In this Article:

- 2022 wasn’t the best year for stocks, and with so much uncertainty still ahead, investors must find a balance between potential upside and risk.

- Eli Lilly (LLY): I wouldn’t mind paying a premium for LLY as the company makes key breakthroughs in its clinical trials.

- Flowers Foods (FLO): While its 5-year gain is almost identical to the S&P 500, FLO stockholders are up 6% this year.

- Meta Platforms (META): Once margins improve and Meta reduces headcount, this tech stock will provide even more remarkable value.

- Walgreens Boots Alliance (WBA): Its retail pharmacy and clinic business is taking off after a partnership with VillageMD.

- Aflac (AFL): The supplemental insurance company provides exceptional recession resistance and value.

- Intel Corporation (INTC): Despite declining financials, Intel’s valuation is becoming irresistibly low.

- Verizon Communications (VZ) and AT&T (T): Two similar businesses with solid fundamentals are set to outperform once the economy turns a corner.

- PayPal Holdings (PYPL): PayPal’s massive payment volume and dominance in the online payments business will keep it trading at a hefty premium.

- Fiverr International (FVRR): Fiverr’s customer retention is top-class, and it has everything it needs to be a multibagger investment in a few years.

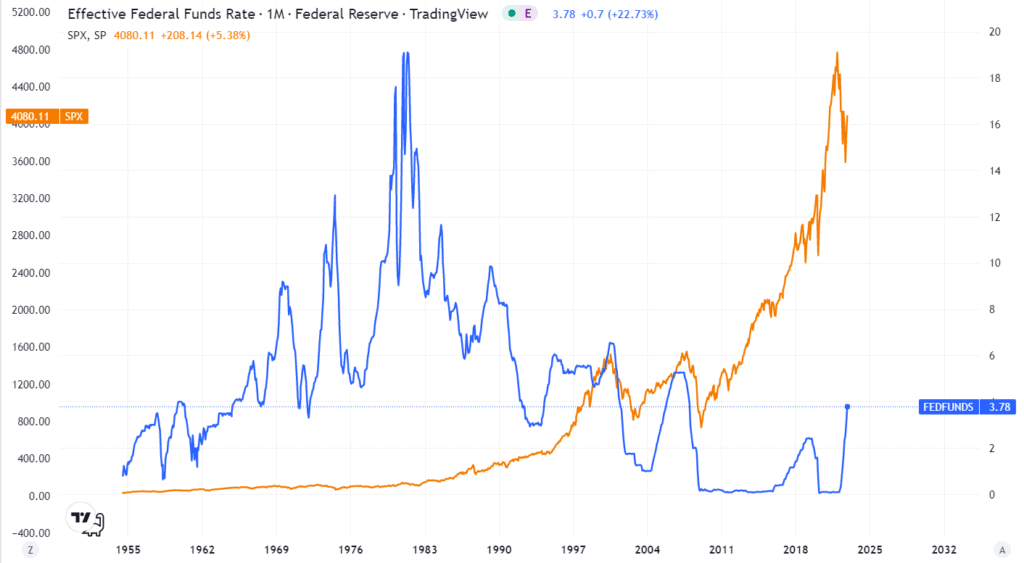

Before we discuss the top 10 stock picks for 2023, we can all agree that the economy has two pathways from here. One, the real impact of the rate hikes sits in front of us and will trigger a deep recession in 2023. Two, the rate hikes in 2022 were appropriate for the level of inflation, and the market will steadily recover in 2023 as rates stabilize. To figure out which path is more likely, let’s take a look at this chart:

[Louis Navellier: The Secret Trading Trick That WON 95% of the Time In 2022]

We can see that, historically, the stock market continued on an uptrend during a rate hike environment. The stock market only went into a deep correction after a lag of at least a year and a half after considerable rate hikes. In 2022 though, the market is heading down while interest rates go up, with little delay. That doesn’t look good.

Conversely, a sensible way to explain this is that things are much more fast-paced in 2022. People can hit sell on their phones a few seconds after getting the news of a rate hike. Moreover, the pace of rate hikes currently is much faster than the ones two decades ago.

The takeaway here is that no one can accurately predict what 2023 holds. Either Federal Reserve Chair Jerome Powell engineers a soft landing, or companies, with a collective debt of $24 trillion, will have to significantly reduce their headcount to make interest payments.

With that in mind, it is critical to find a balance between both of these outcomes before investing. Your assets shouldn’t collapse in the worst-case scenario, nor should they miss out on a bullish stock market. The following ten stock picks for 2023 maintain this balance between upside potential and safety:

Eli Lilly (LLY)

Eli Lilly (NYSE:LLY) is an outstanding stock to consider investing in. The company’s performance compared to other pharmaceuticals is remarkable and is up more than 35% this year alone. They have also reported much better than expected profits last quarter. Net profit margin is up by 30% year-on-year to nearly 21% at a time when most other companies are seeing margin compression. Thus, the premium for the stock is certainly justified.

In addition, they have recently been accepted for review by the Food and Drug Administration (FDA) under an accelerated approval pathway for donanemab. The Alzheimer’s drug by Lilly is very promising and has delivered much more success in clinical trials than competitors. The company states, “Donanemab reduced brain amyloid plaque levels vs. baseline by 65.2% compared with 17.0% for Aduhelm® at 6 months.”

At the same time, they are well-positioned in the Type-2 diabetes market, which is likely to grow for years. That is a lot of diversification within the pharmaceutical industry, and I see more upside as profits increase.

Finally, Eli Lilly makes substantial investments in capital and operating expenses to further its growth. All these factors combined make LLY stock quite attractive for investors looking for long-term growth potential far beyond 2023.

[Exclusive: Luke Lango’s Daily 10X Stock Report]

Flowers Foods (FLO)

Speaking about stocks that provide safety and retain upside, Flowers Foods (NYSE:FLO) is a no-brainer. The bakery company has solid fundamentals and has been consistently beating expectations. In the latest quarter, top-line growth was well above double digits at 12.7%, while net profits increased despite declining margins. Moreover, Flowers Foods’ recession resistance is great because it is in the bakery business.

Furthermore, FLO stock is up 6% year-to-date, outperforming all major stock indices, while its 5-year gain is almost identical to the S&P 500. Combined with the stock’s compelling yield of 3.04%, I wouldn’t sleep on FLO.

Meta Platforms (META)

While many see Meta Platforms (NASDAQ:META) as a failing company, they need to look deeper. Admittedly, not many people are interested in the metaverse, and spending billions on it might not be the smartest of ideas. The potential market for virtual reality products is still small, and everyone socializing in a VR world designed by Meta isn’t plausible. At least not in 2023.

However, suppose we were to put Meta’s expenditure on the metaverse out of the picture. In that case, we’re looking at a tech company that owns Facebook, Instagram, WhatsApp, and Messenger, valued at 11x earnings. That is quite the discount.

In the first nine months of this year, Meta’s “Family of Apps” made $9.34 billion in operating income, while Reality Labs lost $3.67 billion. If Meta reduces their spending on Reality Labs and reduces its headcount, we are looking at an irresistible valuation. Further, profit margins will improve as advertising revenue inevitably picks up. So, even if Meta keeps spending on its metaverse endeavor, I expect a lot of upside for the stock.

[Louis Navellier Reveals How to Make Potential Triple-Digit Gains with Options]

Walgreens Boots Alliance (WBA)

Walgreens Boots Alliance (NASDAQ:WBA) is an excellent choice for investors seeking a safe and passive income source. The company has a solid business model based on its over 9,000 retail pharmacies and provides healthcare services to the U.S. and U.K. In addition, the stock boasts a high dividend yield of 4.68%, far higher than its competitor CVS Health’s (NYSE:CVS) 2.12%.

Furthermore, Walgreens has raised its dividend for 46 years consecutively, with a comfortable payout ratio of 43%. Additionally, the company has started a significant growth initiative in its consumer health segment, which is beginning to take off. In the third quarter of fiscal 2022, the company’s clinics generated $596 million in revenue. The income from the health segment will be an essential source of growth for the company as the VillageMD partnership yields better results incrementally.

However, investors should be aware that the initiatives may not significantly boost the top line, and the stock will likely still underperform as the retail pharma sector is not a hot one. But for those looking for a stable and passive income source, WBA stock is a great option.

Aflac (AFL)

Aflac (NYSE:AFL) is a household name and is among the biggest insurance companies in the U.S. The insurance business is inelastic, and Aflac will undoubtedly profit from that inelasticity. Of course, it is a supplemental insurance company, but consumers are still willing to pay for an additional layer of safety.

Aflac has proven to be resilient during times of crisis, as evidenced by its sound financial performance during the pandemic. Finally, the company has strong investment-grade credit ratings, assuring it will meet its debt obligations and pay its dividend.

AFL stock also includes its relatively high dividend yield of 2.37%, a low payout ratio of 30.78%, and 39 years of dividend increase consecutively. However, that’s not all. Aflac has consistently outperformed analysts’ expectations and is up 21.5% YTD due to its steadily increasing dividend and attractive valuation metrics. Despite that, it is still trading at a price-earnings ratio of 9 times.

[Exclusive: Bill Bonner Final Prediction – America’s Nightmare Winter]

Intel Corporation (INTC)

Despite its recent struggles and declining stock price, Intel (NASDAQ:INTC) remains a major industry player and an attractive option for investors. Despite the decline, the company still generates massive revenues and offers a dividend yield significantly higher than many other tech stocks at 5%.

Furthermore, INTC’s selloff has turned it into a value stock, quickly becoming among the best stock picks for 2023. The company’s importance will also prevent it from losing relevancy anytime soon, as its products are essential for computer manufacturers.

Of course, there is Advanced Micro Devices (NASDAQ:AMD) threatening Intel’s dominance. However, Intel invests heavily in new foundries to regain its technical lead and become a player in the foundry business. Its ambitious European investment plans will also positively affect industries and member states. It is also valued at a much steeper discount than AMD.

I believe with Intel’s current revenue levels and dividend yield, investors may have a once-in-a-generation buying opportunity. Intel’s stock chart shows that the market appears bearish on the company, but there is still plenty of upside for investors who are patient and willing to take a chance on the industry pioneer.

Verizon Communications (VZ) and AT&T (T)

Investors may consider buying Verizon (NYSE:VZ) as the largest wireless carrier in the U.S. trades at a significant discount. Its PE ratio of 8.2x screams a buy since the valuation is nearly at a decade’s low. Verizon also boasts 114.6 million wireless retail connections and can spend less cash on aggressive marketing campaigns or expanding its 5G networks. Alongside that, VZ stock has a dividend yield of 6.88%, which has increased for 17 years consecutively.

On the other hand, AT&T (NYSE:T) trades at a slightly lower valuation but offers less dividend yield. Their fundamentals are similar, providing an excellent buying opportunity at record lows.

Regardless, the most significant concern I have about both of these stocks is their cash-to-debt level. If rates keep increasing, both Verizon and AT&T might find themselves in distress. Still, these concerns are priced in already, and I see a steady recovery for both VZ and T stock in 2023.

PayPal Holdings (PYPL)

PayPal (NASDAQ:PYPL) is a top-rated payment processing company with a strong network and technological and scale advantages. The stock is at a 76% discount since its selloff in June last year, and investors should now consider buying PayPal stock as it is quite oversold.

The company’s profits have turned a corner in the latest quarter, and top-line growth remains robust. I see no reason why the stock should be trading at 2018 valuations, even with slower growth. The company has an astounding total payment volume, and its engagement is rising, making it a cash machine. It is one of the most prominent players in the online payments space, and Wall Street’s take on the stock is positive.

Its selloff in post-Q3 earnings was driven by worries over the competition, supply chain issues, and stimulus rolling off. Still, these concerns are short-term and unlikely to have a large market reaction. PayPal is available in most countries that support online money transfers and is among the go-to payment methods worldwide.

PayPal is a growth stock that I believe will surge in 2023. The payment network is simply too influential to be stuck at its current level in the long run.

Fiverr International (FVRR)

Investors should consider buying Fiverr (NYSE:FVRR) stock due to its enormous growth potential. The company is well-positioned to capitalize on the global freelancing market, estimated to be in the hundreds of billions of dollars. This potential is further amplified by the acceleration of the freelancer market brought on by the Covid-19 pandemic. Fiverr’s unique combination of lightning-quick sales growth and sector-leading gross margins position it as an established leader in its industry and room for multiple winners in the freelancer sector.

Sure, FVRR stock is down 90% from its pandemic high, but that doesn’t mean it’s dead. Fiverr is becoming the go-to marketplace for people looking to hire freelancers for almost anything. The company is spending heavily on marketing, bringing in an inflow of customers. Moreover, the unique thing about Fiverr is that the company’s customer retention levels are remarkable.

As these customers stack up, the company is incrementally improving its revenue in the long run despite short-term losses. I easily see this stock providing multibagger within a few years, which is why Fiverr is among the top stock picks for 2023.

[Alert: Marc Chaikin Reveals Biggest Stock Prediction of his 50-year Career on Wall Street]

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.