Nearly every industry has felt the effects of the pandemic. And the solar energy sector is no exception.

Having said that, the U.S. solar industry still grew 43% in 2020. And it saw a record 19.2 gigawatts built out during the year.

For the second year running, solar was the top technology in new generating capacity. A full 43% of all new generating capacity was solar.

Much of that growth came from residential and utility-scale solar installations. But for commercial solar, last year was a mixed bag.

Solar Project Delays

Commercial solar projects are most commonly large rooftop arrays on warehouses and big-box stores. Some businesses with available land install ground-mounted solar arrays.

Customers for commercial solar come in all sizes. Small businesses and large corporations are all part of the mix. Many schools and universities are now commercial customers – along with government organizations and nonprofits.

Commercial projects range in size from kilowatts to megawatts. Though, sadly, many solar projects are labeled as “discretionary.”

And those budget line items were the first to get slashed when the pandemic hit. It’s taking a long time for companies to add those line items back into spending plans.

Commercial customers focused on environmental, social and governance investments had renewed interest in solar. But developers faced frustrating delays in project completion due to COVID-19.

As we approach mid-2021, it’s clear that commercial solar is still recovering from pandemic-related impacts. The permitting process in many states is slow.

Some government employees aren’t back in their offices yet. And utilities are behind on connecting finished projects to their grids.

In spite of this, commercial solar is about to shine.

[Shocking: Elon Musk’s VERY strange confession about the future of his electric car empire]

Commercial Is Coming Back

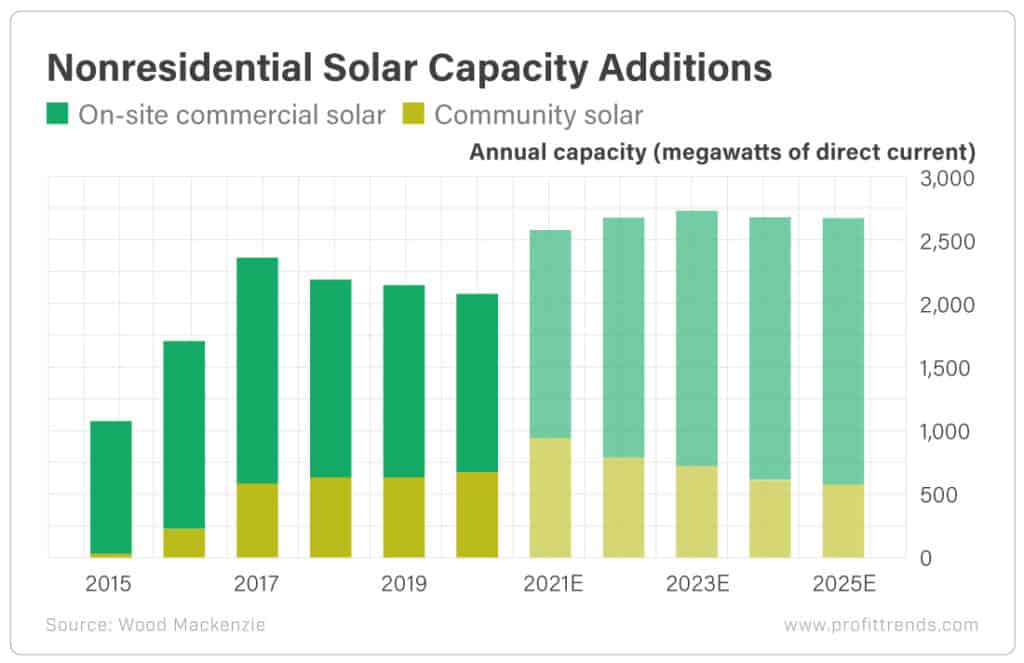

The next five years should see commercial solar really take off. In fact, commercial project additions could increase 50% through 2025.

It should come as no surprise that commercial solar has massive potential. Today, only 3.5% of commercial buildings have solar installed.

Some commercial buildings aren’t suitable for solar. The buildings either don’t use enough electricity or can’t support an array. These account for about 25% of all commercial buildings in the country.

But that leaves more than 70% that could benefit from solar. And that equates to more than 600,000 buildings across the nation. If they all had solar, the U.S. would have another 145 gigawatts of new solar capacity.

Currently, the biggest U.S. utility-scale solar project is about 0.5 gigawatts. So you can see how big the potential is here.

Forecasts show new commercial solar installations of about 2 gigawatts per year through 2025.

That totals just 8% of the total addressable market. But why isn’t commercial solar really taking off?

Well, financing is a big issue.

[Buy Alert: This $3 Stock is in a Perfect Position for Total Global Energy Domination…]

Residential solar has the benefit of standardized financing. And utility-scale solar projects are large enough to finance through investment banks and venture funds.

But commercial solar doesn’t have the benefit of either. The money involved is too little for investment banks.

Every commercial project is different in size due to the variety of buildings involved, and these projects have a fair amount of complexity and customization. That leads to expensive systems.

Combine all of that with a lack of financing options and that’s often enough to kill a deal.

But the opportunity is certainly there. The largest building complex in the U.S. belongs to an aerospace company in Fort Worth, Texas.

Its various buildings cover 8.2 million square feet. That’s larger than 170 football fields.

Its main building alone covers 2.4 million square feet. If it were covered in solar, it could generate 88 million kilowatt-hours of clean power every year.

That’s nearly enough to power 5,200 homes for a year. And installing solar on other buildings like this keeps solar panels off valuable land.

Neighbors like rooftop solar better too. Who wants to look at a giant field full of solar panels?

On a flat roof, they’re out of sight and out of mind. And there’s no environmental impact.

This isn’t thinking outside the box. In the case of commercial solar, it’s thinking on top of it.

There’s clearly a lot of potential here. So solving the financing issue should be easy.

[Read On: The Company About to Bankrupt Every Utility Company in America and Make You Rich]

Best Solar Investments

I’m often asked by investors about the best way to invest in solar. There are a number of solar exchange-traded funds that fit the bill.

There are also companies that manufacture panels and inverters. I refer to them as pick-and-shovel plays.

These companies benefit from every solar installation. As commercial projects ramp up, so too will the shares of these growth companies.

Make sure you have exposure to this market now. As we come out of the pandemic, I expect shares of solar companies to rise as well.

Good investing,

Dave