Table of Contents:

- Keith Kaplan Introduction

- The Timing For This Mission To Mint Millionaires Couldn't be Better

- Your Worst Financial Enemy, Unmasked By a 30-Year Study

- Warren Buffett's Very Bad Day

- The Most Powerful Trading Signal In Your Portfolio

- How This Breakthrough Could Mint Millionaires

- Why Not Automatically Track The Stocks Your Favorite Gurus Like Too?

- When to Sell 50 of the World’s Most Popular Stocks

- Beat the Billionaires: Insights, Errors, and Recommendations from the Brightest Minds on Wall Street

- Millionaire Master Plan

- My “10,000 New Millionaires” Pledge

Brought to You By TradeSmith…

The 10,000 New Millionaires Project

“This is the largest and most important undertaking in our firm's history. And I want you to be a part of it…”

– TradeSmith CEO, Keith Kaplan

Dear Reader,

Smack in the middle of the worst financial crisis in 14 years…

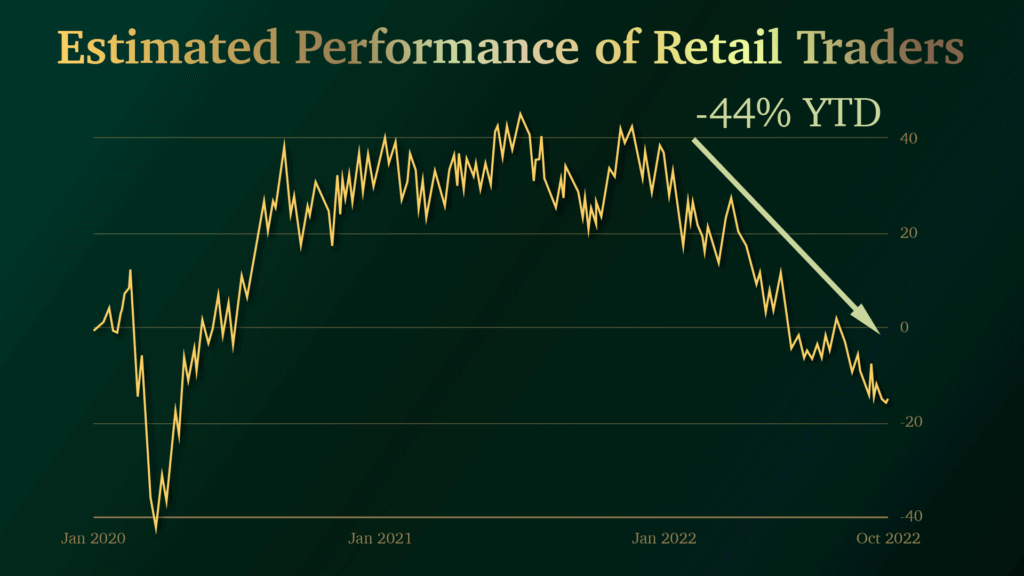

Right when, according to JPMorgan…

Your average investor has seen their portfolio plunge 44%…

Well, my firm is launching a massive new project.

In fact, it's the biggest undertaking in our history.

And the reason we're launching? It will make you think that I've lost my mind.

Are you ready?

Here it is, in a nutshell…

Today, we're officially announcing our plan to show at least 10,000 people how to make their first million dollars in the stock market… and I would love for you to be a part of it.

Before I explain, I should introduce myself…

My name is Keith Kaplan.

And I'm the CEO of a company called TradeSmith.

Our members include wealthy professionals, PhDs and economists, Wall Street insiders, and — of course — financially minded folks just like you.

We have over 69,000 members around the world and they represent over $30 billion in financial assets.

We don't manage that money.

We're not in the business of collecting trading fees either.

Instead, we're a group of dedicated data scientists, mathematicians, and coders who have discovered a powerful way to make more money in stocks.

Even in challenging markets like this one.

The key to our success is a unique stock market signal.

And this signal? We call it the Volatility Quotient.

No other analysts I know of use it. Few even know about it. But as you're about to see, our results using this Volatility Quotient signal have been incredible.

It's calculated based on an algorithm that was first discovered by two Nobel-Prize winning economists…

Which we then apply to no fewer than 3,052 data points, and we do that for each of the more than 150,000 securities we track… which, of course, includes over 51,000 publicly traded stocks, ETFs, and index funds.

We do this analysis around the clock, 24/7.

It took us over 17 years to build a hardware platform that could handle all those calculations. And we spend over $1 million per year maintaining that platform.

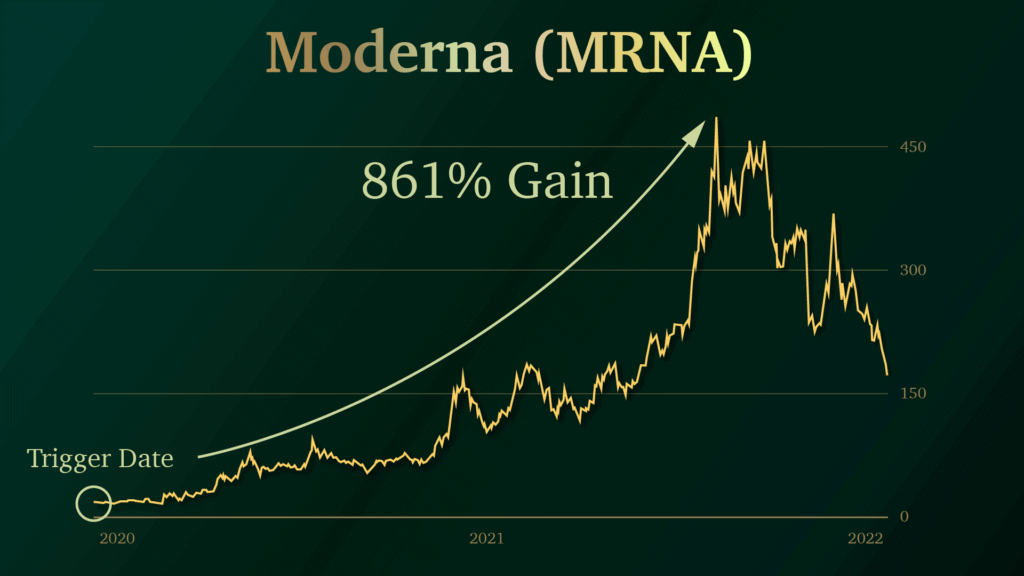

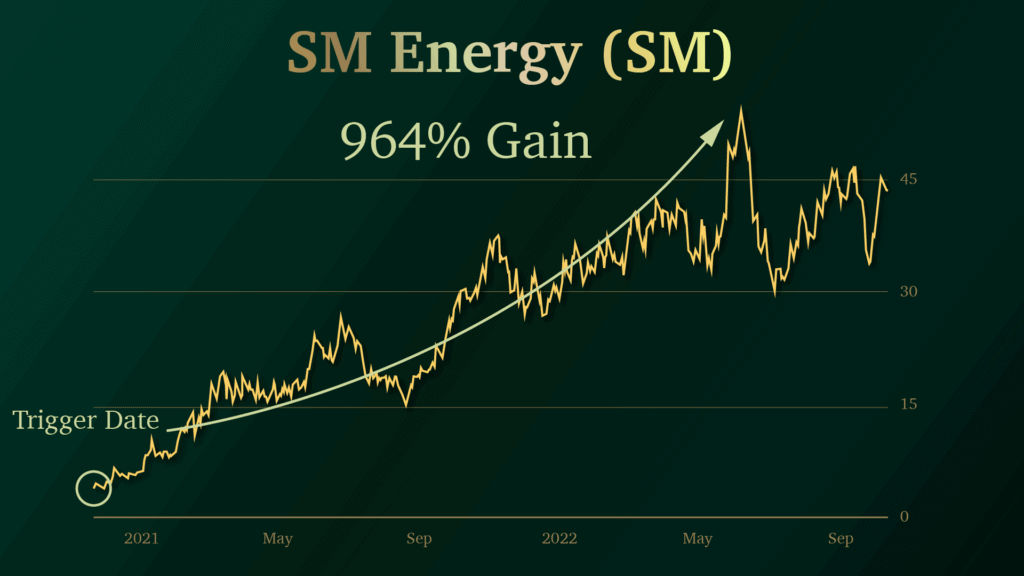

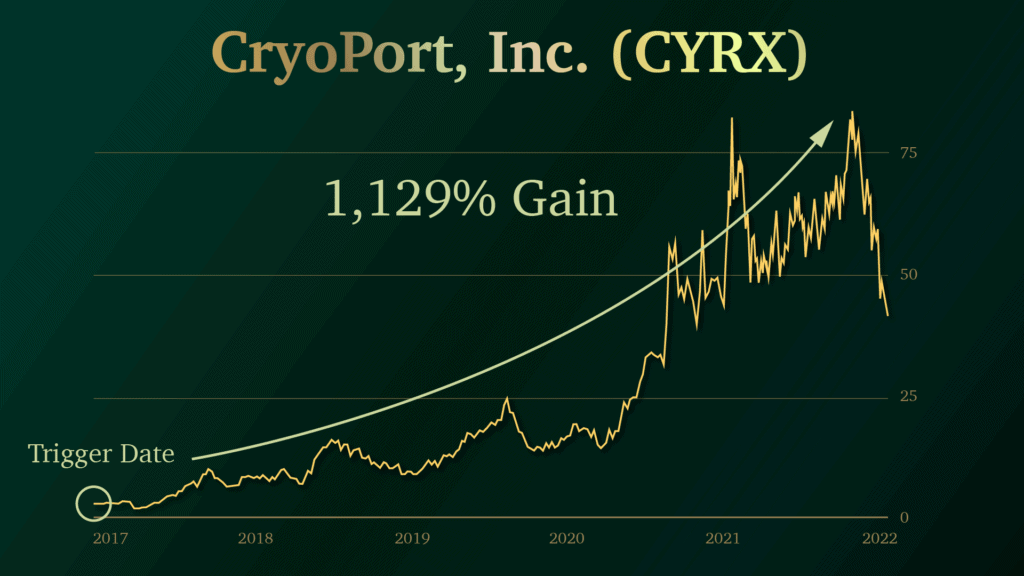

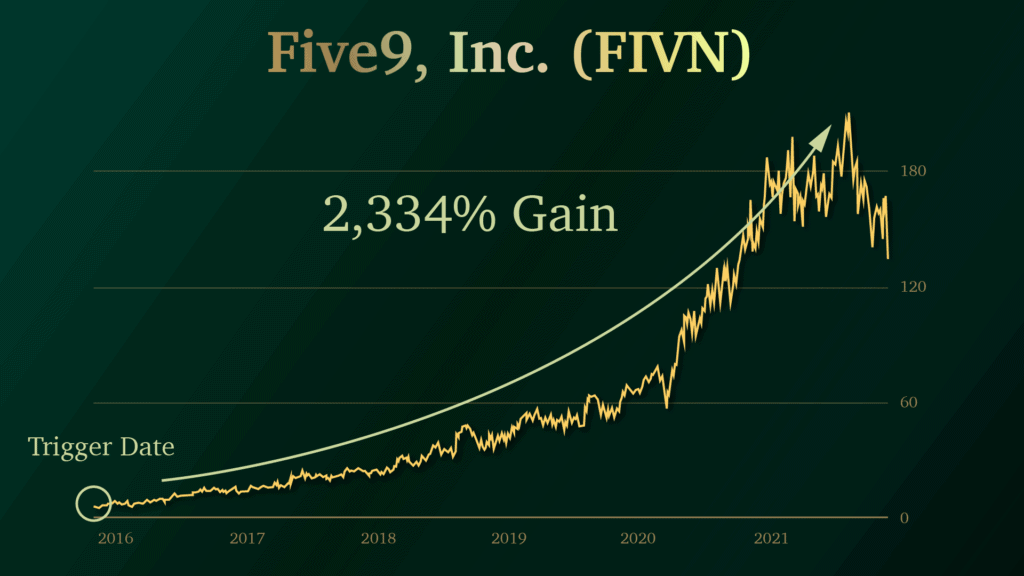

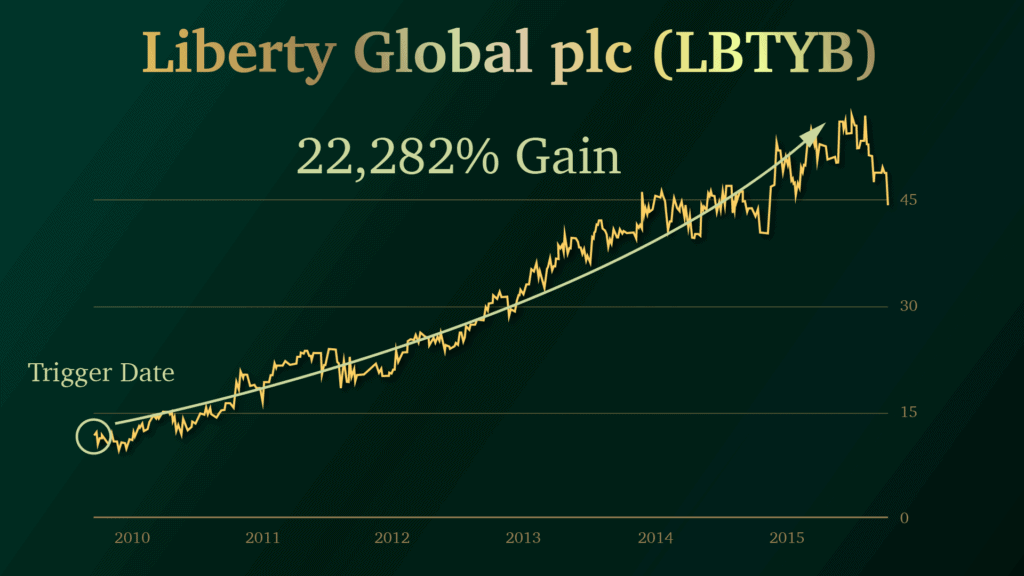

But it's been worth it, with our VQ signals giving folks the chance to make gains as high as 861%… 964%… 1,129%… 2,334%…and higher, and this is just over the last few years.

In fact, we have files jam-packed with success stories from those who know about this signal and have put it to work in their own portfolios.

Including people like Robert S., who recently wrote to tell us…

Or member Frank K., who told us…

And member Amy K., who recently reported…

** The investment results described in these testimonials are not typical. Investing in securities carries a high degree of risk; you may lose some or all of the investment.

Of course, outcomes like these are extraordinary.

But just the same, I'm incredibly proud to say that this signal we've discovered… and the platform we've built around it… is proving to be an absolute game-changer.

We're currently helping over 69,000 people with this approach.

But we want to do more.

Which is exactly why I've decided, after 17 years of hard work and over $5 million invested, to finally pull the trigger on this mission…

We're Calling It Our “10,000 New Millionaires Project”

Our goal is to put at least 10,000 people…

Including viewers like you…

On the same path to seven-figure financial success.

Specifically, I want to show you how you can use our VQ signal to conquer the three most difficult obstacles that typically stand in the way of stock market success.

Which three obstacles?

We'll get to that in just a second.

As far as our $1 million target, I can't say if or how fast you'll get there. Because it's going to be different for everybody, depending on what they bring to the table.

But that's the good news.

Because, regardless of whether you're starting out with $500 or $500,000, this discovery I'm about to share could help you radically accelerate your outcome.

In short, this signal I'm about to show you…

And the system we've built to support it…

Can help you reduce risks, minimize losses, and improve your gains.

It can help you do all that in any size portfolio.

And in any market.

Even better, our VQ signal could help you increase profits by huge margins. Sometimes, as you just saw, by as much as ten times or more.

It can also help you decide when to sell.

It can even tell you which beaten-down shares are due for a rebound.

The results that you could achieve can be astounding.

Just to give you an example, we backtested our proprietary signal — this Volatility Quotient — by applying it to a few actual portfolios.

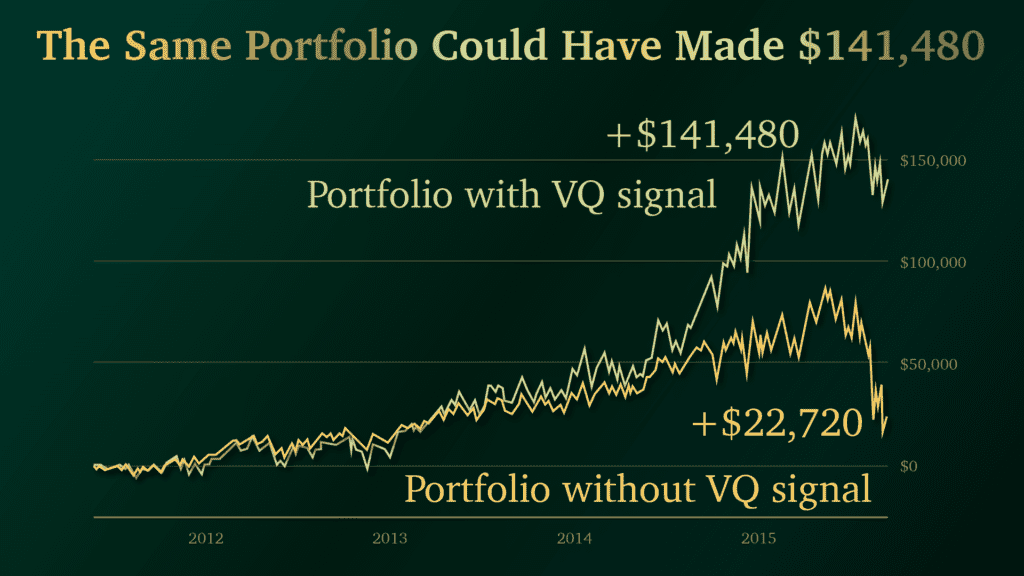

Jeff Z. from Arizona, for instance, showed us his portfolio when it was worth a little over $300,000. Jeff was able to increase that with a gain of nearly $23K.

Not so terrible, right?

But guess what.

It turns out that, had Jeff known to check the buy and sell signals our system generated…

He could have swelled his account by $141,480.

That's almost $120,000 more than he actually made on his own.

And this is just by using our VQ algorithm and related alerts to make a few tiny changes to the way he traded those same shares.

No options or other weird moves required.

Here's another powerful example…

With this one, Robert B. from Florida generated $46,271 in his trading account, from 2017 to early 2019.

That's not bad for just over two years.

It's nearly more than double what Jeff Z. did.

Yet, when we examined every one of Robert's trades… and matched them to what he could have done by using our VQ signal to pick buy and sell dates…

Robert actually could made 10 times as much…

In other words, instead of earning $46,271, he could have added $433,806 to his overall account. With the same stocks. Over the same time period.

That's about $387,000 more that he could have added to his retirement account.

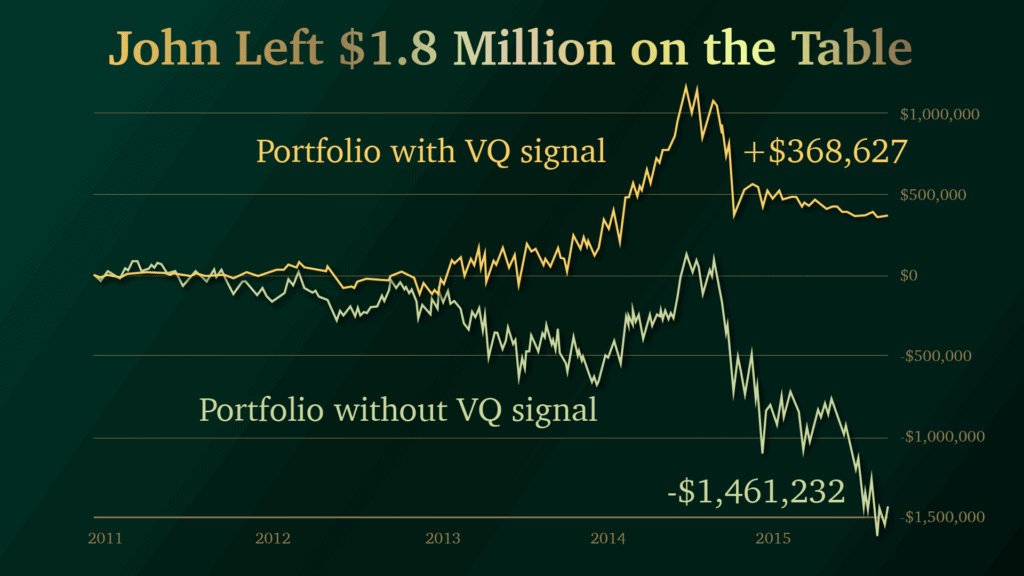

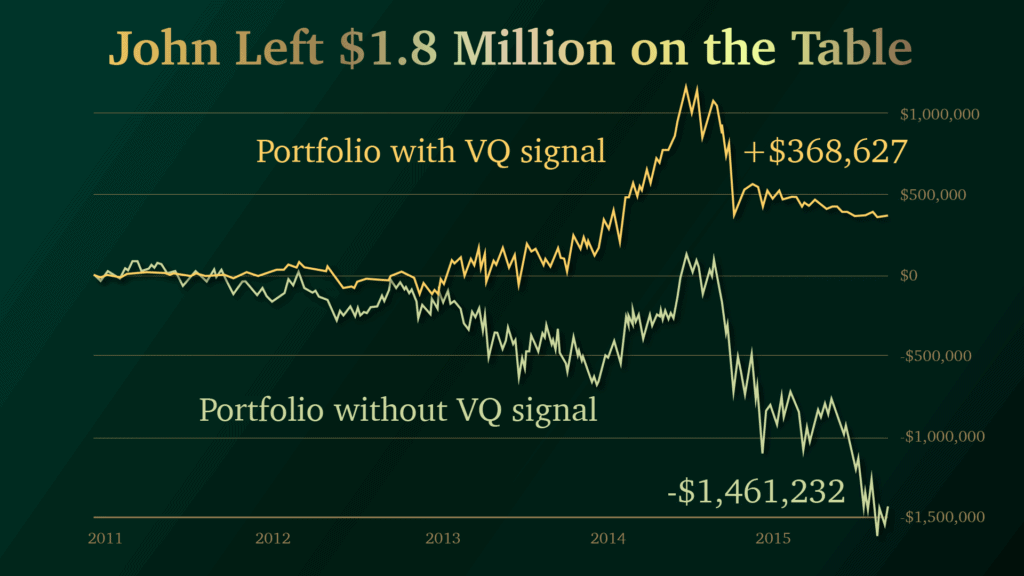

Then there's John M. from Chicago.

John was lucky when we found him. He already had a generous portfolio to work with, valued at over $4.6 million. However, that's where his luck ran out.

Because John had a terrible habit of clinging too long to his losing positions.

Which caused him to lose over $1.4 million.

This is a very common mistake, by the way.

In fact, it's one of the three biggest investor mistakes that I hinted at earlier.

Investors tend to cling to losing positions because they're hoping those companies will rebound. And some will. But some absolutely will not.

Unaided, it can feel impossible to tell the difference.

However, had John known how to use our VQ signal, he no doubt would have seen some of those downturns coming… And he could have cut his losses early.

He even could have made money…

When we looked back over every one of John's trades, we saw enough VQ signals to calculate that John not only could have avoided his $1.4 million loss…

He actually could have piled up a $368,627 profit, again just by making a few small changes to the dates where he bought and sold the same stocks.

When you add that up, where he could have avoided losing $1.4 million… and could have made an extra $368,627… the total works out to about $1.8 million.

That's $1.8 million “extra” he could have had for retirement.

Just imagine what you could do with an extra $1.8 million.

You can see why I'm convinced our “10,000 New Millionaires Project” is something incredibly special.

Not just because I think it could be our firm's greatest legacy, but because I believe this will be our single greatest contribution to the financial community.

Especially now, at a time when millions of Americans are looking at their battered brokerage accounts… and feeling overwhelmed by fear and uncertainty.

In Fact, The Timing For This MissionTo Mint Millionaires Couldn't be Better

Look, I know just as well as you do that right now, a lot of folks are worried about what comes next. And they're not wrong.

Our economy is in crisis. Our leaders seem lost.

And every sector of the market that used to look like a “sure thing” now seems — to the naked eye, at least — completely unpredictable.

Which is exactly why I can understand if you think that our goal to help a minimum of 10,000 people achieve million-dollar outcomes seems crazy.

So let me make it clear, we're not getting into this rashly.

For instance, this new millionaires project… and, in fact, the whole system we've built around our proprietary VQ algorithm… has nothing to do with gambling.

It's not about rolling the dice on “home run” stocks.

It's not about fooling around with crazy options strategies.

And it's not about praying for stock market miracles.

This powerful, calculated strategy we hope to share is about showing you how to improve your “win” rate on every trade… across your portfolio… at a steady, intelligent pace.

It's about showing you how to make better, faster, and more rational decisions… with every possible trade that crosses your radar.

When markets are soaring…

Our signal-driven approach helps you keep your cool, so you don't pay too much or dump good shares too early…

In a crashing market…

Our signal shows you which stocks you need to dump fast and which could soon rebound, so you can decide if you’d like to hang on for more potential gains…

And overall…

In every market, our signal-driven platform can help strip away guesswork and remove destructive emotion from your key financial decisions.

Why are those three outcomes so crucial?

Because, it's in these three exact scenarios that you'll see most people make their biggest mistakes when it comes to wealth-building with stocks.

In other words…

In up markets, people tend to sell their winning stocks too early…

In down markets, they tend to cling to losing shares…

And overall, folks let emotions drive far too many of their financial decisions.

If you can overcome those three obstacles, you can improve your chances of making your first million… or your next million… with stocks.

Unfortunately, each one of those flaws are hard-wired for humans.

In other words, we're actually born to be terrible investors.

There's even research that proves it…

What Even da Vinci, Aristotle, and EinsteinWeren't Smart Enough to Figure Out

See, people like to think the human brain is like a beautiful computer.

And guess what, at least some of the time… that's true.

With a 100 trillion connections that pulse through our few pounds of grey matter, we're capable of amazing invention.

Without our incredible brains, you don't get Einstein.

You don't get Plato, Aristotle, or da Vinci.

But here's the thing…

Having a big brain doesn't guarantee you'll be a great investor.

Take Einstein, for instance.

He's one of the smartest men who ever lived. But that didn't stop him from losing almost every penny of his Nobel Prize money in the stock market.

Meanwhile, even though computers aren't great at philosophy or poetry or coming up with creative scientific solutions, they do one thing incredibly well.

They absolutely feast on details.

They can suck up data points and process them with blinding speed. At levels many times faster and higher than we could ever do without them.

In other words…

If thinking is our super power, theirs is lightning-fast data processing.

They can process incredible amounts of information… and make millions of complex calculations at once, around the clock and in the blink of an eye.

Which makes them extremely useful for making unbiased financial decisions.

According to research from the University of Pennsylvania, our brains not only don't work that way… but they shouldn't work that way, or it could kill us…

Think about it.

You see a big dark shadow in a rustling bush…

Should you stand there like an AI, running through every possible scenario? Or should you turn around and book it out of there, in case it's a wolf or a grizzly?

We do the latter because it's a survival mechanism.

Unfortunately, it also makes us prone to rash, emotional choices. Which leads to error. And, in the stock market, can lead to painful and terrible financial outcomes.

That's exactly why we invested over 17 years and more than $5 million into designing a system that can make the best use of our VQ algorithm.

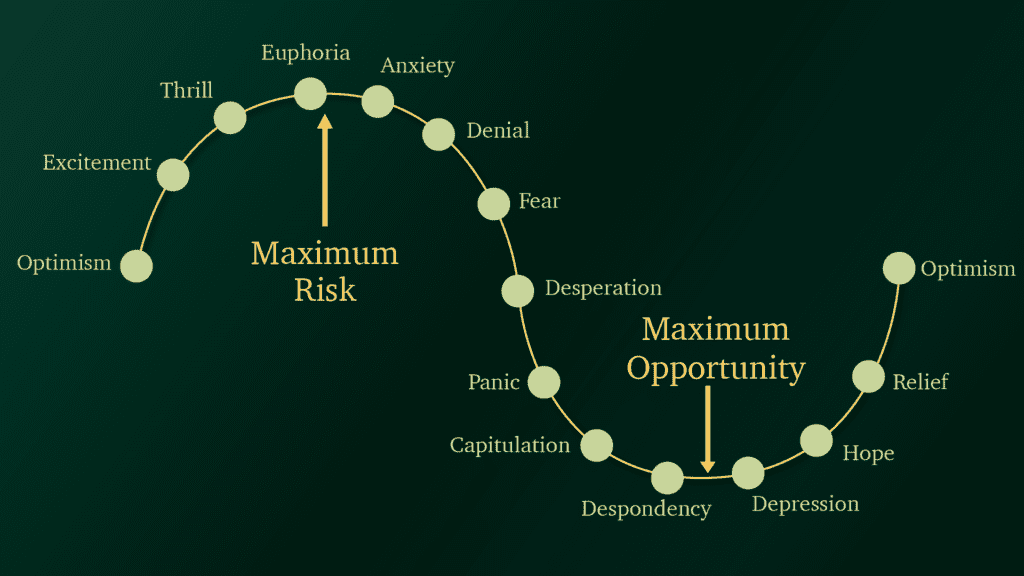

Because, from the beginning, we saw how investors can become blinded by emotion, specifically during the worst extremes of a market cycle.

Take a look at this chart…

Even in a mild market, emotions can cloud your decisions.

But when markets hit a peak… or a trough… your risk of emotional bias increases. And that can severally limit your ability to build real wealth.

This is exactly why the great Benjamin Graham once said…

And of course…

There's research that proves this too…

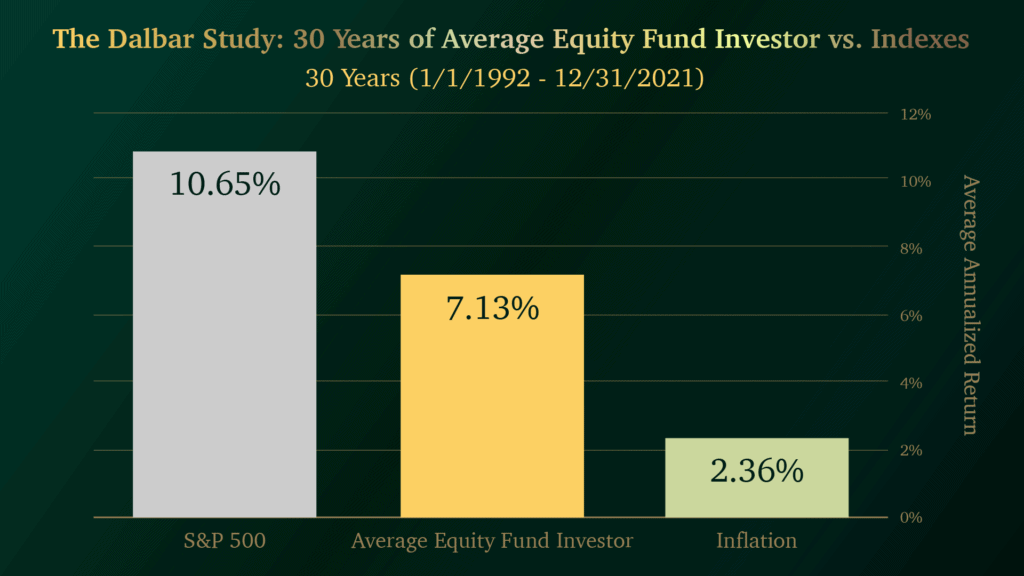

Your Worst Financial Enemy, Unmasked By a 30-Year Study

Maybe you've heard of Dalbar, the investment research firm.

Just this past year, they published the results of a 30-year study.

Take a look at this…

What their study shows is that, from 1992 to 2021, you could have clocked an average 10.65% return just by keeping your money in an S&P 500 fund.

Meanwhile, investors who took charge of their money… presumably armed with nothing but their “gut” or intuition to help them make trades averaged 7.13%.

So… yes, by trying to actively manage their money… most folks did worse than the markets. Bake the inflation effect into those returns, and they drop even lower, to 2.36%.

2.36%!

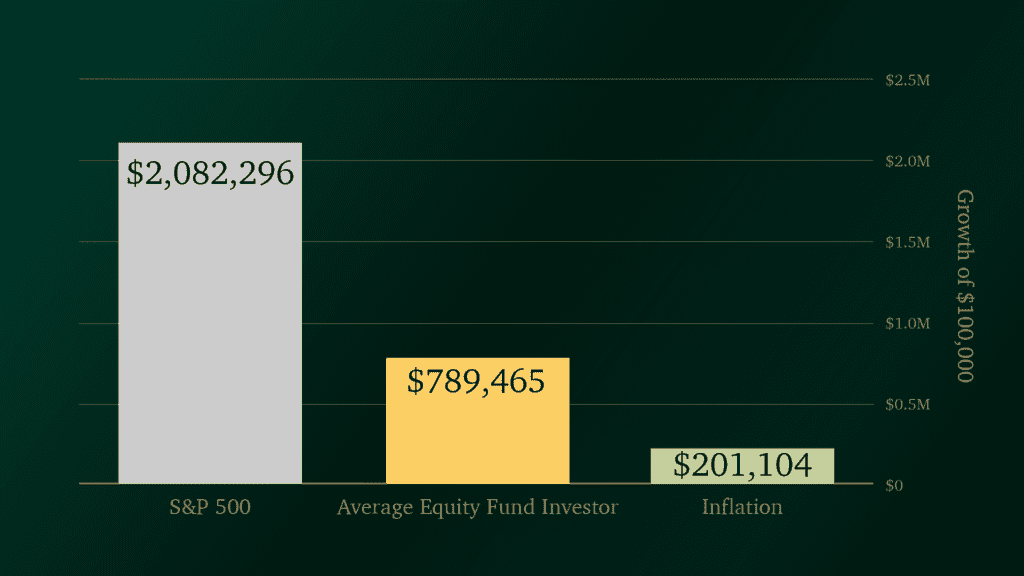

That's the difference between making over $2 million on a fairly normal-sized retirement account… or just over $200,000.

Which is nothing when you're looking at a 20 or 30-year retirement.

By the way, it's not just you.

According to research from Morningstar…

Less than half of active fund managers — 47% — managed to beat passive market investing strategies over the one-year period that ended halfway into 2021.

Over a 10-year stretch, only 25% beat the market.

Do you see what I'm getting at?

Even the pros find it hard to manage money and their emotions at the same time.

That's exactly why you need a precision tool — like our VQ signal — to help reveal the opportunities you might miss otherwise .

And by the way, that's even true for a few famous investors.

Let me show you what I mean…

Warren Buffett's Very Bad Day

When it comes to the world's richest investor, you can barely pick up an investment textbook without reading about Buffett's greatest hits…

Coca-Cola, American Express, Geico, Apple, Gillette…

And of course, his flagship holding company, Berkshire Hathaway.

Had you bought a single $1,000 stake when he first started out, you'd have over $18 million today. And your shares would go for over $400,000 each.

But that doesn't mean Buffett hasn't also made a few huge mistakes…

For instance, he once called buying Berkshire itself a “monumentally stupid decision.”

Buffett also missed out by clinging to Walmart for 20 years… and missed his chance to buy Amazon, which he calls himself an “idiot” for passing up…

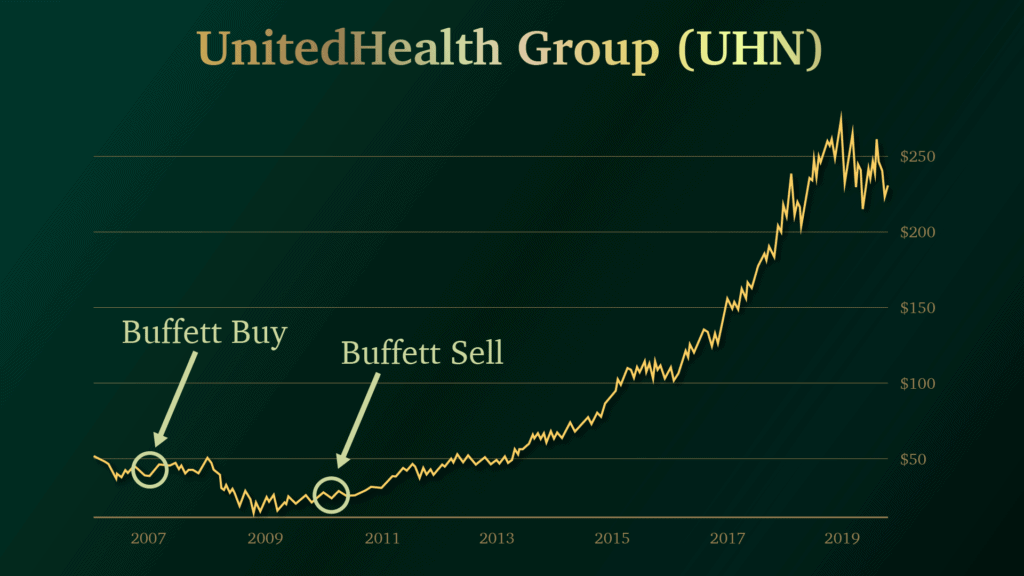

But the one that really has to sting Warren is his massive blunder with a company called UnitedHealth Group…

In 2007, health insurers were flying high.

And Buffett was buying hand over fist, snapping up over a million shares.

But then the stock started tanking…

Down 10%… 20%… 30%… until finally it was 40% down.

Buffett decided to cut and run.

That's a bad run, especially for one of the greatest investors of all time.

But here's the worst part…

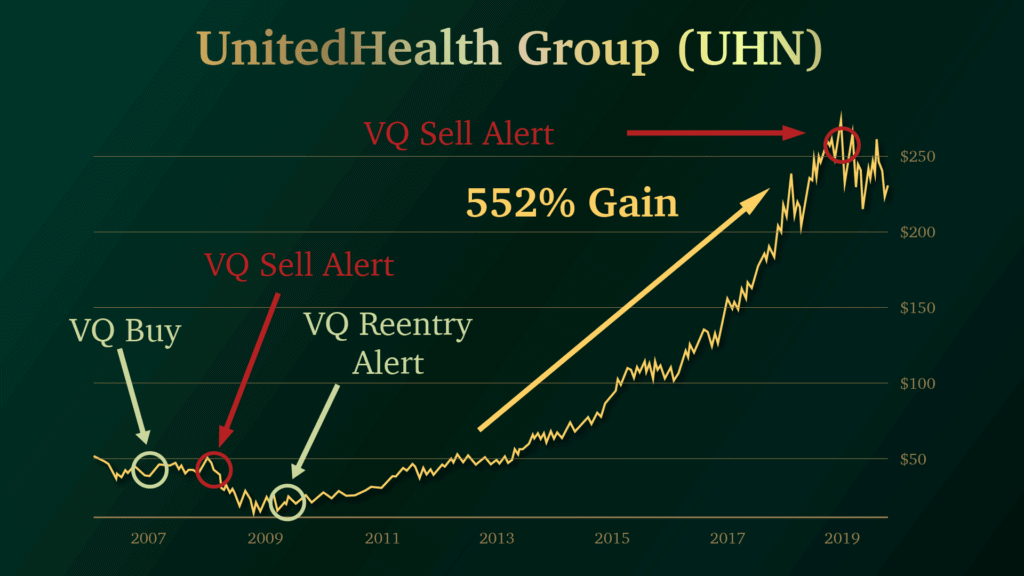

We ran a backtest on Buffett's bad trade.

And it turns out, had he known about our unique VQ signal, there's a chance he would have seen an opportunity to cut his losses much earlier, with just a 7% loss.

Even better, he could have used our VQ strategy to buy back in at a better price… and then ride United Health shares much higher… for a 552% return.

Which would you rather do… lose 40%… or make 552%?

And just so you know, Buffett's original stake was $47.6 million.

Meaning, we could have helped him avoid losing over $19 million.

Then, on the upside, we could have shown him how to buy back in… so he could grow that same initial stake into a whopping $262.7 million.

Of course, it's fun to think about those kinds of billionaire problems.

And Buffett does just fine, most of the time.

But the principle I'm showing you here is exactly the same…

Regardless of whether you've got $100 billion in the bank…

Or $100,000…

Or even $10,000 or less…

You can apply our VQ score to over 150,000 different securities… including the more than 52,000 stocks and funds that are listed on the public exchange…

At any level, with any size stake, our signal can help you decide what to buy…

How much to buy…

And when to sell, either to cut your losses or claim your gains.

To drive that point home, take a look at this next example…

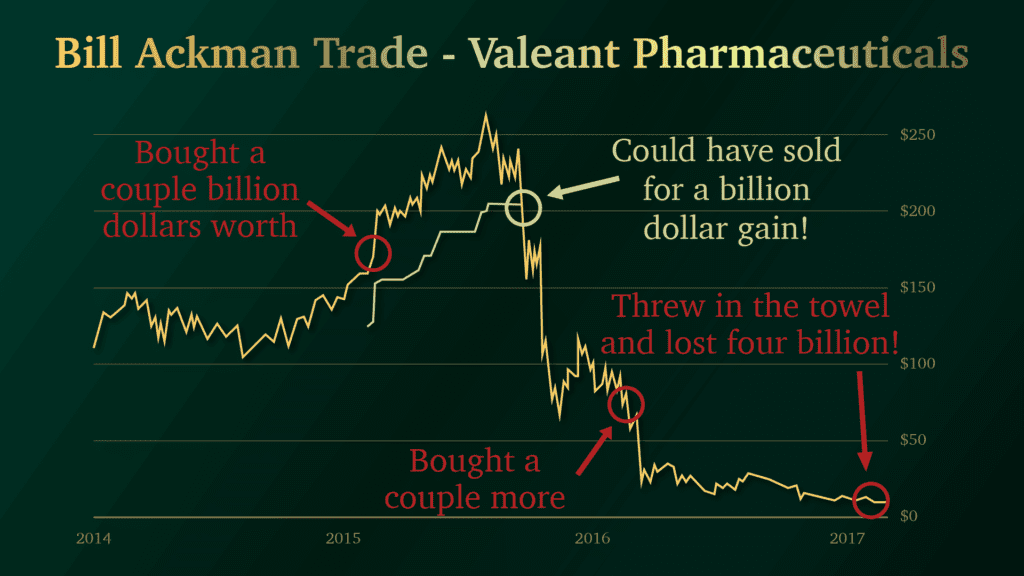

The Harvard Grad Who Lost $4 Billion

Bill Ackman is also a market legend.

Not only did he graduate with top honors from Harvard, his hedge fund after college went on to post a 503% cumulative return over its first dozen years.

That's more than triple the S&P.

Today, he's got over $3 billion in the bank.

But he's also human and capable of making huge emotional blunders that a system like ours could help him fix.

Take his disaster-of-a-trade in Valeant Pharmaceuticals…

Ackman loaded up on shares.

And then he kept on buying, even as they piled up billions of dollars in debt.

Finally, Ackman gave up. But not before losing over $4 billion.

What did he do wrong? He made the same mistake lots of regular investors make. He kept buying a bad company on the way down.

With our VQ signal, he could have protected himself by getting out much earlier.

In fact, our backtested results revealed he could have made $1 billion instead!

Again, you and I aren't weighing billion-dollar decisions.

But the point is clear.

Even with a $10,000 or $5,000 stake, our proprietary VQ reading could have showed you when to get out too.

Right down to the perfect day to cash out with a major return.

I'm sure you can see how that's a significant advantage.

And I don't just mean for your money.

After all, think of your basic health and well-being…

Nobody likes riding a rollercoaster of uncertainty.

What if, instead, you could see what's coming for every trade?

Imagine collecting more gains on every bull market run… and cutting your losses first, before everybody else, when a stock starts to backslide.

The impact on your wealth could be staggering.

Let me give you one more example…

The Fortune David Left On the Table

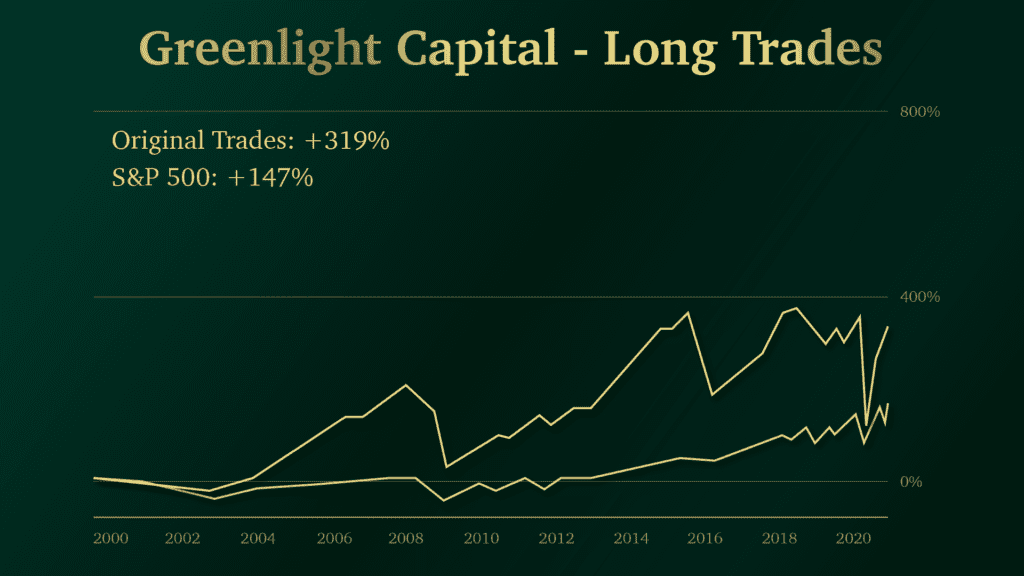

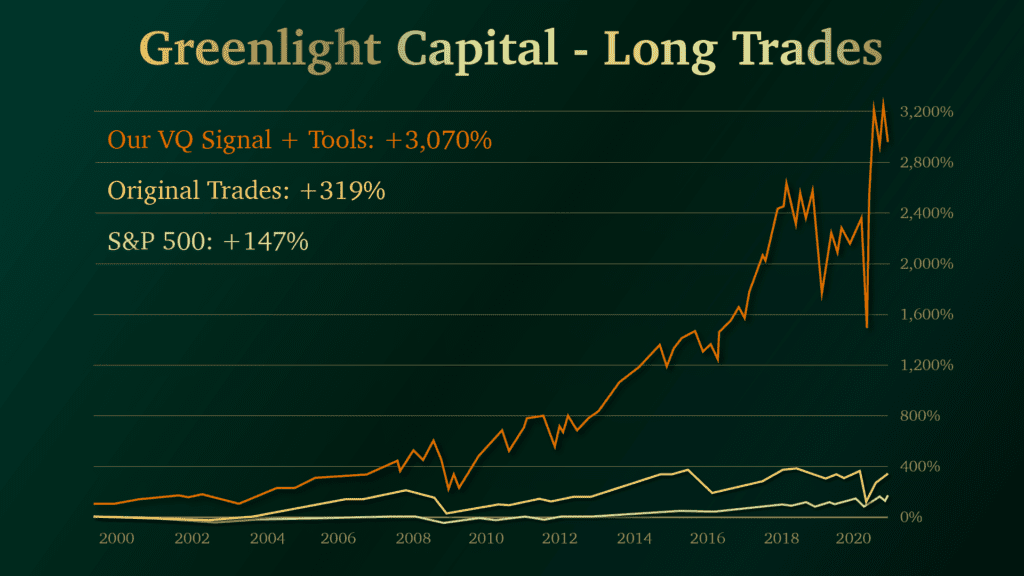

Maybe you've heard of hedge-fund manager David Einhorn.

Time Magazine once named Einhorn as one of the “100 Most Influential People In the World.”

In the financial media, pundits even talk about the “Einhorn Effect” because the market is so quick to react to his big predictions.

From 2000 to 2020, you could have used his recommendations to more than double any gains from the S&P 500…

Sounds great, right?

But take a look at this…

We ran David's trades through our system too.

Had he been using our VQ algorithm and related alerts, instead of making

319%… he could have made 3,070%!

Remember, we're talking about one of the most respected financial minds on Wall Street. And yet, even he could have done better with VQ signals.

And I promise you, if I were to dig into the trading records of other market geniuses… people like George Soros, Ray Dalio, and Peter Lynch…

We'd find even more of the same…

Meaning, you would see that they also sometimes…

Cash in too early on rising stocks…

Cling too long to their losers in hopes they'll go back up…

And, overall, they allow their emotions get the best of them…

See where I'm going with this?

We All Do It

Let me be clear, I'm no saint when it comes to my financial backstory either.

I've never worked a day on Wall Street…

I didn't go to Yale or Harvard…

And my parents were definitely not millionaires.

Instead, they were broke schoolteachers who worked in Baltimore City’s worst schools. That is, until my dad had to quit so he could earn more selling shoes.

Our neighborhood was so bad, you could count on getting your car window smashed if you left anything sitting out in plain sight.

And, at 14 years old, I wasn't buying stocks like Buffett did as a teenager.

Instead, I spent all my free time working as a fry cook.

In fact, there's absolutely nothing about my past that hinted at how I got to where I am now, as the CEO of one of the world's largest private financial research firms.

Except, perhaps, the fact that I was a natural at writing software code.

But even then, after I got my degree and started making great money…

It turned out that I was TERRIBLE at managing it.

In fact, at one point…

I Had To Use Our Daughter's College Fundto Make a Mortgage Payment

Clearly, I'm not telling you that to brag.

Instead, I'm telling you in part as a cautionary tale…

And in part because I want you to understand, I get it.

I actually understand what it's like to take a chance… and fail… on an investment. I know what it's like to be overwhelmed by choices.

And I know what it's like to open those brokerage statements… or your bank statement… and be a little nervous about looking inside.

I took stupid chances… I bought stocks based on “gut”… and, more than once I lost a lot of money that I did not need to lose, had I been more careful.

And frankly…

The God's honest truth is…

It's those failures that really inspired me get up here, on camera, and announce this enormous “10,000 New Millionaires” project we're launching today.

Because now that I've turned my own financial history around… and now that I've seen just how much better someone's investing success can be…

Thanks to the specific tools we've developed here at TradeSmith…

I genuinely want to share those advantages with as many people as I can.

If I can help even a few people watching right now, so they don't make the kinds of mistakes I used to make, it's going to be worth it.

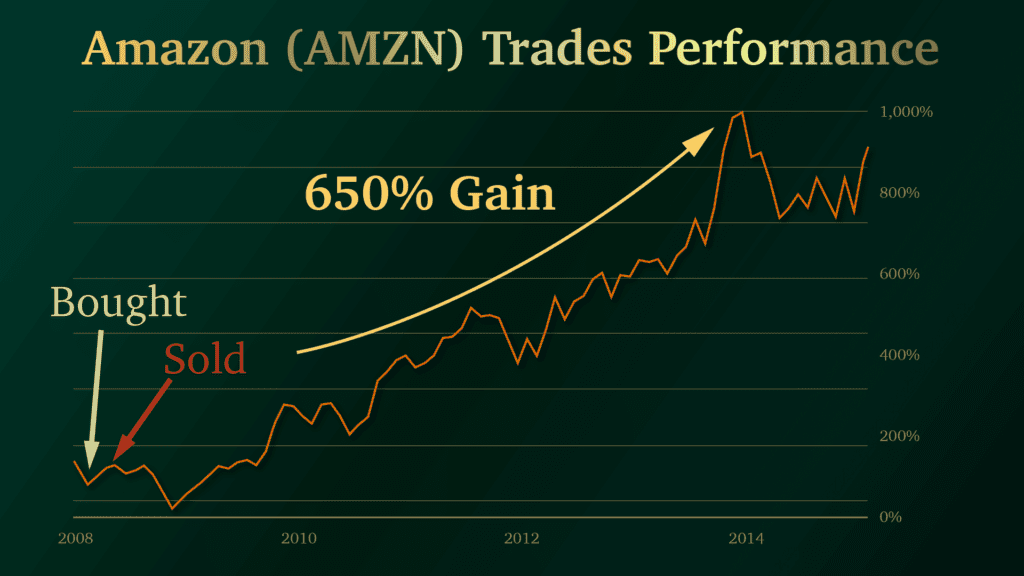

For instance, take what happened with me and Amazon.

See, I had actually bought their stock in 2008 at a multi-year low.

But the markets were still volatile back then.

So, I got cold feet and bailed out of my Amazon stake with a tiny 12% gain.

Had I any idea Amazon was ready to soar much higher… a fact I could have picked up had I known back then about VQ signals and what they reveal…

It turns out I could have made 650% had I just stuck around.

In other words, had I made a $10,000 investment, I could have walked away with $65,000 in profits… instead of a measly $1,200.

Just by making a single change in how I handled those shares. A change that might have been obvious, had I known at that time about VQ and how it works.

Here's another perfect example…

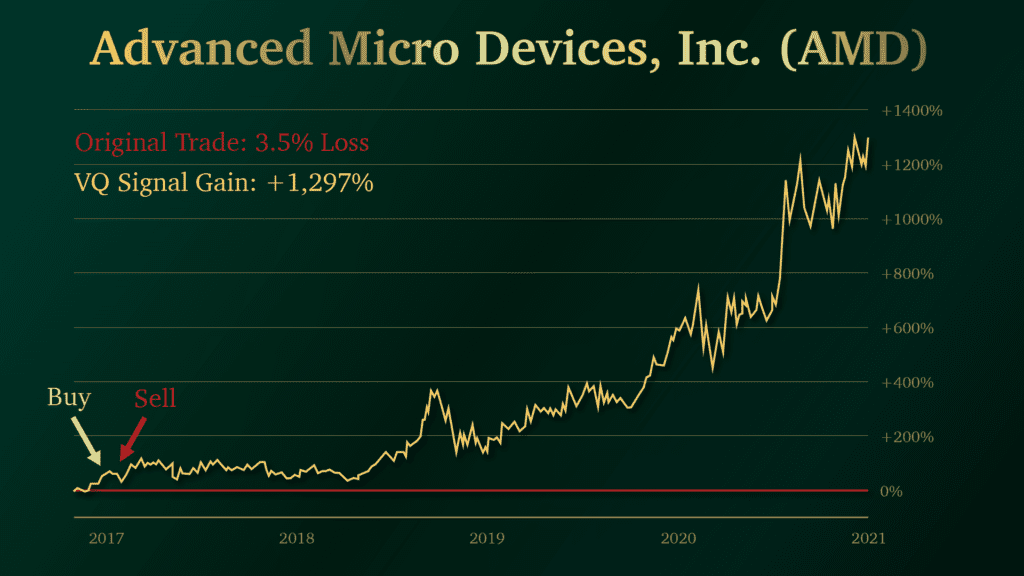

Back in 2016, I bought stock in a company called Advanced Micro Devices.

The ticker was AMD.

Once again, I got lucky because my timing was perfect — even though I had no idea how perfect it was.

AMD shares were cheap and the company was all over the news, thanks to some deal they had cooking with Intel over a few valuable patents.

If I’d had the sense to park my money in the stock and leave it alone… I probably could have made more money on this ONE trade than I’ve made on any other trade in my life…

Instead, once again I got spooked.

My AMD shares were bouncing around and I couldn't take the stress.

So almost as soon as I'd bought it, I backed out… and lost 3.5%.

Yet again, had I known about the VQ signals that virtually all publicly traded stocks can generate…

I would have known that AMD had a history of slightly wider volatility. And that it also had a history of recovering from those dips.

Just by staying put and listening to the signals!

I could go on, but I think you see my point.

For me, it wasn't until 2015 that I'd even heard about this proprietary VQ algorithm and how it can transform personal trading outcomes.

See, that was the year that I first met the team that cracked the code behind this powerful signal, when they hired me to help them design portfolio tracking software.

But the moment I understood how their stock-signal discovery worked, I was blown away by the potential. And I saw a much bigger opportunity.

I showed them how we could build an entire software platform, centered around their brilliant VQ signal. They loved the idea.

Within two years, I had ditched my other Fortune 500 clients.

And the team and I started working full-time together to build a robust set of VQ-centered trading and analysis tools.

Today, I'm proud to say that the result of our mission was a huge success.

Not only that, I'm now the CEO of the firm that hired me to develop it.

Which is why it falls on me to carry forward this mission.

We call our breakthrough suite of tools TradeStops Plus, because of the extra signaling power we've managed to add to our original discovery.

Today, as part of our “10,000 New Millionaires” project, I'd like to invite you to try this platform yourself, 100% risk-free.

Let me give you a better idea of how it works…

The Most PowerfulTrading Signal In Your Portfolio

First, just to remind you, “VQ” stands for Volatility Quotient.

And that's the key to our incredible success.

Because, you see, virtually every one of over 150,000 securities… including all 51,254 publicly traded stocks and funds… can generate a VQ signal.

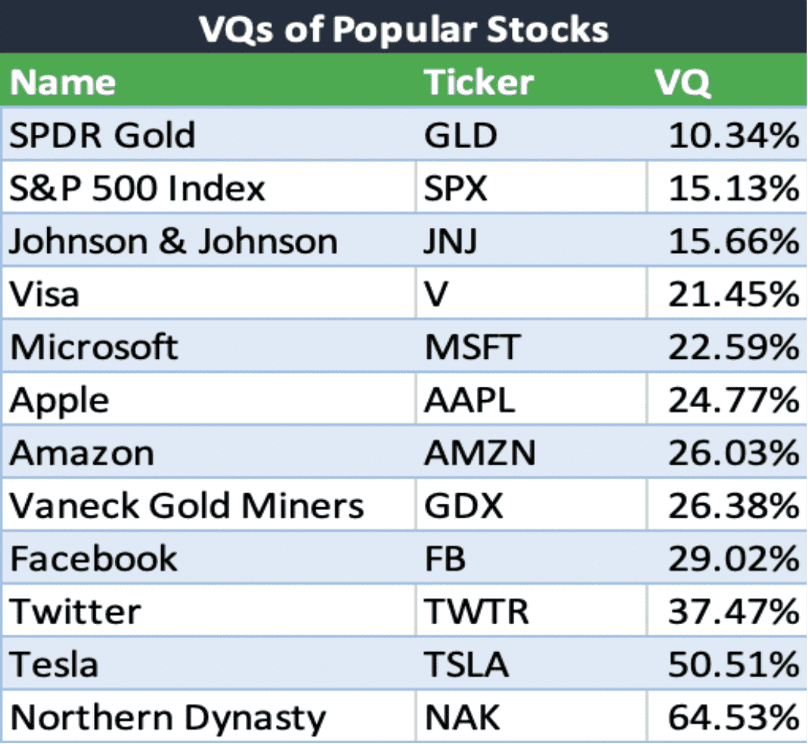

Just to give you some idea, take a look at this…

As you can see, while each of these stocks has a VQ score…

Not all VQ scores are the same, once you start comparing between them.

And there's a very good reason.

It's because — surprise — not all stocks behave the same way.

See, what the VQ shows you is just how much range a stock might have when it starts to move up and down, according to its own normal pattern.

Highly volatile stocks can move a lot, so they tend to have a higher VQ score.

Less volatile stocks tend to move in a smaller range, so their VQ scores are lower.

More or less volatility doesn't mean it’s bad.

It just means you're going to react to big price shifts differently, depending on what the norm is for that share.

For instance, if a high VQ stock like AMD is jumping by a lot, you might not need to worry. Because it's got a long history of trading in a wide range.

Meanwhile, a low VQ stock like Johnson & Johnson rarely swings in price by more than 15.66%.

When it does, that means something big is looming on the horizon.

And it could be time to get out fast.

VQ can tell you how much you're likely to lose on any one share during a downturn. It can also tell you if a selloff is overblown and it's time to consider buying more.

On the way up, you can watch the VQ to see when a stock is too hot or if it's doing just fine, with more room to run… so you can maximize your potential return.

Now, here's the thing…

Calculating the VQ for every stock and then translating those signals into recommended trading steps is not easy.

In fact, we're the only financial research firm in the world that does it.

For one, because we're the firm that innovated the key algorithm.

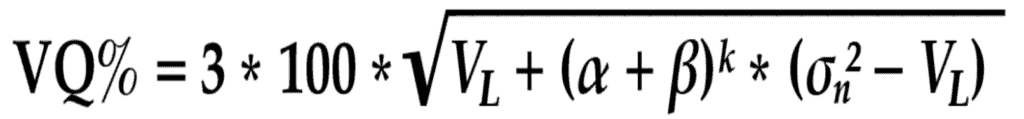

And that algorithm looks like this…

But also, because, remember what I said…

Applying this algorithm to every stock… around the clock… isn't just a one-and-done proposition. Because we're not just looking at one day of stock behavior.

Instead, we're using more than 3,053 past and present data points… with a combined total of 9,250 calculations per day… per stock… every single day.

That's not something you can really do at home, starting from scratch.

In fact, perfecting our TradeStops Plus platform required the work of more than 15 data scientists and coders… and millions of dollars in development…

Applied relentlessly over the last seven-plus years.

But it's been worth every minute of work and every dollar we've spent.

Especially when you consider the potential it has for dramatically accelerating the performance you could get just by using it in your own portfolio.

Let me show you what I mean…

How This Breakthrough Could Mint Millionaires

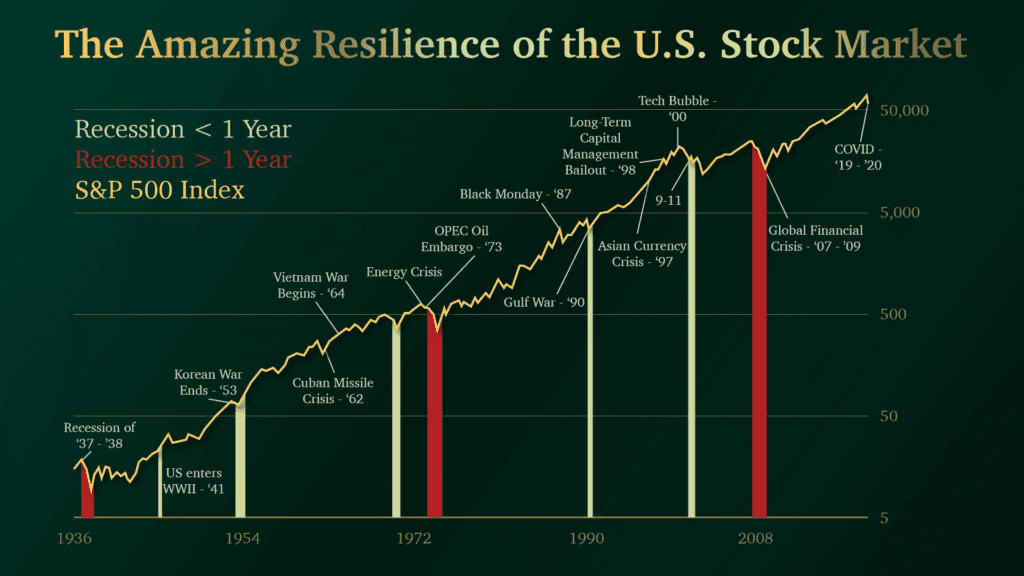

Maybe you've heard it said that…

Even when you consider all the wars, recessions, and market crashes…

When you average together all the good and bad times for the stock market…

You still get a solid 10% annualized return…

And, honestly, that's not bad.

It means you can double your money every seven years.

Just by doing nothing but holding shares in the S&P 500.

But what if you want to do better than 10%…

And what if you want to double your money faster?

Earlier, I showed you how Jeff Z. from Arizona could have used TradeStops Plus to amplify gains on the stocks he was already trading…

By so much that he could have made more than 6X his original return.

In other words, his $22,700 outcome could have swelled to $141,480.

In another example, I showed you how Robert B. could have used our TradeStops Plus suite of trading tools to make more than 9X what he actually made…

And in one more example, I showed you how John M. from Chicago could have turned a $1.4 million loss into a $368,627 gain…

Meaning, he could have used TradeStops Plus to close a $1.8 million gap in his final outcome… all while trading exactly the same stocks.

You also saw how Buffett could have turned a 40% loss into a 552% gain, had he been using the TradeStops Plus algorithms…

You saw how billionaire Bill Ackman could have used TradeStops Plus to make $1 billion… instead of doing what he actually did, which was lose $4 billion…

And you saw how trader David Einhorn could have used TradeStops Plus to amplify his impressive 319% return… until it ballooned as high as 3,070%.

That's nearly 9.7 times better than what he actually did with his client's accounts.

So think about this…

If the market averages 10% per year…

It would take you a little under eight years to double your money.

Now imagine doing 9X better… or even just 5X better than the market average… and now you would double your money in less than two years.

So consider this…

According to CNBC, your average 50+ American has about $203,600 saved for retirement. To be honest, that’s not a lot.

Especially when many folks are hoping to enjoy multi-decade retirements.

But let's just say you've got even less set aside — just $100,000 — and you're able to sock away another $10,000 per year.

If you were to start doing that right now…

With the tools that come with TradeStops Plus in your arsenal…

You could have as much as $1.35 million set aside by 2028.

In the examples you saw, Jeff Z. could have made nearly $119,000 more than he actually made had he used TradeStops Plus to help him trade…

Robert B. could have made an extra $387,000…

And John M. would have been nearly $1.8 million ahead…

Now, I'm not saying that's going to be everybody's experience.

But I hope you see my point…

If you're making money many times faster, you're getting to $1 million faster.

It's really that simple.

Which is exactly why we've launched our “10,000 New Millionaires” mission.

Because we're dedicated to sharing that accelerated profit advantage to as many people as we possibly can.

Because, the fact is, anybody can do this…

You Just Click a Few Buttons

See, for everything going on under the hood…

Actually using our TradeStops Plus platform is incredibly easy.

You can start with a simple ticker and a few mouse clicks.

That's enough for you to call up any share so you can check out it's VQ score.

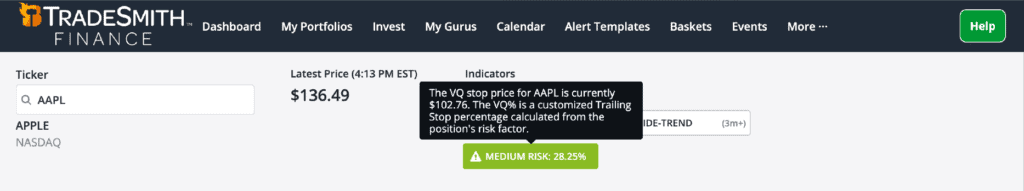

For instance, take a company like Apple…

In this example, at the moment I took the company's pulse…

Our TradeStops Plus tool gave it a VQ Score of 28.25%.

That tells you that, given Apple's price behavior over time…

Across a wide range of past market environments…

The stock has mostly traded above or below its current price of 28.25%.

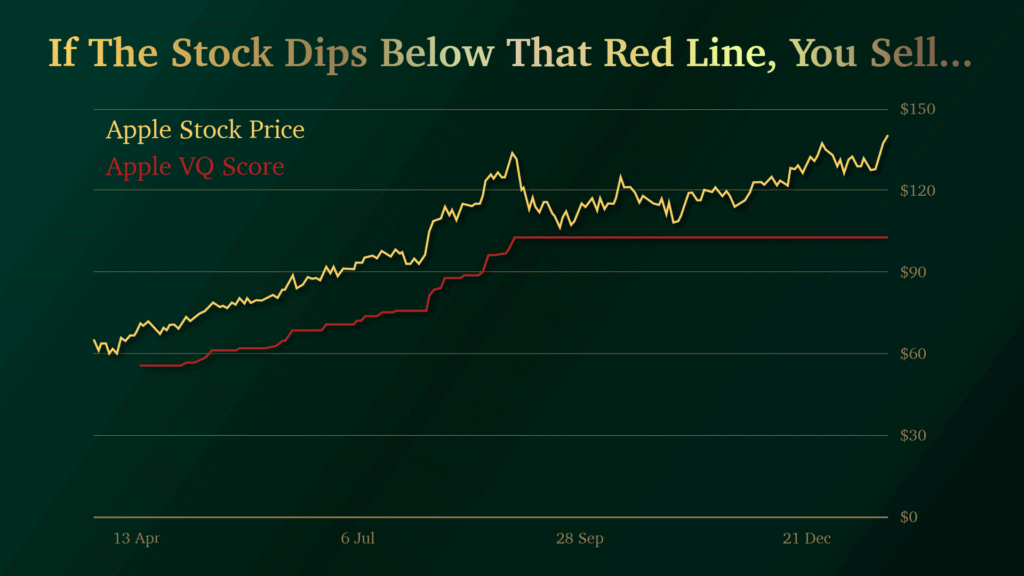

Underneath that scoring report on the platform, you'll also find a chart that looks like this…

See that red line?

That's showing you how the VQ score changes over time with the stock.

If Apple drops below that red line, you get out.

If it stays above the VQ line, you might want to buy more or cash out for potential profits, if the shares look like they're closing in on the top of their range.

Making those judgments might sound tough.

And if all you had to go by was the VQ number itself, it would be.

After all, a 28% signal might be a low signal for one stock but high for another one.

Fortunately, we've designed the TradeStops Plus system so you never have to guess…

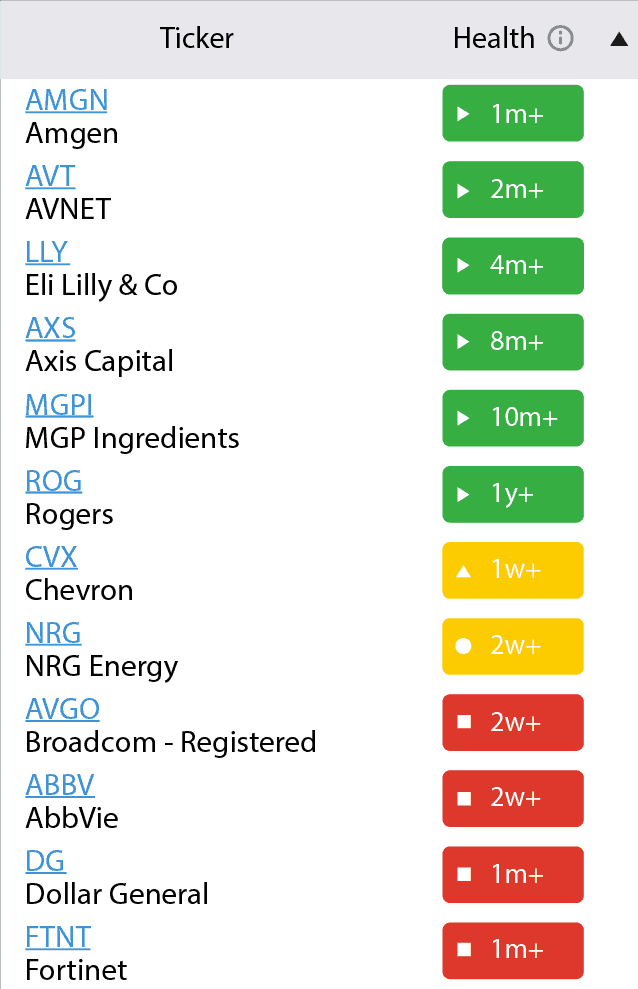

Crystal Clear Trading Signals Based On the Health of Every Ticker You'll Target

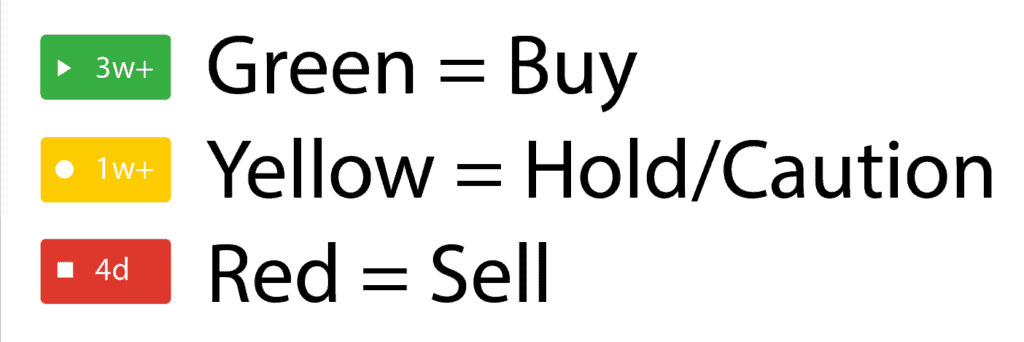

TradeStops Plus alert system doesn't just give you the signal and leave you to sort out what to do next. Our platform helps you translate every VQ score into action.

It works intuitively, just like a stoplight…

Green means the stock is healthy and it's time to buy…

Yellow means caution and it could go either way…

Red means the stock is out of its usual range and you should consider selling.

Think of it like going to a doctor for an annual checkup.

Only, instead of looking for a strong pulse or good blood pressure, you're getting a read on the financial health of every security you care about.

And you're getting a chance to monitor that data around the clock.

And see those time durations inside the boxes?

They reveal exactly when each stock changed status.

So, you'll know instantly which stocks have just made a category jump and which ones are locked into a growing trend.

To sum that up…

First, TradeStops Plus calculates VQ scores around the clock… on over 150,000 securities, including stocks, index funds, mutual funds, and ETFs …

Then, it helps you translate those scores into action, by giving you a constant read on the health of every one of those securities…

And then it signals what response you should consider taking, with the help of “stoplight-style” action alerts, so you'll always know what to do next.

It's incredibly easy to follow.

And, at the same time, it's an incredible advantage over the guessing games that most other folks get stuck playing when it comes to their own portfolios.

But there's still more…

Safely Get Instant VQ Scores For Every Stock You Own

There's another incredible feature built into TradeStops Plus…

And that's the ability for you to get an instant, completely private score for every single security in your personal portfolio.

Again, it's completely private.

We use airtight, bank-level security so that nobody can see your data except you.

And it couldn't be easier to set up…

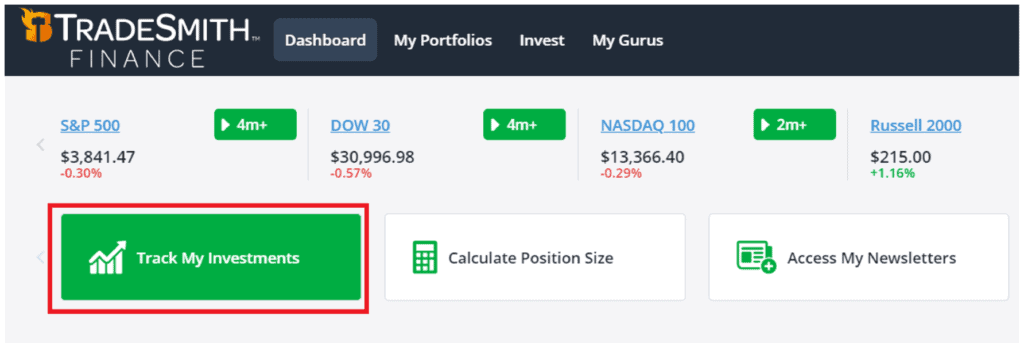

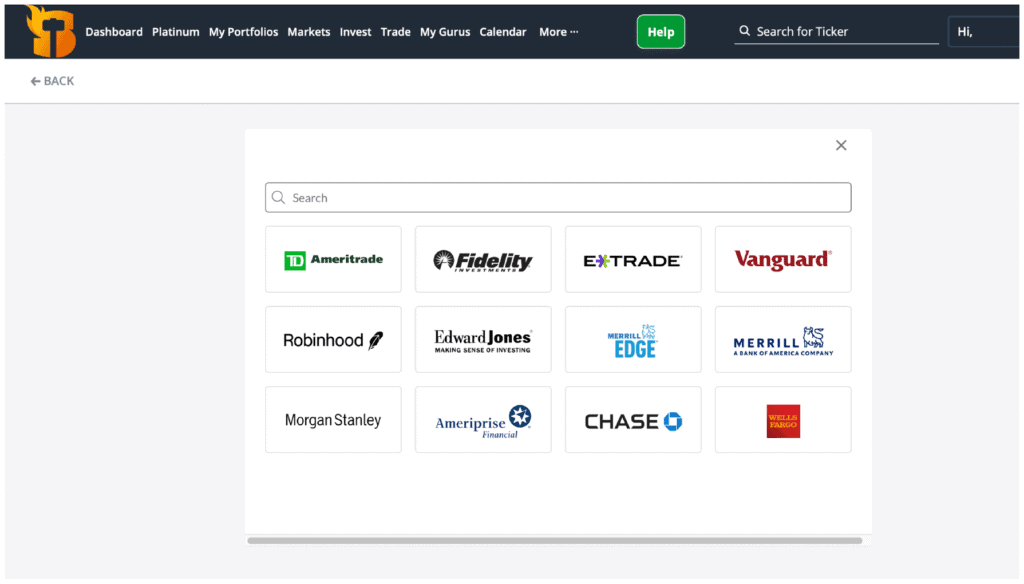

When you first visit the TradeStops Plus dashboard, there's a button…

This button says “Track My Investments.”

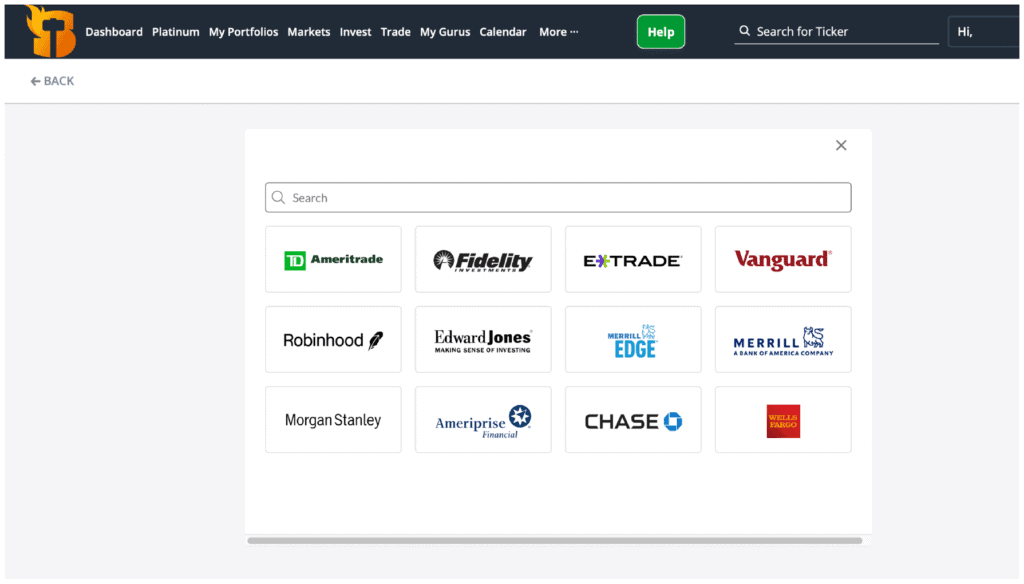

When you click it, you'll get a page that lists popular brokers…

There are so many firms that we work with, you'll see a few big ones listed on the screen… including TD Ameritrade, Fidelity, E-Trade, Vanguard, and more…

But if you don't see yours right away, all you need to do is enter it into the search bar. If it's a well-known firm, chances are it will come right up.

From there, you'll make just a few mouse clicks and, in seconds, you'll get a private glimpse of your entire portfolio…

With VQ ratings and “stoplight” buy, hold, or sell recommendations on virtually every stock, mutual fund, index fund, or ETF you own.

Again, that analysis is just for you.

Nobody else can make changes or see what you're doing.

This portfolio-analysis service is strictly automatic, driven by the power of our TradeStops algorithms. And it serves exactly one purpose only.

It's there to give you a constant read on the health of your holdings.

Every stock you own will get assigned a “stoplight” alert tile, right next to the ticker. With a click of a button, you can calculate the risk on any holding.

If there's a stock you don't own yet but want to know more about you can search for that too. Our servers run this analysis around the clock, 24/7.

Of course, if you don't want to link your portfolio for TradeStops Plus analysis, that's fine too. You can enter the tickers you want to look at manually.

Here's something else that's extremely important…

It's Not Just What Stock You Own, But How Much…

Imagine you own only two stocks.

If one of those stocks has a lot of volatility risk…

And the other is extremely stable…

It stands to reason that your whole portfolio would have higher overall risk.

Now imagine the flipped scenario, with you holding lots of the stable stock and very little of the high volatility stock…

Now your overall risk would be lower, right?

Only, we also know that sometimes a little risk is worth it, because that's how you get the bigger reward.

So how do you keep risk and stability in balance?

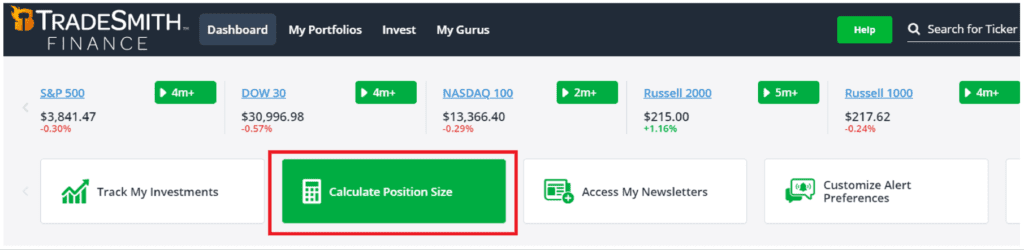

TradeStops Plus has you covered there too.

On your dashboard, you'll see a button that says, “Calculate Position Size…”

Click that button and you can get an exact read on how much risk there is for any dollar amount you want to invest in a specific share…

For instance, I entered “AAPL” into the Position Size Calculator.

And I asked it how much risk I'd be taking on with a $5,000 position.

Instantly, the answer came back… showing me that, with a VQ score of 28%… I would be putting exactly $1,391.38 of my full $5,000 at risk.

That means that if Apple does what it has done before, I could expect my position to go down… or up… by around that much, on normal market volatility.

If I'm comfortable with that amount… and the stock has a green alert… I can feel confident pulling the trigger. And if not, I can safely move on.

You can calculate the ideal position size on any ticker.

Including stocks you already own… to see whether it’s a good idea to buy more… or to sell off some shares to reduce your risk.

And while you're at it…

Why Not Automatically Track The Stocks Your Favorite Gurus Like Too?

After all, we know that lots of folks like to get investing ideas from their favorite financial newsletters.

Which is why, when you agree to try TradeStops Plus, I think you're really going to love this next built-in feature…

It's a tool where we've partnered with some of the best and most popular financial newsletters around, from some of the biggest publishers.

You can call up their actual model portfolios…

And get an instant VQ score on the health status of every one of their positions.

If you've got a subscription to any one… or many… of these publications, there's a good chance that you'll find your favorites listed for access.

So now you'll be able to track and get our analysis on those recommendations too.

It's an amazing way to validate their research.

And there’s still more…

With TradeStops Plus You Can Get Your Own Customized Alerts

Your favorite guru stocks…

Your own favorite stocks, already in your portfolio…

Over 150,000 other securities we track, 24/7…

That's a lot to keep on your radar.

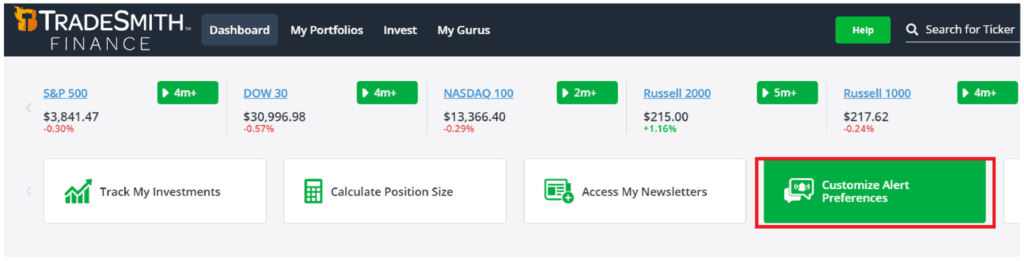

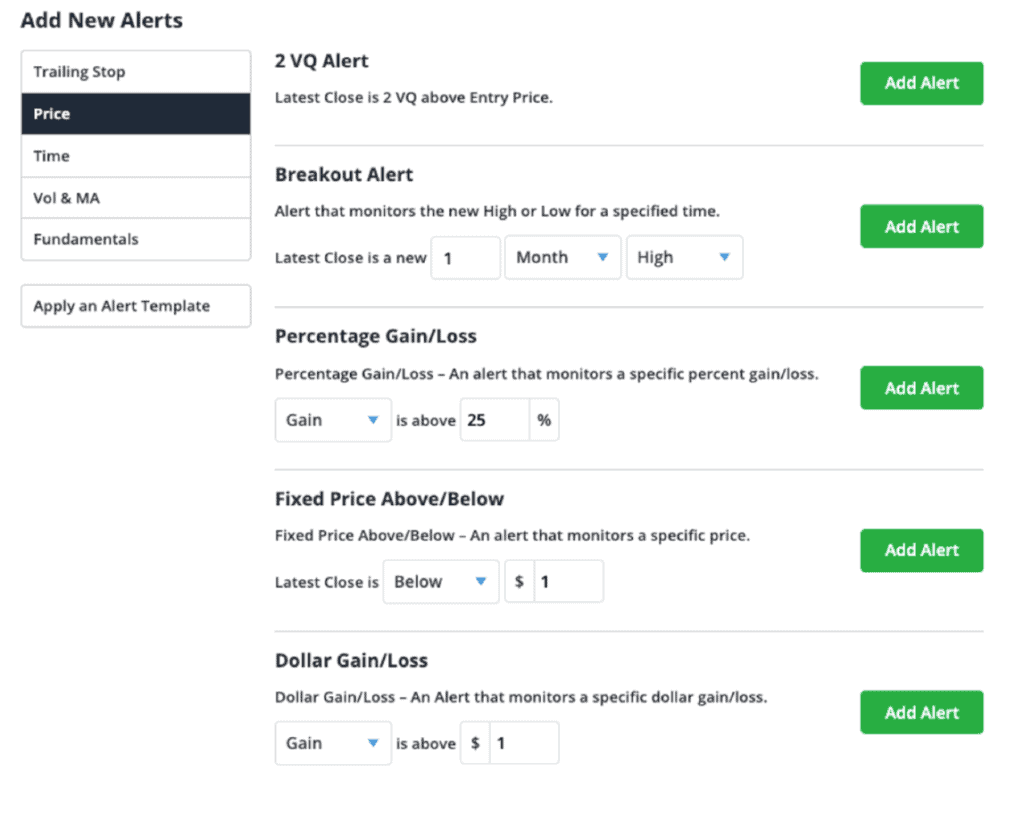

Which is why you can also use your TradeStops Plus dashboard to personally customize trading alerts for any position you want to follow…

Just click the button that says “Customize Alert Preferences.”

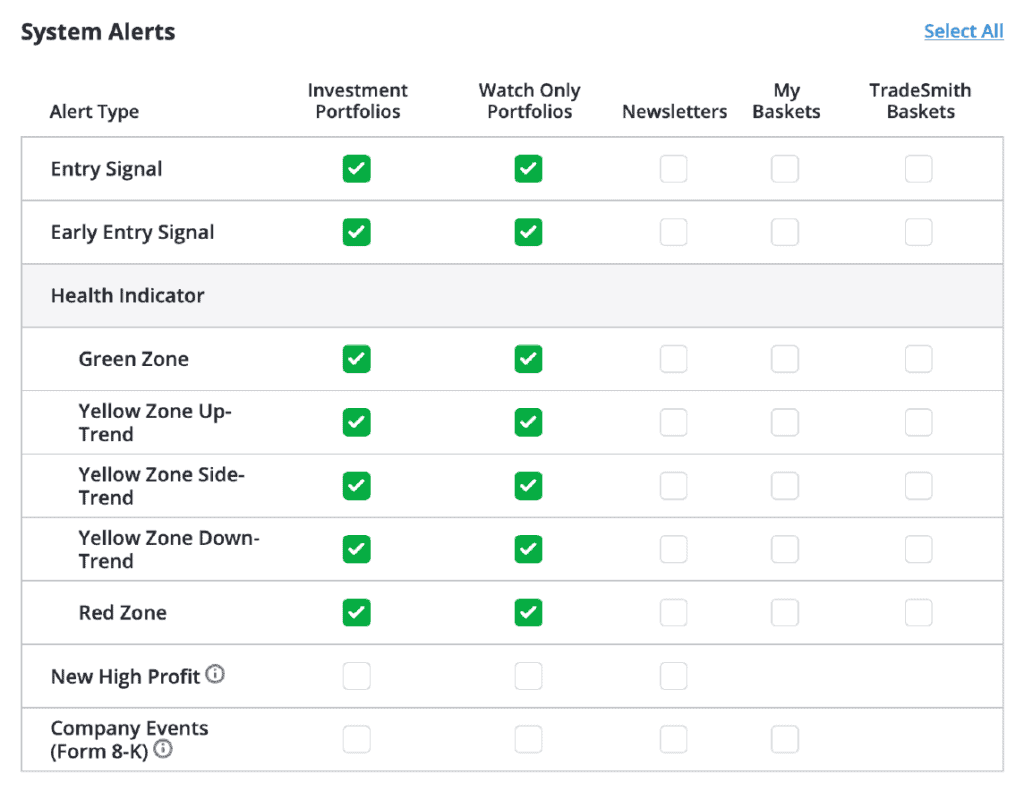

This will take you to one simple page where you can tick boxes to turn on alerts for just about anything you want us to track on your behalf…

This way, you’ll automatically get an alert the instant one of your favorite stocks triggers a change in “stoplight” status…

And you can set custom alerts on your individual positions too…

For instance, use your software alerts to let you know about new highs, gains, and changes in a share price for a ticker you want to watch.

This way, you don’t need to miss a thing.

But you also won’t need to stay glued to your screen.

If it's a good time to buy… if it's the right time to sell… or if any other key details change… you'll find out fast

And then you can decide what to do next.

Now, of course all investing still carries risk, and past performance is no guarantee of future success…

But with TradeStops Plus there to help you keep track of what you need to know, you’ll have much less to worry about.

After all, you follow markets so you can enjoy life… not so you can obsess over how to finance it, am I right?

And what if you have questions about how to use our resources?

Well, We're Here To Help.

What good is a tool this powerful if you don't know how to use it?

Already, we've kept the menus and mouse clicks for TradeStops Plus as simple as possible. And we aggressively test new features to keep them intuitive.

But we also know that it's a sophisticated service…

And unlike anything else you've ever come across…

That's why we have a full-time education specialist on staff.

You'll have immediate access to a full library of almost 30 video tutorials and filmed training bootcamps to help you get started.

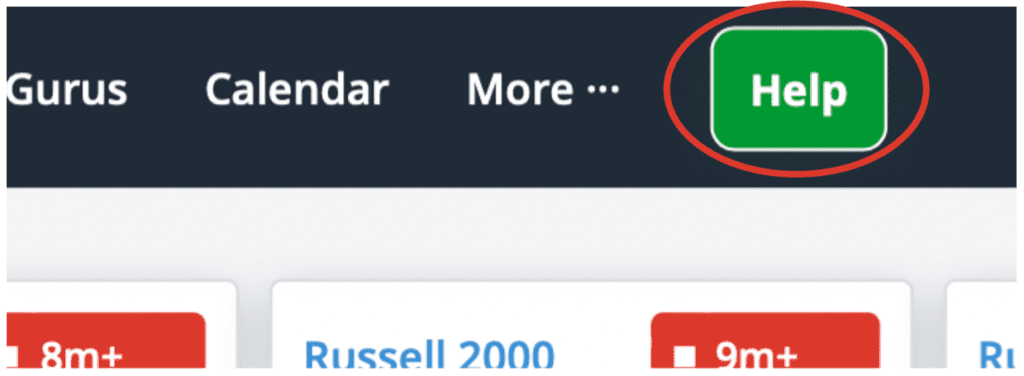

You'll also find step-by-step answers to just about every question you could ask, conveniently available in the green “Help” button on every page…

If you want more in-depth help, you'll also have the number for our Customer Success Team which you can call to talk to one of our reps in person.

You can even book a one-hour appointment with our special members-only concierge and they can help you out.

Of course, we can't give you any personalized investment advice.

But we can do everything else possible to make sure you're 100% comfortable with using the system… and that you're getting the most out of the tools it provides.

You don't need to be a computer whiz or a financial genius to do this.

We've invested a lot of money and time to make it super easy…

Without compromising anything to make it powerful.

So far, that investment is really paying off for our members in a big way.

And you don't have to take my word on that.

Just listen to what some of them have to say…

Of course, using TradeStops Plus up-to-the-minute system pays off for anybody following the alerts it can generate too.

For instance…

You could have seen 861% on Moderna…

964% on SM Energy…

1,129% on Cryoport…

2,334% on a company called Five9…

And even a staggering 22,282% on Liberty Global…

Now, of course, those kinds of extreme results aren't the norm, not for any trading system operating in any kind of market…

And all investing involves risk, where it's possible to lose what you put in. It's only fair — and honest — that I make that perfectly clear.

But this is exactly why we've created the TradeStops Plus system the way we have.

Our goal is dead simple — to help folks make more money, more often, with less risk. That's it. No smoke and mirrors, no exotic claims.

Just a powerful set of tools that you can use to give you a chance to collect more gains… and avoid more loses. Plain and simple.

Of course, the algorithms that drive TradeStops Plus are anything BUT simple.

We've come a long way from the original formula. And it took a lot of mathematical wizardry and coding talent to help us do it.

It costs us even more to keep that system running.

For instance, let's say you link your portfolio profile to our TradeStops Plus platform so you can apply our analysis tools to 20 different stocks.

With as many as 9,250 calculations applied to each stock, that could quickly add up to over 185,000 calculations for just your portfolio health-check alone.

And we have over 69,000 members.

In short, that's a lot of calculating…

Which requires an enormous amount of coding…

And a heck of a lot of digital firepower…

That's why we keep a team of data scientists, mathematicians, PhDs and software engineers on call to keep our platform up and running.

I've been signing checks for years now, just to cover the cost of data feeds, security, and the research and development that we do to upgrade features.

Right now, it comes out to about $2 million in annual costs.

That's why we normally charge TradeStops Plus users $588 per year.

However, I don't want you to pay that much.

Why?

For one thing, we're coming out of an incredibly rough time for investors, especially for those who don't have high-ticket advisors watching their accounts.

For another, chances are that you don't know me from Adam. And I'm pretty sure you've never come across a unique service like TradeStops Plus.

So, it doesn't seem fair for me to ask you to risk committing to something so new.

That's why I'm going to open this up to you at a much lower price.

Accept my invitation today and you can test-drive TradeStops Plus for just $79.

That's for a full year of unlimited access.

With that deal, you'll get…

- A discount of more than 85% below the usual full year access price.

- Our VQ scores for more than 150,000 different securities, calculated around the clock and available for you to search as often as you like.

- Full access to our VQ-driven “stoplight” alert system, which gives you green, yellow, and red alerts… for buy, hold, and sell… instantly on over 51,000 stocks.

- Bank-level secure analysis of your own portfolio data, so you can get an instant, private, and safe read on the health of your holdings.

- Instant risk and position sizing on any ticker symbol you enter, to see — to the penny — how much risk you're taking on and how many shares to buy.

- Full access to our “newsletter center,” where you can link the model portfolios of your favorite gurus and get an updated read on the health of their picks too.

- Completely customizable alerts so you can relax, knowing that if there's a buy, hold, or sell issued on one of your favorite stocks… you'll know about it.

And then, I almost forgot…

You'll also get…

Bonus Report #1:

When to Sell 50 of the World’s Most Popular Stocks

Bonus Report #2:

Beat the Billionaires: Insights, Errors, and Recommendations from the Brightest Minds on Wall Street

And…

Bonus Report #3:

The Millionaire Master Plan, a blueprint you can use to get you started on the path to your next… or first… seven-figure nest egg, using our tools.

Remember, in case you have any questions…

You also have a full library of training videos…

Full access to our members-only boot camps…

Plus, a thorough “Help” center…

And…

You can also always call our dedicated customer success hotline.

They're based right here in the U.S.

While they can't give you any personalized trading advice, they're ready to help you with any other details related to your membership.

Plus, you can always schedule an appointment with our TradeStops Plus concierge, if you need extra help getting set up.

They'll speak with you one-on-one.

In other words, we're prepared to make this as easy for you as possible.

Which reminds me…

Here's one more way I can help make your decision even easier…

Clicking the button won't obligate you to anything.

All it will do is take you to a page where you can review all my invitation details in one place, one last time, before you make up your own mind.

I should warn you, I'm not sure we can keep this access price so low forever.

Others have paid more to get in, so there's every possibility they'll start asking — or even demanding — that we level the playing field again.

So, if you're going to lock in this incredible deal, you should do it soon…

As you make your decision, I only ask that you remember our mission…

My “10,000 New Millionaires” Pledge

We set out today to help a minimum of 10,000 people just like you, with the hope that we can show them how to earn their first million… or their next million… in the stock market…

Strictly by using our TradeStops Plus algorithms and VQ-driven alerts.

I remain committed to that goal. And I want you to be a part of it.

Which is why I've spent so much time with you today, walking you through our suite of TradeStops Plus tools so I could show you how they work.

Already, you've seen how those tools could help you avoid huge losses… and how you could use them to double… triple… or even 10X your potential returns.

You’ve also seen how we’ve already helped so many of our other 69,000 members.

You've even seen how our tools could have helped some of the best investors on Wall Street make a lot more money too.

So now it's go time.

The final decision is yours and yours alone…

The Way I See It, You've Got Three Options

First, you could just pretend you've never heard about the work we're doing…

And that you've never seen this presentation I've given you today…

And you can tell yourself that, sure, it's good enough to just keep going “as is”… trusting future financial outcomes to gut instinct alone.

And, who knows, maybe if you do that you'll get along just fine.

It could happen.

But it sure seems like a lot to risk, especially now.

Markets have rarely been this unpredictable… To say nothing of the headlines.

So, I think it's safe to say, even the smartest folks need all the help they can get.

Your second option is to recognize that, okay, emotionally charged investing is a terrible idea… and it can be extremely dangerous…

But hey, you might be thinking, now that you know about those risks…

Maybe you'll be one of the few who can resist those emotions when the chips are down… when markets are crashing… or the headlines are screaming… right?

Again, I'd have to say, it's not very likely.

As you've seen, even the most successful investors of all time…

People like Buffett, Ackman, and others…

Have succumbed to costly emotional decisions in the past. If they have a hard time resisting those mistakes, how hard will it be for me and you?

That's why I'm going to recommend the third option…

And what I think is the only option…

In short, accept my invitation to try TradeStops Plus risk-free for 60 days.

It will take you two minutes to get VQ scores — privately and with bank-level encryption — on every stock or fund you own or consider owning.

Just as fast, you'll have “stoplight” alerts that will help you determine what to buy, hold, or sell… you'll see how much money you have at risk…

And you'll have a clear picture of what to do next, updated around the clock for as long as you're willing to give our TradeStops Plus service a try.

Our other members love what we've helped them accomplish.

Member Jim S. wrote in to say…

“I'm a very satisified user of TradeStops… my only reqret is that I didn't subscribe much sooner…”

Member Pramila D. told us…

“TradeStops Plus makes you think twice about the emotions that take hold… I like the system so much I've become a Platinum member…”

Member Roger W. wrote…

“I can't believe my good fortune to have stumbled upon TradeStops Plus…Everything is top notch… thank you for all you do!”

And John K. told us…

“I love TradeStops! I am a Platinum member and the VQs have totally protected my portfolio. I've made significant gains as well…”

I could go on.

But I think you know what I would decide.

After all, I've been there myself, trying to make sense of rough markets… financial risks… and my own doubts about what to do next.

Personally, I'd much rather have a hard number, showing what to buy… how much to buy… when to cash out for possible gains… and what to dump immediately.

That's exactly what TradeStops Plus is designed to do.

It's been helping light the path through the markets now for the last 17 years.

And we've only made it more powerful and more effective over that time.

You could, of course, keep going without this tool to help you.

And you could keep on taking the unaided risks so many others take.

But I don't see any reason why you should, when TradeStops Plus can help you avoid making those kinds of huge… and potentially costly… mistakes.

It's time to stop leaving money on the table.

And time to stop losing money you don't need to lose.

Click the button below to get started…

This is the only tool I know of that can help you make more money on the same investments you're already making… while reducing your risk at the same time.

And remember, you can try TradeStops Plus risk-free for the next 60 days.

So, you've really got nothing to lose.

Try it now, decide later.

It starts here… and it could be the most valuable investment decision you'll ever make… I hope to hear from you soon…

Thanks for so much for listening!

Keith Kaplan

CEO,TradeSmith

January 2023

P.S. If you're still here, I just want to share one more of my favorite letters from a TradeStops Plus member. It's a long one, but it's worth reading.

Have a look…

…I’m looking forward to hearing from you soon!

Customer Success hours: Monday through Friday, 9 a.m. to 5 p.m. Eastern

Call us at (866) 385-2076 or drop us a note at support@tradesmith.com

Our U.S.-based support staff are friendly, helpful, and always glad to assist.

Sales tax will be added to orders placed from states where we are required to collect sales tax.

For additional information about sales tax, please go to our tax information page or call member services.

For full disclosures and details, please click here.

©2023 TradeSmith, LLC. All Rights Reserved.

Terms of Use | Privacy Policy