Table of Contents:

- Introducing Joel Litman

- What REALLY happened in 2020

- The stocks you NEVER hear about

- A financial “heist” is underway

- Joel’s prediction for 2023

- Once-in-19-years event is coming

- Where the REAL crash will happen

- Microcap Secrets: How to Make 100% to 500% Gains Using Forensic Analysis

- FREE access to his system

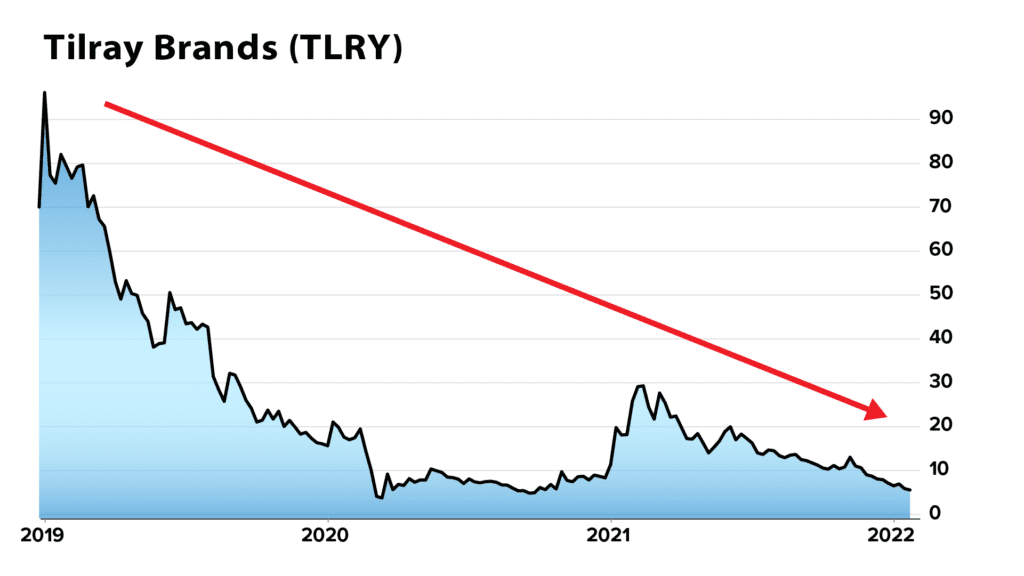

- Top 3 Popular Stocks to Avoid Now

- Joel’s Harvard Club talk

- To get started with Hidden Alpha…

PRESENTED BY ALTIMETRY RESEARCH

THERE'S A FINANCIAL DISASTER

COMING TO AMERICA IN 2023

I’ve warned 200 top institutions. Even the U.S. Pentagon.

But few people realize this could actually happen… Or how a single move right now could make you massive profits as it unfolds.

ANCHOR

Hi, I'm John Sviokla – a retired Harvard Business School professor.

I'm here at the Harvard Club in Boston to speak with professor and Chief Investment Strategist Joel Litman, a forensic accountant and CPA who's lectured at Harvard, Wharton, and the world's top CFA societies.

Joel's ability to predict the market's biggest moves has landed him invitations to the Marine Corps War College… the FBI Nationwide Forensics Conference… and even the U.S. Pentagon, where he recently delivered an eye-opening message that will be the subject of today's briefing.

In short: If you're worried about the market this year, we have big news for you.

After seeing the worst sell-off in half a century, Joel and I arranged to meet today for an emergency briefing.

Joel's predictions have brought him the attention of CNBC, Forbes, Barron's, and more – for good reason.

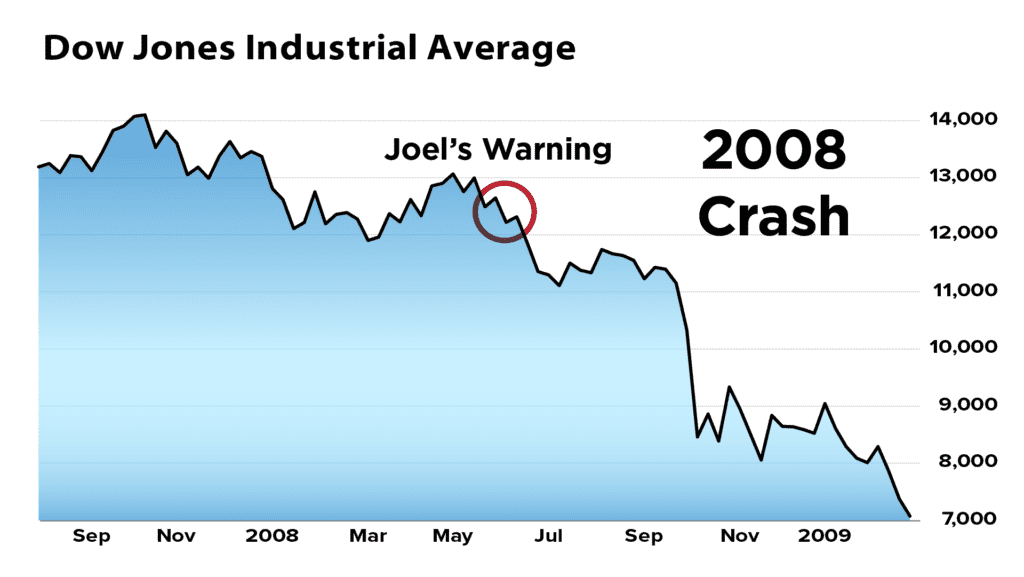

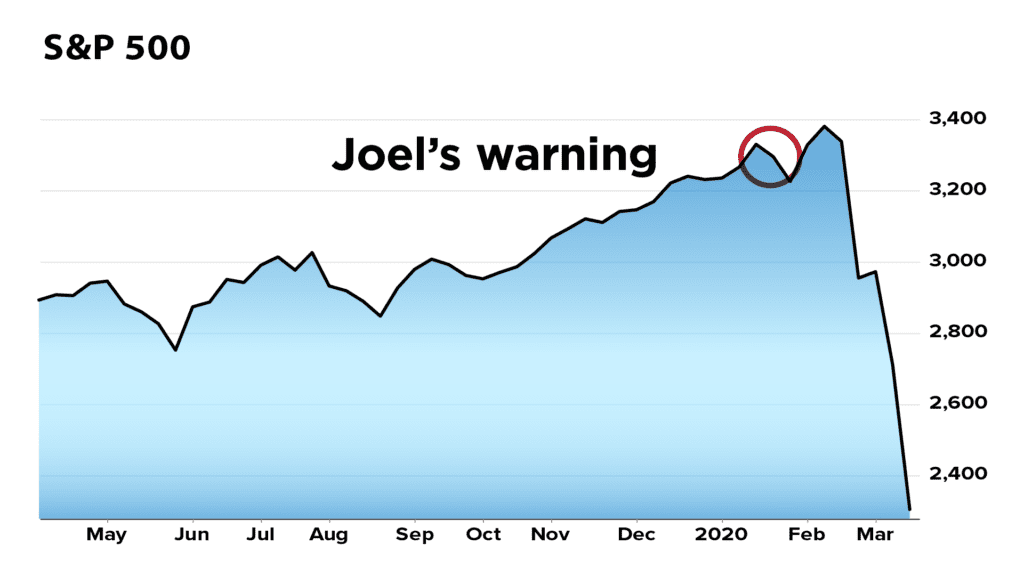

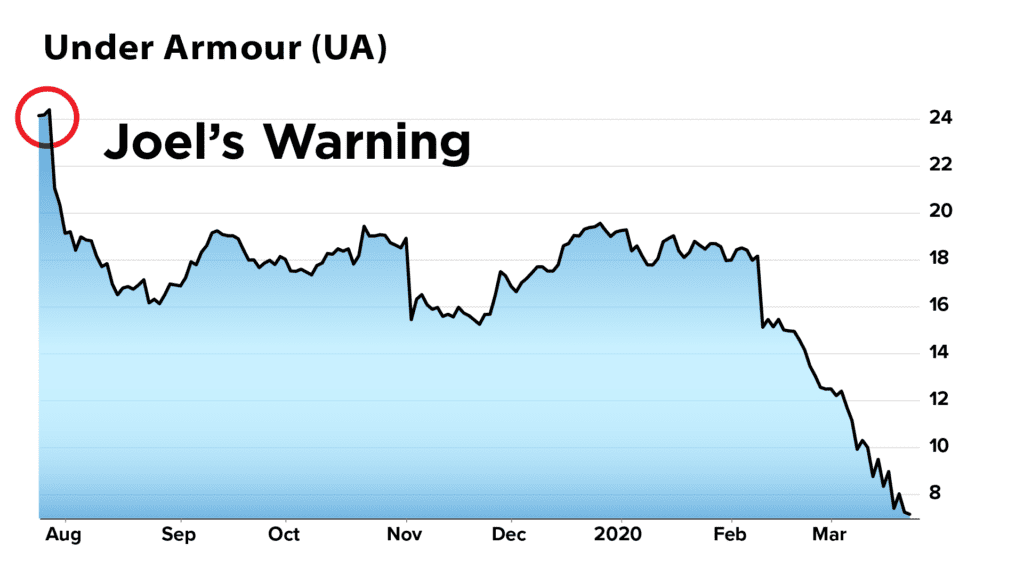

Joel accurately predicted the 2008 and 2020 Crashes…

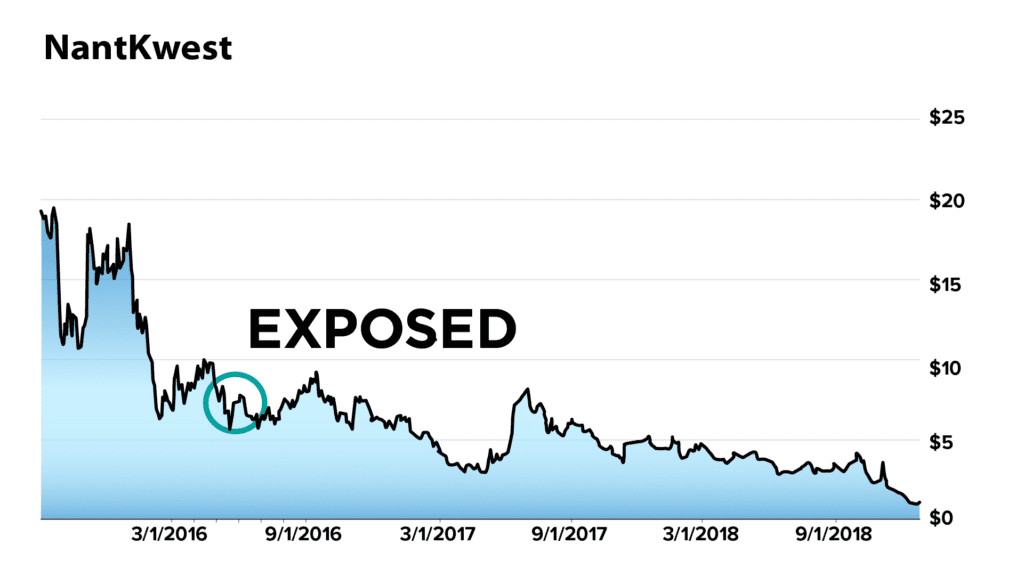

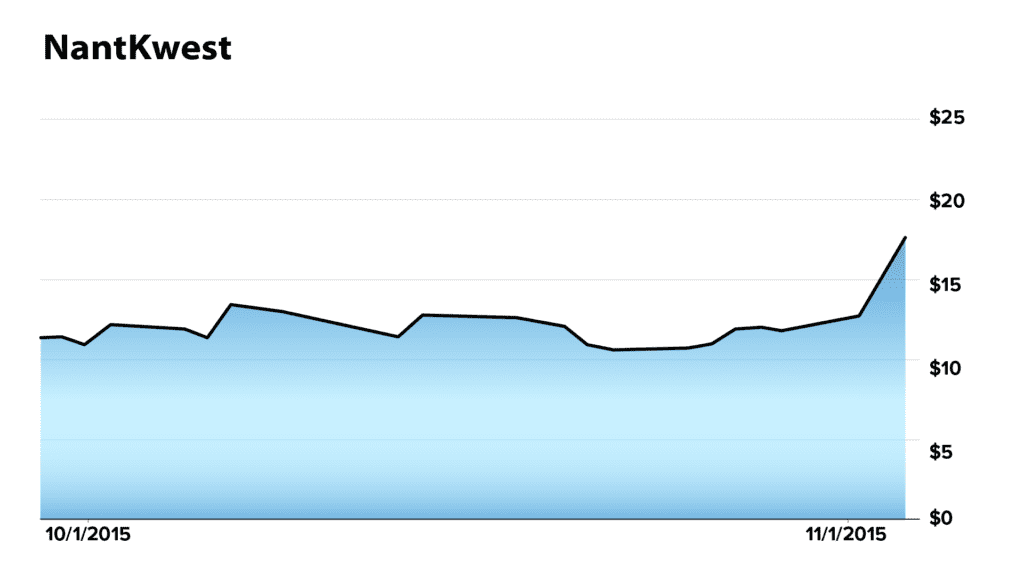

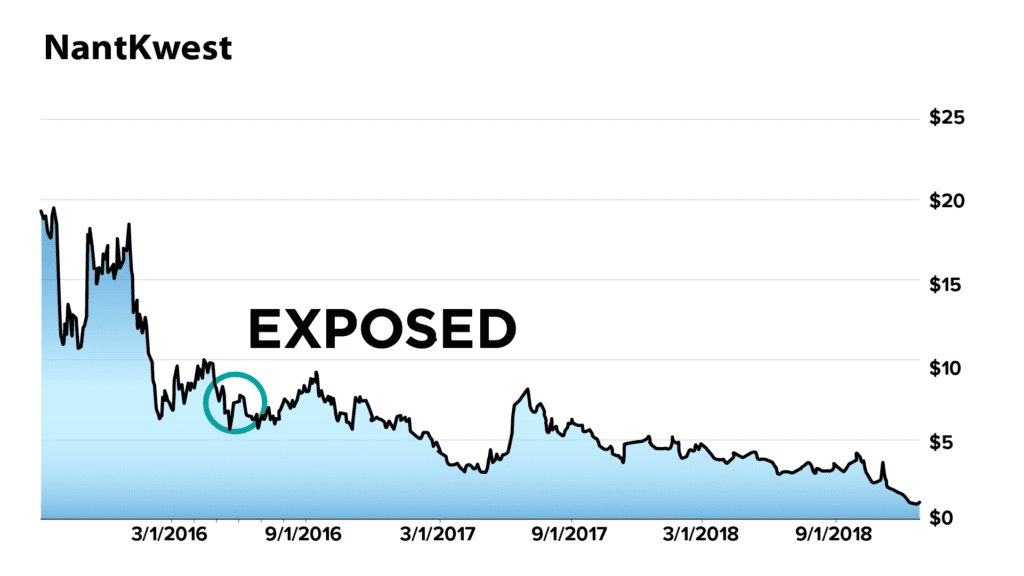

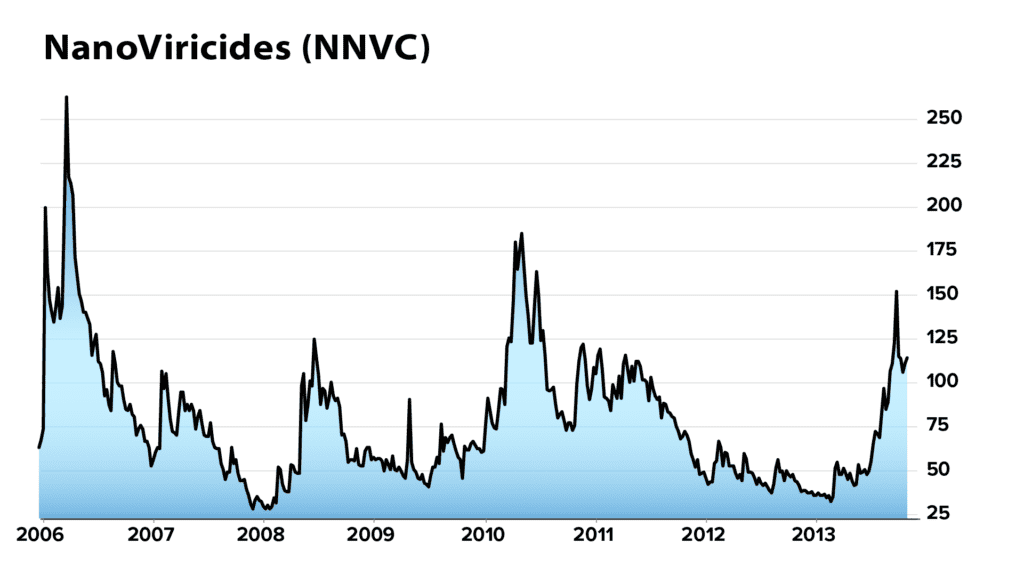

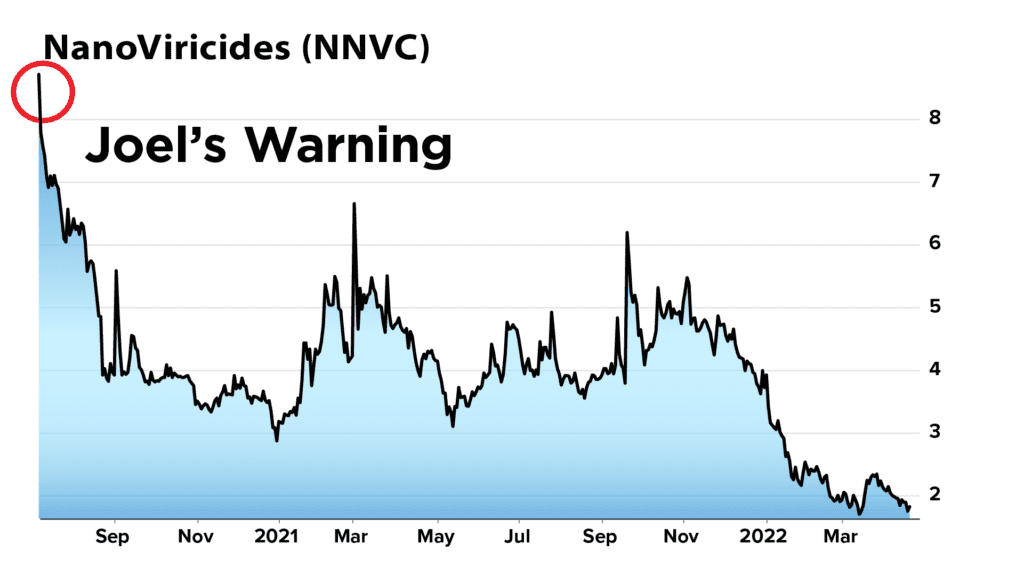

He's exposed 57 companies for potential fraud, with many that went bankrupt or fell to almost zero after his analysis…

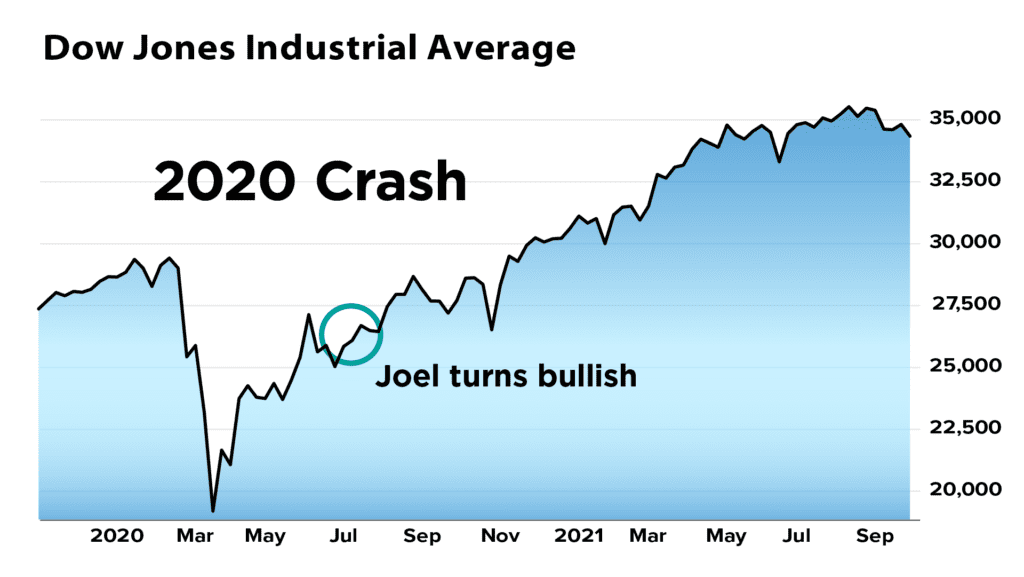

And he called the bottom of the 2020 Crash…

…with a series of stock picks that could have doubled your money – or better – 10 different times.

And now – today – he's sharing his NEWEST prediction, which he believes will lead to an even bigger opportunity.

Professor Litman – welcome back to Harvard.

JOEL

Good to be here, John.

ANCHOR

Joel, you recently gave a lecture just down the street from the White House to high-ranking U.S. Pentagon officials… on what is arguably your most contrarian prediction ever.

You say it represents a MASSIVE FINANCIAL DISASTER headed for America this year, worse than anything we've seen so far… but it's also a generational money-making opportunity 99% of the public will completely miss out on. And it's all being orchestrated by forces beyond our control.

Tell us what's going on…

JOEL

Predicted 2008 and 2020 Crashes

Chief Investment Strategist

Founder, Altimetry

Cambridge, MA

I'll get right to the point…

In short, I predict everyday Americans are about to experience a great deal of financial pain. As we'll explain today, you will almost certainly become victim to it, if you do nothing.

And the whole thing is being facilitated by many of the authorities you trust the most – which means that outside of this briefing you might never even hear about this until it's too late.

But if you know what's coming – and exactly which investments to make, which we'll cover today, including a FREE recommendation of the #1 investment to buy and the #1 to avoid – it's a chance to make a great deal of money.

And that's why I agreed to hold this emergency briefing.

ANCHOR

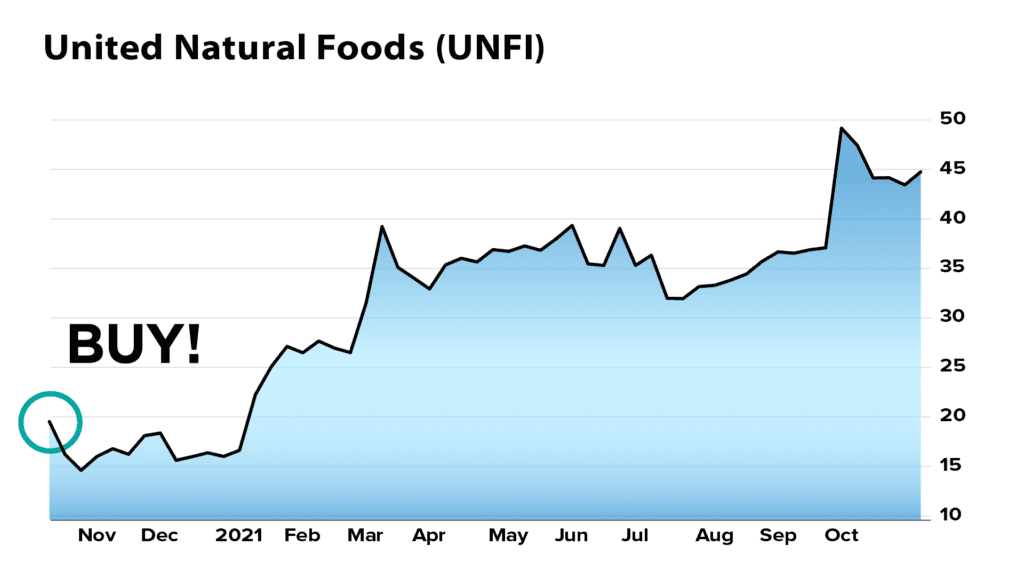

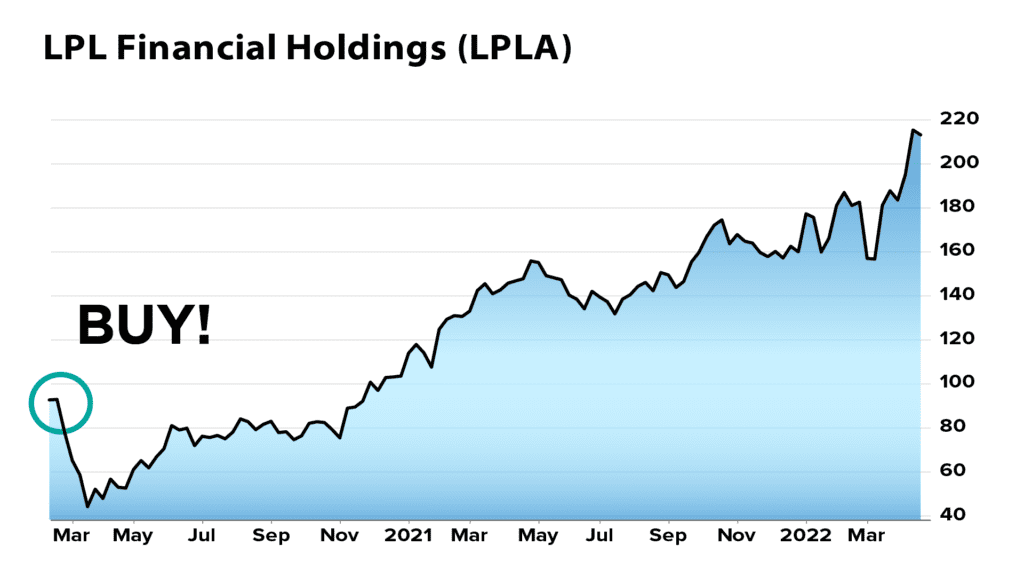

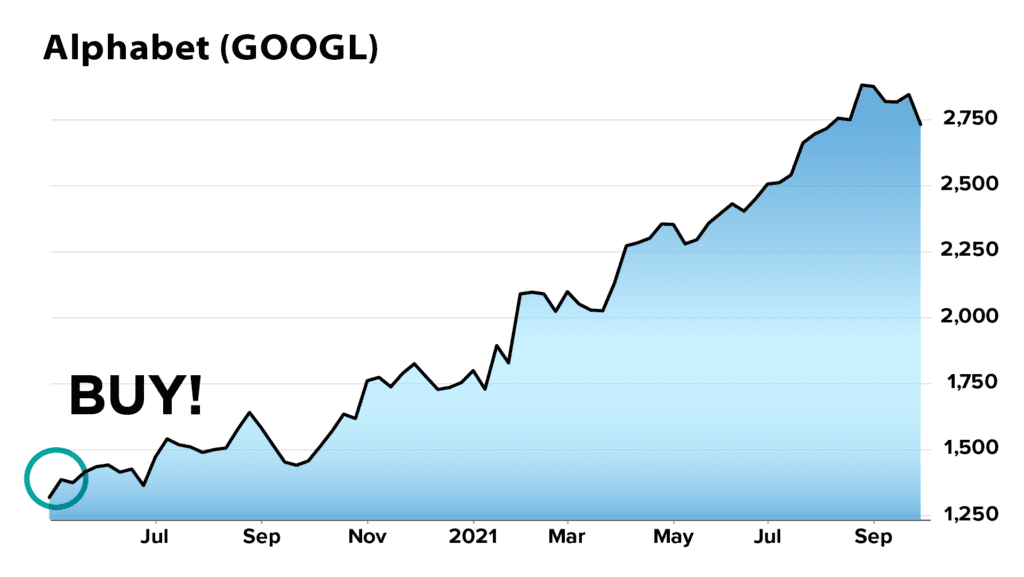

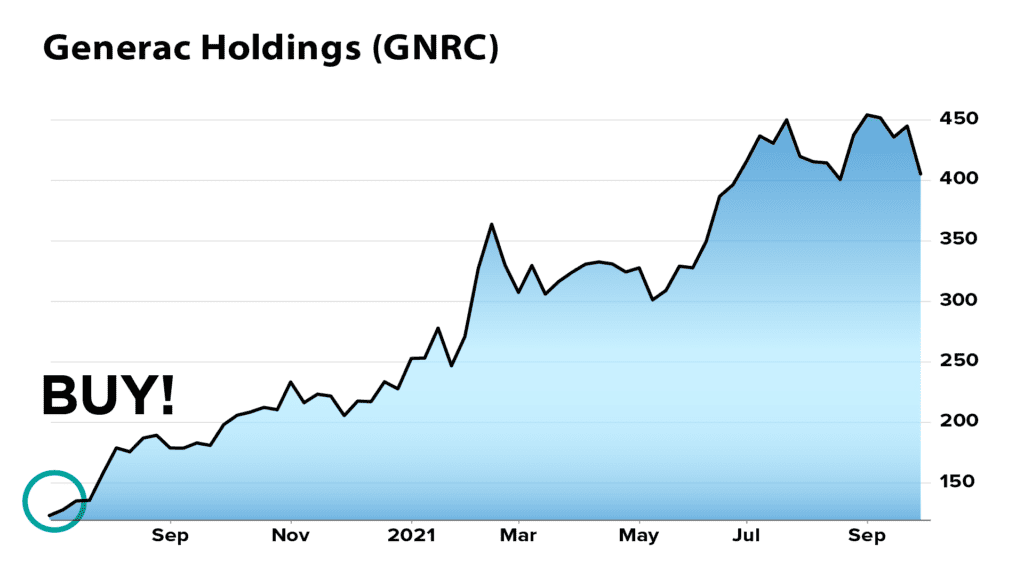

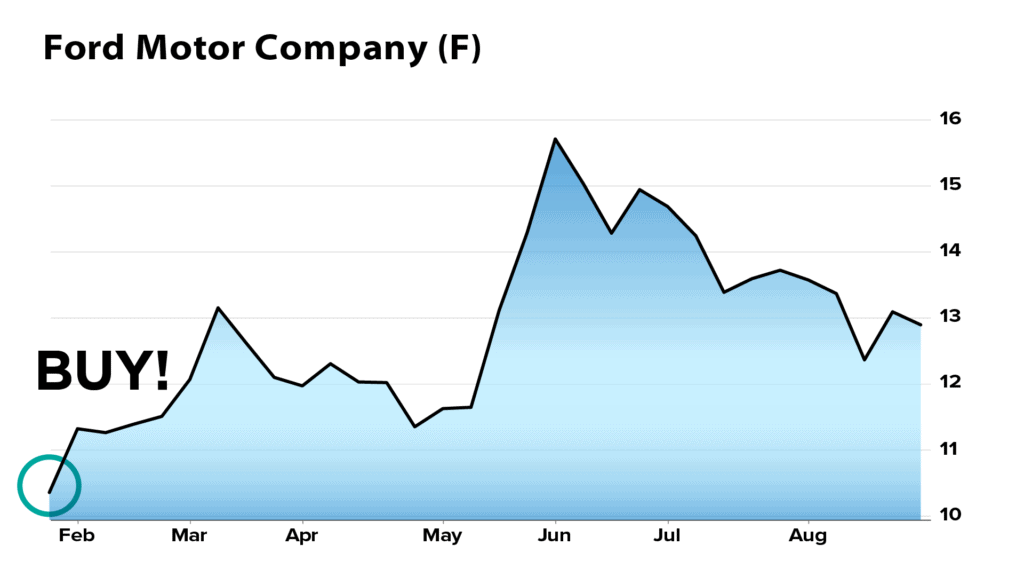

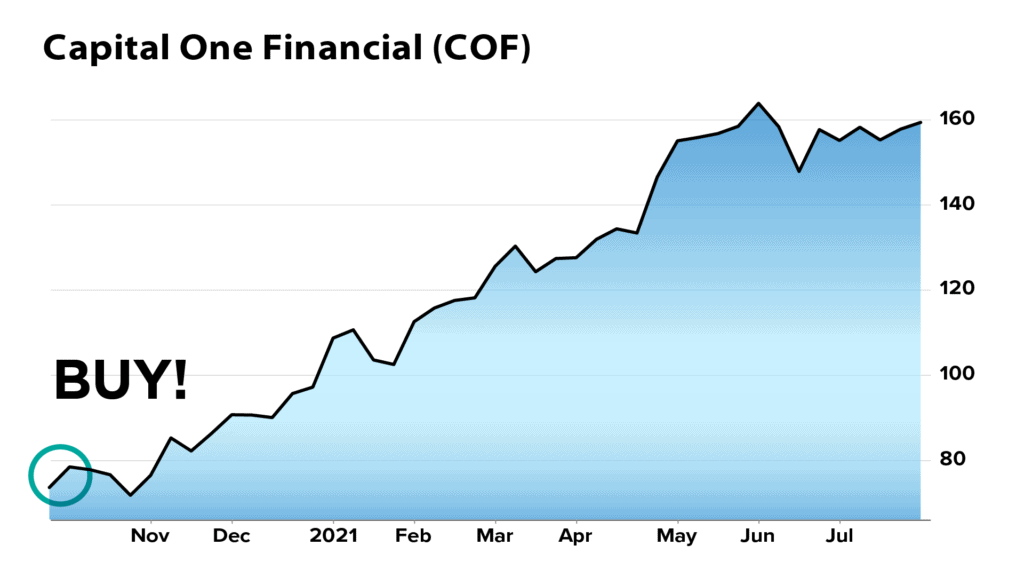

Keep in mind: The last time Joel held an emergency briefing was shortly after the 2020 Crash.

He told our viewers that he was sharing – quote, “the biggest money-making opportunity of the next decade… A chance to realistically make 10 times your money on a single investment.”

If you'd watched that event, you might have dismissed the whole thing as a bunch of B.S.

But the fact is, you could have made 9 times your money, tripled your money twice, and doubled your money, if you'd followed him… for a 123% average gain on all his recommendations through 2020.

So Joel, without further ado…

Let's dive into your newest prediction – because I can say upfront, it’s unlike anything I’ve ever taught at Harvard, MIT, Wharton, London School of Economics, all the places I’ve been a professor. Tell us… What is this disaster exactly?

Bigger problem than a crash

JOEL

John, most everyday folks I've spoken to are worried that a larger crash or a years-long bear market is on the way.

And no wonder, right?

We saw the worst sell-off since 2020. The number of Nasdaq stocks down 50% or more hit a near record. Inflation has hit a 40-year high.

And of course, the geopolitical conflicts caused a spike in fear.

ANCHOR

Yeah, I mean the market went up so much after 2020 – and we've seen such nasty hiccups since then – that I think a lot of people are expecting to see a big and prolonged decline.

JOEL

Sure. But that's only a small part of the full story.

Meanwhile, the experts are saying “Buy Gold” because they're claiming that inflation is here to stay. Or they're saying buy value or alternative assets, because the Fed has been raising rates.

But I'm here to tell you that none of these issues touch on what's REALLY coming to America this year.

There's a much bigger problem headed your way.

It could turn out to be a kind of massive financial “heist” you've likely never considered before, with an opportunity hidden within that's far greater than anything you could make on gold, ordinary stocks, bonds, cryptos, you name it.

ANCHOR

Joel, let me ask you upfront.

This financial “heist” you're predicting… You don't mean hackers stealing my bank account information or a “run on the banks” or a government seizure of my personal property or assets, do you?

JOEL

No – nothing like that.

This is a heist that goes deeper than that and is perfectly legal, which is what makes it so scary.

And the fact is, this has probably ALREADY happened to you on a smaller level – if you have any money in the markets. But this year, I believe it's about to play out on a scale bigger than any I've seen since 2003.

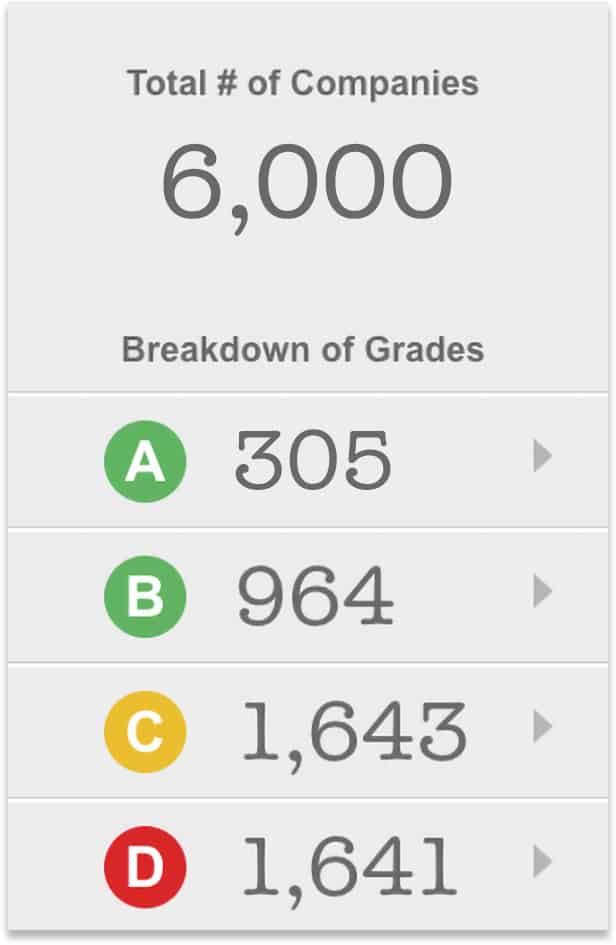

We discovered all of this – along with every other big opportunity we've ever shared – by seeing what NO ONE ELSE can see about the market, John. It's something that we personally created, which is so effective that our research has been followed by the top 10 global investment houses and more than half of the world's 300 biggest money managers.

In short, we've developed a system.

What REALLY happened in 2020

ANCHOR

Today, we're going to have you explain and even demonstrate your system…

But one thing I want to mention upfront…

What you're about to see is the most successful stock predictor I’ve come across in more than 30 years as a professor and partner at a consulting firm where I worked with dozens of the leading minds in technology. It works especially well during the kind of rollercoaster we've seen lately.

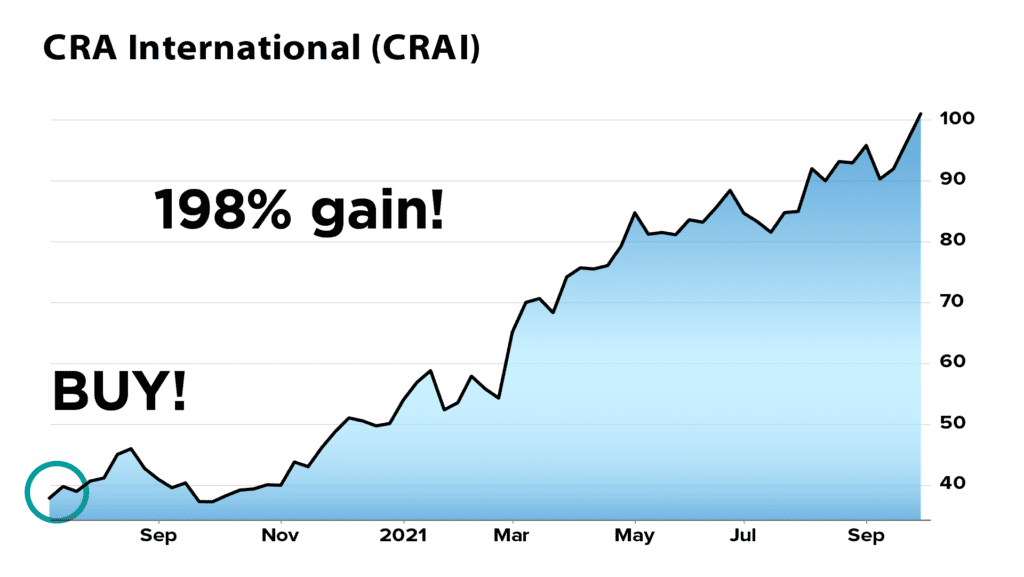

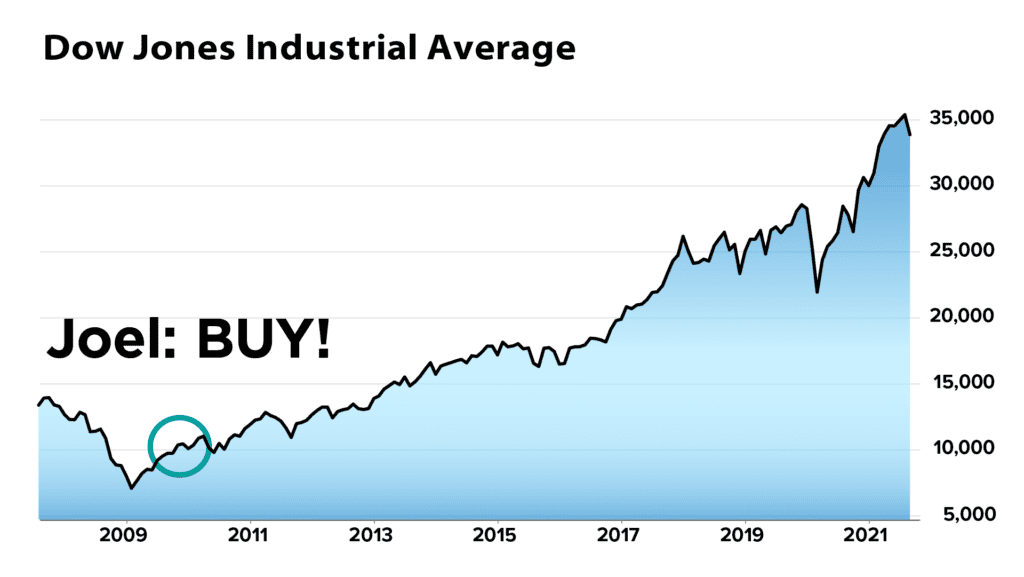

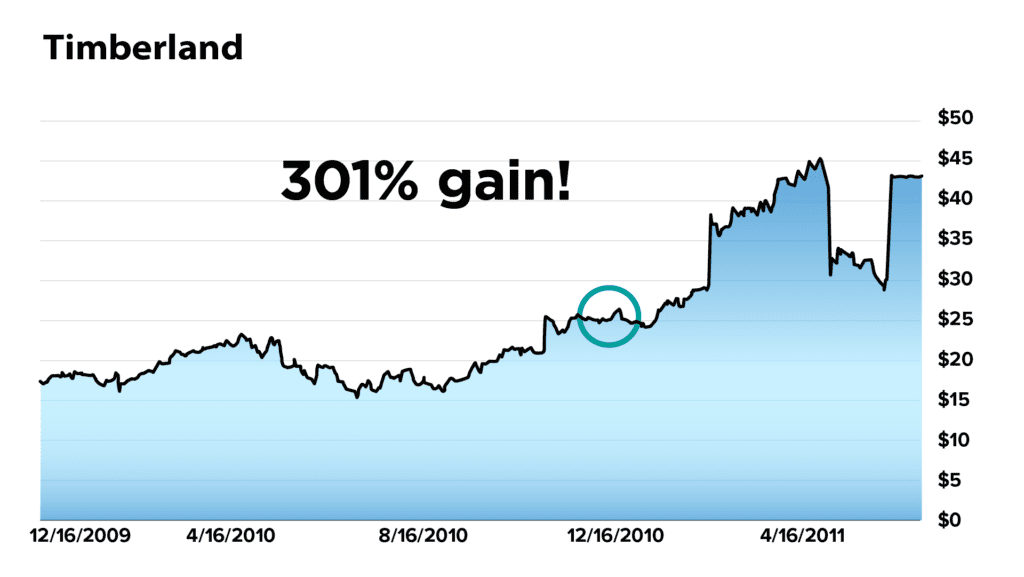

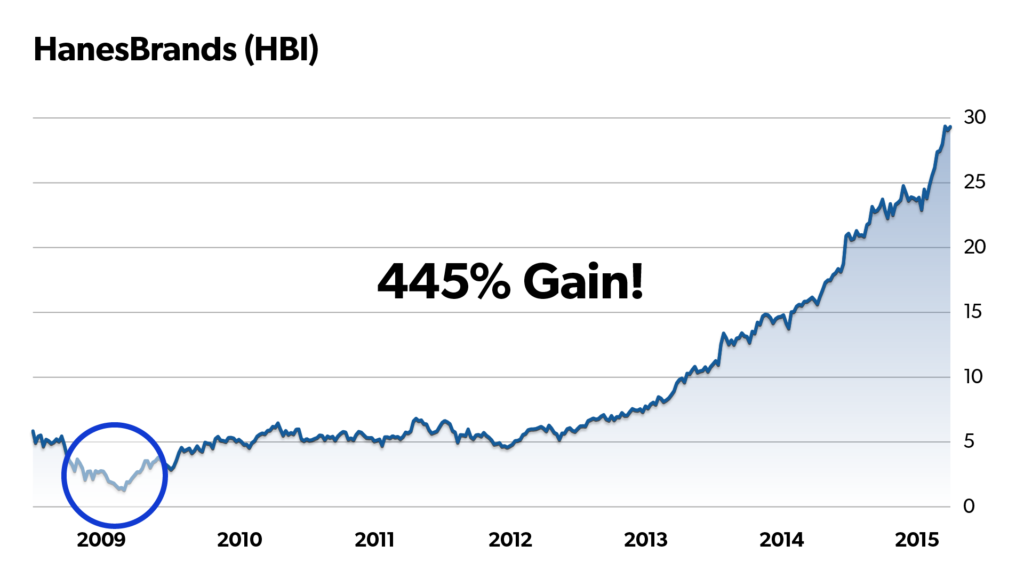

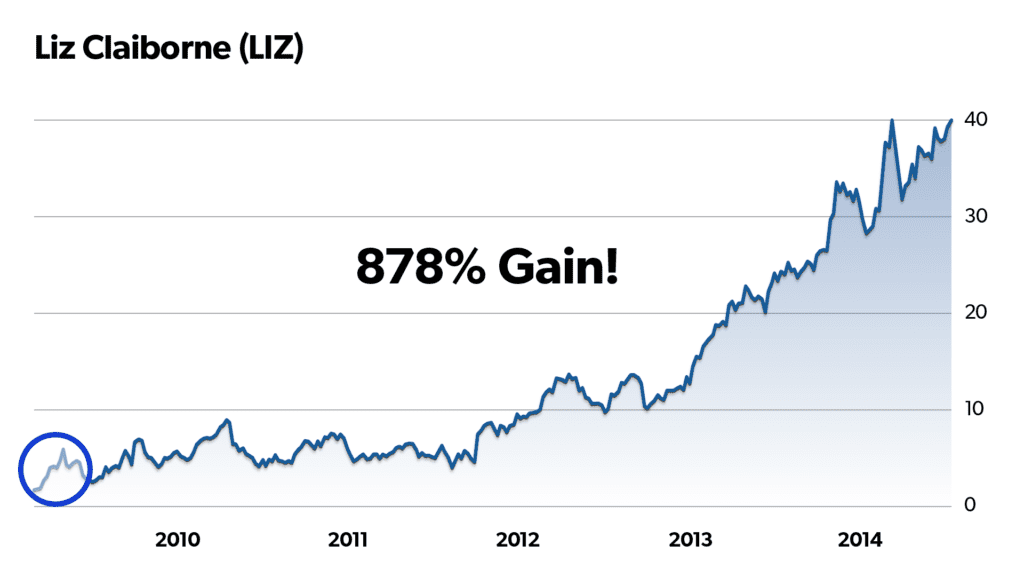

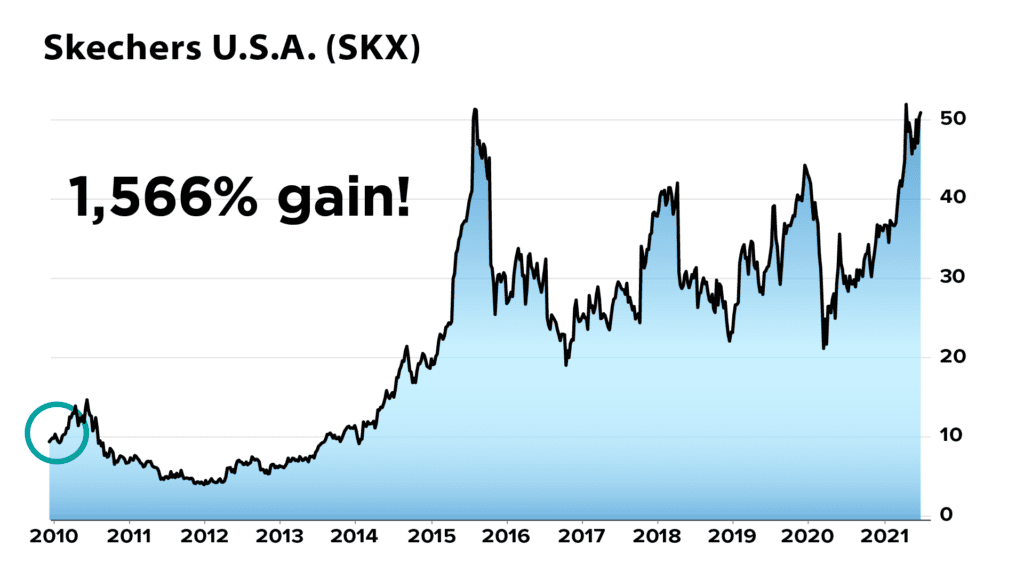

For example, back in 2009 – when the Dow fell 48% – a roomful of wealthy hedge fund managers hired Joel and his team to name their #1 investment ideas.

Joel ran his system and recommended Timberland… which went up 301%.

Hanesbrands, for a 445% gain…

Liz Claiborne, for a 878% gain…

And Skechers, for a 1,566% gain.

So Joel, walk us through exactly what you've created and what it's saying about the market right now.

JOEL

First off, consider what happened back in 2020…

There was a mass exodus out of urban areas as the pandemic swept America… and the housing market boomed, right? By September of that year, we saw a $1 trillion increase in home equity.

Many on Wall Street said, “Buy Zillow.”

ANCHOR

The real estate listing company…

JOEL

Right. And fair enough… If you'd bought Zillow during the depths of the COVID crash, you'd have doubled your money.

But John, my team and I have spent nearly 30 years on and off Wall Street, at places like Credit Suisse First Boston, and as Certified Public Accountants at Deloitte and PricewaterhouseCoopers. And the one thing we've learned is this…

If Wall Street is pushing some investment onto the public… there's usually something else they're NOT pushing that could make you even more money. A LOT more money.

ANCHOR

You mean a better investment they save for themselves…

JOEL

Often, yes!

In fact, I’ve written exposés about this for Harvard Business Review called “Give My Regrets to Wall Street”…

…and in Forbes titled “Wall Street Wrong Again”.

I’ve been disgusted by the behavior I've seen from Wall Street institutions. It’s why I left that world.

So I launched my firm specifically to build a system to uncover exactly what these little-known investments are.

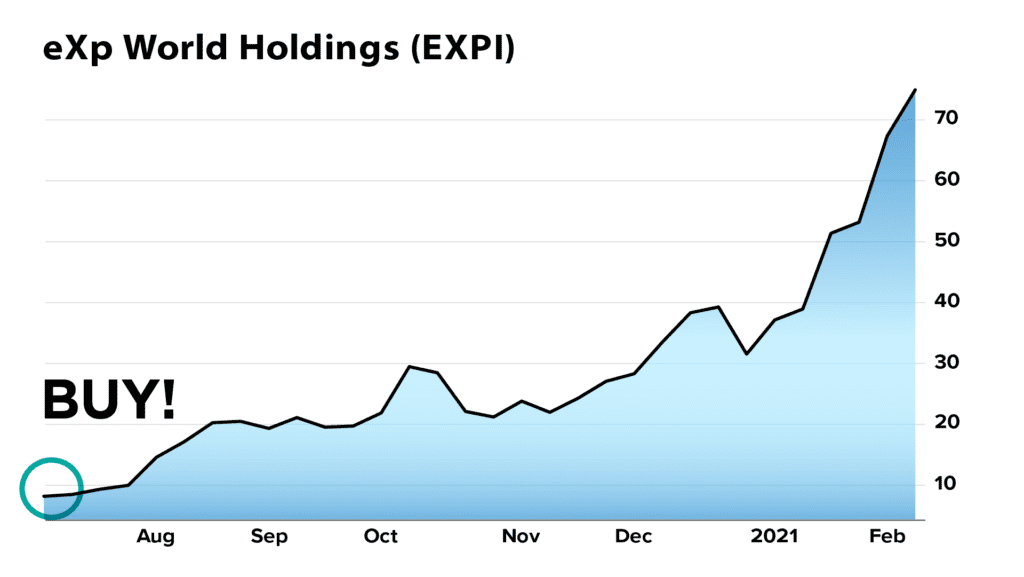

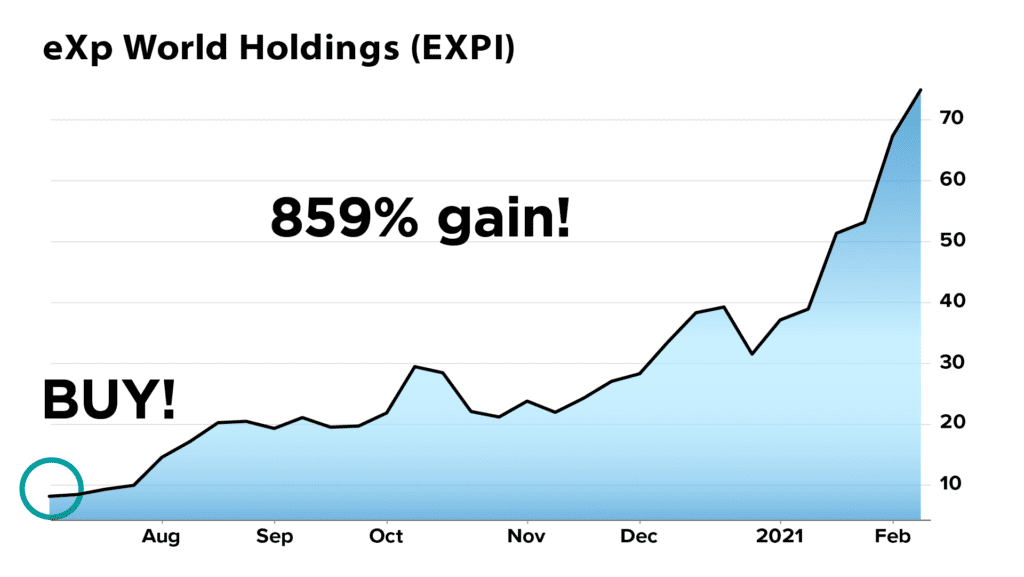

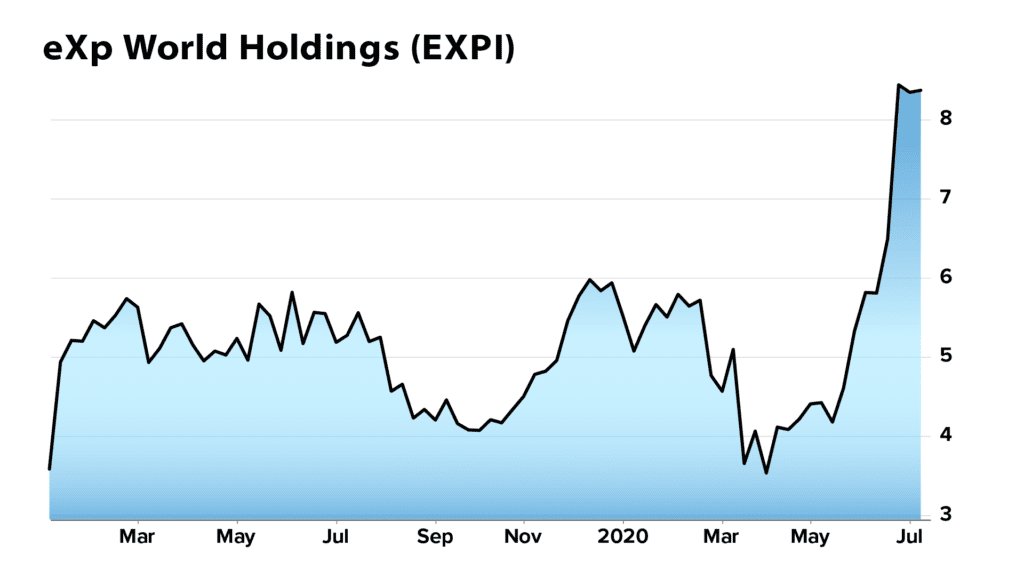

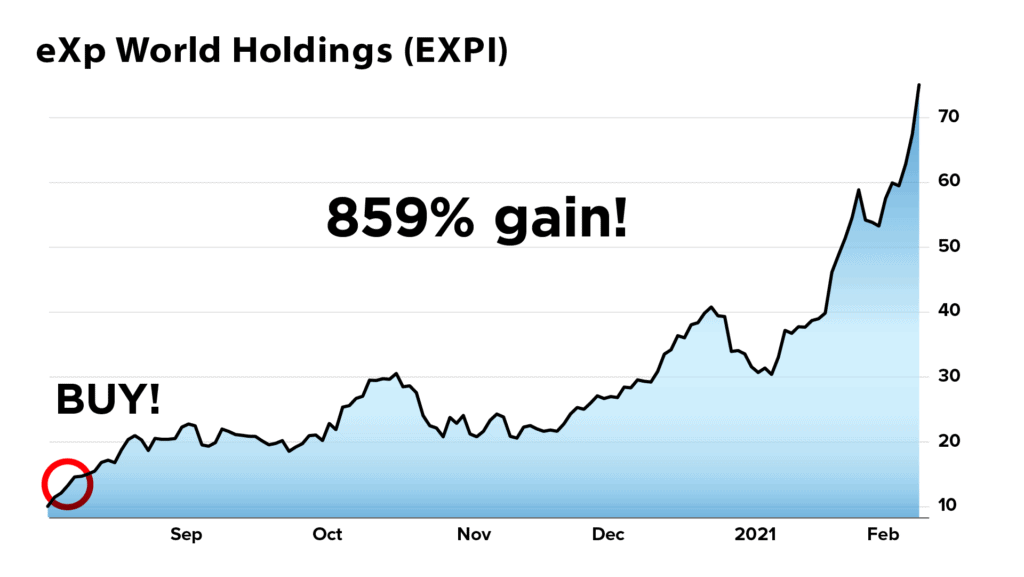

In this case, I ignored Zillow completely, John… applied our system to the real estate sector… and came across a smaller and less-talked-about company called eXp World Holdings.

ANCHOR

And I imagine that company is similar to Zillow…

JOEL

Similar, but it puts the customer-broker platform on a cloud network, and even creates a 3D virtual experience. This was especially important during lockdown.

But here's the thing…

When you type the stock ticker into our system, here's what you see…

ANCHOR

OK, and what is all this exactly?

JOEL

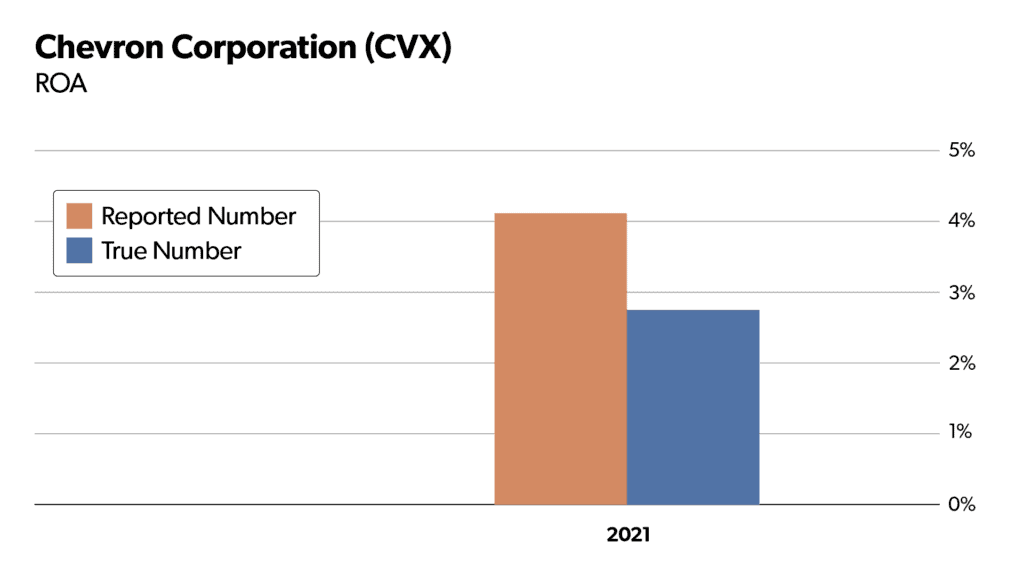

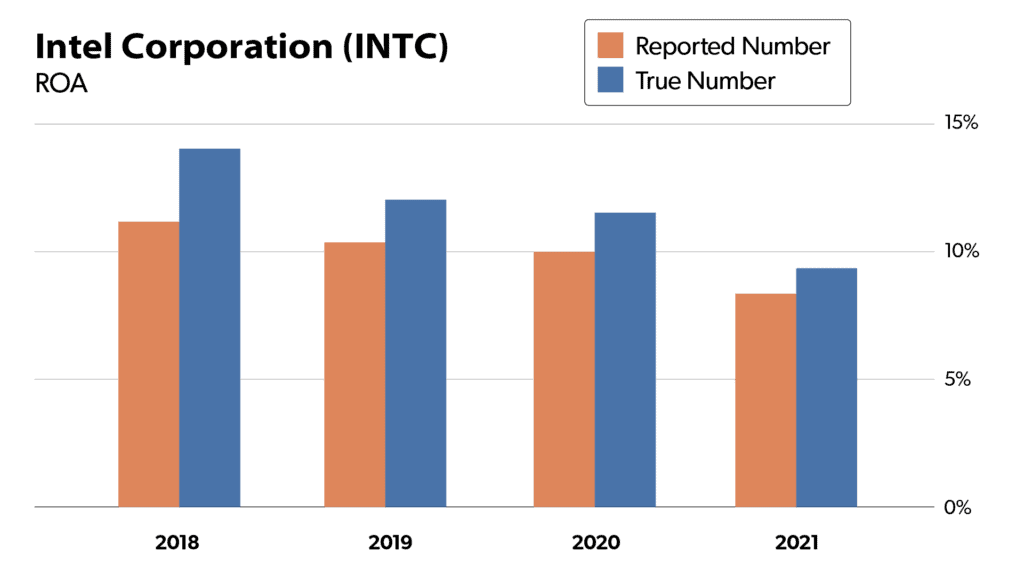

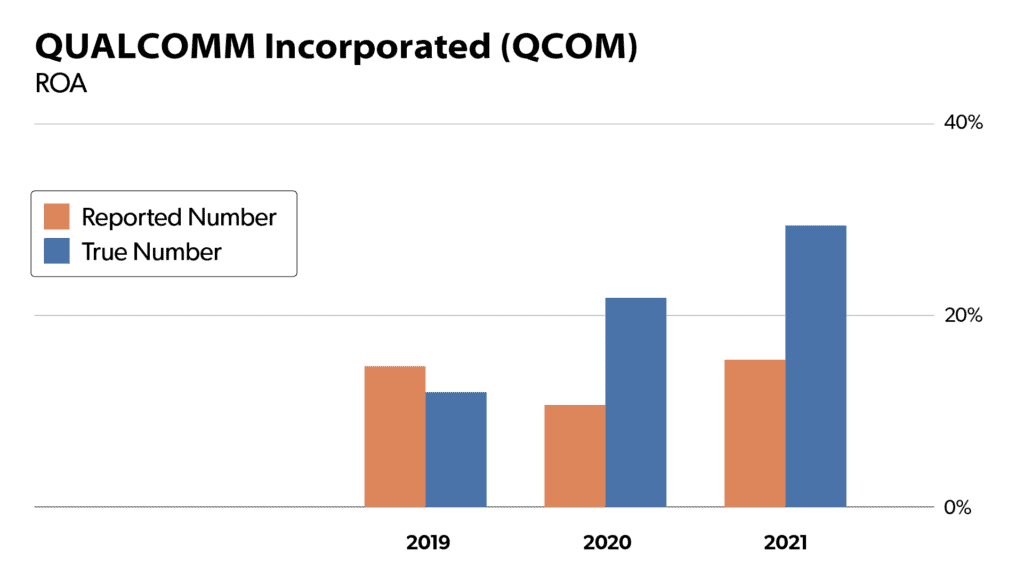

This is a measure of how successful the company is, according to Wall Street. It tracks the one thing the investment world follows more than anything else… the biggest factor that drives stocks up or down.

And that is – the company's EARNINGS.

ANCHOR

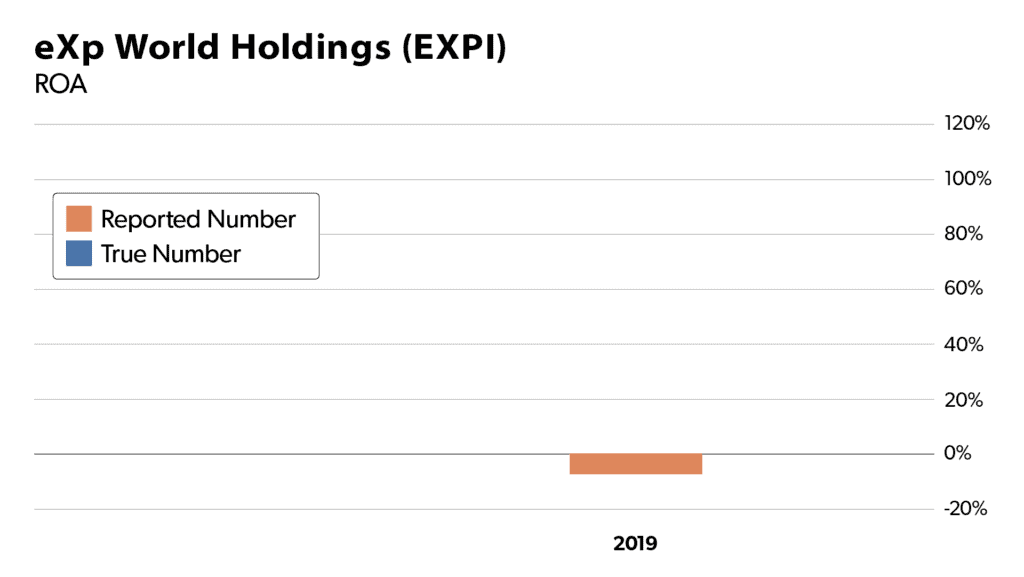

So for this company, we're looking at 2019 here, right? And I gotta say, it looks pretty bad. What is that – negative 7%? So these guys didn't make a penny that year?

JOEL

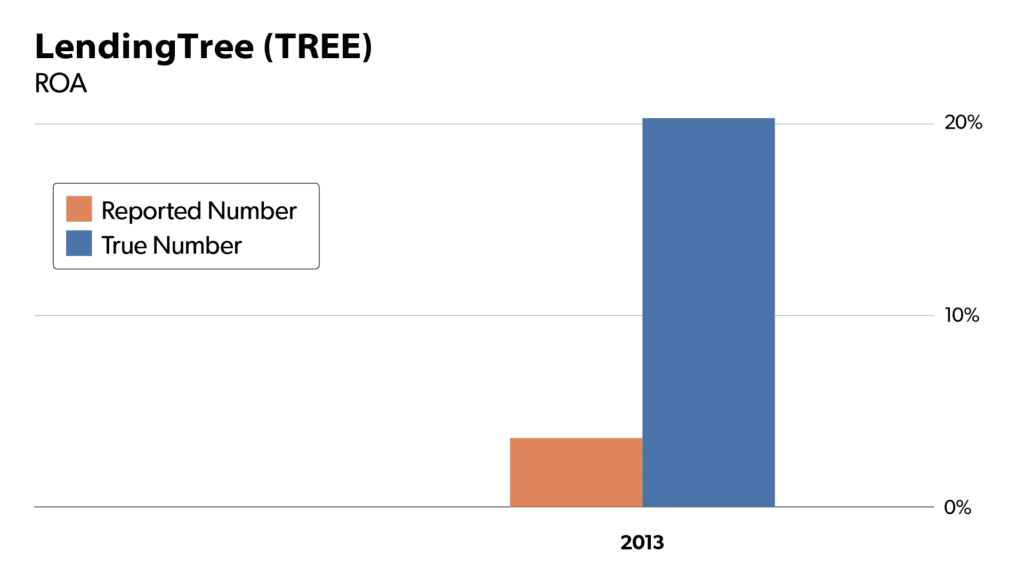

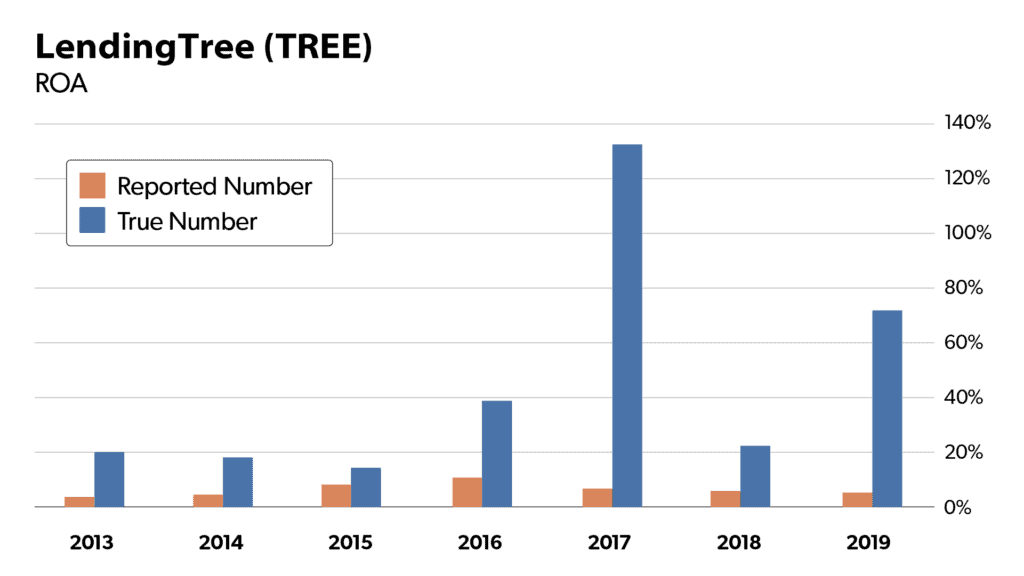

This is the company's Return on Assets – its “Earning Power.” A measure of how effectively they can generate cash earnings.

And yes, this was the number posted on Wall Street.

One look at these earnings and John – you'd have RUN AWAY from this company, right? And sure enough, hardly any Wall Street firms recommended a BUY on this stock.

ANCHOR

And yet, real estate was super-hot at the time…

JOEL

Yes. Now, John… I'm no expert on real estate, even though I've lived all over the world…

But what I DO know is that Wall Street routinely hides the best opportunities for themselves… For example, the research side of an investment bank will hand ideas to the investment side, while telling the public about a completely different idea entirely.

So when I saw how awful this real estate company looked… during a real estate boom… with such little attention from Wall Street… I investigated.

In short, I ran the company through the system we're going to share with you today… the culmination of my life's work… which our clients pay as much as $100,000 a month to access.

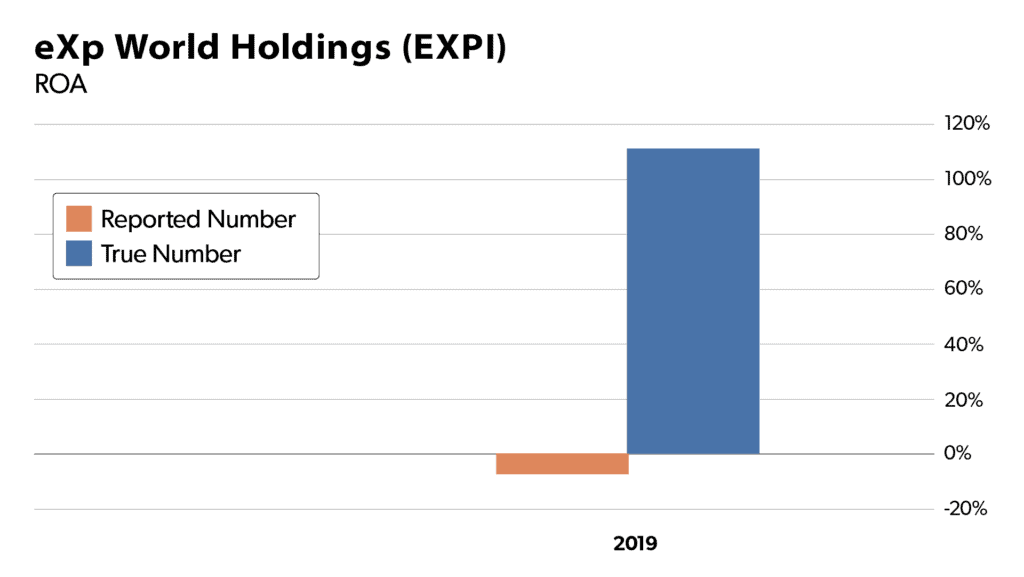

And with one glance, I saw this stock had the potential to rise by 500%, 1,000%, or more. Take a look…

ANCHOR

Whoa! What is all this…?

JOEL

As it turns out, the publicly reported numbers from Wall Street were all completely WRONG. There was a massive discrepancy, which I've spent my 30-year career learning how to detect.

Our system applies more than 130 corrections to the balance sheets of more than 32,000 companies to find – and CORRECT – these discrepancies.

One click… and you can see the REAL, TRUE earning power of the company right here. It was positive… to the tune of 110%, as good as you'd see in a company like Apple or Amazon.

We call that “True Blue.”

So I recommended the stock in July 2020. Sure enough – you could have made 8 times your money on our recommendation, in 7 months.

ANCHOR

So without your system, you and even your entire team of 150 personnel would have missed this stock…

JOEL

More importantly, the general public missed it too.

And we see this happen all the time. For example, I don't claim to know very much about apparel fads.

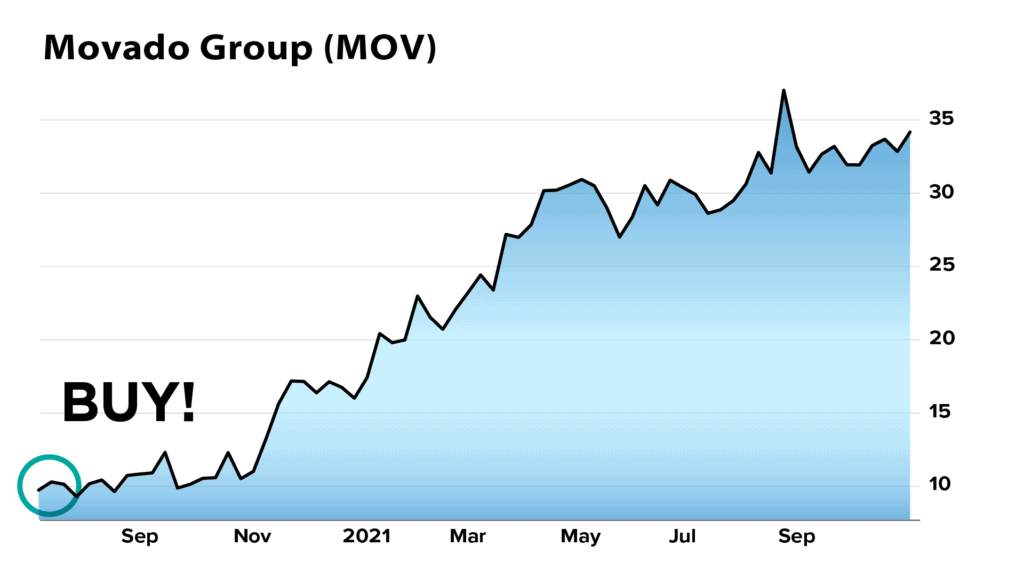

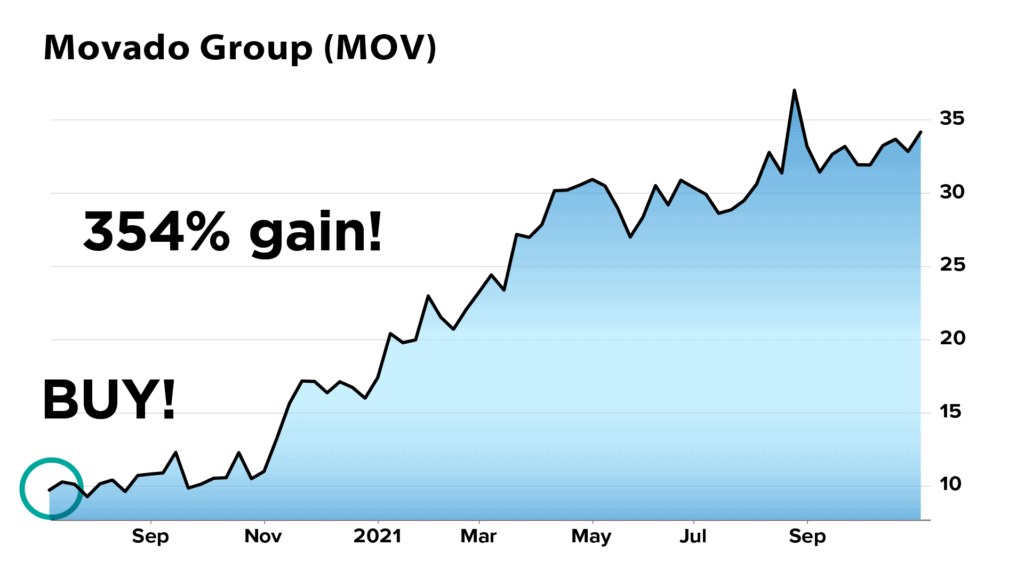

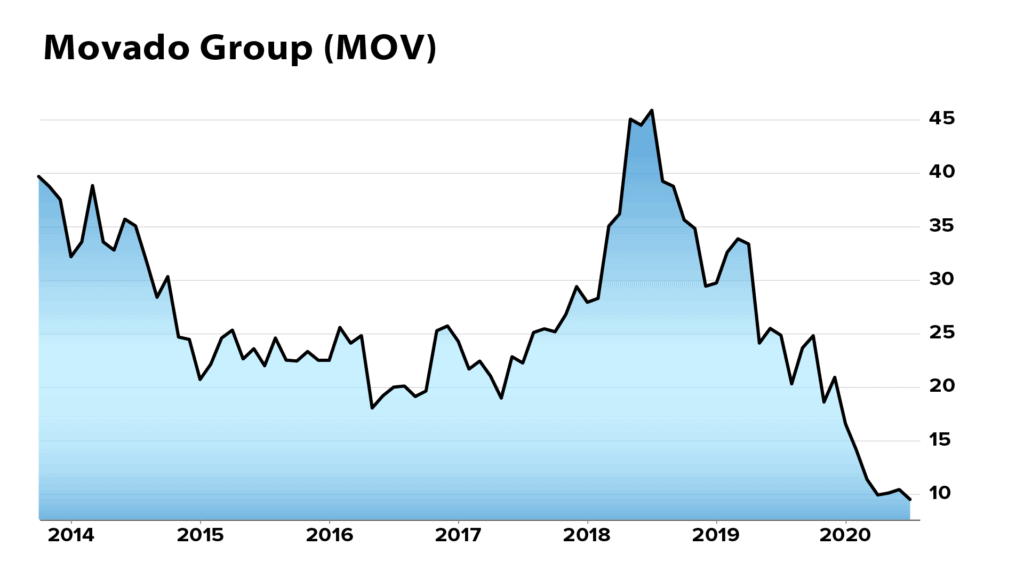

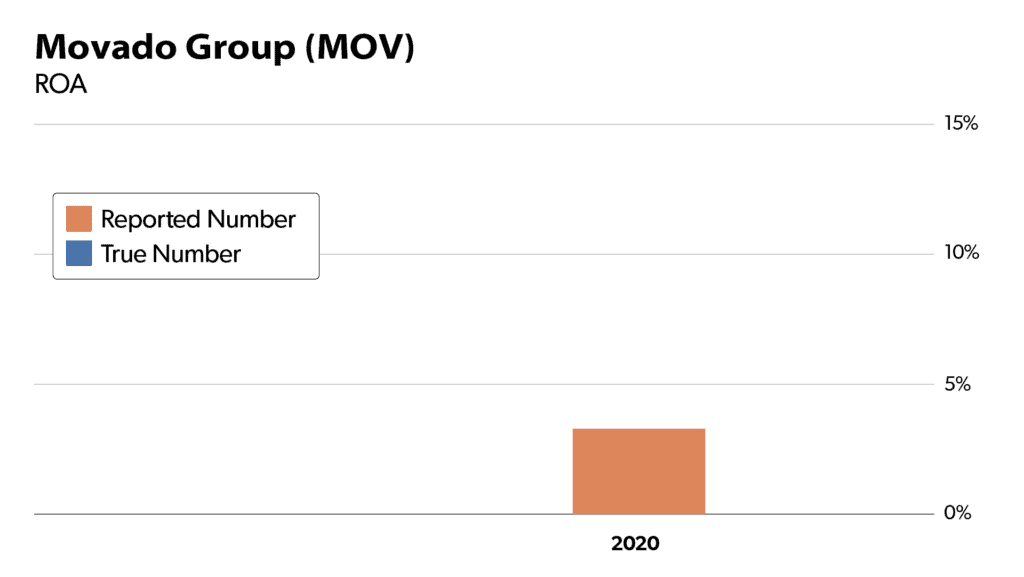

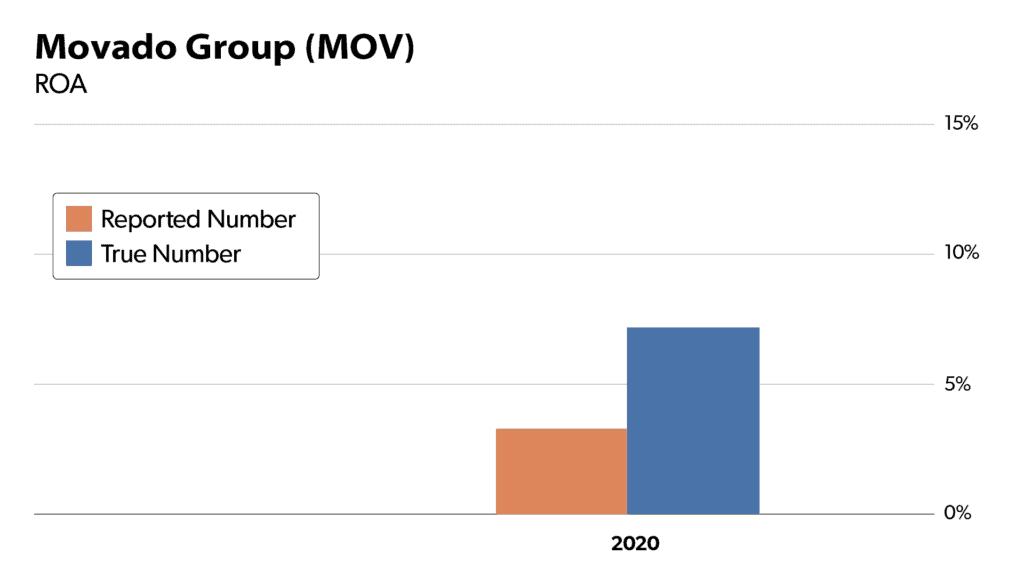

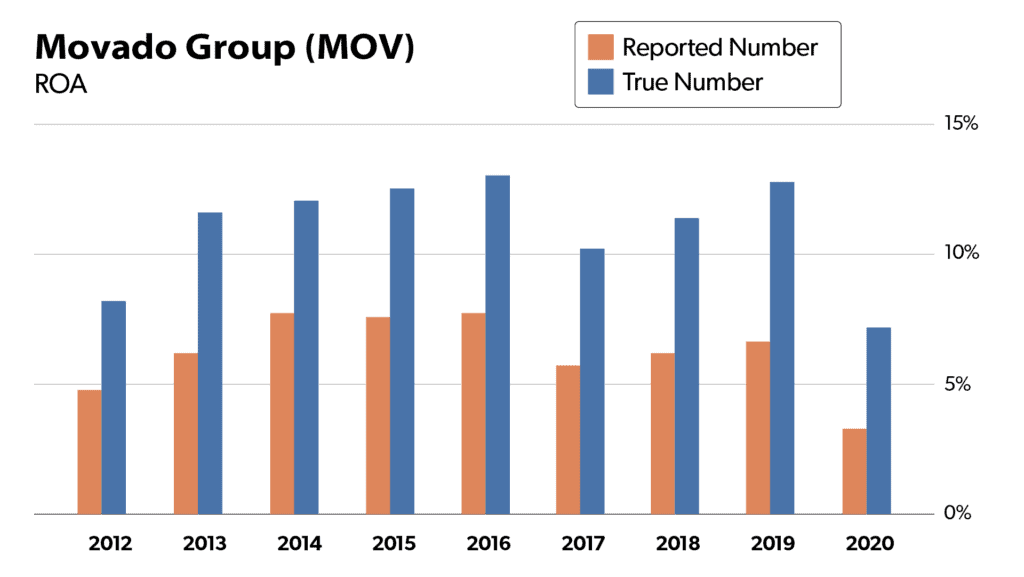

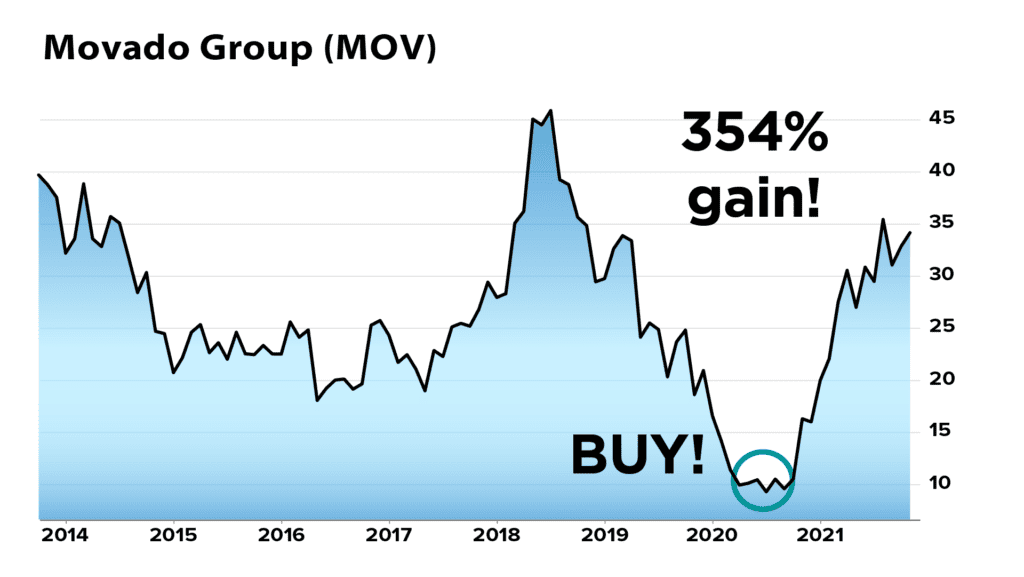

But during the shake-up of 2020, our system picked up on a big discrepancy in a company called Movado – a watchmaker.

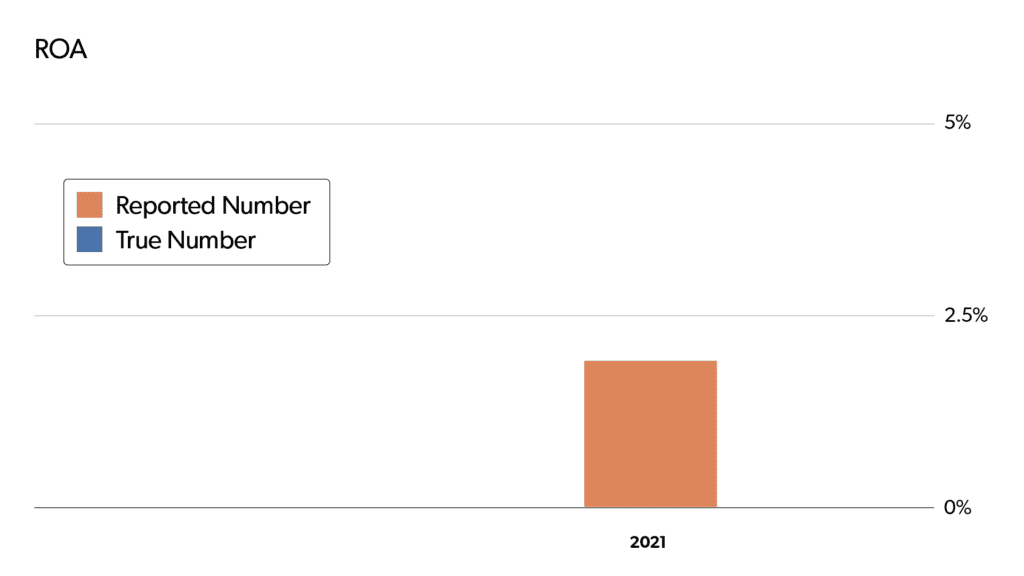

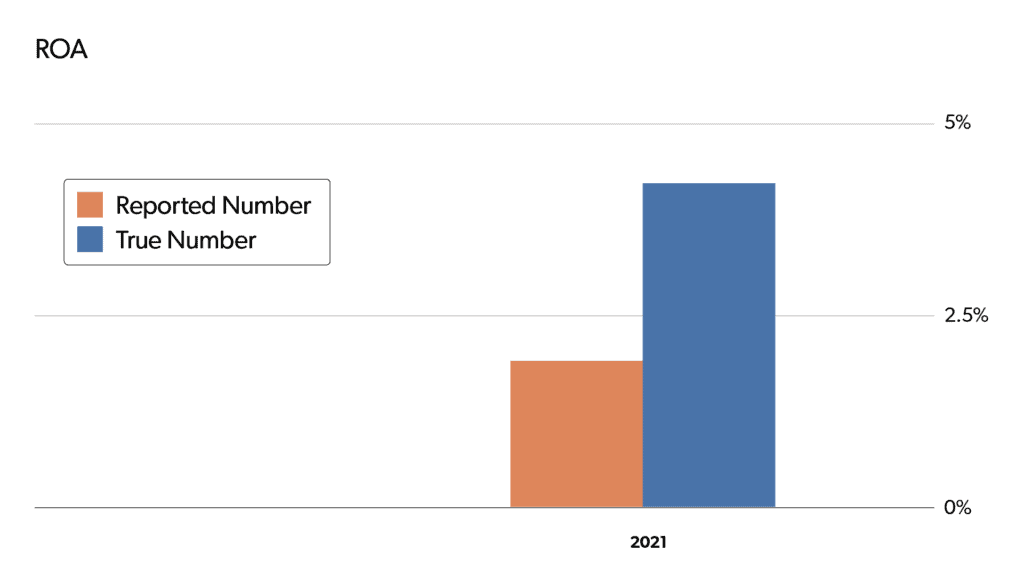

Run the stock through our system, and here's the number posted on Wall Street for how successful this company is. 3.3% Return on Assets.

Not very impressive for a measure of Movado’s earning power, right? There are bank CDs that earn half of that.

But one click… and here's the REAL, TRUE number. Two times higher. And in fact, this discrepancy had been going on for years.

So we immediately recommended this company, and have seen a 354% gain. Meanwhile, not a single BUY recommendation from Wall Street. In fact, one bank had actually downgraded the stock!

ANCHOR

Hold on. If this company is so great, why would Wall Street keep it a secret?

JOEL

So they can simply buy the stock themselves, John!

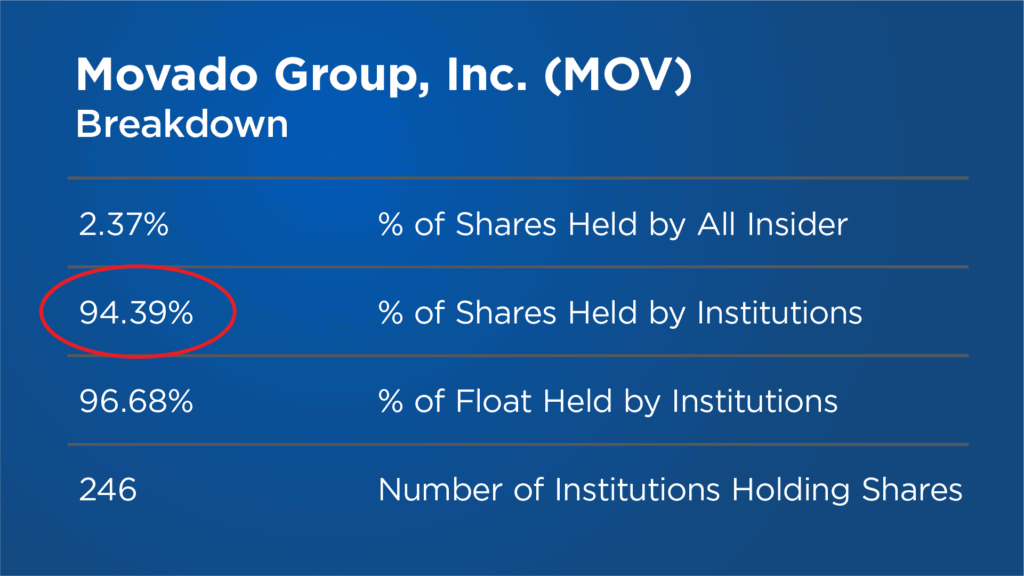

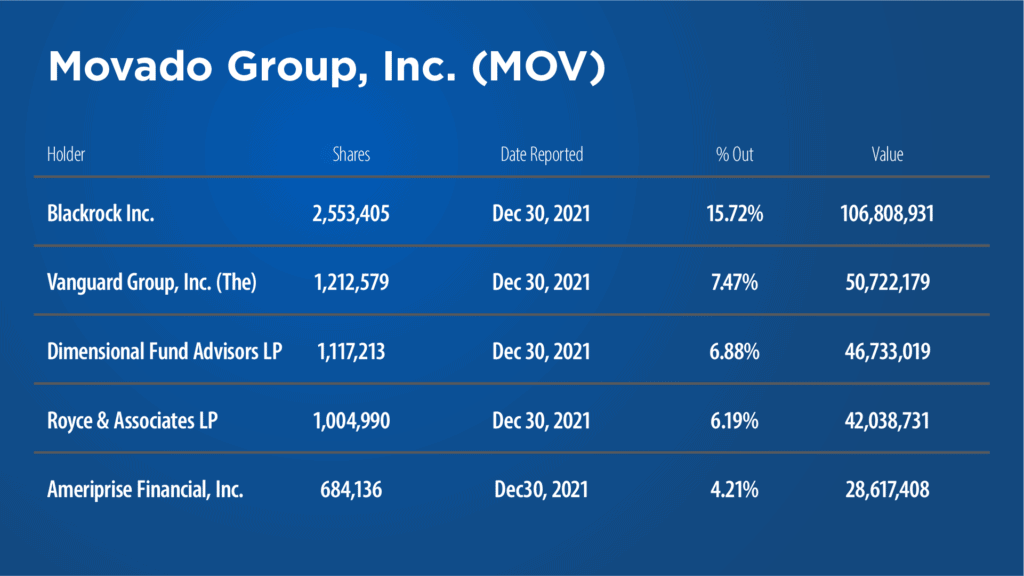

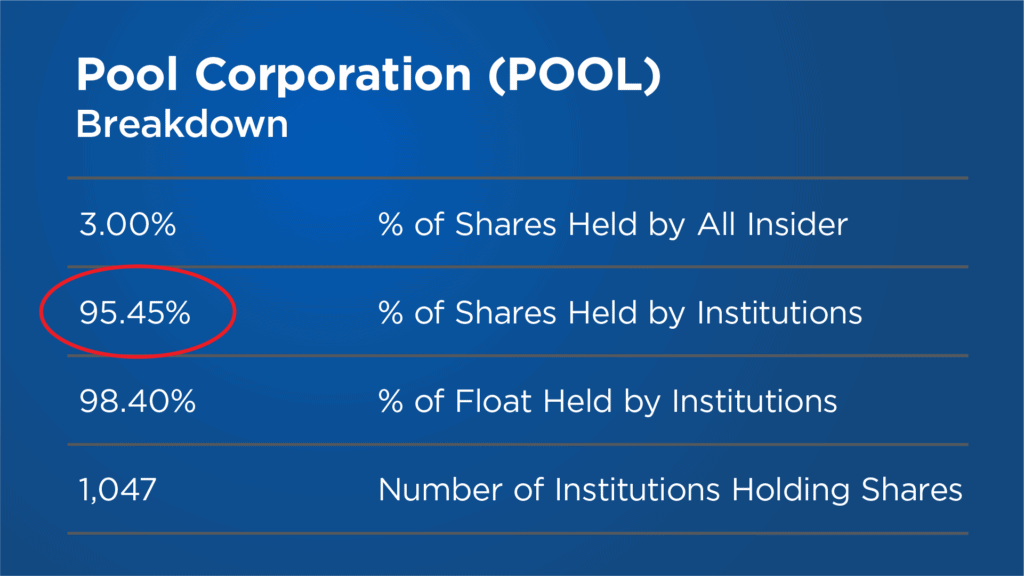

Take another look at Movado. Guess who owns the stock?

93% of its shares are held by institutions… including BlackRock, Vanguard, and more.

The stocks you NEVER hear about

The sad fact is, Wall Street has been keeping the most successful investments to themselves for decades. And they're able to legally do this through an obscure set of regulations surrounding GAAP accounting.

ANCHOR

You mean the “Generally Accepted Accounting Principles”…

JOEL

Right. Now, I'm going to explain what I mean by that and how that's possible…

But the big takeaway here is, the information that's reported to you is NOT ENOUGH to find the best-performing investments. Especially in the kind of jittery market we've seen lately.

Many of the wealthiest investors are looking at completely different numbers, which is one reason you often hear about high-net-worth people comfortably putting millions of dollars into a single investment and walking away with double or triple or, in Bill Ackman's case in 2020, 100 times their money.

…while most Americans are grinding out 2% a year, at best.

ANCHOR

And that's where your system comes in…

JOEL

Yes. And that's because this kind of discrepancy has been taking place among thousands of individual stocks for years, John. In other words, extraordinarily valuable information has been hidden from you.

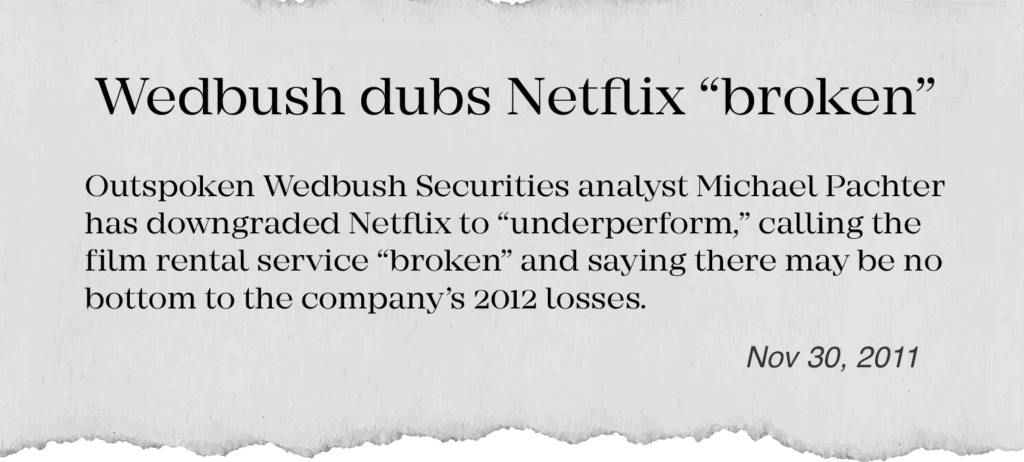

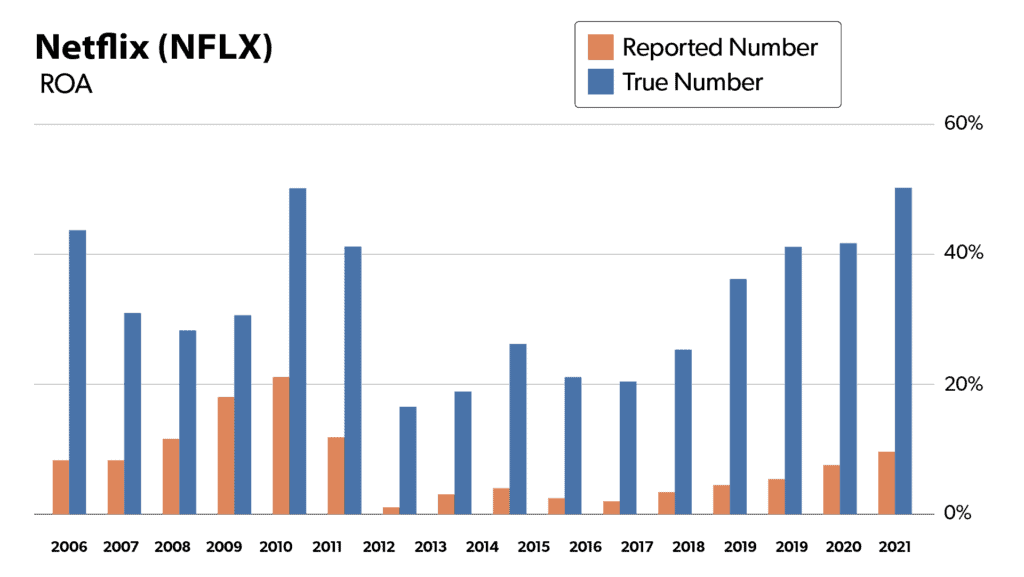

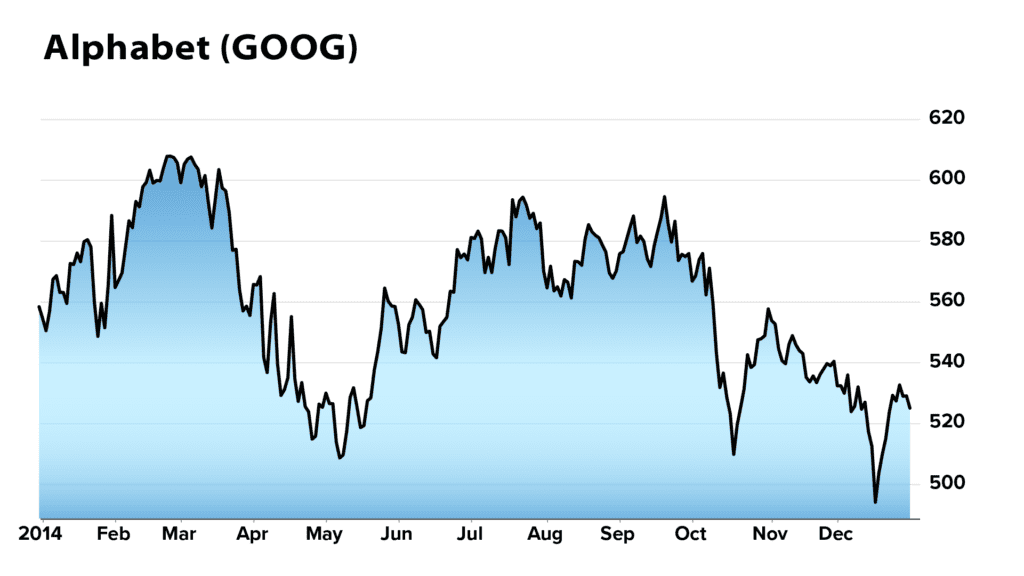

To name a famous example, consider all the Wall Street experts who've told you to avoid Netflix over the years…

One guy – at Wedbush Securities – said back in 2011 that Netflix was a broken company that was unfixable. Incredibly, he urged people to avoid Netflix every single year for an entire decade.

But run the stock through our system – and guess what?

The REAL, TRUE earnings numbers for this company have been crushing the numbers reported on Wall Street for literally decades, John.

This company was minting cash!

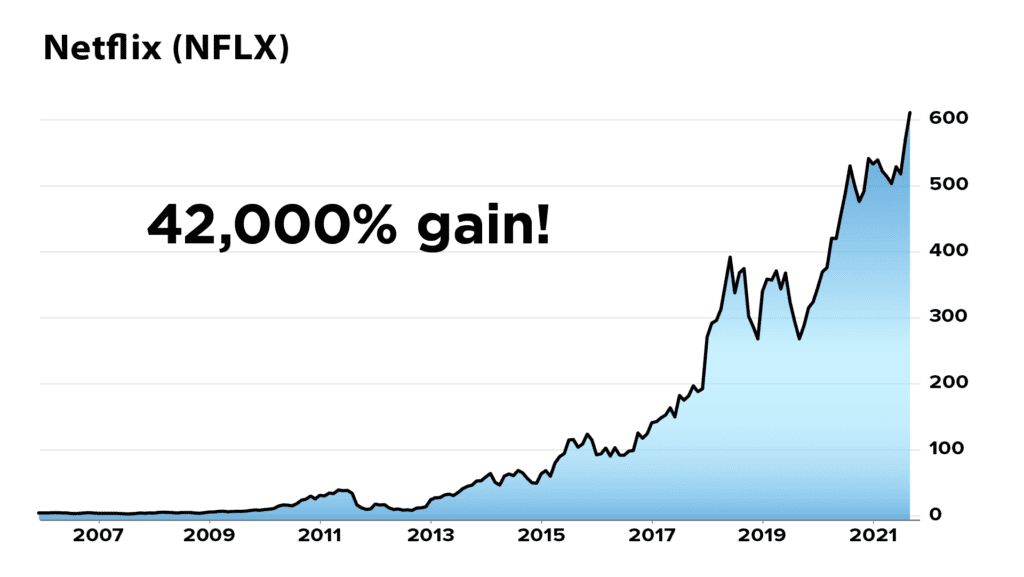

Our system picked up on this as far back as 2006 when the true numbers were 5 times higher than the reported numbers. If you'd bought on that information alone – and continued holding, as our system continued showing a MASSIVE discrepancy – you could have ignored all the noise on Wall Street for a 42,000% gain!

Guess who made most of that gain?

ANCHOR

Wall Street.

JOEL

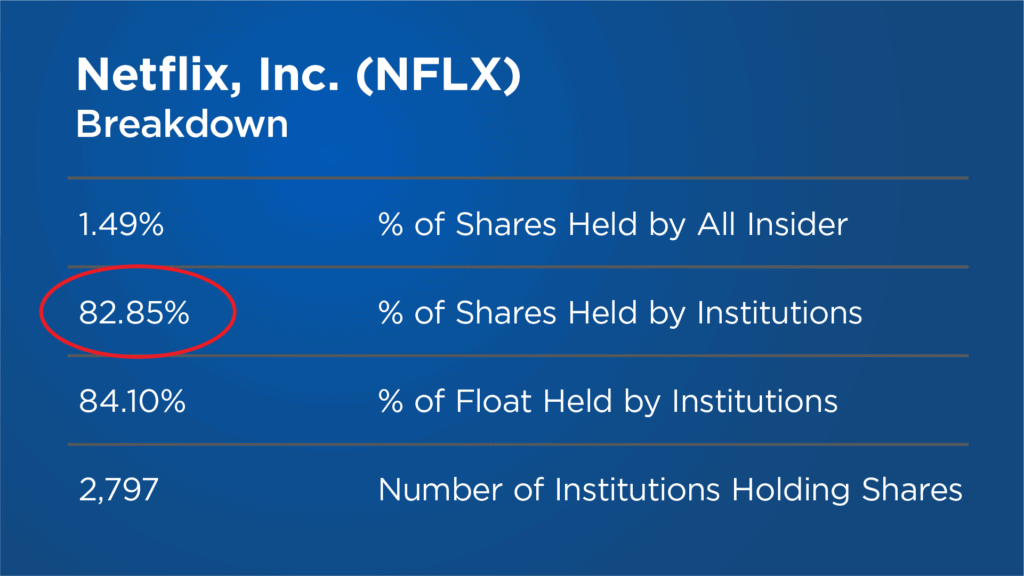

82% of its shares are held by institutions.

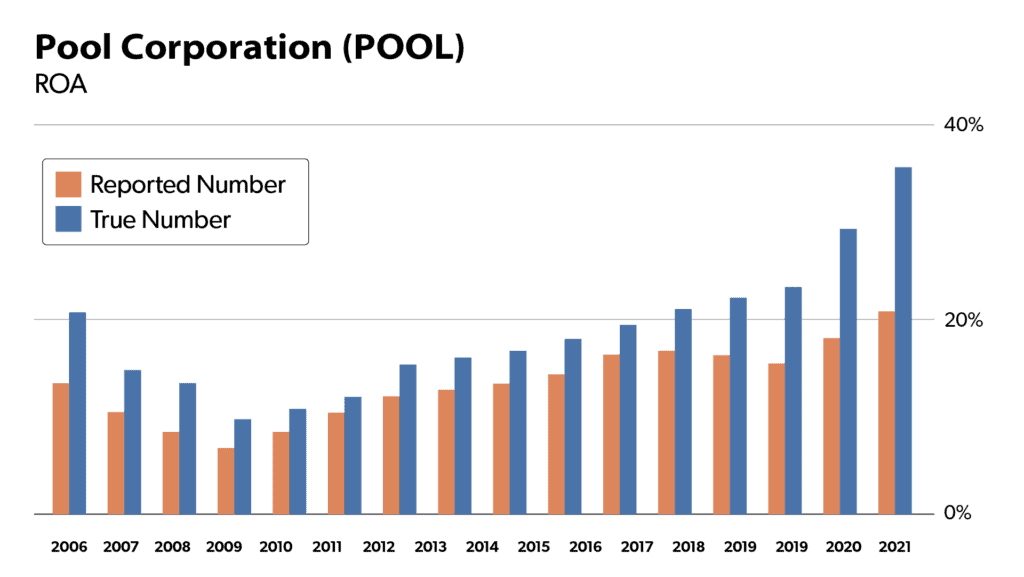

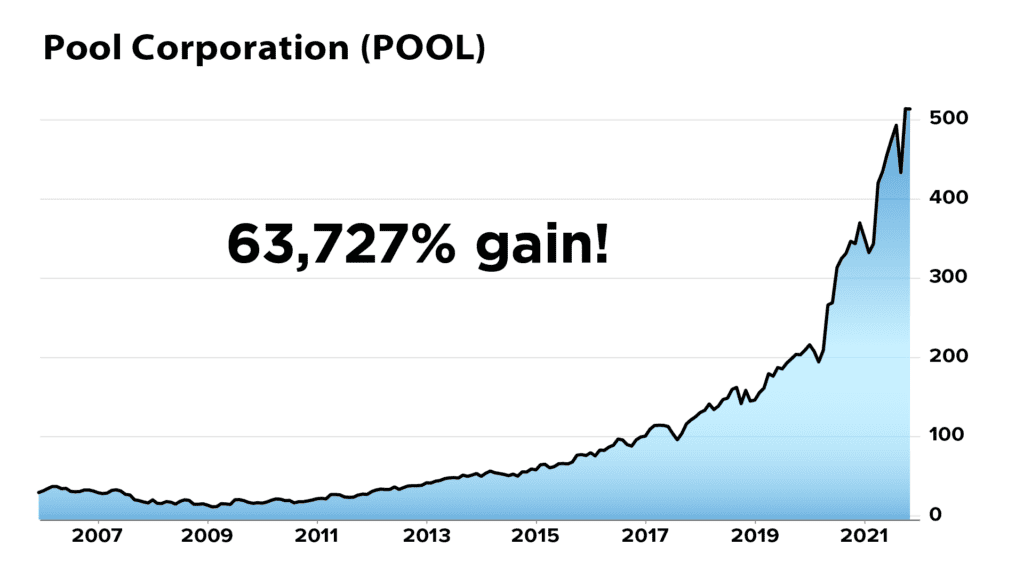

And if you think I'm cherry-picking Netflix… look at this. Here's a lesser-known company ranked 5th behind Netflix as one of the top 30 all-time greatest stocks in the S&P 500 over the past 30 years.

Pool Corporation, a swimming pool supplier.

33.

ANCHOR

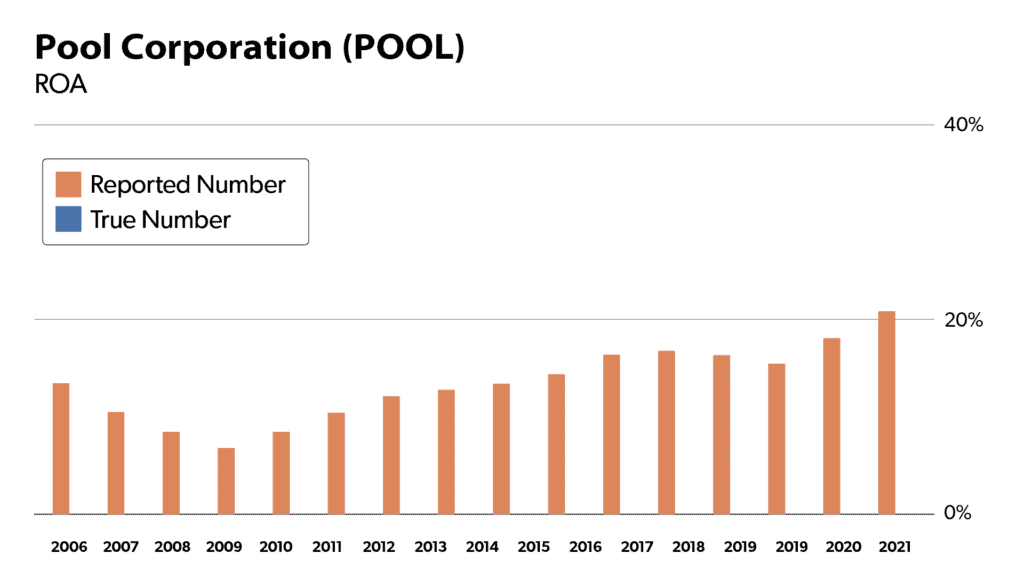

OK. And I assume these are the publicly reported numbers on Wall Street…

JOEL

Yes. Now – with one click – run the stock through our system and here are the REAL, TRUE earnings numbers. Consistently higher, John.

And surprise, surprise… 95% of the shares are held by institutions who can see these numbers BEFORE the public does.

But if you'd been able to access that information at the same time as Wall Street and gotten in at the beginning, you could have made a 63,727% gain on this stock, John.

That turns every $5,000 investment into $3.1 million.

ANCHOR

Got it. So Wall Street can see that certain companies are generating WAY MORE CASH than publicly reported… which, eventually, maybe a quarter or two or even a year later, results in a big earnings surprise… in any kind of market…

JOEL

Yes. Because cash is king. It's all about the earnings surprise.

ANCHOR

Gosh… but it seems so unfair that only the wealthiest institutions have access to this information.

And of course – they couldn’t care less about you unless you have at least $100 million to invest… which I assume is the BIGGEST reason they keep all of this to themselves and their wealthy clients.

JOEL

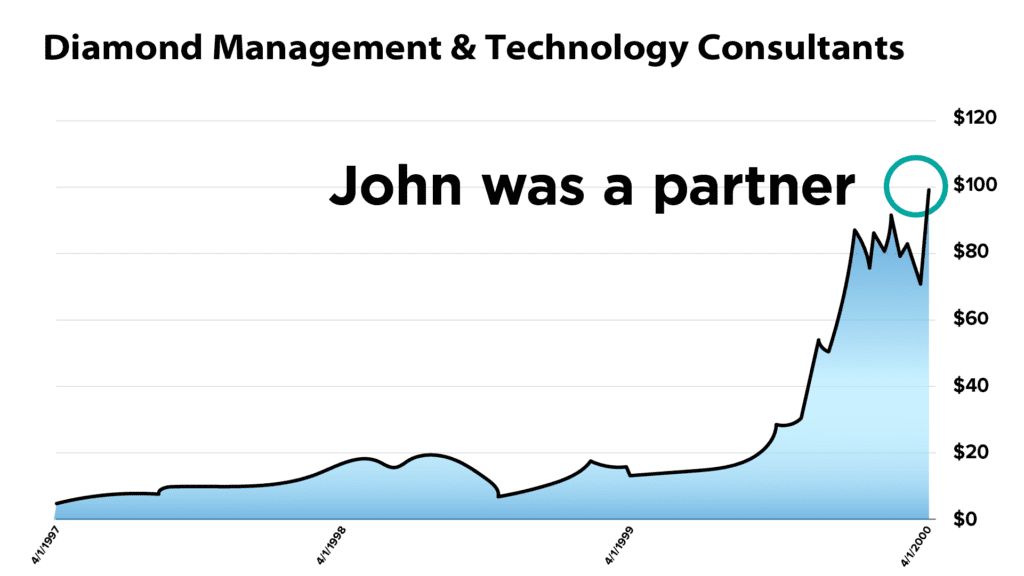

Right – and John, I know you were a partner at a consultant company whose stock went up from a few bucks to a peak of $100… so you’ve seen all this stuff firsthand… The bias by Wall Street toward high-net-worth individuals.

ANCHOR

Of course. And meanwhile, the general public is stuck with the info posted on Yahoo Finance or in a 10K filing… which can be totally inaccurate, from what you're telling me. It’s B.S.!

JOEL

It is unfair, John, absolutely. Especially when you consider how much it costs to calculate the true earnings numbers.

In our case, it requires a team of 150 personnel, including many CPAs and CFAs, on three continents, breaking apart the balance sheets of 32,000 companies and adjusting 130 different line items for each.

The labor cost is so high that the institutions who don't want to do this work themselves pay our firm up to $100,000 a month to access it. In fact, one hedge fund manager once paid us $100,000 for a SINGLE REPORT on a stock he owned. I estimate he made a $20 million profit. Great for him, but how can the average American afford that?

A financial “heist” is underway

ANCHOR

Got it. And that's why you're stepping forward today…

JOEL

Yes. What I've just shown you on a variety of individual stocks amounts to nothing less than a massive campaign of misinformation by Wall Street to keep you out of the best-performing investments.

And now… this same thing is about to happen on a scale so wide, in such an unexpected way, it could be a financial disaster for most people… But also a big money-making opportunity if you know what's coming.

ANCHOR

And with that – let's get right into the details. What exactly is Wall Street not telling the public right now?

JOEL

To start off, I want to show you something…

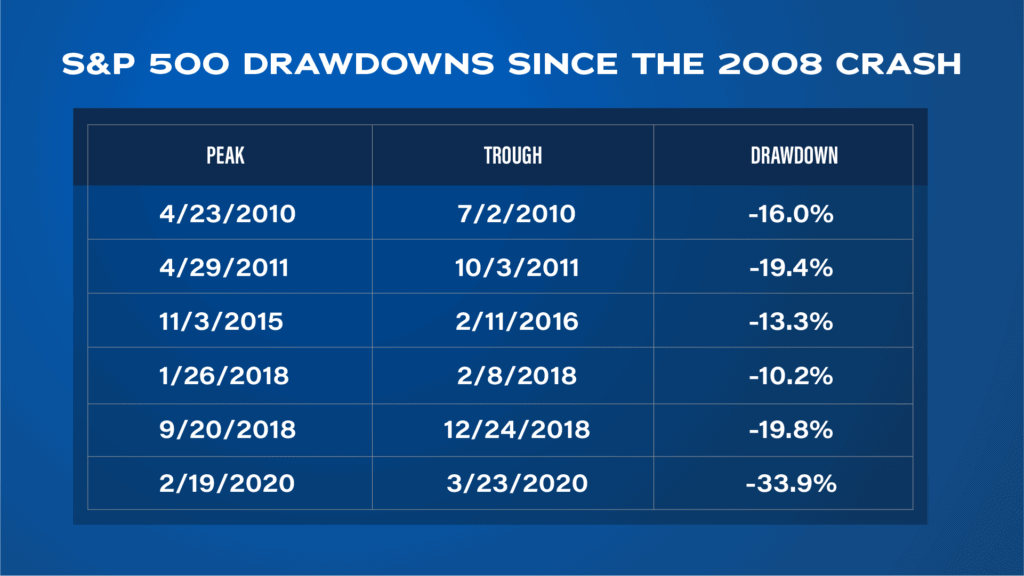

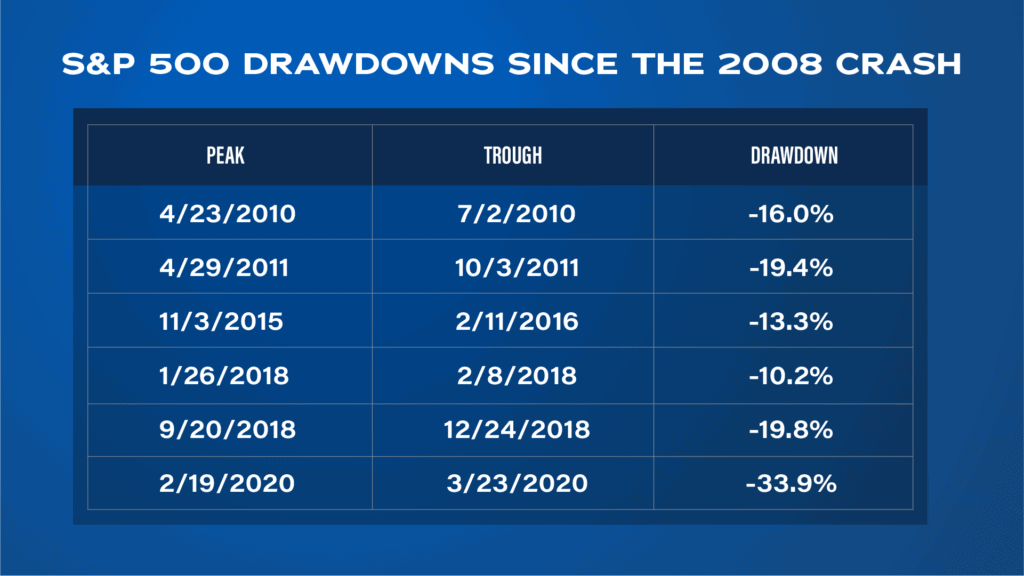

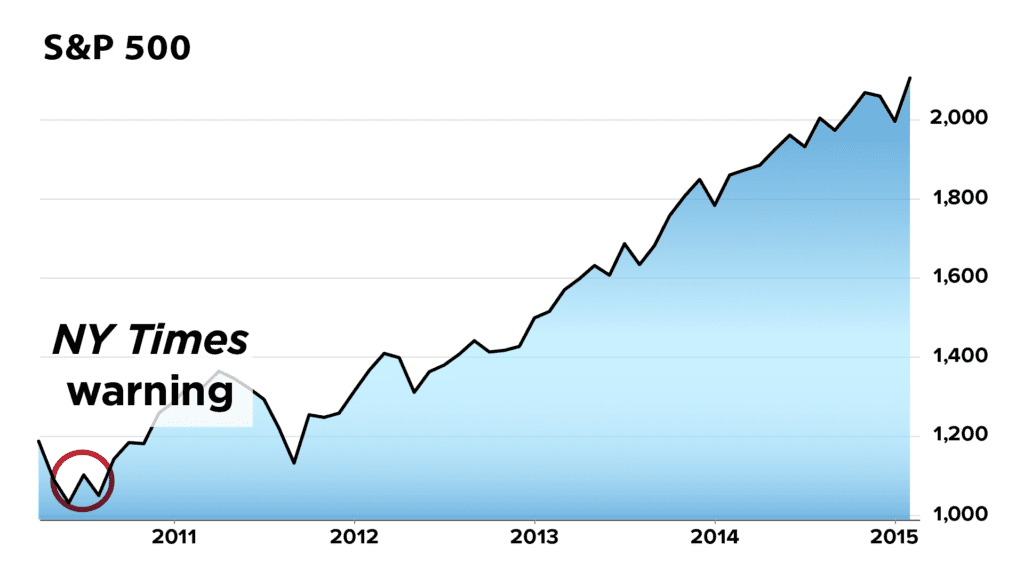

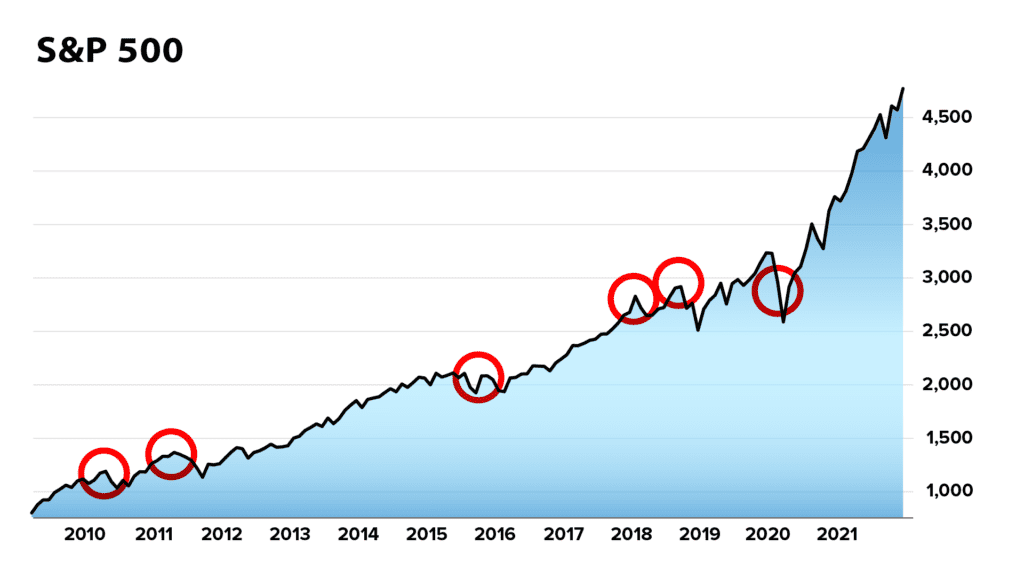

These are the biggest corrections in the S&P 500 since the Crash of 2008. Essentially, these are all the mini crashes we've seen over the past decade. Those are scary numbers, wouldn't you say?

ANCHOR

Yeah, I remember a bunch of these. I mean, heck, the one in February 2020 was the worst one-day drop ever at the time.

JOEL

It's scary enough to see a big pullback like this in the market.

But you know what makes it even scarier? All the Wall Street experts who take to the media to predict that doomsday is coming.

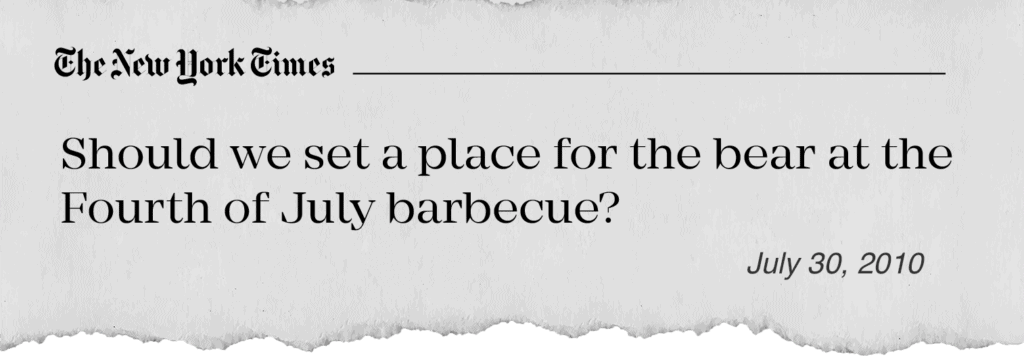

For every drawback you see here, the financial TV outlets and the internet were polluted by some very smart and successful people calling for the end of the bull market.

Take a look…

April 23, 2010: We see the start of a 16% drawdown… and the New York Times quotes a senior analyst at Standard and Poor's asking, “Should we set a place for the bear at the Fourth of July barbecue?”

As it turned out… the Fourth of July is exactly when the market turned around and proceeded to new highs!

Whoops! Guess he was wrong.

Here's another one.

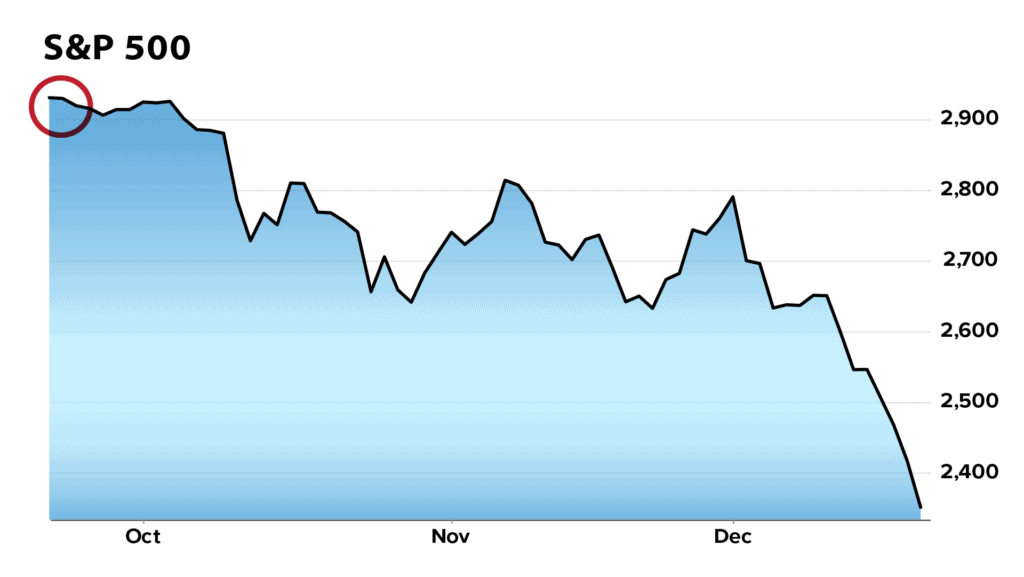

September 20, 2018: We see the start of a 19% drawdown which culminates in the “Christmas Crash” of that year.

ANCHOR

Yeah – that was the worst December for the market since the Great Depression.

JOEL

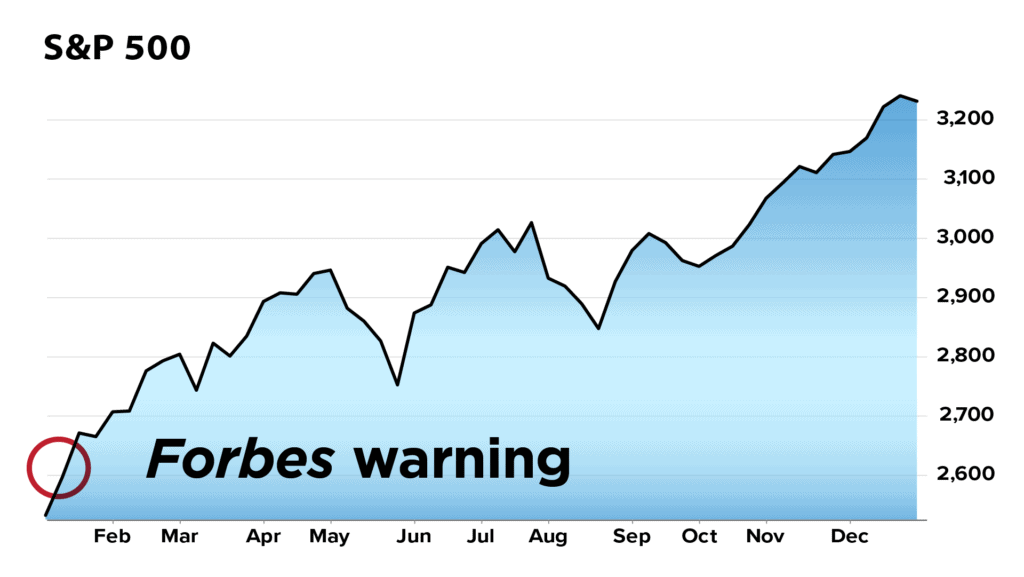

Forbes ran a piece by a Wall Street veteran claiming the 2018 downturn would lead to a historic decline.

But we urged our clients to buy the freaking dip! And as it turned out… in 2019, the market saw its best year in two decades, John.

Are you seeing a pattern here?

ANCHOR

Yeah, I bet you could walk us through that entire list of downturns and show all the fear being spread by Wall Street.

JOEL

I could do that very easily. And my point, of course, is that the market went on to soar after every single one of those downturns.

Not to mention, if you'd known which stocks to buy during the subsequent rallies, you'd have forgotten all about that fear.

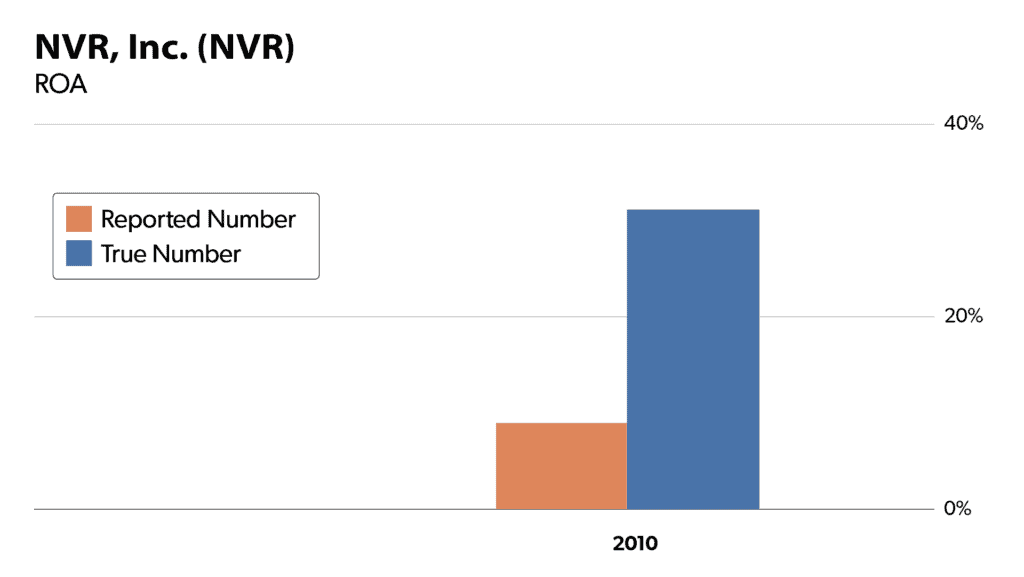

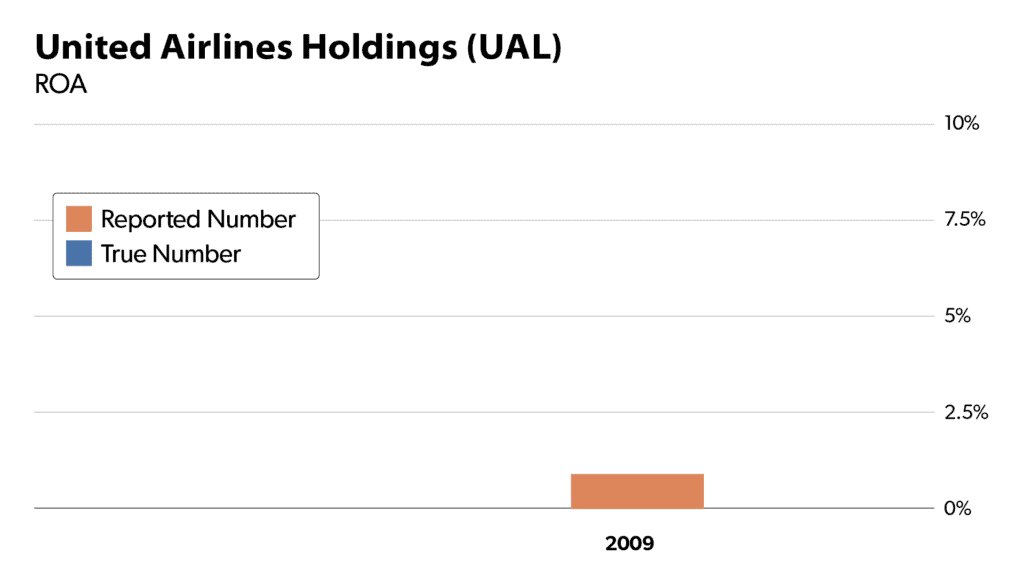

For example, during the 2010 decline, our system pointed to NVR, a homebuilder…

…before it rose 732%.

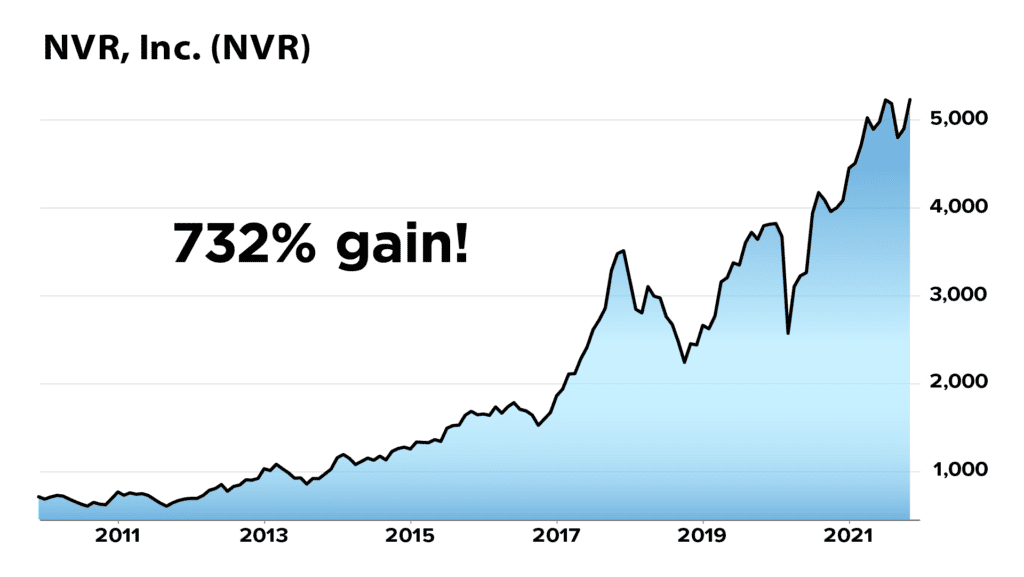

During the 2015 decline, we recommended AMD. Our coverage even got picked up in Barron's…

…and we saw a 6,000% gain.

The simple fact is, if you're able to see the real, true numbers behind a stock – which is what our system allows us to do – there's ALWAYS a money-making opportunity, in any market – bull or bear.

And right now, our system is pointing to a MASSIVE DISTORTION in the overall stock market, which will catch a lot of people by surprise.

Huge distortion in the stock market

ANCHOR

Before you go on – because I know you've got a whopper of a prediction to make about today's market, using your system – how can these distortions exist?

I mean… To your point earlier, how can Wall Street legally get away with posting the wrong earnings numbers?

JOEL

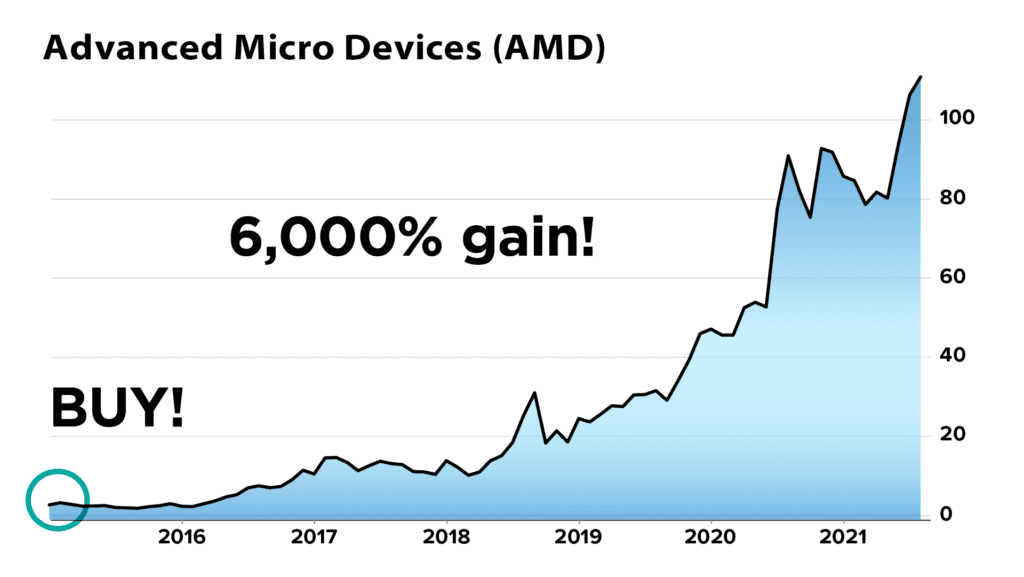

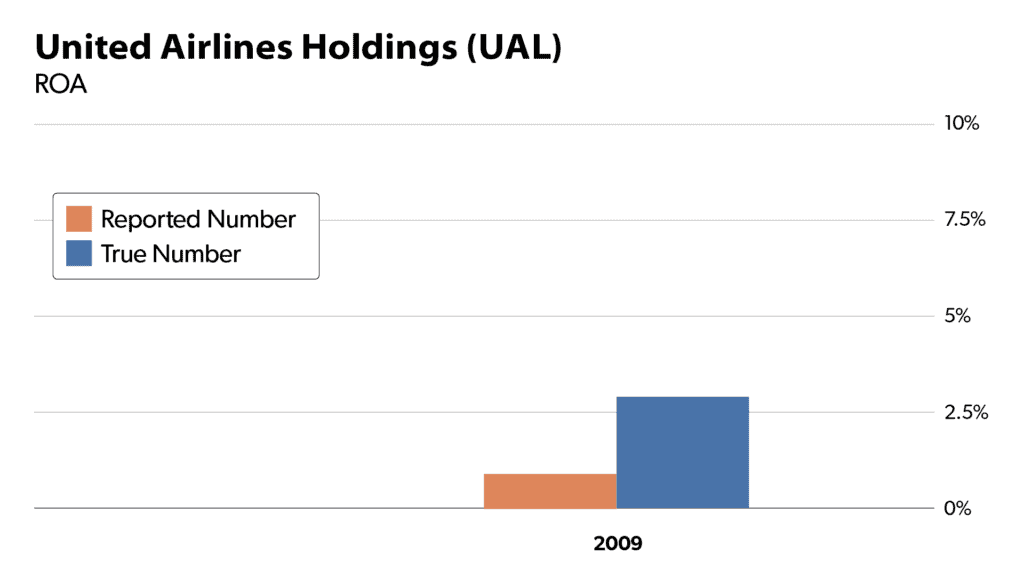

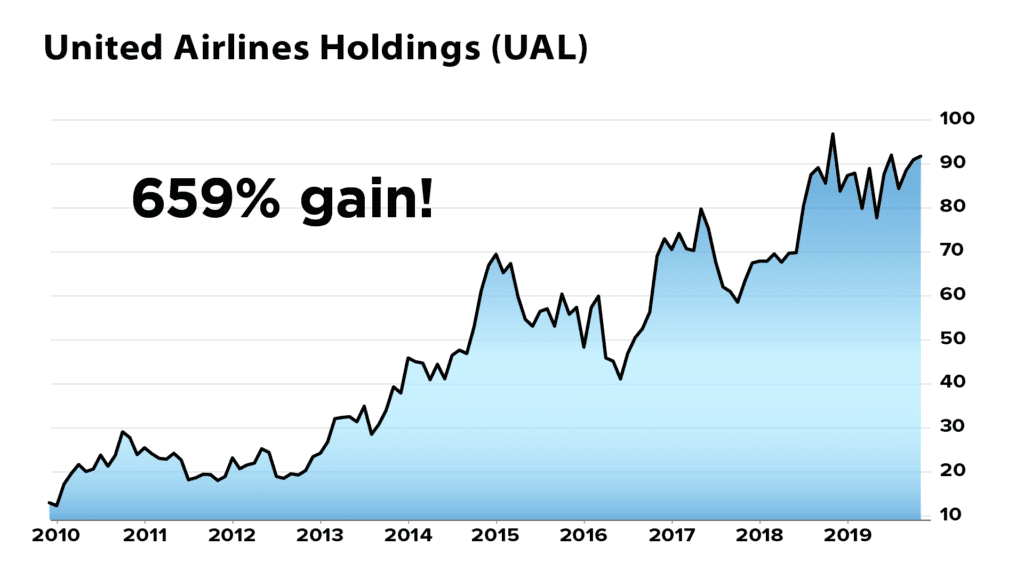

Take United Airlines… one of my favorite examples.

Run the stock through our system… and here's what came up back in 2009 – right after the crash.

Wall Street posted a 0.8% Return on Assets, which is terrible.

And yet, that year my team and I had lunch with 10 of the top U.S. hedge fund managers and urged them to buy United Airlines.

Why? Because – with one click – we could the REAL, TRUE earning power of United Airlines. Almost 4 times higher!

That means we were confident the stock would eventually be trading higher… as more and more people realized this company was generating a lot more cash than you'd have believed by reading the as-reported financial statements.

In this case, we saw the numbers BEFORE the top hedge fund managers did, by simply applying our system. But they ignored us, because a different number had been reported on Wall Street.

Now, was Wall Street LYING to the public about United Airlines?

No. Everyone was just abiding by the standard accounting rules, GAAP – which are a mishmash of overly complex, unclear, and often antiquated rules that result in huge distortions from economic reality.

ANCHOR

I've heard you speak about this before… and it's just amazing.

Essentially, the entire earnings system on Wall Street is beholden to a form of accounting that's completely flawed. I mean – even Warren Buffett has spoken about how inaccurate the GAAP accounting system is…

JOEL

That’s right… Buffett opened three of the most recent annual shareholder meetings for Berkshire Hathaway by railing against the problems with GAAP accounting.

Even an NYU Business School professor has said very publicly, based on extensive research, “Reported earnings are largely detached from reality and don't really matter much.”

And that's because, altogether, there are over 130 inconsistencies within GAAP that cause earnings to be distorted each quarter.

Like whether you depreciate expenses based on 5, 10, 20 years, or even fail to amortize at all. Debt being mis-categorized… and hundreds of non-cash items that distort a company's true earnings power by hundreds of percent.

And that's why, over decades, my team and I developed a system based on FORENSIC ACCOUNTING that allows us to see the real, true numbers… weeks or even months before the public or even some of the smartest money managers have any idea. Again, that's why more than half of the world's 300 biggest money managers have been clients of ours.

They don't want to do this work themselves. Or more likely, they CAN'T, because it can take weeks to audit a single company.

And they're happy paying us up to $100,000 a month to do it – because, again, our average gain for 2020 alone on the kind of investment we're recommending today was 123%!

John – do you know what happens to your portfolio when the average of every single position more than DOUBLES in value?

ANCHOR

It's a beautiful thing, for sure.

So the numbers you find are often multiple times HIGHER… or LOWER… than what's reported to the public…

JOEL

Yep. In the case of United Airlines, they had $764 million of earnings from its acquisition of Continental Airlines that weren’t even showing up on the income statement at all!

This made the company look a lot less profitable than it really was. If you'd bought and held following our system, you could have made 4 times your money overall.

ANCHOR

Got it, so to be clear… United Airlines wasn't doing anything illegal, per se.

They were just following the required accounting rules… which can place literally billions of dollars of debt or receivables or investments in the wrong category of the financial statements, causing assets and earnings to be hugely distorted from reality.

JOEL

Yes. So if you can spot all this BEFORE the market corrects for it… while it's still totally unknown to 99% of the investing public… you gain a huge advantage over everyone else.

And here's the kicker, John.

Many on Wall Street know all about these distortions, and they use that information to their own advantage… making no attempt to share this with the public. I learned this firsthand at Credit Suisse. And that gets to the entire prediction I'm about to share with you… and what I consider a financial disaster headed for everyday Americans.

Joel’s prediction for 2023

In short, I don't think we’ll see a years-long bear market or a long, drawn-out recession at all.

There'll be some hiccups, for sure, as we've already seen. But ultimately, as I'll demonstrate today with our system, we're headed for a massive and sustained new phase in the bull market… which nobody on Wall Street wants you to know about.

That's because it could cause one particular type of investment to skyrocket. And they want to get there first.

Don't expect anybody in the media to tell you about it… But the little-talked-about investment we're going to share today is the #1 place to put your cash immediately.

ANCHOR

OK, but wait. If you're not predicting a long bear market… how is that a financial disaster?JOEL

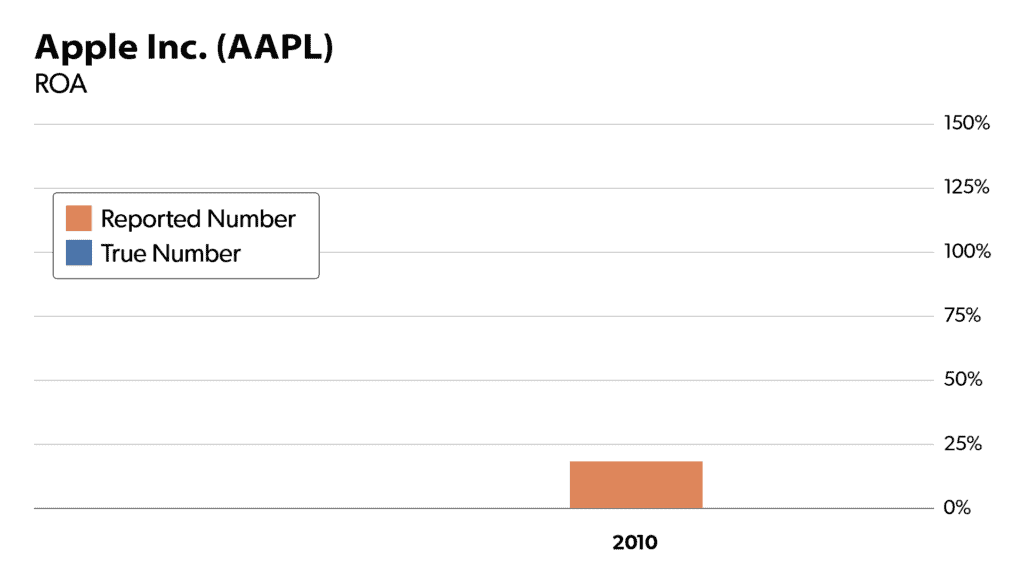

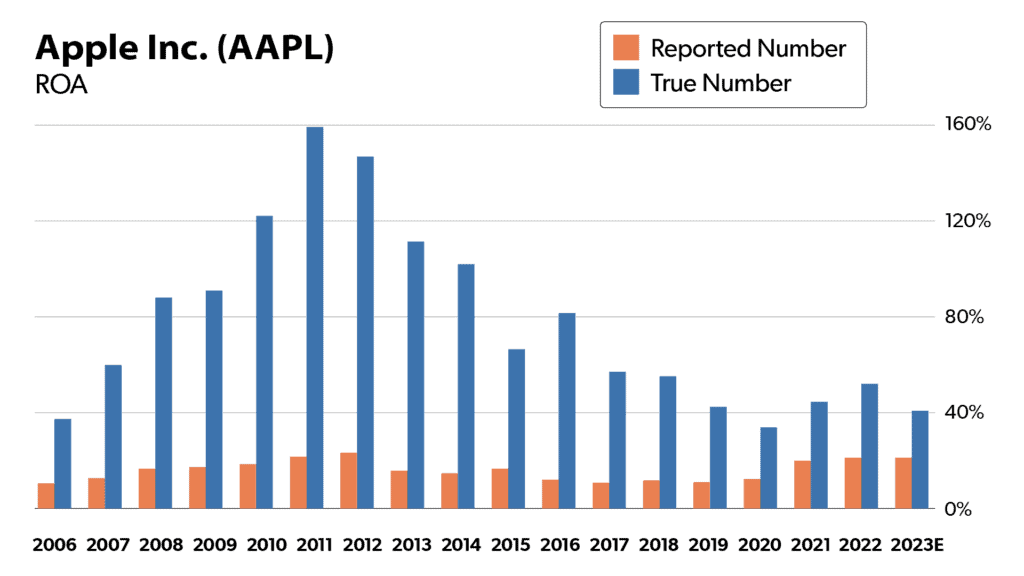

I'll tell you why. Consider Apple, for instance…

Back in 2010, here's the Return on Assets posted by Wall Street. Again, a simple measure of how successful the company is.

18.7%.

Now, is that impressive? Kind of – but not enough to get you excited. For example, Disney posted the exact same number back in 2018, and the stock has done nothing since then.

What REALLY matters is how big the discrepancy is between that reported number and the REAL, TRUE earnings number we determine through our forensic accounting. Th

e bigger the distortion… often, the bigger result you could see by acting on the stock.

ANCHOR

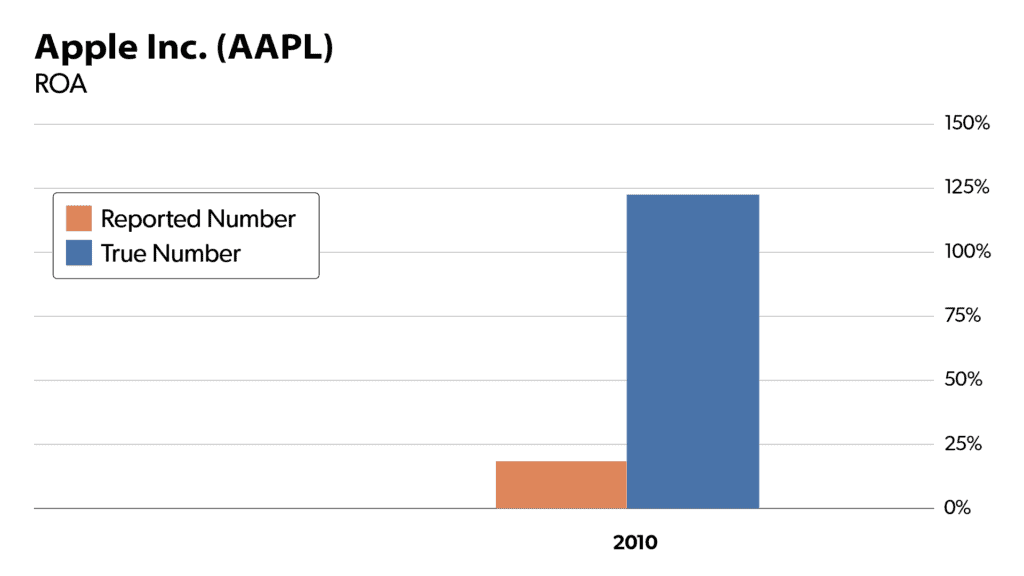

Well – let's run Apple through your system.

JOEL

One click – and boom!

Here's the REAL, TRUE number for Apple back in 2010 – the year they first released the iPad.

Almost 7 times higher! A huge distortion.

And yet, Wall Street didn't correct the number at all!

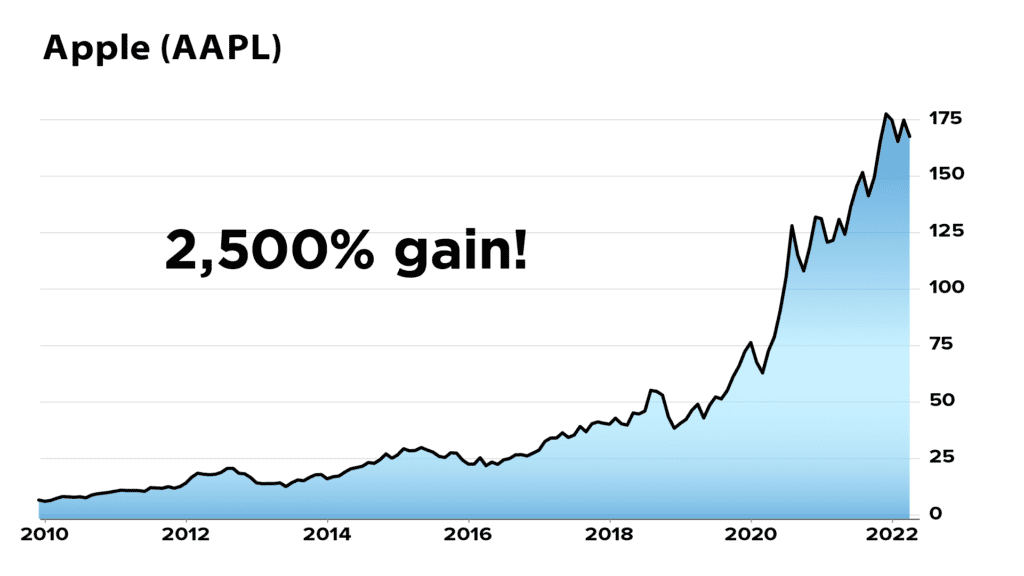

This amounted to an entire campaign of misinformation that would have caused you to miss the 2,500% gain Apple has seen since then.

To miss that kind of money-making opportunity – during what was, at the time, a historic bull market, especially when you're getting close to retirement – amounts to nothing less than a FINANCIAL DISASTER.

With the cost of living getting higher and higher, pension funds a mess, and social security extremely underfunded, you simply can't afford to look at the wrong numbers and miss the potential 10-baggers exposed by our system, in bull or bear markets.

All the things you need for retirement – real estate, healthcare and so on – they're all getting MORE EXPENSIVE! Millions of Americans aren't going to be able to afford these things because they won't have as much money as they should. They're missing out on the best gains in the market. And the sad part is, Wall Street banks and funds WANT you to look at the wrong numbers, while they grow wealthier because they alone have the correct information!

ANCHOR

Was that true of Apple?

JOEL

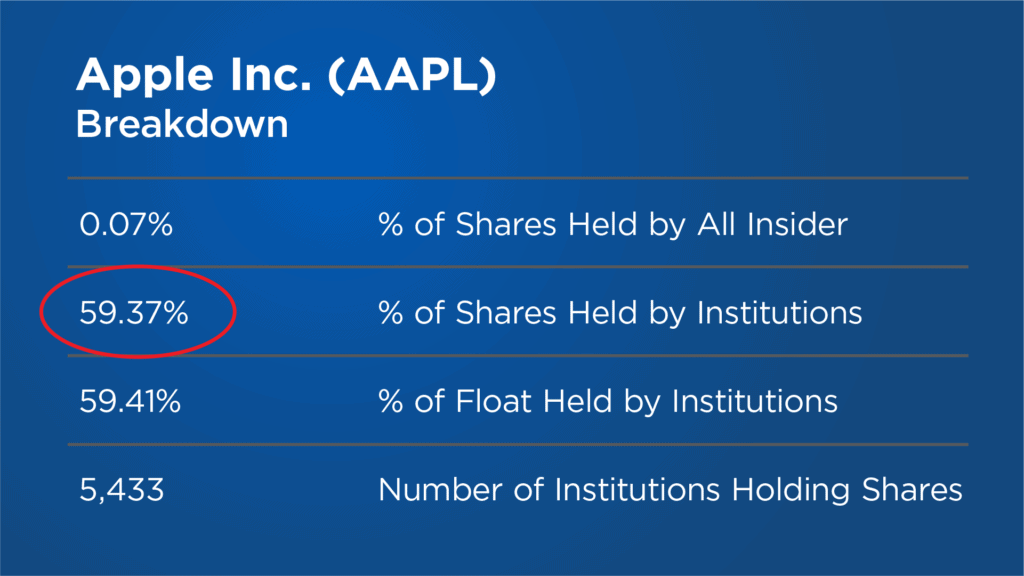

Sadly, yes.

More than half of its shares are held by institutions, who think nothing of spending the $100,000 a month it costs to get the REAL, TRUE numbers behind the best companies… because they know how valuable this is.

We've seen this time and again over the last decade on individual companies, as we've discussed so far.

But today, my research shows it's about to happen ACROSS THE ENTIRE MARKET on a historically wide scale… and across one particular category of investment most people aren't even considering right now!

Mark my words: Missing this opportunity in the coming months will be the greatest financial mistake of your life. If you missed the bull rally that followed the COVID crash, this is your wake-up call to take action now.

ANCHOR

OK, but Joel, some critics might say, “How can you be so sure we're headed for a sustained bull market?” The market's been a mess.

And wasn't Apple a rare exception?

JOEL

That's exactly my point. If you'd used our system and been confident in the bull market that began in 2009… and been looking for the best stocks… Apple wasn't the only pick.

Take a look…

Throughout the early 2010s, we urged our clients again and again to buy stocks.

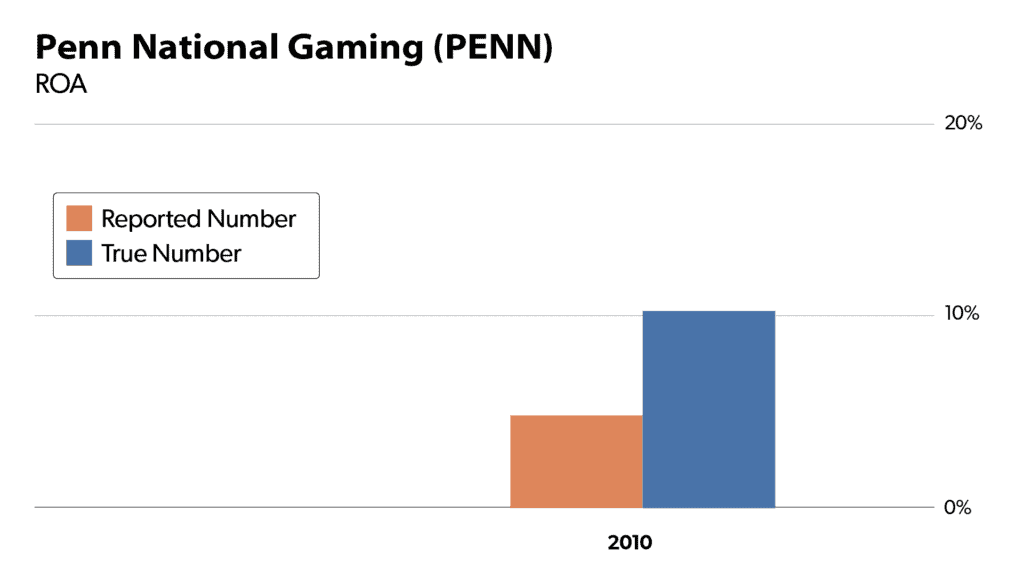

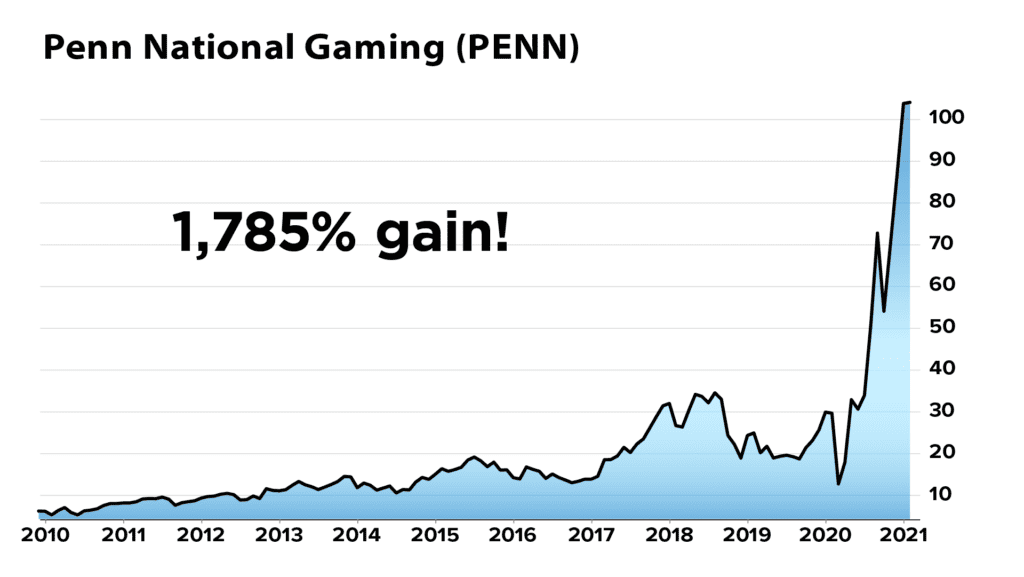

Along the way, our system pointed to a casino company called Penn National Gaming, which had a 110% earnings distortion back in 2010… a distortion that continued for most of the next decade.

If you'd bought and held, you'd have made up to a 1,785% gain! Among dozens of other examples.

And here's the kicker, John…

Back in 2010, Penn Gaming belonged to exactly the category of investment I'm urging you to buy right now.

Do NOT be scared out of the market

ANCHOR

OK, now… I want you to explain this little-talked-about investment you're recommending today…

But again – Joel, why so bullish? The market's been a huge question mark lately, between geopolitical conflicts… the Fed… inflation…

JOEL

It's all noise, John. Take a look…

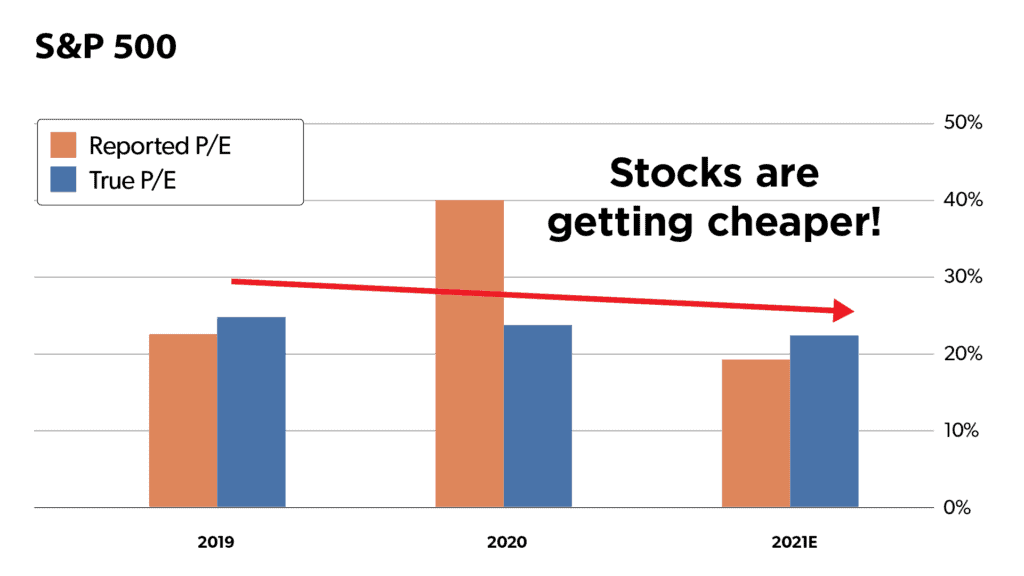

We applied our forensic analysis system to the entire stock market to correct for distortions in every single company that makes up the S&P 500. Essentially – we created our own index using the correct numbers.

And guess what? Even BEFORE the sell-off, stocks weren’t nearly as expensive as people believed. And the sell-off has made them even cheaper!

So the reality is that THIS IS THE MOMENT YOU’VE BEEN WAITING FOR… when some of the world’s greatest companies have essentially gone “on sale” due entirely to media-driven fear.

Especially among the category of investment we're going to discuss in a moment.

ANCHOR

But what about the Fed raising interest rates? A lot of experts are certain it's going to cause a historic recession as all that “easy money” dries up…

JOEL

The idea that the Fed raising rates will lead to a huge crash is exactly the kind of nonsense Wall Street peddles and the mainstream media wants you to believe. It's nothing but a myth pushed on the public to create fear and get more viewers.

Nothing sells better than fear, John, remember that.

You want to know the reality?

Rising rates do NOT kill a bull market!

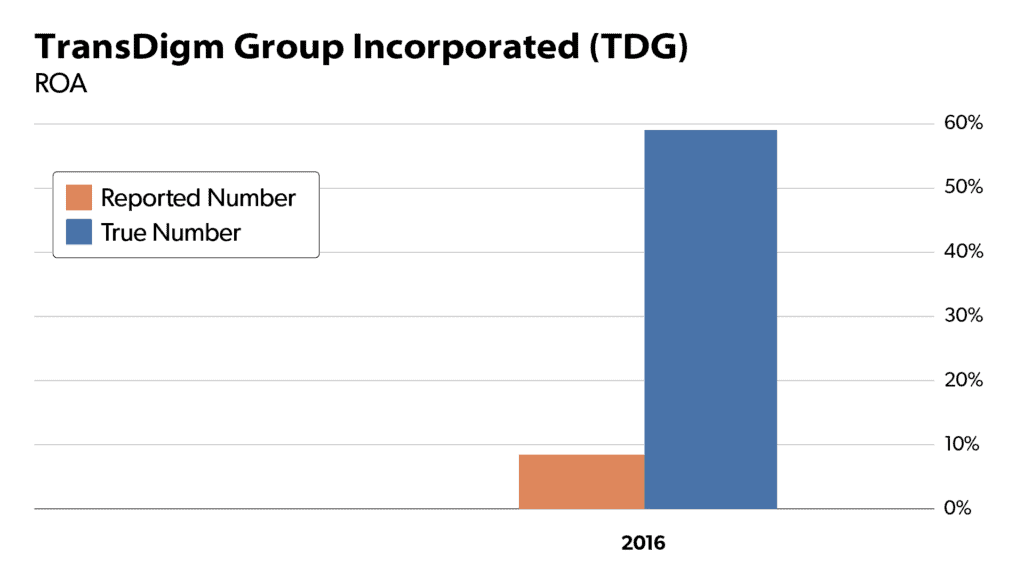

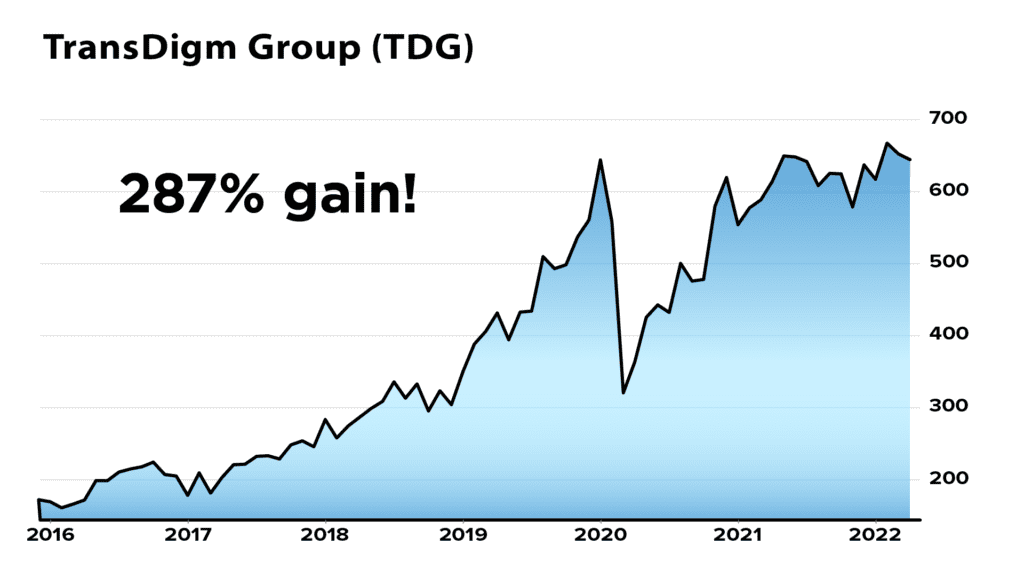

Take TransDigm, for example, an aerospace company.

Back in 2016, the Fed raised rates. If you'd been scared out of the market, you'd have avoided this stock, which our system pointed to as a strong BUY, based on a 571% earnings distortion.

Since then, you could have tripled your money.

ANCHOR

And I assume that wasn't an isolated case…

JOEL

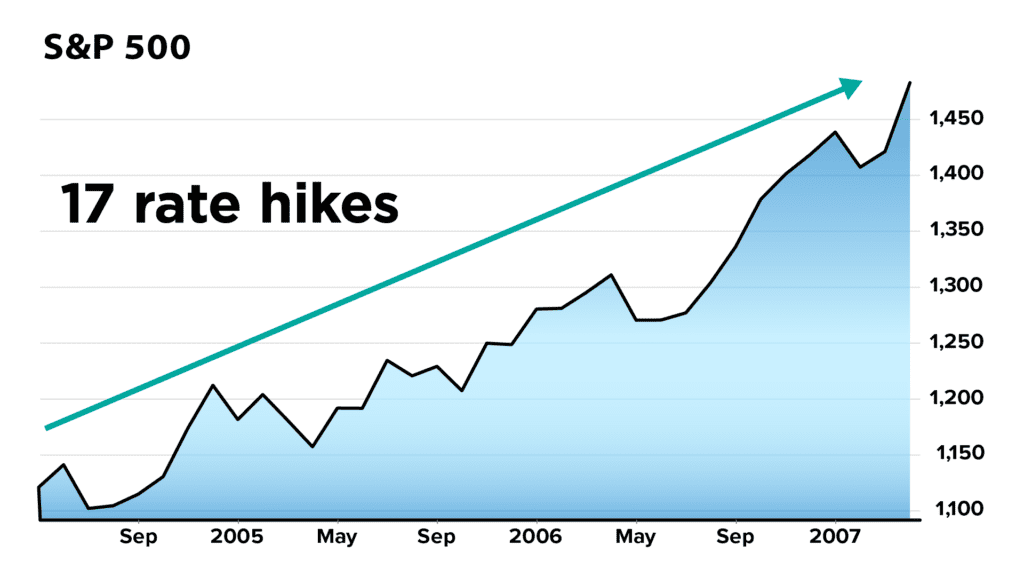

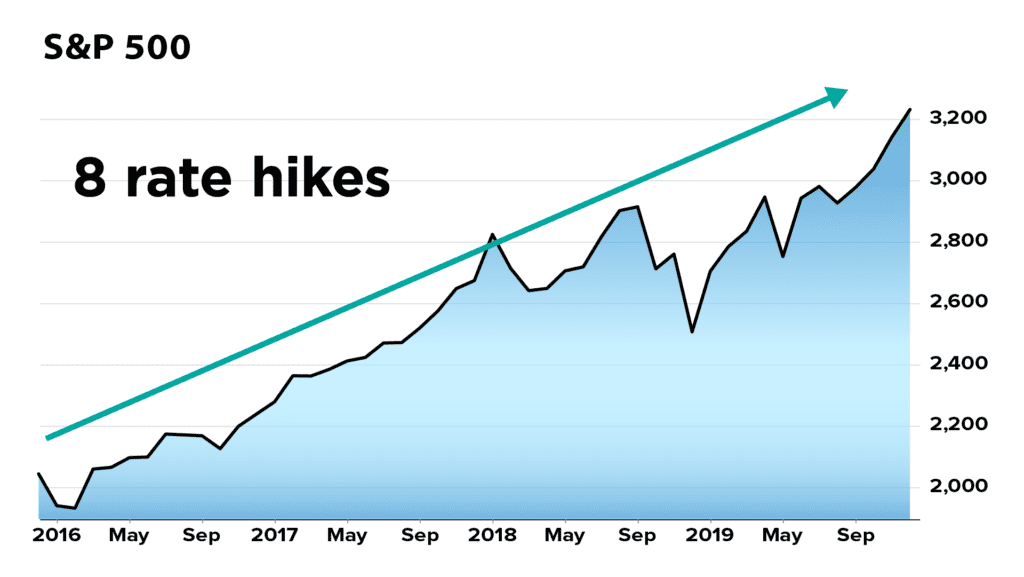

Of course not. And that's because history shows that the Fed raising rates often leads to GAINS in the S&P 500… not crashes.

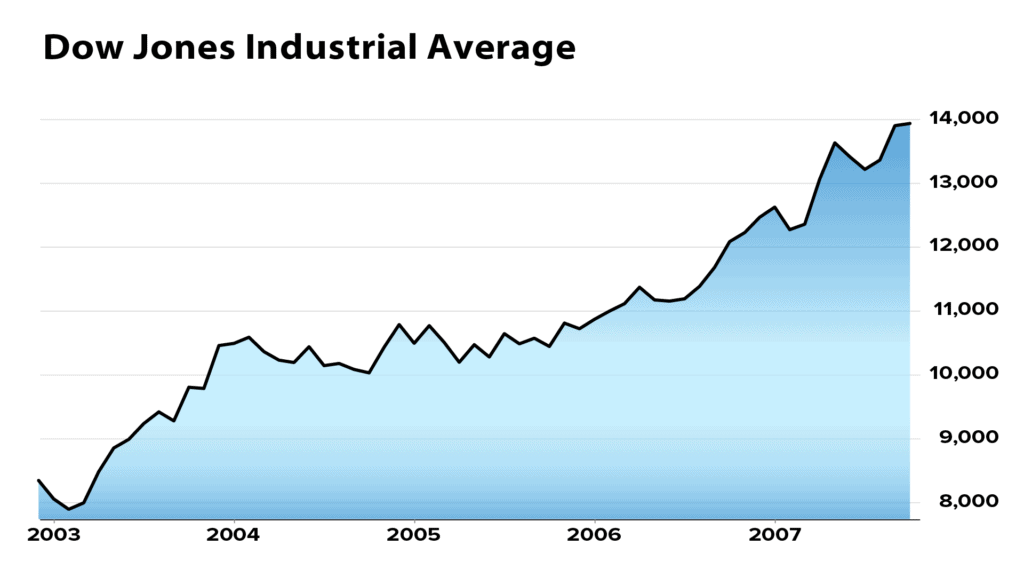

For example, the Fed hiked rates 17 times from June 2004 to mid-2006. Yet the S&P 500 soared over that period… rallying 34% before its peak in 2007.

And the Fed hiked rates from 2016 to 2020. But the S&P 500 nearly DOUBLED, despite all the fear and jitters along the way.

ANCHOR

So all these Wall Street experts are causing panic for no reason…JOEL

The Wall Street media, and let’s face it, that’s all Wall Street research really is, just media, makes money by generating more views and attention. Meanwhile, the smart money on Wall Street, the big hedge funds and institutions, they very purposefully hide what they know.

The general public is left seeing the sensationalist ad-driven headlines… and never hears the truth behind the really smart money. You have to be worth $100 million for Wall Street to even consider you as a client.

But one click in our system, and here's everything you need to know about all that fear in the market right now…

ANCHOR

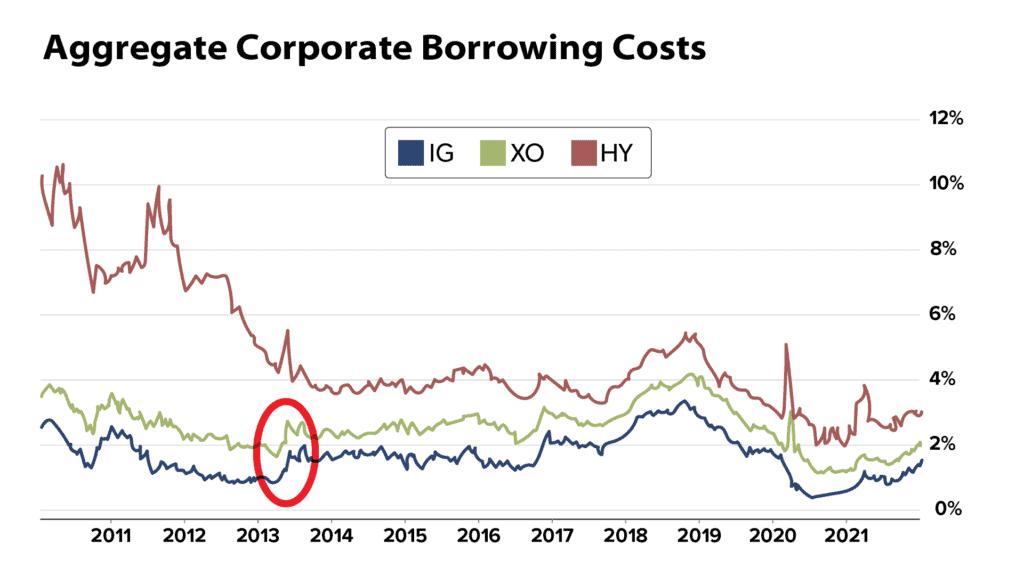

OK – and what is this, the cost of borrowing money?

JOEL

Yep. What kills bull markets are CREDIT problems, John.

Hundreds of years of economic cycles bear this out if one takes time to look, which the financial media does not.

Today – the amount it costs to insure yourself against a bond default – known as a credit default swap – is barely above levels from the last bull market.

In other words, investors aren't panicking over credit… despite all the interest rate hikes.

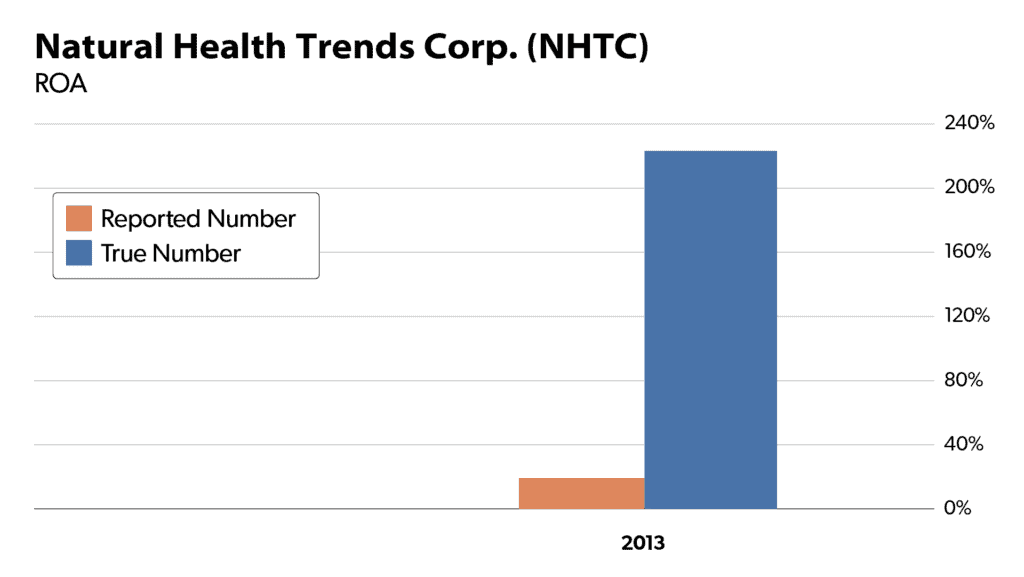

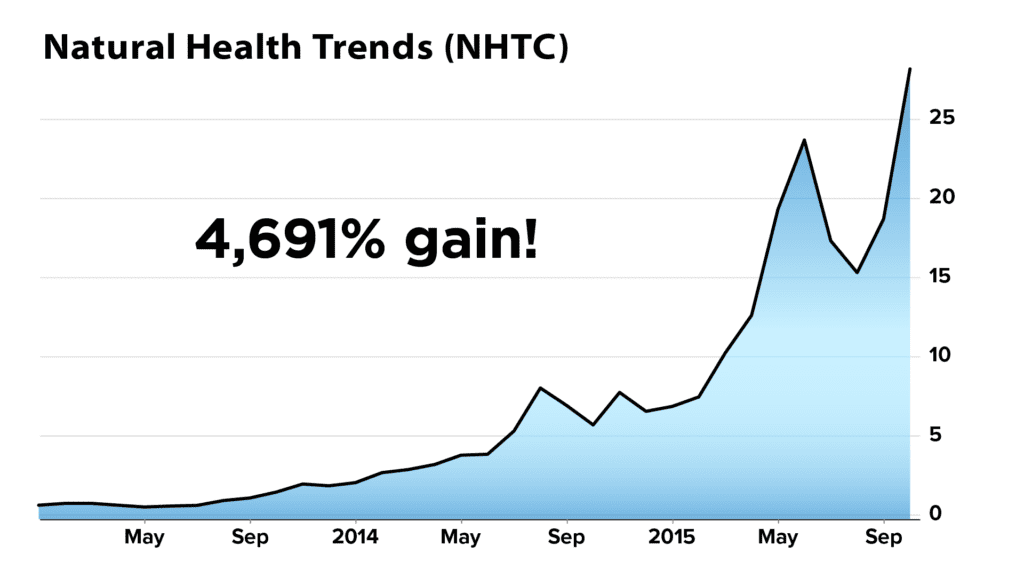

For example, the last time we saw credit default swaps this low, our system pointed to Natural Health Trends Corp…

…before the stock rose 4,691% in 2 years!

This is the kind of gain you could soon miss if you get sucked in by the Fed story. Or the inflation story. Or the geopolitical conflicts.

The recent sell-off is nothing more than a natural and healthy correction.

ANCHOR

So tell us, what do all the stocks you've named have in common?

Where to put your money immediately

JOEL

They're SMALL.

I mean, look. You can do fine in a bull market owning blue chips like Amazon or Wal-Mart. But the stocks we like have the potential to rise 5 to 10 times higher… for a simple reason. They're a fraction of the size.

In other words… imagine if you could have bought Amazon or Wal-Mart when they were still small, before they rose hundreds of percent.

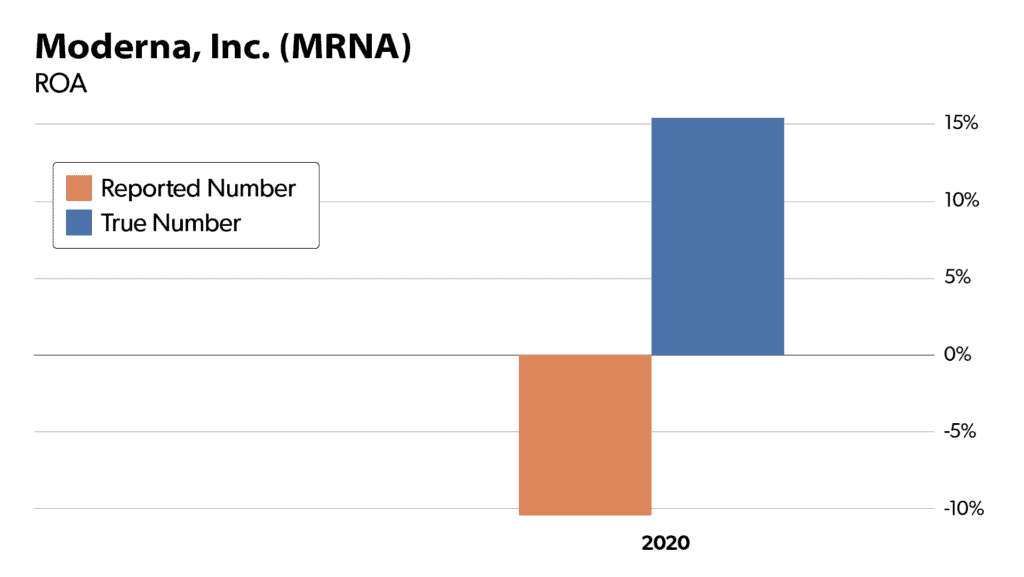

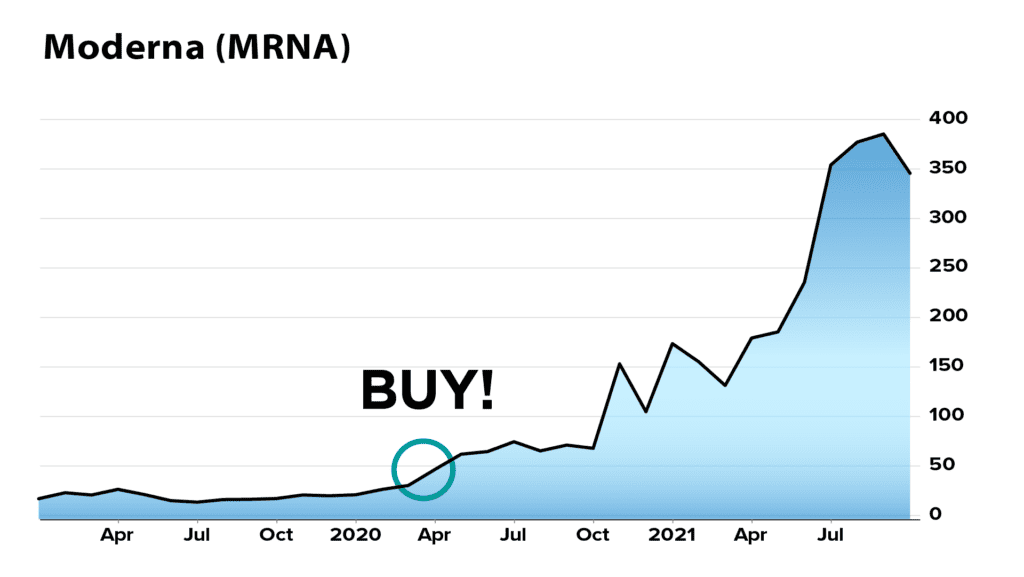

Take the 2020 bull run, for example…

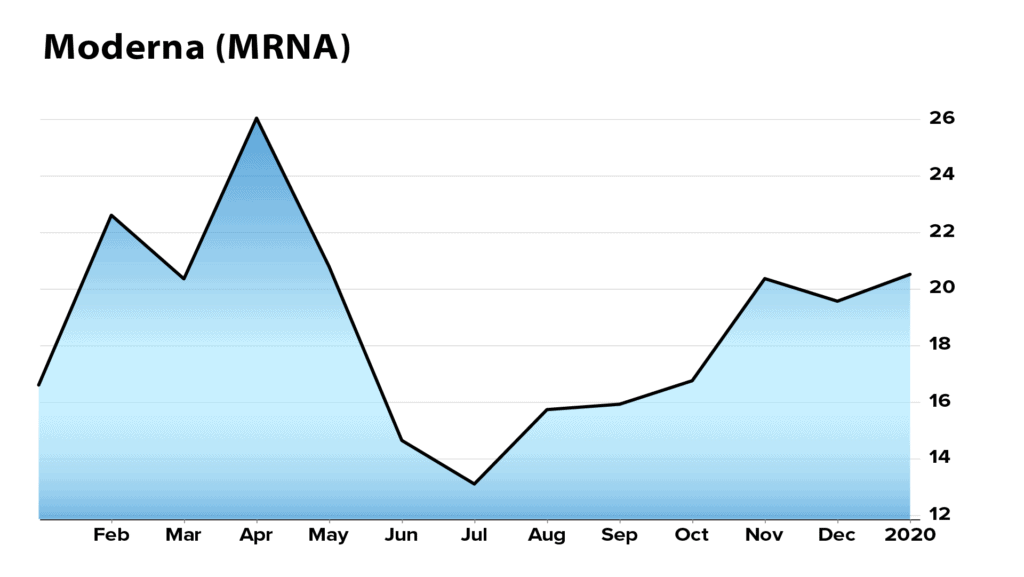

You could have bought Moderna, right? The vaccine maker… which was an obvious candidate for stocks that do well as America recovered from COVID-19.

Sure enough, it had a big earnings distortion. In fact, the earnings were reported as NEGATIVE on Wall Street when really they were cranking out crash…

…and you could have more than doubled your money following our system.

ANCHOR

But I take it you didn't touch Moderna…

JOEL

Nope. The company was already too big.

Instead, we played the COVID-19 recovery by applying our system across the market and looking for smaller companies whose story was being obscured by Wall Street.

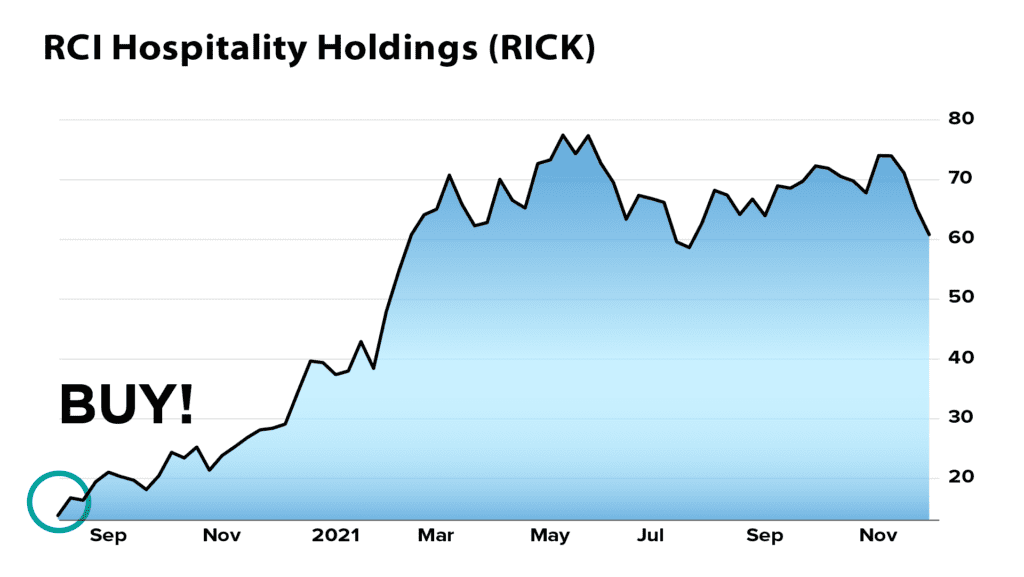

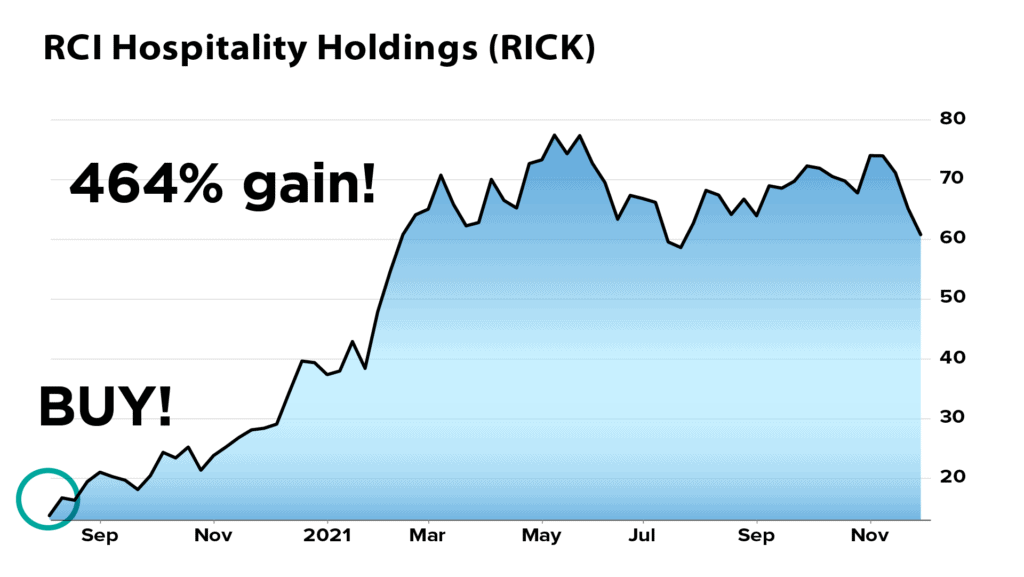

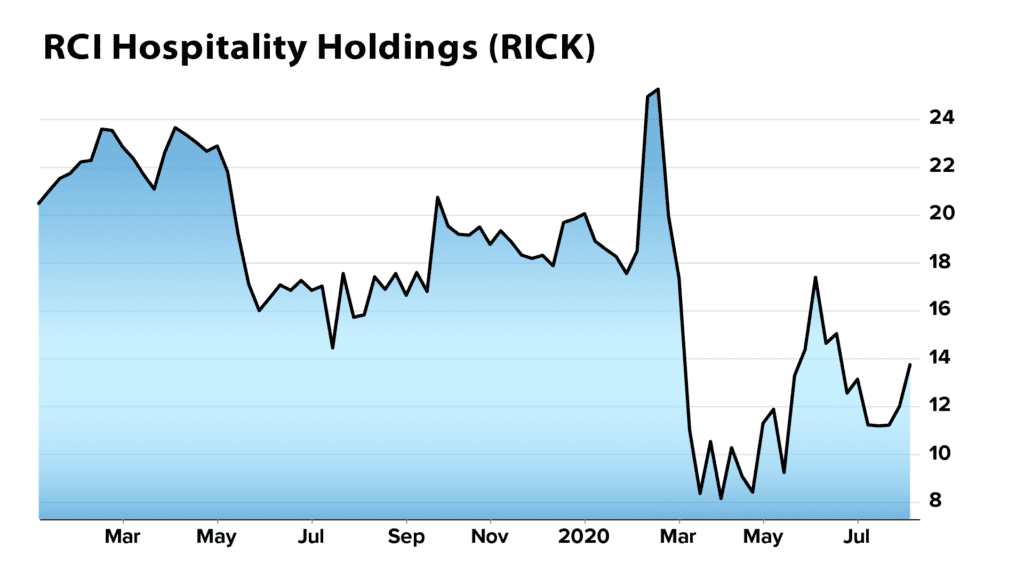

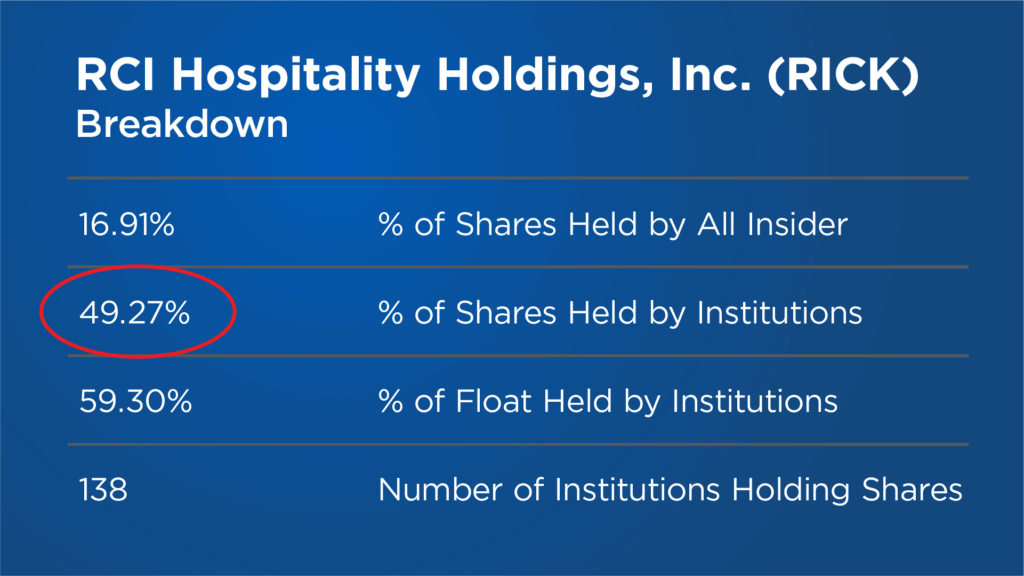

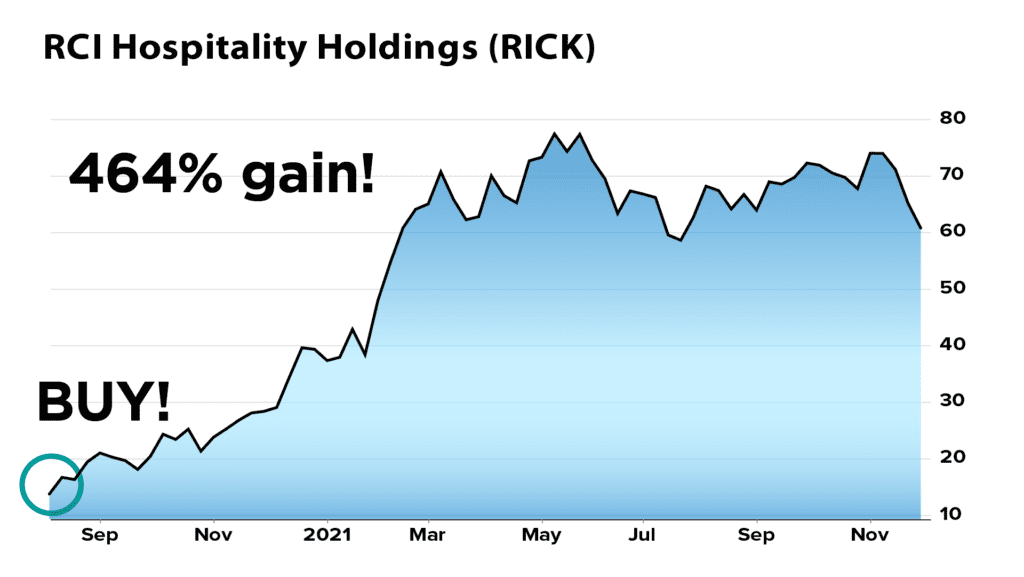

And we found a company called RCI Hospitality. Strip clubs.

ANCHOR

Strip clubs?! During a pandemic?

JOEL

Sounds funny, I know. But almost half the shares were being held by Wall Street… even as experts said their business model would be doomed by the pandemic.

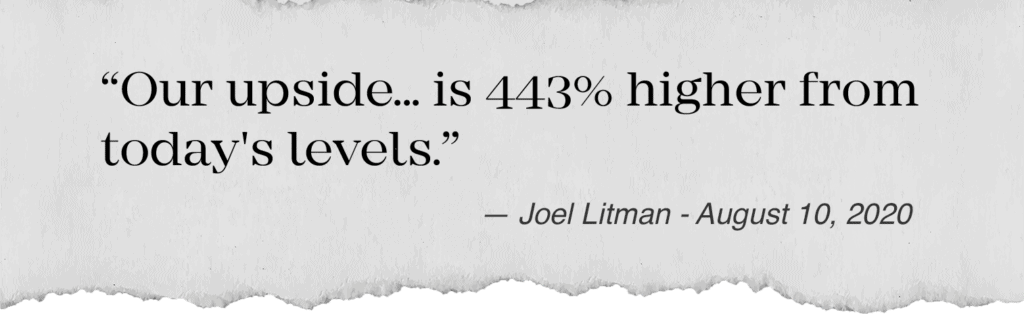

We knew Wall Street was keeping this one for themselves. So we ran the stock through our system and wrote, “Our upside… is 443% higher from today's levels.”

ANCHOR

A bold prediction…

JOEL

Sure enough, the stock is up as much as 464% since our recommendation, 5 times your money!

Standard Disclaimer: This is one of Joel’s best recommendations and no guarantee for future performance. For more information, visit our details and disclosures page.

ANCHOR

So to be clear… you're recommending microcaps.

Didn’t Warren Buffett once say he could make 50% every single year if he could buy microcaps?

JOEL

Yes – but a very particular type of microcap.

In short: We urge you to buy small companies with massive earnings distortions. Especially in one sector.

And that's because I believe the public is dramatically underestimating how strong earnings growth will be in the coming months, regardless of what's happening in the overall market or economy. And this will be most obvious in the smallest stocks.

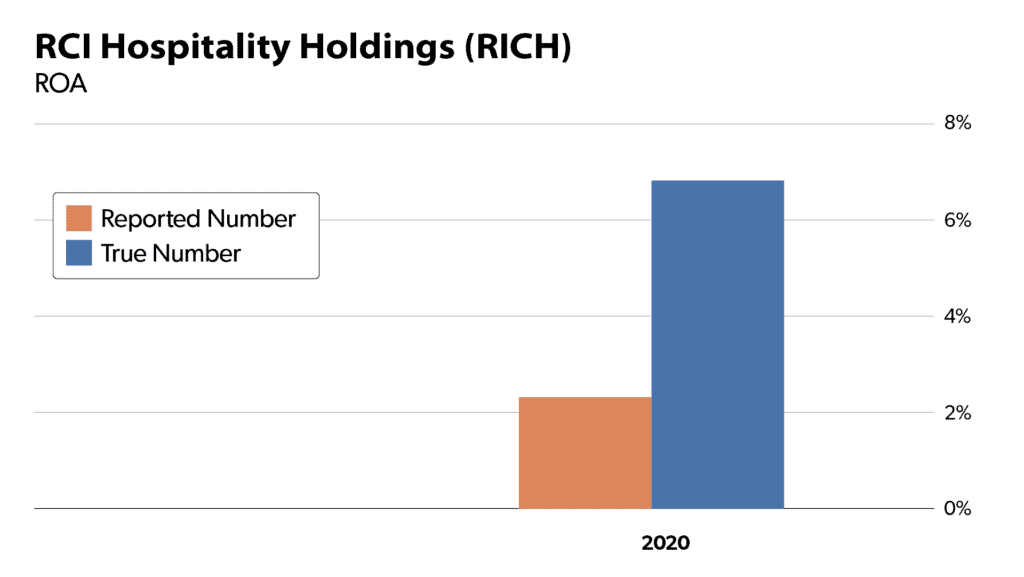

For example, look at RCI Hospitality. It had a 191% earnings distortion when we found it. That's a big, big distortion for a company of that size.

ANCHOR

OK, then which sector should I be looking at right now?

JOEL

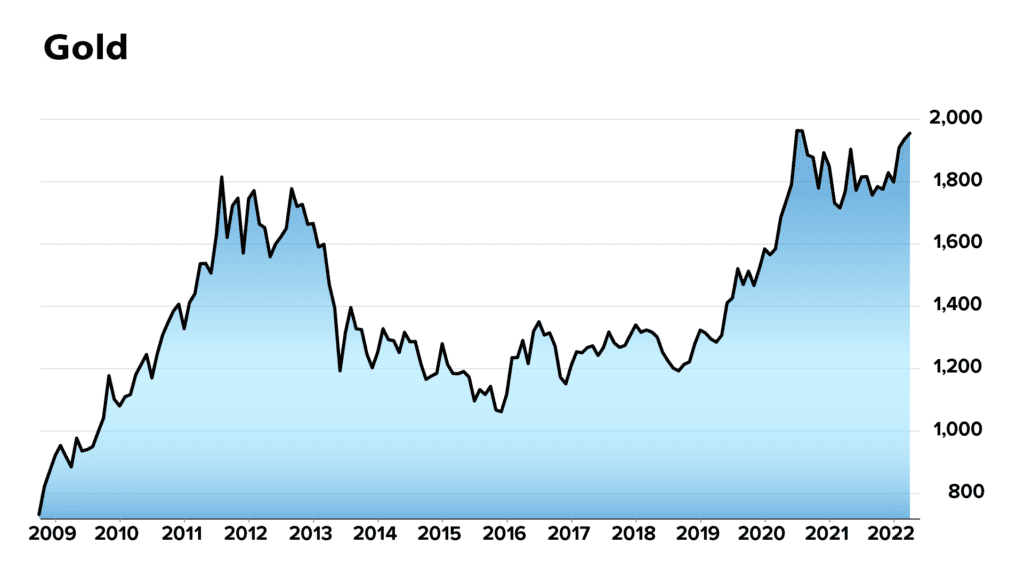

First, let me tell you what sector it's NOT, John.

It's NOT GOLD. In fact – avoid gold for sure.

ANCHOR

Why?

JOEL

Everyone's talking about inflation, right?

The Fed printed $10 trillion to keep the economy afloat during lockdown. Many people believe higher stimulus means higher inflation – from all the new money pumped into the system. And inflation has reportedly hit a 40-year high… which should theoretically drive up gold, right?

But here's the thing, John.

The inflation numbers are totally misleading.

People are forgetting that inflation is also driven by DEMAND, not just the U.S. money supply.

ANCHOR

Explain what you mean…

JOEL

The untold story right now – and it's the main reason why we're bullish – is that something bigger is driving this so-called “inflation.”

Inflation is up, yes. But only because the lockdowns caused people to stop spending as much on services… and to spend on tangible goods instead. And this has caused a major supply chain problem.

ANCHOR

Because delivery trucks couldn't go anywhere…

JOEL

Not entirely, no.

You see – tangible goods require getting factories up and running. And what people don't realize is that this new surging demand has exposed a long-standing problem with most U.S. corporations.

In short, we don't have enough factories!

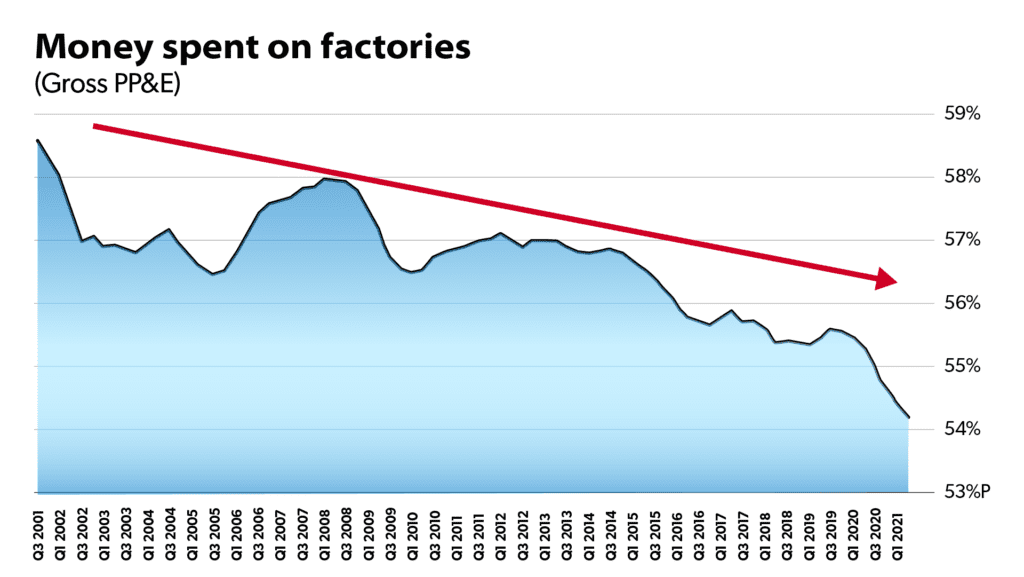

This chart of PP&E ratios tells the full story…

ANCHOR

Tell us what PP&E is…

JOEL

Plant, property, and equipment. It's a balance sheet line-item representing companies' large, physical assets.

ANCHOR

Like a manufacturing facility…

JOEL

Right. And this chart shows how incredibly old these assets are right now in America.

Over the past decade, most U.S. companies simply didn't cough up the cash to renovate their factories.

They limited their capital expenditures, known as “capex,” to maximize their cash flows. Which makes sense, right? Nobody ever wants to replace equipment until they absolutely have to.

But today, with the surging new demand post-COVID-19, this is now creating supply chain issues, where supply can't ramp up fast enough to meet demand.

That means prices go up. But NOT in the serious, long-term way most experts are harping on right now.

ANCHOR

So it's not really inflation in the classic sense…

JOEL

Nope. And this is GOOD NEWS for the market, John, because my research shows it's going to cause what we call a “capex supercycle”… on a scale bigger than we've seen in basically two decades.

As more factories get online, they buy more from their suppliers, who buy more from their own suppliers, and so on, creating a “trickle-up” effect that will lift hundreds of companies with it. Especially the microcaps we're targeting with our system right now.

These stocks have 500% to 1,000% potential.

ANCHOR

Give us an example…

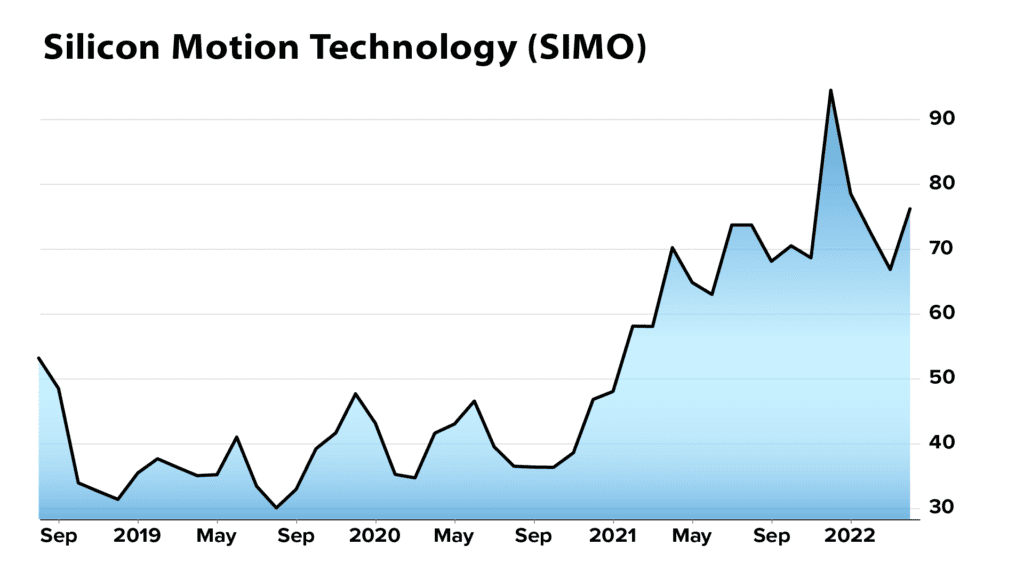

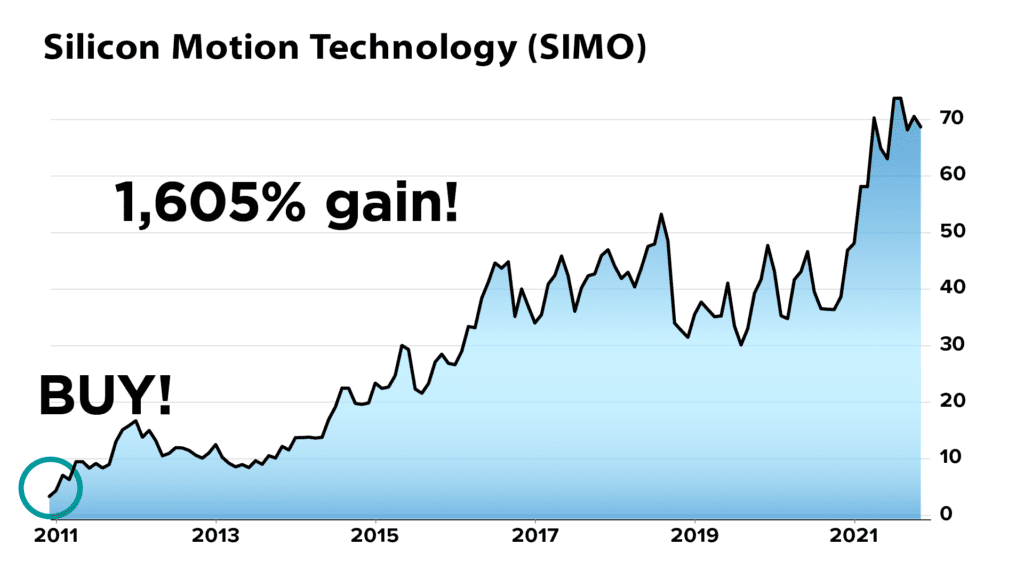

1,605% gain on a single distortion

JOEL

Silicon Motion Corp.

They help make semiconductors, where silicon is crucial.

Silicon has seen rising industrial demand in recent years – even before the pandemic came along. But in the U.S., corporations have been unwilling to invest in the capex needed to ramp up capacity.

ANCHOR

And that creates a supply chain problem…

JOEL

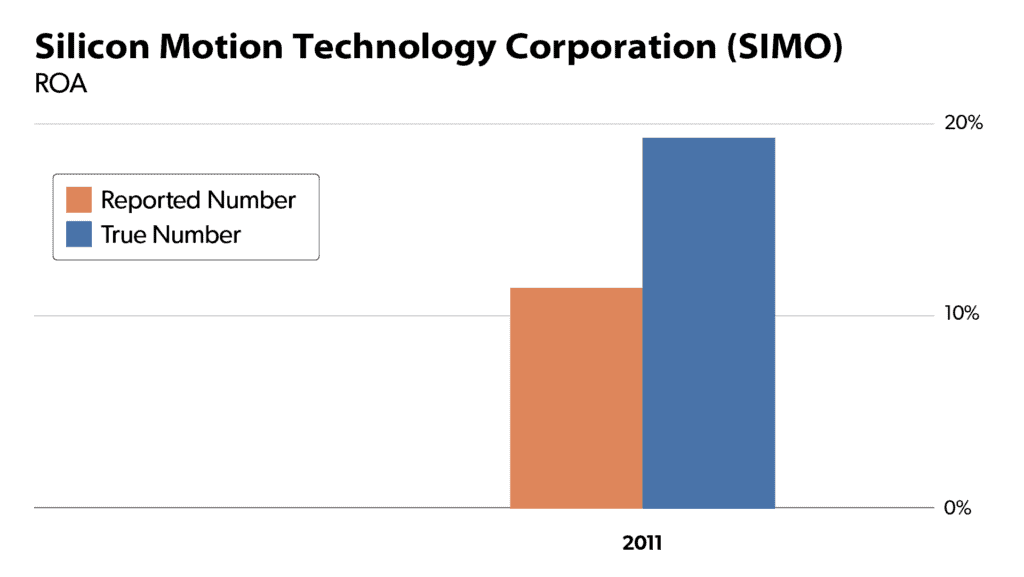

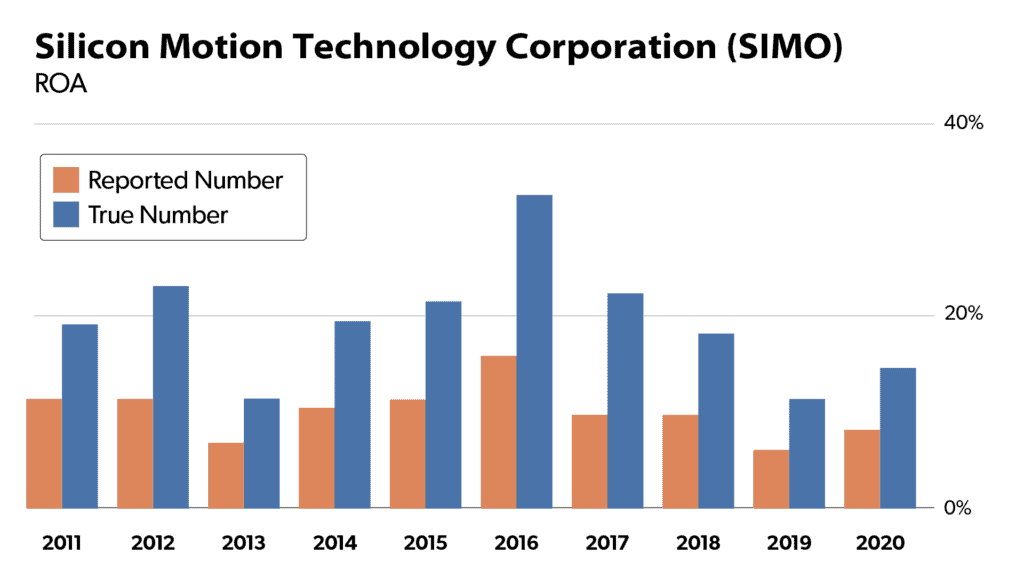

Right. It's been a problem for the last decade, John. Back to literally 2011.

So… run our system across the semiconductor industry, and here's what you'd have seen back then.

A major earnings distortion for this little semiconductor company. A distortion that CONTINUED for the next decade… to the tune of a 105% discrepancy at one point in 2016.

If you'd seen this back at the beginning, John, and bought and held the stock, you'd have made up to 1,605%.

That's the power of finding microcaps with huge earnings distortions at the start of a capex supercycle.

ANCHOR

When was the last time America had a capex supercycle?

JOEL

2003.

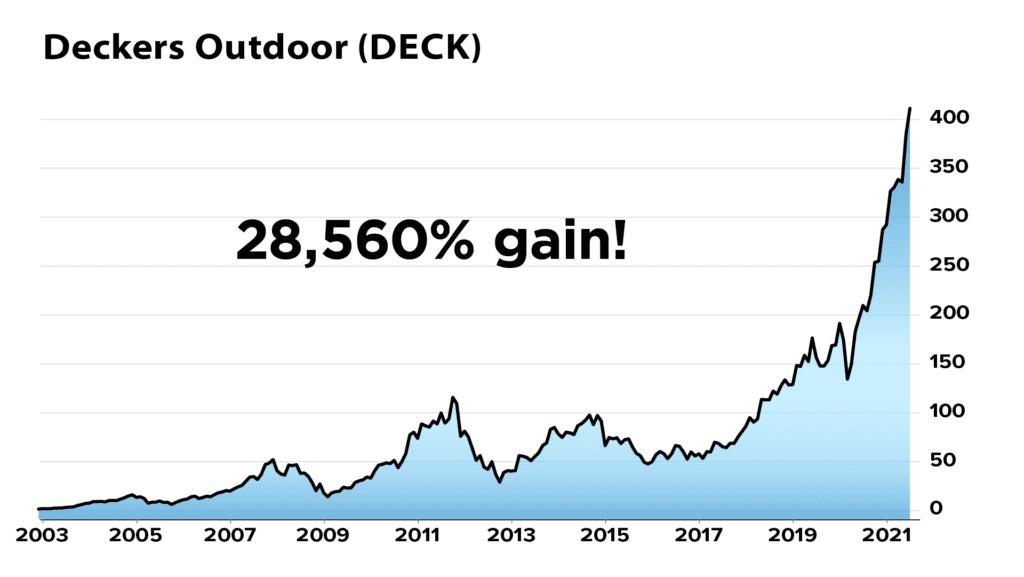

Remember what happened to stocks after that? A straight march higher.

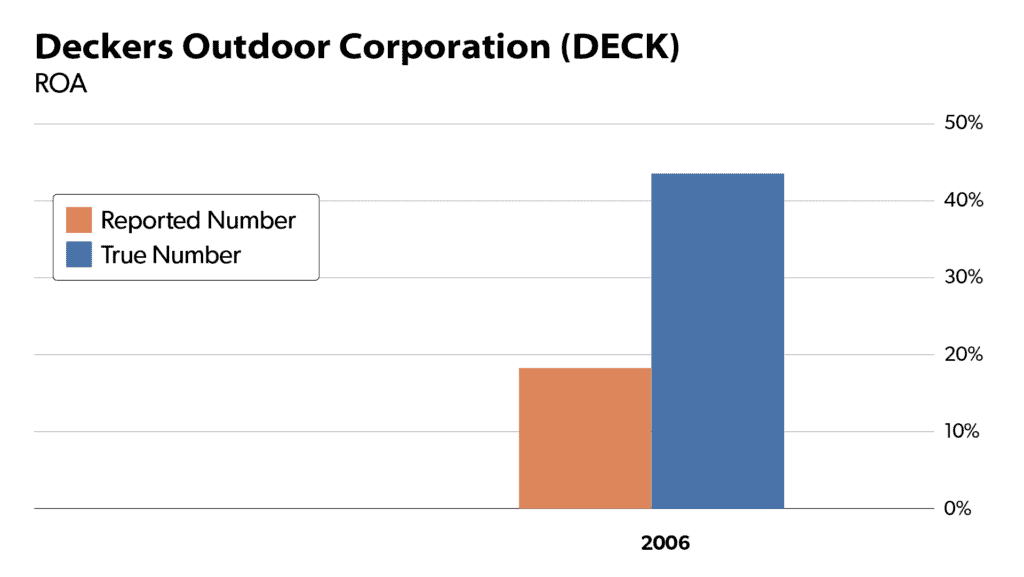

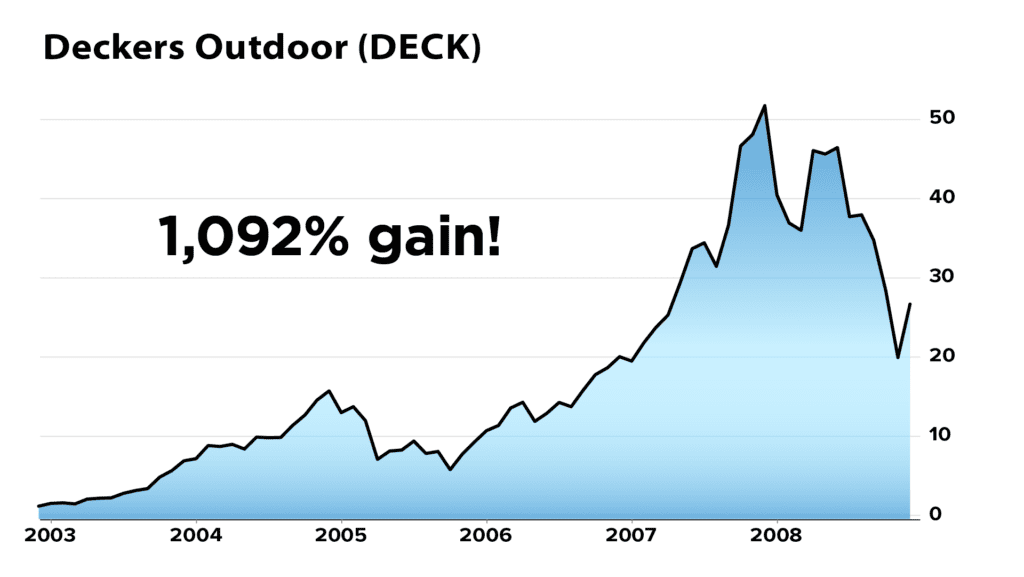

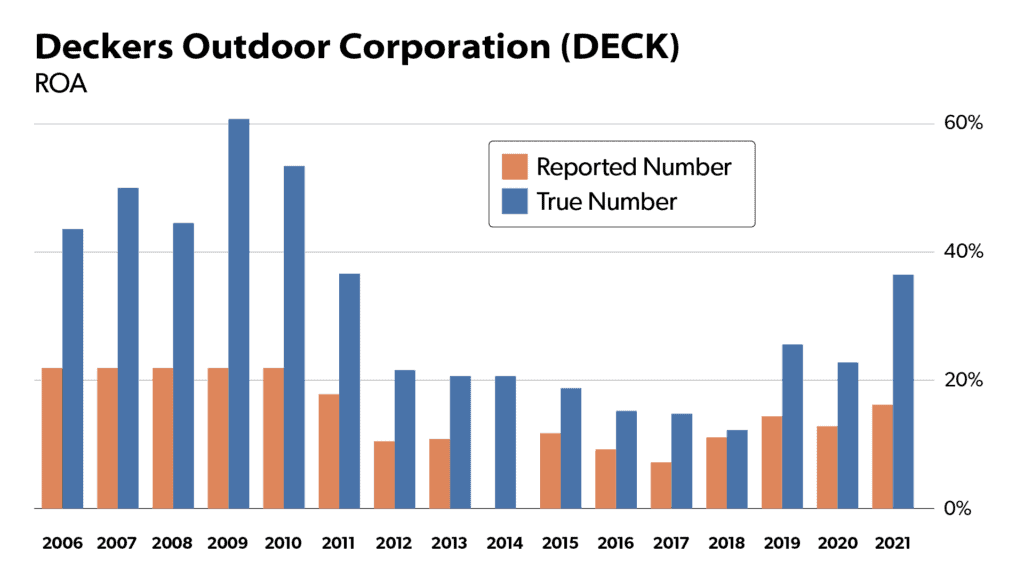

And along the way, our system pointed to a 140% earnings distortion in Deckers Outdoor Corp. They make footwear – exactly the kind of staple that benefits from a manufacturing boom.

Sure enough, if you'd bought in at the start of the capex supercycle and held through 2008, when the cycle ended, you could have made 11 times your money.

And the funny thing is, the distortion continued even after the capex supercycle ended.

If you'd seen that with our system and kept holding, you'd have been up 28,000% by last year. That makes you a millionaire on a $4,000 investment!

ANCHOR

Huh. Y'know, this seems like a remarkably simple way to cut through all the noise and see why certain stocks could keep marching higher…

And yet… I haven't heard anyone in the media talking about this.

JOEL

Nope. Wall Street would much rather you freak out and buy worthless gold mining stocks than potentially make 11 times your money playing the REAL story behind rising prices.

Mark my words: Companies like this – in a variety of industrial sectors – will lead the way to the biggest gains in the market.

ANCHOR

Incredible. I love it.

Once-in-19-years event is coming

Now, in a moment, we're going to hold a demonstration of Joel's system.

He'll type in the tickers for a variety of different stocks and show you what the forensic analysis is saying right now.

Including the name of one small-cap stock you've likely never heard of before, which he believes could make you multiple times your money in the next leg of the coming bull market he predicts. You'll get that ticker FREE of charge in just a moment. Along with the #1 popular stock to avoid.

But Joel, what I'm still marveling over is how, sometimes, your system knows more about a company than even you and your team.

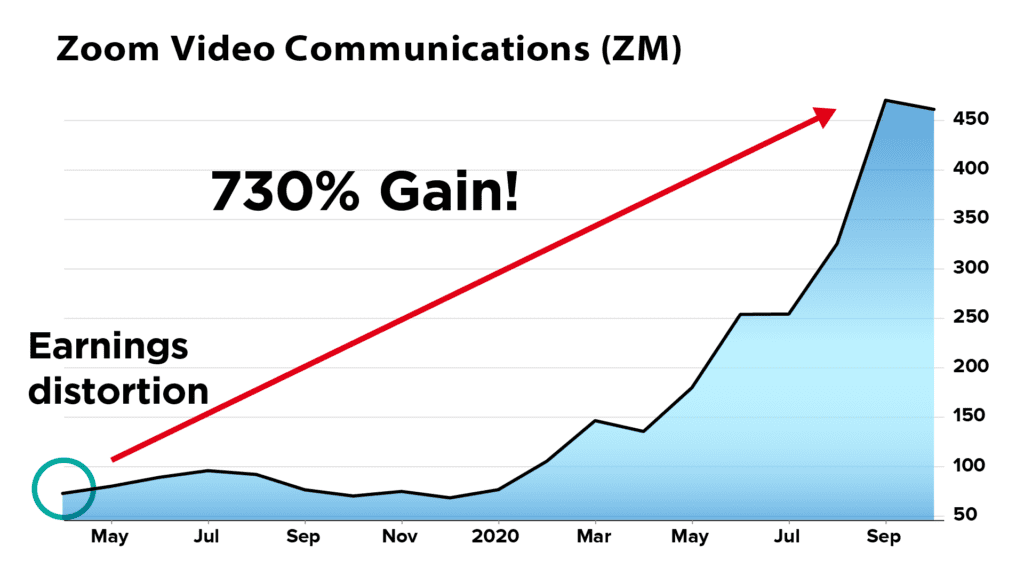

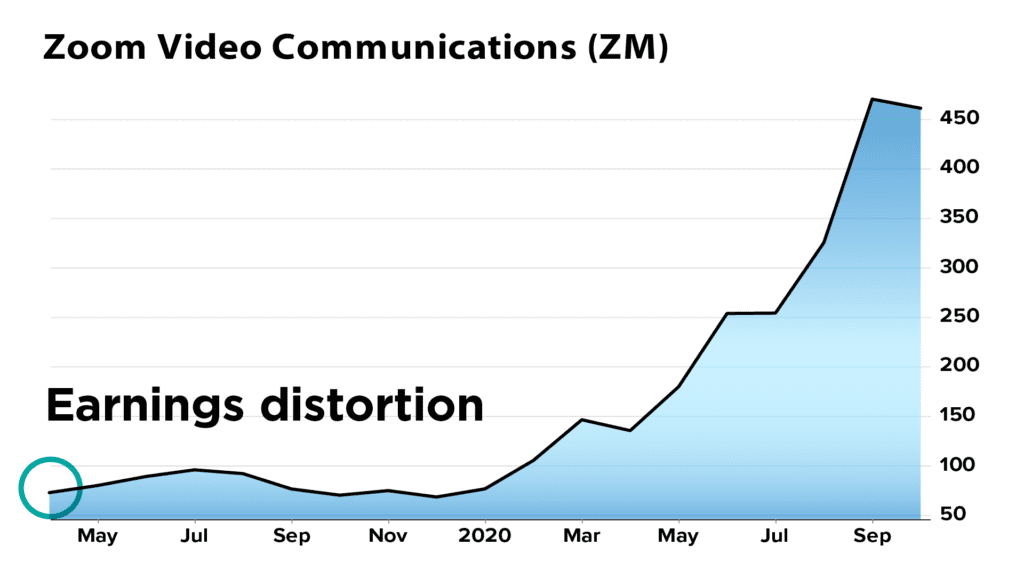

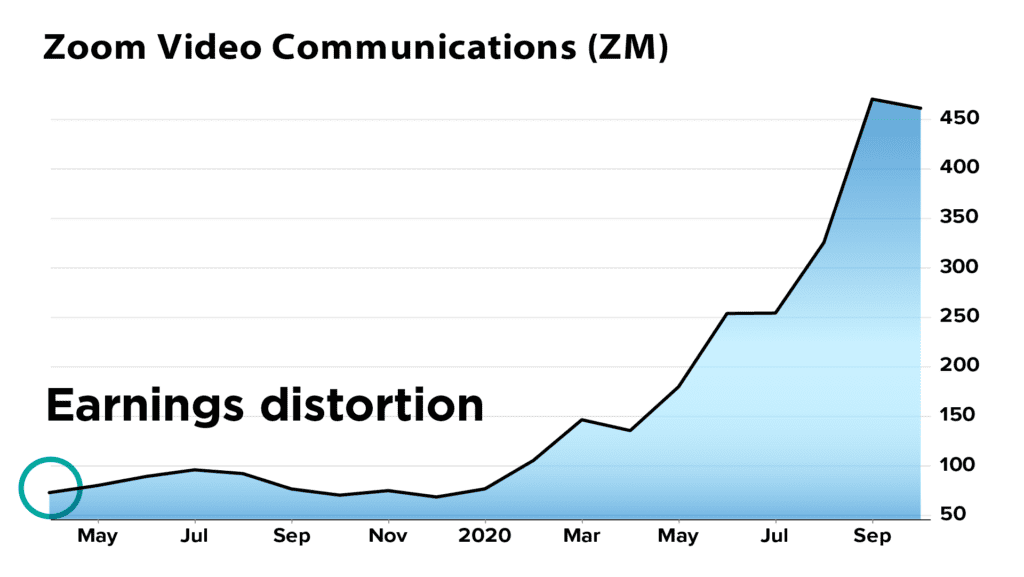

For example, earlier today I was playing around with your system, and just for fun, I typed in “Zoom.”

As we all remember – Zoom became a household name in 2020. And the stock rose 730% on the strength of its 300 million new users.

But get this…

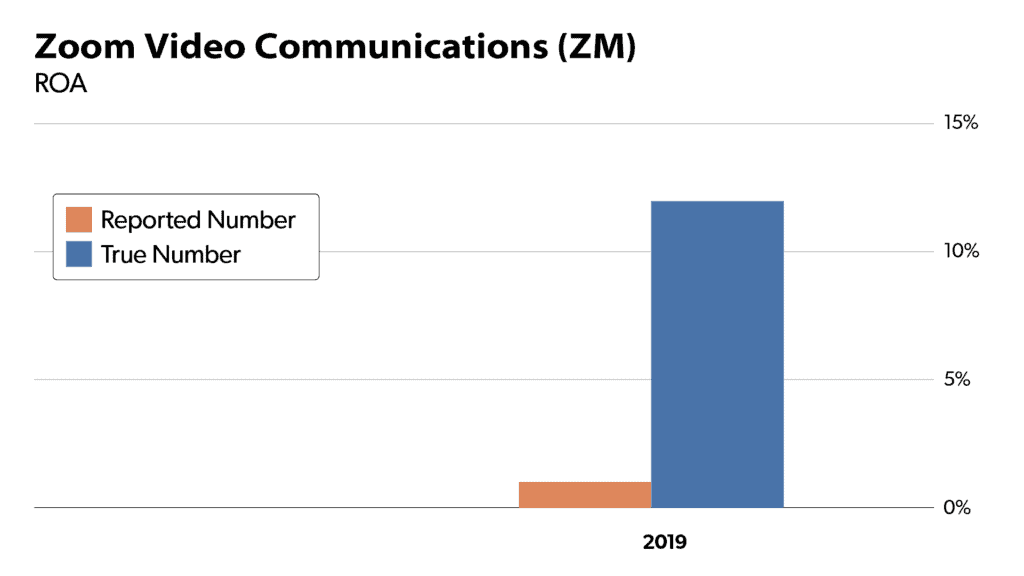

Joel's system detected an 814% earnings distortion as far back as 2019, BEFORE the first case of coronavirus had ever even been reported!

So Joel – how could your system have pointed to such a huge winner back when Zoom was just another tech company?

JOEL

John, this actually leads into the entire secret of how to use our system to find the biggest gains.

Here's the corrected Return on Assets for Zoom in 2019…

This company was minting cash even BEFORE the pandemic!

What that means is… if the coronavirus had NEVER happened, this stock would likely have still had a very nice run in 2020.

So what happened to cause the spike?

In short, a CATALYST!

A reason for everyone to start paying attention to its earnings…

ANCHOR

Which in this case, of course, was the new digital shift forced upon the American workplace by lockdowns…

JOEL

Right, and all of a sudden people realized just how much cash Zoom was capable of generating, which was already better than the number posted on Wall Street. Those two factors combined – a distortion and a catalyst – led to that remarkable 730% gain.

So ideally, John… when we apply our system, we're looking for a particular event that will drive attention to the earnings distortion.

In the case of Zoom or Peloton or RingCentral, it was the pandemic.

In fact, we published a report in May 2020 called The At-Home Revolution all about earnings-distorted stocks that would benefit from lockdown, each of which could have made you a fantastic gain.

ANCHOR

Got it. And that gets to the point we talked about earlier – that the payoff to finding these distortions is an EARNINGS SURPRISE when the world wakes up to how profitable these companies truly are…

JOEL

Exactly. Cash is king.

Our forensic accounting system measures cash earnings far better than GAAP…

But over time, even GAAP accounting will catch up.

And that means, sooner or later, the reported PROFITS catch up. That's when even the general public sees the true number.

And when that happens, the results will surprise the investing public – and cause a huge upward correction in the stock price.

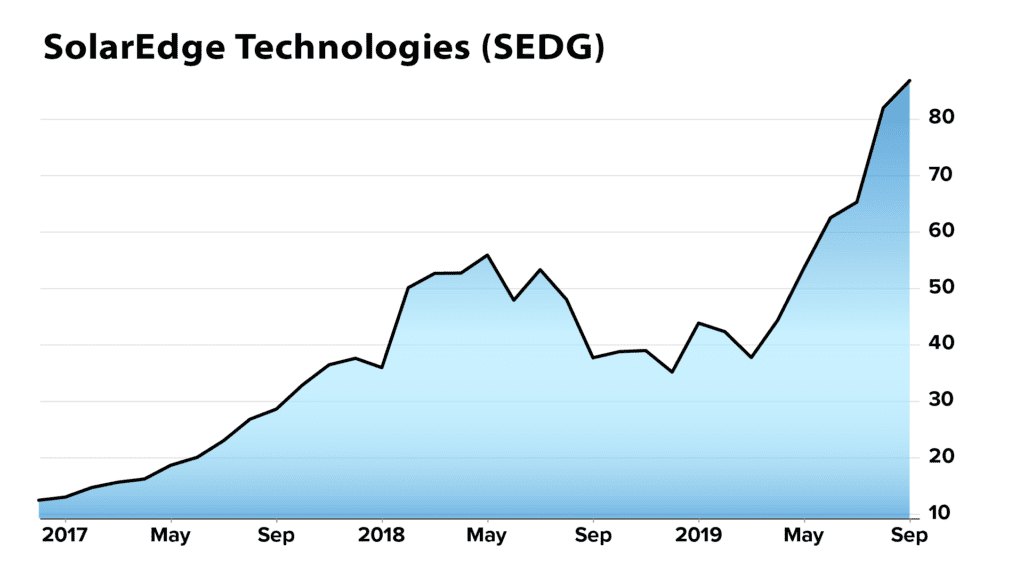

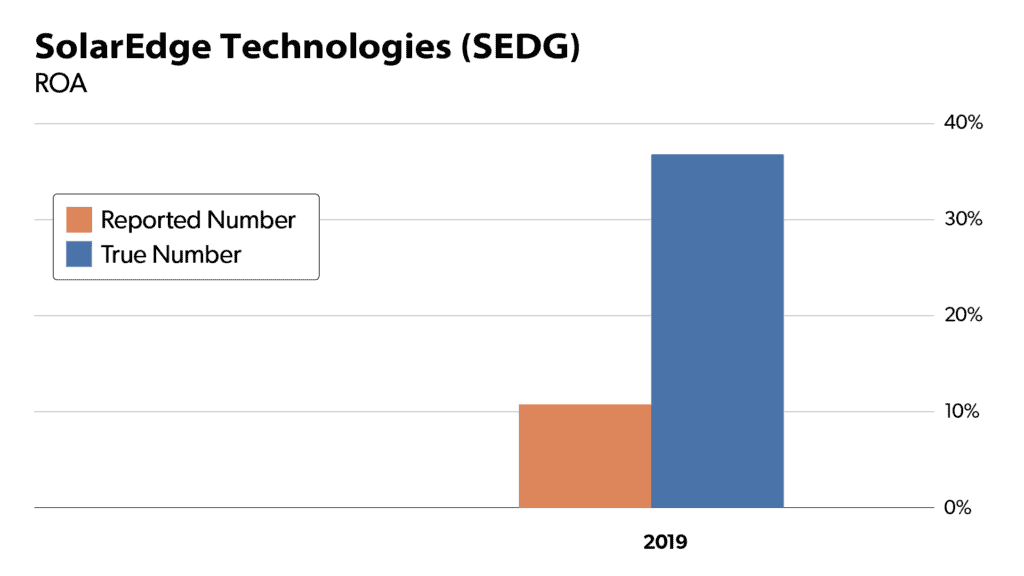

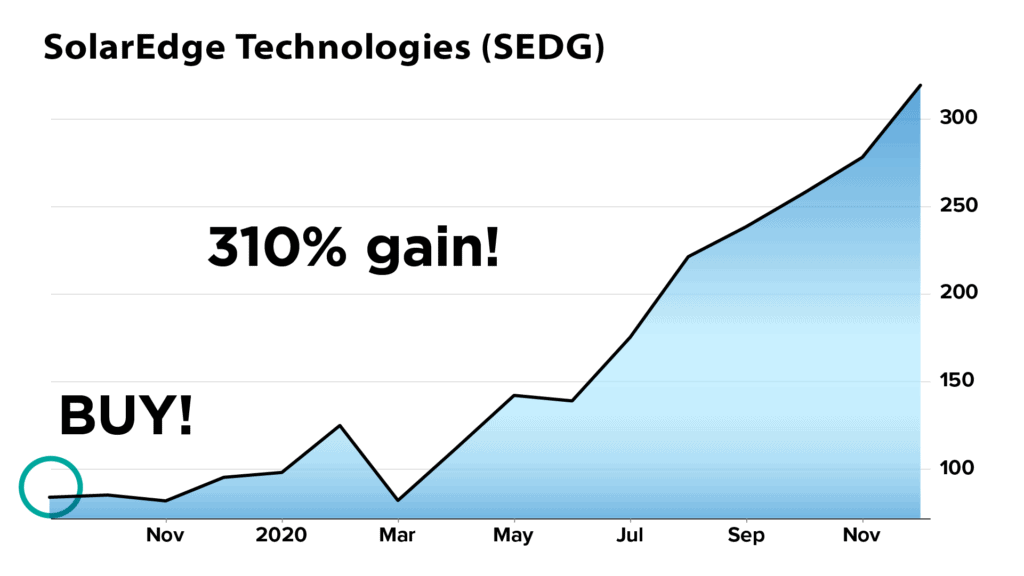

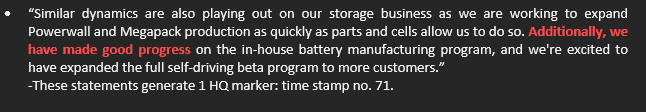

A good example is SolarEdge…

ANCHOR

OK – and that’s, what, the solar energy company you recommended to some of your readers back in 2019…

JOEL

Yep. What caught our attention, first, was the earnings distortion. According to our system, the TRUE earnings were almost three times higher than what Wall Street reported.

That alone got us excited. But 2019 was also the year when renewable energy started to become a very hot topic. For one thing, in 2019 the U.S. consumed the highest amount of renewable energy on record.

ANCHOR

So it had both things you look for. A distortion… and a catalyst.

JOEL

Sure did. The following year, it delivered a 40% earnings surprise.

And what happened? You could have more than tripled your money on the stock.

But as impressive as that might be, I promise you: The capex supercycle will be a far greater catalyst. And I believe the stocks uncovered by our system will be the best way to play it.

ANCHOR

So your system is kind of like having a real-life crystal ball, right? You get to see into the future long before other investors… for the chance to profit as the public catches on to what you already know…

JOEL

Well, call it what you want. But the bottom-line is that finding a small stock with a huge earnings distortion at the start of a catalyst as big as a once-in-19-years capex supercycle is likely the greatest wealth-building opportunity you're going to see over the next decade.

And ignoring this opportunity because Wall Street experts have scared you onto the sidelines will be a DISASTER for your portfolio.

ANCHOR

Well, I'm excited to get the name of your free microcap recommendation to play all this. Along with the #1 stock to avoid.

But right up front, though, I gotta ask the obvious question, Joel.

“What if I'm still terrified of a much bigger crash or bear market this year?”

Where the REAL crash will happen

JOEL

The bigger danger for most people isn't a market-wide crash… it's a crash within a particular company or sector.

Because remember, John… individual stocks can collapse all the time, even at the height of a bull market.

This is why we love using our system to expose the worst stocks.

For example, back in 2020 we published a report called: Ten Microcaps You Must Avoid at All Costs.

Inside, we warned about Bright Mountain Media – which went on to plummet 100%! Cannonau Corp., which plummeted 81%. And Rockwell Medical, which plummeted 73%… among others.

ANCHOR

And you say this works on entire sectors…?

JOEL

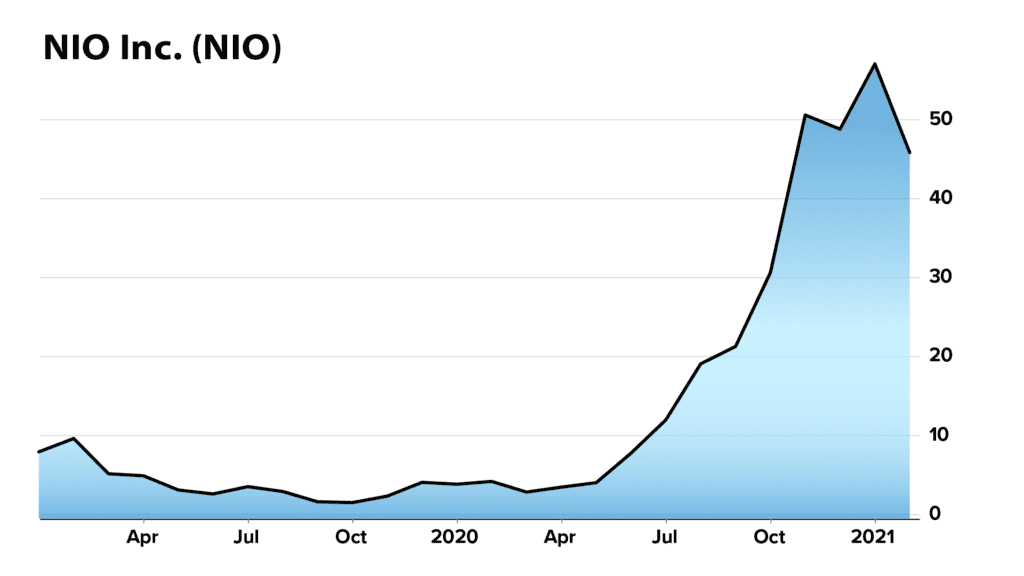

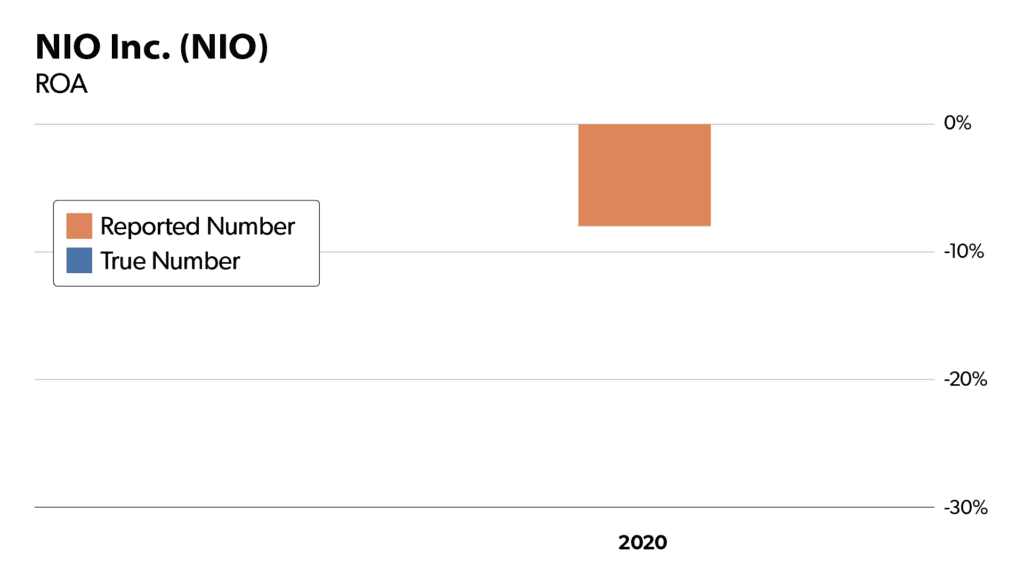

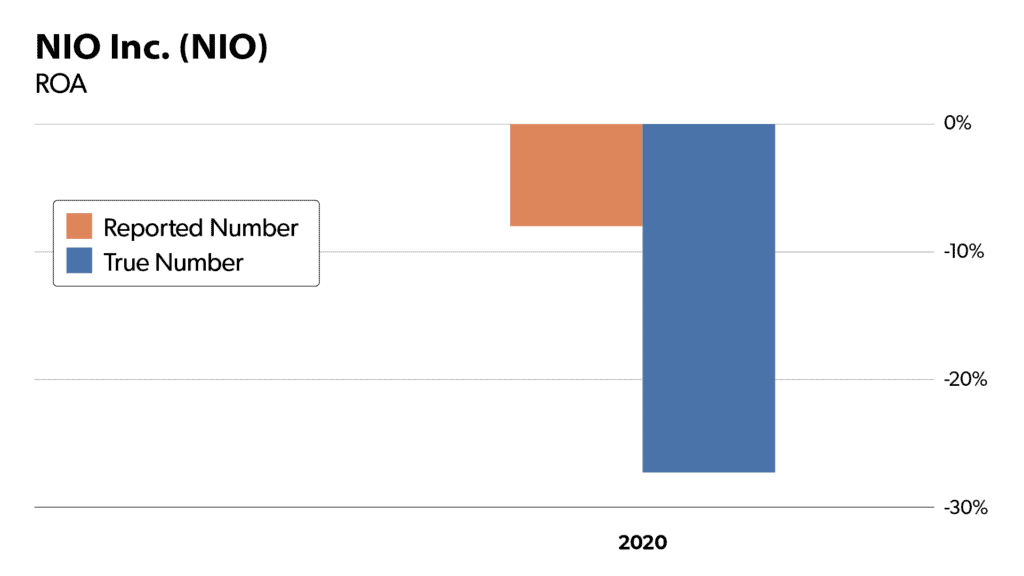

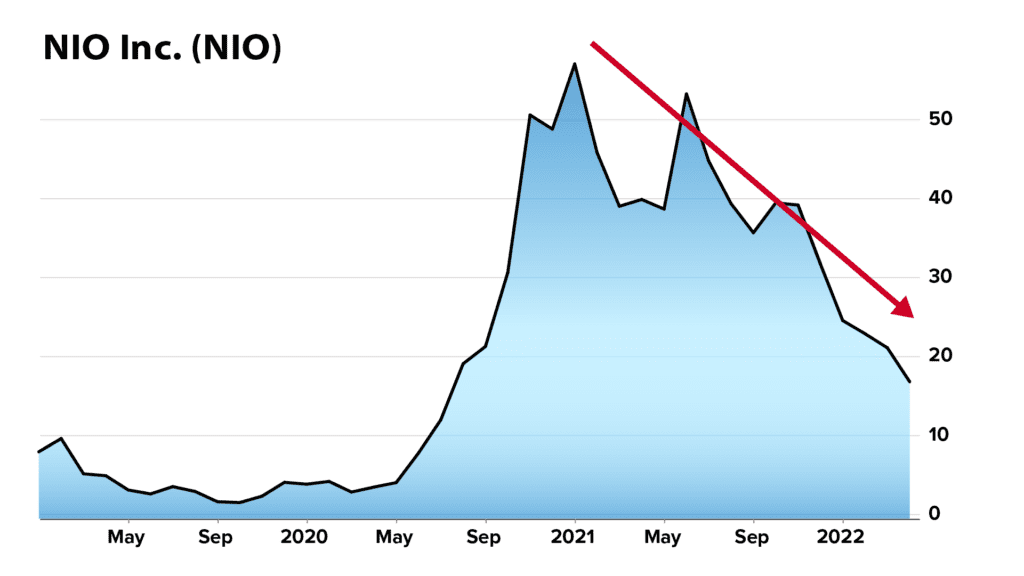

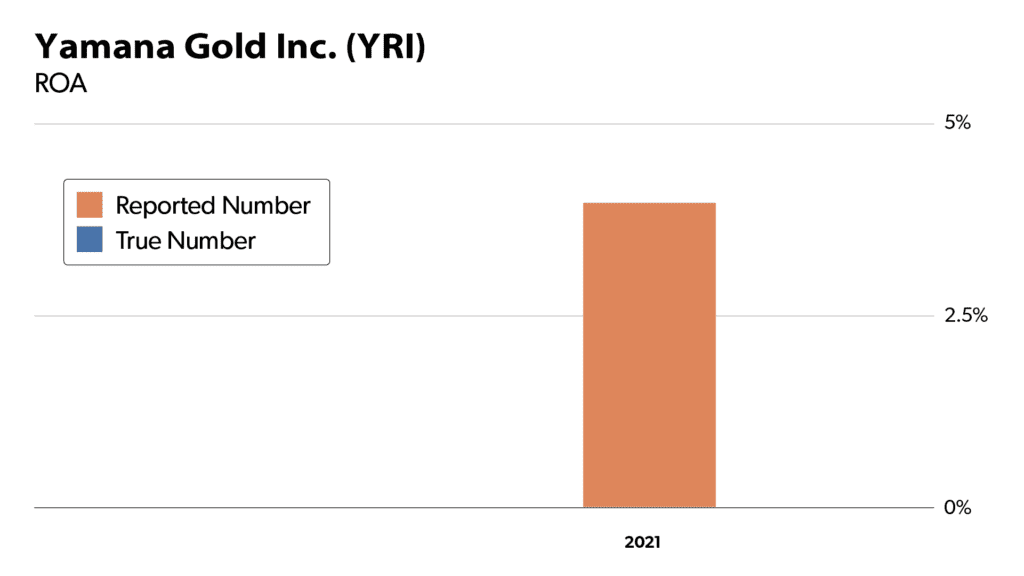

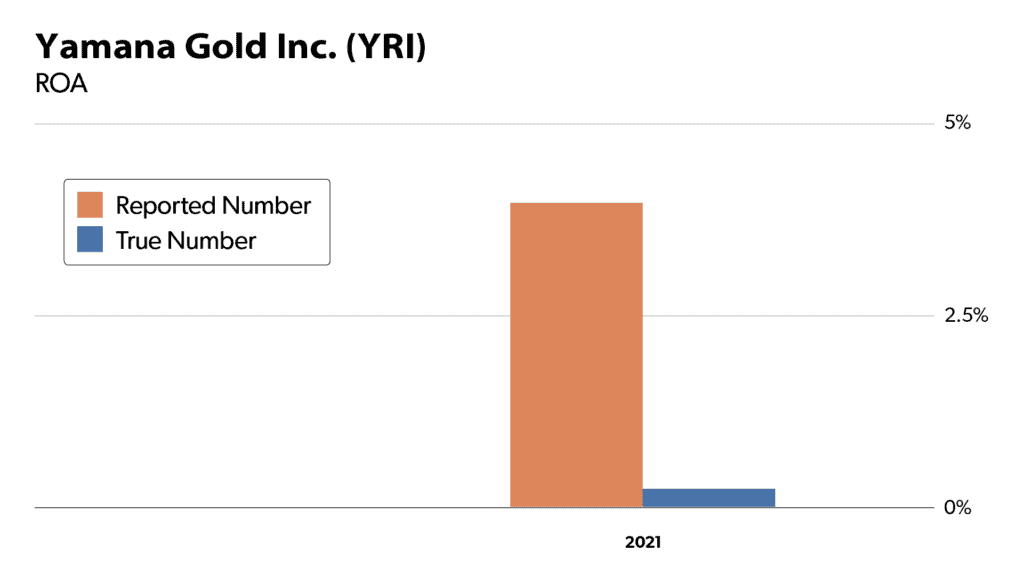

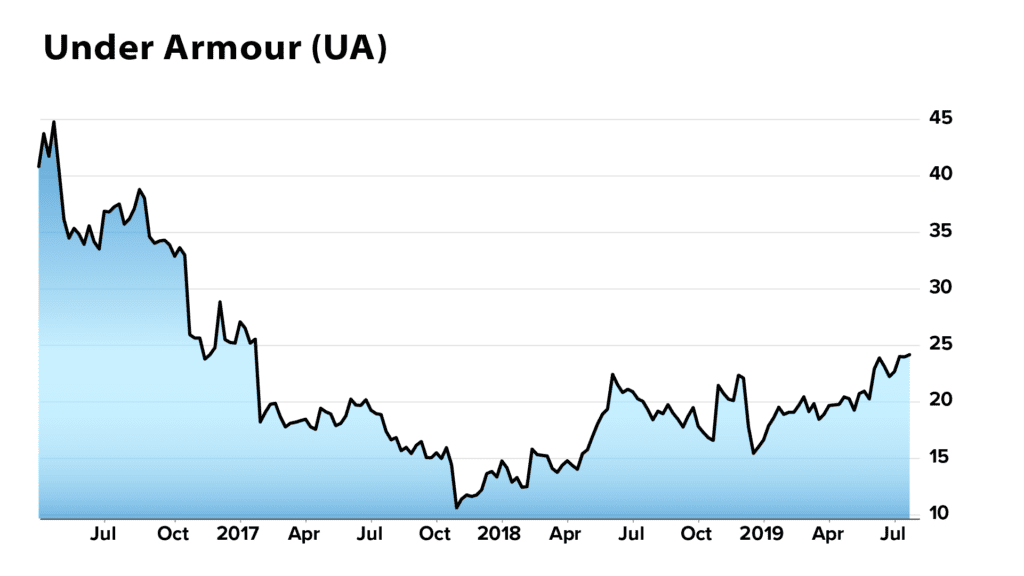

Consider electric vehicles, for example.

One standout is the company Nio, which made headlines in 2020 for its electric vehicle buses. Sounded like a great stock to some people.

But look at this…

Run the stock through our system, and in 2020, the publicly reported Return on Assets was NEGATIVE 8.3%. In other words, a huge red flag.

Now granted, you might have told yourself, “Electric vehicles are so hot – who cares about one bad year?”

Well… one click – and John, here's the REAL, TRUE number.

It's actually more than 3 TIMES WORSE than the number Wall Street would have you believe is true.

The result?

The stock plummeted 57% in 2021… smack in the middle of a bull market!

ANCHOR

Got it. So the real risk right now isn't necessarily a market-wide crash. It's a crash within sectors that have grown too popular or within individual companies with earnings that are far WORSE than the public numbers.

JOEL

Correct. So don't worry about the market. Worry about your individual positions.

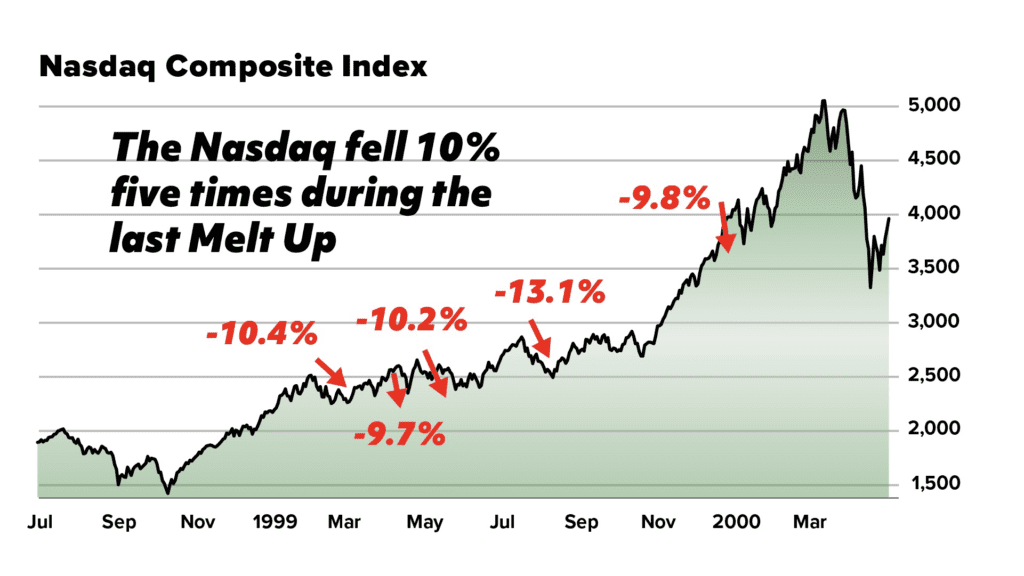

But I also want you to remember this, John: No market ever goes up in a straight line.

During the dot-com boom, for example, the Nasdaq saw five declines of roughly 10% during its final push higher.

ANCHOR

So buy the dip.

JOEL

Yes. When I visit my clients at some of the top 500 biggest financial institutions, the first thing they say to me is, “You’re going to tell me to buy the freaking dips, aren’t you?”

And the answer is yes!

Because if we find a stock with an earnings distortion and a catalyst behind it, and the stock hiccups because of some geopolitical force that affects the entire market, that's a BUYING opportunity, plain and simple.

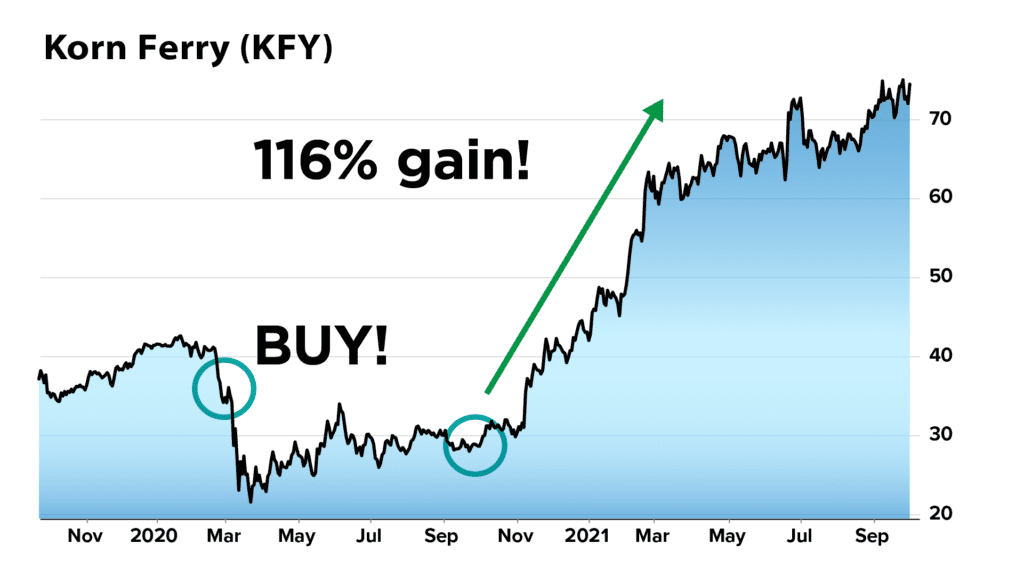

I mean, look. Some folks could have doubled their money on our Korn Ferry recommendation in 2019. But if they'd bought more on the dip in 2020, they'd have made an extra 116%.

Folks could have quadrupled their money on our Generac recommendation in 2019… and made an extra 129% if they'd bought the dip in 2020.

I could keep going, John.

BUY THE FREAKING DIP!

Even works on “surprise” events

ANCHOR

OK, but… I always warned my students at Harvard: Some things can never be predicted…

For example, a little biotech firm developing a new drug to treat cancer. Unless you're a scientist working at the company, it's impossible to know if the FDA will approve the drug… right?

JOEL

You would think so.

But we've seen amazing results with even the most inscrutable companies… because, again, sooner or later a company with a major earnings distortion will see a correction in the stock price.

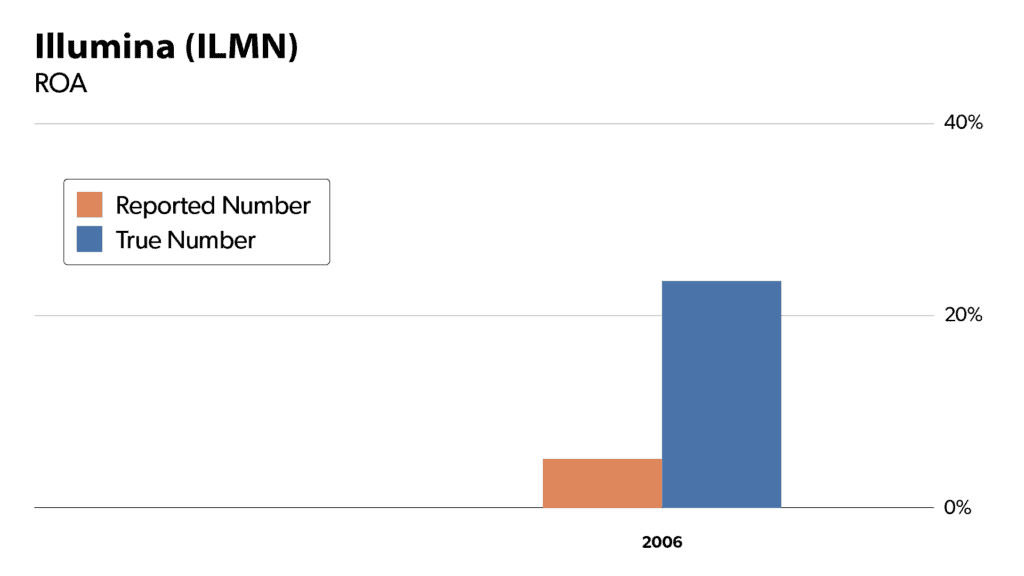

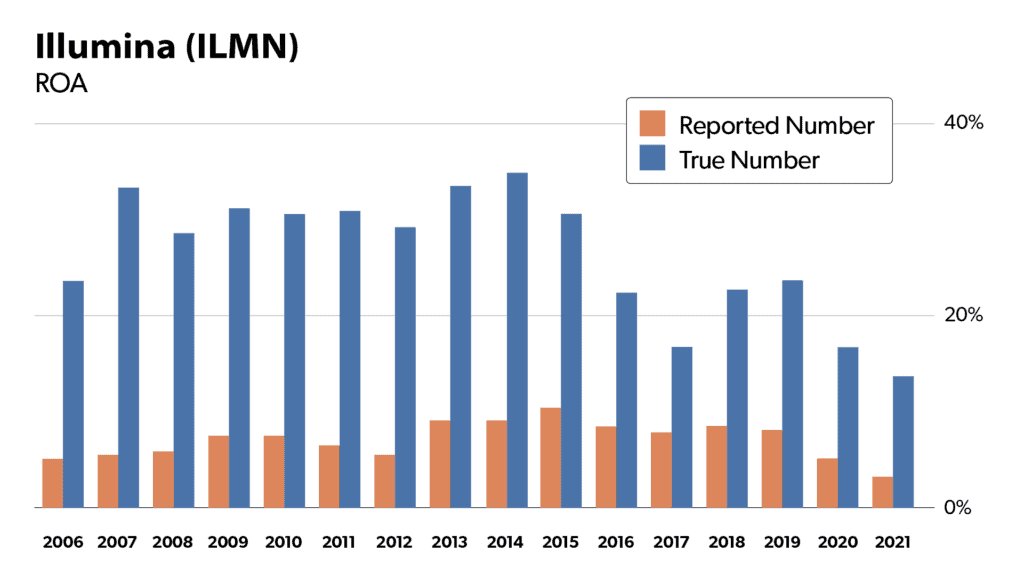

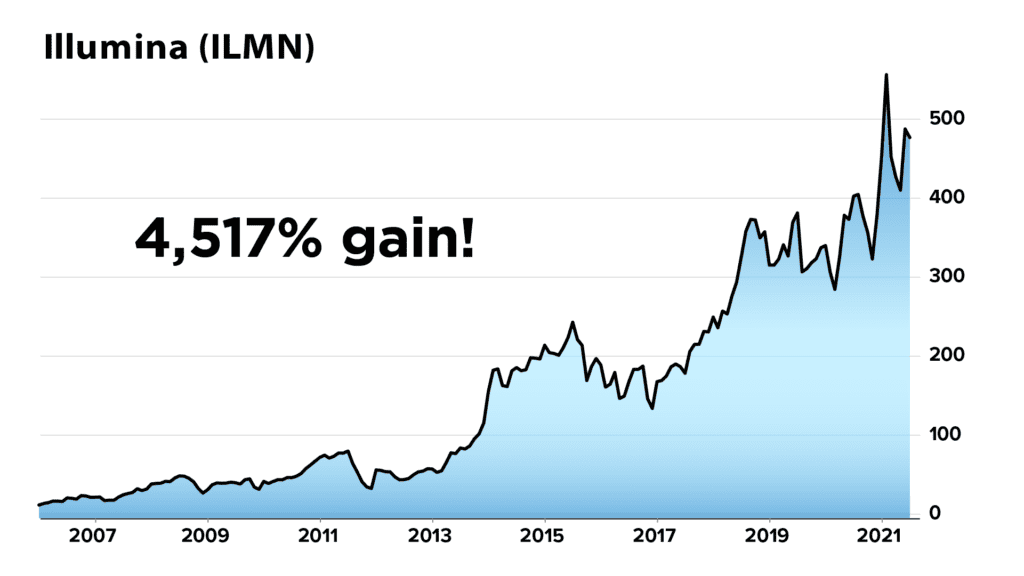

Consider Illumina, for instance…

This is a company that does DNA analysis. And in the early days, nobody really knew what would happen next with DNA research.

But watch this… Run the stock through our system.

ANCHOR

Huh… What is that, a 300% earnings distortion as far back as 2006?

JOEL

This company was minting cash. At one point, its true earnings were 5 times higher than the number reported on Wall Street.

Of course, there was still no telling if gene therapy would ever gain mainstream approval. But all you had to see were the big earnings and realize all the attention on gene therapy was an ongoing catalyst.

Sure enough, you could have made a 4,517% gain.

Bottom-line: Just by focusing on the true earnings, you can accurately pick up on some of the biggest stock moves, sometimes years before the story appears in the press. That's why some people pay $100,000 a month for our data.

ANCHOR

So essentially, the system does all the thinking for you…

JOEL

We call it the Altimeter. For us, “Altimetry” is the study of how high things can go.

But I wouldn't say the system does all the thinking.

I'd say the system finds which companies will surprise the public with earnings… which, for better or worse, only the wealthiest people on Wall Street typically have access to.

ANCHOR

Is this also true of major trends…? Something like crypto?

JOEL

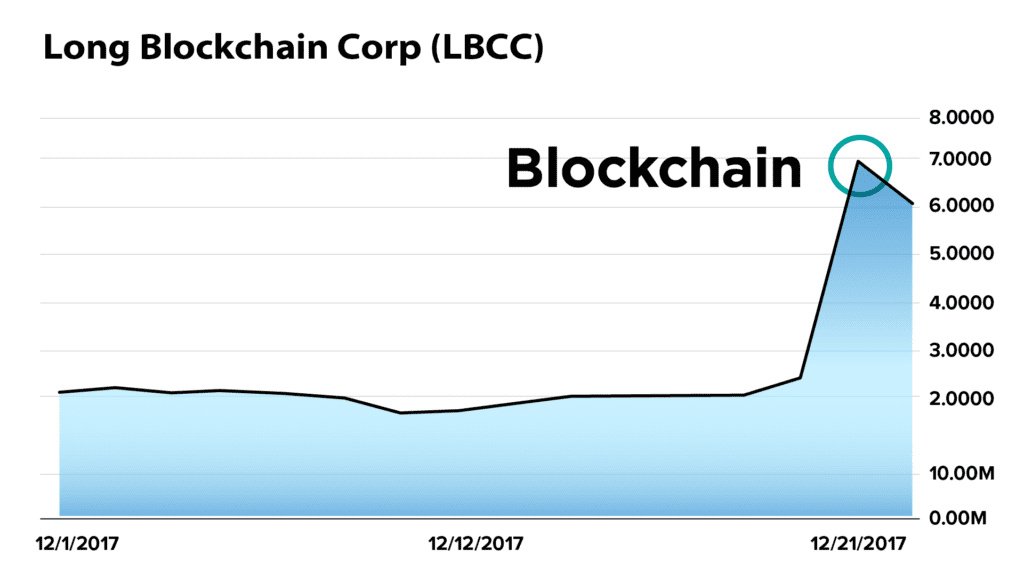

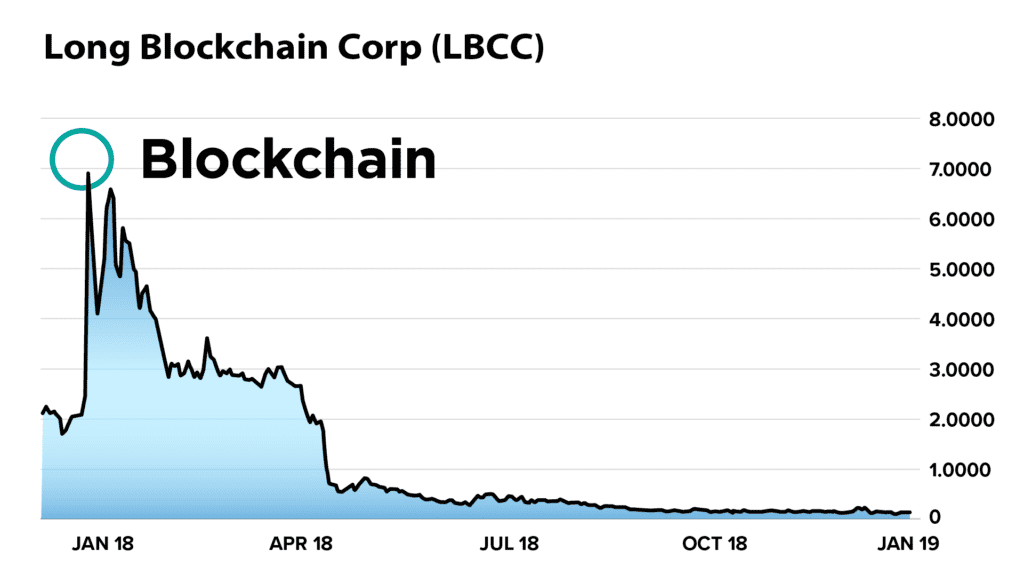

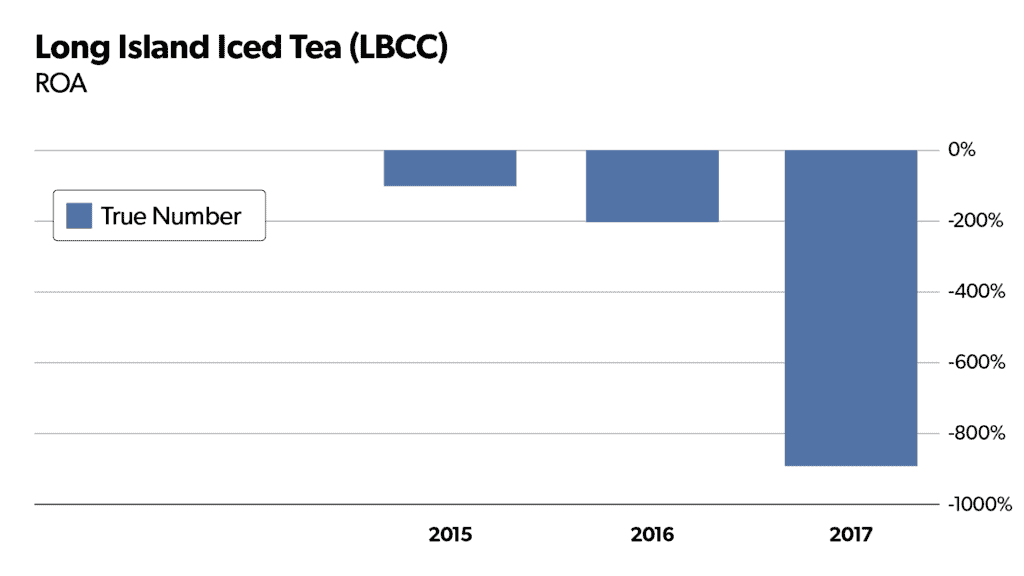

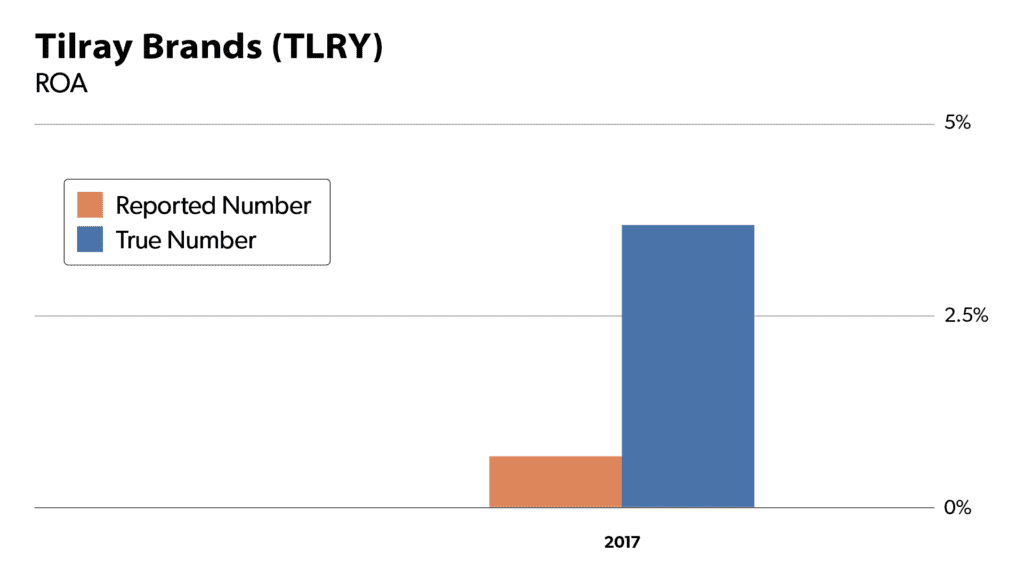

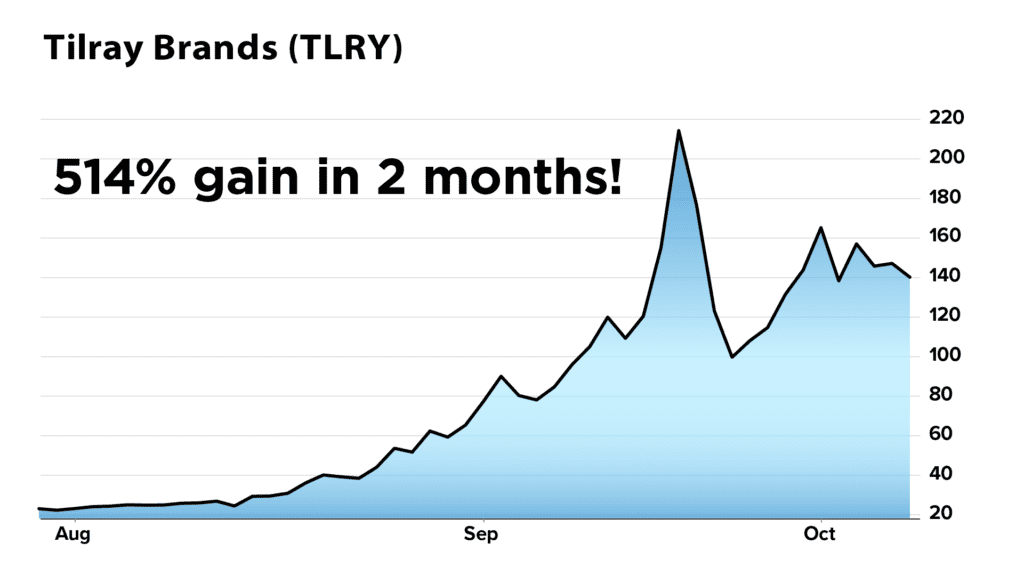

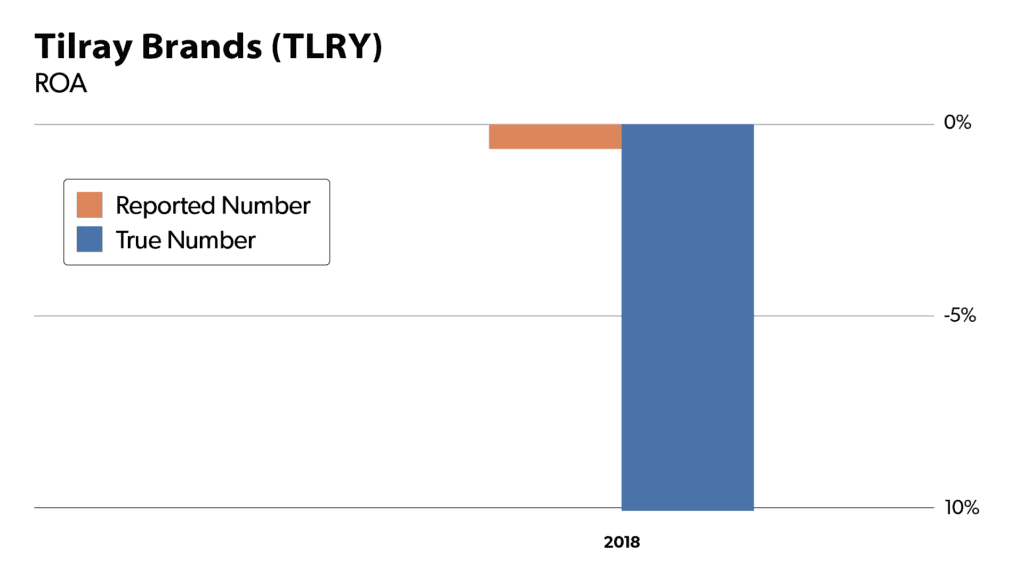

Well, consider what happened back in 2017…

Cryptos were so hot that some of the smallest companies tried to cash in on the hype by adding “blockchain” to their name…

For example, a company called Long Island Iced Tea changed their name to “Long Blockchain Corp.” And this nonsense actually worked! The stock soared 200%.

But just four months later, no surprise, investors got wiped out when the stock crashed 90%.

But now, consider this…

Suppose you'd run our forensic analysis on Long Island Iced Tea BEFORE you got in. You'd have seen that the company's income, which had already been negative, had actually gotten almost 3 times MORE negative over the previous year.

And you'd have avoided it completely.

ANCHOR

But there's a flipside to this story, I take it…

JOEL

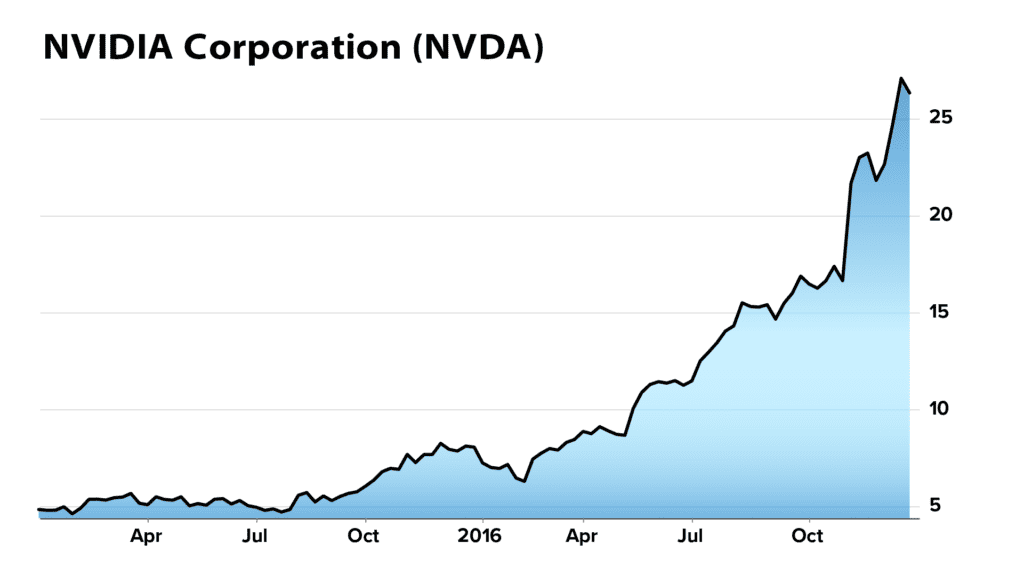

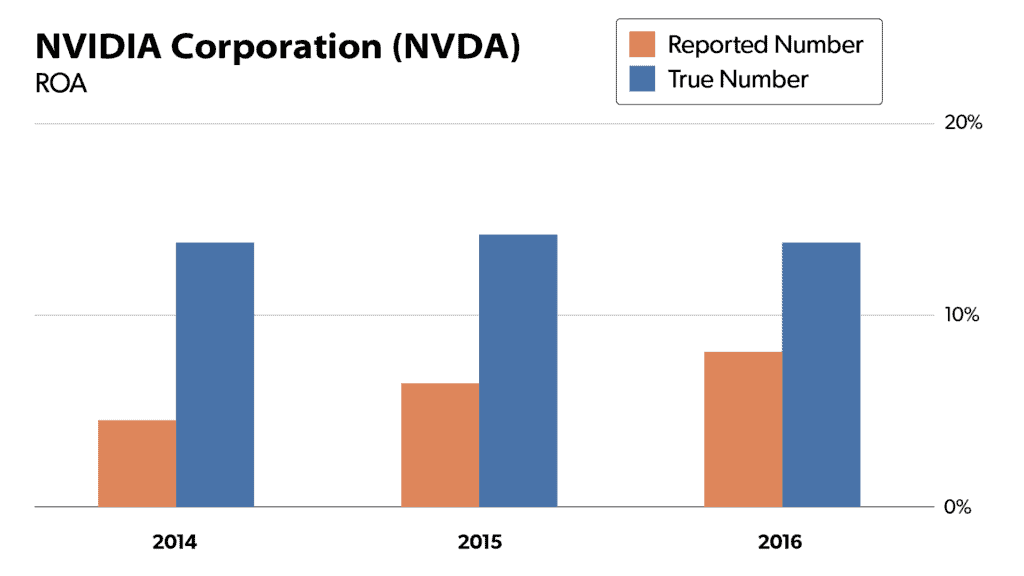

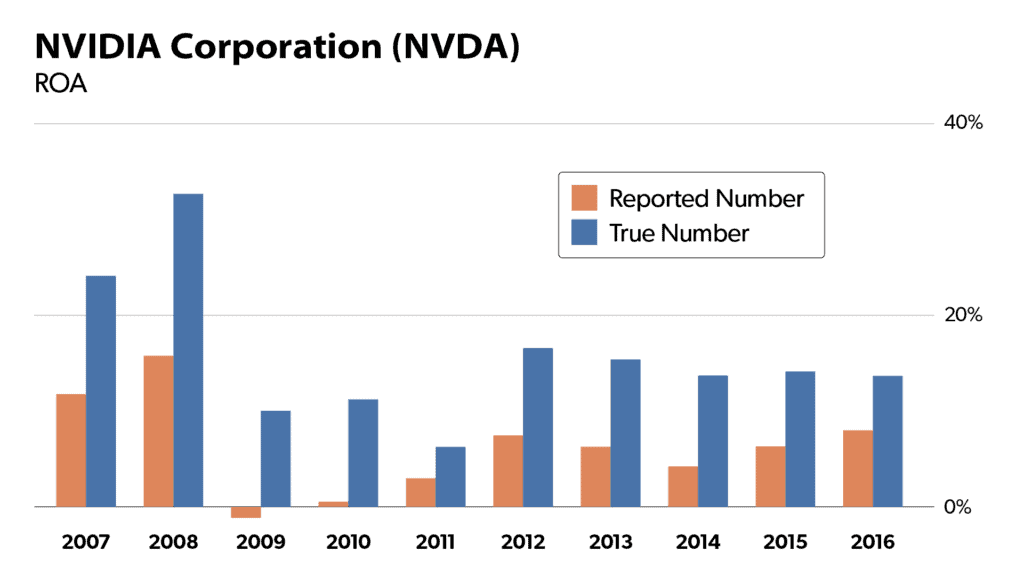

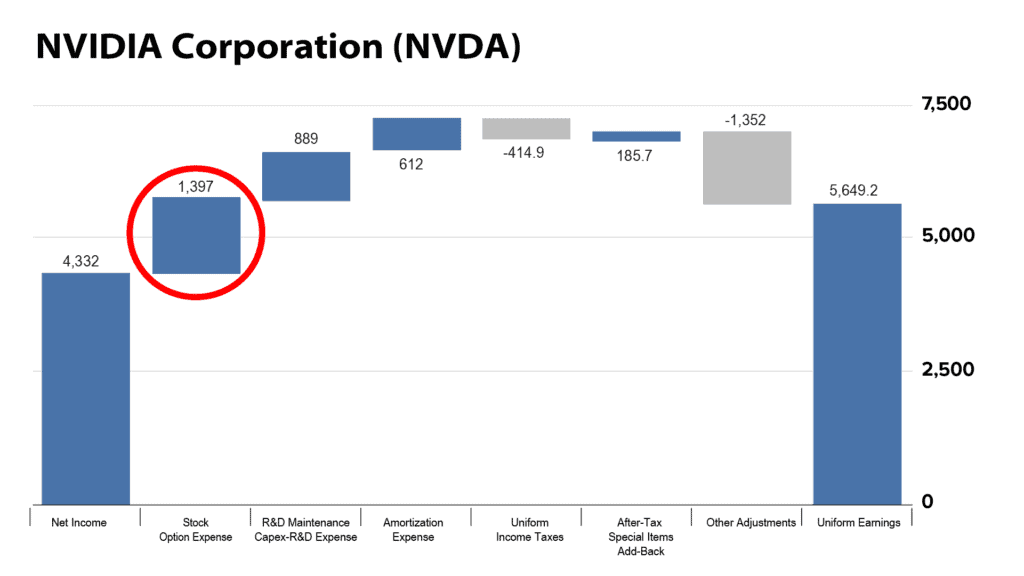

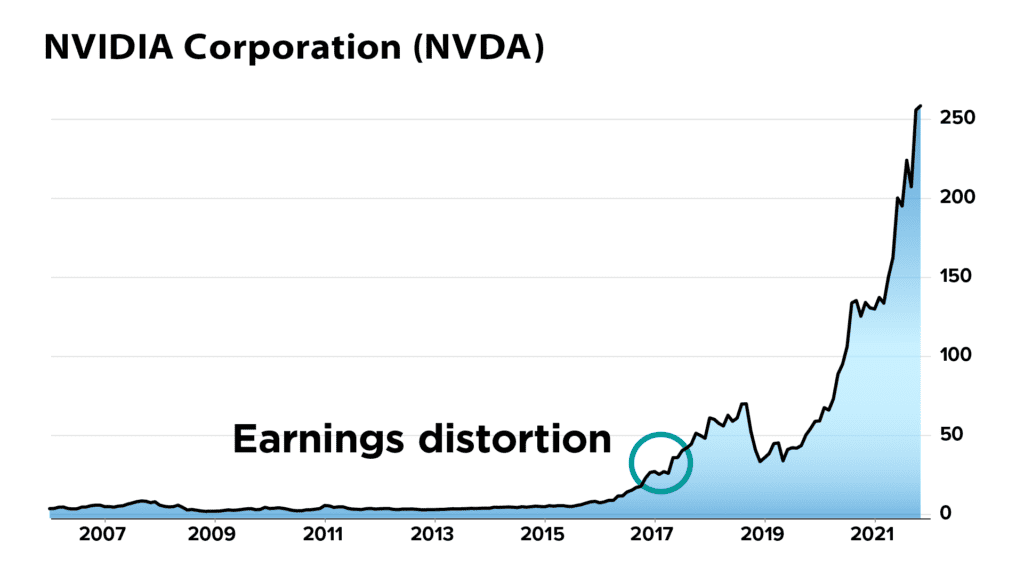

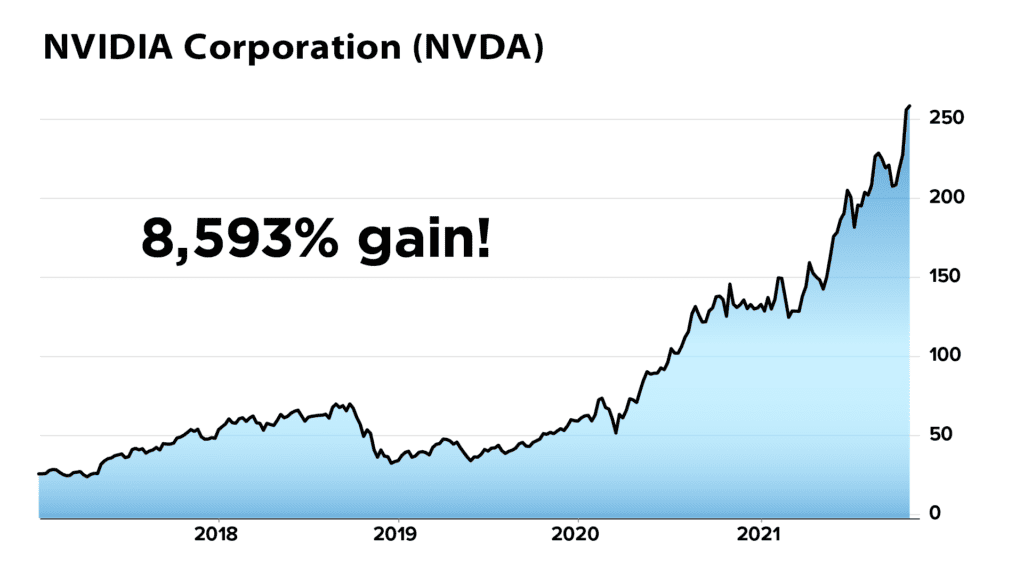

There is. In this case, John, by using our system, you'd have seen that another company entering the crypto sector for the first time was actually the real deal… And that's Nvidia.

People know them as a chipmaker for the gaming industry. But in fact, back in 2017 – the same year as all that Long Island Iced Tea nonsense – they issued a chip for crypto miners!

And were consistently pulling in higher earnings than publicly reported. Up to 3 times higher.

ANCHOR

How long had that discrepancy been going on?

JOEL

2006!

Among other reasons, they recently under-reported earnings by $1.3 billion because of how stock options are wrongly treated in their financial statements.

This stock had none of the hype of all the “blockchain wannabes” that made headlines.

But if you'd seen its true earnings during the 2017 crypto boom and bought in on that catalyst, John, you'd have made up to 11 times your money…

And get this…

If you'd seen the distortion at the very beginning and bought in, you'd have made up to 8,593%!

ANCHOR

Remarkable – what is that, 86 times your money?

So for you, it's more about seeing what NO ONE ELSE CAN SEE – whether that means avoiding the garbage or finding a better way to play a popular new sector.

JOEL

Yes. And this is why the FBI, law firms, and some of the biggest hedge funds in the world have invited us to their headquarters to show them how we do this type of analysis.

ANCHOR

It seems unethical, though, that the government abides by an accounting system where only banks or wealthy investors get to see which stocks have a real chance of making you money.

The 800% “boost”

JOEL

I couldn't agree more. But there's a way to use this to your advantage…

Because the fact is, each of the best microcaps have a “tipping point.” It happens at the exact same point in time for each company. And that's when they cross the $500 million mark.

ANCHOR

You mean when the stock's market capitalization passes $500 million?

JOEL

Yes. Remember: Wall Street knows how valuable it is to find these distortions. Especially on small stocks. But LEGALLY, they can't actually touch them until they attain a market cap of $500 million.

So they keep these stocks on a watchlist, waiting for them to grow big enough to pass that mark.

ANCHOR

Why can't they buy them before that?

JOEL

A section of U.S. law dating back to 1830 called the “Prudent Man Rule” forbids pension fund managers and other large institutional managers from investing in microcap stocks smaller than $500 million.

The idea is that a prudent bank shouldn't be pouring money into a stock that can experience huge swings.

And with most microcaps, that's true!

But of course, NOT with the ones where you can see they're destined for massive earnings growth.

So Wall Street has to wait on the sidelines, basically DROOLING over these stocks.

Meanwhile – by using our system – you can BEAT them at their own game and get into these stocks BEFORE they do.

ANCHOR

That's a huge advantage, for sure. I mean, if you knew one of the biggest hedge funds in New York was about to go “ALL IN” on some microcap… you'd want to get your money there FIRST.

JOEL

John, nothing can make you richer than getting a piece of an unknown stock AHEAD of the smart money on Wall Street.

Essentially, these microcaps with a huge earnings distortion receive a kind of “boost” by Wall Street that can propel the stock up as much as 100% on just that flood of institutional money alone.

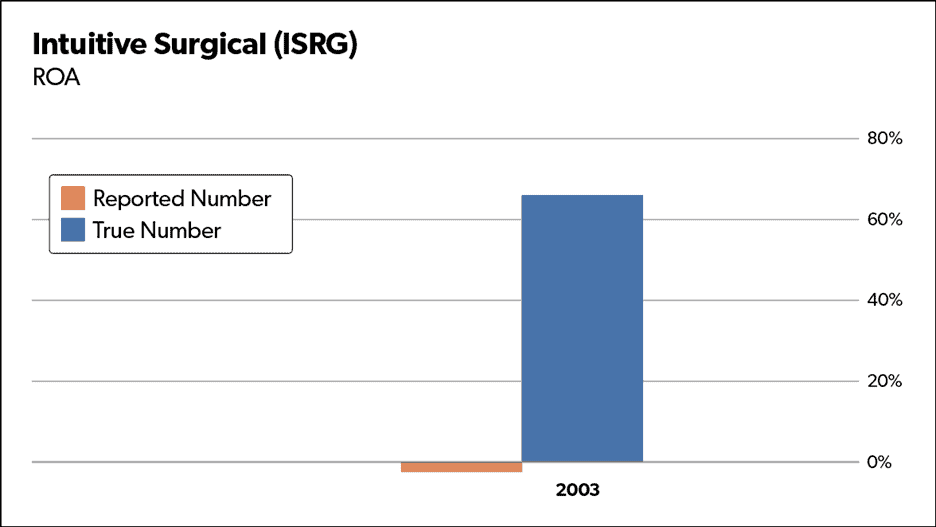

Take Intuitive Surgical, for example…

ANCHOR

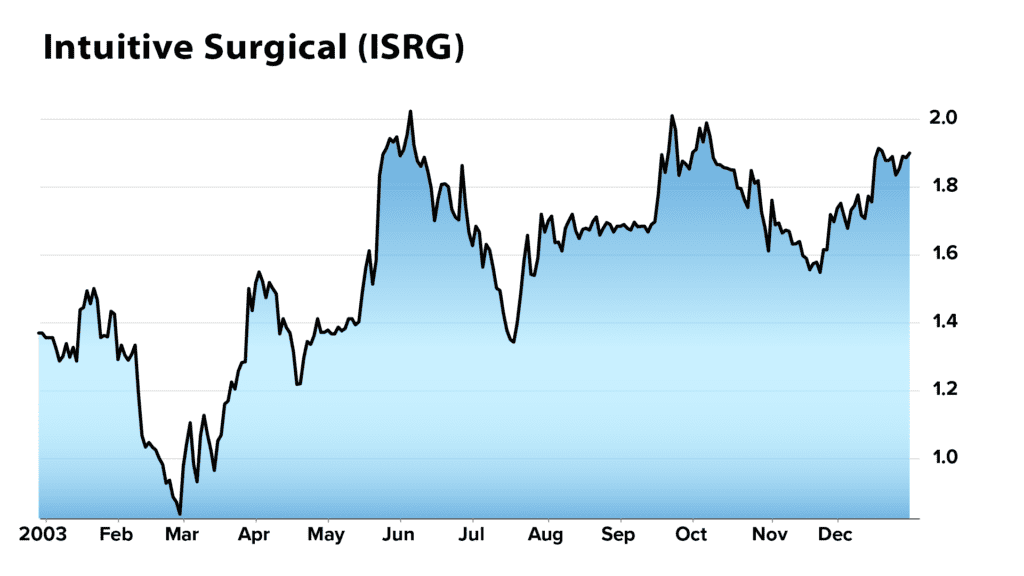

OK, looks like a pretty major earnings distortion back in 2003…

JOEL

Yep. If you'd bought the stock on that information alone – with no Wall Street coverage at all – you'd have made 75% by year's end. Just from the steady trickle of money that any company with good earnings attracts.

Not bad.

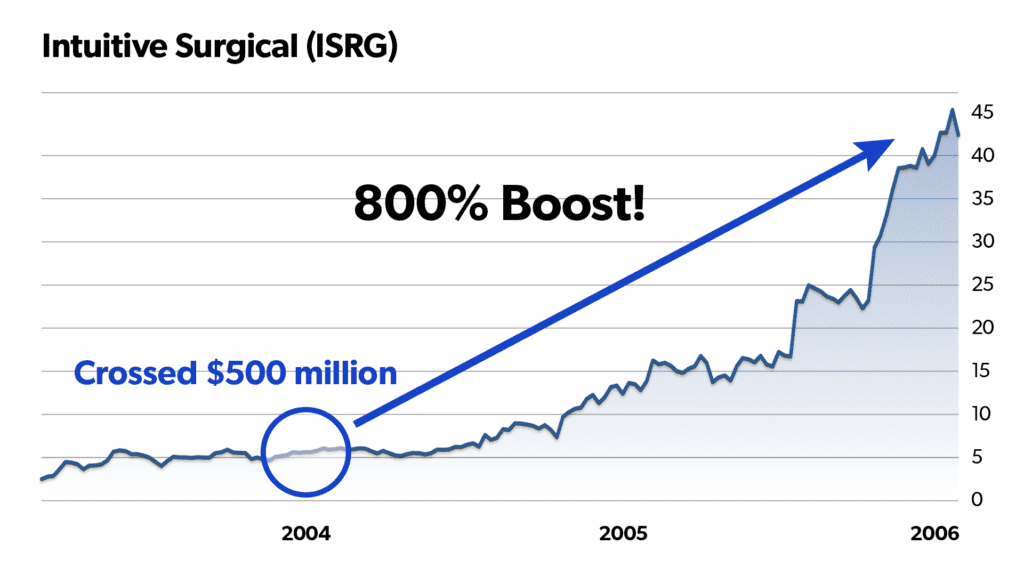

Meanwhile – the distortion continued into 2004. That's when the stock officially crossed the $500 million mark.

ANCHOR

Just from natural growth…

JOEL

Yes. But the second it crossed $500 million, like flipping a switch, the stock appeared on every screen on Wall Street. And for the first time, institutions were able to legally buy the stock.

Within two years, the stock rose another 800%!

ANCHOR

Crazy. And this extra “boost” was simply the result of ALL THE WALL STREET MONEY that finally began pouring into it…

JOEL

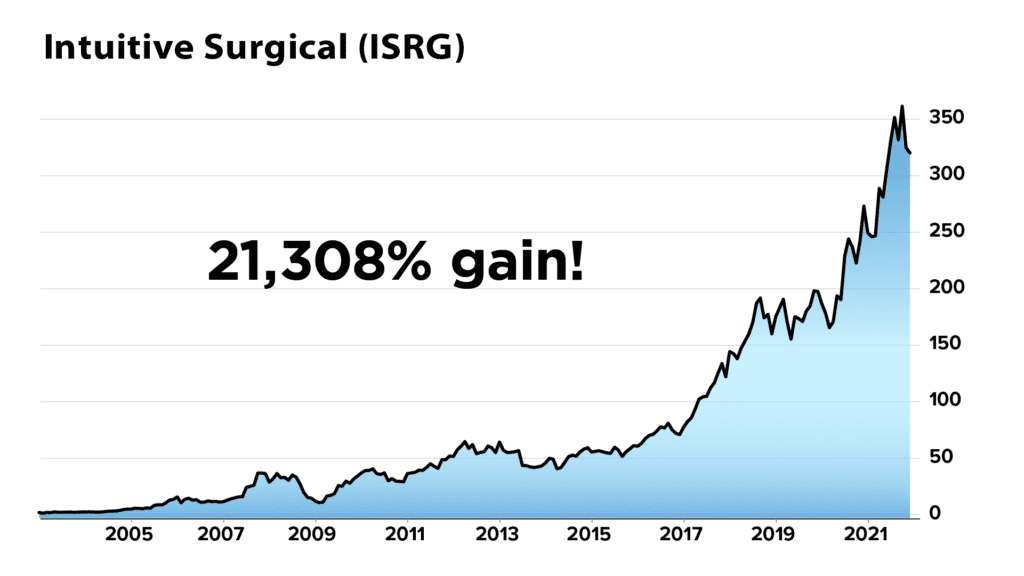

Yep. But the earnings distortion continued… which helped drive the stock higher and higher.

And this is where microcaps get really exciting.

$5,000 in Intuitive Surgical stock 17 years ago would be worth more than $1 million today.

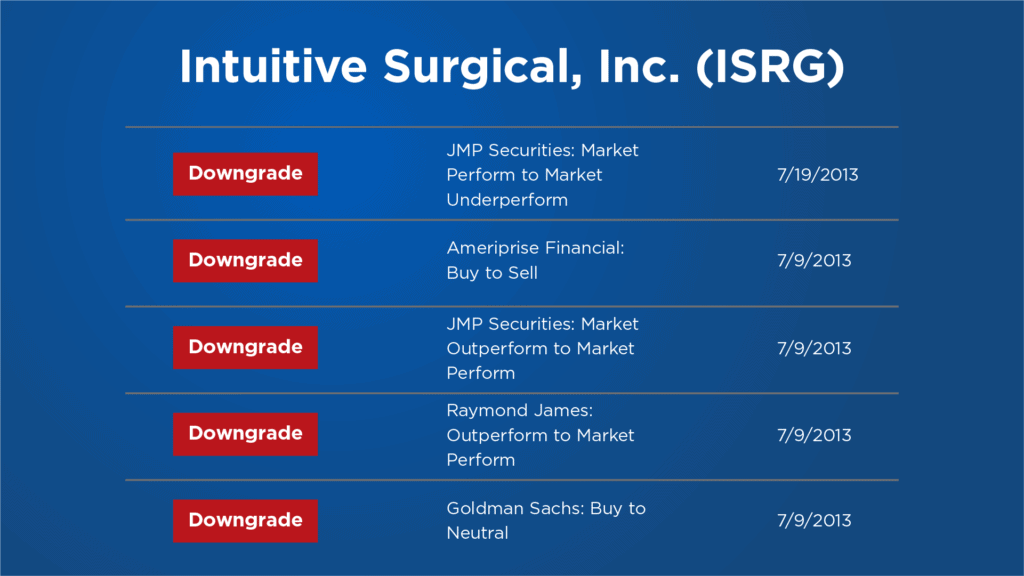

And along the way, 5 different banks on Wall Street downgraded the stock, John. Including Goldman Sachs!

ANCHOR

Wow. You can't trust the banks at all, can you?

JOEL

Not if you want the chance to make serious money.

Now, imagine getting a potential boost like this on almost every successful microcap stock you find… And you'll see why some people consider this approach the biggest secret in U.S. finance.

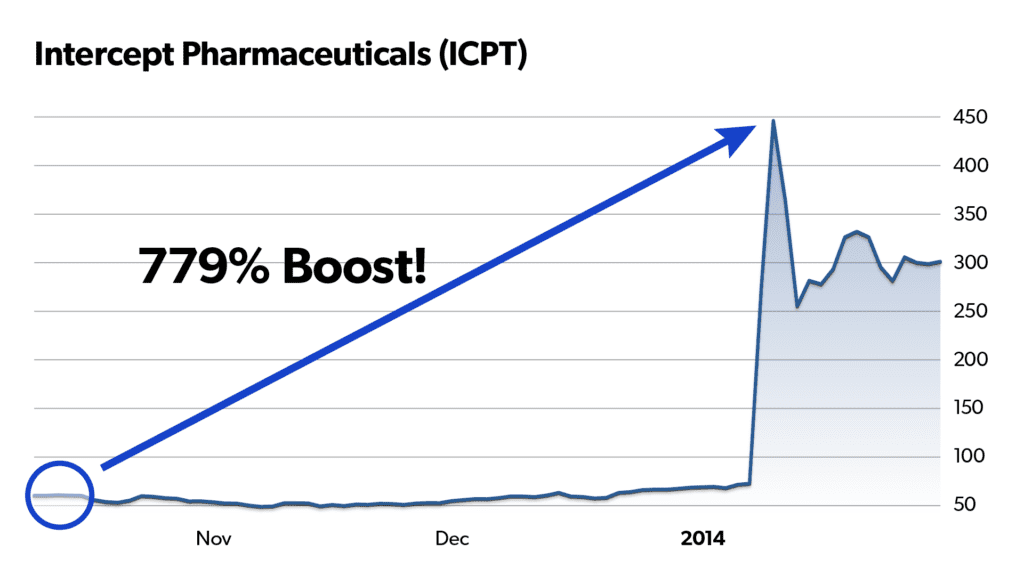

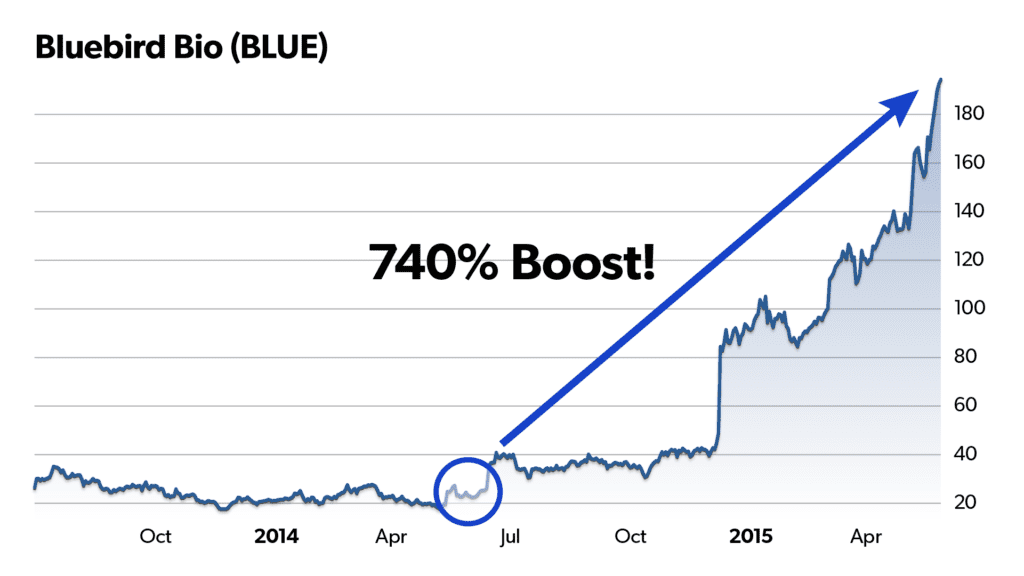

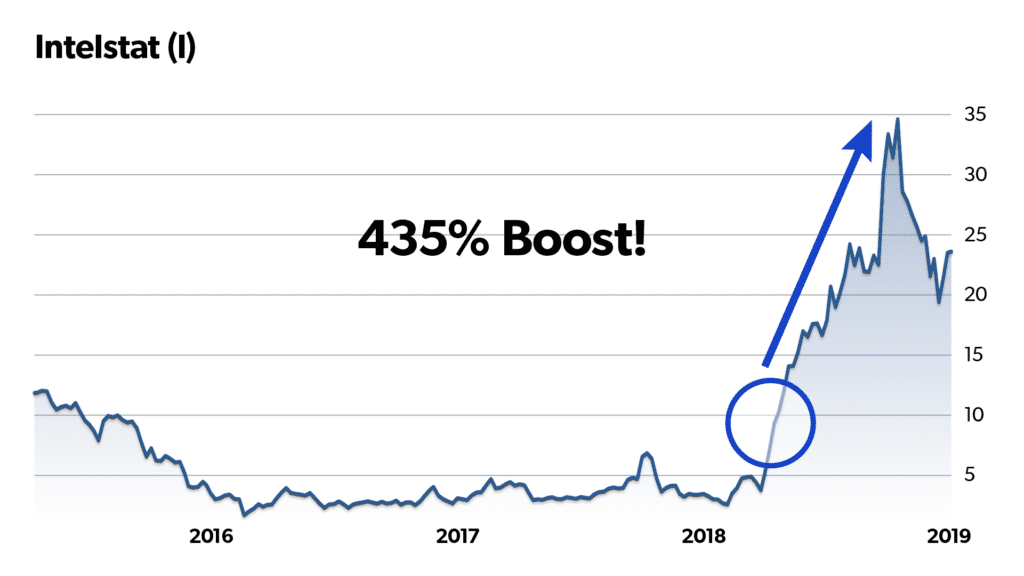

For example, consider Intercept Pharmaceuticals…

In this case – you could have received a 779% boost when it crossed the $500 million mark…

Bluebird Bio, a 740% boost…

Intelsat, a 435% boost… and more.

Take a look…

| Crossed $500 million mark | Boost |

|---|---|

| Intercept Pharmaceuticals (ICPT) | 779% |

| Bluebird Bio (BLUE) | 740% |

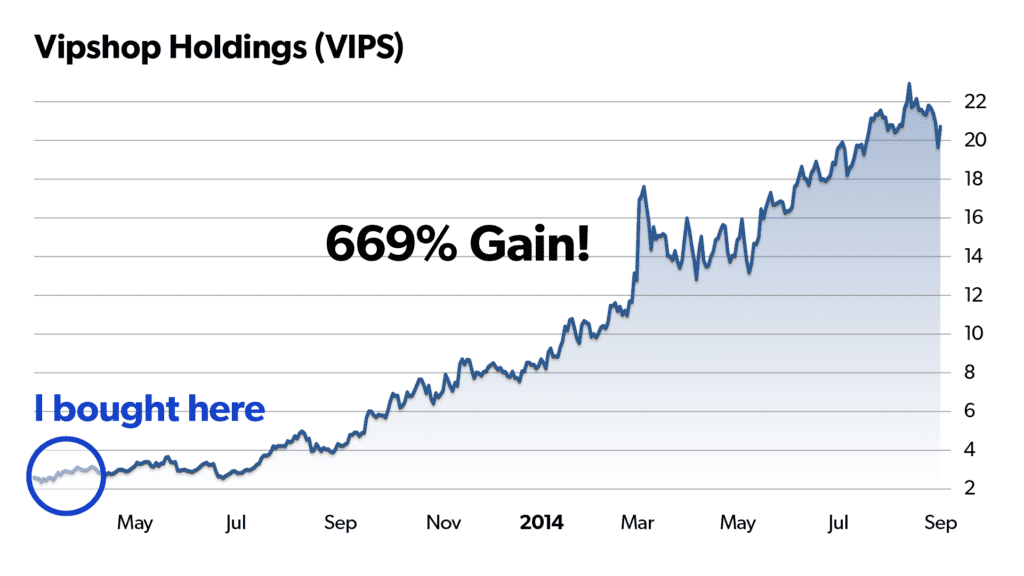

| Vipshop (VIPS) | 587% |

| Intelsat | 435% |

| Himax Tech. (HIMX) | 418% |

| Universal Display Corp. (OLED) | 312% |

| Enphase Energy (ENPH) | 305% |

| Dillard’s (DDS) | 268% |

| AnaptysBio (ANAB) | 217% |

| Sarepta Therapeutics (SRPT) | 178% |

| Exelixis (EXEL) | 106% |

| Sanmina Corp. (SANM) | 107% |

| Broadwind Energy (BWEN) | 157% |

They hide the errors from you

ANCHOR

When did you first realize Wall Street was keeping all of these opportunities to themselves?

JOEL

Back when I worked at Credit Suisse. I was finding all kinds of mistakes.

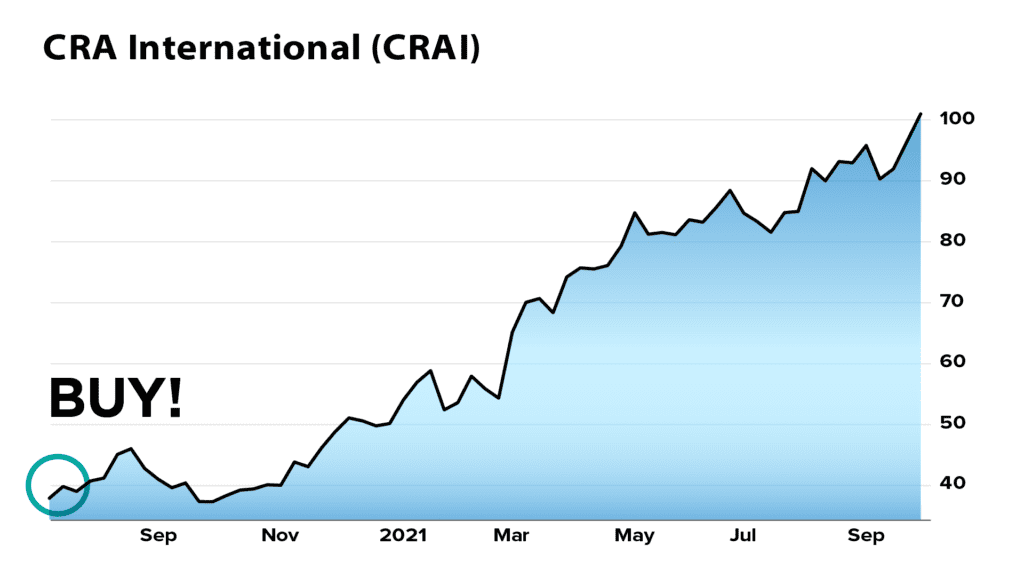

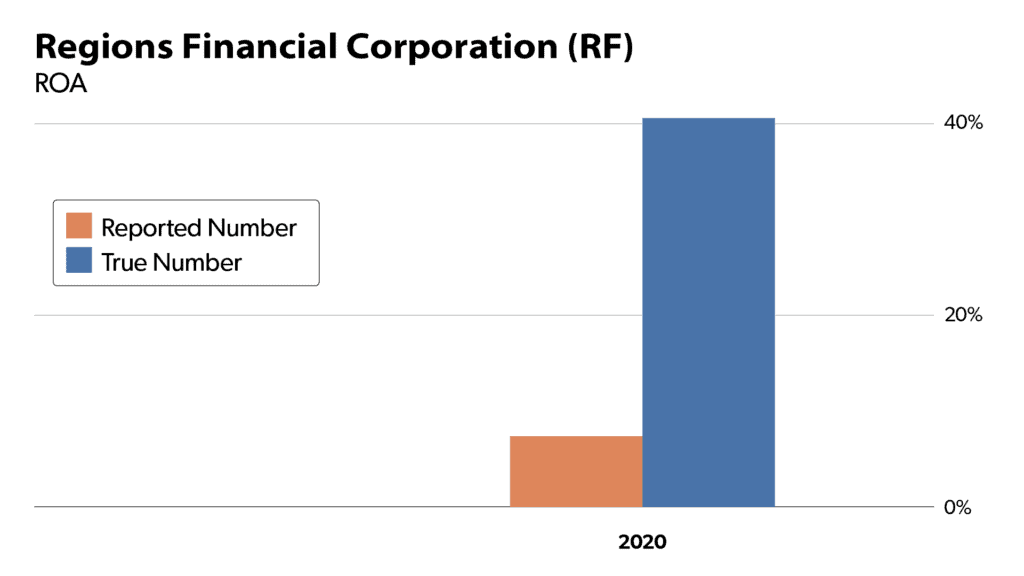

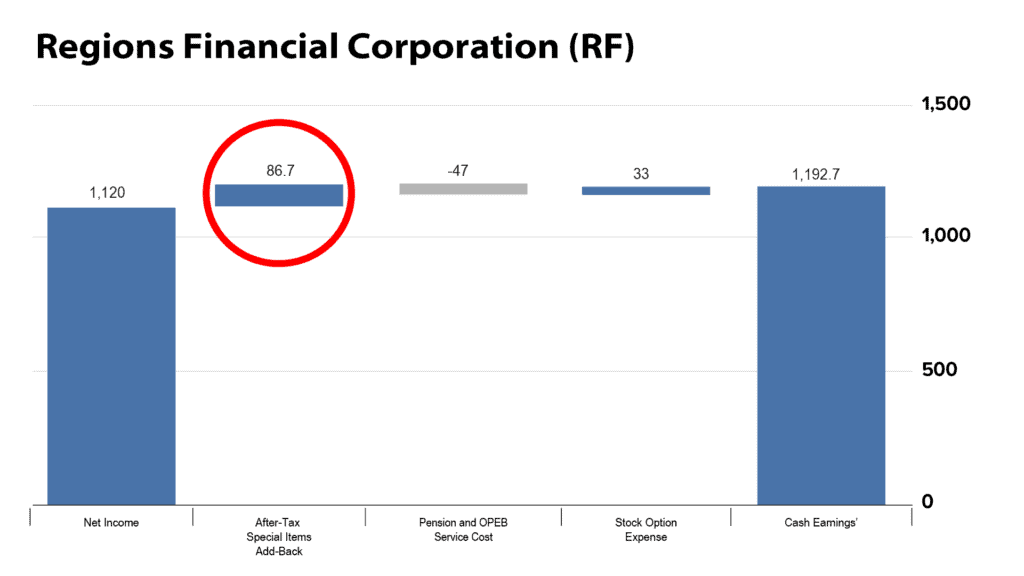

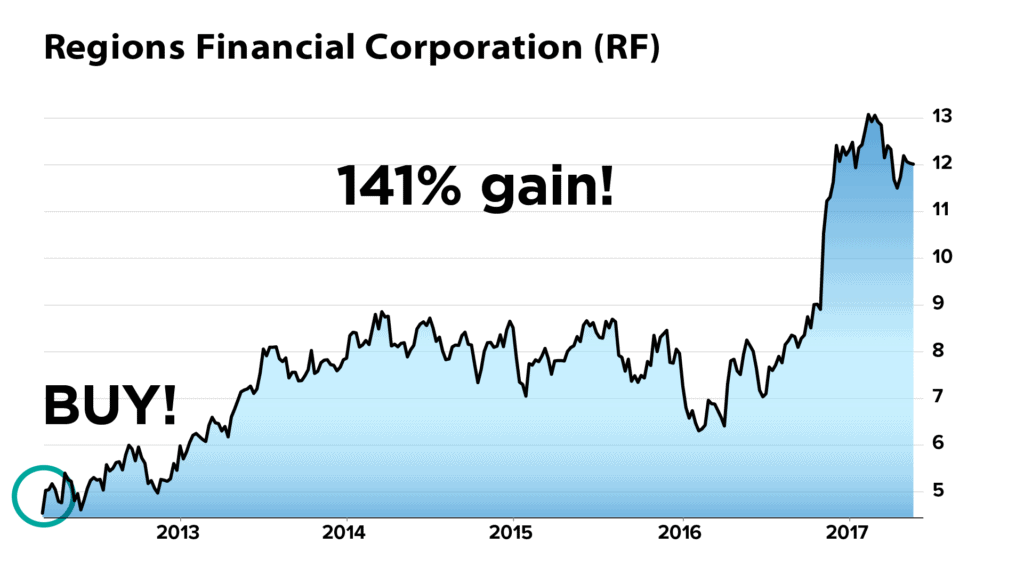

Take Regions Financial, for example…

Back on March 7, 2012, our team found a 460% earnings distortion in this banking company.

In this case, the company had $86 million in mis-categorized after-tax items on the balance sheet… an embarrassing mistake not to catch that – because it made the company look less profitable than it really was.

ANCHOR

I know you worked with two of the original authors of The GAAP Guide… so you must've found mistakes like this all the time on Wall Street…

JOEL

I did. As far back as 2006, I urged my old boss at Credit Suisse to prevent mistakes like this from going public.

After all, if a company like Regions Financial is one of your clients, wouldn't you work hard to catch these mistakes?

I thought so… so I built a system for detecting these financial “red flags” and received a U.S. patent for the basis of that system. But to my surprise at the time, the bosses at Credit Suisse buried it!

ANCHOR

What do you mean they “buried” it?

JOEL

I mean that NONE of the heads at a Wall Street bank had any interest in fixing these huge mistakes on the financial statements of their own multibillion-dollar clients.

And it wasn’t just Credit Suisse. Nobody else on Wall Street would ever be interested, either!

This completely floored me. I chose to study accounting to get to the real underlying performance of a company. After all, what's the point of researching earnings if the numbers are misleading?

ANCHOR

And that's when you realized something darker was going on…

JOEL

Very dark.

In short, Wall Street doesn't WANT these distortions to be fixed.

Money managers are fully aware of these distortions, John, and routinely take advantage of them for their own profit.

In other words, banks and money managers thrive on the earnings mistakes caused by standard GAAP accounting… because it allows them to see which stocks have the highest potential to rise 100% or more, BEFORE the general public has a clue. Especially in the microcap world. And especially during a big shake-up like we've seen recently.

ANCHOR

Gosh, is that legal?

JOEL

It's perfectly legal!

Is it fair? Well, that's a different story.

I don't think Wall Street should have exclusive access to this information. So I left Credit Suisse – not a surprise given that the title of my Harvard Business Review article was “Give My Regrets to Wall Street.”

I know you’ve published dozens of pieces in Harvard Business Review yourself, John, so you can imagine the shockwaves this caused…

After that, I launched my own firm with what is now 150 accounting experts, financial analysts, and support staff around the world.

Together, we run forensic accounting analysis on 32,000 different stocks… and we publish the TRUE EARNINGS in full – to the benefit of anyone who follows our analysis.

In the case of Regions Financial, for example, our clients could have made a 141% gain.

ANCHOR

I can certainly see why your old bosses at Credit Suisse probably aren't too happy about you spreading your system to regular individuals…

JOEL

That’s right, John. Any analysis even remotely similar to ours is primarily in the hands of the largest investors in the world who could afford the high costs of the research.

And they don’t like that I’m sharing it!

That’s why I’ve turned down 2 different job offers from BlackRock.

The fact is, earnings distortions are arguably the greatest secret in the history of Wall Street… especially in the microcap market.

How to get started right now

ANCHOR

OK, now, Joel… you've got a team of 150 personnel on three different continents running forensic analysis, to find these stocks…

But what about someone watching this… who DOESN'T have a team of analysts to find this stuff? How can I do this on my own?

JOEL

Well John, very few people are willing to bother with forensic analysis, because it takes extreme patience and a LOT of time.

But… it's well worth the effort.

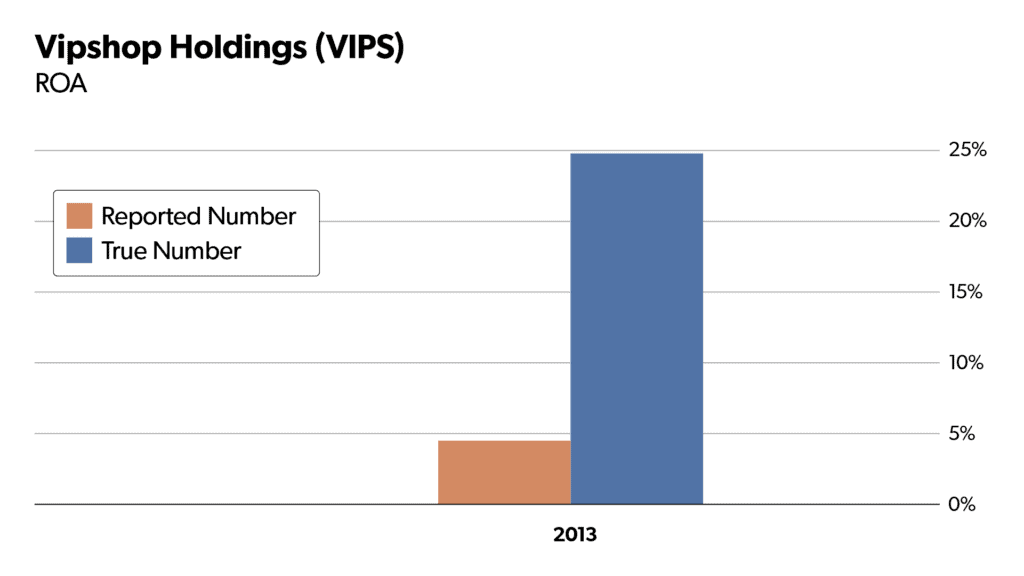

For example, I once made a 669% gain in about a year and a half on a small company called VIPShop…

…after discovering a $1.2 billion distortion in their financial statements.

But of course, most people just want a SHORTCUT to doing this. I get that. I mean, running the forensics on your own is about 1,000 times harder than doing your taxes.

So today, my team and I have written a full Research Report.

It's called: Microcap Secrets: How to Make 100% to 500% Gains Using Forensic Analysis.

Inside, it gives you a shortcut to using our approach, including:

- How to predict which microcaps could soon go up, in bull or bear markets, using TRUE earnings.

- Red flags that indicate a company may be headed for a crash. (In 2020 alone, we exposed a media stock that fell to zero with this secret.)

- The ONE number you must get right when deciding whether to buy a microcap for 100% potential gains. And more.

- Including the top 3 microcaps to buy right now.

ANCHOR

I know there are thousands of folks watching right now who are very excited to access your new report. But, realistically… even a report probably isn't enough to get started, right?

JOEL

Our report gives you an overview of how our system works.

But I agree… to do this analysis yourself, on more than 32,000 companies, updated every quarter, and knowing exactly which line items to correct? That would be impossible for anyone.

ANCHOR

And that's why, today, you're stepping forward in a big way…

JOEL

Yes. Up until recently, we mostly sold our findings to professional investment advisors… And again, these folks have paid up to $100,000 a month just to see stocks with huge earnings distortions.

But today, we're doing something with our online system unlike anything we ever imagined we would do.

We've launched a one-of-a-kind research service for everyday folks, called Hidden Alpha. “Alpha” is a term used by Wall Street to describe an investment with outsized returns.

And quite simply, it's the only place where, each month, you can get the full details on which companies have real potential to make you 500% gains or more… using our forensic analysis.

Each month, we'll publish all the details of our newest recommendation, including how each stock fits into our system's view of the market as a whole.

Most importantly… when the system says to sell, we'll alert you on when to close your position for the biggest potential gain.

ANCHOR

Got it. So in Hidden Alpha, you and your team show which companies have the biggest earnings distortions and what your forensics say…

JOEL

That's right. We focus on mid– to large-cap companies. And we also publish special portfolios, like the top 3 microcaps to buy now.

ANCHOR

And to be clear…

For years, ironically, your best clients were Wall Street institutions who knew about these distortions but didn't want to perform this analysis themselves. But today – you're making the results of your system available in a simple, all-in-one product tailored for the general public.

JOEL

Yes. We're tired of Wall Street having all the advantages.

So… after years of helping institutional investors get wealthier… today we're leveling the playing field by giving you access to the same information we've provided Wall Street for years, but with the ability to GET AHEAD of the smart money… every single month.

Today, for example, one of our newest recommendations is among the most promising we've seen in years.

Take a look…

This is the Return on Assets for a small company in the video streaming sector. And frankly, it's not that impressive.

But now – run the stock through the Altimeter and here are the REAL, TRUE earning power numbers. More than 2 times higher.

Even better, it's involved in a promising technology that could revolutionize the way we watch movies online.

That's a major catalyst, considering all the companies who are trying to become the “new Netflix” right now.

I urge you to buy this stock immediately.

You could double or triple your money. But only if you buy in now, before the public catches on to these numbers.

And that's just one of the stocks in our fully built, done-for-you model portfolio of 10 stocks we urge you to buy immediately.

Wall Street pays him $100,000/month

ANCHOR

Excellent. Now, in just a moment, we'll hold a demonstration of the Altimeter.

We'll show you the results of a variety of different popular stocks. Including Joel's FREE recommendation of the #1 little stock to buy NOW. And the #1 stock to avoid.

But first, I want to make something clear…

As Joel mentioned, for decades, his clients were institutional investors…

These are folks managing hundreds of millions to billions of dollars who make their living in the markets… and don't have the time or the resources to do this kind of analysis on their own.

They've paid Joel's firm up to $100,000 a month.

In other words: For two decades, unless you'd worked at the top 300 money management firms – more than half of whom have followed Joel, along with the top 10 money managers – you'd have likely NEVER known about forensic stock analysis and how successful it is.

But today…

Joel is sharing a unique way for you to access his analysis and all of his top recommendations yourself… to see which stocks are positioned to go up, which are positioned to go down… and why.

Each month, he'll name a company with the potential to double or triple your money, as the result of his deeply nuanced analysis of the earnings distortions on Wall Street.

And by the way… I’m a retired Harvard Business School professor and former senior partner at PricewaterhouseCoopers. I’ve taught at Oxford, the London School of Economics, MIT, Wharton, you name it. And let me tell you: I RARELY endorse anybody.

But the fact is, I’ve been using Joel's research for 20 years…

And I can tell you that Joel’s forensic-based analysis is an absolute must-have if you have any serious assets in the market. It’s the only RATIONAL way I’ve seen to evaluate which stocks give you “alpha” – a serious edge in performance power.

So, as you can imagine, a lot of people have paid good money for Joel’s work.

For example, in the past, Joel has charged $2,000 for a complete, monthly updated model portfolio of his microcap stock picks… and thousands of people have happily paid that price.

But today, Joel is doing something special for everyone watching.

In short, you can try his work RISK-FREE.

Typically, Hidden Alpha will cost $199 a year.

But because we’re at a rare moment in history, when a historic sell-off across the market has created enormous uncertainty for most Americans… he’s agreed to do something incredibly generous

If you order right now, you can try Joel’s work risk-free… for over HALF OFF the normal rate.

You’ll pay just $49 for an entire year.

That’s a 75% discount.

And again, it’s totally risk-free for anyone watching right now.

That means you’ll have the next 30 days to review Joel’s special report and model portfolio… which shows you which stocks could double your money by applying forensic analysis to company earnings.

I think you’ll find this offer more than pays for itself…

As subscriber Chris H. writes,

In fact, one of Joel's first ever subscribers was Dave Daglio, a former Chief Investment Officer at BNY Mellon, which has $1.8 trillion in assets under management.

The best part, though, is that you can get all of this for less than the price of a casual dinner. And if you’re unhappy… you can get a FULL CASH REFUND of everything you pay today.

To get started, simply click the link below right now to place your order.

And keep in mind…

We haven't even gotten to the best parts of this offer yet!

When you join Hidden Alpha today, you'll also receive three incredibly valuable bonuses…

Beginning with one particular bonus that could show you how to make even more money with your subscription…

And change the way you look for stocks, forever.

Joel, can you talk about that?

BONUS #1: FREE access to his system

JOEL

It's simple. Through today's special offer, we'll also give you FREE ACCESS to the system itself, for the next year.

You can type in any stock ticker… see its true earnings… and see what's REALLY going on inside the stock.

For example, let's do a live demo on some of the FAANG stocks.

ANCHOR

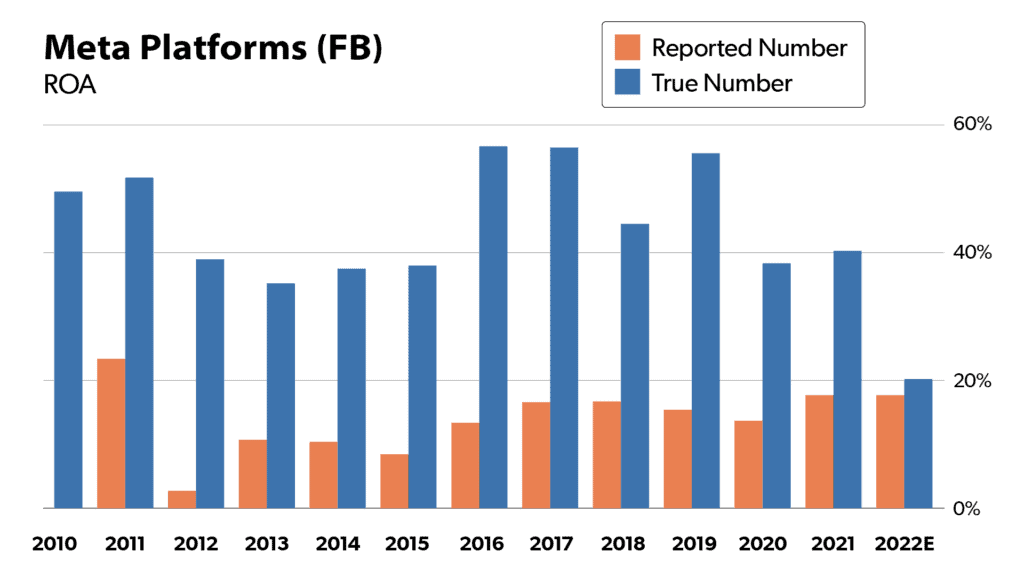

Sounds good. I'm personally curious about Facebook.

They recently changed their name to Meta Platforms… which makes me question their entire business model. What does the Altimeter say?

JOEL

Type in Facebook… One click – and boom!

The company's true earnings have been more than twice the reported number, John. And that's why up until recently, anyway, the company had impressive profitability.

In fact, our team recommended Facebook to our clients back in 2013, when we first noticed this. We corrected 50 distortions in the financial statements… and saw a 1,300% gain.

But… then they changed their name to Meta and poured way too money into the metaverse. Big mistake.

The company has underperformed on earnings… causing a huge drop in the stock of late, enough to make Jim Cramer cry on national TV.

In fact, we recommended selling Facebook on October 5, 2021 – almost at the EXACT TOP. It’s down over 66% since then, as Mark Zuckerberg realizes no one really cares about the metaverse.

This is what I mean by worrying about a crash within INDIVIDUAL stocks or sectors rather a market-wide crash itself. In this case, the growth in streaming just isn’t there anymore.

So I’d recommend you AVOID this company until those fundamentals look a little better.

ANCHOR

Let's move on to Apple…

JOEL

Type in Apple…

And lo and behold, another massive earnings distortion. There's a reason why this stock has had such a fantastic run.

They're minting cash, year after year.

ANCHOR

Got it. And finally – Netflix…

JOEL

Netflix, we looked at earlier.

The true earnings are 5 times higher than the reported number, John.

And after a significant sell-off, the stock is up almost 50% in the last few months

Granted, the market worried this “commodity business” was slowing down. But our metrics have showed returns are still very robust.

So at this point, I think Netflix might be an interesting stock to watch. But to be honest, you're much better off putting your money to work in the microcap stocks we're recommending.

Again, these stocks are smaller, so they have a lot higher profit potential than Netflix.

In fact, besides the multi-baggers we've already recommended, we recently backtested our system across the entire universe of microcaps to see exactly how much money you could make in this kind of market.

And the results blew us away. Take a look…

- 1,701% gain on SIMO

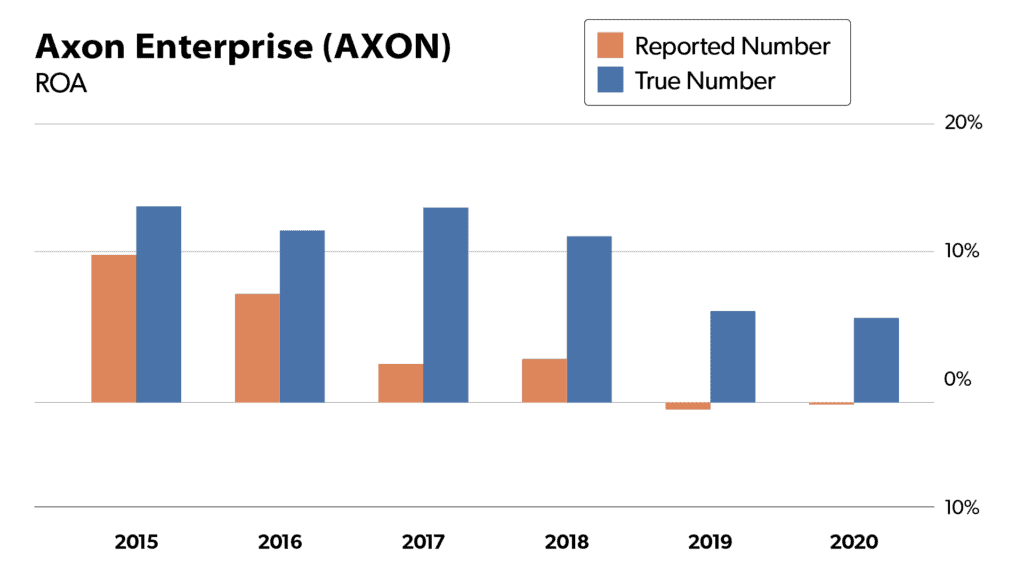

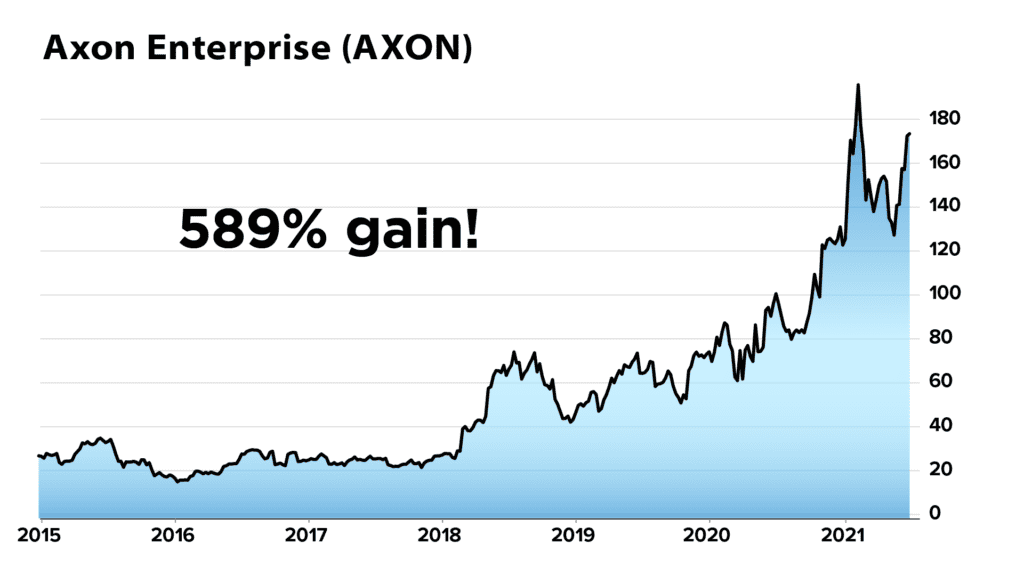

- 1,772% gain on AAXN

- 1,257% gain on JAZZ

- 1,107% gain on MLNX

- 1,056% gain on MDCO

- 1,157% gain on ALNY

- 1,216% gain on AMED

- 741% gain on ADUS

- 777% gain on LHCG

- 457% gain on ASGN

- 663% gain on PRFT

- 611% gain on PRSC

- 495% gain on AEIS

- 506% gain on USPH

- 472% gain on MED

- 222% gain on INGN

- 415% gain on JKS

- 289% gain on HA

- 395% gain on GTLS

- 321% gain on KAI

Altogether, you could have made 10 times your money on 7 different occasions by applying our forensic analysis to microcaps.

And more than quadrupled your money 17 different times!

THIS is where to put your money right now if you want 500% to 1,000% upside. Not the FAANG stocks.

ANCHOR

Great. So there you have it.

Order now, before today’s offer expires, and receive one FREE year of access to check out any of the S&P 500 stocks in our Altimeter system – so that you can plug in your own large-cap stock ideas and run this kind of analysis on almost any company, industry, and trend.

And of course, you’ll also receive up to 75% OFF Hidden Alpha…

And TWO MORE BONUSES we haven’t even covered.

Not to mention, you can try all of this 100% RISK-FREE.

But today’s offer – the BEST offer, with all of the bonuses – could be taken down at any time.

So if you’re interested, we urge you to place your order right now. Click the link below to get started.

And keep in mind, even folks who’ve worked on Wall Street have openly praised Joel’s work. For example, we heard from Matt Rakowski, a former head of credit at Goldman Sachs.

He recently said: “Joel Litman’s forensic-based research has brought me significant gains in my portfolio. Some of the stock ideas are really incredible with huge upside, and long before the rest of the Street sees it.”

Now, Joel, I want you to run your system on two of the most talked-about sectors of late, with all of the big shake-ups we've seen.

And that's GOLD and OIL.

But real quick… let's talk about your refund policy.

What if a new subscriber to Hidden Alpha is unhappy?

100% Satisfaction Guarantee

JOEL

The biggest reason I’m doing this is because I want to help other people. That’s why we’re making this offer completely risk-free.

So if you’re unhappy with my work, simply contact our college-educated Customer Service Team at our 1-800 number and you’ll get a full, prompt, cash refund of everything you paid.

ANCHOR

Although, frankly, I doubt you’ll ask for a refund…

As subscriber Ruizi L. writes,

And we also heard from Dr. David Eifrig, a partner at the largest independent financial research firm in America. He's a medical doctor who once worked on the trading floor at Goldman Sachs. He says:

“I think Joel Litman is one of the most exciting things to come around in this industry in my lifetime. Joel has incredible insight into how businesses truly operate. When he showed me a stock recently, I immediately emailed my team and said “We’ve got to buy this.”

And by the way, once you get in, don't be surprised by the wealth of information you'll receive.

Joel puts an extremely high level of energy into EVERYTHING he does – not just with the investment world, but even his own personal life!

For example, I love this…

When Joel wanted to learn karate, he studied with a Kyokushin karate champion who held a world record for breaking blocks of ice.

When he studied Thai kick boxing, he sought out and studied under a four-time world heavyweight champion.

In other words, Joel Litman is exactly the kind of guy you want working on your behalf… because he never takes any shortcuts, and he goes to the absolute limit in everything he does.

And that's why Joel and his company Altimetry are releasing this special offer for his breakthrough investment research service, Hidden Alpha.