In this Article:

This year, in less than two months, the U.S. witnessed three of its four largest bank failures in history.

It cost a total of $548 billion in assets.

That’s more than the losses suffered during the 2008 financial crisis. Back then, banks collectively lost $373 billion in assets.

But while investors guess which bank could be the next to go, they’re missing how the turmoil in the banking sector could ignite another crisis… this time in the energy sector.

It doesn’t matter whether you’re talking about renewables or fossil fuels. Any new energy project requires large amounts of funding to get off the ground.

Just last year, $2.4 trillion was deployed in new energy investments. And $673 billion in that financing came from banks.

That’s why the cost and availability of credit play a key role in funding energy projects.

And it’s why the uncertainty in the banking sector could intensify an energy crisis.

So today, I’ll explain how the recent turmoil in the financial world can impact the future of energy. But if you position yourself correctly in the energy markets, you can turn this crisis into an opportunity…

Capitalize on Cashless America: 2 Stocks Set to Explode From FedCoins

Lending Standards Are Tighter

Since March of last year, the Federal Reserve has hiked interest rates 10 times.

The most recent hike came on May 3, when the Fed raised rates by another 0.25%.

The Fed is approaching Stage 2 of what Inside Wall Street editor Nomi Prins calls its three-stage pivot – or a pause in rate hikes. Although, that does not mean the previous hikes will stop affecting the markets.

In fact, rate hikes take time to ripple through the economy.

And so far, they’ve affected banks in two major ways…

First, we’re seeing a massive exodus from banks that are refusing to boost rates paid to depositors. In other words, customers are fleeing banks to receive better returns on their deposits elsewhere – like in money market funds.

Second, when interest rates rise, bond prices fall. This is basic bond math. As a result, bonds held in bank reserves are losing value.

To counter this issue, banks are taking great measures to preserve their precious capital.

Part of that includes limiting lending activity. This, in turn, makes fewer funds available for new energy projects.

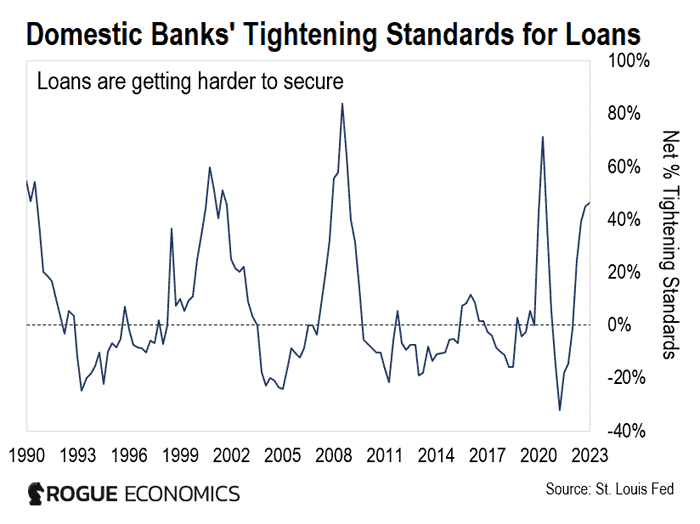

But stricter lending standards aren’t something new. You can track how loan officers at domestic banks have tightened or loosened the standards for loans over the years. Take a look at the chart below…

Marc Lichtenfeld Oxford Income Letter: The #1 Oil and Gas Income Play for 2023

Since the Federal Reserve started hiking rates in 2022, banks have tightened standards in commercial and industrial loans. This is indicated by the blue line moving higher.

In simpler terms, banks are becoming more selective about making loans to businesses. So there will be less money available to fund new projects.

With interest rate hikes, funding was already getting more difficult.

Now that the banking crisis is underway, lending is set to take a further hit. We’ll start seeing less funds available for both renewable and fossil fuels projects.

Here’s why that can compound an energy crisis…

How to Profit From the $87 Trillion AI Wave with Whitney Tilson

Funding for Energy Projects Is Drying Up

Investment in new energy supply is already running low to meet future demand.

We talked about this in earlier essays about the global energy crisis and the end of the shale revolution. We said that investment in new energy projects is on a downward trend. Part of that has to do with corporations pouring cash into dividends and share buybacks, instead of spending on new initiatives.

For example, spending on new oil and gas projects is at the lowest levels in nearly 20 years.

Instead, oil firms are focusing their capital to lift stock prices. This keeps the price of energy high. And the more expensive the supply of energy is, the more profitable these companies are.

It’s also why there’s been a massive push into renewable energy. Now that there are fewer developments in oil and gas, we need new sources of energy.

Nomi has talked a lot about “New Energy” throughout these pages. It’s one sector receiving bipartisan support in Congress.

For Democrats, clean energy is key for environmental safety. For Republicans, renewable energy can lower future energy costs for rural communities.

So overall, the trend for clean and sustainable energy sources is growing in the U.S.

But following the closure of Silicon Valley Bank (SVB), we could see renewables take a hit.

That’s because SVB was the sixth-largest lender to the clean energy sector. In 2022, SVB allocated $1.2 billion to renewable energy projects.

The bank also committed $5 billion in renewable energy financing over the next four years.

With SVB underwater, the sector now has less funding available. And less funding means fewer projects to support the growth of clean energy in America.

Throw in a credit crunch spurred by recent bank failures, and the outlook for tight energy supplies gets even worse.

So while a sense of calm has recently returned to the energy markets, you shouldn’t let your guard down. Bank failures threaten a new phase of tight energy supplies and price volatility. That means being selective about your energy investments.

For now, avoid investing in energy companies that rely on outside sources of funding – such as banks. Also, avoid energy companies with large debt maturities due this year. Instead, pick ones that generate enough free cash flow to help fund their own projects.

Nilus Mattive Weiss Crypto Investor: Three High-Rated Cryptos with Huge Potential

Best regards,

Clint Brewer

Analyst, Rogue Economics