Table of Contents:

- Introduction

- Who is Matt Milner?

- The reason the “Shadow Market” can be so profitable…

- Turn the Tables on the Rigged Game…

- Getting in on a Company at the Ground Floor…

- The biggest potential gains you’ve likely ever seen in your life.

- The Early-Stage Playbook is something totally new in the financial world.

- Get access to the 12-lesson video course on Pre-IPO investing.

- How to invest in the right pre-IPO companies

- Maybe you still have some questions about private investing?

Dear Friend,

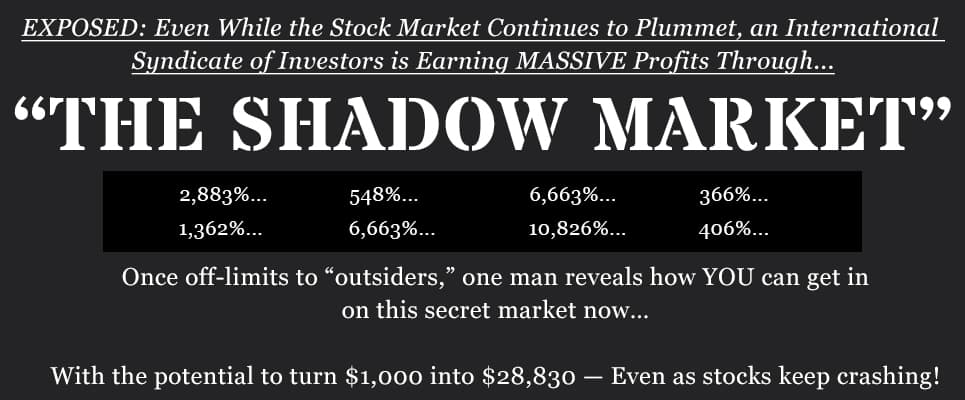

The stock market is bleeding like a stuck pig.

The Dow is down 20%… the S&P is down over 24%… and the tech-heavy Nasdaq has crashed a whopping 32%…

But despite this bloodbath…

A small and secretive group of investors is earning massive profits through what I call “The Shadow Market”

To be clear, this has nothing to do with “shorting” stocks or trading options.

And it doesn’t involve commodities, bonds, currencies, cryptos, or anything else you may have heard about before.

In fact, I can almost guarantee you’ve never been exposed to this unique investment before…

That’s because, for more than 80 years, it was literally illegal for you to invest in it…

But not anymore.

And that’s why, in this urgent presentation, not only will I show you how to get access to this ultra-profitable investment…

But I’ll also show you how to make your first trade as soon as Monday, November 14th!

But before I do all that, let me show you a few examples of exactly how profitable these trades can be — regardless of what’s happening in the stock market or the economy.

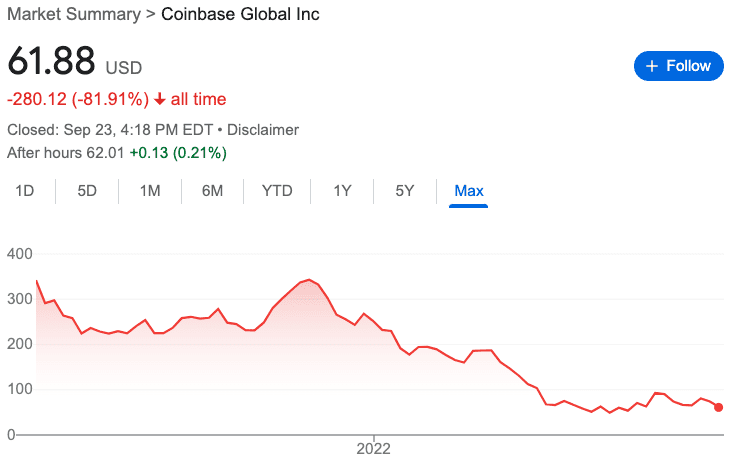

To kick things off, take a look at this chart:

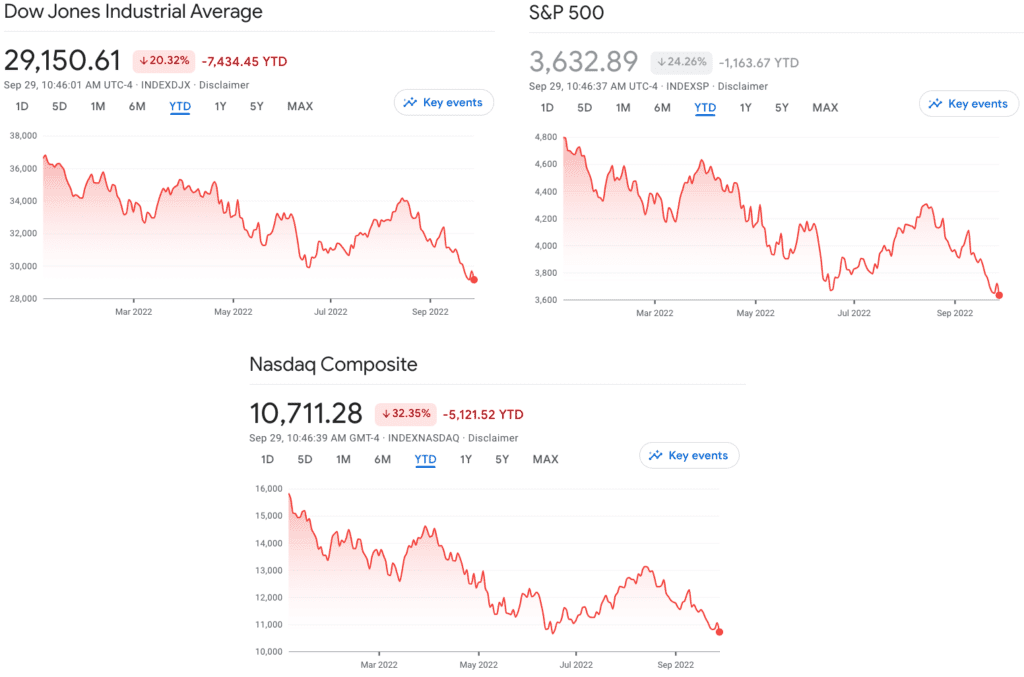

This is the chart for a company you may have heard of before — Robinhood, the stock-trading app.

After climbing to a peak of around $55 per share late last year…

Robinhood’s stock price collapsed. It now trades at about $9.

That’s an 80% loss.

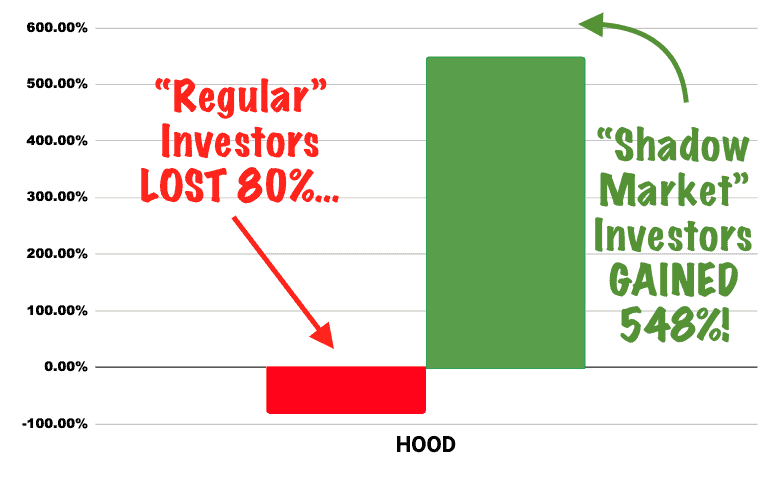

So if you’d invested in HOOD the “regular” way, your $1,000 investment would have withered into just $200!

But there’s also a different group of Robinhood investors…

And not only haven’t they lost a dime on this stock…

But even after watching the 80% drop from the sidelines, these investors are still sitting on a massive profit.

More specifically…

Even after the 80% crash…

These investors are still UP 548%!

I want to repeat that:

Even though HOOD has lost 80% of its value in the last year…

One group of Robinhood investors is sitting on a gain of 548%.

That’s enough to turn that same $1,000 investment into $5,480!

Over five times their money on the same exact company!

Incredible, right?

And again, just in case you’re wondering…

These profits did not come from:

- Shorting Robinhood’s stock…

- Buying complicated “put options” on the company…

- Or investing during the company’s IPO.

Instead, these investors used a different strategy to earn these staggering gains.

In fact, they earned their profits using a different market entirely..

It’s something I call “The Shadow Market.”

But before I tell you more about this secretive market and how it works…

I want you to take a look at another example of the types of profits investors could earn here.

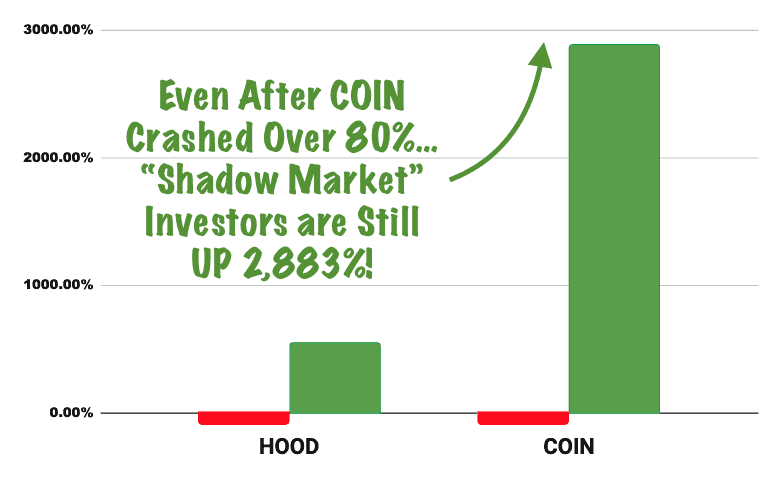

This one involves another company you’ve probably heard of — Coinbase:

Like Robinhood, Coinbase has plummeted over 80% from its peak!

But if you knew about “The Shadow Market…”

Coinbase’s crash would have meant nothing to you.

Because as you’re about to see, “Shadow Market” investors in Coinbase are sitting on gains as high as 2,883%!

That’s 28 times their money — from the same stock that crashed over 80%!

And again, there’s nothing crazy going on here:

These investors aren’t shorting Coinbase stock, there’s no options involved, no warrants, nothing like that at all.

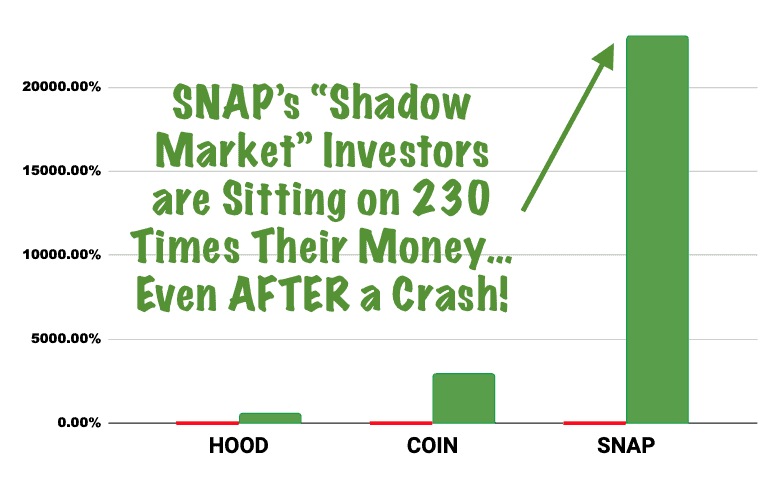

And here’s another example that’s even more incredible: Snapchat, the company behind the popular social-media app.

SNAP has crashed over 87% from its peak!

But for “Shadow Market” investors, this is no sweat…

Because these investors are UP an incredible 23,029%!

That means they’re up 230 times their money — on a stock that’s lost nearly ALL of its value!

Now of course, these are some of the best performing examples in the “Shadow Market.”

This is a big deal:

Even though the overall stock market has plummeted by nearly 30% so far this year…

And even though many investors are down even more than that…

“Shadow Market” investors can still be sitting on huge gains, time and time again!

This helps explain why some of the richest people on the planet are moving more and more of their money into “The Shadow Market”…

According to UBS, the bank responsible for managing the funds of HALF the world's billionaires…

Its clients are moving more money into “The Shadow Market” than ever before!

“World's richest families invest more [here] amid

volatile markets – UBS”

— Reuters

And Bloomberg reported that this market has become a “favorite” among billionaires…

“[“The Shadow Market”] has become

billionaire families’ favorite…”

— Bloomberg

Meanwhile, The Wall Street Journal claims that this market has become an “escape” from stocks for the wealthy…

“Wealthy Investors Pile Into [“Shadow Market”] to Escape Stock Volatility”

— The Wall Street Journal

And here’s the best part:

For the first time in nearly a century, now you have the chance to join the world’s wealthiest investors in the “Shadow Market”…

And potentially earn gains of 548%, 2,883%, 23,029%… and possibly even more.

That’s because, just a few moments from now, you’ll discover…

How You Could Make Your First “Shadow Market” Trade as Soon as Monday, November 14th!

By the way, now seems like a good time to start explaining why I call this market “The Shadow Market.”

Simply put, I gave it this name because investing in this market has been hidden from Main Street investors for decades.

In fact, for 82 years…

Unless you were a member of the ultra-rich elite…

You were LOCKED OUT from this market.

And I mean that literally:

It was literally ILLEGAL for more than 90% of individual investors to invest in this market.

But now…

Thanks to a recent discovery my team and I made, now YOU can invest in “The Shadow Market” — Starting with as little as $100!

If this sounds crazy or “too good to be true,” I get it…

Gains like 548%… 2,883%… 23,029%, especially in a crashing market, are hard to fathom…

And if I were an outsider to this market, I might not believe it at first, either.

But I’ve been involved in “The Shadow Market” for decades now…

So big gains like those don’t surprise me anymore.

And as you just saw, while most people have been losing their shirts in the “regular” market…

“Shadow Market” investors have been making a killing.

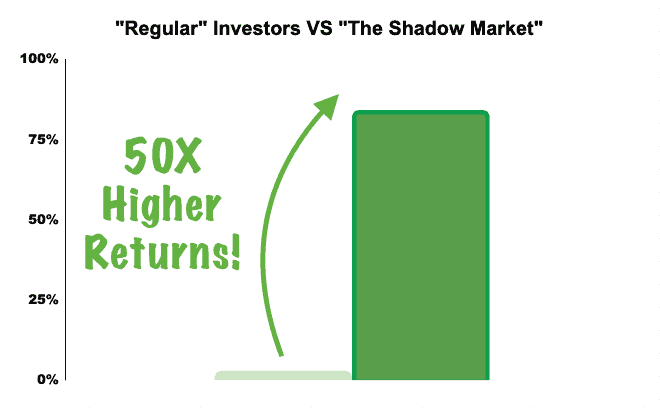

In fact, after an extensive six-month study where it tracked 147 companies…

Manhattan Venture Partners concluded that “Shadow Market” investors could have earned gains up to FIFTY TIMES HIGHER than regular investors.

That’s 50x higher returns — from the same exact companies!

That means investing the “regular” way — or other words, the way you’ve probably always been told to invest…

Could get you NOWHERE.

And at the same time, a different group of investors (a group that you were banned by law from joining) could be making a killing!

Does that seem fair to you?

Does it seem fair that most Main Street investors are suffering crippling losses….

While behind the scenes, the “big boys” are getting fat with profits?

It sure doesn’t seem fair to me.

But I’m here to show you why it doesn’t need to be that way anymore.

I’m here to show you why it’s finally YOUR turn…

And why right now is the perfect time to take advantage of this.

Because as you’ll see in this urgent presentation, the doors to “The Shadow Market” have finally been opened wide for you.

That’s why, today, I’ll also be showing you everything you need to know about this market — including:

- How I discovered this under-the-radar market…

- How much you could potentially make here in profits…

- And why you were locked-out for 82 years.

Even better, I’ll explain how you can get started in this market today — potentially for as little as $100!

(By the way, if you’d like to verify any of the claims I’ve made here, feel free to view the Details and Disclosures link at the bottom of this page. Everything is there for you to peruse in full.)

But before we move on, I have to warn you, there’s one small “catch”…

You’ll want to read this message in full by Monday, November 14th

Because that’s when a NEW set of “Shadow Market” investments is set to “go live…”

And as you’re probably starting to understand, you might very well want to invest in them.

But right about now, you might be wondering something:

Why am I telling you about all this?

In other words, why do I care about helping YOU make money — especially in a way you probably didn’t even know existed?

To explain, let me properly introduce myself…

My name is Matt Milner.

And I’ve been investing and operating in “The Shadow Market” for over 30 years.

First of all, the truth:

I stumbled onto this investing secret.

You see, I didn’t grow up wealthy…

I’m not a silver-spooned insider who was taught about this market from birth.

I had to claw my way into an Ivy League college, Cornell University. But once I was there, I started meeting people who were born into wealth, and who could open doors for me — or at least show me where the doors were hidden.

That’s how I got a job offer at Bear Stearns while I was still in college. Bear was a top Wall Street firm, the stuff of legends. So I didn’t hesitate: I took a leave of absence from Cornell and dove in.

And that’s when I started learning how “the game” really works. Over time — after stints at Bear, after business school, after years at other top banks like Lehman Brothers — I realized how everything is rigged against Main Street investors like you and me.

But surprisingly, I also discovered a small corner of Wall Street that didn’t seem rigged. Furthermore, it seemed to offer nearly unlimited upside. I’m talking, of course, about “The Shadow Market.”

So that's where I decided to focus all my energies. I learned all the ins and outs of this little-known market. And eventually, I quit Wall Street and ventured into “The Shadow Market” on my own.

And before long, I saw firsthand how it can build extraordinary wealth.

For example, I was there to “ring the bell” in person when a “Shadow Market” company got listed on the stock market…

The thing is, because of archaic laws that had been put in place by the “insiders,” I soon realized something:

The insiders were still the ones getting rich…

While Main Street investors like you (and my own family) were still being locked out!

But then, as you’ll learn about later in this presentation, “The Shadow Market” slowly, slowly, slowly started opening up…

And now, thanks to a recent discovery my team and I made, YOU can invest in “The Shadow Market” — Starting with as little as $100!

I’ll explain all the details in a moment…

But it was this discovery that made me change my career path…

This is when I decided to make it my mission to show Main Street investors like you how to take advantage of “The Shadow Market.”

For example, I started sharing my writings and research about it online, so anyone with an Internet connection could learn about it.

Well, one thing led to another… and now I’ve had the chance to speak about “The Shadow Market” all over the country, …

(This is me on stage talking about The Shadow Market to close to 2,000 people at one of the largest investing conferences in the world).

But then I went even further…

I decided to team up with literally one of the largest financial publishing companies on the planet. This company has more than 15 million readers, and offices all across the globe.

My goal now isn’t just to show you where the door to “The Shadow Market” is hiding…

My goal is to teach you everything I’ve learned about “The Shadow Market, and exactly how to profit from it…

Even during down markets like we’re seeing right now!

To explain what I mean, let me show you some more examples of how “Shadow Market” investors made a killing — even while the same stocks were getting crushed.

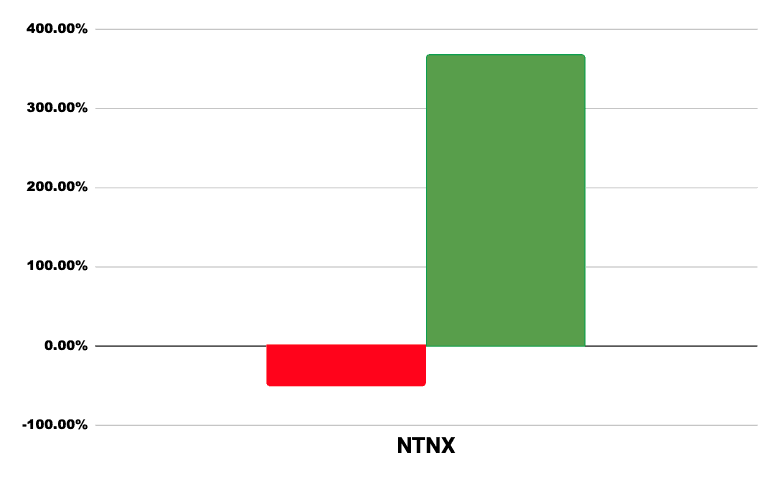

For example, look at the cloud-computing company, Nutanix.

Nutanix is down 50% this past year…

So if you’d invested the “regular” way, the way you’ve probably always been told to invest…

You’d soon have lost HALF your money in this stock!

But if you’d known about “The Shadow Market…”

You could be up 366% — even AFTER the crash in Nutanix stock!

That’s nearly 4 times your money, on the same exact company!

Imagine turning $1,000 into over $3,660, even while everyone else LOST half their money!

It might sound crazy, but that’s exactly what “Shadow Market” investors have the power to do.

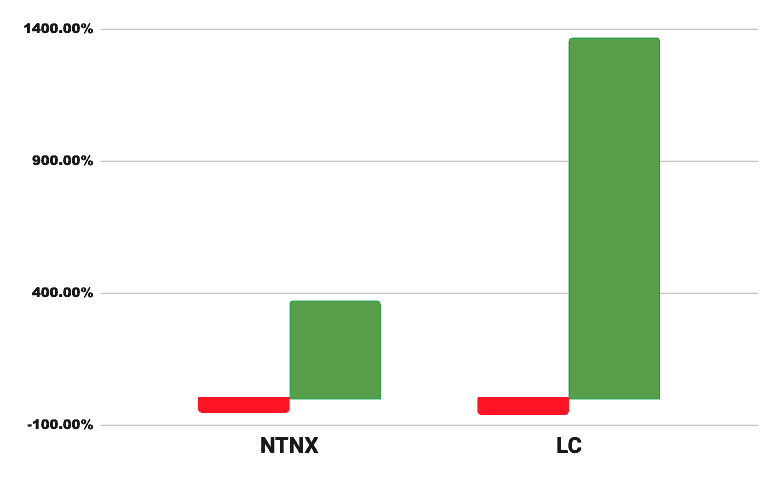

It was the same story with another company, Lending Club (NYSE: LC).

LC is down 60% this past year…

But “Shadow Market” investors?

Well, they could be up 1,362% on the exact same company.

And again, that’s the gain even AFTER Lending Club crashed!

To be clear, that’s THIRTEEN times your money…

Enough to turn $1,000 into $13,620.

Or $10,000 into $136,200!

A six-figure fortune from the same exact company.

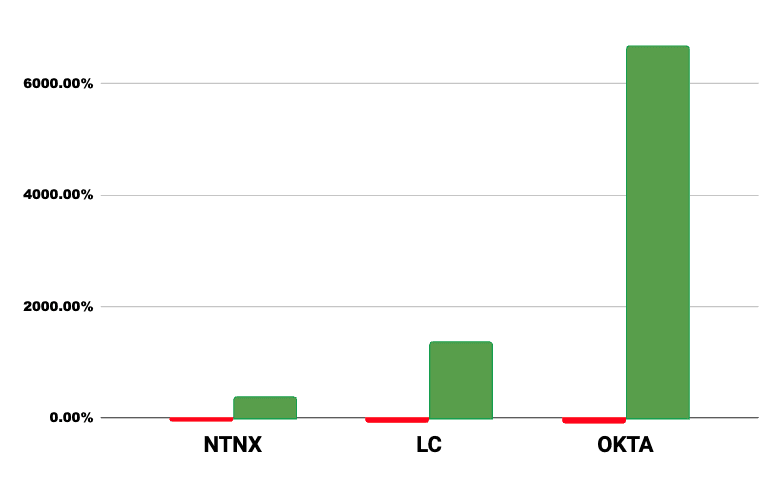

And here’s another example…

Take a look at a company called Okta (Nasdaq: OKTA). It provides digital-security software to companies across the globe.

Okta is down almost 80% this past year:

But if you’d been able to get in on Okta in “The Shadow Market…”

You’d be up 6,663%!

That’s SIXTY-SIX times your money…

Enough to turn every $1,000 investment into $66,630…

Every $10,000 into $666,300…

And every $100,000 into more than $6 million.

You’d be a certified multi-millionaire from this single investment…

Even AFTER its stock crashed.

Now of course, these again some of the best performing examples in this market. Nothing is guaranteed…

But do you see how this market could be crucial for you right now?

Especially if stocks keep falling, just like experts predict it will.

For instance, Morgan Stanley is forecasting continued stock crashes, even without a recession:

“US stocks will keep falling even if the economy dodges a recession, Morgan Stanley's top strategist says”

— Business Insider

Expert market forecaster Jeremy Grantham is also predicting more pain in store for stocks:

“Famed bubble caller Jeremy Grantham: Stocks can fall more”

— Associated Press

And according to ABC News:

“Keith Lerner, co-CIO and chief market strategist for Truist Advisory Services, said the rate hikes instituted by the Fed would weigh on the economy for at least 6 to 12 months and potentially even longer.”

— ABC News

Well, as I mentioned earlier, today I’m going to pull back the curtain for you, and bring this market OUT of the shadows.

So now let me take a minute to explain exactly how this market works, and why it could be so profitable for you…

The reason the “Shadow Market” can be so profitable is simple: it has a built-in advantage that you never had access to — until now.

Like I said, this market takes place “in the shadows” — out of view of the public eye.

But to be clear, this market is entirely legal and legitimate. In fact, it’s under the jurisdiction of the SEC.

It’s just that most investors simply don’t know about it, and they don’t know how to take advantage of this built-in advantage.

But that’s what makes investing in this market so profitable!

What’s this advantage I’m referring to?

It involves getting into a company at the lowest price possible.

I’m talking about getting in at the ground floor, way before the company goes public and its stock starts trading on an exchange.

Because if you can get in at that early stage, you can get your shares at dirt-cheap prices.

Think of it like this:

Imagine you're at a party, standing in a circle with five other people…

Someone strikes a match. It's burning hot.

He quickly passes it to the next person. But even then, the flame has already started burning down.

But then the match gets passed to the next person… who passes it to the next person… and so on.

And by the time it gets passed to the fifth and final person, the match has gone out completely.

There's no more fire at all. It’s just a tiny puff of smoke…

Here’s the thing: in a way, this story of the burning match also describes what happens in “The Shadow Market.”

You see, historically, only company-insiders and the ultra-rich could invest while the “match” — in other words, a new company —was red hot.

By the time the company gets to you — by the time the general public is able to invest in it in the stock market — the fire is gone. The biggest profits have already been made!

Essentially, by the time ordinary investors are able to invest in a company in the stock market, it's dead.

And that explains how the market is rigged against you…

The insiders — the ones who get access to the burning-hot startup companies — they're the ones who make all the money. They’re the ones who get rich.

And meanwhile, Main Street investors like us get screwed.

So if you’ve ever worked hard… done the right thing… saved your money… invested in the stock market… just like stockbrokers or mainstream press told you to do…

But you STILL haven’t gotten where you want to be financially…

I want you to understand something:

It’s NOT your fault!

You’re working with a broken model. A model where you’ve been pushed to the end of the line, holding matches that have already burnt down to nothing.

As the old saying goes:

Wall Street follows its own “Golden Rule” — those with the gold make the rules.

And up until recently, the rules have been in THEIR favor!

Because, by law, you were LOCKED OUT of “Shadow Market” opportunities for 82 years!

The game has been RIGGED against you for a very long time.

And here’s the guy who rigged it…

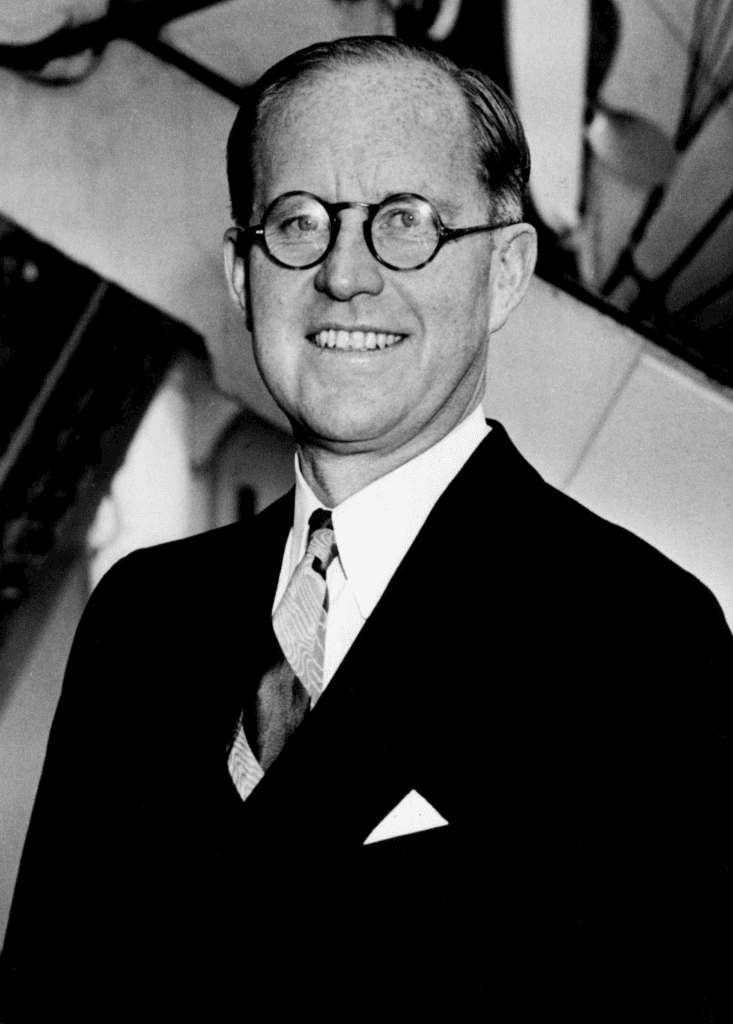

Do you know who this is?

This is Joseph P. Kennedy.

Joseph Kennedy was the father of John F. Kennedy, Bobby Kennedy, and Ted Kennedy.

He also was a big ally of FDR. You can’t get any more “insider” than that!

But Joe was also famous for something else. He was the founder of the Security Exchange Commission, the SEC.

Basically, he helped create the laws that govern the stock market, including the 1934 Securities & Exchange Act.

This law was meant to protect the public from investing in risky deals, which were all over the place after the stock market crashed in 1929.

But sadly, like most things the government does to “protect” you, this law did something else:

For 82 years, it legally prevented ordinary people from investing in “The Shadow Market.”

Like I said, it was designed to help the insiders profit, and to leave the rest of us with table scraps.

Because you see, in the past, there were only two real ways to get into these “Shadow Market” deals:

The first way was to get a job in Silicon Valley that came with stock options. Basically, you worked your butt off 7 days a week for years and hoped that your options ended up being worth something.

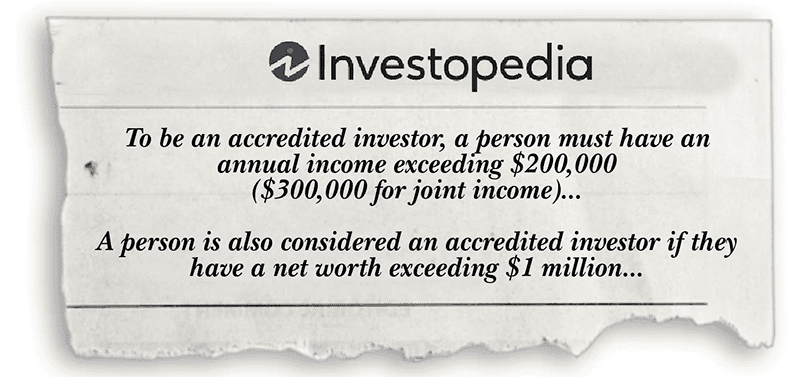

The second way was to be called an “Accredited investor…”

That’s a legal definition created by the U.S. government. Here’s the definition from Investopedia:

Essentially, an accredited investor is someone who’s wealthy already — with a net worth of least $1 million.

If you were accredited, you could get into “Shadow Market” deals. So to get into these deals, you had to be rich already!

For example, a guy named Paul Graham was already an accredited investor…

In 2009, he plunked down $20,000 in exchange for 6% of Airbnb, the hospitality startup.

Well, today, at Airbnb’s current market cap of roughly $70 billion, a 6% stake would be worth $4.2 billion.

Can you imagine turning $20,000 into $4.2 billion?!?!

That’s over 200,000 times his money.

But Paul was an insider. He was connected already. He was rich already.

Meanwhile, for 82 years, outsiders like you and me were literally locked out of these opportunities by law.

And that’s why you’ve never been able to take advantage of these “Shadow Market” deals…

Until now.

Today, the rigged game ENDS.

Thanks to H.R. 3606, now YOU can get into “The Shadow Market” too!

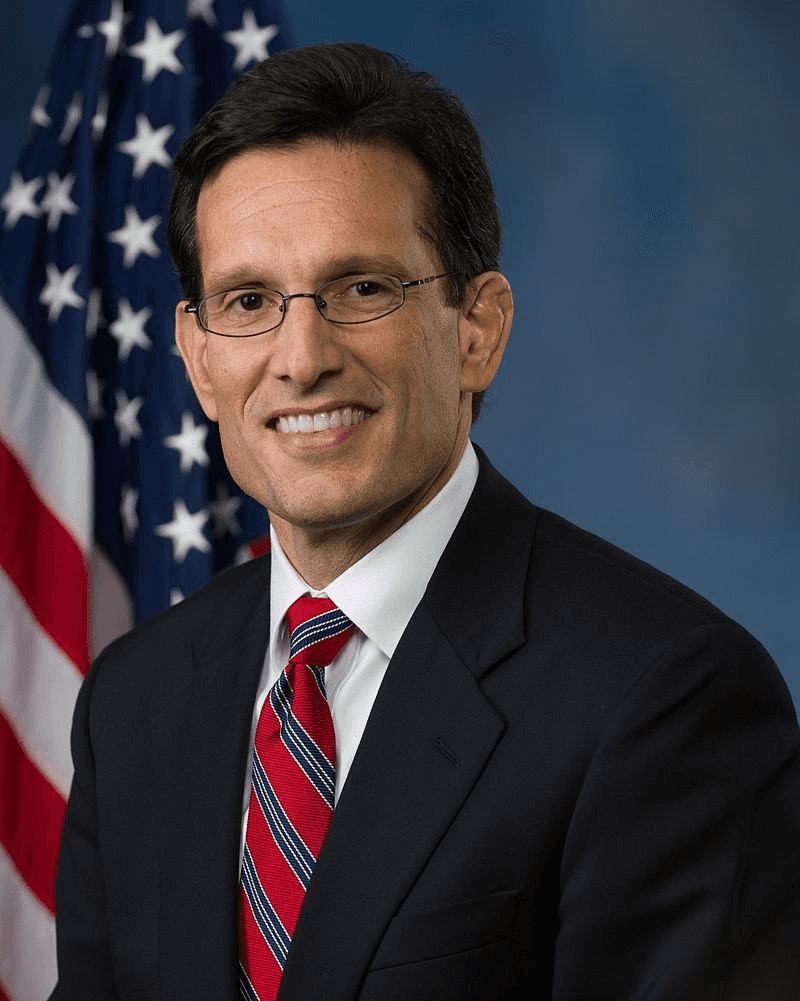

It all revolves around the man you see right here:

This is Eric Cantor.

He’s the one who opened the door so ordinary people could invest in “The Shadow Market.” He’s the one who made it legal.

You see, back in 2012, Congress started passing a revolutionary new set of laws, H.R. 3606.

Or as it’s commonly called, the JOBS Act.

Cantor was the Congressmen who helped write this law, and championed its passage.

But most people didn’t really hear about this historic event, or understand why it was so important to their financial future.

And that’s unfortunate…

Because this law did something truly amazing:

The JOBS Act rewrote the rules of investing!

For the first time in 82 years, it gave individual investors access to the same kinds of opportunities as the insiders.

This is what lets you take advantage of “The Shadow Market” — 100% legally and approved by the SEC — and finally get your money into these early-stage deals.

In short? The door is now open!

After locking out the public for 82 years, now everyone can get into groundbreaking startup companies at their earliest stages!

Now YOU can finally profit from “The Shadow Market” — locking in potential gains as high as 81,900%! — Regardless of what’s going on with stocks!

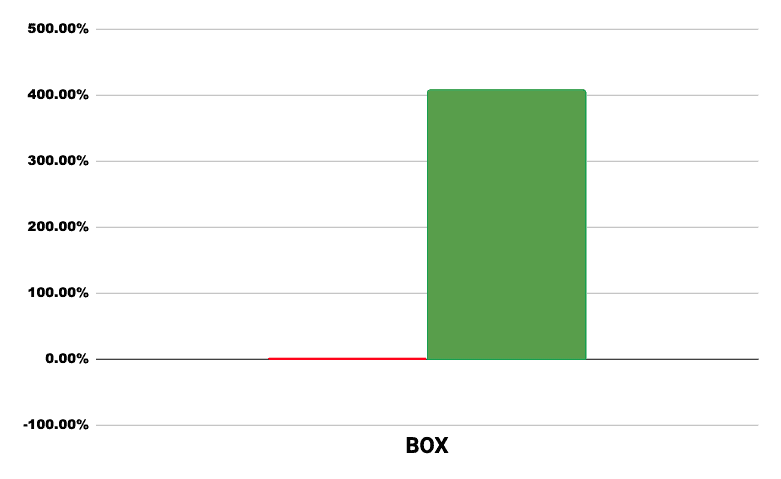

To see how powerful this new law is, take a look at online storage company, Box.

Box has gone nowhere this past year. It’s done zilch for its investors…

But anyone who got into Box in “The Shadow Market” could be looking at 406% gains!

5x your money on the SAME exact stock — even AFTER the stock has flatlined!

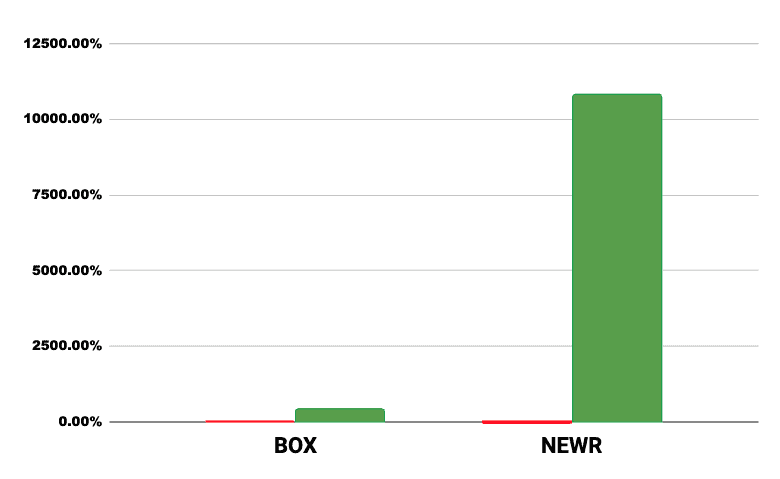

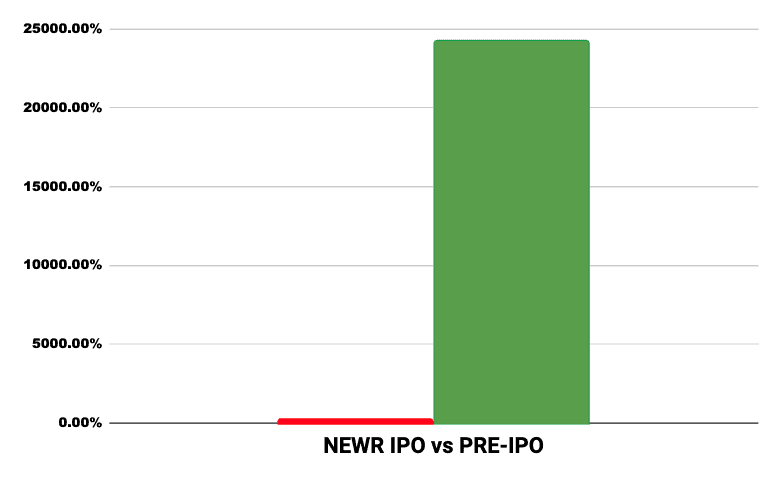

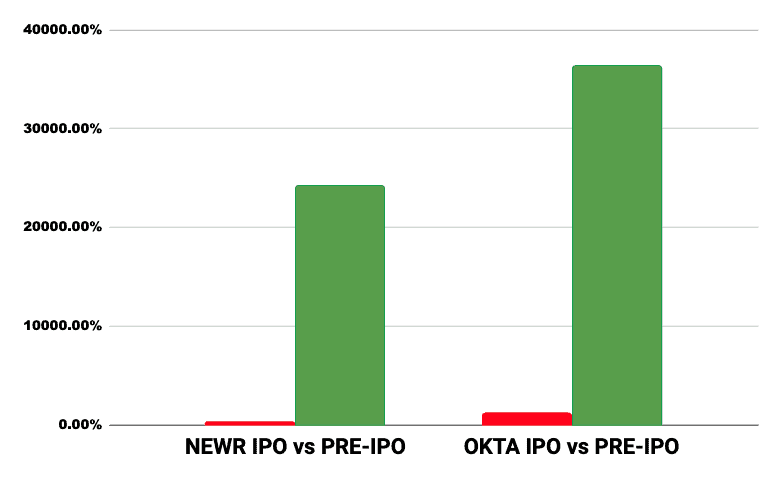

It’s a similar story with a company called New Relic. New Relic develops cloud-based performance-tracking software for website and app owners.

New Relic investors are down more than 44% this year!

But investors who got into New Relic in the “Shadow Market” could still be looking at 10,826% gains!

That’s 108 times your money! Enough to turn $1,000 into over $108,000!

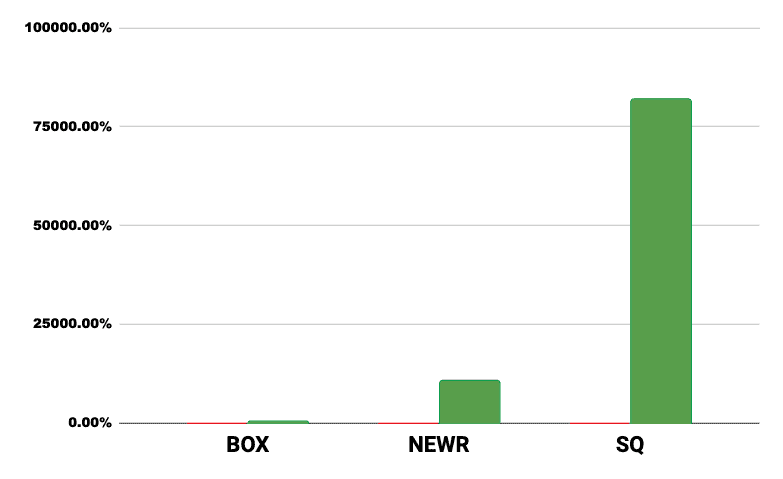

And take a look at Block Inc., the payment processing company that created Square:

It’s down a whopping 75% this past year…

But even after its massive crash…

Anyone who bought Block Inc. on “The Shadow Market…”

Get this…

Are you ready…?

“Shadow Market” investors in Block would be up 81,900%!

The fact is, an extraordinary (and certainly rare) gain like that would turn a $1,000 investment into $819,000.

That’s nearly a million dollars from a single “Shadow Market” investment — even after its stock has taken a beating.

And I don’t think I have to tell you this… but those gains would be even higher if investors had sold BEFORE the 75% crash.

That’s the extraordinary power of “The Shadow Market.”

A market that YOU can access right now.

And in a minute, not only will I show you how to get started making your first “Shadow Market” investment — even with as little as $100…

But I’ll also start sharing the details behind a powerful, three-step system my team and I have developed…

A system that could help you identify the “Shadow Market” investments that have the greatest financial potential.

But first, let me take a step back and re-cap what we’ve covered so far…

With “The Shadow Market,” You Can Get Ahead of Everyone Else… Turn the Tables on the Rigged Game… and Position Yourself for Potentially Enormous Profits!

Basically, because of the law change I mentioned a moment ago, startup companies can now sell their shares to everyday investors — before the company trades on a stock exchange.

Why would you want to do that?

Well, as I’ve been explaining, when it comes to investing, the game is rigged against the public.

It’s the insiders vs. the outsiders. Wall Street versus Main Street.

Remember the burning-match analogy from earlier?

It’s the insiders who get access to the match while it’s still burning hot…

And it’s YOU who gets left holding the worthless embers.

Because, you see, when the match is still red-hot, that’s when a company is still private…

But eventually, as the “match” gets passed around, as the company grows, it eventually goes public in what’s known as an Initial Public Offering, or IPO.

And this is when the company can finally be invested in by the public.

This is often when the insiders who got in before the IPO can SELL — and that’s when the real money gets made. And who ends up holding the bag when these stocks plunge afterwards? Ordinary investors like you!

That is, until the law change I mentioned a moment ago.

Thanks to this new law, now Main Street investors can invest BEFORE companies go public.

And to be clear: you don’t need to be a company insider, the family member of a founder, or an accredited investor.

And the best part is this:

When You Invest in “The Shadow Market,” You’re Getting in on a Company at the Ground Floor…

Giving You A Way to Profit if the Company Goes Public!

For instance, look at some of the examples I already showed you…

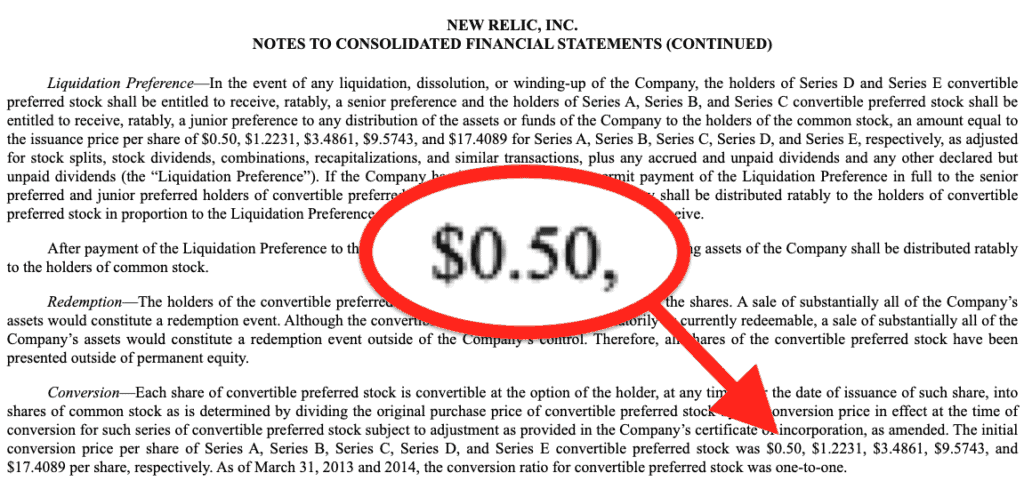

Like New Relic…

If you’d managed to get in at the very lowest price on the day the company IPO’d (when “regular” investors were finally allowed in)…

You’d have paid around $33 per share.

And then, if you’d held your shares and cashed out at New Relic’s absolute peak…

You’d be looking at 257% gains:

Not bad, right?

But now let’s say you were one of New Relic’s pre-IPO investors… in other words, one of its “Shadow Market” investors…

Well, instead of paying $33 per share…

You could have gotten your shares for just 50 cents!

And if you’d cashed out at the same time as “regular” IPO investors, right at the peak…

You’d be sitting on gains of 24,230%!

Over 240 times your money — from the same company!

In fact, even if you didn’t time this trade perfectly…

And you simply decided to cash out right on IPO day…

You’d still be sitting on a gain of 6,500%!

Here’s another example:

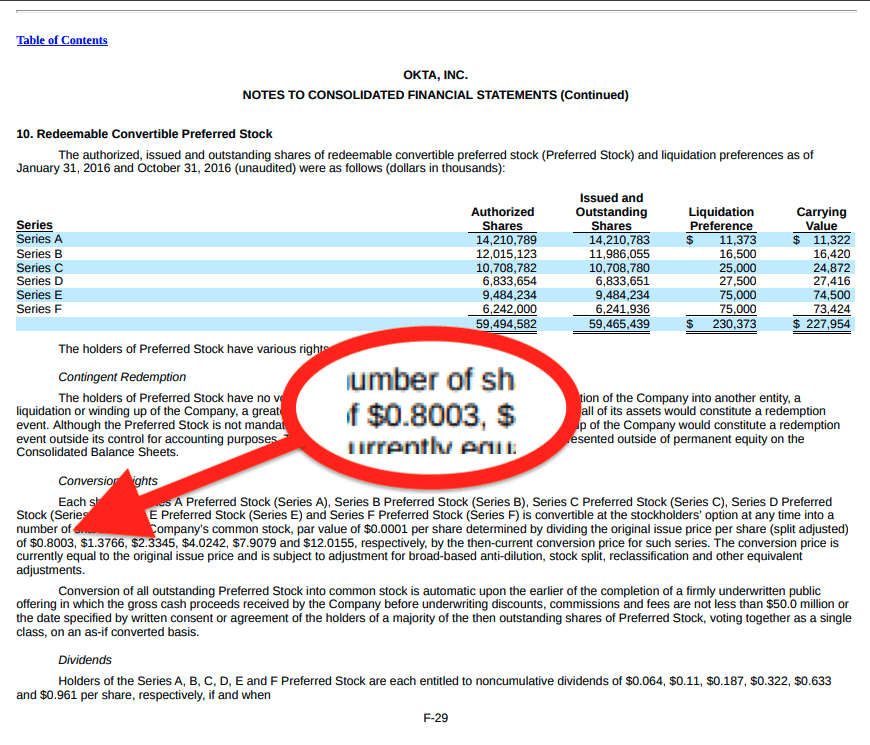

Remember Okta, the digital-security software company I mentioned earlier?

Well, Okta’s IPO happened on April 6th, 2017.

And if you’d bought shares that day, when Main Street investors were finally able to invest, you could have gotten in at $17 per share.

And if you’d managed to sell at Okta’s absolute highest price after that…

In the best-case scenario for “regular” investors… those who invested right at the IPO…

You’d be looking at gains of 1,141%:

To be fair, making 11 times your money is nothing to sneeze at…

But now let’s compare that to what the “Shadow Market” or pre-IPO investors made.

These are the people who were able to get in BEFORE you. And these insiders who had access to pre-IPO shares…

They were able to buy shares of Okta for only around 80 cents!

Which is why they could have made gains of 36,358% instead!

That’s 363 times your money, simply by getting in BEFORE the company went public!

And again, even if you’d cashed out right at the IPO, you still would have still outperformed public-market investors:

Instead of earning 11x your money…

You’d have made more than 20x your money — nearly double the return, even without worrying about timing your exit perfectly.

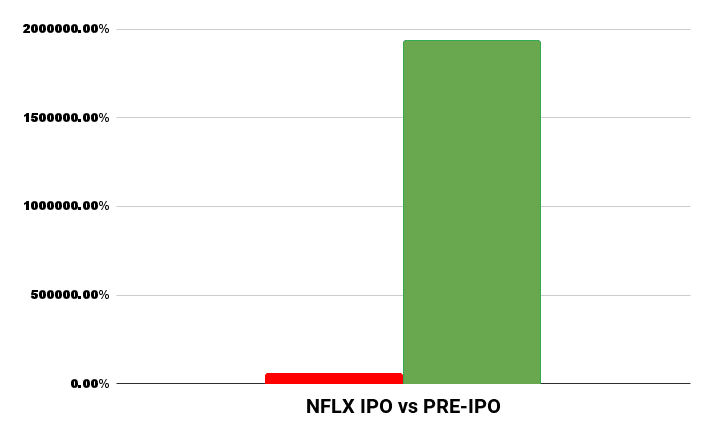

Let me show you one more example — take a look at Netflix:

When it went public in May 2002, the doors to buying its shares finally opened up to public investors…

And if you’d had the foresight to buy Netflix on IPO day…

And hold onto it until the absolute peak…

You’d have made 56,950% gains.

That’s an incredible gain, right? And you’re probably wondering how it could get any better.

But if you’d invested BEFORE Netflix went public…

You could’ve gotten shares for as little as 50 cents per share…

Adjusting for the stock splits Netflix has had over the years…

That comes out to just over 3 cents per share!

Meaning, if you got in BEFORE Netflix went public, and sold at the absolute peak…

You’d have made 1,931,900%!

That’s nearly TWO MILLION percent gains…

Or over 19,000 times your money — on the same investment!

Of course, either scenario would be amazing — no need to get greedy here…

But I’m showing you these examples to prove a point…

Investing PRE-IPO… BEFORE shares are available to the public… Is the absolute best way I’ve ever seen for anyone to make potentially life-changing money.

To be clear, I'm not saying it's easy or common to identify an early-stage company that will go on to become the next Netflix or the next Airbnb…

Because the truth is, most startups don't even end up going public, and many others end up going out of business entirely.

But as I'll explain in a moment, my team and I put together a number of resources related to this topic…

And not only will these resources show you how to find and invest in the most promising pre-IPO companies…

But they’ll also show you how to profit from them — even when the company never has an IPO!

Again though, investing like this simply wasn’t available to you until very recently…

But thanks to the JOBS Act that I mentioned earlier, now YOU can get in on companies before they go public…

Leading you to the biggest potential gains you’ve likely ever seen in your life.

And it’s super-straightforward to do…

Just like you’d order groceries online, or buy a book from Amazon.com, now you can go online and invest in these “Shadow Market” or “pre-IPO” shares.

There are special websites for this, fully regulated by the SEC…

They’re like eTrade, or TD Ameritrade, or Robinhood… but instead of using them to buy stocks, you use them to buy “pre-IPO” shares.

Basically, these websites connect investors like you with startups seeking capital.

And just to be clear here:

You don’t need to meet any financial requirements to use these websites…

And in many cases, you can get started with as little as $100!

Which is exactly why I’m doing everything in my power to get the word out about this. I’m trying to blow open the doors to pre-IPO investing now, and reveal all the secrets.

In fact, I want to send you 4 red-hot pre-IPO opportunities on Monday, November 14th…

Because my mission here is simple: to help folks like YOU learn about this market, so you can potentially invest and profit from it on your own.

Specifically, I created two resources to help you:

3 Simple Steps to Identifying the Hottest “Shadow Market” Deals…

First, I’ve developed a thorough system to help investors identify AND profit from these pre-IPO “shadow market” deals…

I call it the “A.S.E. Process.”

Basically, the A.S.E. Process is my way to methodically sort through pre-IPO opportunities…

This way, you can identify the pre-IPO investments that have the greatest chance of returning the most money.

You’re going to be shocked how straightforward it is…

Each letter in the A.S.E. Process corresponds to one of the three steps in the overall system.

The first step, “A,” stands for Allocate.

This step shows you exactly how much of your total portfolio to put into early-stage investments. And it also shows you how much capital to put into each deal.

If you follow this step closely, you’ll dramatically reduce your risk — and you’ll dramatically increase your potential returns.

The second step, “S,” stands for Screen.

In this step, your goal is to weed out the riskiest investments. So it helps you quickly screen out the companies that have the highest risk of failing.

This way, you can focus on the final step…

The “E”-step, which stands for Evaluate.

This is the most critical step in the process. This is where you really dig into each company you’re thinking about investing in.

You’ll want to see if a company has certain characteristics — or as I like to call them, “indicators.”

Following these indicators could be the absolute best way to help predict if a company will succeed or fail.

Which leads me to the second thing I want to do for you today…

It’s a way to virtually “take you by the hand” and walk you through this entire process…

This way, when you start making your first set of pre-IPO, “Shadow Market” investments, you can do so with certainty and confidence.

In short, I created an education service I call the Early-Stage Playbook.

The Early-Stage Playbook is my solution to help you learn, step-by-step, how to buy into Pre-IPO “Shadow Market” deals starting today.

It shows you exactly how to use Pre-IPO investing so you can maximize your profits, and minimize your risk.

To be clear…

The Early-Stage Playbook is something totally new in the financial world.

It’s not just another newsletter, like the ones you might have seen before from other companies or other people.

This is a complete pre-IPO coaching and education program — and it walks you through exactly how to get inside tomorrow’s hottest companies, today. BEFORE they go public, while they’re still “in the shadows.”

With The Early-Stage Playbook, you’ll have access to a 12-lesson online video course on pre-IPO investing that provides you with everything you need to become a successful pre-IPO investor.

For example, your access to the Early-Stage Playbook includes:

- An easy-to-understand video course on exactly how the pre-IPO market works…

- How to identify Pre-IPO opportunities for yourself…

- The full A.S.E. system I use to screen for only the best deals…

- A little-known tax loophole that could help you double your returns overnight…

- Powerful strategies to reduce risk…

- And MUCH more…

Again, in total, the course contains twelve video lessons.

Each video is online, so you can go at your own pace.

And every lesson contains powerful wealth-building information, explained in very simple terms.

The Early-Stage Playbook is a fully interactive online course.

Basically, it teaches you everything you need to know to start building a portfolio of early-stage investments.

In fact, by the end of the 5-hour course, you’ll know more about making money in the Pre-IPO markets than your friends, your family, even your financial advisor.

I’ll show you which websites to use, how they work, everything.

Now, let’s be clear about something…

The companies I’ll share with you aren’t compensating me in any way.

I run an independent provider of investment research.

I don’t accept any form of compensation from the companies I write research on.

Bottom line here: I am unbiased. I have no axe to grind.

As I’ve said, Pre-IPO investing is something I do with my OWN money, and I own stakes in 57 different startups.

And these are the types of startups I introduce to my readers all the time…

For example, I identified a private startup aiming to disrupt the transportation market.

The name of the company is Elio Motors, and its goal was to create an “ultra-affordable” car that sells for less than $8,000.

And a year after I told my readers about it, Elio went public — and its stock went through the roof.

My members would have had the chance to triple their money…

But sometimes, these private companies don’t need to go public at all for you to make money.

Here’s an example…

I let my readers know about an opportunity to invest in a small private company called Cruise Automation…

This was a HOT deal, because Cruise builds software for self-driving cars.

If you’d been one of my readers at the time and you’d claimed a stake in Cruise, you’d have done great…

Because, over a year after my readers had the chance to invest, General Motors stepped in and acquired this startup for $1 billion…

Meaning my readers were able to see gains of 1,011% without Cruise ever having an IPO at all!

(And more recently, Cruise has been valued at around $30 billion… Meaning early investors are looking at estimated gains as high as 33,233%. That’s the equivalent of turning $1,000 into more than $332,330!)

These are the types of deals I aim to find for you all the time…

With the Early-Stage Playbook, you’ll have everything you need to start investing in private companies today!

There’s only one catch…

You Must Take Action TODAY!

As I mentioned earlier, a handful of “Shadow Market” Pre-IPO opportunities are set to “go live”…

In fact, on Monday, November 14th, I’m prepared to send you an email listing each of these opportunities in detail.

You’ll see exactly what the companies do

Where to go to invest…

Exactly how to invest…

Everything.

And you’ll find it all in an email I’ll send you on Monday. I just need your “go ahead” today.

When you agree to sign up for the Early-Stage Playbook today, I’ll put you on this special list, so you’ll receive this email as soon as I send it.

And I’d hate for you to miss out.

Which is why I want to rush you access to the Early-Stage Playbook ASAP!

To get started investing in pre-IPO deals within the next few minutes, simply agree to give Early-Stage Playbook a try today.

As a member of Early-Stage Playbook, you’ll instantly get access to the 12-lesson video course on Pre-IPO investing.

PLUS you’ll get my email on Monday, November 14th detailing FOUR brand-new, red-hot pre-IPO deals you can invest in — some for as little as $100!

Not only that…

But I’ll send you another set of new pre-IPO deals each and every week!

Imagine sitting on a portfolio filled with profit opportunities…

And knowing you have the power to hunt down new ones right at your fingertips…

Each of these opportunities could potentially help you turn a few thousand dollars into millions.

That’s the power of private market investing, as I’ve shown you today.

And as a subscriber, that’s exactly what you’ll be getting access to.

But perhaps you’re wondering: how much does it cost to join Early-Stage Playbook?

Well, to be clear, a service like this doesn’t come cheap.

Keep in mind, when you join, you’re not just getting access to a simple research report…

You’re getting access to me and my entire team of research analysts. And hiring just one of these analysts can be very costly.

Furthermore, think about the upside potential in early-stage investing…

How private market investors could’ve seen gains like 36,358% on Okta… 24,230% on New Relic… and an incredible (and incredibly rare) 1,931,900% on Netflix.

Furthermore, keep in mind how profitable pre-IPO investing can be even AFTER a stock has completely crashed!

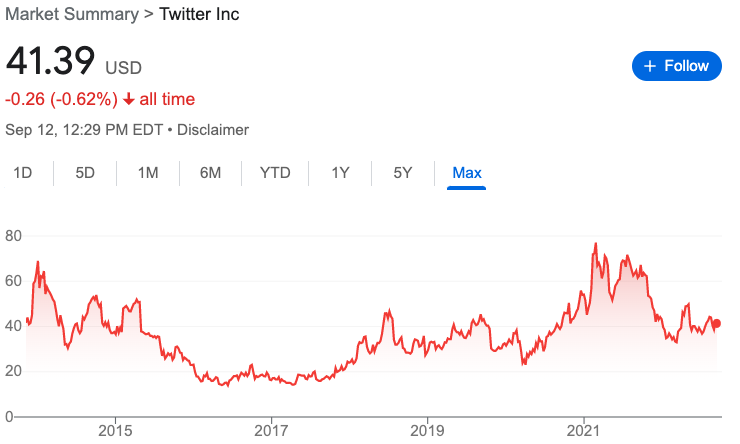

I mean, just take a look at Twitter as another example…

Even if you’d bought and held Twitter for years…

You’d have barely made a dime!

I mean, even if you’d somehow managed to buy Twitter at its lowest public stock price… and then sell it at the peak…

You’d only have made 449%.

So for public Twitter investors, that’s the BEST-case scenario

But if you’d been able to get into Twitter in “The Shadows,” BEFORE it went public…

You could have made 19,159,275%!

That’s 19 MILLION percent gains by getting in BEFORE Twitter ever IPO’d.

Of course, this is a best-case scenario for private investors. 19 million percent gains are nearly impossible to predict. That would take incredible foresight and timing.

But I’m showing you this example to prove a point:

Knowing how to invest in the right pre-IPO companies could be the most valuable thing you’ll ever do.

And getting in early like this is the only way I know to avoid the wild ups and downs of the stock market and potentially come out ahead.

Through the Early-Stage Playbook, I’ll show you exactly how to start investing in these private deals ASAP.

So I’m sure you could see why a service like this could easily go for tens of thousands of dollars.

But that’s nowhere near what the price will be if you act right now: I’m not going to charge $120,000, like an average analyst might cost…

Or $10,000…

Or even $5,000.

Because this service is so unique — and because there’s no one else out there with a program like this — I could certainly set a very high price for it like that.

But instead, I’ve set the standard price for The Early-Stage Playbook at $250.

If you’re anything like me, and you visit Starbucks a couple times a day, you probably spend that much on coffee every month.

But because I appreciate your serious interest in learning more about early-stage investing (which you’ve demonstrated by making it through this entire presentation)…

I’m offering a special, one-time discount…

When you take me up on this offer right now, you can enroll in the basic version of The Early-Stage Playbook for a single, one-time payment of $39.

Again, that $39 is a one-time payment for the basic package.

But when you click the “Subscribe Now” link below, you’ll learn about an even better deal I’m offering for you today.

I wanted to make this a very easy decision for you — again, the last thing I want is for the price of The Early-Stage Playbook to be a roadblock.

To be clear, you’re not going to find this deal on my website. In fact, it’s unlikely you’ll ever see it again anywhere.

This is the lowest price I can possibly offer you.

And I’m doing it because, once you’re in, it’s up to you to go through the Early-Stage Playbook video course…

Watch or read every lesson…

Learn everything you can about pre-IPO investing…

And be prepared to take action for your future.

I can’t do all that for you.

But what I CAN do is make it as easy as possible for you to get started. And that’s what I’m doing right now.

We covered a lot of ground here today.

So let me recap everything:

When you join through this page today, though this special offer:

You’ll immediately get access to the Early-Stage Playbook…

That’s where you’ll learn everything you need to know about early-stage investing, and everything you need to know to build a profitable portfolio of startup investments.

You’ll get the entire 12-video library that shows you exactly how to do everything we’ve talked about today.

In total, that’s more than 5 hours of video coaching, directly from me and my business partner.

PLUS, on Monday, you’ll get my email revealing FOUR brand-new pre-IPO opportunities you can get in on ASAP.

Meaning, by this time Monday, you could own a small portfolio of high-potential, Pre-IPO investments — the type of investments that have the potential to return 300%… 400%… or more if they go public.

After that, I’ll continue to send new pre-IPO opportunities right to your inbox each and every week, completely free!

On top of that, I’m essentially charging the very lowest price I possibly can to make up for the cost of getting this message in front of you today.

Again, you can enroll right now for a one-time discounted price of $39.

And to be clear, that’s a one-time fee. You won’t be charged again!

I know for a fact this is a good deal…

And I hope you’d agree…

But just in case you’re still on the fence, I’m going to sweeten this offer even more:

“Ironclad 30-Day COMPLETE SATISFACTION GUARANTEE.”

If you decide for any reason that this course isn’t right for you, you’ll have a full 30 days to contact me and cancel your subscription.

And if you do, I’ll refund 100% of your subscription money, immediately.

There are NO hidden fees and no “restocking” charges of any kind.

It’s simple: if you don’t like anything about the service, you can you get your money back.

That’s how I’d want to be treated. And that’s why I’m offering this to you.

Just click below to get started with your satisfaction-guaranteed trial subscription today:

To sum it up, here’s what you should do right now…

In this presentation, I’ve shown you how you’ve been LOCKED OUT of investing in pre-IPO “Shadow Market” deals for 82 years…

And how it’s been proven time and time again that getting into companies BEFORE they IPO or get bought-out can be one of the most profitable investments you could ever make.

I’ve also invited you to join my Early-Stage Playbook service at a HUGE discount.

And I’ve shown you how you can test this service — and get access to my video series — with a satisfaction guarantee.

Again, you’re entitled to a 100% refund any time in the next 30 days for the cost of your subscription — so you’re fully protected.

And even if you do decide to request a refund, all the videos and course materials you received will be yours to keep, with my compliments.

At this point, the decision is completely in your hands.

Only one of two things can happen from here:

Either we’ll go on together… or you’ll go at it alone.

Either you’ll join me — and start getting in early on the hottest companies of tomorrow.

Or, when these companies go public and hand “insiders” huge gains, you can read about it in the paper.

It’s up to you. But I’d hate for you to be stuck kicking yourself for missing out…

Click the link below:

But please do it now.

Because as you’ve learned today, there’s nothing to lose here for joining this service…

But there’s everything to gain.

And don’t forget…

On Monday, November 14th, I’ll be sending an email detailing FOUR brand-new private investments you can act on ASAP, if you choose.

And with that, I’d like to thank you for your time today…

And I’ll see you on the inside as a member of the Early-Stage Playbook!

Sincerely,

Matt Milner

Founder, Crowdability

October, 2022

P.S. Maybe you still have some questions about private investing? Let me try to anticipate a few of them, and answer them for you now.

QUESTION: I’ve heard I need to be an “accredited” investor to get into private deals? Is that true?

ANSWER: Not at all! You can get into these deals regardless of your net worth or income — sometimes for as little as $100!

It doesn’t matter if you make $250,000 per year or $25,000 per year…

And it doesn’t matter if your net worth is $10 million or $10,000.

Thanks to the JOBS Act, now anyone can invest in these deals.

Investment minimums can be as low as $100!

And all the information you need to get started is in the Early-Stage Playbook, which you’ll get access to when you sign up today.

Plus, you’ll get 4 actionable investments in your inbox this coming Monday, November 14th.

QUESTION: How do I invest in private deals like this? Can I do it online, through my existing stockbroker, etc?

ANSWER: It’s far more straightforward than you’d think!

Early-Stage Playbook is a highly comprehensive video course…

And inside this series of 12 videos, we’ll tell you exactly where to go and exactly how to make your investment.

But long story short: you’ll be making your investments on special websites called “funding platforms.”

These websites are just like online brokers like eTrade or Schwab — but instead of being for stocks or bonds, they’re for private market investments.

And these websites are super straightforward to use. Investing on one is like ordering a book from Amazon.

Bottom line: If you can order a book, you have what it takes to open an account and invest on one of these “funding platforms.”

Early Stage Playbook’s 12-video course shows you how!

QUESTION: What if I invest in a startup but it doesn’t go public?

ANSWER: There are multiple ways to profit from pre-IPO investments!

As I mentioned earlier, it’s difficult to identify early-stage companies that will one day go public and become “the next Netflix” or “the next Airbnb.”

But early-stage investors can even make money when a company doesn’t go public.

In fact, many successful startups never go public…

Instead they get bought out by larger competitors.

That’s what happened with one of the startups I mentioned earlier, Cruise Automation.

Again, Cruise got taken over by General Motors six months after I showed my readers a way to invest in it…

And if they’d invested, they would’ve made 1,011% on their money without the stock ever hitting an exchange.

I explain everything in great depth in The Early-Stage Playbook course. That’s where you’ll discover how common takeovers are, and how to identify the companies that have the highest potential of being bought out.

For full details and disclosures, please click here. This link contains critical information that will help you use our work appropriately and give you a far better understanding of how our business works — both the benefits it might offer you and the inevitable limitations of our products. The investment results described on this page are not typical. Investing in securities carries a high degree of risk, and you may lose some or all of the investment.