Table of Contents:

- Introducing Nilus Mattive

- One good crypto investment right now

- Just consider a simple example from the Dot-Com Collapse… Amazon.

- The Weiss ratings system accurately called the last major bottom in the cryptocurrency markets

- How can we determine which cryptos are the Apples of the future?

- Three High-Rated Cryptos with Huge Potential

- The Golden Crypto That Every Investor Should Consider in 2023

- How to Earn Bitcoin Without Risking Any Investment Money

- Here’s the deal…

“BORN AGAIN CRYPTO”

Why this 24-year Wall Street veteran, known for his conservative investment strategies, has finally turned BULLISH on a handful of cryptocurrencies …

Hi. My name is Nilus Mattive.

Back in March 2001, I was a very young Wall Street analyst starting a new job with Standard & Poor’s.

Ironically, that very same month, the raging bubble in technology stocks was finally topping out.

Within a year, hundreds of those same Nasdaq companies had lost 80% or more of their value …

Thousands of additional internet businesses were going belly-up or getting bought out for pennies on the dollar …

And investors — including millions of regular Americans — had lost more than $5 trillion in total wealth.

It’s hard to believe that was more than 20 years ago already.

Yet now I see history repeating itself in an entirely new financial market — one that didn’t even exist back when I first started my career on Wall Street.

I’m talking about the world of cryptocurrencies.

See, I believe the parallels will continue.

Yes, just like we saw with crappy tech stocks 20 years ago, thousands of cryptocurrencies could keep crashing until they’re completely worthless — I’ll even name seven of the biggest, most dangerous ones in a little while.

However, there may also be a handful of cryptos that soar thousands and thousands of percentage points from their prices today … which is exactly what happened to a handful of tech stocks after the Nasdaq implosion.

So, this might be a rare opportunity for investors who get in before the crypto market soars again.

That’s why I put this video together — to show investors why now, at the height of all the crypto negativity, is actually the very best time to invest some money into the space.

And by the end of this presentation, I’m going to share my thoughts on three off-the-radar cryptos that could result in some potentially big gains going forward …

I’ll also discuss another crypto that is an obvious choice for anyone who likes the idea of investing in gold …

Plus, I’ll even talk about ways to earn Bitcoin without even risking any investment money at all.…

All I ask is that you stick with me for a few minutes so I can show you why I’m so confident in my forecast.

As you’ll see, more than 120 years of history — going back to the very beginning of the Industrial Revolution – demonstrates that certain cryptos could deliver bigger profits than even some crypto enthusiasts believe possible.

And that prediction is also backed up by a scientific ratings model that accurately called the last crypto market bottom back in 2018.

That’s why I say NOW is the time to take action.

Of course, I know this might be hard to believe … even if you’ve already been investing in the crypto space.

After all, we’ve seen some colossal failures over the last year — from the Luna collapse all the way up to the implosion of the FTX exchange.

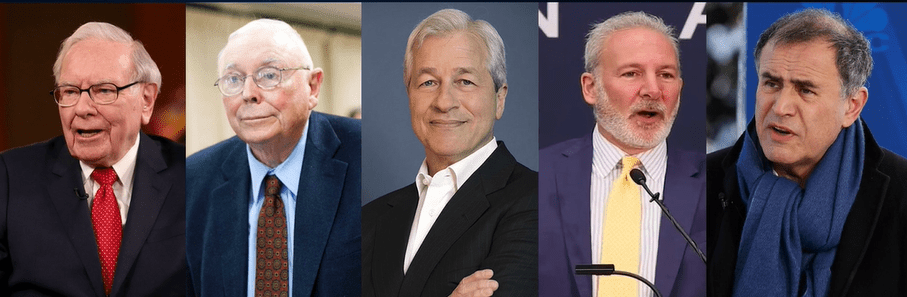

Warren Buffett, Charlie Munger, Jaime Dimon, Peter Schiff, Nouriel Roubini and many other long-time crypto naysayers are celebrating these events …

And mainstream headlines have declared the death of crypto everywhere you look.

Some of your own friends and family members are probably even enjoying “I told you so” moments …

Whether you actually invested in cryptos or simply brought up the subject at some point in time.

Well, here’s the thing …

I was one of these people in the wake of the Dot-Com Collapse …

I felt really smart for having avoided most of the carnage in my own portfolio and in the guidance I was giving other people …

And I continued to avoid the technology sector in the wake of the collapse, too.

That proved to be a huge mistake.

In fact, as I’ll show you — even someone who bought the right technology stocks at the very top of the Nasdaq Bubble and simply continued holding on through the bitter collapse — would have ended up far richer than all the people who stayed on the sidelines.

And obviously, anyone who bought them after the crash did far better still.

In one particular case, Warren Buffett himself missed out on making $765 billion in extra profits by waiting way too long to act!

Instead of watching his returns soar as high as 76,601% … he had to settle for a maximum return of just 730%!

So yes, cryptos are extremely risky. That means people can lose money and should always understand what they’re doing before they invest.

Anyone who claims otherwise isn’t being honest.

However, all of my research says we could see at least a handful of cryptos go on to future prices that seem almost unimaginable right now — and these are the rare type of investments that can give savvy investors incredible gains like we saw from some of the most exceptional tech stocks after the original Nasdaq collapse.

So, I’ve already invested my own money in a couple of beaten-down crypto investments, and I want to talk about why I did it.

I also want to introduce you to some of my new favorites, including one that is trading around $1 right now.

Which brings up the biggest paradox I’ve learned after more than two decades as a professional investor …

It is precisely at moments like this …

When it feels completely wrong and dangerous to buy …

When every mainstream news outlet is shouting warnings …

And prices are still way down …

That the risk vs. reward equation is probably most tipped in an investor’s favor.

After all, a single 76,000% gain is enough to turn a modest $1,500 investment into more than a million dollars.

Or to put it another way: One good crypto investment right now could be worth keeping your money in the broad stock market for the next 7,600 years!

Yes, now, that’s an exceptional return … the kind of outlier that the average investor shouldn’t expect to achieve.

But it happened!

Still, maybe you think cryptos are nothing like what we saw with the Tech Bubble …

Or that this is just a modern-day tulip mania.

Well, I get it.

After all, I’ve built my entire 20+-year reputation recommending dividend stocks and other boring income-producing investments …

In fact, pretty much every time I’ve been featured on a major media outlet like Bloomberg Businessweek, MarketWatch or Fox News, it was to help regular Americans build better retirements through very conservative investment strategies.

Growing up as a middle-class kid in a Pennsylvania coal mining town, I learned to value safety over hype from a very young age.

So, I was a crypto skeptic for a long time, too.

But after finally digging into the crypto world over the last couple of years …

And comparing what I learned to what I saw in my early days on Wall Street …

I have a different outlook now.

I’ve even flown from my home in Santa Barbara, California, all the way down to a place they call Bitcoin Beach in El Salvador …

Just to get a better handle on what’s really happening in the crypto space.

Bottom line?

I now think certain crypto investments have major upside ahead.

Which is why I’m not ignoring them like I ignored tech stocks in the wake of the Nasdaq Collapse.

Because I believe what’s happening in the world of cryptos right now IS almost a perfect parallel to what happened with the Internet Bubble 20 years ago.

Most people are completely focusing on all the losses and failures taking place …

They’re using those losses to dismiss the entire crypto space …

And in the process, they’re completely ignoring a handful of giant opportunities right in front of their faces.

Investments that could result in major gains.

Just consider a simple example from the Dot-Com Collapse … Amazon.

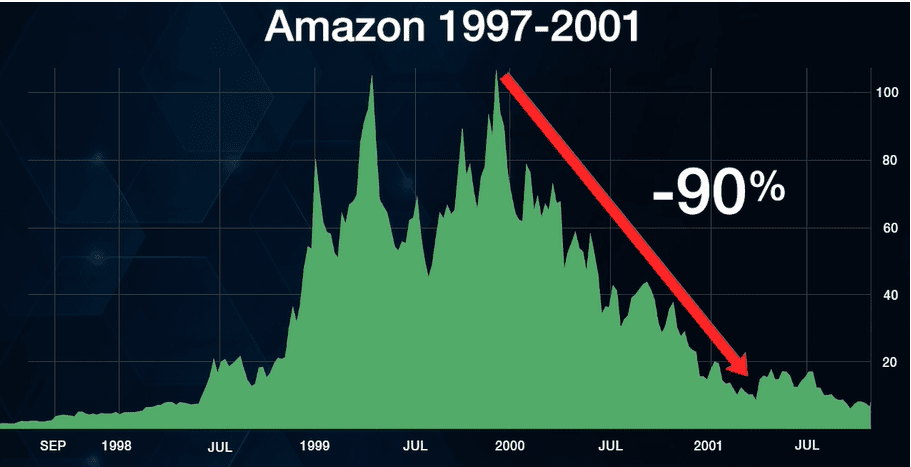

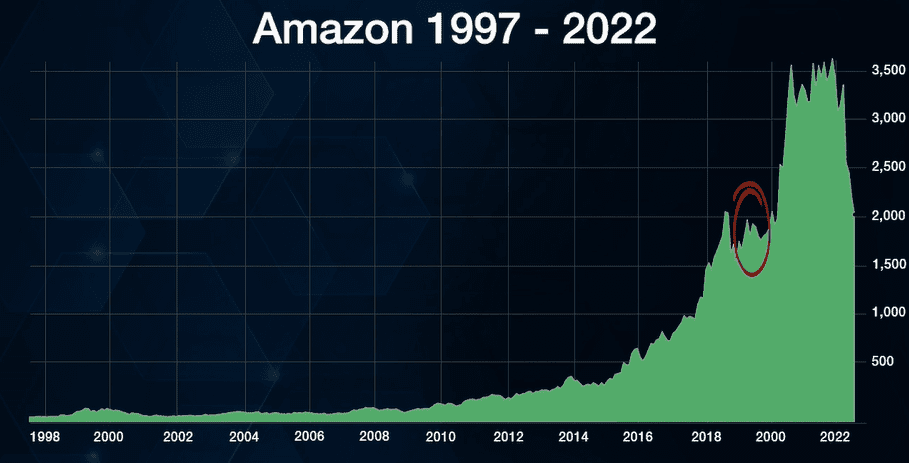

Here’s a chart of Amazon from the day it went public back in 1997 through June 2001, after the Big Tech collapse really got rolling …

Notice that Amazon’s stock went from single digits all the way above $100 in a matter of a few years …

Then it fell all the way back down to $10 by 2001.

So, if an investor bought the stock at the top, they lost as much as 90% of their investment.

And a lot of people locked in those losses for good and never returned.

Most others decided not to buy Amazon after it collapsed.

This is exactly how it is for anyone who bought cryptos at their most recent highs, too!

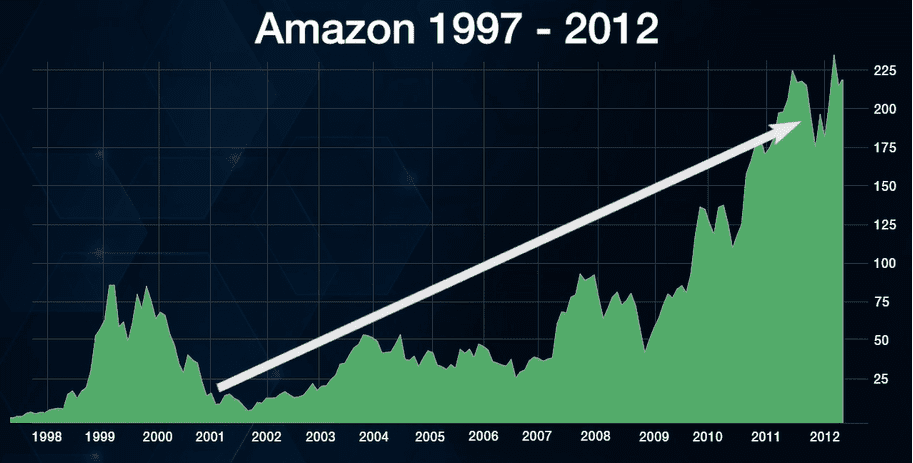

But here’s what happened to Amazon through June 2012 …

It went on to hit $200 a share.

That’s twice the level it hit during the top of the Dot-Com Bubble.

So even if someone bought at the top of the prior bubble, they doubled their money.

And if they bought after the collapse, they made as much as 20 times their money.

Every $1,000 became $20,000. That’s a huge, 20x gain!

Yet it’s still just the beginning of this story.

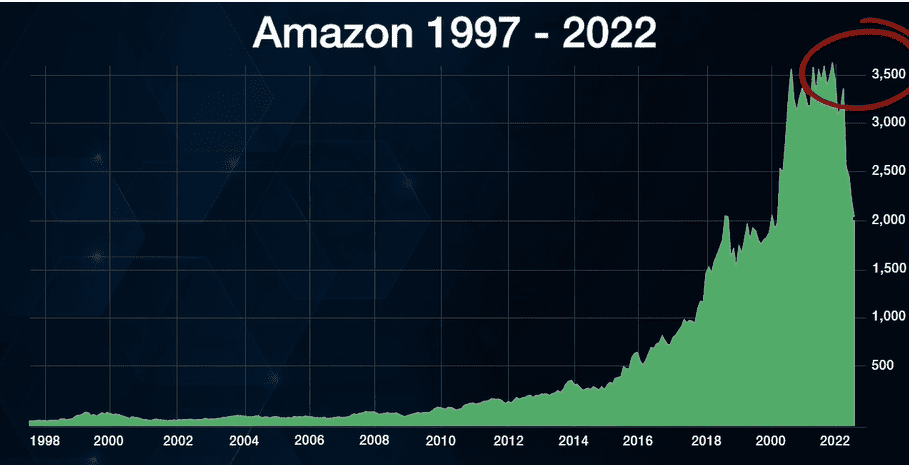

Because here’s Amazon through the middle of May 2022 …

At the top of its most recent bullish cycle, Amazon was above $3,500 a share.

So simply buying after its Dot-Com Collapse and holding it would have resulted in a 350x gain.

That means $1,000 invested into Amazon at that time would have been worth $350,000 two decades later.

Now look, this is just to illustrate a point. As we always hear, past success does not guarantee future results. That's one of the most basic rules anyone needs to understand before they risk anything in the markets.

However, we can definitely study past trends and apply what we’ve learned to the present time.

Which is why I also want to remind you that Amazon was not some secret, unknown company.

Its IPO in 1997 was a huge event.

Everyone had heard of it by the time the Nasdaq collapsed.

Many people were already buying books from the company.

It’s the same exact thing with Bitcoin right now.

Every single American has certainly heard of it. But most just aren’t taking the time to consider investing in it yet.

Even some of the of the smartest, most famous investors on the planet — including Warren Buffett.

Which is funny.

Because looking at my chart of Amazon again, there’s this area that I circled …

Well, that’s where Warren Buffett started investing in Amazon, right around $2,000 a share in May 2019.

Up until that point, and especially around the early 2000s, Buffett was an outspoken critic of internet companies.

Which is why he watched Amazon go up 20,000% before he finally bought in.

And it’s no secret that Buffett is also an outspoken critic of cryptos right now, including Bitcoin.

You can pretty much substitute the word “crypto” for “internet companies” in the comments he makes.

He says he doesn’t understand cryptos, they’re all based on magical thinking and so on and so forth … just like he said about internet companies 20 years ago.

Well, I have to laugh when I hear all the haters saying Bitcoin is just computer code.

Guess what … so is Amazon’s website!

That didn’t prevent it from completely changing the way our entire country shops!

This is yet another reason I believe history may be repeating itself.

A lot of people completely misunderstand what some cryptos even are …

They don’t know that they’re technology projects with real-world utility, just like some of the websites we all know and love.

This is why Bitcoin reminds me of Amazon after the Tech Wreck.

So, let me pose a hypothetical question …

If someone could go back in time to 2001 and put $1,000 into Amazon, would they do it?

I certainly would — which is why I’ve already put far more than $1,000 into Bitcoin.

Because even if my bet doesn’t work out, the loss won’t ruin my life.

Meanwhile, if I’m right and Bitcoin ends up being similar to Amazon … every $1,000 investment right now could be worth a lot more down the road.

But let me be clear … Bitcoin is NOT the biggest crypto opportunity right now.

Not by a long shot.

There are far better cryptos to buy right now, just as there were far better technology stocks than Amazon in the wake of the Tech Wreck.

Take Apple.

Sure, you know the company and all its products now.

But after the Dot-Com Bubble, Apple had been left for dead.

People thought it was a doomed company, long past its glory days of selling Macintosh computers.

This is why Apple’s stock was trading for as little as 20 cents a share in April 2003.

Twenty cents!

That gave Apple a total market capitalization of just $5 billion.

To put it in context, Bitcoin would have to fall all the way down to $250 to be worth as little as Apple was in the wake of the Dot-Com collapse!

Can you imagine how many people would say it was completely done at that point?

Yet as you know, Apple didn’t die.

It ended up inventing entirely new categories of consumer devices like the iPhone, the iPad, the Powerbook and the Apple Watch.

Today, Apple is one of the most valuable companies in the world.

And do you know what’s really interesting about Apple?

Warren Buffett ignored its stock all the way up until 2016, too.

Today, it’s his biggest stock position!

Meanwhile, a little-known, scientifically based rating system said Apple was a “Buy” all the way back on Sept. 27, 2004 … not long after it had completely bottomed out.

To put this into perspective:

Someone who waited for Warren Buffett to buy Apple could have made as much as 730% through the stock’s all-time high on Jan. 4, 2022.

That’s really good, right?

Well, someone who bought Apple right after it bottomed could have made as much as 76,601%.

That’s 104x better!

To put it into dollar terms …

Buffett initially invested about $1 billion into Apple back in 2016.

Which could have grown to as much as $7.3 billion at the stock’s most recent high point.

But if Buffett had invested in Apple back in April 2003, he could have made more than $765 billion in profits instead!

So, Buffett not only missed out on a 20,000% return before he bought Amazon … he made a much bigger mistake by not buying Apple sooner!

My point here is simple:

Warren Buffett is one of the most successful investors in history.

Yet even he missed most of the gains made by tech stocks like Amazon and Apple after the Nasdaq collapse …

All because he didn’t have the guts to buy when prices were low and skepticism was still high.

Now, like my old compliance officers on Wall Street used to say, what happened in the past is no guarantee of what happens in the future.

But what are the odds that Buffett is making the same mistake right now in the crypto market?

Obviously, I’d say they’re quite high.

Especially because the very same ratings system that identified Apple as a “Buy” more than a decade before Buffett is now telling us that the crypto markets have bottomed out as well!

More than that, it has identified several small cryptos that could be the biggest winners going forward.

It’s called the Weiss ratings system and it accurately called the last major bottom in the cryptocurrency markets, too.

That was in late 2018.

Coin Intel News broadcast it all over the internet, saying, “Weiss Ratings Calls the Bottom.”

Bitcoin News wrote, “Weiss Ratings declares now best time to buy Bitcoin.”

Countless blogs and websites also picked it up and spread the news.

Sure enough, just three days later, Bitcoin hit rock bottom. And that marked the beginning of the largest crypto bull market of all time.

How much could investors have made if they bought Bitcoin at that point?

The numbers are shocking.

- Bitcoin surged 20.1 over, enough to turn a $10,000 investment into $200,832.

- Ethereum, the system’s highest-rated crypto, surged 54-fold, enough to turn a $10,000 investment to $545,760.

- Cardano, also among its top-rated coins, surged 102 times, enough to transform $10,000 in starter capital into $1,020,648.

- And Chainlink topped them all. It exploded 234x higher, a phenomenon that could have grown a $10,000 initial investment into an asset worth $2,338,746.

And as I said a moment ago: The Weiss ratings system is now telling us that the last great crypto bottom is here!

Obviously, this is extremely time-sensitive news.

Because the crypto markets have traditionally bottomed just once every four years.

What’s more, I have every reason to believe that this could actually be the biggest bottom the crypto markets will ever see.

Which means right now could be the absolute best time to get into a handful of cryptos.

The reason why is simple …

Crypto Is Following the Same Pattern as Every Other Major Technological Innovation

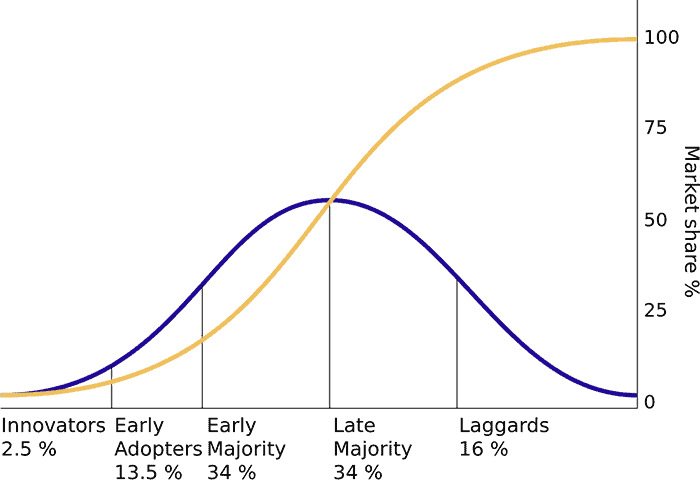

Take a look at this chart:

This curve goes by several different names.

But it shows how a major innovation is adopted by a large population of people.

Notice there are very early adopters — industry insiders, tech nerds, dreamers, whomever.

These are the people who were talking to each other on the internet back in 1993 or buying Bitcoin in 2010.

Then there are people like me, who were already buying and selling on eBay back in 1999. Or getting into cryptos during the last bull market.

When we add them to the very early adopters, it’s about 15% of the total population.

And what’s important is that shortly after this point, the curve really starts to steepen.

It goes from 10% or 20% adoption to 50% adoption and then 75% adoption in very short order.

Finally, you have the laggards. The last 15% or 16%.

Maybe that aunt or uncle who just refuses to get a smartphone.

Or, in the professional investment world, the Warren Buffetts who don’t get involved until everything is completely proven and modeled out.

AFTER most of the gains have already been made.

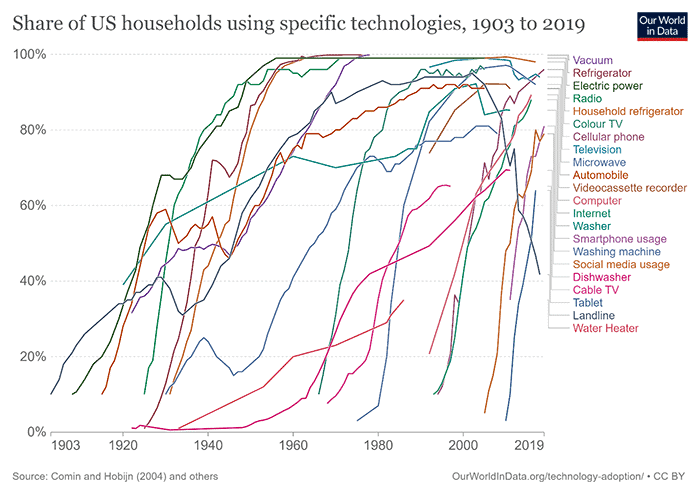

This basic adoption curve has now been backed up by more than a century of innovations.

In fact, here are the adoption curves on many different inventions and technologies …

For example, electricity adoption was about 10% back in 1908. Within 30 years it was at 75%.

Or how about refrigerators?

In 1930, only 12.8% of the population had one. Twenty years later, 86.4% of the population had one.

And then there’s color TV …

In 1966, adoption was at 10%.

By 1978, it was 75%.

The basic pattern is the same each time.

And overall, especially in more recent examples, adoption actually happens faster.

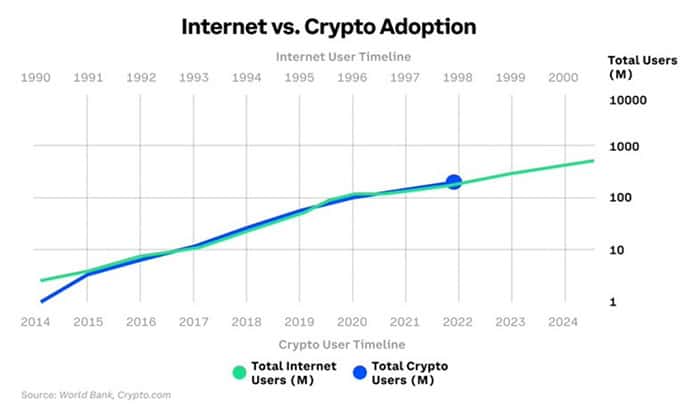

So, where are we with crypto adoption right now?

And how does it stack up to internet adoption 20 years ago?

Take a look …

The two are trending in almost perfect lockstep.

We are just at the same point in cryptocurrency adoption as we were with the internet during the 1998–99 bubble.

So, everything lines up – from the fundamental adoption rates right down to the big price collapses both markets experienced after the first two phases of adoption.

This means that if I’m right, some of the best opportunities in the crypto market are still ahead of us …

Because they happen during the big upward part of the adoption curve …

Which begins right around the time 10%–20% of people embrace the innovation.

And that’s the point in time we’re at right now.

Could Bitcoin still go down a lot from here?

Sure, it could. It could continue to crash for a variety of reasons.

Remember, at one point after the Nasdaq collapse, Apple was trading for just 20 cents a share … the equivalent of Bitcoin falling all the way back to $250.

But I don’t see that happening.

And either way, I believe it’s more likely that Bitcoin will eventually end up much higher than it is today.

After all, once we pass that early adoption threshold, history says widespread adoption comes in large chunks at a faster and faster pace.

So, if Bitcoin has hit a previous high of $68,000 with less than 10% adoption, it’s completely reasonable to think it can go up quite a lot by the time we hit 75% adoption.

This is why, for every Warren Buffett who says Bitcoin is going to zero, there’s a Cathie Wood who says it can go as high as a million.

Especially because by definition, Bitcoin’s supply is strictly limited.

Just a little bump in adoption from Wall Street and large investors — which we’re already starting to see — could send Bitcoin’s price higher, and at a very fast rate.

And if Bitcoin has that type of upward potential, then past bull market cycles show that a handful of lesser-known cryptocurrencies could do much better still.

Just as Apple had far more upside than Amazon did.

How can we determine which cryptos are the Apples of the future?

Simple: The Weiss Ratings Model …

The one that identified Apple as a “Buy” all the way back in September 2004 …

The very same system that called the last big bottom in crypto in 2018 …

And the very same model that specifically identified some of the biggest winners of the last big crypto bull market …

Is identifying three specific cryptos as “Buys” right now.

I want to be clear — the system currently likes Bitcoin and Ethereum as well. But those are names that everyone knows.

These other cryptos are much smaller and that means they could also have more upside.

Remember, even though there’s no guarantee that history will repeat itself, this is what we’ve seen happen in past crypto bull markets as well as with tech stocks in the wake of the Nasdaq collapse.

And also remember: To the best of my knowledge, the ratings system that has identified these investments is the ONLY unbiased, scientifically based crypto ratings system in the world.

After all, most of what you hear in the crypto world is nothing more than personal opinions based on rumor and speculation.

Worse yet, a lot of the so-called experts in the space have plenty of conflicts of interest — in many cases, they might merely be hyping certain tokens that they already own or get paid to promote.

Just look at what’s been happening with people like Sam Bankman-Fried, Tom Brady, the Kardashians, and Kevin O’Leary.

It’s no different than what I saw on Wall Street back in the late 1990s and early 2000s with high-flying tech companies and penny stocks.

And quite frankly, a lot of people in the world of crypto don’t even have any traditional financial markets experience at all. They think the old rules don’t apply, and they’re wrong.

I know from more than 20 years working in the financial markets that people who have access to unbiased information are in the best position to invest wisely.

That’s why I want you to download an urgent special report the minute this video is over.

It’s called Three High-Rated Cryptos with Huge Potential.

In it, we share full details on three smaller cryptos that have high potential upside as the next crypto boom gets underway.

Again, I know that might sound hard to believe right now.

But a lot of people felt the same way in the wake of the Dot-Com Collapse — when Apple was going for a meager 20 cents a share.

Twenty cents!

Anyone who simply tuned out all the doom and gloom and bought back then could have since booked gains as high as 76,601%.

So yes, there’s no guarantee history will repeat itself this time around.

And yes, we’re talking about making risky bets here.

But if I have to sound crazy to get people to consider investing in some of these small cryptos right now, that’s fine.

Because they remind me of what Apple was back in 2000 — misunderstood technologies that could eventually revolutionize how we live, work and play.

For example, one of these small cryptos is like the New York Stock Exchange of the decentralized finance world, also called DeFi.

The full explanation is in my report, but essentially this small crypto is rapidly gaining prominence as a critical lynchpin in an emerging digital trend that is already worth more than $65 billion and growing by thousands of percent a year.

The last time I checked, this crypto was trading around $5. Yet our ratings system says it could ultimately be worth $140 or more!

Meanwhile, the second of these small cryptos provides another critical component to the emerging world of DeFi — namely, pricing information.

You can think of it like the Bloomberg terminal of the future – a crucial piece of infrastructure for tomorrow’s digital financial markets … one that was recently trading for a lot less than $10.

And the third crypto? That might be the most exciting of them all …

In fact, around the Weiss Ratings office we call it Ethereum on steroids.

That’s because it takes Ethereum — the second-largest crypto in the world — and makes it faster and more efficient.

Which is setting up this crypto to be a major building block of the next generation of the internet, commonly called web3.

Yet it was recently trading under $1!

Think about the potential size of its market — the next generation of the internet — and compare that to this crypto’s current price.

Now you can understand why I’m saying investments like this could have a ton of runway.

More importantly, they are NOT just digital Beanie Babies …

They are literally game-changing technology projects just like Amazon and Apple were in the early 2000s!

Of course, you don’t have to take my word for it.

I’d rather you download the full report, read all our research, and then decide for yourself.

After all, it’s your money on the line, and you should be the one who makes the ultimate decision to invest or not. We’re here to educate, NOT advise.

I just encourage you to learn as much as you can and then make the best choice for yourself.

So, I’ll tell you how to get a copy of that report in just a minute.

First, however, I want to reiterate a point I made earlier …

These cryptos are unique. They have real utility. And we believe they have growth ahead of them.

In contrast, most other cryptos — thousands of them, in fact — are pure junk.

For example, the Weiss ratings system currently rates over 500 cryptocurrencies, and most of them get very bad grades.

The system rates them poorly despite all the hype out there on the internet.

In fact, let me name seven that are each worth more than $100 million in market cap yet were recently given the lowest grades by the Weiss ratings system:

- Bitcoin SV

- IOST

- Lisk

- Hxro

- MultiversX

- Nano

- Suku

By avoiding these kinds of low-rated cryptos, we believe investors can cut their risk down.

I wouldn’t be surprised to see all the names I just mentioned — and many more — go all the way to zero just as so many crappy internet companies did in the wake of the Nasdaq collapse.

Of course, eliminating all risk is impossible with any investment … especially in the crypto world. As I’ve said before, there’s always, ALWAYS a risk of loss. And that's why it’s so important to learn more about the few cryptos we actually think have real potential.

Which brings me to one other crypto that I’m really excited about.

It is unlike almost any other digital currency out there at the moment.

That’s because it’s backed by physical gold on a 1-to-1 basis.

That means for every dollar that goes into this crypto, $1 dollar of gold is sitting in a vault.

And you can verify that right down to each serial number on each individual gold bar.

I think of this crypto like a completely digital version of a gold mutual fund or ETF.

It is run by a U.S.-based company that is regulated by major financial governing bodies …

It is backed 100% by physical gold stored in secure vaults …

And investors can buy it or sell it in practically any amount they like.

The differences?

Well, because it’s a crypto, it trades around the clock 24 hours a day, seven days a week …

And it has extremely low commissions compared to many of the traditional choices available.

Even better — owners can request their share of the physical gold backing this investment any time they like!

Oh, and it is also possible to earn a small yield from this particular crypto — which makes it the only income-producing investment in pure physical gold that I’ve ever seen.

I’ve put all the details on this unique investment in another report called The Golden Crypto That Every Investor Should Consider in 2023.

It covers all the pros — as well as a few cons — plus the special way to periodically squeeze a little more out of this crypto.

And like the first report, you can download a copy right at the end of this presentation.

Of course, there’s one last thing I promised to reveal at the beginning — ways for people to earn Bitcoin on a regular basis without having to risk any investment money.

I think these strategies are great for people who are still feeling skeptical about the crypto markets but want to find ways to get involved.

Because, yes, there are actually several different ways to earn Bitcoin on an ongoing basis starting almost immediately.

My favorite strategies for doing that are outlined in a third and final report called How to Earn Bitcoin Without Risking Any Investment Money.

I have to say: Following the information in this report is a complete no-brainer … especially if our research — and more than 120 years of history — is right, and we see one last and final upward explosion in crypto prices.

I’m sure you can see why we normally sell these types of report for $79 apiece.

But the good news is that you can get all of them at zero cost along with a trial subscription to Weiss Ratings’ flagship newsletter on cryptocurrencies, Weiss Crypto Investor.

The reason we insist on packaging the reports with the monthly newsletter is pretty simple: I don’t want to send you some ideas and then never talk again.

I want to make sure you get ongoing updates on everything happening in the crypto markets.

After all there’s so much happening beyond the things I’ve already covered — unique blockchain projects that I’m testing out personally, the emerging world of NFTs and digital art, the buildout of web3, the continued development of the metaverse …

The list goes on and on.

And that’s also just like we saw with the internet.

Remember, some of the biggest Internet success stories came AFTER the Dot-Com Collapse.

- Facebook.

- Google.

- Netflix.

- Spotify.

None of them were even public in 2000.

Most hadn’t even been founded.

I think we could see the same thing happen in the world of crypto.

Which is why you should start learning about the space and all the different opportunities becoming available.

That’s exactly what we cover in each monthly issue of Weiss Crypto Investor.

I write it in partnership with Juan Villaverde, a crypto researcher and advanced mathematician who was the main architect of The Weiss Ratings Crypto Model.

Every month, we alert readers to cryptos that could be poised for growth along with other strategies and industry developments that we believe are critical to know about …

We also warn our members about hyped-up cryptos that look good on the surface but aren’t worth the risk …

And each month, we send our latest forecasts about the broad crypto market so members always know where things could be headed during this period of heightened volatility.

Obviously, we don’t give this information away for free.

In fact, one year of Weiss Crypto Investor is normally $129.

But if you click on the button below now, we’ll send you 12 monthly issues for just $39.

That’s only 10 cents a day — probably less than what’s in the cracks of your couch.

When you join now, we’ll also give you immediate access to download all three reports where you’ll learn all about the three best cryptos out there right now …

The unique crypto that is fully backed by physical gold …

Along with several ways to start earning extra Bitcoin …

Plus, we’ll give you immediate access to a series of tutorial videos that can open an even bigger world of undiscovered cryptos.

All as a thank-you for giving Weiss Crypto Investor a try.

In fact, since the crypto world moves faster than practically any other market on the planet, I’ll also give you a free membership to our Weiss Crypto Daily e-letter, which we publish five days a week, Monday through Friday.

Weiss Crypto Daily is another way to keep our members on the cutting edge of all things crypto.

Our team of crypto experts send alerts on up-and-coming opportunities. We warn about scams and misinformation. And we provide our unbiased responses to the breaking crypto news of the day.

Just Listen to What Others Are Saying …

Of course, we want to make sure that YOU are 100% satisfied with everything you get.

So, here’s the deal …

Try Weiss Crypto Investor for 12 full months.

If you’re not absolutely thrilled with all the research you get … if you’re not happy with your results … or if there’s anything else you don’t like …

Just let us know and we’ll rush you a full refund, no questions asked.

We’ll give you back every penny you’ve paid for your membership, and you can still keep all your special reports and videos — as my gift to you.

Yes, even if you cancel on the very last day.

All told, you get $516 in free gifts and discounts …

A full year of our very best crypto research …

And the full money-back guarantee I just outlined.

All you have to do is click the button below and join now for just 10 cents a day.

You’ll save $516 and get immediate access to everything I’ve outlined so far including:

- Gift #1. Three High-Rated Cryptos with Huge Potential

- Gift #2. The Golden Crypto That Every Investor Should Consider in 2023

- Gift #3. How to Get Free Bitcoin Every Single Month

- Gift #4. Our Video Tutorial Series on How to Buy Undiscovered Cryptos BEFORE Nearly All Other Investors

- Plus, Gift #5. The Weiss Crypto Daily, five days per week

Obviously, the decision is all yours.

But here’s the way I see it …

In this presentation, I’ve shown you how I personally watched the Internet Bubble pop back in 1999 from the heart of Wall Street …

And how even super-investors like Warren Buffett missed out on making hundreds of billions in extra profits because they waited too long to buy investments like Amazon and Apple.

I’ve also shown you why today’s crypto market reminds me a lot of that situation — from the rates of adoption to the similar price collapses to all the mainstream skepticism … in some cases from the very same people who later ended up buying in years later!

I’ve also explained how the very same ratings model that identified Apple as “Buy” soon after it bottomed…

And called the last big crypto bottom …

Is now identifying three lesser-known cryptocurrencies as “Buys” right now.

I’ve even offered to send you a bonus report that gives you ways to earn extra Bitcoin …

Plus, I’ve explained that you can try all my ongoing research for a full year and get a refund of every dollar you paid for it all the way up to the very last day of your membership.

So, I’d love to see you activate your membership, download everything and then make your final choice.

Because if I’m right, this could be an incredible opportunity to see returns that eclipse returns from the traditional stock market.

To put it another way …

The last time something like this happened, I was fresh out of college and starting my career on Wall Street.

This time around, I’m 45 years old.

So, I’m not even sure if another major moment like this will happen again in my lifetime.

And if it does, I might already be in retirement.

That’s why I already own some crypto investments myself.

And why I’d like you to join me for the ride.

All you have to do is click the button below, claim all your free reports and then look for my follow-up e-mails going forward.

Of course, no matter what you decide, thanks for watching this presentation. I really hope it helped you better understand what’s really happening in the crypto market right now.

Weiss Crypto Investor

© All rights reserved | 11780 US Highway 1, Palm Beach Gardens, FL 33408-3080 | 877-934-7778