GET JIM RICKARDS LATEST PREDICTION

RIGHT HERE

He helped save America from a 1.9 trillion dollar banking crisis…he warned of 2008 financial crisis, the Coronavirus Crash, Brexit, and more…now he’s warning American’s to prepare for:

“Bloody Wednesday”

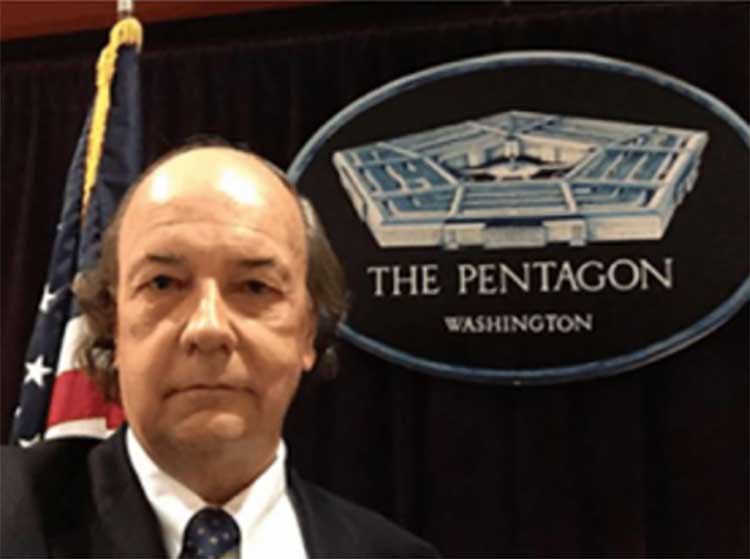

Inside: Why legendary economist and former advisor to the Pentagon, the CIA, and over a half a dozen more intelligence agencies warns that we could see an 80% “DOW drop”…and the 5 steps you need to take now to prepare.

HOST: Inflation?…a market crash?…Another bubble in tech stocks?

For most investors, it’s a confusing and tumultuous time.

With the fallout from the coronavirus still looming…

Millions of Americans still unemployed…

And trillions of new dollars being artificially pumped into the stock market over the last two years…

Many Americans are left to wonder when will the euphoria finally end…

And once it does just how bad will the economic fallout be?

“We are in a worse position than in 2008”

– Billionaire Investor Ray Dalio

Hi, my name is Chris Ford.

And to answer these questions, tonight during this exclusive interview, we will be sitting down with one man who is most qualified to tell us what lies ahead.

He and his firm have been at the forefront of nearly every major economic event of the last 20 years.

Predicting everything from Brexit to the election of Donald Trump, the Coronavirus Crash, and even the 2008 financial crisis.

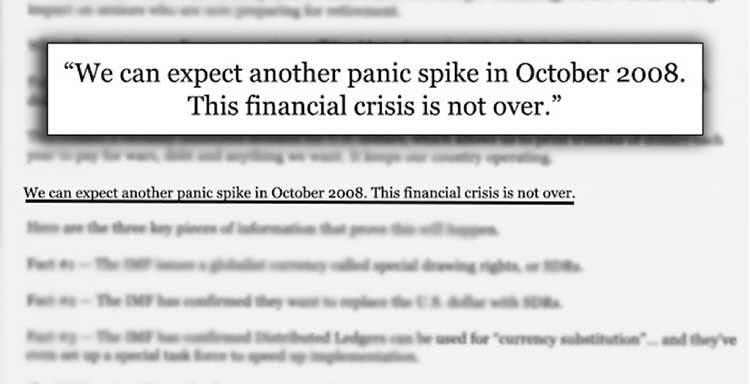

In fact, in September 2006, a full two years before the 2008 financial meltdown…

He began warning our intelligence officials in Washington of a looming financial crisis.

His full thesis was so in depth, that the CIA circulated his warning among its senior staff.

And it appeared in the CIA's official journal, Studies in Intelligence.

That material remains classified to this day.

But nevertheless, in August of 2007, he shared the same warning with officials from the US Treasury Department.

He even supplied the Treasury with a plan for averting the crisis called “Proposal to Obtain and Manage Information in Response to Capital Markets Crisis.”

But Washington still failed to heed his warnings

So in September of 2008, just when people thought that the worst of the subprime mortgage crisis was behind us…

He wrote this letter to top advisors in the presidential campaign:

Three weeks later, Lehman Brothers would collapse, marking one of the most devastating financial crises of our lifetimes.

But anyone who listened to these repeated warnings was able to side-step the carnage.

And that’s why it’s so important that you hear this message today.

Because now, Jim Rickards – one of the world's leading economists and former advisor to the CIA and the Pentagon – is coming forward with a brand new warning…

“We are on the cusp of one of the biggest

financial crises of our lifetimes –

a “Bloody Wednesday” that could

send stocks plummeting by

as much as 80% overnight”

And it looks like some of the brightest financial minds of our time are beginning to agree …

People like billionaire investor Jeremy Grantham, a man who accurately predicted the last three bubbles is now warning that:

“When you have reached this level…the bubble has always, without exception, broken in the next few months, not a few years”

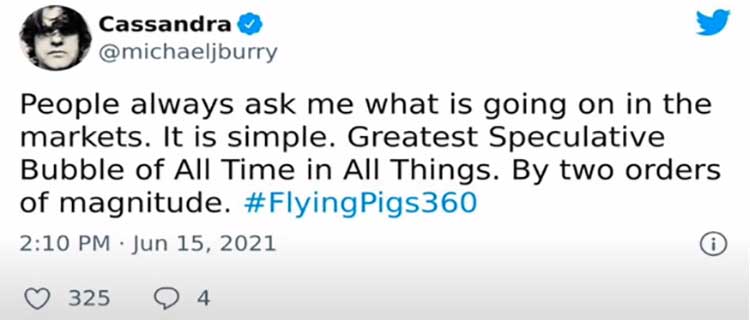

And Michael Burry, the man who became famous after shorting the 2008 crash is saying that we are on the cusp of:

“The mother of all crashes”

And that:

“The losses will approach the size of countries”

Even Warren Buffet has joined the choir of billionaires calling for a crash:

And tonight, Jim is going to show us why the next few weeks may prove to be the most critical moment in most people's financial lifetimes.

And why a massive “inflation shock” set to hit the markets this December could bring the inevitable meltdown to our doorstep much sooner than anyone thinks…

But more importantly, Jim will show us exactly the steps he’s recommending you take to avoid the coming carnage…

Including a special investment that he’s personally put more than $1 million dollars of his own money in preparation for this type of event.

And he’ll even show you a few simple moves you can make in your own portfolio now to set yourself up to profit in the days ahead.

In fact, here’s everything we plan on covering over the next few minutes:

- Why March 12th could prove to be the most important date in your financial lifetime.

- The surprising “Inflation Shock” set to hit the markets that could send the Dow plummeting (and what it means for your investments).

- Why the government and the federal reserve will be helpless to stop it.

- Details on a 10X crash protection that could soar as the market's tank.

- The surprising investment that billionaires like Ray Dalio are flocking to now (in fact, one billionaire has put over half his net worth in this single investment)

The 5 unique steps you can take to help protect your investments and potentially even profit in the days ahead.

You’ll get all of that free in tonight's exclusive interview.

But before we get started, I should warn you…

Some of what you are about to hear WILL be controversial and offensive…

And goes against much of what you’re hearing about the markets and inflation in the mainstream media today.

So if you’re a “dyed-in-the-wool” Democrat who blindly believes in the reckless policies being championed by the Biden administration…

Or an economic Pollyanna who believes no matter what happens America’s best days are still ahead of it.

Then I can tell you right now, this message is NOT for you…

Tonight we have NO plans on painting a “rosy” picture of America’s future in the months ahead.

We plan on giving you nothing but the facts of the situation, and where the analysis shows that they lead…

In other words, tonight you are going to get nothing but the truth…if that’s what you’ve been looking for…then you’ve come to the right place.

So with that…Let me welcome the man of the hour.

Jim Rickards.

Welcome Jim.

JIM: Thanks, Chris, glad to be here.

HOST: Jim, I’m sure our viewers are anxious to get to the subject of tonight’s event so let’s get right into it.

You’ve been warning about an “inflation shock” that could rock the markets in just the next few weeks. Can you explain exactly what this shock is? And why it’s going to have such an impact on the market?

JIM: Look, what I’m about to say will not be a popular opinion…mostly because it goes against the grain of everything you're being told in the mainstream news.

You see, earlier this year if you turned on any major network…CNBC or Bloomberg or Fox Business, or looked at any headline, or any website, or any financial pundit, they were all screaming inflation, inflation, inflation.

All of them. All of them. That was the story. That was the narrative.

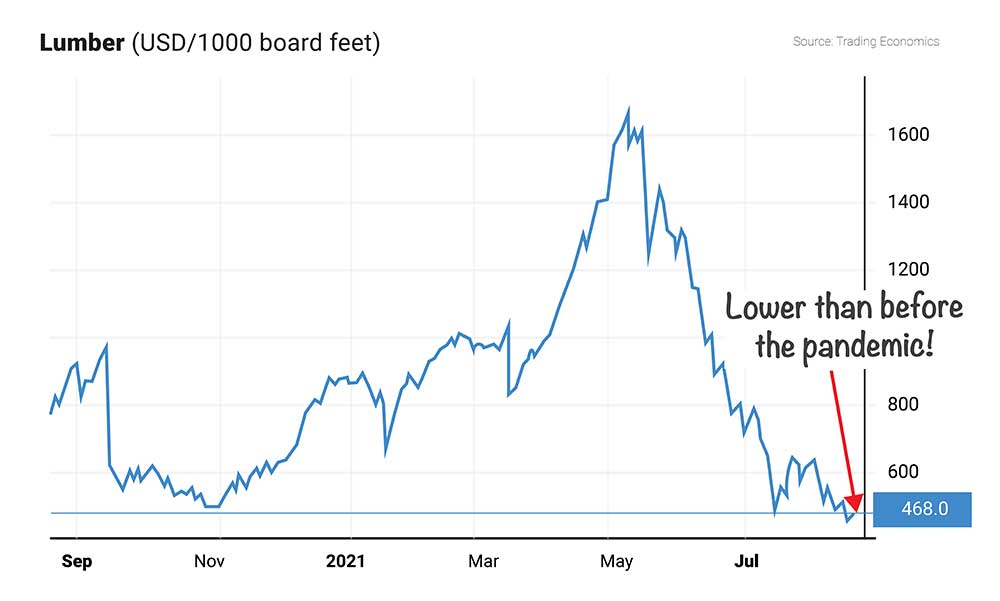

In fact, they were hyping up stories about the soaring cost of lumber…

The prices of used cars skyrocketing.

And even Bank of America was even warning of “transitory hyperinflation.”

We were hitting peak inflation fear.

But if you look at what’s happening today, you’ll see that none of that panned out the way people were expecting…

The price of lumber has fallen back down to pre-epandemic lows…

The price of used cars is cooling off.

And even though we have seen some inflation, yes the prices are up at the grocery stores…

It wasn’t anything near the hyperinflation that Bank of America was predicting.

So now millions of Americans are wondering what’s going on? Where is all this inflation we were supposed to see?

I mean, it's a reasonable question.

We “printed” nearly five trillion dollars since the start of the coronavirus, after all.

But I’m here to tell you… high inflation is not coming. Not anytime soon. And that is what should really have you scared.

In fact, that's the whole reason I wanted to do this event tonight.

To warn people about what comes next.

HOST: But why should we worry about not seeing high inflation. Isn’t that a good thing?

JIM: Well, a back off in the rate of inflation, or disinflation, could be one of the most dangerous signals the market could be giving right now.

Actually, to demonstrate exactly what I mean, I've brought something with me today.

HOST: Can we go ahead and bring that out for Jim?

JIM: What I have here is a dry sponge.

And I want you to think of this sponge as the economy…

And this pitcher of water, as all of the debt and monetary and fiscal stimulus we’ve been dumping into the markets.

Now at first when I begin pouring the water on the sponge…

It starts absorbing the water becoming wetter and wetter and wetter…

Until it finally reaches a point it has absorbed so much water that it simply can’t absorb anymore.

No matter how much water I pour on it, the sponge won't absorb another drop.

In other words, the sponge has become “super-saturated” with water.

HOST: Right, it just starts spilling over on to the plate.

JIM: Exactly.

Well, something similar is happening to our economy today.

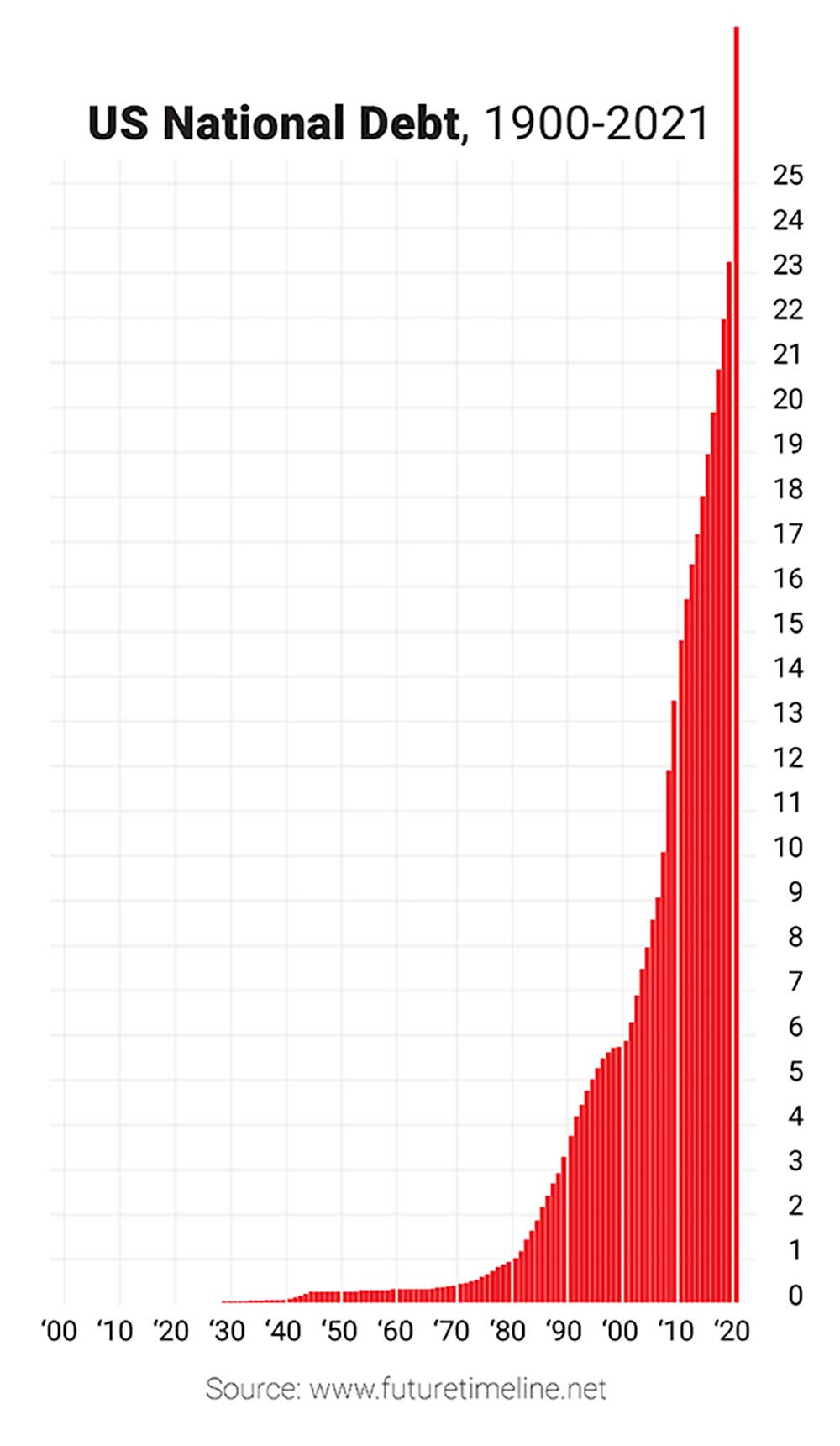

You see, over the past few decades, in order to avoid any type of crisis in our economy or financial system…

We've been using every spigot we can find to pump money and debt in the system.

After the dot.com crash, Alan Greenspan lowered interest rates forcing money into the economy and inflating what would become the housing bubble.

Once the housing bubble began to collapse, Ben Bernanke, a man I've had personal conversations with by the way, lowered interest rates even further and began something called quantitative easing, what most people consider “money printing”.

It was an unprecedented step in American history.

Then, after the coronavirus hit, we printed a whopping 5 trillion dollars to keep the economy from complete collapse.

Now the U.S. debt has never been higher…

And we've never had so much money in the economy at such low interest rates.

You see, we've poured so much debt and so much money into the U.S. financial system over the years…

That our economy has essentially become “super-saturated” with money.

So no matter how much spending or stimulus the Fed and the government continue pouring on…

All of that money is doing nothing to stimulate the economy or create the massive amount of inflation everyone is expecting.

Because most of it is sloshing around on the sides of the plate…staying in the banking system.

HOST: You mean it’s staying in people's savings accounts.

JIM: That’s a small part of it. Savings rates have increased.

But mostly the money is going straight on to the balance sheets of banks.

Why? Well you have to ask yourself, “how does the Fed ‘print money’? How do they create money?”

Basically what they do is they buy bonds from the banks.

They call them primary dealers.

By the way, I used to be general counsel and chief credit officer at one of the biggest primary dealers. I talked to the Fed every day.

So I was right in the middle of those operations.

But the point being, the Fed calls the dealers and says, “I want to buy some bonds.”

And then the bank, and it could be Goldman Sachs or Morgan Stanley or Citi or whoever, delivers the bonds to the Fed and the Fed pays for it.

But when they pay for it, the money comes out of thin air. They just print it.

That's what makes people worried about inflation. Because they see all of this money “creation.”

But here’s where you're a garden-variety Milton Friedman groupie goes wrong.

Sure the money is going to the banks….But the banks aren’t loaning out the money.

People aren’t borrowing…

And banks are so awash with cash that they are actually trying to discourage deposits.

So what do they do? Instead of getting the money out into the economy so people can use it to buy houses, cars, and so on…

The banks are just giving the money back to the Fed in the form of excess reserves.

They essentially have no choice and the Fed pays them an interest rate. So they think why not? I just leverage up and do fine.

HOST: So essentially people are saving more of their money, and the banks aren’t lending it out.

JIM: Exactly, add those two things up and there is almost no money flowing through the economy.

I know that might sound crazy to some of our viewers tonight.

Let me briefly explain why in slightly more technical terms…

I’m going to run through a little bit of basic math. But once you understand this you’ll be ahead of 99% of the population.

And you’ll understand exactly why it’s not inflation you need to be worried about, in fact it’s pretty close to the opposite.

Let’s put the equation on the screen.

M x V = Nominal GDP

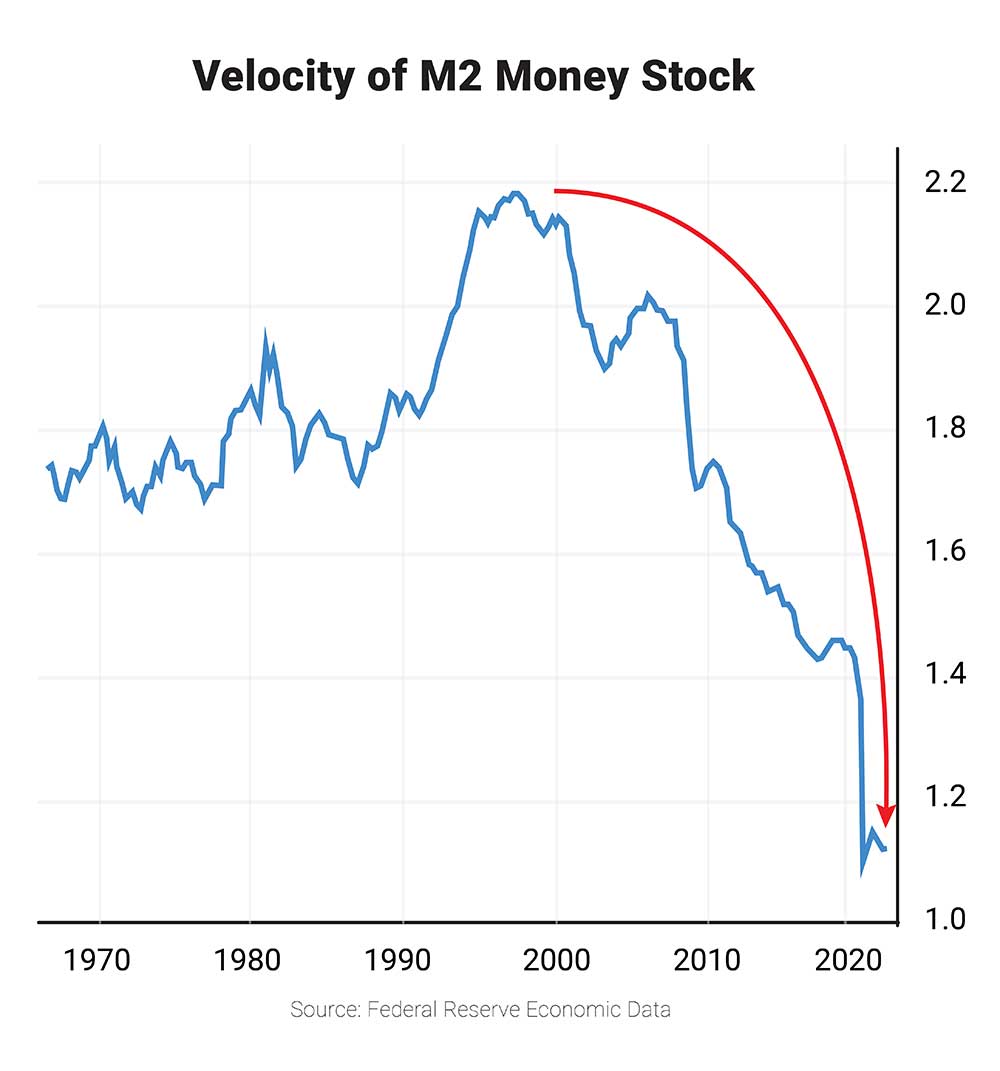

This is the quantity theory of money, and it states that MxV=Nominal GDP

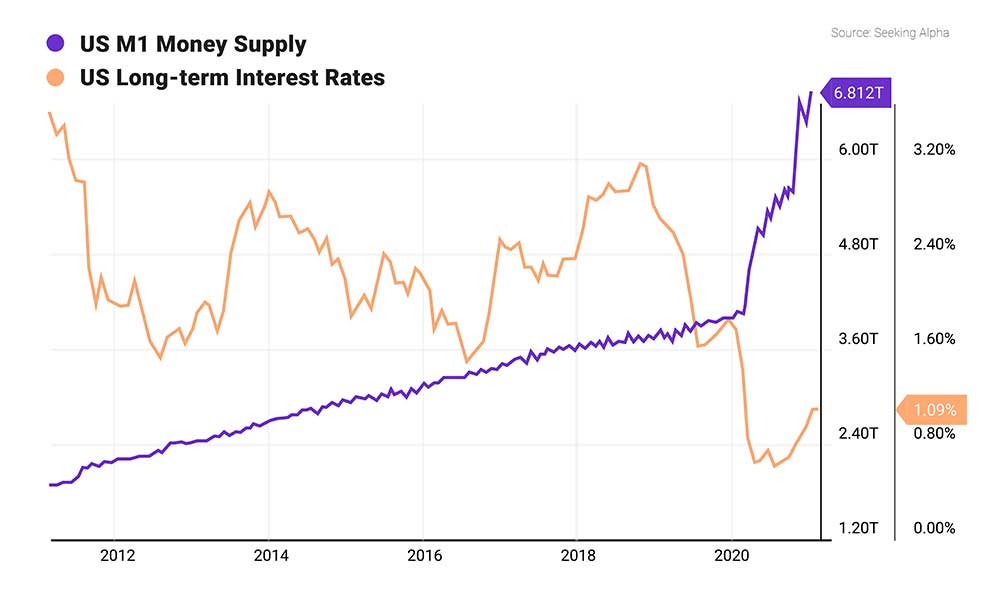

The M in the equation stands for the supply of money…

And that has been skyrocketing, there’s no doubt about it.

But take a look at the V.

That stands for the velocity of money, or how fast the money is being turned over in the economy.

Imagine it like this:

If I go out to dinner and tip the waiter with a dollar…

And then that waiter takes the exact same dollar and uses it to take an Uber home…

And then the Uber driver takes that same dollar and uses it to put gas in his tank…

Well, that dollar has a velocity of 3. It moved from me to the waiter, to the Uber driver, to the gas station attendant.

That single dollar supported 3 dollars’ worth of goods and services.

But what happens if I decide to stay home that night and watch T.V. and keep the dollar in my pocket.

Well that dollar has a velocity of zero. It isn’t moving.

That’s exactly what’s happening in America's economy today. The velocity of money is tanking.

Ever since the year 2000, it looks like it took an Acapulco cliff dive.

Particularly in mid-2020, it goes vertically straight down and that's continuing.

And it’s been getting worse and worse. Banks aren’t loaning out money, people aren’t spending.

So here's my question for listeners and viewers. What is $5 trillion times zero?

Well, where I went to school, it's zero.

So it doesn't matter what the money supply is.

Double it. Triple it. Quadruple it. If money has no velocity, and people aren't spending it.

They are essentially pouring water on a wet sponge.

And that’s the real danger we're confronting right now.

HOST: Okay Jim, so just to bring this full circle, what does this have to do with a market crash?

JIM: Well by almost any measure you can think of, the market right now is in a massive bubble.

Let me show you what I mean.

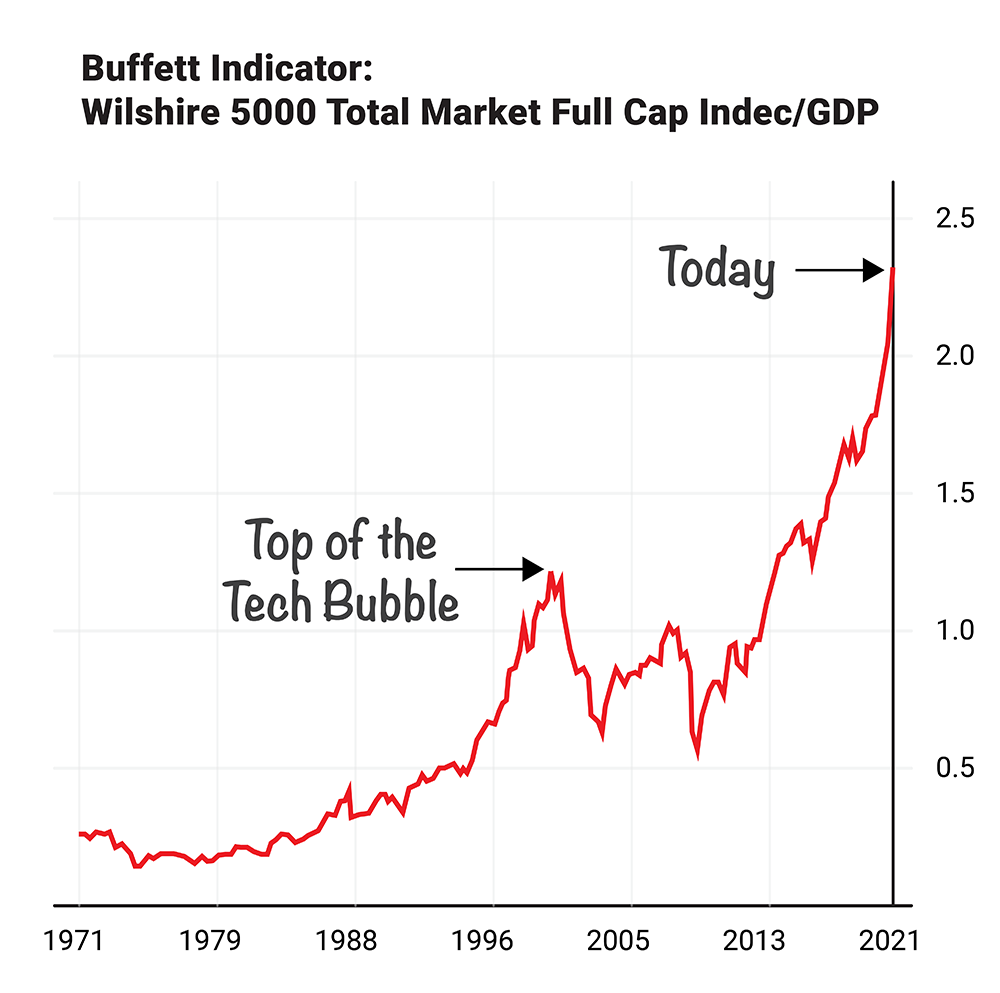

Take a look at this chart:

This is the market cap to GDP ratio…

It gives you a gauge of how much money is invested in the stock market relative to the size of the economy.

And it's Warren Buffet’s favorite indicator for predicting a market crash…

In fact, in 2000, at the peak of the dot.com bubble, when it hit its highest level in history Warren Buffet said it was a “very strong warning signal” of the crash to come.

Well here’s where it stands today.

Almost 150% higher than where it was during the very height of the dot.com bubble.

Which incredible enough on its own.

But here’s the thing…

It's not the only bubble indicator that is soaring off the charts right now.

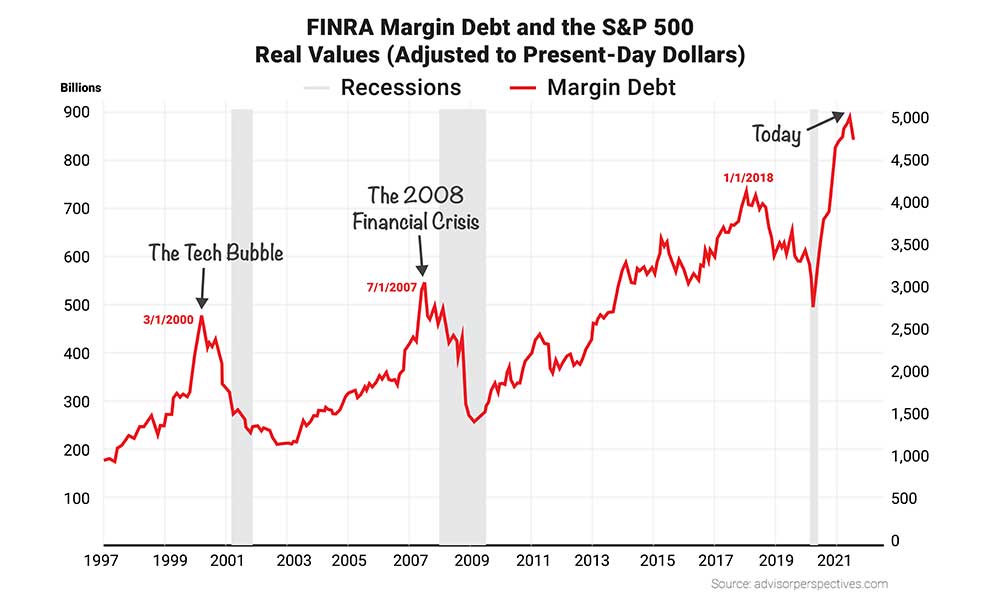

Take a look this:

It’s what’s known as the margin debt chart.

It shows us how much money people are borrowing to invest in the stock market.

Just before the dot.com bubble burst, it shot up to almost 500 billion dollars…as more and more people borrowed money to buy stocks.

And just before the 2008 financial crisis it shot up again and people leveraged up their accounts.

Well here’s where it stands today.

Almost twice where it was at almost any point in history.

That means there’s almost a trillion dollars of borrowed money floating around in the stock market as we speak…

And just to prove my point…

Here’s one more…

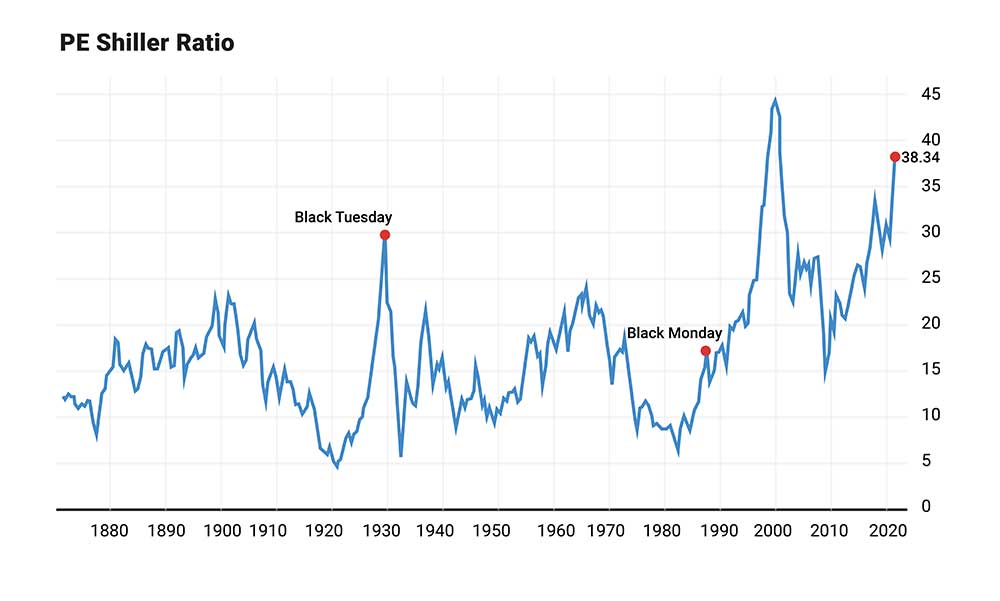

This what’s known as the Shiller PE Ratio…It’s a bubble indicator developed by Nobel Prize-winning economist Robert Shiller.

It’s at one of its highest points since the Great Depression.

And these aren't the only indicators screaming for a bubble.

The list goes on and on…

You see, like I said, by almost every measure you can think of, the stock market today is in the middle of a historic bubble.

One that’s ripe for a crash.

And remember, it’s not just me saying this. Some of the brightest financial minds of our time, people like you’ve mentioned before.

People like Jeremy Grantham saying this is worse than 1929.

“We haven’t seen anything like this not even in 1929”

And Michael Burry, who is saying this is the “greatest speculative bubble of all time. by two orders of magnitude.”

In fact, an entire cacophony of billionaires and leading financial minds are all singing the same tune:

“Lots of people are going to suffer”

– Former Federal Reserve Economist Nouriel Roubini

“Biggest bubble in world history getting bigger. Biggest crash in world history coming”

– Rich Dad Poor Dad Author Robert Kiyosaki

So it’s becoming clearer and clearer by the day that it's only a matter of time before the bubble bursts.

But here’s the most important part…

Once it does, which I think could be as soon as March 10th at 8:31 a.m.

There's going to be a big difference between this crash and the ones that we’ve seen before it.

After this one, the government and the Federal Reserve aren't going to be able to save us.

Remember, we've pumped so much money in the economy for so long that fiscal spending and monetary stimulus won’t work.

At this point it is simply pouring water on a wet sponge.

So when the next crash comes we are going to be all on our own.

HOST: So Jim what does this mean for people watching from home tonight?

Think Japan in the 1990’s

JIM: It means that once stocks crash, the market won't recover for years.

Decades even.

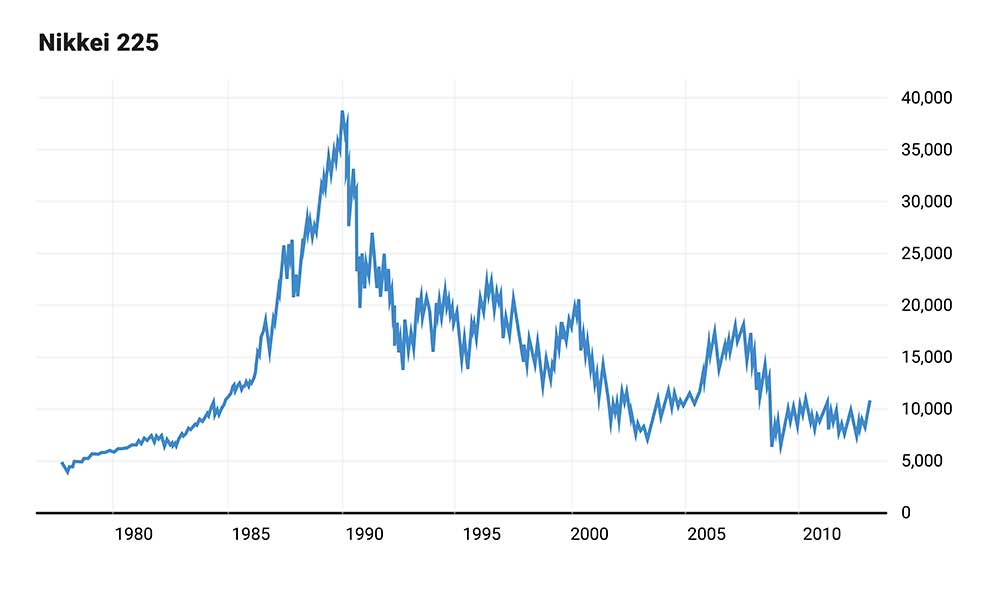

Just look at what happened to Japan.

In the 80’s they had a massive asset bubble.

Just before the bubble popped their real-estate and the stock markets had been hitting all-time highs.

Just like America today.

Then in 1989, the bubble burst and the Nikkei fell by over 60% in just a few short years.

Economic growth slowed to a crawl. They did everything they could to stimulate the economy but nothing worked.

And Japan experienced three lost decades.

Which by the way, means anybody that was at retirement age in the 1990's lost over half their wealth.

Wealth that was never recovered in their lifetime.

And that’s exactly what people like Charlie Munger and Ray Dalio are saying we are heading today.

“2021-2031 will be a lost decade for U.S. stocks.”

– Ray Dalio

That's why it is important that if you have money in the markets…

You need to make some of the moves we are going to talk about tonight immediately.

Because you may not get another chance in your lifetime.

HOST: Now Jim, I want to talk about this for just a moment, because I feel like this is an important point.

For those of you watching tonight that are at or nearing retirement…

Imagine what something like a lost decade would mean to you.

Could you withstand losing over half your portfolio's value in just a year? Then watching it stay there for more than a decade or even two?

What would that mean to your lifestyle in retirement…what would it mean for the people in your life who rely on you…or to the people you may have to rely on during those difficult times…

What would it mean to the inheritance you planned on leaving to your children or your spouse?

I know these are hard things to consider. And our goal tonight isn’t to scare anyone.

But it’s important to remember that the small consequences of acting too early in this case are nothing compared to the dangers that come from acting too late.

That’s what makes what Jim is saying right now so important.

And it’s exactly why you should make some of the moves he’ll be recommending here in a moment.

JIM: That’s exactly right.

And it’s important to keep in mind that Japan isn’t just some far off example…

This happened right here in America too…

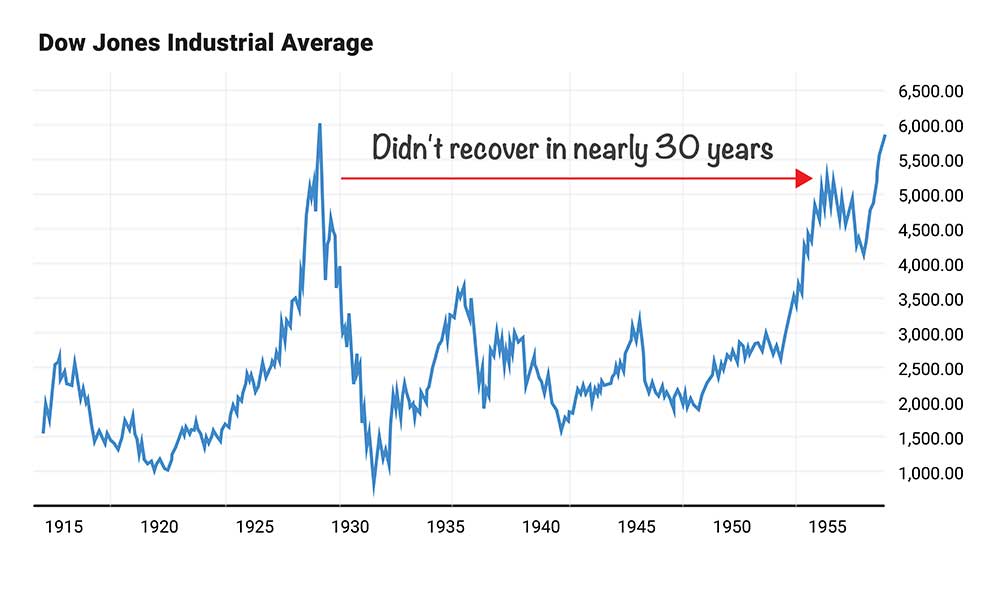

Just look at what happened in America during the 1930’s.

During the 1920’s, the U.S. had a spectacular bull market.

Trading on the exchanges had become a national past-time.

People were borrowing money to buy stocks.

Just like the people that are “borrowing on margin” today…

But then the bubble burst…

The market fell by more than 85%…

And again it took almost 30 years to recover…

No amount of fiscal stimulus got us out of it.

You might remember FDR’s new deal, where we spent billions creating programs like Worker Progress Administration to provide jobs for the unemployed…

Instituting the Social Security Act, and on and on.

In fact, most people don’t realize this but between 1933-1937 the money supply increased by more than 42%.

Still nothing worked.

It took repricing gold in dollars and essentially devaluing the currency by more than 40% overnight to get the economy jump started again.

And it wasn’t until decades later that the stock market followed.

HOST: Jim it’s interesting that you bring up the Great Depression, because in your best-selling book The New Great Depression, you deal with the issues that during the pandemic would wreck on the economy…

You made several predictions we’ve already seen come true.

You were one of the first to say that the lockdowns of 2020 would go down as one of the biggest policy blunders ever…and that they wouldn't stop the coronavirus.

You were also one of the first to say that the jobs we lost during the economic calamity that followed would never return…

And indeed that’s exactly what we saw happen.

But you also talked about something called a “perception/reality gap”…

The idea that the market could continue to see all-time highs until the economic fallout of the coronavirus was fully realized.

Then economic reality would set in and we could see another crash…is that what you see playing out in the markets today?

JIM: That's exactly right, Chris.

And that’s what a lot of people are going to get wrong about this correction…

You see, the 2008 financial crisis was exactly that…a financial crisis that was limited mostly to the financial system.

But what we are going through now is an economic crisis…it’s in our economy and that can’t be solved with more debt and money printing.

You see, it's obvious to anyone that’s paying attention that we are going through a new Great Depression in an economic sense.

Many of the millions of jobs we've lost aren't coming back.

And according to Harvard University's economic tracker, there are 37% fewer small businesses open today than before the pandemic.

And it may take years for the economy to return to its full capacity.

But when you look at the stock market today, none of this is priced in.

The Dow’s trading at all-time highs.

And more people are piling into the stock market every day.

So it’s only a matter of time before the perception/reality gap closes and the economic reality catches up with the stock market.

HOST: And you think that could happen in just the next few weeks?

JIM: Yes. And I'll get to exactly why I think that in just a moment…

But if you just look around you, the signs are becoming more obvious by the day.

Just look at what's happening in China.

A scenario like one we've described is already beginning to play out in China.

They are basically the canary in the coal mine.

China is the world's second largest economy. And was one of the fastest growing.

And they have no qualms about printing money or devaluing their currency.

In fact according to CNBC…

“The Chinese print more money than any other country has printed, in gross terms, in world history”

But what’s happening there now. A major economic slowdown, major.

And they are beginning to panic.

How do we know?

Because they just lowered their Reserve Ratio Requirement.

It's basically a rule when regulators look at the banks and they say, “Okay, how much money are you allowed to lend?”

Well, it's based on a percentage of capital available.

So as an example:

If you're a bank and if you have, say $10,000 in capital, they may let you lend out $100,000.

Well, they can adjust that. They can say, “You know what? We'll let you lend a little bit more.”

Just think of it as a thermostat. Your house is cool, you turn up the thermostat.

If your house is too hot, you turn it down a little bit.

The Triple R, Reserve Ratio Requirement, just call it the Triple R, when they lower it, it means the banks can lend more.

So why would the Chinese government be telling the banks they can lend more?

The answer is, the economy's slowing and they are beginning to panic.

Their stock market is already in trouble.

And they badly need to get money out of the banks and into the economy.

They're basically begging them to get out there and start trying to force-feed money into the economy.

Lowering the Triple R, is something they do rarely, by the way, but that's a sure sign that they're beginning to panic…

To quote CNBC, when China makes a move like this, it “reeks of desperation.”

But they are going to be better off, because in the U.S., our banks don’t have to lend if they don’t want to.

They can just sit on the reserves.

But in China, if you don't lend, you'll be in front of a firing squad.

I mean, they don't mess around.

So the point is, China is lowering the tripwire. They are the canary in the coal mine.

That is a huge signal. They are basically shooting up a flair and saying that the Chinese economy is in trouble.

And we aren’t going to be far behind.

But it’s not just China, by the way.

Nearly every major economy in the world is having trouble right now.

Even before the coronavirus, things weren’t looking good.

Almost every key economy was on the verge of recession.

Now we are in a much worse position.

HOST: Jim, this all makes sense…the damage wrought by the coronavirus and the government's response to it has ruined economies worldwide…and yet the stock market is still trading at all-time highs, so it's only a matter of time before the “perception/reality” gap closes and the stock market crashes.

But based on what you're saying it almost seems obvious… I mean, don't other investors see this coming? Shouldn't all of this fear already be priced into the market?

JIM: Well, some of the best investors do see this coming.

The people like the ones we mentioned before, Jeremy Grantham, Michael Burry, Warren Buffet’s right hand man Charlie Munger, and so on.

But if you mean the broader market, the truth is…the stock market rarely sees a market crash coming…

Did the stock market see the crash or the panic coming in 1998? No.

Did it see the dot.com crash coming in 2000? No.

Did it see the mortgage collapse in 2007? No.

Did it see the greatest one-month drawdown percentage-wise in market history in 2020? No.

Every time just before a crash, euphoria hits all-time highs and everybody thinks that this time it’s different.

It happened in stocks in 1929.

And the housing market in 2008.

Then the market gets hit in the eye with a 2X4, people lose a third or more of their wealth and everybody wonders what happened.

We are seeing the same thing happen today…meme stocks on bankrupt companies are soaring.

Speculative crypto plays like Dogecoin and NFT’s are hitting all-time highs.

These aren’t signs of a healthy market. They are signs of the top of the bubble.

HOST: So the market has no idea when a crash is coming. In fact, it often thinks the exact opposite.

JIM: Well, just because the stock market never sees it coming, doesn’t mean the market as a whole doesn’t have a clue.

You see, there is a market out there that consistently gets it right. It has a very good track record.

And a very long history of getting it right.

And that’s the bond market. I'm talking about US government securities.

And in particular, the 10-year Treasury note.

Why 10 year?

Well, in general, the 10-year note is a good proxy for all the important decisions that we make.

Because it’s exactly how long the average American owns their home and pays their mortgage before moving out or refinancing.

And when boards of directors of large corporations are talking about multi-billion dollar fixed assets and investments, say they are building a new plant or branching into a new country or buying 747s for your airline, what's the horizon on that?

When you're actually in the boardroom, and I've been in these boardrooms and these discussions…

The answer is five to ten years, somewhere in there.

The plane may last longer, but 5-10 years, that's your horizon.

So the 10-year Treasury note is a good proxy for the real rate over time for all the important decisions we make in the economy.

From someone buying a house all the way to large corporations buying a 747.

And in that sense, it's approximately the economy.

So, what has the 10-year note bond market been doing?

Well, on March 31st, 2021, the yield to maturity hit an interim peak of 1.745%.

That's not historically high, but it's been high relative to the last couple of years.

It's about 1.2%. So it's down half a percentage point, almost two and a half percentage points from, round numbers, 1.75 to 1.2.

From these levels, for the bond market that is an earthquake.

So what does that tell me?

That bond market is saying that the inflation narrative is false.

That disinflation is coming.

That the economy is slowing down.

And once the perception/reality gap closes, we are heading towards a massive, massive crash.

In fact, billionaire “bond king” Jeff Gundlach is warning people not only that the stock market will crash…

But that:

“If you want to own US stocks, you should [go in] knowing that you're going to take a bloodbath if you overstay your welcome…”

And billionaire Leon Cooperman is saying that:

“When this market has a reason to go down, it's going to go down so fast your head’s going to spin.”

And Gary Shilling a former Federal Reserve Board member, is saying that when this happens…

“there's going to be a lot of blood on the floor.”

I agree.

That's exactly why I'm calling this “Bloody Wednesday”

Because when this happens it will be fast and it will be bloody…

And based on what I’m about to show you in a moment, it will be on a Wednesday.

HOST: So Jim you're essentially saying the bond market is already flashing signs that the stock market is heading for a crash. And billionaires who already know this information are moving their money.

JIM: Exactly.

There are a lot of other signs, by the way.

I picked that one because it's very accessible and it's easy to understand.

There's a long list of signs that are indicating the same thing.

HOST: Now Jim you've singled out a date that you believe we could see this bubble burst. The 10th of this March. What's so special about that date?

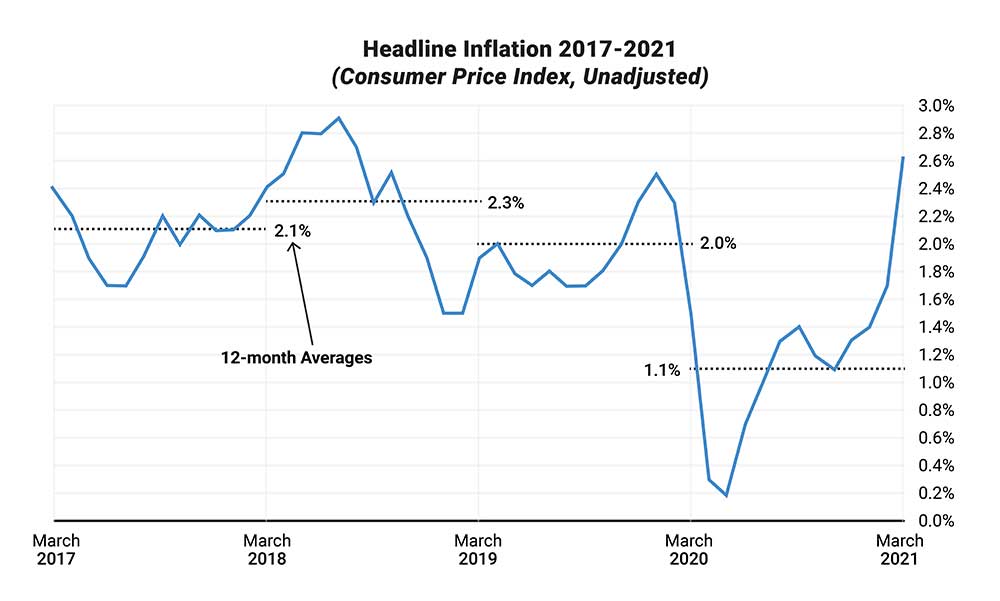

JIM: That’s the date that the new CPI numbers are released.

They are the number the government uses to measure inflation.

And I think they are going to come in low.

HOST: But haven't they been high over the last few months?

JIM: Yes, but not as high as everyone thinks…that's why this is going to be such a shock.

You see, for the past few months, the inflation numbers have included what are called “base effects”.

Not to get too tactical or too geeky…

But you have to ask yourself, how does the government calculate inflation?

Well, the way they do it is they take the monthly data, and they compare it to the prior year.

So May 2021 is compared to May 2020. June 2021 is compared to June 2020.

So it's year over year.

So when you hear numbers for May, June, and July of 2021 that are a little bit hot, and they are, they're comparing it to May, June, July of 2020.

That’s why they’ve been so high lately.

Because think about it, what was going on in May, June, July of 2020?

We were in the aftermath of the worst recession, the worst collapse, since 1946.

It had been over 75 years since we had something like it, and prices were plunging.

Airlines were shut down, restaurants were shut down, movie theaters were shut down, et cetera, all across the economy. People were in their homes, practically sheltering in place, afraid to go out.

So what do you think is going to happen to prices in that environment? Well, many prices should plunge.

And that is exactly what they did in 2020.

But the best estimates are that about half of these headlines that everyone is seeing in the news are these “base effects”.

That's what's getting everybody so worried about inflation.

And the important thing is, those “base effects” are non-recurring.

They're not happening again.

In fact, they’ll start going away next month.

That’s what makes these new CPI numbers so important.

Because the entire world is watching to see if they come in low…

If they do, the markets could take a nosedive on that exact same day when people realize that we are heading for low growth. That fiscal and monetary policy are essentially useless to save us this time.

If I'm right we could be in for one of the biggest market corrections of our lifetimes.

We're talking 1930's market collapse.

And as I showed you earlier the bond market is already preparing and essentially betting that I’m right.

That’s why it’s so important for you to get into position now.

Because if you wait until after the 12th, well…it could already be too late.

HOST: So what you're saying, Jim, is that after these “base effects” wear off, we could see a decrease in the rate of inflation. Say it drops from 3% to 1.5%…we could see the market tank.

JIM: Exactly, Chris. It means that the inflation narrative will disappear and people will realize that stocks are one of the most dangerous places to be right now.

People will start pulling out their money and you do NOT want to be the last one left holding the bag.

Like we talked about earlier billionaires like Charlie Munger, Jeremy Grantham, and Michael Burry are making their moves now.

And here's the thing….

Even if I'm not right, a lot of the investment opportunities we are going to talk about tonight could still do very well.

In fact, I've put over 1 million dollars of my own money into one of these investments.

That should tell you how confident I am.

HOST: And we will detail those investments in just a moment.

But let me ask you one last question before we do.

Should the pandemic be factoring it to anyone's investment decisions right now. Or is the worst behind us?

JIM: That’s a good question.

None of this analysis we're going over…

none of what I'm saying relies on the

pandemic to make the point.

Look, the pandemic is a serious issue. I'm not denying that.

I know because like you mentioned before, I wrote a best-selling book about it.

But my point being that everything we talked about today is completely independent of that.

And now, of course, we're getting another wave, a new spike in Covid cases, the Delta variant.

And unfortunately, we may see our government overreact and shut down our economy again.

If they do, this could all happen tomorrow.

HOST: Do you really think they'd lock down the economy again?

JIM: Look, I just got back from LA.

When I flew in from New Hampshire, there was no mask requirement.

But when I got off the plane in LA, I'm getting yelled at every five feet.

The guy at the Hertz Rent-A-Car place wouldn't let me out of the parking lot unless I put a mask on.

Can you believe that?

I'm sitting in my car by myself and asking me to put on a mask or he won't let me out of the parking lot.

So I did, and then I ripped it off two seconds later.

But my point is that LA is locking down again.

New York's locking down again.

This is happening as we speak.

Look, I don't want to turn this into a medical discussion…

But what is that going to do for people going out, borrowing money, spending money, et cetera?

The answer is we're killing the economy again for no reason.

Lockdowns don't work.

And by the way, this is in my book.

The New Great Depression chapter 1 and also in chapter 2.

I have 200 endnotes. I didn't make it up. There are primary sources. So for that, I relied on D.A. Henderson, not a household name.

You know who D.A. Henderson was?

He was the single man credited with eradicating smallpox on the planet Earth.

He led the effort.

There was a multi-decade joint effort, but he was the leader and he's given credit for eradicating smallpox.

So, I dare say he knows a little bit about epidemiology.

He was the Dean of the Bloomberg School of Public Health at Johns Hopkins University.

He received the Presidential Medal of Freedom, which is the highest civilian honor the US has.

It's equivalent to the Congressional Medal of Honor.

But it's for civilians, not for combatants.

He received the Presidential Medal of Freedom.

I could go on, but suffice to say, this guy is the most successful, credible, credentialed virologist of epidemiologists of the 20th century.

He wrote a paper in 2005 and it's in the endnotes of my book.

And guess what he said? Lockdowns don't work.

So, it's not Jim Rickards making it up. It's the greatest virologist of the 20th century saying lockdowns don't…

And he explained why.

And I cited that in the paper and I said, “Lockdowns are really good at destroying the economy, but they don't work.”

They don't work in terms of stopping the spread of the virus. Virus goes where it wants.

But the unfortunate reality is that we could see lockdowns again worldwide.

And that means this all could happen any day now.

HOST: So we need to be prepared for both these new CPI numbers and potentially a new wave of lockdowns. So what can everyone tonight do to prepare?

JIM: Well, there are some relatively simple moves that you can make to help insulate yourself from the coming carnage.

First recommend doing whatever to make sure you have enough cash on hand to cover at least 3-6 months’ worth of expenses.

Plenty of people will get wiped out in the early stages of this crisis as the market crashes…

Remember, a market crash is more than just about the stock market.

People will lose their jobs, their homes, and watch their retirement accounts shrink to nothing.

Think 2008 on steroids.

So having a little cash on hand will ensure that you are well insulated against the coming storm.

I also recommend moving a large part of your portfolio to cash.

Having a large cash position will limit your downside during a crash and give you plenty of dry powder to enter back into the market at rock bottom prices once the bloodbath is over.

As the old Wall Street adage goes…best time to buy stocks is when there is “blood in the streets”.

And once this happens, there will be plenty of blood spilled.

Having cash both in your personal accounts and in your portfolio means you’ll be one of the sharks instead of the prey.

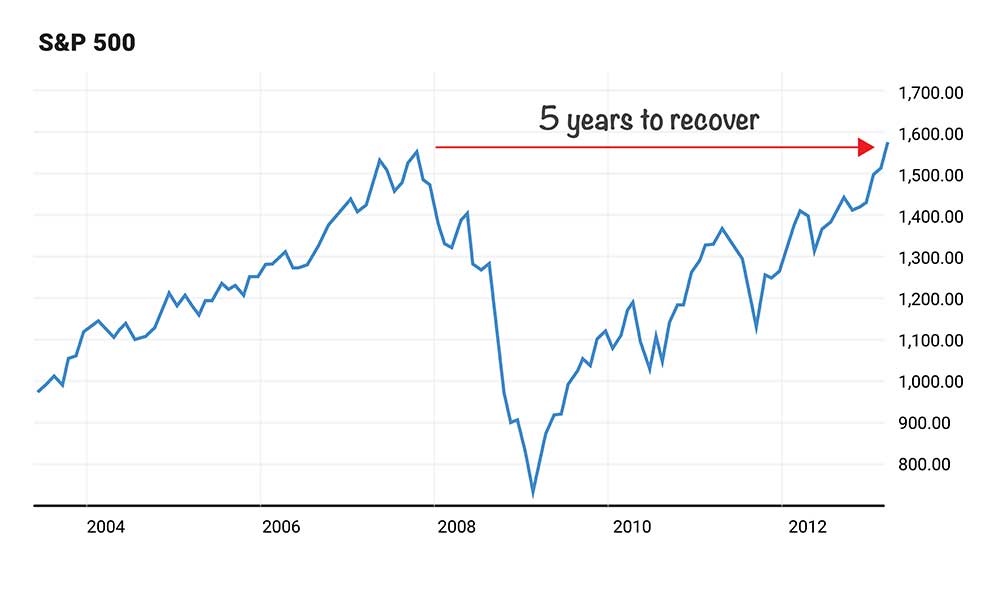

HOST: Jim, that makes a lot of sense. I think a lot of people on tonight's call wished they had gone to cash before 2008 and then bought back in at rock bottom prices.

I mean, the S&P 500 was cut in half during that time. Anybody that tried to ride it out in stocks had to wait at least 5 years for the markets to recover.

But anybody that went to cash and bought even just a run of the mill index fund anywhere close to the bottom of the market could have doubled their money in the same time frame.

JIM: Exactly. That’s why having cash right now is so vital. And like you said you could have done that with a run of the mill index fund.

But with the recommendations I’m going to be making tonight you’ll have a chance to do much better than just doubling your money.

In fact, if done right, a market crash is one of the few times where you can make life changing gains in a short period of time.

That’s why some of the plays we are going to recommend tonight have the chance to go up 1,000% or more in just a matter of days as stocks fall.

HOST: Now Jim, I’m anxious to get to those plays, but before we go any further…

I know that in addition to going to cash, you’ve broken down everything you’re recommending into 4 simple steps readers can take to set themselves up to profit in the months ahead.

We’ll cover them in just a moment…

But first, I’d like to let the viewers know that you've done everyone watching this call tonight another tremendous favor.

Jim has taken everything we’ve talked about here tonight and compiled it into a special dossier titled, “The Bloody Wednesday Survival Guide…How to Survive and Prosper in the Decades That Lie Ahead”

In it, you’ll find all the facts and figures we’ve talked about tonight along with a few special investment opportunities we will be covering on tonight's call.

It includes things like:

- The ONE investment you need to be making right now.

- Specific portfolio allocations for the coming correction.

- 5 unique investments that could give you massive returns during a market crash.

- And more.

We’ll go into more detail on some of these strategies in just a second.

But considering that in the past Jim’s dossiers have been the subject of study by the CIA, and have been circulated at the highest level of the intelligence community, and even requested by members of the senate and congress.

It’s hard to put an exact price tag on the value of receiving this type of dossier yourself.

However, for reasons that we will explain a little later, after we’ve gone through all of the recommendations.…

Jim has generously offered to make this dossier available for immediate download to anybody viewing this presentation tonight.

We’ll show you how to claim your copy in a moment.

But let’s go ahead and get into some of the specific recommendations now.

Jim, in addition to going to cash, what else should our readers be doing?

JIM: Well, the one mistake I see almost 99% of investors make is not properly allocating their portfolios.

That’s why I break down all of the portfolio allocation in the dossier…

And the first step I’m going to recommend is that you allocate at least 10% of your Portfolio to what I call “the world’s most indestructible asset”.

Step #1: Put Up to 10% of Your Portfolio

in World's Most Indestructible Asset

There is one asset that performs surprisingly well during times of crisis…

And it will be the single most important safe haven for what lies ahead.

In fact, Ray Dalio, one of the men who has been warning about a correction, has invested more than $400 million into this one asset.

And billionaire investors like Paul Singer, Paul Tudor Jones, “Bond King” Jeffery Gundlach, and even Warren Buffet have been flocking to this one asset.

Now it may surprise you when I say this…

But I’m talking about owning gold, but not in the way you might think.

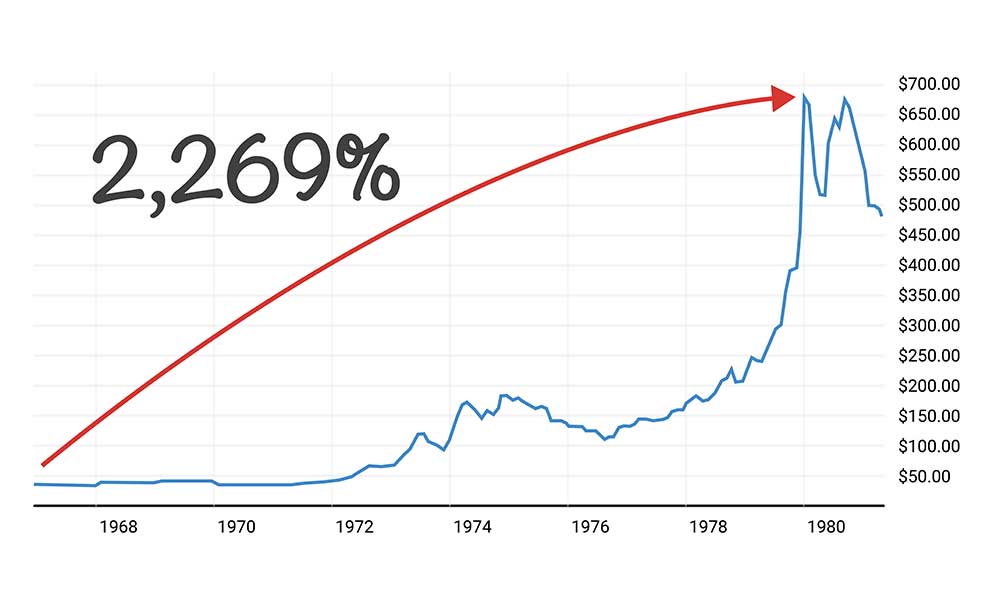

You see, most people only think of gold as an inflation hedge.

And they are right, gold does tend to do well during times of high inflation…

In fact, during the stagflation of the 1970’s gold shot up over 2,269% during the course of a decade.

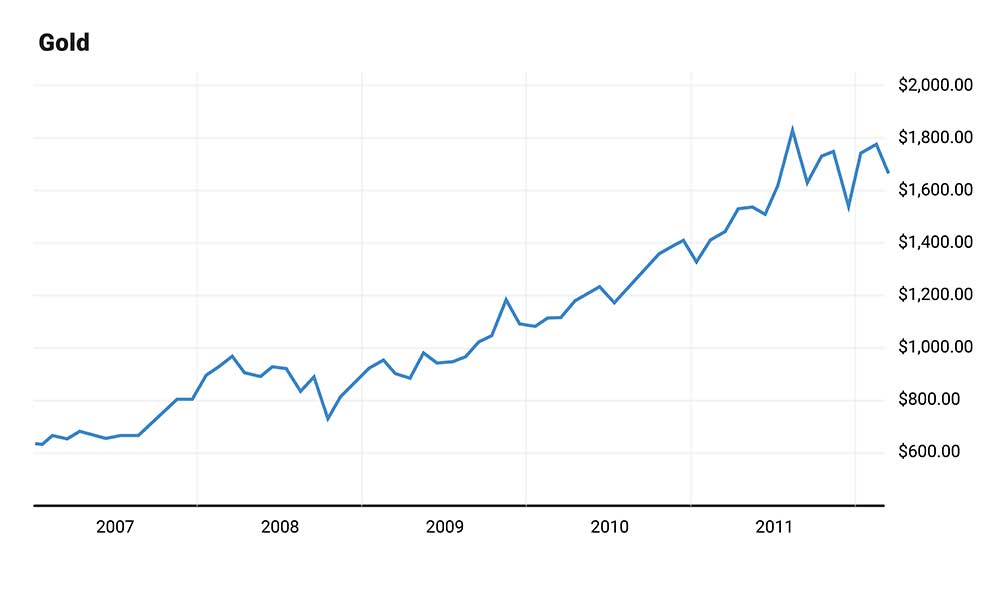

But here’s what most people don't realize.

That in the years following the 2008 financial crisis, the biggest market correction of our lifetimes…gold did tremendously well.

That’s because as USA today put it, regardless of what’s happening…

And Egyptian billionaire Naguib Sawiris, a man who recently put half his net worth in gold said people “tend to go to gold during a crisis and we are full of crises right now.”

And he is exactly right.

That's why I like to call gold the world's most indestructible asset.

And here’s the best part…

Even though it's not likely in the near term, eventually the government will try to print its way out of an economic downturn.

And if we do get runaway inflation, gold is the best to be.

That's why billionaires are taking stakes in gold right now…

I think it’s safe to say that gold has a long, long way to run in years to come.

In fact, as this crisis unfolds I believe that gold itself will hit at least $14,000 an ounce in the coming years.

That’s why, in order to protect my family's wealth, I’ve invested more than $1 million of my own money in gold, and some special gold related investments I’ll detail here in a moment.

And I recommend you move 10% of your investable assets to gold.

But here’s the problem, many people go about investing in gold in exactly the wrong way…

You see, thanks to my deep connections in both the intelligence and financial community…

I’ve probably been allowed to do more in depth research on the subject of gold investing than anyone else…

I’ve visited secret gold vaults in Switzerland, whose location I’m not authorized to disclose.

It’s safe to say that no one has had the kind of insider access I’ve had on the subject of the yellow metal.

That’s why I’d like to offer to send along a copy of my book, The New Case for Gold, to everyone watching tonight.

It includes many of the finer points of gold investing and details why it may be the best investment for the coming decade.

It includes things like:

- The secret lever the government still has left to pull during the next crisis and why it would send gold to $14,000 overnight (It’s only been used once before, and Trump was a big supporter of it. In fact, he said making this move “would be wonderful.” Pg. 34)

- The REAL reason Russia and China have been secretly buying up gold by the metric ton (and what it means for anyone investing in gold now. Pg. 43)

- The 5 secrets of the worldwide gold manipulators and how to take advantage of their schemes to profit (Major banks and governments around the world are using schemes to manipulate the price of gold, but you don’t just have to be an innocent bystander in this game. In fact, you can use this information to your advantage and make a lot of money. Pg 108).

- The U.S. government’s secret scheme for removing physical gold from circulation (and why you should NEVER store your gold at a bank)

- The three countries where you can easily and safely store some of your gold outside of U.S. borders (Plus, a special depository located in Texas that is protected by the Tenth amendment where you can vault your gold without fear of confiscation from the U.S. Government)

- A new “shadow gold standard” that is being used by world leaders (and why a special type of gold investment could give you a “seat at the table” during the next monetary reset.)

- My favorite way to invest in gold mining stocks (and how it helps you avoid the #1 mistake nearly ALL gold investors make)

I believe that this book will be the single greatest resource on gold investing in the years to come.

And even though it retails for almost $26 in bookstores across the country, I’ll send everyone watching tonight a FREE hard-cover copy of my book when they claim their dossier.

HOST: And for everyone watching tonight’s call Jim has included an additional hidden chapter of this book.

One that’s not available in any print version, and never has been released anywhere before.

In it he details some of the most unique gold and precious metal investment opportunities that he has come across in his research.

Like:

- Jim’s #1 Gold Play for 2021- a special development taking place in the Arctic as we speak. It’s something that very few people realize is happening let alone how to invest in it. But here Jim will guide through exactly what this is and how to stake your claim

- The World’s Last Pure Silver Mine – A little known silver mine that trades for less than $4 a share that may be sitting on the largest deposit of pure silver in the world.

- Secret Island Silver – A special silver coin from a secret mint located off the coast of the Cook Islands that has unique properties which make it substantially more valuable in a time of crisis.

Now Jim, some of these investments are incredibly unique and things I’ve never seen anywhere before.

Can you detail some of them for the audience?

JIM: Sure. In fact, in addition to the dossier and a copy of my best-selling book, I brought a special gift along tonight for any viewer that wants to claim one.

Can we get a close up shot of what I’m holding in my hands?

Take a look at these:

These may look like old continental dollars, or maybe even gold certificates to you.

But they are far more valuable than any of that.

These are actually thinly printed sheets of real gold that have been covered in a nearly indestructible protective polymer.

See how they look and feel almost just like real cash.

And they have their own protective security marks printed on them just like a U.S. 100 bill.

They come in multiple denominations ranging 1/1000 troy ounce all the way to 1/20th of a troy ounce.

And what makes them so interesting and so potentially valuable to everyone watching tonight, is that they could solve one of the biggest problems with storing physical gold for worst case scenarios.

You see, during a time of crisis it’s nearly impossible to use physical gold for barter.

That’s because a single 1 ounce American Gold Eagle is worth more than $1,900.

But with goldbacks, you could trade much smaller denominations of gold as easily as you can a few dollar bills.

And because of the materials required…

And the government-level security features on each bill, they are nearly impossible to forge.

And as we speak they are being printed as an alternative currency in places like Utah, Nevada, New Hampshire.

And they are legal to spend and use anywhere in the United States.

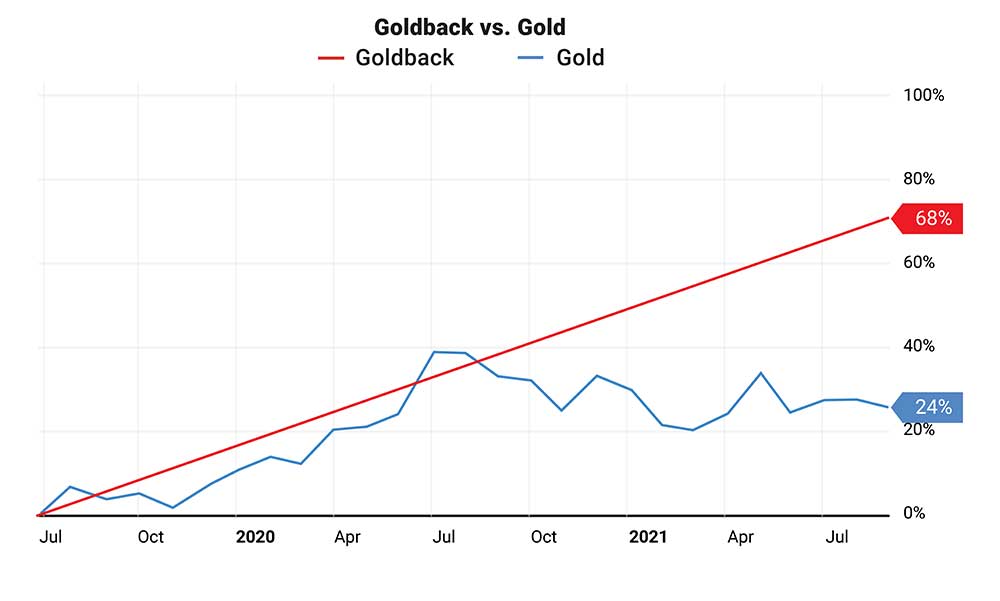

And here’s the best part…

Since they started being minted a little over two years ago, they’ve been soaring in value at twice the rate of gold.

Which means that as gold rises in value, these could skyrocket.

In fact, if gold does go to $14,000 an oz., it's not unthinkable that these will trade at twice the spot price of regular gold.

Which means that each one of these goldbacks could become incredibly valuable.

Of course, they are new type of speculative investment and nothing in the market is guaranteed, but…

They’re usefulness as an alternative investment is all detailed in this new chapter.

Including where you can get these goldbacks and special vaults where you can have them stored for free.

HOST: They are truly beautiful pieces of work. I could easily see these being incredibly useful to have during a crisis.

I could even see them being passed down from generation to generation like a family heirloom.

JIM: I’m glad you think so, Chris, because this one's for you.

In fact, I think it’s such a good idea for people to keep physical gold on hand in addition to their cash reserves.

When you claim a dossier today, along with everything else we are sending out, I want to send one of these along as well.

HOST: Thank you Jim. That’s incredibly generous of you.

And we’ll show everyone how to claim Jim’s gift in just a moment along with a copy of his book and the dossier.

But first Jim, I’d like to turn our attention to the second step you mention in this dossier.

Step #2: How to 10X Your Money

from the Coming Crash

In it, you are recommending people buy something you refer to as “portfolio insurance” Can you take a second and explain how that works?

JIM: This is a very special type of crash protection play that very few investors even realize exists.

In fact, it’s similar to the secret that Joseph Kennedy, the father of John F. Kennedy used to launch the Kennedy family fortune right in the middle of the 1929 crash.

And nearly identical to how billionaire Mark Cuban protected his investments and profited more than 1.4 billion dollars during the dot.com crash.

And this type of “portfolio insurance” play is one of the most powerful wealth-building tools you can have in a time of crisis.

And I’ve found a way that allows even average investors to get in on this opportunity…

Without having to “short stocks” or anything complicated like that.

And the results have been absolutely incredible.

In fact, the handful of the people who I’ve shown this strategy to in my high-end research services have reported back making as much as 1,300% returns in a little under two weeks.

To taking home over 1,000% returns in just as fast as 2 days.

Of course, those are rare and exceptional examples, obviously the markets and stocks don’t crash everyday…

But it shows just how powerful this strategy can be…

And I’ll lay out everything in the special dossier I’ve put together for tonight's event.

But here’s the most important point…

Returns like that are a big reason why I DON’T recommend just going into cash and sitting on the sidelines during this crash.

You see there are plenty of moneymaking opportunities to take advantage of along the way.

HOST: Speaking of which, let’s go ahead and talk about a few of those opportunities right now.

In step 3 of the dossier you talk about investing in “Anti-Meme stocks”. Can you explain exactly what that is?

Step #3: The 5 “Anti-Meme” Stocks Set

to Soar When the Bubble Bursts

JIM: Right now millions of investors are trying to chase gains at the end of the bubble…

You've probably heard of “meme” stocks like AMC, GameStop, and Hertz

But it's a dangerous game because most of these companies aren't fundamentally sound.

Just take a look at these headlines.

This kind of “gambling” strategy is a clear sign of a massive bubble on the verge of bursting…

But here’s what most people don’t realize.

By positioning yourself now, there is as much opportunity to make money on certain stocks during a falling market…

Rather than just trying to chase them on the way up.

Let me show you what I mean…

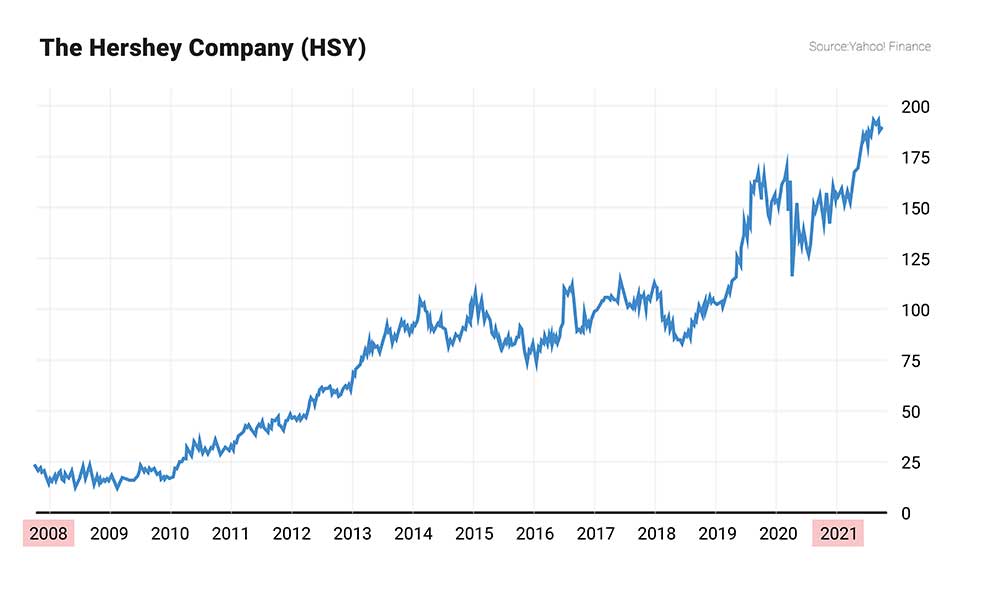

Just take a look at what happened with Hershey Inc, just after the financial crisis in 2008…

The stock shot up by more than 416%.

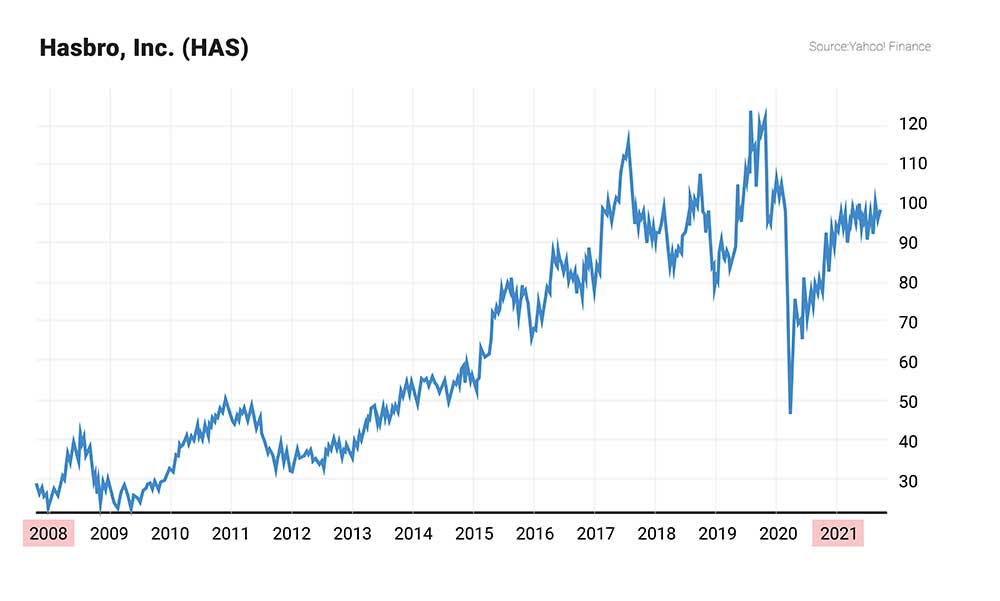

The same thing with Hasbro. Since the last recession it’s shot up more than 345%.

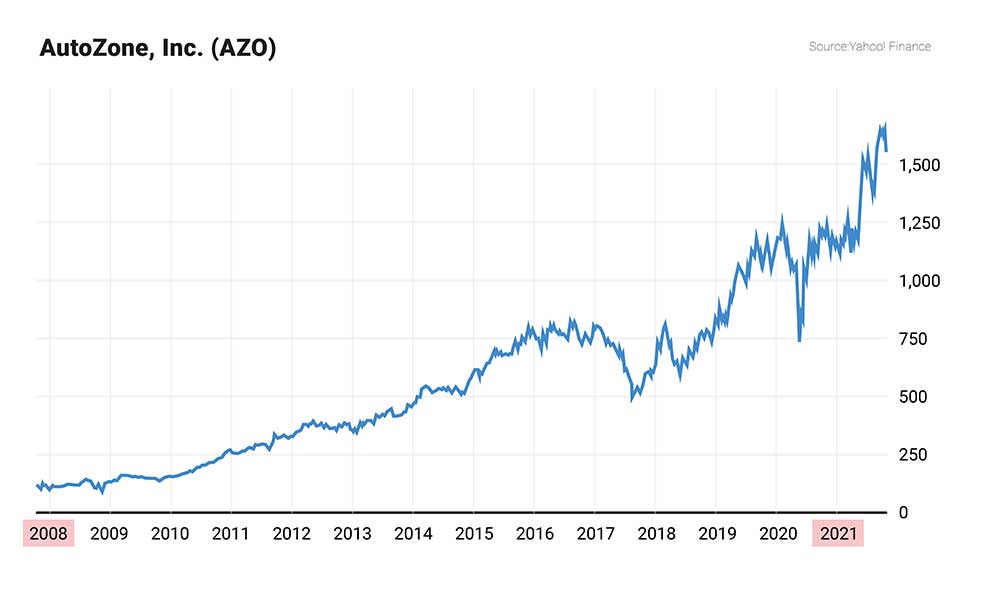

Or Autozone which since the 2009 recession has shot up more than 1,064%.

You see, all these companies have a secret ingredient that has them perform very well even during tough times…

They each have a high return on invested capital.

Which means that they can thrive and expand during tough times instead of withering away.

And instead of being nearly bankrupt companies, people are gambling on at the top of the bubble.

These are all very well run companies people will flock to once the crash hits.

That' why I call them “Anti-Meme stocks”.

And I've identified 5 companies that have extremely high returns on invested capital

All of which I believe are set to soar in the days and months ahead.

Again, in the dossier, I detail all five of them and I give you a full breakdown on each company.

HOST: Now Jim, I’m excited to tell everybody about step #4, because again, I’ve never seen anything like it and I think it’s a tremendous opportunity for everybody on this call tonight. You want to go ahead and tell them?

JIM: Well, step 4 is more of a request than a step…

Step #4: I’d Like Everyone to Mark

This Date on Your Calendar:

March 10th, 2021

You see, one of the most important assets you can have during a crisis, isn’t cash gold, or real estate…

It’s a community…

A community of like-minded people. People who share your values, who understand your worldview, while at the same time possessing skills that compliment your own.

And in today’s divisive political environment, where everybody seems to be at each other’s throats….

I know just how hard something like that can be to find.

That’s why I’m offering to invite everyone watching tonight to a special virtual event that I’m hosting.

You see, one of the things I’m well-known for is helping the intelligence community host their first ever Economic War Games.

This was where we stress tested the U.S. financial system against threat from other countries.

And it was there that I discovered some of the secrets I still use to this day to help show a small group of people how to profit from massive geo-political events.

These are strategies that I’ve never seen before anywhere else.

And they are strategies that could help you collect sizeable profits as this crisis unfolds.

Now typically this event is kept behind a $2,000 paywall.

But tonight, I’m going to offer everyone that wants to claim one, a free ticket to the event…

Because not only will I be revealing some of my best strategies for profiting during a time of crisis…

But I’m going to make an important announcement regarding this “Bloody Wednesday”.

That’s why everyone tonight that wants to claim one, will get a free ticket to the event

HOST: Now Jim, that’s an incredible gift, and I’m sure everyone watching tonight wants to know what they need to do to claim it and keep in touch with you as this crisis unfolds.

JIM: I know that handing you this information and wishing you the best of luck just isn’t enough.

That’s why, tonight I’m opening up membership to my research service Strategic Intelligence through this special offer and inviting everyone on this call tonight to join with a risk-free trial subscription.

And when you do, you’ll get everything we talked about tonight at no additional charge.

My mission with this research service is simple.

To help you profit from and avoid some of the most “unthinkable” events and financial crises I see on the horizon.

You see, over the course of my more than 40-year long career working at the highest levels of the finance and intelligence communities…

I’ve developed a vast network of connections and market insights that have allowed me to stay one step ahead of some of the biggest economic events of our time.

I’ve actually been inside the secure meeting rooms called vaults inside of the Pentagon.

I’ve personally helped the CIA host their economic wargames.

I’ve been in the CIA Directors’ secure conference room on the seventh floor of Langley headquarters.

I’ve been inside the West Wing of the White House.

I’ve been inside the U.S. treasury and talked to Tim Geithner.

I’ve been inside the boardroom at the Federal Reserve and I’ve personally had conversations with Ben Bernanke.

I was the man that Reagan administration turned to help negotiate the end of the Iranian crisis, and the man who the Nixon administration turned to help craft the Petrodollar Accord.

I don’t mean to brag.

But I believe it’s safe to say that when it comes to helping you protect your wealth and telling you what’s really going on behind the scenes in America today…

No one has connections or credentials quite like mine.

And in my flagship newsletter Strategic Intelligence, I share all the market insight I’ve gathered with you…

HOST: Now Jim to be clear, this is NOT a widely publicized newsletter…

In fact, tonight’s call is one of the VERY few places you’ll be able to reserve your membership.

And your newsletter is the only place where you plan to continue to update everyone on this crisis.

JIM: That’s right.

And once you’re in, in addition to everything we are giving away tonight, you’ll also get immediate access to all of the current membership benefits.

That includes things like:

- A private access link that allows you to join an exclusive live intelligence session with me once a month.

This is where you’ll be able to get on a call with me and a small group of other members as I give you my analysis and update you on exactly what’s happening in the markets.

There will be a moderator and you’ll even be able to submit questions for me to answer.

Now remember I can’t give out any personalized investment advice, but this is as close as you’ll come to get your own personal briefing from the contacts I have in the intelligence community.

On top of that monthly intelligence briefing, you’ll also get invitations to all of our live events…

Where you can hear from and shake hands with some of the biggest names in finance and investing.

People like Robert Kiyosaki, George Gilder, Ray Kurzweil, James Altucher, and more…

These events are typically hosted in high profile locations. Like the one we recently hosted in New York City.

And you’ll always be provided a special link that allows you to join online in case you can’t make it.

Remember your first invitation to attend one of these events virtually is on the date I just mentioned, and that’s where I’ll be giving a massive update on this coming crisis.

And all this is completely free for members of Strategic Intelligence.

You’ll even get access to our private model portfolio that’s updated in real time.

You see, because they are more speculative in nature, most of the opportunities we have talked about tonight aren’t part of the official model portfolio of my research service and won’t be tracked.

That means that once you get access to the model portfolio, you’ll get the chance to see dozens of opportunities that my readers are already taking advantage of right now.

Opportunities we didn’t have time to cover tonight and that have never been made available anywhere else.

And even though I can’t give any specific investing advice based on your personal financial situation, I will include exact portfolio allocations.

So you’re never lost about what you need to be doing with your money during each stage of this crisis.

HOST: And it appears, Jim, that membership to your services has been well worth it.

In fact, here’s what some of your past members have had to say.

“When I first saw that you created Strategic Intelligence I was so excited, and when I signed up I knew it was going to be good…but I NEVER expected it to be THIS good. This is a crazy value for the money. Thank you SO MUCH JIM!”

Megan Boyland

“Jim, you and your team are stellar. I’m seeing bubbles everywhere right now. So I’ve become a student of your work and love reviewing all of your books and material. I’m recommending Strategic Intelligence to anyone how is interested in protecting what they have.”

Johnathan Eckmeier

“I’m subscribed to multiple financial research services, but Jim’s Strategic Intelligence is the only one I wait for each new issue with bated breath.

Bob Sinclair

JIM: Thanks, Chris. I’m glad to see that my work is helping out the everyday American, rather than just benefiting the members of the intelligence community and the political elite.

Washington failed to heed my warnings in 2008, but fortunately because of my newsletter, I was able to warn my small group of readers just before the worst of the crisis hit.

Now unfortunately, it appears that millions of Americans are going to be faced with a similar choice.

They can either heed this warning and take a few simple steps to protect their family’s wealth, or they can get swept under the current once this massive tsunami hits.

But they don’t have long to decide. Because once this “Bloody Wednesday” hits it’ll already be too late.

HOST: So just to recap everything that our viewers will get tonight.

In addition to their 12 monthly newsletter issues they’ll get:

- “The “Bloody Wednesday” Survival Guide: How to Survive and Prosper in the Decades That Lie Ahead” – Jim’s Intelligence Dossier that breaks down the full extent of this crisis, along with a timeline and exact step by step instructions you need to take to prepare. Including the two reports listed below:

- How to 10X Your Money During a Market Crash – My definitive guide to buying “portfolio insurance” plays, attached with my Dossier.

- The 5 “Anti-meme” Set to Soar In Once the Bubble Bursts – 5 stocks that could skyrocket as this crisis unfolds, attached with my Dossier.

- The New Case for Gold – Jim’s definitive guide on gold and gold investing for the coming decade.

- The New Case for Gold Hidden Chapter – An updated chapter of his book that includes seven of the most unique gold and silver investment opportunities that Jim has come across, along with details for investing in each one.

- A FREE Goldback – Jim’s gift to everyone who takes him up on this offer tonight.

- One ALL-Access Ticket to the Paradigm Shift Summit – a virtual event where Jim plans to reveal a massive update about this coming crisis (valued over $2,000)

- Access to live Intelligence Briefings with Jim – Where you’ll have the chance to join Jim and a small group of people on a live call and submit general questions for Jim to answer.

- Access to the Strategic Intelligence Model Portfolio – Along with recommended portfolio allocations so you’re never lost on where you need to put your money during each stage of this crisis.

Now Jim, this is an incredible value, and it’s hard to put an exact price on it.

In the past, just your dossiers alone have been used by the Pentagon, the CIA, members of congress.

Your expertise has been used by Wall street CEO’s, heads of state and even sitting U.S. Presidents.

Your speaking fee alone is over $25,000.

And you even do private consulting work for foreign governments like the government of Liechtenstein for an undisclosed fee.

So I’m sure everyone tonight wants to know, what does it take to get started?

JIM: Listen, my team and I are NOT doing this for the money.

In fact, as you are about to see, we are going to lose money on everyone that takes advantage of the risk-free trial subscription.

Our only goal tonight is to get this information into as many hands as possible.

That’s why, even though access to some of my mid-tier research services in the past has cost upwards of $2,000 a year.

And some of my high-end research can go for as much as $4,500.

Today we are offering a trial subscription for just $49…

Again, that's for the entire year.

In addition to that, anyone who signs up tonight will lock in that low rate from year to year as long as they choose to be a member of Strategic Intelligence.

HOST: That’s a truly incredible offer. In fact, I’ve never seen anything like it. Can you explain what you mean by a “trial subscription”?

JIM: It works exactly how it sounds. If at any time during the first 6 months of service, if you don’t feel like you’re getting the best financial research available…

Simply call my team and we will give you a complete refund, no question asked.

You can even keep all of the reports, the dossier, the goldback, everything it’s all yours.

It almost seems silly when we are asking for such a small commitment in the first place.

But I don’t want ANYTHING holding someone back from protecting their family’s wealth as this crisis unfolds.

With this offer, I tried to eliminate every excuse that I think someone could have.

HOST: Well, with the trial subscription, the guarantee, the bonuses, and the extremely discounted price, it seems like you’ve done just that.

JIM: Well just in case, I’ve got one more thing for everybody.

Look, like I said on the call tonight.

What we are talking about here is completely independent of the fallout from the pandemic.

But no doubt, the burden of that will be with us for decades to come.

And many people now need reasonable voices to help them separate fact from fiction in the days and years ahead.

That's why tonight, I want to send everyone who joins Strategic Intelligence a copy of my best-selling book, The New Great Depression.

Here's some of what you'll find inside.

- Why lockdowns don't work (Along with source material for a Presidential Medal of Freedom winning virologist).

- The exact equation I used to predict both the election of Donald Trump and the rise global pandemic (and how understanding this one very simple technique can help you “see the future” even when everyone else can’t)

- The exact portfolio allocations I’m making to weather the coming storm

- The one “much hated” investment you could make right that has the potential to soar over the coming months as this all plays out.

- My predictions for the economy in a post-covid (and post lockdown) world (and what you and your family need to do to prepare).

HOST: Jim, that's another incredibly generous gift.

We will open up the links now so everyone can begin to reserve their memberships below.

All you need to do is click the box below this screen and you’ll be taken to a secure order form.

Anybody that wants to sign up can go ahead and do so now.

And Jim, on behalf of everyone watching tonight I'd like to thank you for your time.

That wraps up our event tonight.

And think you can see why we wanted to get Jim's message in front of all you tonight.

After predicting so many major macroeconomic events over the last 20 years…

From the 2008 financial crisis, to Brexit, to the election of Donald Trump, and more.

Jim’s track record is second to none.

He's helped people avoid some of the biggest crises of our time.

Now with the urgency of his stark new warning looming…

You've now been given the opportunity to decide.

Are you going to be one of the victims of the next market crash?

Or are you going to be one of the people that takes action and side steps the devastation that lies ahead.

It's up to you.

But you don't have long to decide, because come 10th of March…

It might already be too late.

Thanks for joining us. This is Chris Ford, signing off.

February 2022

© 2021 Paradigm Press, LLC. Legal Notices: In order to ensure that you are utilizing the provided information and products appropriately, please be sure to visit Paradigm Press Terms and Conditions and Privacy Policy pages.

I have misplaced my link to the March 14, at 2PM link to Jim Rickard’s live presentation as to what is about to happen in America. I registered so please send me another link so I won’t miss his presentation.