Table of Contents

- Introduction

- Who is Derick Aguirre?

- How I make enough money to replace my income

- When. To. Sell.

- There’s never any questioning the track record of these signals.

- The foundation of this signal is the mathematical equation

- A tool called The Position Sizer

- Let’s look at real investor portfolios…

- TradeStops is the safety net for our money.

- “Derick’s 7 Rules to Master Your Trading Mindset”

- “TradeStops — Pre-Buy Checklist”

- Go for it.

40-Year-Old Pharmacist Turned Stay-at-Home Trader:“

This investing secret allowed me to

retire in a bull market.

Now, I’m using it to

retire my wife in a bear market.”

It all comes down to ONE profit amplifier I discovered that can multiply the returns of newsletter picks by as much as 7X — without options, shorting, or any other gimmicks.

Hi, I’m Julie Devante, Creative Director for TradeSmith.

I’m so thrilled to be bringing you an event unlike anything you’ve ever seen before.

The man I have with me today has an urgent message for anyone who is overworked, scared, frustrated, or just fed up with the way things are going in this country…

If that’s you, you’re so lucky to be here today.

Because…

You’re about to see how it’s possible to achieve financial freedom through the stock market — even in the bleakest of times.

Yes, right here and right now… in this brutal market.

Where even the greatest financial minds of our time are having a hard time making a profit…

This man by my side…

Is NOT a financial guru trying to sell you a bag of parlor tricks…

He’s NOT a politician, celebrity, or influencer trying to shove politics down your throat…

He’s an everyday person who has tapped into something extraordinary.

That is, a way to amplify profits on stocks by as much as 7X — without using options, shorting, or any other gimmicks.

In fact, you could achieve these outsized results on the same stocks you already own.

And unlike most people you see on camera these days, this man has zero financial interest in whether or not you follow in his footsteps.

He’s NOT a salesman.

He’s here to share the unvarnished truth of how he got to where he is today…

A story that is bound to leave you speechless, slack-jawed, and utterly mesmerized.

His name is Derick Aguirre. He’s a father, investor, newsletter subscriber, and now an avid devotee of the unique trading signal we’re going to share with you here today.

Derick, thank you so much for inviting me into your home to speak with you.

It’s a real honor, Julie. Like you just said, I’m not a salesman…

But I do have a powerful message…

That I believe could do some good and actually help people recover what they lost this year…

AND, maybe even put them on a path to a life of freedom as opposed to being at the beck and call of your job like I was for so many years.

JULIE:

Derick, you’ve done something really extraordinary over the past few years. In 2019, you started with a pretty basic understanding of the financial markets…

And at that same time, you also made a decision to go part-time as a pharmacist while juggling a full-time role as a stay-at-home dad.

And yet, here we are now, 36 months down the road, and you have been able to retire FULLY — at age 40 — from your career.

You estimate that over the last three years, your net worth has ballooned considerably, which is incredible considering the sharp drop investors have experienced in their portfolios this year.

So, this basic understanding of finance turned into now having enough money to call it quits…

To never have to work “for the man” again…

Or pursue a career you never wanted to begin with.

DERICK:

Yeah, I’m a free agent for the rest of my life.

And I'm here to share the discovery I made a little over a year ago that changed everything.

It's actually rooted in a single math equation that I was completely unfamiliar with.

And I wager 99% of people watching this are as well.

JULIE:

Now, before we dig into that very juicy part of your story… we have another guest with us today.

Derick, can you do the honors, please?

DERICK:

This is my beautiful wife of 12 years, Liz.

JULIE:

Welcome, Liz.

Thank you.

I’m so proud of everything that Derick has been able to accomplish. He’s pursuing the life of his dreams. We both are!

So, we felt like it’s important to get our message out there to as many people as possible.

JULIE:

So, I want to make sure I get this straight…

Liz, YOU were actually the first person to stop and say:

“Wait a minute… Derick. Do you realize you are making more money as a stay-at-home dad than a pharmacist?”

LIZ:

Yes, that’s exactly right! Most people think a stay-at-home parent is someone who has taken a step back and that's not true.

They work incredibly hard.

Derick has taken that to a whole new level. He was maintaining his role as a stay-at-home parent, working part time as a pharmacist, and then doing his trading “on the side.”

Back in 2019, our twins were seven years old and our youngest was two.

When the little one was napping, Derick was learning how to make money by trading the markets.

First, it was just a few hundred bucks a week. But then, after six months, he was trading like a pro.

At that point, it was pretty easy to look at things objectively and say “Wait a minute. He's making more money trading. We don't need the pharmacy job anymore.”

DERICK:

Yeah, and it was last year… and for the first time we were able to take a good look at the money coming in from going to work versus the money coming in from trading.

And once you factor in the additional stress and time away from home that going to a job requires… there was no contest.

I put in my notice and have been staying at home and trading to bring in my share of the family’s income ever since.

JULIE:

Wow, what a satisfying moment that must have been.

I’ve had the privilege of meeting a lot of newsletter subscribers over the years — doctors, engineers, and business owners.

And you know what all these people have in common…

They all want to leave the 9-5 grind and make a living off the market as traders.

It’s a fantasy shared by everyone.

DERICK:

Yes, definitely. I still have to pinch myself sometimes.

I’m the rare person who will get to tell my grandkids that I left my W-2 at 40 for good to spend my time doing the things I love.

Not because I inherited a rich uncle’s estate…

Or collected a lottery jackpot…

The financial freedom I traded my job for was 100% self-manufactured.

And almost no one, except my wife and I, would have ever believed we could do it.

We don’t flaunt our wealth.

LIZ:

Exactly. Aside from our home here in Texas where we raise our three kids, we actually live very modestly. We don't flaunt our wealth.

DERICK:

That's also partly because of our background.

Liz is not even one generation away from poverty.

JULIE:

Is that right? Looking around, I almost can’t believe that. You guys are like the picture-perfect American family.

DERICK:

That’s kind of you to say. The kids get their good looks from me. Just kidding, it’s definitely my wife.

JULIE:

Ha, so humble.

But, Liz, can we take a moment to address what Derick just said? You’re not even one generation away from poverty?

LIZ:

Sure. Actually, I used to hide from this but now I'm not embarrassed at all. I've found that sharing my story is powerful.

So, I was raised in Poteet, Texas — where the poverty rate is double the U.S. average.

My family was so poor that we spent a year living in a tent underneath a tree.

For the vast majority of my childhood, we lived in this abandoned clinic with no electricity and no running water.

We drank rainwater and scavenged food from dumpsters just to survive.

We literally came from nothing.

No one expected me to rise up from this extreme disadvantage early in life and go on to become a successful physician.

DERICK:

And a real estate investor… podcaster… public speaker. Don’t be modest, love.

LIZ:

And Derick, he left college the semester before he was set to graduate with an electrical engineering degree, because he knew in his heart, he didn’t want to spend his life doing that. Then, he chose to be a stay-at-home dad over a full-time career as a pharmacist.

No one expected that Derick would be able to kiss it all goodbye at age 40 and replace his salary by trading.

But what he was doing all along was really living life on his own terms — and today is no different.

JULIE:

You know, what comes to mind here is the term “dark horse.” The type of person that seemingly comes out of nowhere and wins the race. Leaving everyone else stunned on the sidelines.

Give us a little perspective on the mindset that made that possible and how it ties into your investing, Derick.

DERICK:

Sure, I believe we’re here for a very short time and we need to do whatever it takes to spend it doing what we love —with the people we love.

And I love two things…

My family…

And the stock market.

I know, I know… my family’s way up there for sure.

Ever since I discovered the thrill of investing and trading the stock market, I was hooked.

LIZ:

Yes, I watched Derick devour books on how to become a better investor…

He joined Stansberry Alliance, so he could read every newsletter they publish…

DERICK:

I was always trying to do all the “right things,” you know. That I’m sure most of the people watching right now have already done.

I learned about “money management”…

I diversified my retirement portfolio to the recommended 60/40 stocks to bonds…

I followed CNN news feeds and traded on world events…

But none of these things led to me making enough money to replace my income as a pharmacist…

It wasn’t until I found this signal that I finally could begin relying on the stock market to grow our wealth instead of a job.

LIZ:

And I’ll add here that, given my upbringing, I'm extremely loss-averse.

So, Derick has to take that into consideration whenever he puts our money into the market.

DERICK:

I had to figure out how to ensure success, otherwise I knew Liz wouldn't approve.

And that’s what I’m here to share today — how I do that.

How I make enough money to replace my income while, at the same time, minimizing my risk to a level I would have never even thought possible.

LIZ:

I know firsthand what it’s like to live without money. And then when you get it, to always fear losing it.

I mean, I would have hidden all our money under a mattress if I could!

With Derick's help, I'm finally past that and we're here to share our story so that others can know what’s possible for them too.

Because life is short!

JULIE:

It sure is, Liz.

Derick, when I first met you in the halls at a Stansberry conference in early 2021, we were still in the midst of an exuberant bull market.

And you shared with me that you had already retired early…

What really stuck with me, though, was that when I followed up with you in 2022, in the throes of a bear market…

I got you on the phone and you remained absolutely undeterred.

You didn’t call up your old pharmacy and beg for a job back when the market started crumbling.

LIZ:

Julie, you are exactly right. We never once, even for a second, considered that.

DERICK:

Yeah, quite the opposite!

JULIE:

Right! You told me…

You are now on track to retire Liz from her full-time career as a physician!

In one of the worst markets of our generation.

Because you don’t get that kind of supreme determination unless you are 100% confident in the tools you have in your investing arsenal.

Would you say that’s accurate?

DERICK:

Oh yeah.

The fact that markets have completely turned around since I kissed my old life goodbye doesn’t matter one bit.

It doesn’t deter me at all.

And that’s because I’ve finally discovered the secret to not worrying about which way the market is moving.

Let me say something to those watching because I’ve been in their shoes.

I know you’ve probably heard that before in a lot of different sales pitches.

“THIS WORKS NO MATTER WHAT THE MARKET IS DOING!”

I know. I’ve heard it too.

And half the people who were shouting that from the rooftops are probably out of business at this point.

But I can say to you right here, as someone who’s in the same boat you are, that the signal I’m about to show you is…

A mathematical antidote to fear —

even when the market feels like its spinning out of control.

And that’s saying a lot when you no longer have the safety net of the job you left behind.

LIZ:

Seeing Derick have this kind of confidence in what he was doing really helped me have peace of mind too.

JULIE:

I’m sure everyone watching is ready to hear exactly what you’re talking about.

So, let’s respect their time and not beat around the bush.

What is the secret is that allowed you to walk away from a career to become a stay-at-home trader?

DERICK:

Absolutely. Let’s go for it.

While I rely on my favorite investment experts for almost all my stocks picks and trades…

I took the most important part of the equation and I handed it over to something much smarter than any human could ever hope to be.

JULIE:

What is “the most important part of the equation,” Derick?

DERICK:

It’s When. To. Sell.

Now look, a lot of investors and experts out there have systems in place for when to sell, I know.

Usually, it’s a trailing stop, which is a set percentage that you sell at. So, with a trailing stop… if a stock drops, say, 10% or 20%, you automatically sell it to stave off any additional losses.

But, blindly following a system like this can cost you a lot of money.

Because every stock is highly individual in the way its share price moves.

So, you don’t want a standardized sell signal, like a fixed trailing stop.

Because you end up selling your winners too early and holding your losers too long.

That’s why…

With the dynamic sell signal I’ve been using, I’m now beating the financial experts I follow at their own game.

And, look, I only really became a student of the markets three years ago.

So, if this signal can make all the difference for me, it can work for almost anyone.

And since discovering it, I LIVE by it.

LIZ:

Truthfully, we are always talking about this.

Even with his rules, it is hard. Our emotional minds want to react to the news or events that we think will influence the market.

Anytime Derick is struggling with wanting to break his rules, we sit down and talk about it and revisit why the strategy works.

DERICK:

Exactly. Even when you have an edge that you know works, you still have to be disciplined about following it.

But I get reminded pretty quickly. Because…

Anytime I've gone against this signal, I've lost money.

And it’s only served to reinforce my belief that without it, I can’t win.

I’ll even show you some of my mistakes betting against it.

JULIE:

That’s brave, and of course I’d love to see that, Derick.

DERICK:

Hey, for sure. I’m an open book. The good and the bad!

JULIE:

Derick, you mentioned you’re a financial newsletter subscriber.

Are you saying that you use this sell signal alongside the investment recommendations you get from analysts?

DERICK:

Exactly. It’s my override switch.

You know, I voraciously read over 30 newsletters.

JULIE:

30 newsletters?!

LIZ:

He’s legitimately obsessed with the stock market.

DERICK:

Of course, I have my favorites… but that’s a lot of research to take in. And more stock picks than anyone should rightly put their money into.

So, what this signal has been able to do for me is… it’s actually two-fold.

First, it pinpoints when to consider selling in order to protect myself from losses — which, this year especially, has been invaluable.

I could not make the money I do without this.

Second, it also lets me know — out of the sometimes hundreds of trade recommendations I get in a month — which ones I should actually make AND which ones I should steer clear of before I pull the trigger.

LIZ:

We sit down in the evening and talk about the trades Derick made that day.

It’s amazing how he knows when to sell… and he never even has to second guess his choice.

And he knows what to buy and what NOT to buy out of all the recommendations he gets every week.

Those were the two biggest struggles he used to face every day.

JULIE:

Now, before we met today, Derick opened up his accounts to me so I could see the trades he’s making.

Derick’s results are real-life trades, not backtests. And we’ll be sharing those results with you at home today.

You’re also going to…

See how this sell signal would have trounced the returns of investment newsletters that maybe even YOU subscribe to — by 7 times over.

So, if you subscribe to even ONE newsletter yourself, you do NOT want to miss this.

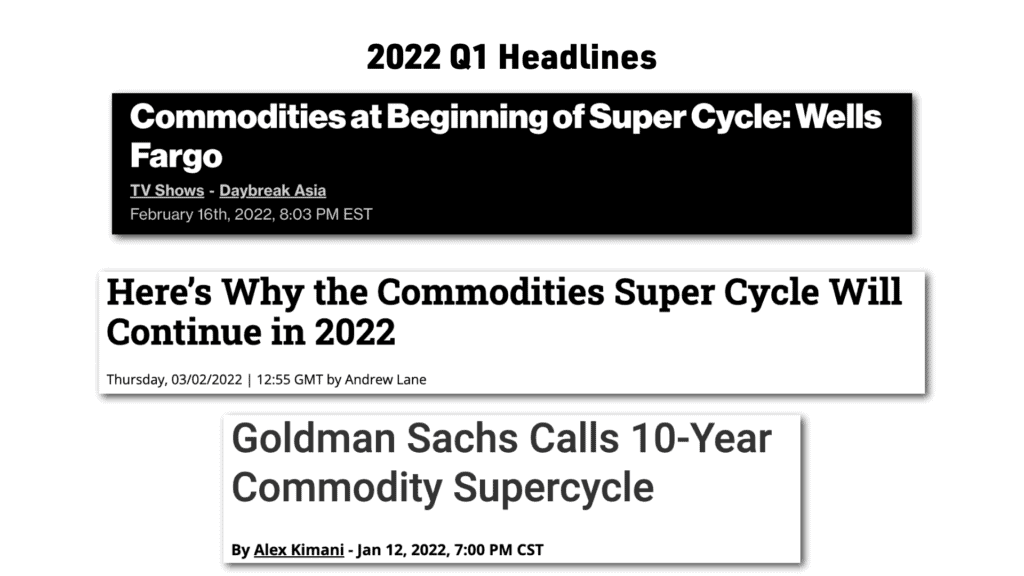

So, Derick, let’s look at an example of how this works. This year you invested in commodities stocks. A lot of analysts have been bullish on commodities.

We all saw oil soar earlier this year.

Many experts were calling this the beginning of a 20-year commodities supercycle.

And then, crash. I know a lot of people are now stuck holding the bag on commodities companies down 20% from their recent highs.

So, tell us what you did that was different.

DERICK:

Sure.

I was able to time the sale of my commodities stocks, down to the day.

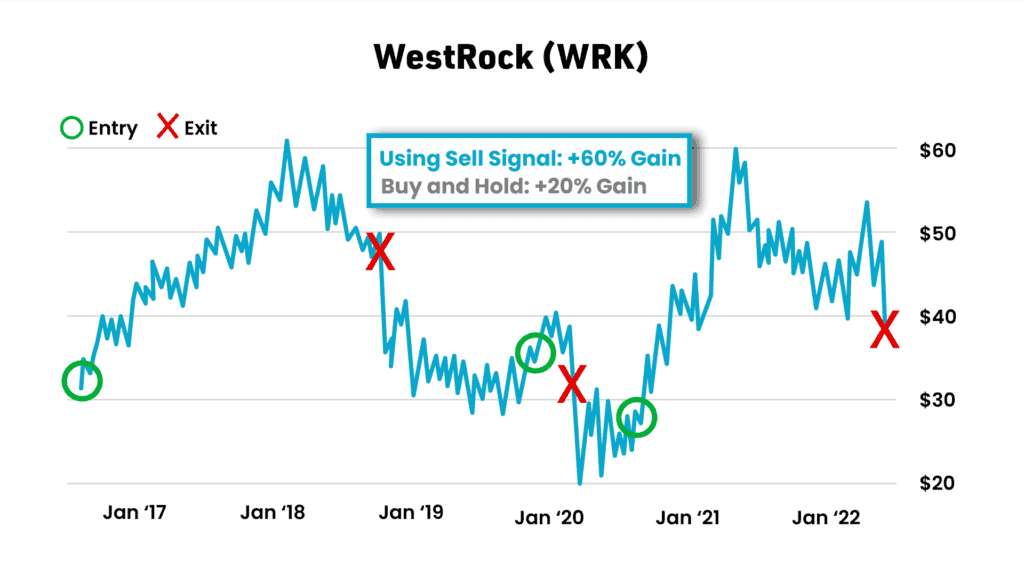

For example, I was in a company called WestRock.

I got a sell signal on June 22nd.

I didn’t hesitate to sell.

And here’s why.

When I look at the history of WestRock stock all the way back to 2016, I can see that by obeying this signal for all entries and exits, any investor would have netted a 60% gain instead of a 20% buy-and-hold gain.

JULIE:

Wow, That’s 3X more profits.

LIZ:

Just from following a signal that alerts us to get out before the stock price tumbles. And then helps us get back in at a much lower price on the rebound.

DERICK:

That’s exactly what it did.

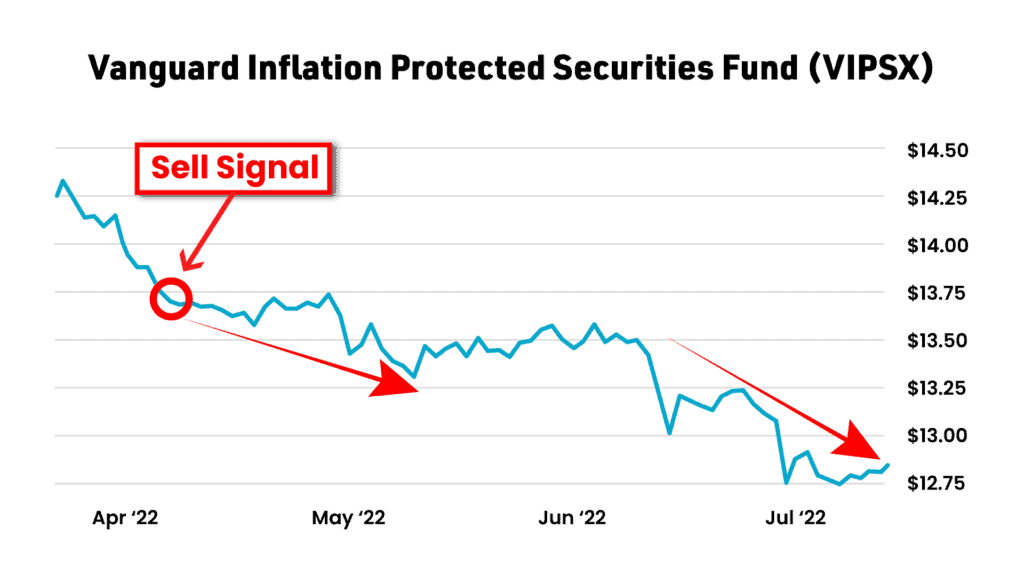

And on April 6th of this year, the sell signal triggered on a Vanguard mutual fund I was heavily invested in, inside my 401(k).

I sold and look what happened.

Two sheer drop-offs after the fact.

LIZ:

And had he not gotten that sell signal, our money could have still been sitting there… just losing value every day.

DERICK:

Exactly.

I also owned VMware stock, a recommendation from one of Stansberry’s analysts.

But on May 6, I got a sell alert and…

I cut that stock loose.

12 days later, the stock was down -7%.

Now, you don’t need to have the same level of trust in this signal yet that I do.

Believe me, I needed to give this a run for its money first too.

But I had been able to see what happened to VMware the LAST time this sell alert triggered.

It could have saved anyone who took action and dumped the stock a fortune. VMware bottomed out at a -30% plunge after the signal.

So, I knew exactly what to do when I saw it appear again.

That’s the great thing about this signal too. You can see every real-life result anytime it’s ever triggered.

There’s never any questioning the track record of these signals.

Every historical example is easy to find.

LIZ:

That’s the kind of thing that’s really important to me.

I’m seeing Derick put his hard-earned trust in something, so it helps give me peace of mind because we can see how the signal has performed this year, last year, or even over the last ten years.

JULIE:

We’re going to show everyone watching exactly where to access all of this today, in just a moment.

DERICK:

It’s so important, because when you have a consistent edge, you have the ability to win consistently over time.

This signal is my consistent edge.

And I’d be putting myself at a severe disadvantage without it.

JULIE:

Ah!

That brings me to what you said earlier.

You have actually made that mistake before. To some pretty disastrous consequences.

Tell us what happened.

DERICK:

Sure. Man, I still get a little agitated to think about it.

But I subscribe to a cannabis stocks newsletter. I love the analyst. He’s very smart. And his writing style is very persuasive.

He pitched a group of cannabis companies so well, that I thought, “This guy is really on to something here.”

Well, I checked and…

11 out of 16 of them had an active SELL signal triggered on them.

But I was so bought in to the story… that I pushed that out of my mind…

And I purchased a portfolio of cannabis companies — 16 stocks.

LIZ:

I fell for this too. The story made complete sense and I was 100% onboard. It proved to be a painful lesson for both of us.

JULIE:

Would you call that letting your emotions take over?

DERICK:

Definitely. I was only paying attention to how I reacted to someone’s pitch instead of believing in the data…

JULIE:

And you got burned?

DERICK:

Oh yeah.

I’m currently sitting at as much as a -64% loss on the cannabis positions I’m still holding.

So, I’ve lost over half of my money so far on the ones I haven’t already sold…

JULIE:

We’ve seen this happen time and time again. An analyst can have a very compelling thesis on a stock or a trend. And as exciting as it is, it’s just really disconnected from the market.

We saw it with cannabis, cryptos, and SPACs. So many people have been burned by blindly believing a story without the tools to fact check the data.

You can fall in love with a thesis but also be regimented.

When they come together, you can make a lot of money.

When they don’t, you’re probably going to lose.

DERICK:

Exactly. For my cannabis trades…

Had I followed the sell signal that money would be invested somewhere else.

Somewhere much more profitable, I’m sure.

LIZ:

You just needed to learn to trust it. Since then, I’ve seen you use it to stop yourself from entering trades that looked great in the newsletter but that we later realized weren’t winners.

DERICK:

Yeah, absolutely. I can think of two trades that came from an analyst I really respect. Had I not had a way to quote-unquote “check his work,” I would have taken these trades at face value.

Instead, I checked the signal. It said “no go.”

I skipped those trades and later saw that both of them went sour.

Again, it took me a while to put my full faith and trust in a signal that contradicts what some of the smartest investors I know are recommending, but…

After I monitored and validated results for six months, I changed my strategy to follow this sell signal to a T.

And my results have not disappointed.

JULIE:

I love that you were skeptical. I think everyone watching can relate.

Now, in a moment, we’re going to help break down exactly what makes this sell signal more accurate than anything else you've ever used.

But you just touched on a fascinating point. And I want to share something with you both that you’ve probably never seen before.

Now, you follow Dr. Steve Sjuggerud of Stansberry Research, correct?

DERICK:

Absolutely. He’s a titan.

JULIE:

I remember him calling the “Bernanke Bubble” early on… his readers made over 400% gains off that.

DERICK:

He called the bottom of the housing crash. I mean, you name it — health care, tech, and gold — Steve has shown his readers how to double their money in all of them.

JULIE:

The stuff of legends, for sure.

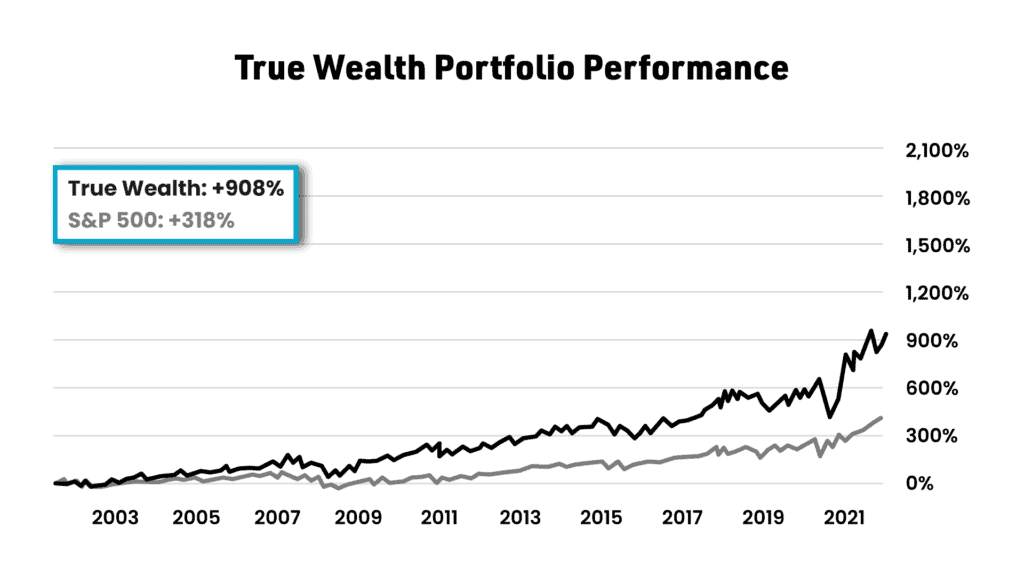

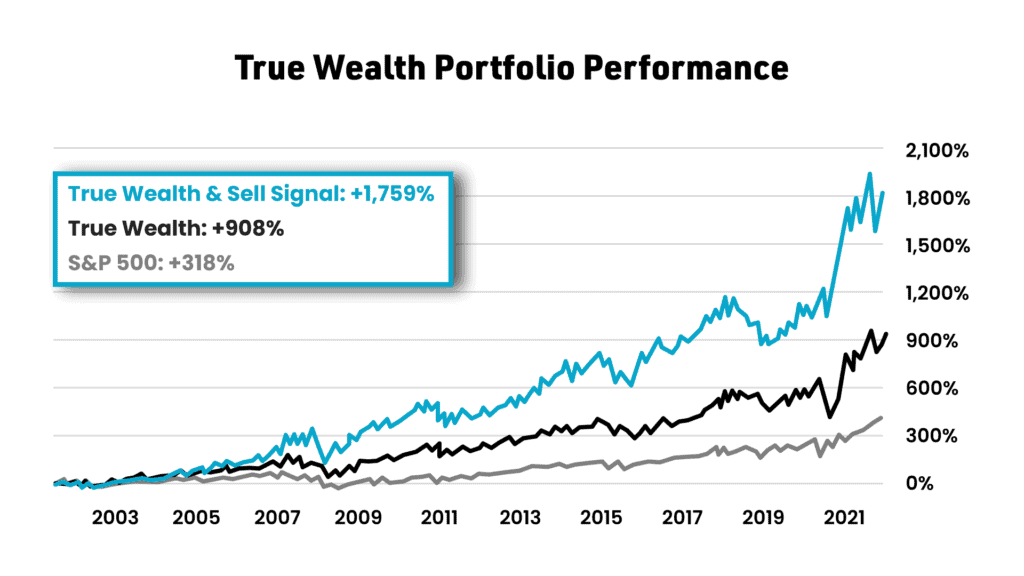

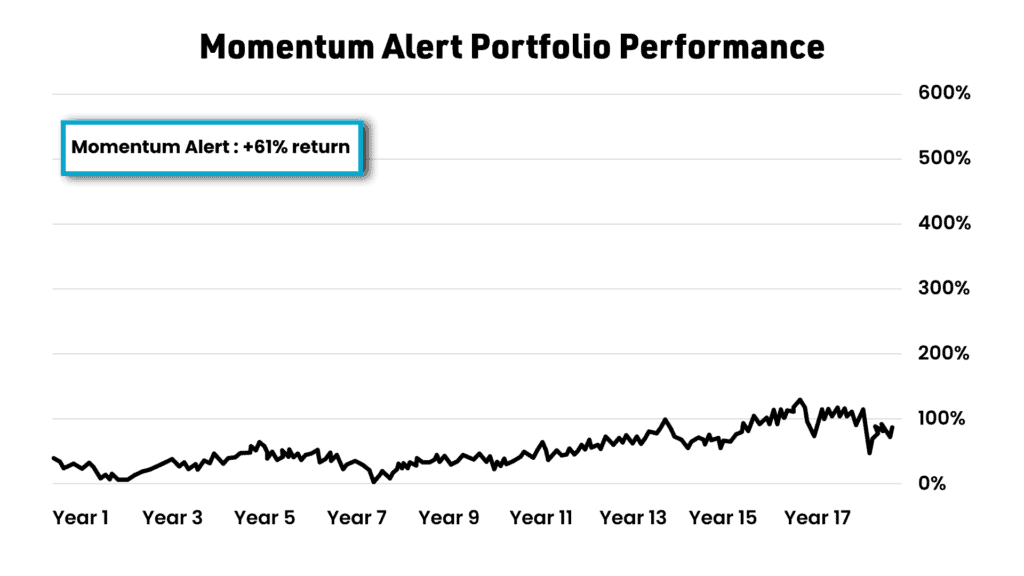

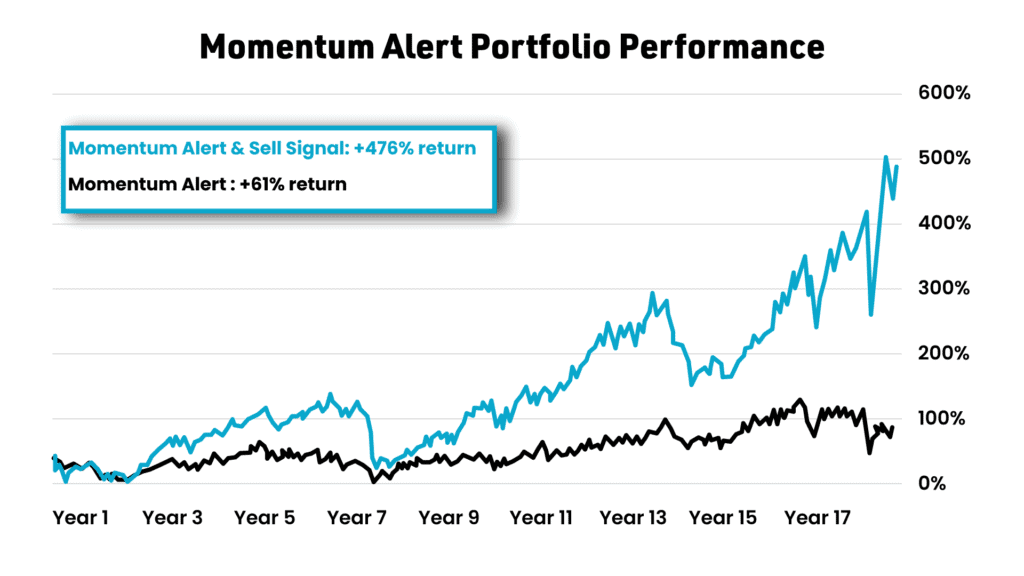

But take a look at this chart.

It shows the performance of Dr. Sjuggerud’s True Wealth model portfolio over 18 years.

Now, with starting capital of $10,000… a newsletter subscriber would have had the opportunity to bank $90,800 in profits. Incredible, right?

But take a look at what our backtests show would have happened to that same $10,000 if someone would have invested in the same stocks, yet chose to sell according to the very same sell signal you swear by, Derick.

That profit turns into $175,900.

LIZ:

That’s $85,000 more!

I can’t even imagine how great that would be to put that away for our kids’ education right now.

JULIE:

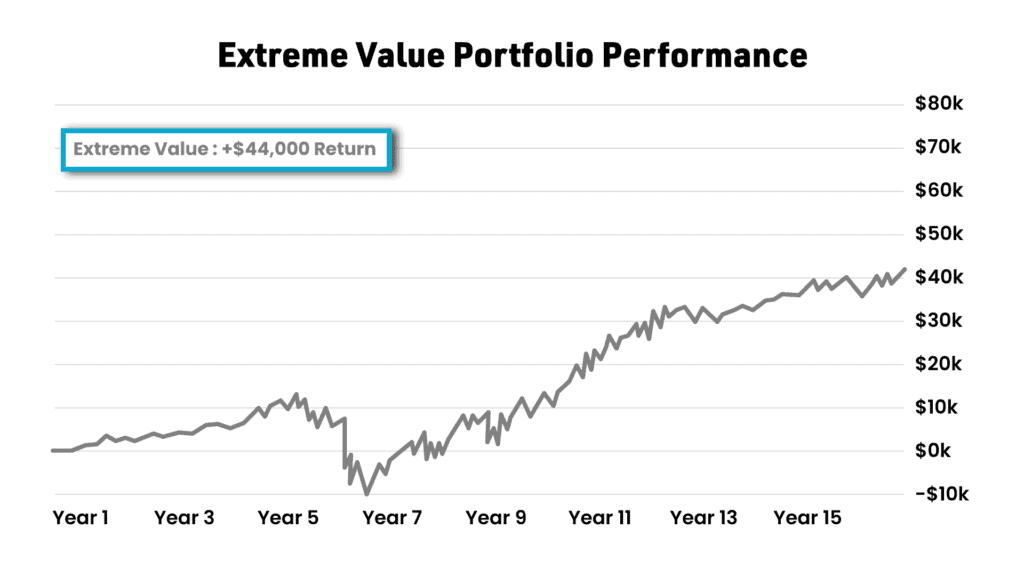

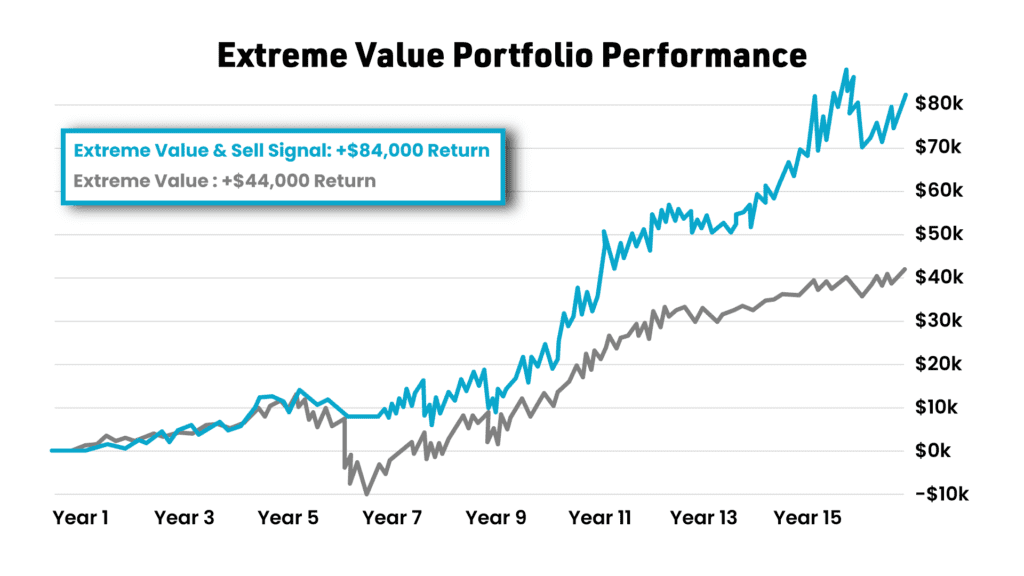

We’ve also done the same backtest on investment analysts at other publishers.

Take a look. This is Dan Ferris, a highly sought-after value investing expert.

Over 16 years, Dan could have shown his subscribers a way to turn $10,000 into $44,000 in his Extreme Value service.

But if his readers were doing the same “fact checking” you are with this sell signal, they would have had the chance to take home $84,000 in profits.

DERICK:

Nearly twice as much money.

JULIE:

I’ll show you one more to really drive home the hard numbers here before we get into how it all works.

This is an Oxford Club service called Momentum Alert.

Over 18 years, it grew 61%.

It actually underperformed the S&P 500.

DERICK:

I think most people can relate to owning a service that loses far too many times for their liking!

JULIE:

Right, I mean every newsletter is written by people with emotions and innate biases.

And that’s where this sell signal makes all the difference.

It would have completely turned that underperforming model portfolio around.

LIZ:

See, this is exactly why we believe in it. What a huge difference.

JULIE:

Yep. A seven-fold difference to be exact.

Momentum Alert gained 61% without this sell signal.

With it, the gain was boosted to 476%.

DERICK:

Julie, you know I was already a fan before today, but I’m almost speechless right now.

JULIE:

The results of these multi-decade backtests are why Alex Green, Chief Investment Strategist from The Oxford Club said:

When you look at the numbers, it proves again and again that this can take

– Alex Green,

returns to the next level.

Chief Investment Strategist,

The Oxford Club

LIZ:

I just feel so lucky to have this in our arsenal right now and going forward.

Having access to this concrete sell signal has given Derick and I a level of confidence we never had before.

There’s no price you can put on that. Whether the market is up, down, or just pure chaos, we’re calm because we know what to buy, when to hold on through volatility and when to sell to lock in our gains.

I’ll go so far as to say we’re even more aligned now! Because…

Now I’m totally comfortable with what Derick is doing when he’s trading our family’s money.

And I know he’s doing the right thing to protect our accounts from losses.

JULIE:

That’s truly priceless Liz.

Alright, let’s take this sell signal out of the “black box” it’s in and show everyone exactly what makes it work and where they can find it.

Derick, walk us through what makes this sell signal the ultimate edge an investor can have.

DERICK:

I’d love to.

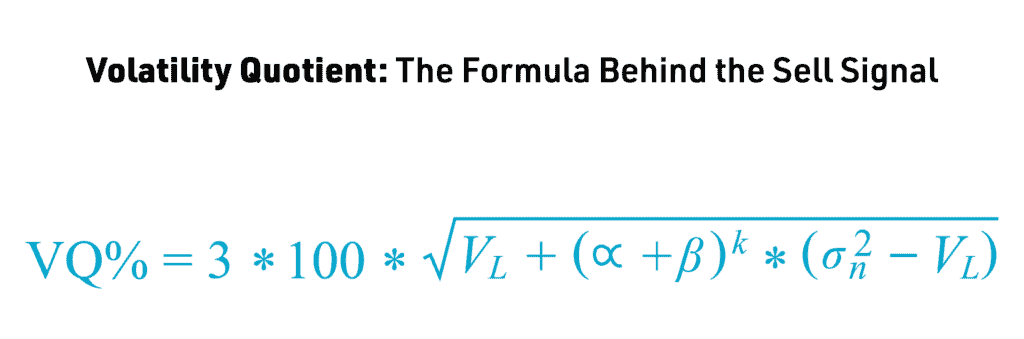

So, the sell signal we’re talking about here is, as you know, inside a tool called TradeStops Pro.

The foundation of this signal is the mathematical equation I mentioned right when we sat down.

It’s called the volatility quotient and it’s what sets it apart from anything else out there.

Inside TradeStops Pro, there’s a dashboard where you can log on and see the buy or sell status of any stock, ETF or mutual fund you want.

It’s color-coded red and green, so it’s all very easy to see at-a-glance.

If the stock is green, I know I can confidently buy that recommendation. And especially if it recently turned green, I may even be a little more aggressive with my trade.

If the stock is red, I won’t touch it.

Because if a stock is green, it’s inside its normal range of volatility — it’s got momentum and it’s trending UP.

If a stock is red, it’s outside it’s normal range of volatility. Right? It’s high risk. And it’s trending down.

JULIE:

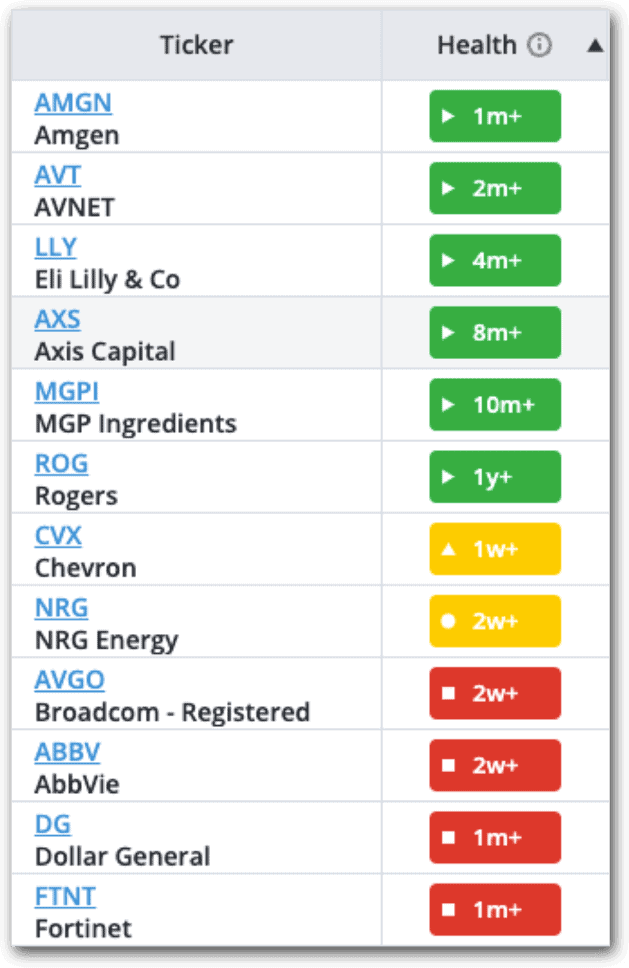

In shorthand at TradeSmith, we call green stocks “healthy” and red stocks “unhealthy.”

And unlike generic stop losses, the volatility quotient, or VQ takes into account eight real-time triggers to help you determine the best time to buy and sell anything.

DERICK:

That’s why I use it on stocks I already own as well. When the red sell signal triggers, I cut that stock loose without question.

Not just because it’s headed down. It's because the VQ formula can identify when a stock is not likely to rebound because it’s outside its normal volatility range.

LIZ:

That right there is the magic that human eyes can’t see.

JULIE:

Right! Especially across over 150,000 securities at the same time.

DERICK:

Here’s what’s really great about all this, Julie.

I don’t need to manually look up every stock I own to check whether it’s red or green.

I can simply sync my brokerage accounts right into TradeStops and I can see every position I own with the red and green signal right next to it.

JULIE:

That’s true, and TradeStops even shows you how many days or weeks it’s been since that signal triggered.

DERICK:

Yep, and I can see the VQ for every stock, ETF, and mutual fund I own too. So, I know exactly how risky those positions are.

JULIE:

That’s important because as you get older, you certainly don’t want to own too many shares of risky stocks and too few shares of stable, reliable companies.

And if you’re a younger investor, it might be the opposite. You don’t want to be underinvested in growth.

DERICK:

So true, Julie.

And honestly, that’s a deadly trap too many investors fall into.

Buying the WRONG amount of shares.

JULIE:

YES. I bet 9 out of 10 people watching this are buying the wrong amount of shares when they invest.

DERICK:

That’s definitely possible. It’s a question NO ONE knows how to answer…

“How much should I buy of a given stock?”

Most people answer this question incorrectly because they don’t have the tools to know any better…

This was always just guesswork for me before.

You know, say you have $5,000 in your brokerage account, and you’re deciding what to do with it.

You just read a great write-up on a Chinese electric car stock and you also think you should buy an S&P 500 ETF for diversification.

So, you put $2,500 into the electric car stock and $2,500 into the S&P ETF.

One month later, the Chinese stock is down -30%, and the S&P ETF is up 8%.

You’re losing money and kicking yourself for putting so much of your capital at risk.

JULIE:

Yep, been there. Done that. I got caught up in the SPAC craze of 2020 and staked way too much money on high-risk companies. Some of which are down over -80%.

DERICK:

Of course. We all have made mistakes. But I don’t have that problem anymore.

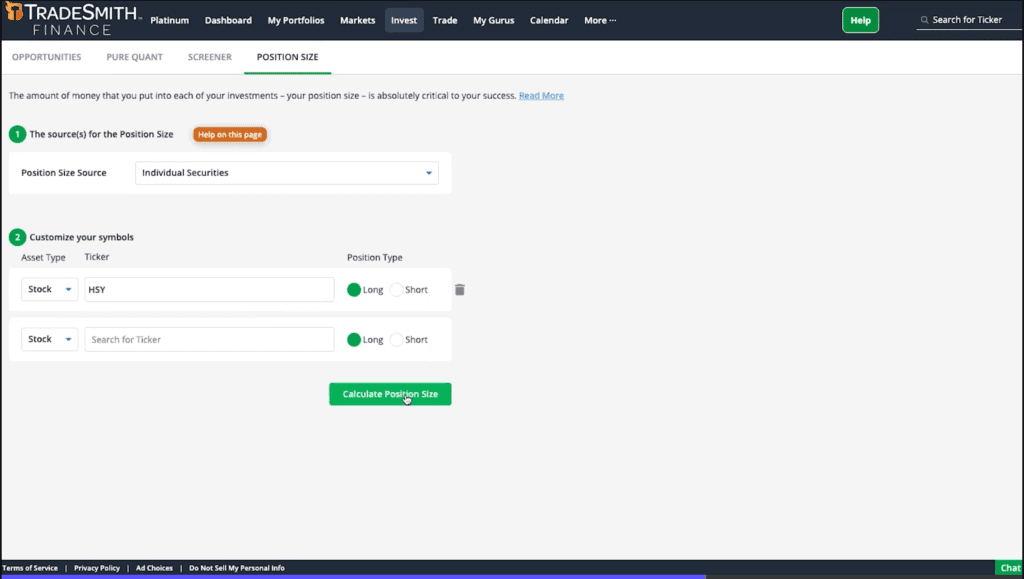

Because inside TradeStops…

I have access to a tool called The Position Sizer. And I don’t recommend buying a single stock without using it first.

Check out how it works…

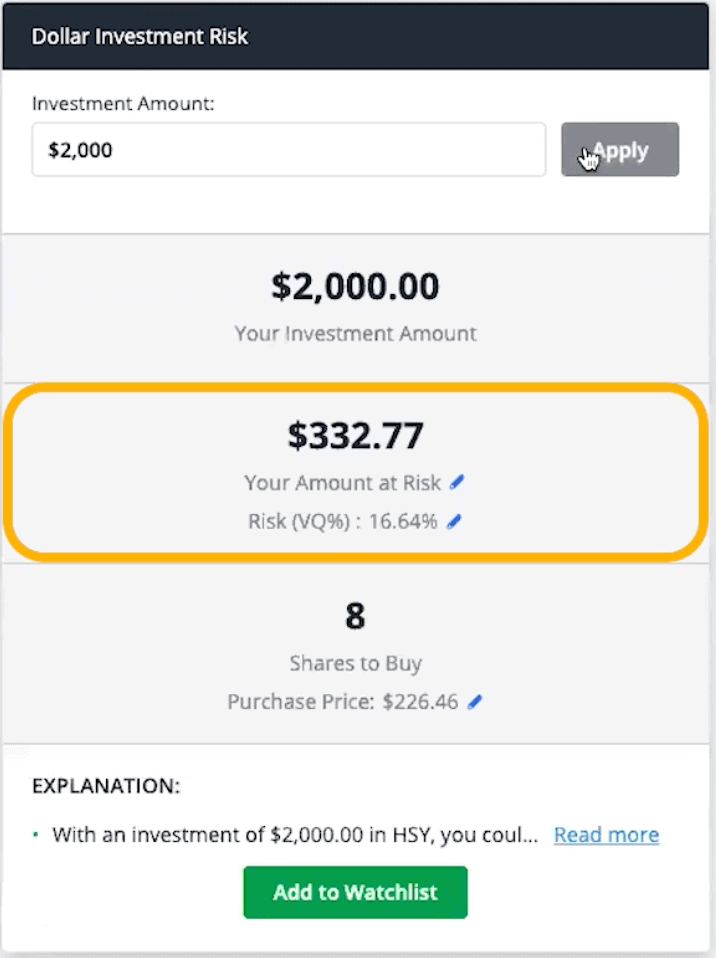

Let’s say I’ve synced my 401(k) account here and I want to add Hershey stock to that portfolio.

I enter the ticker here, HSY, and click “Calculate Position Size.”

The Position Size Calculator gives me two options…

Option 1: I can tell it how much I want to spend, in this case $2,000.

And the tool will tell me, based on the Volatility Quotient, how much money I am putting at risk if I buy that amount of stock.

JULIE:

And this is based on the maximum possible price drop you can expect based on its normal volatility.

DERICK:

Exactly. Think of it as the “worst case scenario” in normal market conditions.

Option 2: The second way I can position size here is even more crucial and it works if you have any of your accounts synced with TradeStops.

What this does is calculate how much of Hershey stock I should buy so that I’m spreading equal risk across my portfolio – position by position.

So, since this account is synced…

TradeStops knows all the positions in that account… it knows how risky each one is… how much capital is invested in each one and even how much cash is sitting in the account.

And by processing all of that data…

…it can determine the ideal position size for any stock you want to buy.

JULIE:

I love this feature. It’s so useful on every trade — whether it’s long or short-term. In both cases, you get to remove the guesswork when it comes to how much you should buy.

DERICK:

And of course, Hershey is a low to medium risk stock. If you put TSLA in here — a stock that is considered to have “Sky-high risk” according the volatility quotient, the results would be very different.

JULIE:

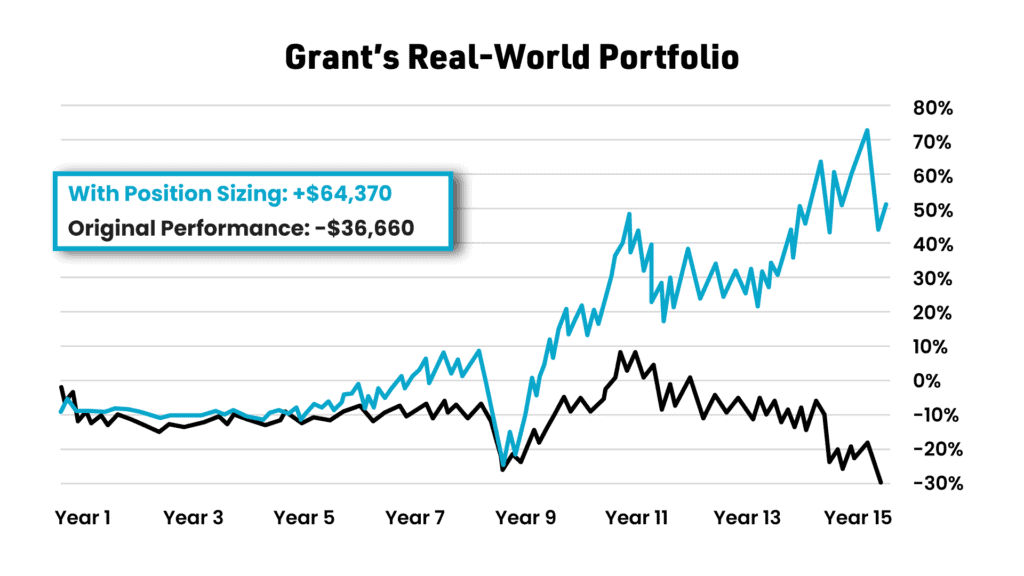

Guys, we actually backtested this…

Let’s look at real investor portfolios using position sizing to see how big of a difference it would’ve made in their returns.

Meaning… investors willingly sent us all of their trades over the course of 5-15 years.

And we didn’t change anything about what they bought and sold… we just adding correct position sizing.

And look at the difference it made…

This is Grant’s portfolio. And simply by incorporating proper position sizing by using our tools, he could have taken his six-figure portfolio from a LOSS of -$36,660 to a profit of $64,370.

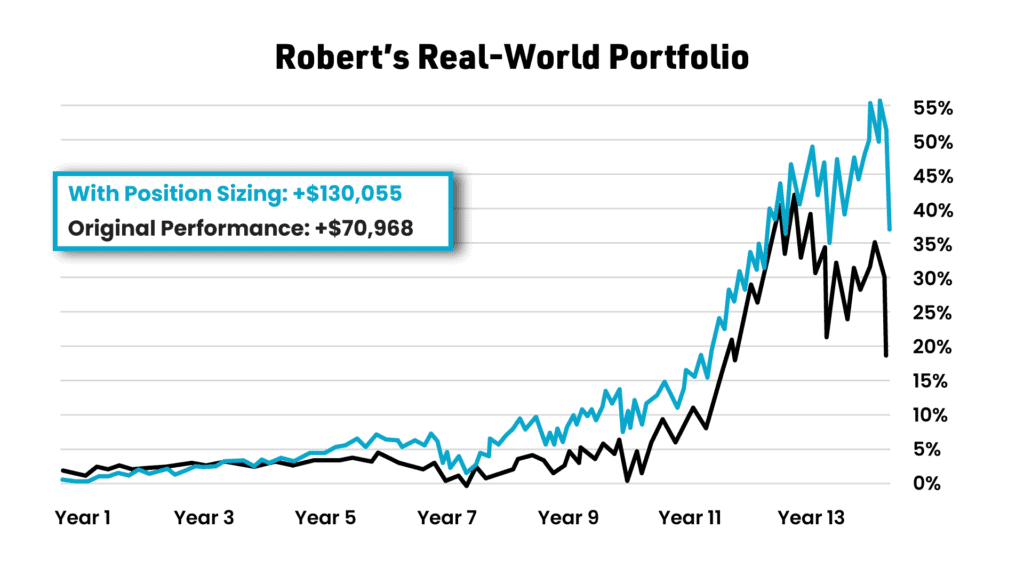

This is Robert’s. Look at that. From a $70,000 gain to a $130,055 profit.

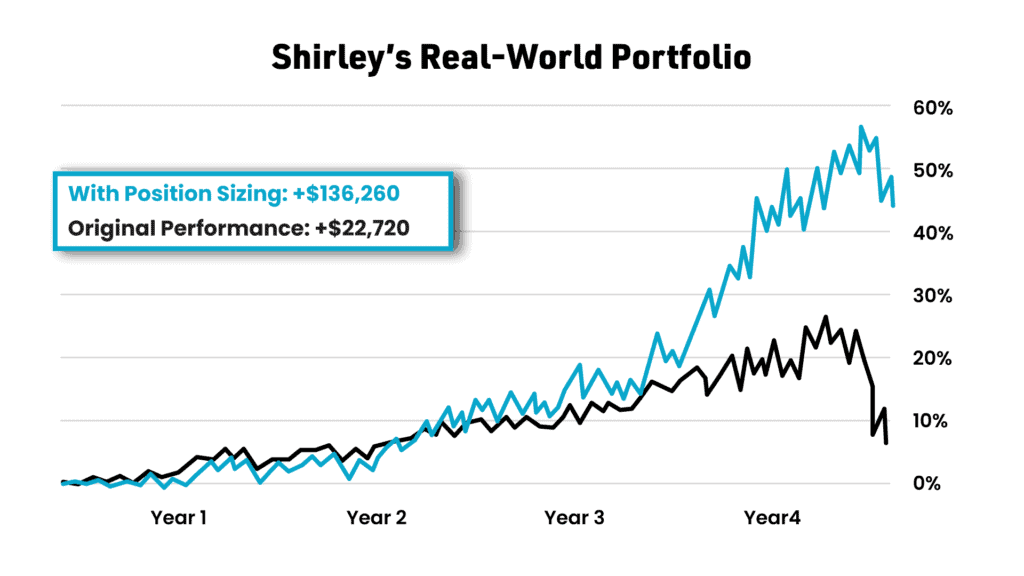

Shirley here made a profit over 5 years of $22,720. But if she would have position sized, she could have multiplied that profit by 6X — into $136,260.

DERICK:

That is incredible.

JULIE:

So, yeah, you’ve been religiously position sizing since you joined TradeStops. And while these are some of the best examples from our backtesting, and nobody can promise you’ll see the same results, if your trajectory is anything like these customers of ours, you’re going to come out light-years ahead of where you’d be without it, Derick.

LIZ:

I have no doubt.

And Derick does position sizing on nearly every trade he makes, which is no small feat because he’s an active trader.

AANNDD… you use TradeStops to help you manage and track everything from your newsletters to your trades to your various accounts.

DERICK:

Oh yeah, that’s a great point.

I could never operate at the level I do without TradeStops.

Just like my brokerage accounts, I can sync all my investment newsletters right to TradeStops.

It’s so cool.

Because once you do that, you can see every active recommendation for every service you subscribe to right on the TradeStops dashboard.

That means, you’ve got all the information you need right there to help you decide whether those recommendations are right for you or not.

You can see if an analyst’s pick is red or green and how risky the stock is based on the volatility quotient.

You don’t have to take any research or analysis at face value.

You can easily do your own spot checking on each recommendation.

JULIE:

Also, TradeStops pulls in the actual newsletters and trade alerts from these services as well, so you can read them all in one place.

I always think of this feature as a “command central” for newsletter subscribers.

DERICK:

Great way to put it.

Before I had access to this dashboard, I’d have a bunch of stocks and options trades lumped into one account and I was trying to remember, “oh, I got that pick from True Wealth… and that one was, I think… from Doc Eifrig…” And I couldn’t keep them straight.

JULIE:

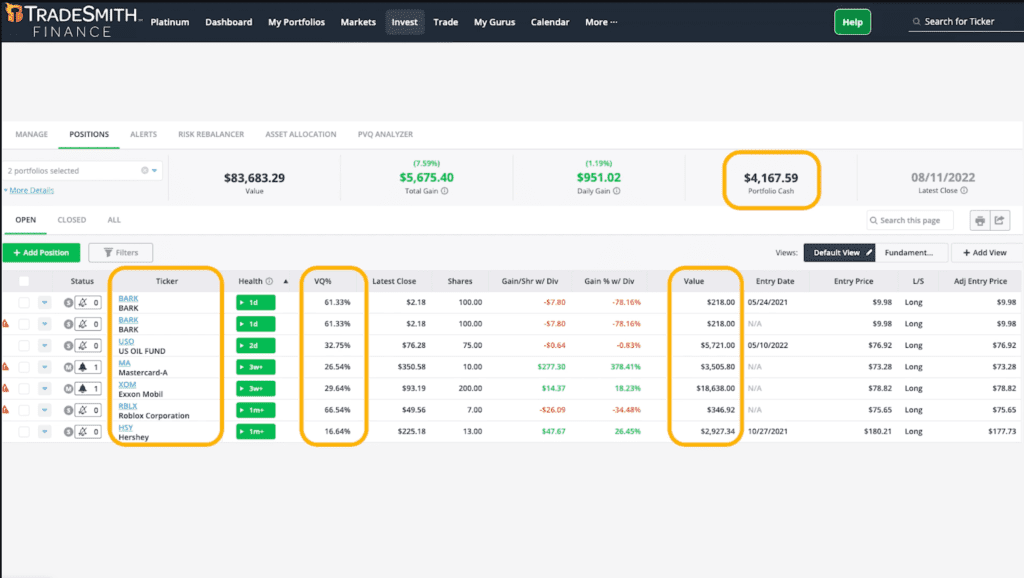

You sent me a screenshot of how you manage this now, so I want to pull that up here.

Wow, tell us what we’re seeing here, Derick!

DERICK:

Sure, this is how I track the performance of the trade recommendations that I personally execute.

The great thing about this view, which I’ve never found available anywhere else, is that I’m not forced to silo my track records by account — like, say, my 401(k) trades versus the trades for my daughter’s account.

I can track every single service I subscribe to in one place.

I can see my open and closed trades — how much I bought and sold them for. I can see the average days held and the overall gain.

JULIE:

This is great, because often when you’re executing a trade, you don’t get filled at the same price that’s showing in a newsletter’s track record. So, this is an easy way to track the REAL ROI you’re getting from each service you subscribe to.

LIZ:

And for someone like Derick, more than 30 services and newsletters, this kind of over view is priceless!

JULIE:

I mean…

You can quickly see if a service you’re following is underperforming and losing you money.

If so, CANCELLED. Saving you thousands of dollars a year.

Or, you can see which ones are outperforming, so you can decide whether you want to trade those recommendations more aggressively.

DERICK:

I refer to this daily. It helps me keep everything organized the way I want it and it's totally customizable, so you can separate out accounts, newsletters, watchlists, and strategies. This is your command central to see if what you’re doing is actually paying off for you. You’ll know pretty quickly.

JULIE:

You guys, this has been SO enlightening to sit down with you here today.

And I think everyone watching probably feels the same.

DERICK:

It’s really been my pleasure to share this. TradeStops has been life-changing for me.

LIZ:

It’s what makes it possible to live the way we want to live.

TradeStops is the safety net for our money.

It validates every move Derick makes before he makes it. And, gives me tremendous peace of mind.

JULIE:

To everyone watching, I sat down with Derick before we met today and I asked him a question point blank:

If you were going to join TradeStops today… and start all over again from the beginning…

What would you want?

What kind of offer would get you off the fence if this was all new to you?

Can you share with the folks watching what you said?

DERICK:

The entire reason I agreed to sit down for this interview is because I am so passionate about this product.

It has truly changed how I trade. I was skeptical at the beginning. I didn’t trust the tool so I suspect that others might be feeling that way too.

But fast forward to today, and I can honestly say that TradeStops is one of the most important tools in my tool box.

So, if you’re on the fence, just take the plunge.

Do whatever it takes to get TradeStops into your hands.

It gives you access to all the things I swear by… the buy and sell signals, the Position Sizing Tool, the Newsletter Center and so much more.

Believe me, it has been worth every single penny.

LIZ:

I know that once people get their hands on this, they’re going to get hooked once they see the results it could help them achieve.

And they’re likely to eventually become a member for life, just like Derick.

JULIE:

Thanks to Derick and Liz coming forward to share their story, we decided to consult with Keith Kaplan, TradeSmith’s CEO, and we were able to strike a deal that will open up TradeStops for you at the lowest price possible — a deal that will give you 87% off the retail price today. Meaning…

We’re dropping the annual subscription rate from $588 to just $79 today.

To see the full details of everything you get for that incredibly low price, simply click the button on this page right now.

I think you’re going to be shocked at the tremendous value.

Because in addition to every feature that’s part of the TradeStops Suite of tools, we’re piling on brand-new bonuses we just created.

Each one is designed to help you follow in Derick’s footsteps of financial freedom — no matter what age you are or what stage of life you’re in.

So, when you step forward to claim your TradeStops membership today, you’ll get:

“Derick’s 7 Rules to Master Your Trading Mindset”

Derick, can you tell us about this one?

DERICK:

Definitely. These are the “Trading in the Zone” rules that I consider to be non-negotiable when entering any trade.

I keep them right by my desk at all times and I wanted to share them so that others can too.

So, in this bonus video, I talk about the importance of heeding all seven guidelines and the life-changing impact they can have once you know them.

JULIE:

We'll also give you… the “TradeStops — Pre-Buy Checklist.”

This handy checklist shows you exactly what you’ll want to do inside TradeStops before you buy any stock.

In three basic moves, you can research and assess a stock… plan your exit ahead of time… and figure out exactly how much to buy.

Look, I have to remind you… all investing carries risk and past performance is no guarantee of future success. But this checklist takes all the stress and confusion out of buying and selling. Just check off the three steps and you’re good to go.

We’re also going to guarantee your satisfaction today.

Meaning, we’ll give you 60 days to try TradeStops before you have to decide whether you want to stick with it or not.

If for any reason you are not 100% satisfied, we’ll refund every penny.

The details are all in black and white on the very next page.

LIZ:

Wow. 87% off is an amazing deal PLUS, a 60-day money-back guarantee?!

I hope readers will appreciate just how great this deal is.

DERICK:

I can tell you that 60 days was definitely enough for me to see the tremendous value here.

And listen…

I spent the first 60 days trying to PROVE the tool WRONG.

I was such a hardcore skeptic.

And time and time again the tool was proving me wrong. It was proving analysts wrong.

Soon enough, I knew I was going to have to change the way I was doing things.

Again, I would say to just take the plunge. You won’t regret it!

JULIE:

You’re not the only one who feels that way, Derick!

TradeStops member, Ernest G. said:

I am addicted to TradeStops! It is the cornerstone for building and maintaining my portfolios.

I never add a position without using the rebalancer.I have [an elite] subscription and it is the

– Ernest G.

best decision I’ve made in a long time!

Chris A. told us:

Finally, I have the final “tool” in my

investment toolkit to take all of these great [trade] ideas and know how much to buy and more importantly when to exit a trade.TradeStops helps me maximize the

– Chris A.

profitability of these ideas!

And Kevin T. said that:

After 30 years of investing, TradeStops has

– Kevin T.

allowed me to secure the best profits of my investing career while minimizing my losses.

And Hal C. wrote:

TradeStops might just be the best investment I have

– Hal C.

EVER made in my three decades of investing.

So, go ahead and see the incredible offer we put together just for this special event here today.

Click the “Special Offer” button here and you’ll see a bulleted list of everything that’s included in TradeStops.

- You’ll see every free bonus you’re getting just for trying it out and you’ll see the 60-day risk-free, money-back guarantee

- And of course, the 87% discount you’re eligible for as a thanks for joining us here today.

Go ahead and click… there are features in TradeStops that Derick and I didn’t even TOUCH ON today and they are just as valuable.

Thank you for joining Derick, Liz and I today, here at their beautiful home in Texas.

Derick, any final words before folks step up and join TradeStops today?

DERICK:

Honestly, I think I've said it all, but my biggest take home would be to just give TradeStops a shot.

Great stock picks and trade recommendations are important, for sure. But…

What gives me the real edge here are the tools I have access to in TradeStops.

There’s just no comparison.

Go for it.

LIZ:

There’s no way we would be where we are right now — with Derick retired at 40 — staying home and trading with more confidence than we ever thought possible…

And now working his way toward retiring ME in the middle of a terrible market — if he hadn’t made the decision to try TradeStops when he had the chance.

JULIE:

Thank you so much, Derick. Thank you, Liz.

And thank you for joining us today.

Signing off from Texas…

I’m Julie Devante and on behalf of TradeSmith, I’m so excited to welcome you into TradeStops on the very next page.

Take care now.

As compensation for sharing their story, Derick and Liz were granted Platinum access to TradeSmith’s full suite of products at no charge.

For full disclosures and details, please click here.

©2022 TradeSmith, LLC. All Rights Reserved.

Terms of Use | Privacy Policy