasty – small banks punch above their weight.

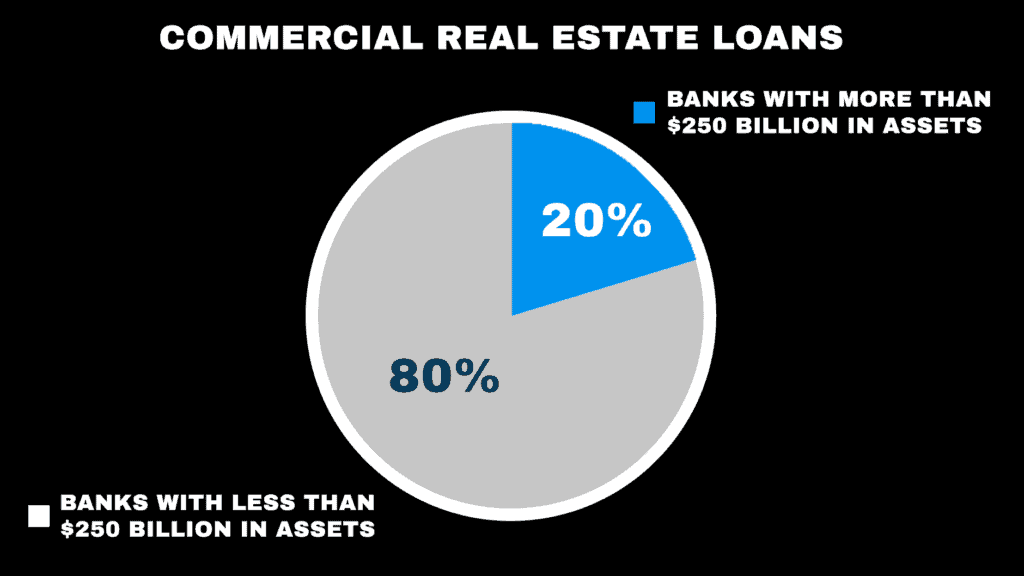

They own around 80% commercial real estate loans… auto loans, which are the THIRD largest consumer credit market… commercial and industrial loans… consumer loans…

AND the $13 trillion single family residential market.

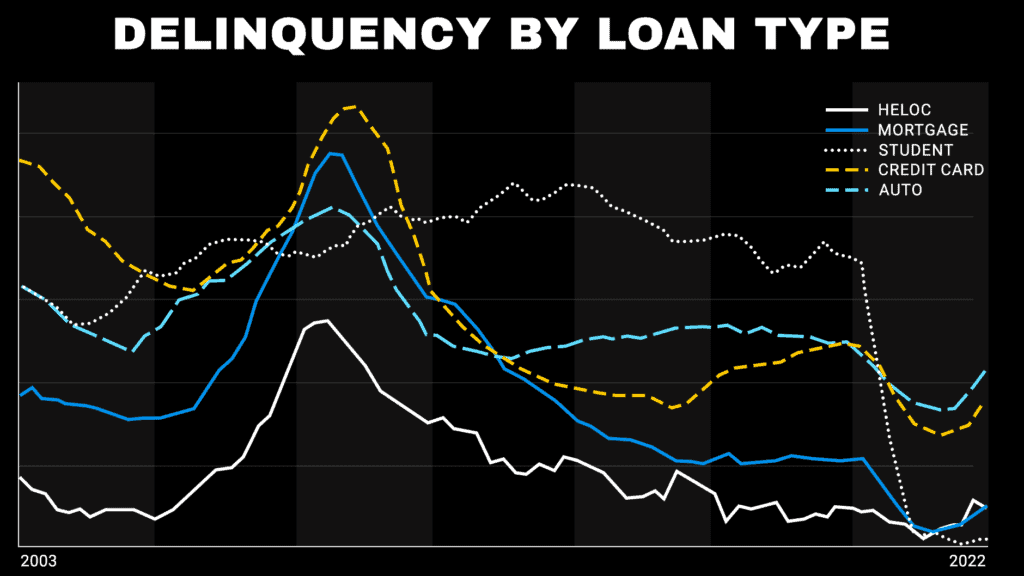

Look at this overlap in credit card delinquency and defaults on residential, commercial, and autos from the subprime crisis.

Small banks went into OVERDRIVE with lending from 2020 onwards.

James: It’s like one big wave.

Mark: Right. Because most people are probably using their credit cards to bridge the gap on mortgage payments since they’re living paycheck to paycheck.

James: We all remember the game – at some point in our lives – of using one credit card to pay for another and how, 15 years ago, this seemed normal!

Mark: Well, it seemed normal again when money was flowing from the fountains thanks to the Fed.

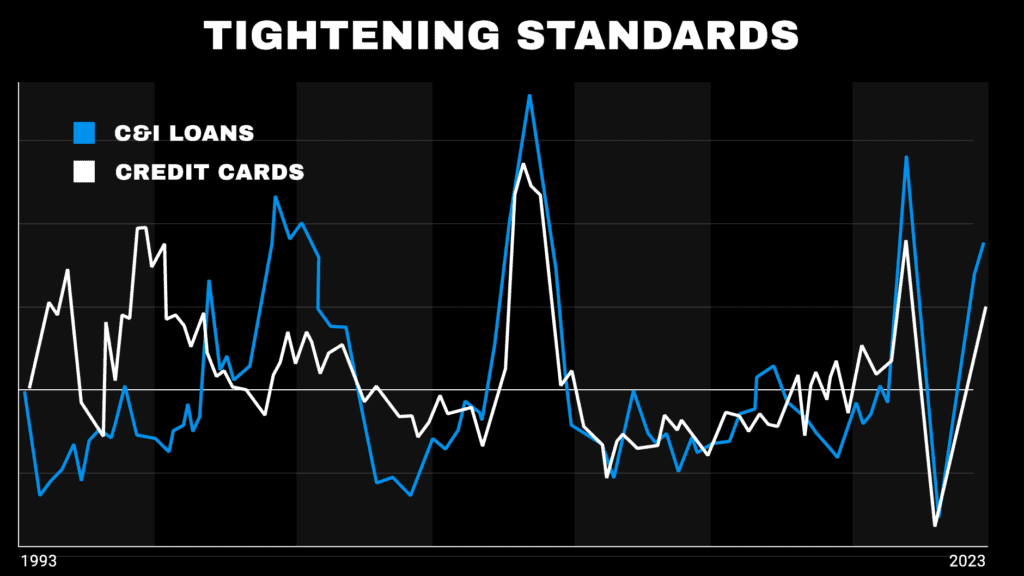

But these defaults are happening, faster and faster, and with the major banks getting hit… they’re going to do one thing: tighten up.

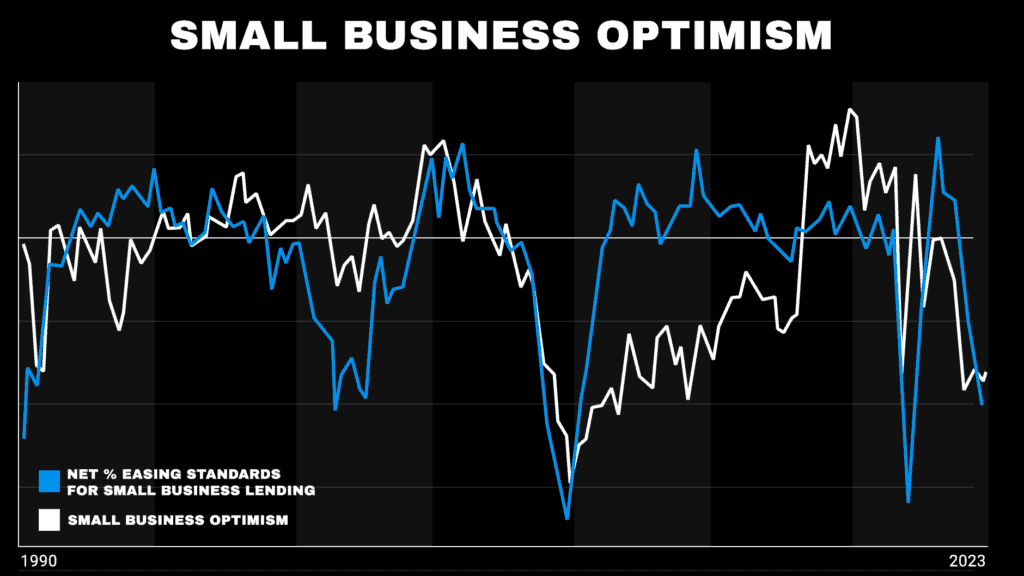

Every time the Fed has opened the discount lending window, dumping money, we see tightening of lending standards by banks.

The blue line is the Fed discount window – the red line is the net percent of banks tightening standards for lending.

This is because as the expense of all that debt on their balance sheets rises, they need more cash on balance sheets for write-downs.

The result is they freeze new loans – they stop lending to consumers.

When consumers can’t get loans, we almost always get a recession.

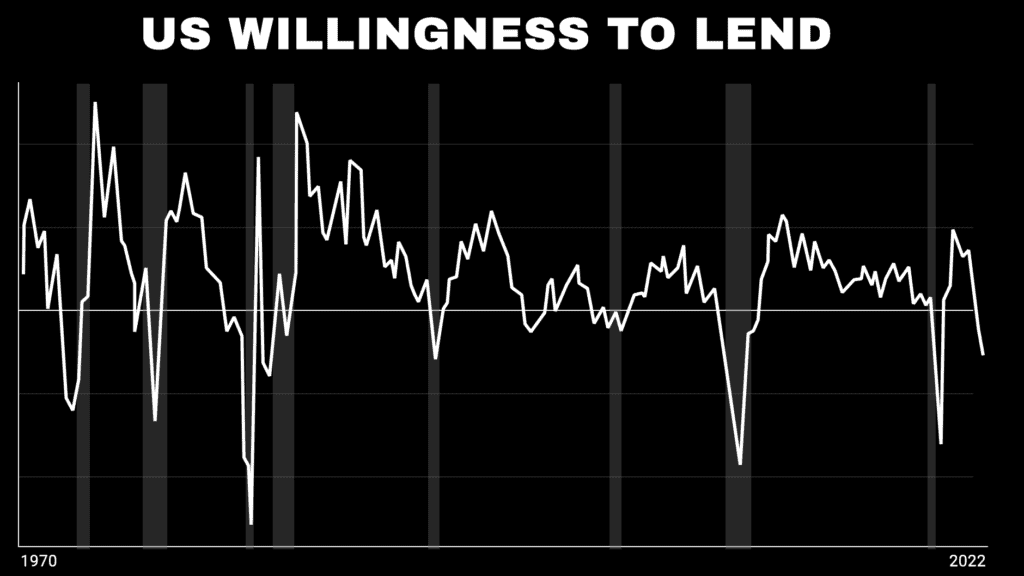

Here’s one chart – the highlighted areas are recessions. The white line tracks loan officer willingness to provide credit to consumers.

Banks were scared before SVB, Signature, Credit Suisse, and First Republic failed.

These banks already saw $620 billion in unrealized losses last year – the highest we’ve ever seen… 6-times higher than 2008.

Nearly HALF of banks have started tightening their standards… meaning not only can consumers not get loans…

But now, businesses, too. In 2020 and 2021, when the Fed was sitting there buying mortgage backed securities… banks were waiving income proof requirements. They were waving away reports because they wanted to get money out the door.

That’s over now. That’s gone – for consumers and for businesses.

James: And when consumers can’t get loans… and small businesses can’t get loans… the credit pool dries up.

Mark: Exactly, James. Imagine when farms can’t borrow for equipment, for repairs, for expansion, for seeds, for fertilizer. Whatever it is they need.

Remember… it wasn’t one big bank falling that triggered the Great Depression.

It was the unwind of thousands of small, regional banks who had loaned consumers money to speculate with

That brings us to the second wheel: small business.

We are in a credit addicted economy.

The bond bubble fueled a freewheeling, open-handed, “driving drunk” economy with no limitations. Or, as we like to say, the “addict” economy which needs its next hit of cheap credit.

But banks are scared now.

And when they tighten up… when credit tightens… everything goes out with the bathwater.

James: Meaning small businesses can’t get loans… or pay escalating interest on those loans.

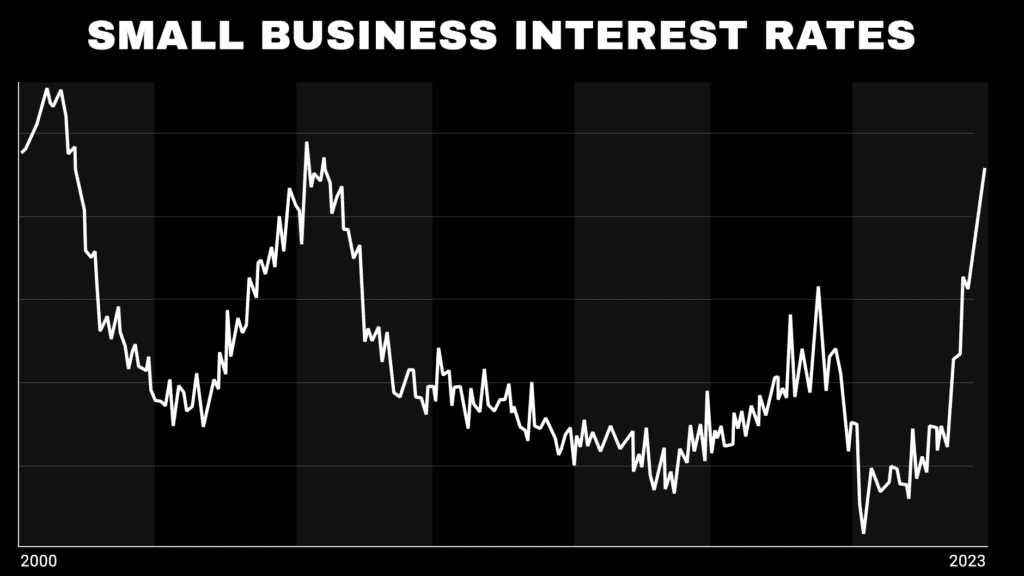

Mark: Yes! We’re already seeing those small business interest rates more than double.

How many of them can handle that squeeze before they start to crumble?

Corporate bankruptcy filings hit a 12 year high within the first two months of 2023.

Commercial bank deposits have already started to fall – something we haven’t seen since 1948.

One report showed that 500 startups failed almost immediately when SVB went under…

And another report shows that almost 30% of the Russell 3000 is at risk of collapse due to lack of capital.

One venture capital fund actually forecasts we are going to see – and I quote – a “mass extinction event” for early stage startups…

I’m talking about 80% of these small businesses disintegrating.

In their words, “It will make 2008 look quaint.”

Bank of America published this sentiment analysis recently, showing how small business optimism plummets with tightening credit.

And we’re watching startups across the board slashing valuations by 90% or more.

Which means that you have the Blackstones of the world taking writedowns.

But this is really dangerous in one other category.

Commercial real estate – including farms.

James: You’re saying farmers are impacted here?

Mark: Farmers borrow money all the time.

Equipment breaks down. They need new machines for their property. They need to get credit from small banks to expand property.

Little known fact: farmland is considered commercial real estate.

Small banks own almost 70% of commercial real estate loans.

The tighter lending gets, the tighter margins become for farmers… for small businesses… for the manufacturers producing farming equipment… seed, fertilizer…

James: Which comes back to the root of everything – food. This all means our food gets more expensive.

Mark: Commercial Real Estate is in a CRISIS with defaults on loans rising sharply. Elon Musk, of all people, has even come out of the woodwork to sound the alarm about imminent defaults on mortgages and commercial loans “hammering banks.”

To paraphrase Steve Blitz from TS Lombard – a rise in commercial real estate default alone would be a catalyst for a major crisis.

Michael Hartnett, the CIO of Bank of America, has even called commercial real estate…

“the next shoe to drop.”

James: So not only is the consumer in peril from credit collapse… not only are regional banks and lenders teetering on the edge… but small businesses, which make up nearly half of our national GDP… and nearly 50% of all employment in America… are also jeopardized.

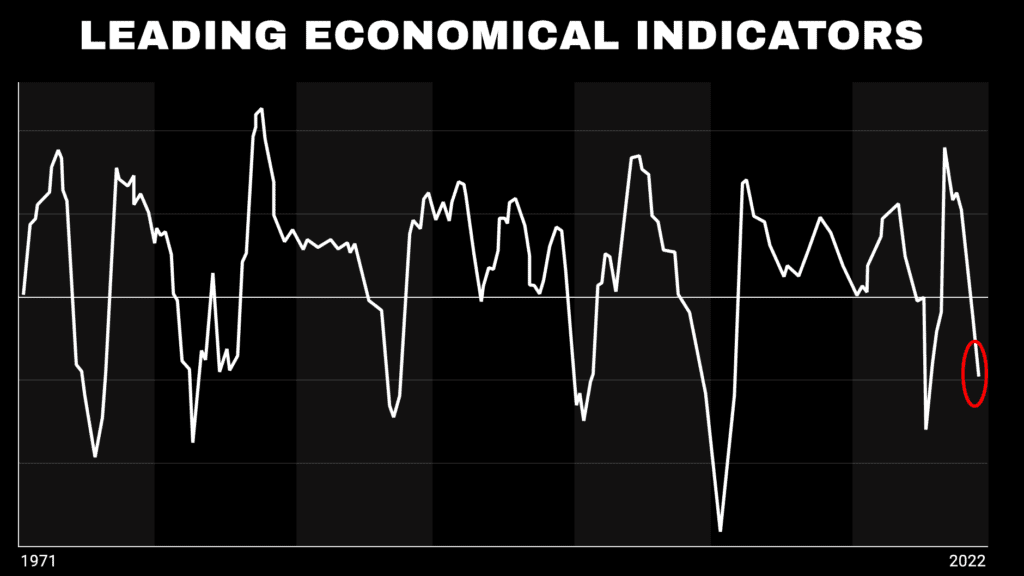

Mark: It’s already been reflected in the Conference Board’s Leading Economic Index.

This is one of the most accurate predictors of recession we have…And it just saw its biggest year-over-year drop since 2008 when Lehman went under outside of Covid… signaling an imminent recession.

James: That. is. a. scary chart.

Mark: James – this is the last one.

Because this is the sign everything is coming down.

It’s why consumer defaults are going to explode…

Why banks are preparing for insolvency across the board…

Why the market is going to see a 50% haircut.

Everyone is battening down the hatches.

James: Let’s see it.

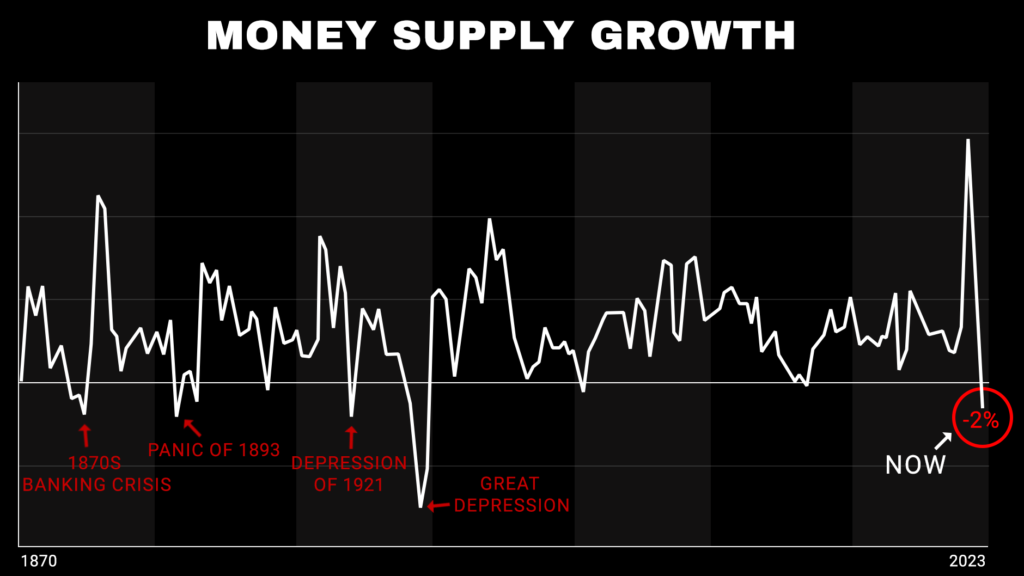

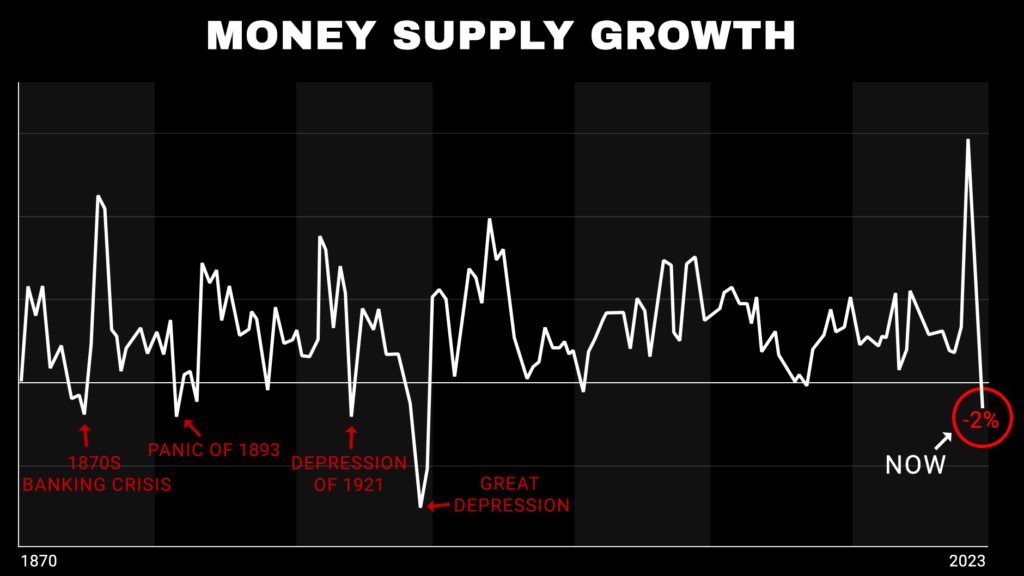

Mark: This is a chart of the M2 – it tracks money supply growth.

It has been a critical indicator for tracking events like recessions.

Not only has it fallen at its sharpest rate since the Great Depression…

But this is the first time a drop has coincided with a rate hiking cycle by the Fed.

One of the key reasons that we're seeing that is because if you go back to the 40s, you can see that there has been a continuous increase in the money supply.

And without a reset, without pulling some of that back, you inherently start seeing this liquidity running amok.

James: You’re talking about a double whammy. A historic, powerful indicator of a recession… combined with an unprecedented event… money supply dropping EVEN as the Fed reopens swap lines, backstops banks, and increases rates to nearly two-decade highs.

Mark: All the pieces are on the board now.

That’s why I call this the Endgame – it’s like all the pieces set to the finish on a chessboard.

“Checkmate” actually comes from a word meaning “the king is trapped.”

In this case, the “king” is the US economy.

It’s trapped. There is too much debt. There is too much inflation. There is too much pressure from every angle.

Consumers can’t sustain it, because the banks and businesses they support are failing.

The shadow of every crisis of the last century is looming over us… from the S&L, to the Tech Wreck, to the Subprime.

James: It looks so much like all of them… because, like you said, it is all of them – bonds underscore every equity and asset.

Mark: Now you’ve got it. This is everything collapsing.

With small banks and small businesses collapsing, you’re looking at the two engines of the economy locking up…

And unfortunately… that’s going to hit the hardest in 3 places over the next 12 months.

But, these three “Impact Zones” also harbor the fortune-making investments of the next few years.

James: So knowing about these “Impact Zones” could help our viewers not only avoid the punishing effects of this bubble… but score their own windfalls in the process?

Mark: Exactly.

James: Alright, let’s dig into them.

Impact Zone #1: Banks

One is the most obvious… it’s going to be in banks and the financial bedrock of the world. The very markets we have our money locked up in.

James: This is the epicenter of the entire Endgame crisis you’re talking about.

Mark: Right. And while pundits want to make everyone think the whole situation has been resolved… it’s because they need to distract people away from what’s already started to build.

We’re looking at the biggest drop in small business credit in 20 years.

This will fracture the economy, the consumer, the markets…

Remember – housing is due for a huge drawdown. The markets are going to be sliced to ribbons. Trillions in wealth, up in smoke.

We’ve talked a lot about those things today,

But knowing where those hairlines will start is key.

Which is why I’ve put together this new report, ENDGAME: The Final Bubble Survival Blueprint.

Impact Zone #1 Report

ENDGAME: The Final Bubble Survival Blueprint.

James: Can you walk us through what’s in this first report, exactly?

Mark: First and foremost, these are the stocks you need to dump, as far as I’m concerned.

Remember, more than 1,000 financial institutions globally are going to turn to dust.

You need to be OUT of the stocks they’ve loaned money to…

And in particular, you need to check right now to see if your money is in any of these groups.

Because if you’re hoping the FDIC is going to be able to bail you out of every failure… you’re in for a rude awakening. Their hands are going to be full.

Specifically, I’m naming the biggest banks to fall…

AND the 3 investments to make RIGHT NOW for the best shot at profiting while the Endgame unfolds…

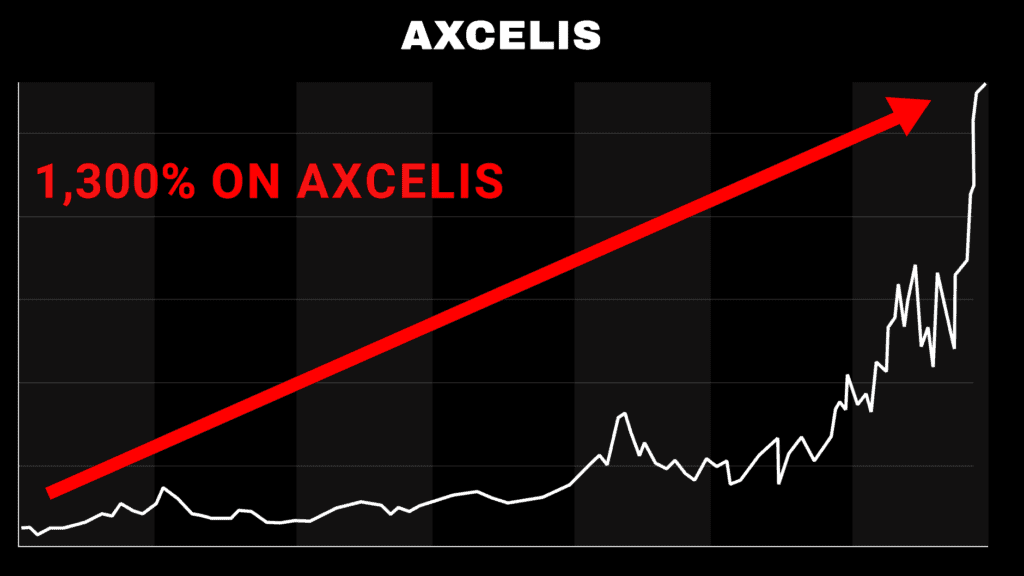

Following the 2008 subprime crisis, we saw companies like Axcelis Technologies jump 1,300%…

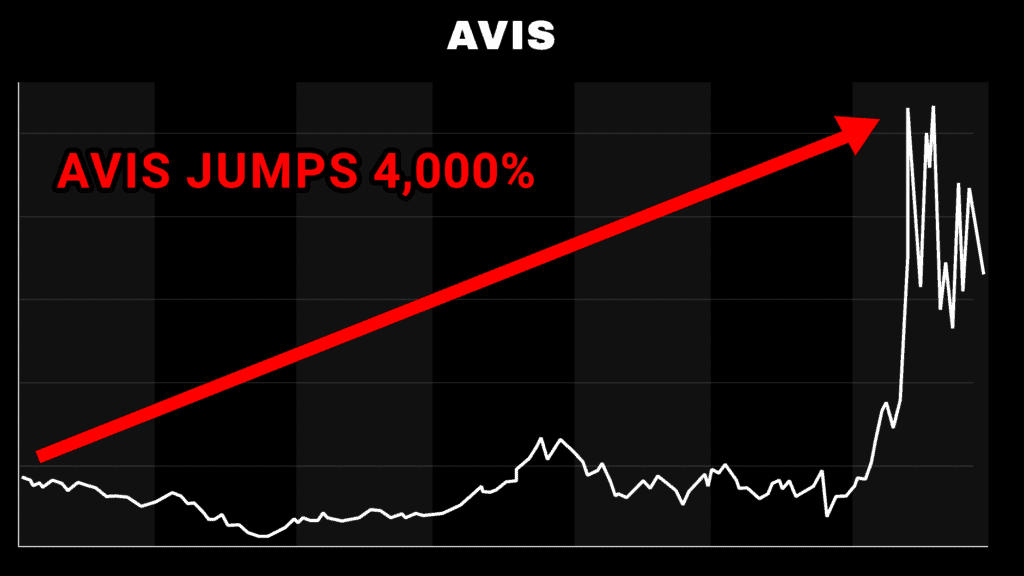

Avis popped 4,000%…

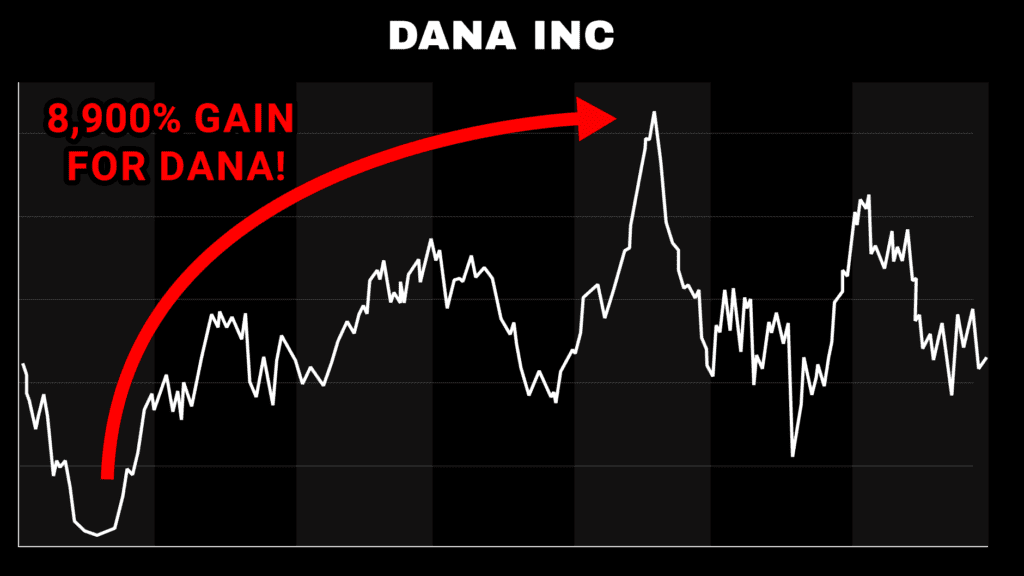

and Dana Inc burst 8,900% higher.

That’s because each was strategically positioned in the most important areas for consumers in the throes of an economic crisis.

My three key investments are inspired by decades of economic data… showing where I expect the next major moves to unfold.

James: Amazing. I am sure everyone watching would love to get their hands on this report… but you’re saying it’s only for the first impact zone.

What’s Impact Zone #2 – and how will you deal with it?

Impact Zone #2: Energy

Mark: The second impact zone is one everyone feels at home every day… and that’s energy.

James: Now, not to diminish everything else we’ve discussed today… but this is really your wheelhouse.

Some of your biggest winning investments EVER were in the energy sector… and it features prominently on reasons you were summoned to Bloomberg for your opinion…

Your knowledge of the energy sector and its intricacies is among the most advanced in the world.

Mark: Well thanks for saying that.

I’ve spent a lot of time studying the energy sector. In my opinion, it’s one of the first places anyone has to turn their eyes if they want to grasp WHY the world is the way it is.

But more importantly, for the Endgame economy… it’s imperative.

Energy is the lifeblood of the world.

Every sector relies on it.

What moves cars to the store?

What moves the tractor-trailers which haul food?

What powers the machines which enable farmers to produce crops?

Energy.

But more importantly, I’m talking about fossil fuels.

James: And you think ENERGY is the second major impact zone?

Mark: The entire financial system is interconnected. Economies are built on the back of energy. For example, about $2 trillion of the German economy is leveraged off of $20 billion worth of oil.

James: That’s Lehman Brothers levels of leverage.

Mark: Worse when you consider Germany’s GDP is just under $5 trillion.

We have one of the most dynamic and precarious situations in energy I’ve ever seen, James.

First, we have an administration which hates fossil fuels… and has drained out Strategic Petroleum Reserves – unsuccessfully – to suppress the price of oil.

Second, we have rising GLOBAL demand for oil in India, China, and the other BRICs. Russia is engaged in a military conflict that requires mobilization of troops and machines at scale, for one.

Third, we have OPEC+ slashing production by more than 1 million barrels per day

These factors all lead to oil going UP.

This puts Powell on his backfoot, because loosening the reins of interest rates – as he’s being pressured to do – would certainly cause speculation to ramp up… and trigger an inflationary gallop that would take oil prices out of control.

Remember – money buys oil. Oil powers everything.

However, it plays a key role to our story here in one particular way: diesel.

James: The New York Times actually wrote “diesel… powers the economy” just recently.

Mark: When we think of energy, we think of ourselves – our cars. How much it costs us to fill a tank for the week.

Our usage is tiny compared to the commercial and industrial energy needs.

And the most widely used fuel there… is diesel.

To quote one source, “Without diesel fuel, the U.S. economy would collapse in a matter of days.”

And unfortunately, the current banking crisis has just made port in the energy sector… causing diesel prices to hit a record high.

There’s a lot to cover here… but I’ve condensed the whole situation into a new report,

Impact Zone #2 Report:

Diesel Doomsday:

Powering Through the Gas Crash

I want people to read this report immediately, because with everything we’ve discussed today… you must understand how the breakdown in banks, in small business, in consumer spending – how all of these things are going to stress the diesel energy sector to the breaking point.

But, it has equipped one company I outlined with the ability to secure a king’s ransom…

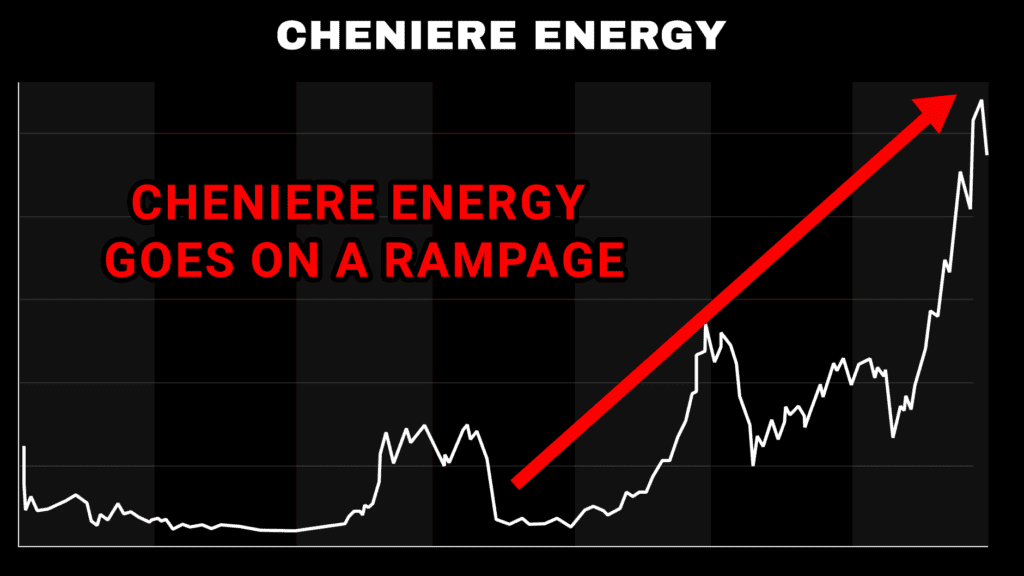

Just like Cheniere Energy jumped 2,500% in two years…

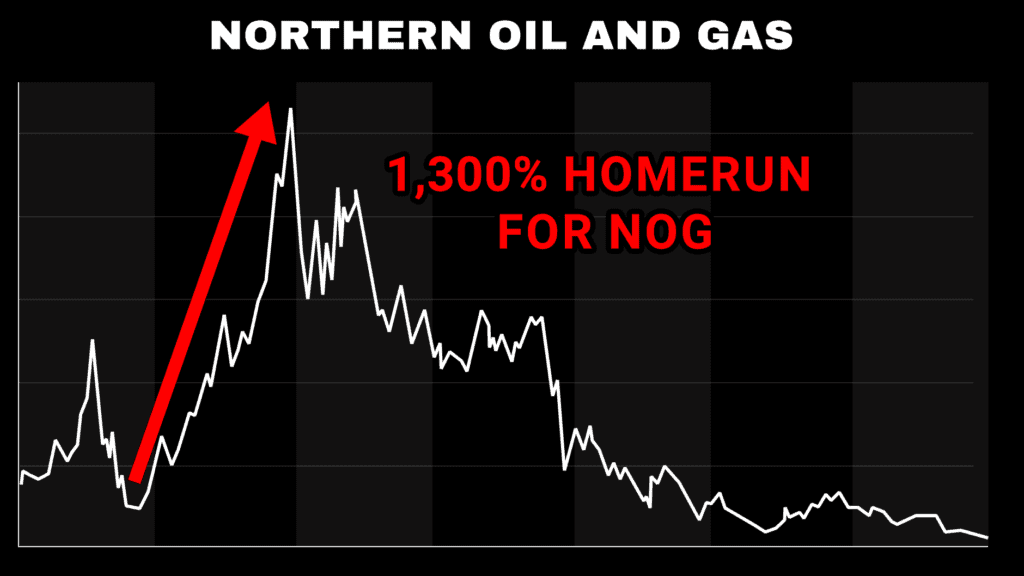

or Northern Oil and Gas ripped 1,300%…

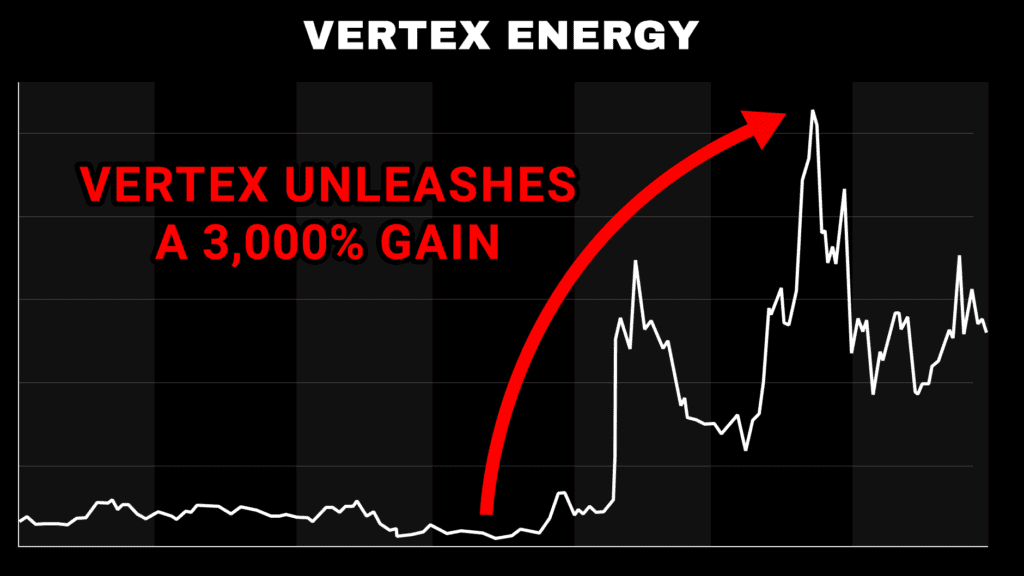

even Vertex Energy, which galloped 3,000%.

All in under two years.

James: This sounds like a fascinating report. And, to your point, some of this stuff really comes out of left field.

Mark: Frederic Bastiat, one of the great French economists of the 1700s who promoted capitalism… he wrote a book called “That Which Is Seen, and That Which is Not Seen.”

People SEE the obvious things rippling across the markets. But it’s not the animal they see coming that bites them – it’s the one hiding behind you.

I think energy is one of the big ones most people aren’t watching… and my report, Diesel Doomsday: Powering Through the Gas Crash, spares no details explaining how this will touch our lives.

James: So that’s the 2nd impact zone… what’s the third?

Mark: The third impact zone hits even closer to home.

We’re talking about food, James.

Impact Zone #3: Food

James: Now, you did actually allude to this a little earlier – you mentioned how farmers are being hurt by the decline of small businesses credit.

Mark: That’s right.

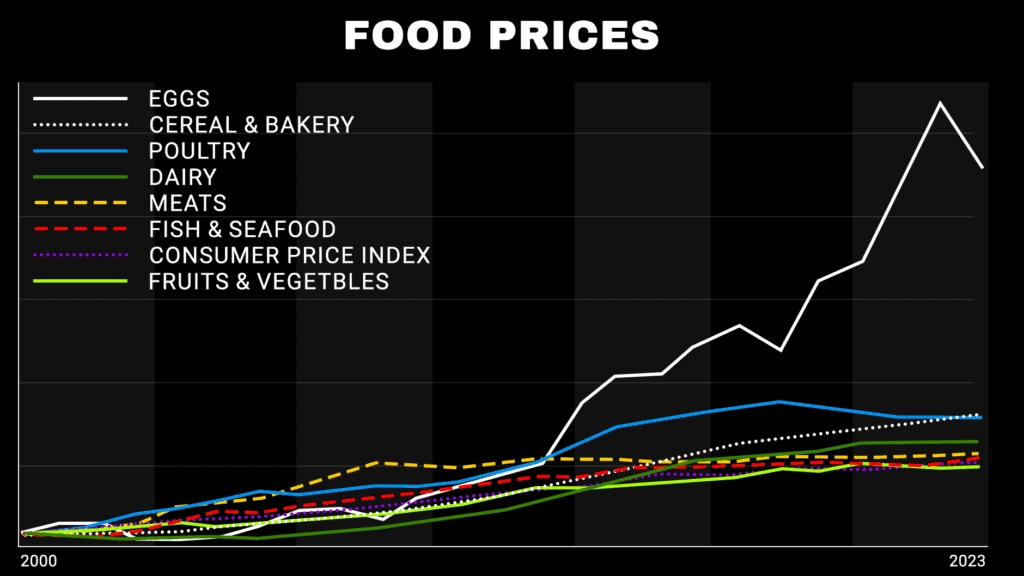

Look, food prices are rising at the highest rate in decades.

Egg prices have nearly doubled.

Last year, global food prices hit an ALL TIME high.

And it shouldn’t be any surprise when U.S. farms are hitting an 8-year high in bankruptcies…

When, according to the US Department of Agriculture, bankruptcies in America have increased the most in agricultural states.

According to the IMF, we are in the midst of a “global food crisis.”

James, in my opinion, this is the most devastating casualty of the Endgame economy – it’s the same devastation which drove the farmers and people of France mad during the Mississippi Bubble… ultimately leading to the French Revolution.

James: When people can’t get food… they don’t just get angry. They rebel.

Mark: I’m not saying people will be grabbing pitchforks and storming buildings, but this is a dangerous place for elected officials to let the economy enter.

Farms are the backbone. And we already saw how commercial real estate – their farmland – is failing at the highest rate on record.

The banks which loaned them money are tightening their belts, meaning farmers can’t expand… they can’t improve their technologies…

James: They can’t grow more crops, or herd more cattle.

Mark: That’s where my third report comes in, James.

Impact Zone #3 Report

Ag-Pocalypse: America’s Last Two Agricultural Saviors

This report outlines TWO companies I think every American needs to own now.

James: I had the pleasure of reading this report, and it actually goes a little bit further.

You share real insights on how to increase discretionary income for groceries… how to strategically reduce grocery expenses…

As well as the relationship globally between social unrest, food inflation, and fiscal policy…

Even why food prices have surged 155% since 2000.

Pretty unconventional things to touch on… in addition to the TWO companies…

But in my opinion, it makes this report one of the most practical.

I mean, you show how agricultural stocks like Scott’s Miracle-Gro… FMC… Nutrien… and others are already up 100%… 300%… even 500% or better over the last 3 years as this situation has advanced.