In this Article

U.S. stocks are, at present, subject to bouts of volatility as Wall Street braces for the Fed’s two-day policy meeting slated to begin on Sep 20. Hopes of a less aggressive Fed were dashed after hotter-than-expected inflation raised concerns that the central bank may continue to tighten its monetary policy to tame a stubborn rise in prices of indispensable commodities and services.

Due to a drop in gas prices, the consumer price index (CPI) increased just 0.1% in August after remaining unchanged in July. However, analysts had estimated a decline of 0.1%. More importantly, the core rate of inflation that omits energy prices advanced 0.6%, more than analysts’ forecast of a gain of 0.3%. This broader increase in prices of goods and services cemented expectations that the Fed may hike interest rates by at least 75 basis points in its policy meeting that concludes on Sep 21.

In fact, some analysts now project an increase of a full percentage point, indicating that there will be more gyration in the stock market in the near future and that policymakers won’t get bogged down by a deepening selloff.

Lest we forget, interest rate hikes negatively impact the stock market. Rate hikes tend to curtail consumer outlays, increase the cost of borrowings, slow down economic growth, and in the process, impact the stock market. But investors shouldn’t get disheartened. In such a gloomy scenario, it’s prudent for them to buy dividend aristocrats like Chevron (CVX), Albemarle (ALB), and W.W. Grainger (GWW) for a solid stream of income.

Being dividend aristocrats, these stocks have a fundamentally sound business that helps them stand out from other dividend players. They are known for providing profits for a pretty long time and have remained unperturbed in the middle of market volatility. These stocks flaunt a Zacks Rank #1 (Strong Buy) or 2 (Buy).

Chevron is among the largest publicly traded multinational energy companies, whose acquisition of Nobel Energy did improve its average output last year. This Zacks Rank #2 company is known for having raised its dividend for over 35 consecutive years.

Chevron has a dividend yield of 3.63%. CVX’s payout ratio presently sits at 39% of earnings. In the past five-year period, CVX has increased its dividend five times and its payout has advanced 6%.

Chevron Corporation Dividend Yield (TTM)

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for its current-year earnings has moved up 2% over the past 60 days. CVX’s expected earnings growth rate for the current year is 126.3%.

[Larry Benedict Trading Demo: One Ticker Retirement Plan and Guide to Options]

Albemarle is a specialty chemicals company, whose focus continues to remain on improving its lithium business. Thanks to its acquisition of Rockwood Holdings, the company is now expected to do well in the near term. This Zacks Rank #1 company is known for having raised its dividend for at least 25 successive years.

Albemarle has a dividend yield of 0.55%. ALB’s payout ratio presently sits at 20% of earnings. In the past 5-year period, ALB has increased its dividend five times, and its payout has advanced 4.8%.

Albemarle Corporation Dividend Yield (TTM)

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for its current-year earnings has moved up 63.7% over the past 60 days. ALB’s expected earnings growth rate for the current year is 425.3%.

W.W. Grainger is primarily the distributor of maintenance, repair and operating (MRO) products and services. The company’s initiative to reduce its inventory, and pricing actions should certainly aid growth. This Zacks Rank #2 company has increased its dividend for more than 25 consecutive years.

W.W. Grainger has a dividend yield of 1.31%. GWW’s payout ratio presently sits at 27% of earnings. In the past 5-year period, GWW has increased its dividend five times, and its payout has advanced almost 6.1%.

W.W. Grainger, Inc. Dividend Yield (TTM)

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for its current-year earnings has moved up 6.6% over the past 60 days. GWW’s expected earnings growth rate for the current year is 41.5%.

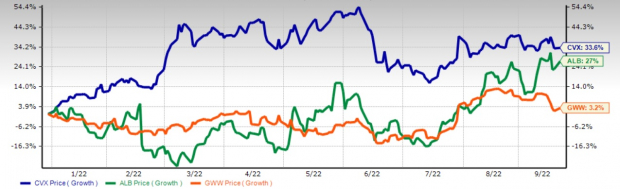

Shares of Chevron, Albemarle and W. W. Grainger, by the way, have already gained 33.6%, 27% and 3.2%, respectively, in the year-to-date period.

Image Source: Zacks Investment Research

[Exclusive: Bill Bonner Final Prediction – America’s Nightmare Winter]